A new report by BMI Research states that a possible victory by frontrunner presidential candidate Andrés Manuel López Obrador poses “minimal downside risks to an otherwise strong outlook” for Mexico’s mining industry.

According to the market research firm, the populist candidate’s policy goals would indeed represent a major shift from the current administration and that is why they have stoked investor fears around a possible disruption in the country’s trade relationships and recently liberalized energy sector.

However, when it comes to mining, BMI forecasts rather positive results. “While broad-based foreign investment concern could weigh on mining investment in the near-term following an AMLO victory, we see limited downside risks to the industry as some aspects of his agenda would benefit the sector. For instance, the focus on improving security, increasing infrastructure spending and expanding broadband internet coverage to remote areas would be a boon to the operating environment for miners,” the firm’s document reads.

Besides the possible perks of López Obrador’s infrastructure plans, BMI says that Mexico will continue to be an attractive investment destination because it is possible that mining merger & acquisition will continue the growing trend it showed in 2017 when it doubled compared to the previous year and reached $554 million. The highest paying deals were led by Canadian companies, such as Leagold Mining, who paid $350 million to purchase the Los Filos gold mine from Goldcorp; Agnico Eagle, who paid $80 million to purchase a gold project; and Teck Resources, who paid $50 million to purchase of the San Nicolás copper-zinc project.

“The dominance of domestic miners in Mexico's mining industry will also reduce the impact of uncertainty surrounding the upcoming elections on the country's mineral production growth outlook. Fresnillo, for instance, will continue to ramp up spending over the coming years to support projects including the San Julián silver mine expansion and near-term growth projects at the Fresnillo and Herradura mines. Additionally, Grupo Mexico will spend $413 million on the expansion at the Buenavista zinc-copper mine, which will double the firm's zinc production by 2020. Grupo Mexico is also developing the $159 million Pilares copper project, which will produce 35kt of copper annually with operations beginning in 2019,” the report states.

Analyzing the possibility of former Finance Minister José Antonio Meade taking the presidential seat, BMI says that the Institutional Revolutionary Party candidate is very likely to maintain the status quo and, therefore, continue to boost the mining industry. “PRI’s platform outlines a goal of an ‘open economy’ that benefits Mexican families, with policies focusing on preserving macroeconomic stability, promoting investment and competitiveness, and reducing inequality.”

But between the extremes of López Obrador and Meade, there is an outlier: former member of the National Action Party Ricardo Anaya who is now the candidate of a right-left coalition and who has been dealing this week with corruption allegations against him.

Mexico’s presidential election will take place on July 1, 2018.

The post Mexican election to pose limited risks to positive mining outlook: BMI appeared first on MINING.com.

from MINING.com http://ift.tt/2GRIZBP

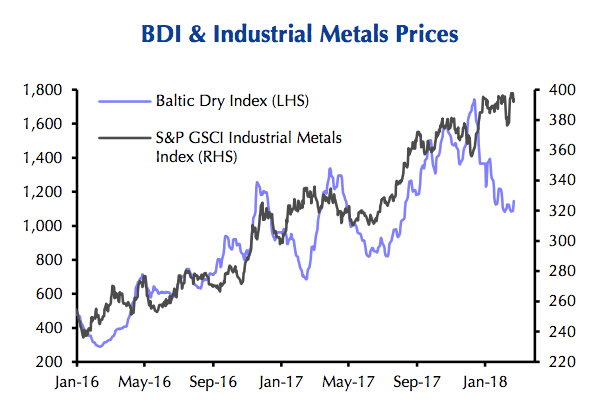

Copper futures trading on the Comex market in New York fell for the fourth straight session on Wednesday on fresh doubts about the strength of the economy in top consumer China.

Copper futures trading on the Comex market in New York fell for the fourth straight session on Wednesday on fresh doubts about the strength of the economy in top consumer China.

Steelmaking raw materials made strong gains on Monday as Chinese mills, responsible for half the world's steel output, on the back of speculations that the certain provinces may extend steel supply curbs beyond the winter.

Steelmaking raw materials made strong gains on Monday as Chinese mills, responsible for half the world's steel output, on the back of speculations that the certain provinces may extend steel supply curbs beyond the winter.