Despite beginning the year in good shape, the global iron ore industry is starting to experience a fresh drop in prices that has analysts trying to decide whether this is the start of a deeper downtrend or a pull-back.

According to the Metal Bulletin, the price for benchmark 62% fines slipped Tuesday below $73 per tonne, down $1.36 per tonne month-to-date average.

Chinese iron ore futures ticked higher, but kept near one-month lows on Tuesday, as ample supply of the steelmaking raw material countered transport disruptions caused by heavy snow in the country.

Experts at UK-based research and consultancy group Wood Mackenzie say whether the current reverse becomes a rout or not, iron ore’s near future is not looking good. As a result, the consultancy has dropped its price forecast for seaborne to $63 a tonne or 12% below last year's average of $71 per tonne.

In a note Tuesday, they warn that, as 2017 was full of positive "surprises," 2018 could bring a few too. So far, they add, risk to the consultancy’s 2018 forecast for Chinese steel and seaborne iron ore is on the upside and they name five trends to keep an eye on this year.

1. China’s environmental policy:

Beijing's increasingly stringent environmental policy was a big story in 2017 and will remain a key driver of the market in 2018, they said in a note Tuesday, adding they expect China's environmental scrutiny to tighten.

Wood Mackenzie says the new emission license and environmental tax law that came into force this month will put further pressure on steel mills to fully comply. While hot metal and steel production constraints continue, the researchers note, steel margins will remain strong and plant operators will continue to chase productivity.

“Ultimately it all depends on demand our base case view is for stable consumption with restocking ahead of environmental closures. This should support iron ore demand and prices with a continuing preference for high-grade ores,” Wood Mackenzie says.

2. Steel restructuring – shutdowns and swaps

China's long running steel restructuring program slowed down last year. Wood Mackenzie believes a key uncertainty that will weigh on prices is the extent to which steel intensive infrastructure investment can offset slower growth in other sectors.

The consultancy believes restrictions on local government project financing will add to the challenges facing the Chinese steel sector in 2018 and it predicts little if any volume growth this year.

3. Supply side response

2017 was the year when iron ore's transition towards a two-tier pricing structure became firmly entrenched. For 2018 Wood Mackenzie expects price spreads to widen further, though some of the world’s top iron ore producers have already begin taking measures to avoid the imminent impact of increasing discounts in revenue.

4. Investment revival

Investment in the iron ore industry has plummeted since 2012. From a peak of almost $50 billion in 2012, we estimate total capex at $13 billion last year. But the experts at Wood Mackenzie believe 2018 may see that trend reverse, as Australian majors need to replace several depleting mines by early next decade, and the need for increased automation to reduce costs, among other factors.

5. Tightening industry structure

Vale, BHP, Rio Tinto and Fortescue Mining Group, alias “The Big Four,” increased their collective share of global exports from 62% in 2013 to 70% last year and it’s forecast at 72% in 2018.

Wood Mackenzie says an even more consolidated industry is likely as supply rises and prices come under pressure.

The analysts at Wood Mackenzie are not alone. Earlier this month, the Australian government itself said it expected a 20% decline in iron ore prices this year, hurt by rising global supply and cooling demand from China. However, most private forecasts expect the price to remain largely flat.

The post Wood Mackenzie cuts iron ore price outlook as markets fall again appeared first on MINING.com.

from MINING.com http://ift.tt/2GwATiD

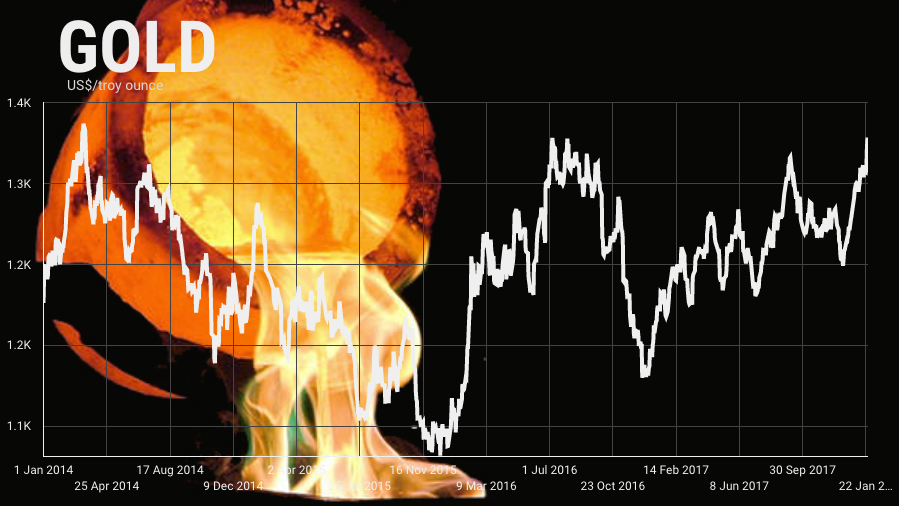

In morning trade on Thursday, gold jumped to its best level since August 2016 touching a high of $1,365.40 an ounce after comments from US Treasury Secretary Steven Mnuchin at the World Economic Forum in Davos Switzerland sent the dollar lower.

In morning trade on Thursday, gold jumped to its best level since August 2016 touching a high of $1,365.40 an ounce after comments from US Treasury Secretary Steven Mnuchin at the World Economic Forum in Davos Switzerland sent the dollar lower. However, says Woodmac, zinc has the potential to rally even further:

However, says Woodmac, zinc has the potential to rally even further: