samedi 31 mars 2018

Notre top 5 de la semaine : de l'éléphant qui fume à la galaxie qui nous bouscule

from Les dernières actualités de Futura-Sciences https://ift.tt/2GmusCp

vendredi 30 mars 2018

Community group in New Zealand worried about OceanaGold’s project

A community group from New Zealand’s Waihi town, in the North Island’s Hauraki district, is expressing concerns over plans announced by OceanaGold Corporation (TSX/ASX: OGC) to mine for gold under the nearby open Martha pit.

This week, the Melbourne-based company presented its project to the District Council. The Martha Project exploration target is the first stage of an anticipated 10-year mine life extension for the historic Martha Underground Mine. It comprises two mining areas below the current Martha Pit, including Phase 4 of the Martha Open Pit and the Martha Underground Mine. According to OceanaGold, Phase 4 contains approximately 77,000 ounces of gold in P&P Reserves, while the expectation for Martha Underground is an exploration target of between 500,000 ounces and 700,000 ounces of gold.

Mining at the site stopped in April 2015 when a major slip and a rockfall affected the area. Reminiscences of this accident combined with the idea of an expanded mine are causing concerns among residents in adjacent neighbourhoods.

At a town meeting with company representatives following OceanaGold’s commencement of the permitting process, citizens and members of the environmental organization The Coromandel Watchdog of Hauraki said they feared the potential vibrations from underground drilling could cause another wall collapse. They also expressed worry over excessive noise from blasting and damages to their houses.

Later on, the activist group took its complaints to social media. “OceanaGold has announced that they are extending the life of the Martha mine – by mining underneath the Pit. Yep, the same pit with the collapsing walls…. but wait, there’s more! They are also looking to mine under even more homes in Waihi Town – in Mueller Street and Gilmour Streets north of Kenny Street. This unsustainable industry has had this town by the proverbial for years – many times longer than the mine was originally consented for,” a Facebook post reads.

According to the New Zealand Herald, the Australian miner mitigates the impact of its activities by contributing $300,000 per year to the town. The firm also plans to continue hosting community meetings to follow up on residents’ concerns.

The post Community group in New Zealand worried about OceanaGold’s project appeared first on MINING.com.

from MINING.com https://ift.tt/2J5T2VX

Illegal gold miners invade Grace Mugabe’s farm

About 400 illegal gold miners invaded a farm that belongs to former Zimbabwean first lady, Grace Mugabe.

Local newspaper Newsday reports that Mugabe was touring the farm, located in the northern village of Mazowe which is some 40 kilometres north of Harare, when she ran into the miners. They were allegedly uprooting lemon trees, digging shafts and loading gold ore into lorries.

“When Grace arrived at the farm and tried to confront the panners, they immediately broke into Kutongwa Kwaro, a song by Jah Prayzah synonymous with President Emmerson Mnangagwa’s ascension to power at the expense of her husband, former President Robert Mugabe, who was ousted following a military intervention,” Newsday’s story reads.

In the verbal confrontation with the politician, the so-called “zama zamas” said that if Mugabe wanted them out, she would have to speak to their boss. They claimed they were employed by a Chinese miner but declined to provide a name.

Following the altercation, Mugabe brought the matter to the police. “The crowd, which was being led by one known as Nyazvigo, started to shout obscenities at me and continued with their unlawful activities. The illegal activities have since destroyed my irrigation infrastructure, which feeds lemons pool section, and there is massive land degradation," the former first lady’s police statement reads, according to a Business Live report.

The situation forced Mugabe to have a taste of her own medicine. Back in 2015 and under her command, police destroyed maize and groundnuts crops on the same farm when they forcefully evicted villagers to take control of the land.

The post Illegal gold miners invade Grace Mugabe’s farm appeared first on MINING.com.

from MINING.com https://ift.tt/2pRdphx

Rift africain : le continent se sépare en deux

from Les dernières actualités de Futura-Sciences https://ift.tt/2E7tYdr

Dex-Net, un robot d'une dextérité étonnante

from Les dernières actualités de Futura-Sciences https://ift.tt/2GX5eHX

East Africa Metals and Luck Winner fail to agree on Ethiopian projects financing

Vancouver-based East Africa Metals (TSX-V:EAM) revealed that its previously announced Ethiopian Project Financing Memorandum of Understanding with Luck Winner Investment Limited failed to materialize.

In a press release, East Africa said that “despite the best efforts of both parties, negotiations failed to define a viable transaction that would be in the best interests of East Africa shareholders and Luck Winner.”

The firm, however, states that it has initiated discussions with a number of interested parties for the financing of its projects in Ethiopia and in particular the Terakimti Oxide Gold Project, an open-pit conventional mine located in the Tigray National Regional State and whose mineral resource has been estimated in 1,125,000 tonnes grading 3.2 grams gold and 24.0 grams silver per tonne containing 107,000 ounces of gold and 812,000 ounces of silver.

“The parties include companies and groups based in North America, Europe and China,” the media statement reads.

Despite the recent setback, last year, East Africa was able to secure $2 million in financing from Luck Sky Resources Investment, an affiliate of Luck Winner Investment, to continue exploration programs in the east African country.

The post East Africa Metals and Luck Winner fail to agree on Ethiopian projects financing appeared first on MINING.com.

from MINING.com https://ift.tt/2pQX3FS

Intelligence artificielle : la France dévoile son plan pour rester dans la course

from Les dernières actualités de Futura-Sciences https://ift.tt/2GCDlY5

Avaaz launches campaign against Belo Sun’s massive Brazilian mine

U.S.-based online activist network Avaaz launched a campaign to gather signatures to oppose the construction of the Volta Grande project, expected to become Brazil’s largest gold mine.

Canada’s Belo Sun Mining Company (TSX:BSX) is behind the project, which is located in the Amazonic state of Pará. Even though it has been denied a construction licence a couple of times, management has kept on working on improving its application and searching different legal avenues to meet the standards set by Brazil’s Indigenous Affairs Agency FUNAI.

According to Avaaz, the miner is close to getting the permit and, thus, the network is asking activists to ramp up protest actions. “Experts say the main investor, Agnico Eagle Mines, cares about its international reputation as a sustainability leader — and a million voices demanding they pull out of this project could be the game-changer to end this insane venture,” the campaign page reads.

Back in 2015, fellow Canadian miner Agnico Eagle invested about $11 million into Belo Sun Mining and became the owner 17.4% of Belo Sun shares on a non-diluted basis. More investments followed in 2016.

Volta Grande, however, has been receiving delays since 2013. The licence has been revoked because, according to different legal instances, the miner failed to assess the impact on local Indigenous communities. Belo Sun rejects such allegations. “According to current Brazilian regulations, only projects located less than 10 kilometres from indigenous lands require an Indigenous study. In accordance with best practices, Belo Sun completed Indigenous studies on the two closest indigenous lands, despite the 12 and 16 kilometres distance from the Volta Grande Project,” the latest corporate press release on the issue reads.

But Avaaz’s call to action says that the project would surround Indigenous sacred lands where one tribe could face extinction. In particular, opponents fear its vicinity to the controversial Belo Monte dam complex may lead to devastating and irreversible consequences for the quality of life and cultural heritage of nearby communities.

Volta Grande is an open-pit project near the Xingu River, a tributary of the Amazon. It is expected to produce an average of 205,000 ounces a year over its nearly 17-year life.

The post Avaaz launches campaign against Belo Sun’s massive Brazilian mine appeared first on MINING.com.

from MINING.com https://ift.tt/2pPtx3e

Stockage d’électricité : un tour du monde des innovations

from Les dernières actualités de Futura-Sciences https://ift.tt/2J5TL9u

Amérique du Nord : les plus anciennes traces de pas découvertes

from Les dernières actualités de Futura-Sciences https://ift.tt/2pVQCRc

Calls for gold exploration on Warwick Mountain delayed

Following a request by the Colchester County council, Nova Scotia's Department of Natural Resources delayed issuing a request for proposals for gold exploration in the Warwick Mountain area until early May.

The 30,000-hectare terrain between Earltown, Tatamagouche, and Wentworth is considered to have potential for the development of multiple gold mines.

But according to local publication The Chronicle Herald, Colchester council is worried about the fact that extractive activities would take place in the county's watershed. Thus, community members want to have a "best mining practices policy" in place before getting miners' hopes high.

Yet, Natural Resources spokesman Bruce Nunn told the newspaper that environmental policies already exist and that each miner that is allowed to move beyond exploration has to go through a provincial environmental assessment approval and an industrial approval, and is very likely to need a federal approval as well.

The post Calls for gold exploration on Warwick Mountain delayed appeared first on MINING.com.

from MINING.com https://ift.tt/2pOXPDe

En Amazonie, 81 villages précolombiens témoignent d'un passé densément peuplé

from Les dernières actualités de Futura-Sciences https://ift.tt/2pQmYxq

Le robot Dex-Net est étonnamment adroit

from Les dernières actualités de Futura-Sciences https://ift.tt/2GDlOim

jeudi 29 mars 2018

Randgold reports record year

Randgold Resources' Chief Financial Officer, Graham Shuttleworth, announced today that since the company declared its maiden dividend for the 2006 financial year, its dividends have increased by 1,900%.

"Randgold Resources had one of the best years in its history of achievement and delivery in 2017, posting another production record of an already high base and pruning the cost of production to its lowest level in six years," Shuttleworth said in a press release.

According to the CFO, the sustained dividend growth validates the business model and reflects the profitability and financial strength of the company, which at year-end had net cash of more than $700 million and no debt. The company, he said, intends to maintain a net cash position of around $500 million to fund new growth opportunities, while any surplus capital will be returned to shareholders.

However, management says that Randgold's hunt for what it calls "its next world-class gold deposit" will not impact the firm's 10-year plan to remain profitable at a long-term gold price of $1,000 per ounce.

The Jersey-based miner, which operates the giant Kibali gold mine in the northeastern region of the Democratic Republic of Congo, also stated that it is committed to working towards positive partnerships. “The mutually beneficial relationships it has patiently forged with its host countries and communities are serving it well, and over the years the company has effectively dealt with the differences that inevitably arise in even the most well-intentioned partnerships,” chairman Christopher Coleman wrote in the brief. “Randgold is consequently confident that it is well-equipped to cope with the occasional turbulence in its operational climate,” he added.

Together with other big firms, Randgold submitted a proposal to address concerns related to the DRC's recently modified mining code. Among other things, the new law raises royalties and taxes on operators.

The miners are proposing linking a sliding scale of royalty rates to the prices of the key commodities, which industry representatives believe would be a more effective mechanism than what they call "the windfall tax" introduced in the new code.

The post Randgold reports record year appeared first on MINING.com.

from MINING.com https://ift.tt/2GHIUEI

Of all things molybdenum could crash cobalt, nickel price party

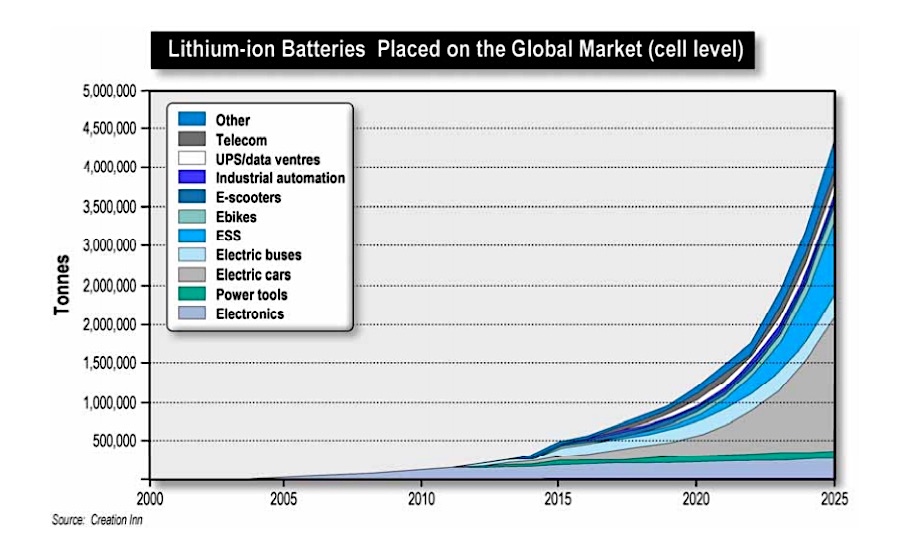

Cobalt’s rise to six-digit territory seems inexorable as the hype around electric vehicle demand for battery materials shows no signs of cooling.

Despite a pullback this week, at $95,000 a tonne cobalt is up another 24% in 2018 as it builds on a more than fourfold increase in value from record lows early 2016. Batteries – mainly for cellphones – constitute 55% of cobalt demand at present, but is set to rise substantially as the world’s automakers move away from internal combustion engines.

Nickel, together with manganese and cobalt the crucial elements in batteries favoured by most of the world’s automakers, has also been swept up by the positive sentiment trading at $13,315 a tonne on Friday, up a third over the last 12 months. The rise is despite the fact that only 5% of nickel production goes into batteries and less than 1% in EV power plants.

Worries about supply is not only reflected in prices for battery materials but also the furious pace of research into new technologies to reduce loadings or find substitutions for pricey raw materials

Worries about supply is not only reflected in prices for battery materials but also the furious pace of research into new technologies to reduce loadings or find substitutions for pricey raw materials.

At the beginning of this year US researchers touted a breakthrough for lithium ion battery technology which replaces cobalt with iron, currently trading at a tenth of the price.

Now lithium sulphur batteries are being hailed as the future of the industry.

Lithium sulphur batteries have been studied extensively and is considered to be the natural evolution of lithium ion batteries, but at the moment the technology falls far short when it comes to size and recharging limitations due to sulphur’s instability.

In a study first published in the journal Nature Nanotechnology, US researchers this week said they found a way around these shortcomings creating a lithium-sulphur battery that is cheaper, lighter, safer (won't catch fire) and more efficient holding three to five times the charge of today’s lithium ion technology.

According to a report from Phys.org, a team led by Kyeongjae Cho, professor of materials science and engineering at the University of Texas, found that molybdenum, mainly used as an alloy in the steel industry, solves the problems associated with lithium sulphur batteries:

[Molybdenum] creates a material that adjusts the thickness of the coating when combined with two atoms of sulfur, a coating thinner than the silk of a spiderweb.

It improved stability and compensated for poor conductivity of sulfur, thus allowing for greater power density and making lithium-sulfur batteries more commercially viable.

Lithium sulphur batteries use a solid lithium metal anode and a carbon cathode, with no need for nickel or cobalt:

"This was what everyone was looking for, for a long time. That's the breakthrough.

"We are taking this to the next step and will fully stabilize the material, and bring it to actual, practical commercial technology," Cho said.

The post Of all things molybdenum could crash cobalt, nickel price party appeared first on MINING.com.

from MINING.com https://ift.tt/2Gk5805

Gold particles make the invisible visible

To understand how enzymes work, scientists need to make molecules involved in enzymatic activities visible through techniques such as fluorescence microscopy.

However, many times molecules cannot be detected because they don’t emit light. Gold can be the solution to such problem.

A researcher with the Leiden Institute of Physics decided to tackle the issue by attaching single molecules to gold nanorods. The nanorods act as very small antennas by emitting light, enhancing the fluorescence of the attached molecule. This allowed Biswajit Pradhan to study single proteins and other complexes that are otherwise undetectable by fluorescence.

In detail, the scientist permanently attached a short single-stranded DNA to the tip of a gold nanorod. Then he allowed complementary DNA strands to diffuse around it. Each complementary strand contained a single molecule that he wanted to investigate. "Because of the weak binding of the short DNA strands, the binding time is short. Each complementary strand binds temporarily and is then replaced by a new complementary strand. This allowed us to study single molecules on the same nano-antenna," Pradhan said in a media statement.

This technique -he added- can be applied to many research fields, such as improving solar-cell efficiency and phototherapy of cancer.

The post Gold particles make the invisible visible appeared first on MINING.com.

from MINING.com https://ift.tt/2uBPUy0

Exploration spending in Canada’s poorest regions keeps sliding

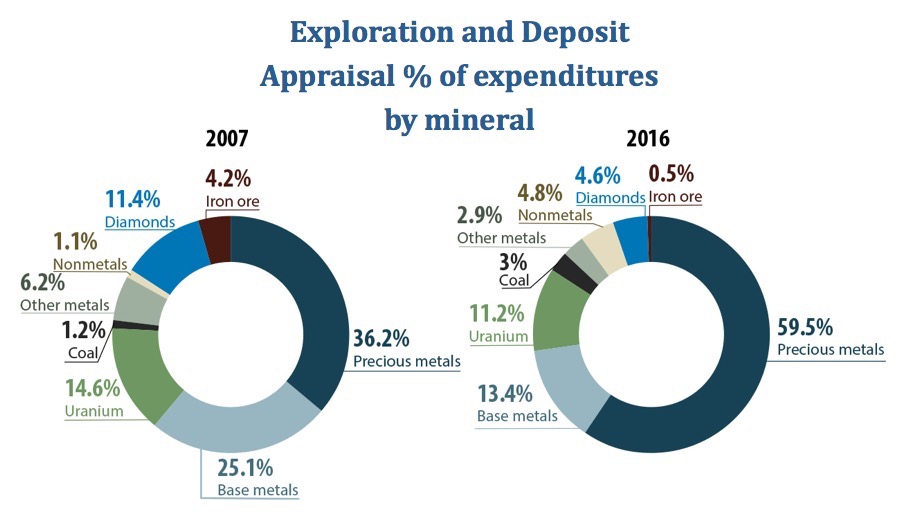

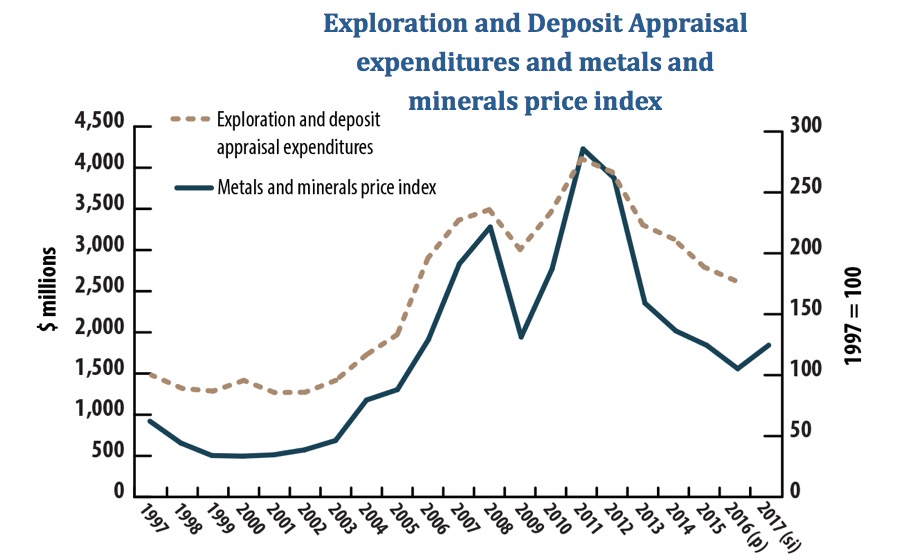

Canada’s Northwest Territories and Nunavut, two of the three regions with the lowest income per capita, have experienced a dramatic decline in exploration spending during the last ten years, data from Natural Resources Canada (NRCan) shows.

According to NRCan most recent numbers, spending in the N.W.T. is expected to decline to $81.3 million this year, down from $90 million in 2017. Exploration spending in the territory peaked in 2007 at $194 million.

Source: Natural Resources Canada.

In Nunavut, the situation is even worse. Investment in mineral exploration in Canada’s newest and northernmost territory is expected to fall by more than $58 million. That contrasts with the $169 million the territory received last year and is a far reach from the $338 million companies spent on mining exploration in Nunavut in 2007.

Across the country, instead, mineral exploration and deposit appraisals have picked up. In 2017, spending on both increased almost 30% to 2.1 billion, from $1.6 billion a year earlier. And for this year, NRCan is predicting a further 6%cent increase, to $2.2 billion.

Tom Hoefer, executive director of the N.W.T. and Nunavut Chamber of Mines, believes what’s deterring investors are ongoing disputes over land claims in the Northwest Territories, along with their interim land withdrawals.

"To find a mine you have to be able to explore the ground for it," Hoefer told CBC News.

Source: Natural Resources Canada.

In Nunavut, in turn, land use permits are being granted and then put on hold due to changing mandates on land use and access related to the Draft Nunavut Land Use Plan, the latest annual global survey of mining executives released in February by the Fraser Institute shows.

Mineral exploration in Canada’s northern regions has led to major discoveries in the past, including Rio Tinto’s Diavik diamond mine, as well as De Beers and Mountain Province Gahcho Kué diamond mine.

The post Exploration spending in Canada’s poorest regions keeps sliding appeared first on MINING.com.

from MINING.com https://ift.tt/2GVmi12

Miners ask Congo to introduce sliding royalty scale

Miners operating in the Democratic Republic of Congo submitted Thursday a new proposal for the government related to the recently passed new mining code, which substantially increases the cost of doing business in the central African nation.

The likes of Glencore, Randgold, Zijin, China Molybdenum and Ivanhoe are suggesting a sliding scale of royalty rates for key commodities instead of the windfall tax introduced in the new legislation.

The proposal, signed by companies responsible for 85% of the DRC's copper, cobalt and gold output, suggest that obtaining royalties based on each average production “would immediately give the government a higher share of revenues than what is provided in the new code,” the said in a joint statement.

The scheme suggested by the companies also deals with stability arrangements, state guarantees and mining conventions.

It’s the second proposal in less than a week the industry submits, hoping to soften some provisions of the code in exchange for higher royalties.

The DRC signed the new mining code into law in early March.

More to come…

The post Miners ask Congo to introduce sliding royalty scale appeared first on MINING.com.

from MINING.com https://ift.tt/2pQ7l8q

Antibiotiques : favorisent-ils le dangereux Clostridium ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2uuJ9hl

Scandale Cambridge Analytica : Facebook ne convainc pas avec ses mesures

from Les dernières actualités de Futura-Sciences https://ift.tt/2GfcDFk

Canada’s Asanko, South Africa’s Gold Fields team up in $203m Ghana JV

South Africa’s Gold Fields (JSE, NYSE: GFI) and Canada’s Asanko Gold (TSX: AKG) are teaming up to develop one of Ghana’s newest gold mine, the Asanko Gold Mine (AGM), is located in the country’s Ashanti Region.

As part of the deal, Gold Fields is acquiring a 50% stake in Asanko’s local subsidiary, which gives it a 90% ownership in AGM, for a total of $203 million, the companies said.

The South African miner is paying $165 million upfront on closing of the transaction and a deferred payment of $20 million, it said.

Gold Fields' local unit, in turn, has agreed to subscribe to a 9.9% share placement in Asanko by way of a private placement of 22,354,657 Asanko shares at a price of approximately.$0.79 cents.

The Canadian gold miner’s main assets in Ghana are the Obotan operation and the Esaase deposit, collectively the AGM, which are situated 100km north of Gold Fields’ Tarkwa and Damang operations along the prospective and under explored Asankrangwa greenstone belt.

More to come…

The post Canada’s Asanko, South Africa’s Gold Fields team up in $203m Ghana JV appeared first on MINING.com.

from MINING.com https://ift.tt/2E4HiPJ

Nasa : quelles seront ses prochaines missions ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2Gjq4j0

Mathématiques : le prix Abel 2018 décerné à Robert Langlands

from Les dernières actualités de Futura-Sciences https://ift.tt/2urcKIq

Jaguar et Google présentent I-Pace, une nouvelle voiture autonome

from Les dernières actualités de Futura-Sciences https://ift.tt/2pQXChZ

Tiangong-1 : suivez en direct la chute de la station spatiale chinoise

from Les dernières actualités de Futura-Sciences https://ift.tt/2IbPAYx

mercredi 28 mars 2018

Grizzly wants to buy Robocop

Edmonton-based Grizzly Discoveries announced its intentions to purchase the cobalt-copper-silver "Robocop Property," located within the Fort Steele Mining District in southeastern British Columbia.

In detail, the property is located east of the company's Greenwood property or approximately 45 kilometres south of the town of Fernie, immediately north of the Canada-US border.

Robocop is comprised of five mineral claims totalling 9,891 acres. In a press release, Grizzly said that different areas with significant historic cobalt-copper-silver in soil anomalies have already been identified. "Historic drilling during the 1990's (Teck Explorations Ltd.) and early 2000's (Ruby Red Resources) has yielded grades of up to 0.18% Co, 0.28% Cu, 4.1 parts per million (ppm) Ag over 1 m core length (Pighin, 2009) and 0.134% Co, 1.19% Cu and 33.8 ppm Ag over 1.23 m core length (Thomson, 1990) for individual core samples," the brief reads.

Under the terms of the Letter of Intent it signed with the project's undisclosed vendor, Grizzly would acquire a 100% interest in the Robocop Property subject to a 3% net smelter royalty by issuing to the vendors 2,000,000 units, with each unit consisting of one common share of Grizzly and one transferrable share purchase warrant.

"We have been able to negotiate a favourable purchase of 100% interest in the Robocop Property, which we believe will provide an excellent cobalt exploration opportunity for Grizzly. It is in the same region of BC as our Greenwood Property, where we have excellent relationships with the First Nations, and years of operating experience. We feel that the historic sampling and drill results are very significant, and that this Property has excellent potential for the discovery of a Co-Cu-Ag deposit," the company's CEO, Brian Testo, said in the statement.

The post Grizzly wants to buy Robocop appeared first on MINING.com.

from MINING.com https://ift.tt/2J1T01a

Barrick Gold founder and chairman Peter Munk dies at 90

Barrick Gold's (TSX, NYSE:ABX)(TSX:ABX) founder and chairman emeritus, Peter Munk, passed away Wednesday, peacefully and surrounded by his family at the age of 90.

Munk, an iconic Canadian entrepreneur and philanthropist, was born in Budapest in 1927. When the Nazis invaded Hungary in 1944, he escaped with his family, ultimately arriving in Toronto in 1948 at the age of 20.

Even though he didn’t have social connections or a command of English, Munk felt welcomed immediately by Canadians, and he would go on to profess a lifelong love of his adoptive country. In 2011, he remarked, “This is a country that does not ask about your origins but concerns itself with your destiny.”

Munk founded Barrick in 1983 and built it into the world’s largest gold mining company in less than twenty-five years.

He first co-founded Clairtone Sound Corp. in Toronto in 1956, at a time when sound systems were called “hi-fi’s.” The company made high-end consoles that included radios, turntables and, later, televisions. In their day, they were recognizable and prized.

But mounting losses forced Munk and his partner out of the company and the duo decamped for Fiji to invest in a hotel. They would turn that into the Southern Pacific Hotel Corp., which at its peak consisted of 54 resorts in the South Pacific.

He returned to Canada in 1979 and a few years later, in 1983, he founded Barrick, transforming it into the world’s largest gold miner in less than 25 years. He did so by leading a small team of partners who trusted one another implicitly and who together balanced boldness and prudence in the pursuit of fierce entrepreneurial ambitions.

One of Canada’s most significant philanthropists, Munk donated nearly $300 million to causes and institutions that were close to his heart. With his wife, Melanie, he established the Peter Munk Cardiac Centre at the Toronto General Hospital in 1997. Munk donated more than $175 million to the institution, including a $100 million contribution in September last year, which remains the largest single gift ever made to a Canadian hospital.

The historic gift is currently being invested in efforts to optimize the quality of care and improve health outcomes for those struggling with cardiovascular diseases, both domestically and abroad.

To his alma mater, the University of Toronto, Munk gave $47 million to create what has become Canada’s preeminent degree-granting institution for the research and study of global affairs, the Munk School of Global Affairs. In 2008, he founded The Munk Debates, which quickly became Canada’s most important public policy debate series, bringing the world’s brightest minds together to debate the biggest issues of our time.

For his leadership as an entrepreneur and philanthropist, Munk received numerous awards and honours, including honorary doctorates from the University of Toronto, Concordia University, Bishop’s University, and the Technion-Israel Institute of Technology. In 2008, he was named a Companion of the Order of Canada, the country’s highest civilian honour, limited to no more than 165 living Canadians at any one time.

Munk is survived by Melanie, his wife of 45 years; by his five children, Anthony, Nina, Marc-David, Natalie, and Cheyne; and by his fourteen grandchildren.

To learn more about Peter Munk's life please click here.

In lieu of flowers, Barrick noted that donations may be made to the Peter Munk Cardiac Centre.

The post Barrick Gold founder and chairman Peter Munk dies at 90 appeared first on MINING.com.

from MINING.com https://ift.tt/2J3uugk

Kinross closer to making decision on reopening gold mine in Chile

Canadian miner Kinross Gold (TSX:G) (NYSE:KGC) may soon make a decision about whether or not to restart operations at its La Coipa gold and silver mine in northern Chile, as it expects to receive the remaining permits to resume mining by July.

Operations at La Coipa mine, located in Chile’s Atacama Region, were halted in 2013, when the targeted orebody run out of riches. But the results of a pre-feasibility study (PFS) completed in 2015 lead Kinross to evaluate extending the mine life, through the so-called Phase 7, which has an expected initial investment of $200 million.

According to that study, La Coipa is expected to generate a 20% internal rate of return during the expected 5.5 year mine life at an assumed gold price of $1,200 per ounce, with average annual production of 207,000 ounces gold equivalent and average all-in sustaining costs of $767 per ounce of gold equivalent.

The so-called Phase 7 at La Coipa mine will need an initial investment of $200 million.

In a conference call with investors in February, when Kinross published its 2017 results, president and CEO J. Paul Rollinson said that obtaining the final permits for Phase 7, would help his company make a decision on the project.

"We are not in a hurry to put it into production," said Rollinson, noting that Kinross has other priorities at the project level, according to local paper Diario Financiero. “So no decision eminently. It's not a big needle mover in our portfolio, but it's moving along,” he said.

Earlier this year, Kinross agreed to pay $65 million for the 50% of the Phase 7 deposit it did not already own to gain full ownership and related mining rights.

The transaction, expected to close in early May, followed studies that allowed Kinross to add 844,000 ounces of gold and 34 million ounces of silver in 2017 to mineral reserve estimates from the Phase 7 and Purén deposits, which comprise the La Coipa Restart project.

Kinross has a diverse portfolio of mines and projects in the USA, Brazil, Chile, Ghana, Mauritania and Russia, employing about 9,300 people worldwide.

The post Kinross closer to making decision on reopening gold mine in Chile appeared first on MINING.com.

from MINING.com https://ift.tt/2I9yOt6

L'interstitium, nouvel organe du corps humain ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2GdWAI1

Kepler résout l’énigme des supernovae rapides

from Les dernières actualités de Futura-Sciences https://ift.tt/2GA8b3r

DRDGold okays Sibanye-Stillwater $110 million-assets exchange deal

South African DRDGold approved Wednesday a deal proposed by Sibanye-Stillwater (JSE:SGL) (NYSE:SBGL) to exchange some its assets for a 38% stake in the mid-tier gold miner.

The transaction, valued at R1.3 billion (roughly $110 million at today’s rates), also gives Sibanye the option to buy another 12.1% of DRDGold shares — enough to give it control of the firm.

The assets the precious metals producer is transferring have probable gold mineral reserves of 3.82 million ounces, it said. And while Sibanye-Stillwater plans to retain long-term exposure to the West Rand tailings retreatment project (WRTRP) in South Africa, it’s leaving the development of such endeavour to DRDGold.

Deal grants Sibanye-Stillwater a 38% stake in DRDGold, which receives some assets that boost its gold reserves by 91% to 5.7 million ounces.

WRTRP is a large-scale, long-life surface tailings retreatment that will retreat material with a 35% higher gold content than the material treated by DRDGold at its flagship Ergo metallurgical plant on the East Rand.

The transaction virtually doubles DRDGold’s gold reserves, giving it immediate access to facilities that can generate cash for it in a matter of months. It also cuts overhead unit costs through increased production and puts an end to DRDGold’s single asset operating risk.

For the company, tailings around Sibanye’s Driefontein and Kloof mines near Carletonville, are relatively rich in gold compared with what it has been mining so far to the east.

The first phase to unlock the tailings will focus on processing 28 million tonnes of tailings at Driefontein dump 5, which has a grade of 0.469g of gold a tonne and contains 421,000 ounces of gold, DRDGold has said.

It will be funded by debt and the company has indicated it has an "in principle commitment" from a financial institution for the facility to upgrade one of the plants to process 500,000 tonnes a month and a network of pipelines and equipment.

DRDGold has established itself as one of South Africa’s top gold tailings retreatment operator, using its Ergo plant to treat old dumps around the city.

Sibanye-Stillwater is South Africa’s largest gold producer and the world’s third largest producer of palladium and platinum.

The deal, which is expected to close in the second quarter of the year, remains subject to, and conditional on environmental permits for DRDGold to operate the selected Sibanye-Stillwater assets.

The post DRDGold okays Sibanye-Stillwater $110 million-assets exchange deal appeared first on MINING.com.

from MINING.com https://ift.tt/2E0L78E

Mozilla : une extension Firefox pour empêcher Facebook de vous suivre

from Les dernières actualités de Futura-Sciences https://ift.tt/2Gkad4x

Télescope spatial James-Webb : le lancement repoussé à mai 2020

from Les dernières actualités de Futura-Sciences https://ift.tt/2GgchhE

Yhnova : la première maison imprimée en 3D a été inaugurée à Nantes

from Les dernières actualités de Futura-Sciences https://ift.tt/2Gz2iU1

Le boson de Higgs explique-t-il l'origine de la matière noire ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2I7K60Y

mardi 27 mars 2018

Copper price: 120% premium for Brazil junior another bullish sign

It’s not a big deal; only around $350m, but the Oz Minerals bid for Avanco Resources is another sign that quality assets can command a premium in a copper market hungry for new supply.

Glencore owns 8% which sets up the tantalizing, albeit slim, prospect of a counter offer from the world’s number three copper producer

Oz Minerals’ cash and shares offer on Tuesday was made at a 121% premium to the ruling share price of its fellow Perth-based firm. With the board and just over 30% of the company’s shareholders in favour of the deal Avanco’s stock duly doubled on the ASX. Punters seem to believe the price is probably fair – Oz Minerals also gained despite its generous off-market offer, upping its market valuation to over $2 billion.

Avanco’s top shelf shareholder registry buttresses the idea that smart money has been scouring for copper assets long before the metal's recovery from six-year lows struck early 2016.

Number one investor Appian Capital which has already accepted, invested in Avanco back in 2014 and together with BlackRock and Greenstone, private equity firms hold just under 50% of the company. Glencore owns 8% which sets up the tantalizing (perhaps slim) prospect of a counter offer from the world’s number three copper producer.

Avanco owns the two-year old high-grade Antas mine in Brazil which currently produces 12–14kt of copper per year, but Oz Minerals is really after its land holdings and late stage projects in the Carajás province of the South American nation.

At around 1,800km2 it’s the second largest land holding in a region known for iron oxide copper-gold deposits of which Vale’s 200ktpa Salobo is the prime example. In January this year Avanco acquired an option for 100% of the Rio de Janeiro giant’s Pantera copper project near Antas.

The deal provides an “organic pathway” to seven mines within just six years

Oz Minerals' Prominent Hill mine in South Australia which produces over 100,000 tonnes per year shares the same geology (so does BHP’s Olympic Dam copper-gold mine in the region).

The acquisition also includes one of the largest tenements (1,370km2) in the Gurupi greenstone gold belt in Brazil where Avanco’s CentroGold project boasts a 2.2m ounce resource.

Oz Minerals, which is seeking at least 50.1% of Avanco, said in a statement apart from “expansive” land holding in Brazil and Australia, the deal provides an “organic pathway” to seven mines within just six years.

Copper was last trading at $2.98 a pound ($6,580 a tonne) in New York, a 9.6% slump so far this year.

SEE ALSO: These charts show just why copper price fundamentals are so strong

The post Copper price: 120% premium for Brazil junior another bullish sign appeared first on MINING.com.

from MINING.com https://ift.tt/2pNOV83

Tumeurs du cerveau : un diagnostic amélioré grâce à l’intelligence artificielle

from Les dernières actualités de Futura-Sciences https://ift.tt/2GshsdZ

Dégradation des sols : les scientifiques tirent la sonnette d’alarme

from Les dernières actualités de Futura-Sciences https://ift.tt/2pIQyon

Rio Tinto fully out of coal sector with $2.5bn Kestrel mine sale

Mining giant Rio Tinto (ASX, LON:RIO) has agreed to sell its Kestrel coal mine in Australia to private equity manager EMR Capital and Indonesian coal company Adaro Energy , in a deal worth $2.5 billion.

The transaction makes of Rio Tinto the first major miner to exit the coal industry, and comes only a week after it announced the $1.7 billion-sale of its Hail Creek Mine, also in Australia, to Glencore, as well as an undeveloped project in Queensland to Whitehaven Coal for $200m.

The company said it expected the deal to be completed in the second half of 2018.

More to come…

The post Rio Tinto fully out of coal sector with $2.5bn Kestrel mine sale appeared first on MINING.com.

from MINING.com https://ift.tt/2Gblisq

Copper Mountain gains approval for $71m acquisition of Altona

Canada’s Copper Mountain Mining (TSX: CMMC) has obtained shareholder approval for its planned acquisition of Australian junior Altona Mining (ASX:AOH) in a deal worth A$93 million, or about $71m at today’s rates.

Under the agreement, each Altona share will be exchanged for 0.0974 Copper Mountain shares, which equates to a 41.7% premium based on closing prices at the time of both companies first agreed on the deal, in November.

The transaction, qualified as a merger, gives Copper Mountain access to Altona’s assets, which include $30 million in cash, a permitted development project in Queensland, Australia and a large mineral land tenure position in the highly prospective area.

Copper Mountain’s main asset is the 75%-owned Copper Mountain open pit mine, in southern British Columbia, which is forecast to produce between 34,000 and 38,500 tonnes of the red metal this year

The combination of the two companies will result in a mid-sized copper miner, with an expected annual production of about 73,000 tonnes of the metal.

The transaction is expected to close by mid-April 2018, subject to applicable regulatory approvals.

The post Copper Mountain gains approval for $71m acquisition of Altona appeared first on MINING.com.

from MINING.com https://ift.tt/2GbfqiR

Ce robot est étonnamment adroit

from Les dernières actualités de Futura-Sciences https://ift.tt/2IVScen

Vedanta shuts protests-ridden copper smelter in India for 15 days

Vedanta, the London-listed natural resources company controlled by one of India’s richest men, said Tuesday it was shutting its copper smelting operations in the south of the country, for a 15-day scheduled maintenance.

The halt, originally scheduled for April, comes amid local media reports of massive protests around the smelter and even in front of the home of Vedanta’s chief executive Anil Agarwal in London, against the expansion of the group’s Sterlite Copper plant at Thootukudi, in the southern state of Tamil Nadu.

The smelter is one of the India’s biggest and has been a target of criticism and demonstrations by environmentalists, who say the operation is a major source of pollution and a risk to fisheries.

Vedanta refuses such claims. In an email statement to MINING.com, it said that both, the group and its subsidiary Sterlite Copper, were “fully compliant” with all applicable environmental regulations and committed to operating in accordance with international best practices.

“The ‘Zero Discharge’ concept has been a key focus by Sterlite Copper since the inception of the Tuticorin plant, and achieving a zero harm environment is an essential goal and a top priority for our business,” Vedanta said. “A recent environmental impact assessment showed our operations are well within the stipulated standards.”

Tuticorin was closed down about two months in 2013 after locals complained about emissions that had allegedly polluting their water and air since the smelter was established in 1996. An environmental court later ruled the smelter could operate, but should take extra steps to prevent pollution.

Vedanta says it has not only implemented all of the authorities recommendations, but also that it has adopted state-of-the-art technology to improve safety and energy conservation while reducing waste.

The company, India’s largest miner and No. 1 iron ore exporter, also noted the planned expansion of the Tuticorin plant had already received all necessary regulatory clearances.

The post Vedanta shuts protests-ridden copper smelter in India for 15 days appeared first on MINING.com.

from MINING.com https://ift.tt/2GzprWI

Une éléphante surprise en train de fumer intrigue les scientiques

from Les dernières actualités de Futura-Sciences https://ift.tt/2pJFpTC

Dent intelligente : un capteur pour analyser vos repas

from Les dernières actualités de Futura-Sciences https://ift.tt/2IY3TRJ

lundi 26 mars 2018

Diamonds and sapphires allow masers to operate continuously

Scientists from Imperial College London and UCL used a synthetic diamond grown in a nitrogen-rich atmosphere to create a new maser that operates continuously.

A maser (microwave amplification by stimulated emission of radiation) is the older, microwave frequency sibling of the laser. It was invented in 1954 and has traditionally been used in deep space communication and radio astronomy.

However, early versions of the maser had to be cooled to temperatures close to absolute zero (-273°C) to be able to function and even though in 2012 researchers were able to demonstrate that a maser could operate at room temperature using the organic molecule pentacene, the system produced only short bursts of maser radiation that lasted less than one thousandth of a second.

But with the new additions, carbon atoms were ‘knocked out’ from the diamond using a high energy electron beam, creating spaces known as ‘vacancies.’ A press release by Imperial explains that the diamond was then heated, which allowed nitrogen atoms and carbon vacancies to pair up, forming a type of defect known as a nitrogen-vacancy (NV) defect centre.

When placed inside a ring of sapphire to concentrate the microwave energy and illuminated by green laser light, the maser worked at room temperature and continuously.

“This breakthrough paves the way for the widespread adoption of masers and opens the door for a wide array of applications that we are keen to explore," said lead researcher Jonathan Breeze in the media statement.

According to Breeze and his team, such applications could range from medical imaging and airport security scanning, to improvements in sensors to remotely detect bombs. Masers, they say, could also be used to develop new technology for quantum computers and space communication methods to potentially find life on other planets.

The post Diamonds and sapphires allow masers to operate continuously appeared first on MINING.com.

from MINING.com https://ift.tt/2DWXm6g

Lundin closes $400-million financing to complete Ecuador gold project

Canada’s Lundin Gold (TSX:LUG) has closed a $400-million financing that will help it complete the construction of its flagship Fruta del Norte gold project in Ecuador, expected to begin production in late 2019.

The Vancouver-based company, which last month secured a $250-million investment from Newcrest Mining, which is part of the total announced today, said the Australian miner now owned 27.1% of Lundin’s outstanding shares. Zebra Holdings and Investments S.à.r.l. and Lorito Holdings S.à.r.l. (the Lundin Family Trusts) collectively own 22.3%; and Orion holds an 11.4% stake, Lundin said.

Lundin has been developing Fruta del Norte for over a year, following an agreement with Ecuador’s government.

“This investment significantly reduces risks around the funding of the project and represents a strong endorsement for Fruta del Norte and our management team,” the company’s President and CEO, Ron Hochstein, said in the statement.

Shares soared 3.9% in early trading after the news and were still up, though only 1.35% to Cdn$5.24 at 1:08PM ET.

Lundin has been developing Fruta del Norte for over a year, following an agreement with Ecuador’s government allowing the miner to move ahead with the project.

It acquired the halted project in 2015 for $240 million from fellow Canadian miner Kinross Gold (TSX:K) (NYSE:KGC), which had to suspend work on the venture after it could not reach an agreement with authorities regarding the terms for developing the asset.

The Fruta del Norte asset, discovered in 2006, contains about 7.3 million ounces of gold. Lundin predicts eventual average annual production of about 340,000 ounces.

The underground gold mine will be Ecuador’s largest and it’s expected to operate for 15 years and produce over 325,000 ounces of gold annually, and encompasses six of the company’s 29 mining concessions, which cover 70,000 hectares of land.

The post Lundin closes $400-million financing to complete Ecuador gold project appeared first on MINING.com.

from MINING.com https://ift.tt/2IRfK3U

Hecla Mining sues Montana after told to clean up before starting new projects

Silver producer Hecla Mining (NYSE: HL) is taking Montana environmental regulators to court for labelling the company and its top executive as "bad actors," while giving them 30 days to iron out a complaint that accuses them of violating the state’s mine clean-up laws.

The Montana Department of Environmental (DEQ) notice to the company, which could require it to pay up to $30 million, focuses on some old operations in Central Montana. However, the consequences of this impasse with the state’s authorities could affect the Hecla’s plans to build two new mines.

Montana’s 'bad actor' law has only been used once before, and Hecla’s president and CEO is the first top executive at a large company to be scrutinized under it.

The Coeur d’Alene, Idaho-based firm is pursuing development of two large silver and copper mines in northwest Montana, which would employ about 300 workers each. They would be constructed beneath the Cabinet Mountains Wilderness, an area of remote, glaciated peaks and valleys that take their name from the area’s box-like rock formations.

Because of ties Hecla’s president and chief executive officer, Phillips Baker, has with the old mines in question, the company must now stop mining in Montana until it pays back the reclamation costs incurred by the now-defunct Zortman Mining Inc. and Pegasus Gold Mining Inc., Bloomberg BNA reported.

Hecla could resume mining once it proves that Baker will not be involved in mining or exploration in the state, the article says.

Hecla vice president for external affairs, Luke Russell, said the company had no direct relation with Pegasus. Two Hecla subsidiaries, not Baker, were the applicants for the Montana projects, he said.

“It is a far stretch to suggest now that Hecla, a 127-year-old company, is required to pay for reclamation of a mine conducted by another, totally unrelated company,” Russel told Bloomberg.

The bad actor law, passed in 1989, blocks individuals who don’t clean or pay for the clean-up of old mines from starting new ones.

The post Hecla Mining sues Montana after told to clean up before starting new projects appeared first on MINING.com.

from MINING.com https://ift.tt/2I8aFTY

Un couple de baudroies surpris dans les abysses : une première

from Les dernières actualités de Futura-Sciences https://ift.tt/2pFWMFy

SolGold on a roll, confirms major copper-gold target at Ecuador project

Shares in Ecuador-focused miner SolGold (LON:SOLG) (TSX:SOLG) received a fresh boost on Monday, after it said it had found “strongly mineralized” extensions at its 85%-owned Cascabel copper-gold project, 180 km north of the country’s capital Quito.

The discoveries, the Australian miner said, are predicted to significantly increase Cascabel’s high-grade resource tonnage. The project, located on the northern section of the prolific Andean Copper belt, has been compared to Rio Tinto’s world class Oyu Tolgoi copper mine in Mongolia and the results from 11 of the 12 drilling rigs currently engaged at the Alpala cluster, SolGold said, suggest there is much more intense mineralization in the property than evident in previous drilling results.

"The current focus on drilling for extensions to the high-grade resource at Alpala is proceeding at pace and the mineralization we are encountering supports this approach,” chief executive Nick Mather said in a statement. “A collateral outcome will of course be a likely increase in the overall resource size.”

The executive also said the early intersection of strong porphyry style veining and strong visible copper sulphide mineralization confirmed Aguinaga as an important second resource target at Cascabel.

SoldGold believes that cluster has the potential to deliver a step-change to the magnitude and value of its Ecuadorian project.

The company stock jumped almost 2.3% in early trading, following the update, and was still up, though only 0.17% to 22.14p at 1:46 PM, London time.

In January, the miner tabled an astonishing maiden resource for Cascabel of 430 million indicated tonnes grading 0.52% copper and 0.43 gram gold per tonne, plus 650 million inferred tonnes grading 0.45% copper and 0.30 gram gold.

Ecuador has gained ground as a mining investment destination in the past two years thanks to a revised regulatory framework and a major investor engagement campaign that has already attracted around 420 applications for concessions in less than a year.

Currently, the nation’s emerging mining sector employs 3,700 people, but the government estimates the figure will rise to about 16,000 in the 2017-2020 period.

The post SolGold on a roll, confirms major copper-gold target at Ecuador project appeared first on MINING.com.

from MINING.com https://ift.tt/2GezInH

LSEV, la première voiture imprimée en 3D, arrivera en 2019

from Les dernières actualités de Futura-Sciences https://ift.tt/2Grl7bY

Un continent de plastique bien plus grand que prévu

from Les dernières actualités de Futura-Sciences https://ift.tt/2GwfPf0

L'étoile de Scholz a frôlé le Soleil et bousculé des comètes il y a 70.000 ans

from Les dernières actualités de Futura-Sciences https://ift.tt/2upPASU

Commentaires sur Comment optimiser la vente de ses bijoux ? par Virginie Renger

Bonjour, j’aimerais savoir combien

La valeurs de cette bague or(diamanter, il y a ecris a l’intérieur 18 k jj

from Commentaires pour Gold.fr https://ift.tt/2G7C63F

L’Homme de Denisova s'est hybridé avec Homo sapiens à deux reprises

from Les dernières actualités de Futura-Sciences https://ift.tt/2pF7QTs

dimanche 25 mars 2018

Indian woman continues fight to repatriate blue diamond

Lalita Shinde, a member of the trust that is in charge of managing operations at the Trimbakeshwar temple in northwestern India, approached her country’s National Archives this week and presented a memorandum demanding the repatriation of the blue Nassak diamond, which reportedly once graced the crown of Lord Shiva idol.

The trustee has been in this quest for a few years now. According to local media, she says that the gem was looted by several rulers some 200 years ago and ended up at a private museum in Lebanon.

Munich, Germany's Reich der Kristalle museum replica of the 1820s Rundell and Bridge recut of the Nassak Diamond. Photo from Wikimedia Commons.

Shinde says she has written letters to former President Pranab Mukherjee, Prime Minister Narendra Modi, Union minister Sushma Swaraj and the Archaeological Survey of India asking them to do something about the lost jewel. Last year, officials from the latter told her that only diplomatic efforts could return the stone to the temple.

The blue Nassak, also called ‘Eye of Lord Shiva,’ is a 43.38-carat diamond that, in the rough, weighed 89 carats. It was supposedly found in the Amaragiri mine located in the Telangana state and originally cut in India. Different sources of information indicate that the diamond was the adornment in the Trimbakeshwar Shiva Temple from 1500 to 1817. The British East India Company allegedly took the gem during the Third Anglo-Maratha War and sold it to British jewellers Rundell and Bridge in 1818. From that moment on, the rare stone has had different owners but has never returned to its birthplace.

“My demand is that the government should get back the diamond from the Lebanon museum as soon as possible,” Shinde told local journalists.

The post Indian woman continues fight to repatriate blue diamond appeared first on MINING.com.

from MINING.com https://ift.tt/2uqAM6D

Squelette Ata : non, ce n'est pas celui d'un extraterrestre

from Les dernières actualités de Futura-Sciences https://ift.tt/2ITfYYy

Protests in India against Vedanta's copper smelter

Local media in India report that hundreds of people gathered in the Tuticorin district, which is located in the southeastern state of Tamil Nadu, to protest against Vedanta’s (LON:VED) Sterlite copper plant.

The protesters were asking authorities and the company to stop expanding the smelter and to shut it down. They say that, for more than two decades, gas emissions and effluents from the facility have been polluting groundwater in the area, all of which has caused an increase in serious diseases among the residents of surrounding villages.

According to the Press Trust of India, many shops in the area remained closed in response to a business strike called by 50 associations in support of the protesters.

The rally took place on Saturday, just one month after 250 people were arrested in the same district for holding a hunger strike against the plant’s expansion.

Activists have been ramping up protest actions as Vedanta’s plan to double the smelter's capacity from 400kt to 800kt p.a in 24 months has just started. “Completion of this project will make the Tuticorin smelter one of the world’s largest single-location copper smelting complexes,” the company has said in corporate statements.

Such expansion goal worries many citizens who still recall that back in 2013, the Tamil Nadu’s Pollution Control Board had to close the plant after a sensor in the smelter’s smokestack showed sulphur dioxide levels were more than double the permitted concentration at the time.

A few days later, India’s Supreme Court allowed the plant to restart operations. However, the company had to pay a fine of over $15 million for polluting the surrounding land and water sources and, according to the press, for running the smelter without approval for a considerable period of time.

MINING.com reached out to Vedanta India for comment on the protesters’ allegations but did not receive a response by publication time.

The post Protests in India against Vedanta's copper smelter appeared first on MINING.com.

from MINING.com https://ift.tt/2GqHZrO

Mexican environment officials visit mine following cyanide spill

Personnel from Mexico’s Federal Attorney’s Office for Environmental Protection visited the San Dimas mine to evaluate the extent of the damage caused by a cyanide spill that reached the nearby Piaxtla river.

San Dimas, located in the northwestern Durango state, is owned by Canada’s Primero Mining (TSX:P). The project consists of five ore blocks contained within a 22,500 hectares contiguous property. San Dimas uses long-hole stoping and mechanized cut-and-fill underground mining methods and all its ore is processed at the closeby Tayoltita mill, which uses conventional crushing/grinding coupled with cyanidation and zinc precipitation for recovery of gold and silver.

The recent spill took place on March 11 and was immediately reported, but only this week were officials able to visit the site. According to the information provided to them by the company, 200 litres of effluent were released into the environment due to an oversight in the closing of the valve of a pipe that carries remnants of cyanide solution. By leaving the valve open, the pipe exhausted its fuel reserves and, since it’s located on sloping terrain, the solution started to leak out until it reached the river.

The solution is said to have traveled some 250 metres downstream, reached a concentration of 100-180 mg/l of cyanide, and killed an undetermined number of fish, most of them juveniles measuring between 1 to 5 centimetres. “In response to the emergency, the company removed the dead fish and implemented a wildlife monitoring program around the Piaxtla river,” the government agency explained in a press release that preceded the visit.

According to local media, the Attorney’s Office now has to file a post-inspection report and, if it deems it necessary, execute an administrative procedure against the miner.

The post Mexican environment officials visit mine following cyanide spill appeared first on MINING.com.

from MINING.com https://ift.tt/2I2snYF

La sixième extinction de masse des animaux est sous-estimée

from Les dernières actualités de Futura-Sciences https://ift.tt/2DSm3kb

Drôle de Tech : le futur du jeu vidéo, un robot Iron Man et un drone qui s’envoie en l’air

from Les dernières actualités de Futura-Sciences https://ift.tt/2pFwcM9

Sidaction : 10 infos méconnues et importantes sur le Sida

from Les dernières actualités de Futura-Sciences https://ift.tt/2pEx43y

Two injured in mine blast in the U.S.

Two people were injured following an explosion that took place Saturday afternoon near the Fred Weber Quarry in Jefferson County, Missouri.

Five people were reportedly at the mine when the incident happened. One of the miners suffered minor injuries while another had to be taken to a nearby hospital. The cause of the blast is still unknown, according to local TV station KMOV.

Officials from the Mine Safety Health Administration are now at the rock quarry and have taken over the investigation. The site is owned and operated by asphalt and aggregate producer Fred Weber Inc.

The post Two injured in mine blast in the U.S. appeared first on MINING.com.

from MINING.com https://ift.tt/2HY7WMD

samedi 24 mars 2018

Quand la biodiversité tombe en dessous du minimum vital

from Les dernières actualités de Futura-Sciences https://ift.tt/2pBx3ht

Ils éliminent le virus du Sida chez des souris

from Les dernières actualités de Futura-Sciences https://ift.tt/2DQbC0D

vendredi 23 mars 2018

B.C. miners halt exploration program to address community concerns

Following a community outcry, Aben Resources (TSX-V: ABN) and Eagle Plains Resources (TSX-V: EPL) decided to suspend their planned drill program at the Chico Gold Project, which is located 125 kilometres east of La Ronge, Saskatchewan.

The program, which consists of 1,200 to 2,000 metres of drilling in some four or five holes at various locations, had all the required permits and started to be conducted on March 9, 2018. However, according to local media, just a week after the campaign started, technical staff were met at the site by a group of trappers from the N-74 fur block who said they were never consulted about the work.

The group’s reaction prompted a meeting between the parties involved, which was held on March 21. At the audience, Aben and Eagle Plains learned that citizens of the community of Pelican Narrows and members of the Peter Ballantyne Cree Nation feel they were not properly informed about the exploration activities.

“Following the meeting a decision was made by Aben and Eagle Plains to suspend the program. Aben may revisit plans to explore the property in the future, following meaningful consultation with the community and PBCN members,” a press release issued by both companies reads.

Management suspects that there was a breakdown in communication at some point beyond their control, so the companies are going to look at ways to enhance their consultation policies.

The Chico property has a 1.5-kilometre mineralized structural corridor which has yielded numerous highly anomalous samples ranging up to 4.5 g/t gold.

The post B.C. miners halt exploration program to address community concerns appeared first on MINING.com.

from MINING.com https://ift.tt/2HZjbnT

Saskatchewan miner launches aggressive exploration program in Ontario

A month after closing the acquisition of Rapier Gold, GFG Resources (TSX-V:GFG) announced the launching of an aggressive exploration program at the Abitibi greenstone belt, which is located west of Timmins, Ontario.

In a press release, the Saskatoon-based company said that the fully funded, C$3 million exploration program will be conducted 30 kilometres west of the Timmins West gold mine and will include airborne and ground geophysics, till sampling, prospecting, mapping, and approximately 8,000 metres of diamond drilling.

According to the firm’s President and CEO, Brian Skanderbeg, this is the first ever systematic, district-scale exploration program in the under-explored portion of the Abitibi greenstone belt. “Our 565-square-kilometre land package has all the geological hallmarks that have led to over 70 million ounces of gold production in the Timmins gold district and the recent multi-million-ounce gold discoveries at Borden Lake and Cote Lake. Our goal in 2018 will be to build a sound structural model utilizing modern exploration techniques to define and prioritize drill targets focused on making a new gold discovery,” Skanderbeg said.

The executive added that the 2018 program is aligned with the overall objective to drill test six to eight priority targets that are prospective for high-grade gold mineralization. He explained that the majority of the campaign and drilling will focus on the Pen Gold project located between Goldcorp’s Borden Lake gold project and Tahoe Resources’ Timmins West gold mine.

A high-resolution helicopter-borne magnetic survey was already conducted over a large portion of Pen Gold property. With the data that the survey provided, the miner will build a property-wide structural model in order to trace the main deformation zones and prospective second-order structures. “These data are crucial to providing context to known occurrences and will identify new structural targets,” the brief reads.

For the Dore Gold project, GFG said that field work and data compilation will be done to better define drill targets for a future drill program.

The post Saskatchewan miner launches aggressive exploration program in Ontario appeared first on MINING.com.

from MINING.com https://ift.tt/2Gjv3E1

Condor Gold raises £2.5 million as 2017 loss narrows

Shares in Condor Gold (LON:CNR) fell more than 2% in London on Friday after the Nicaragua-focused miner announced full year losses, partly offset by lower costs and impairments.

The company, which also said it had raised £2.5 million in a placing of about 5.1 million units to fund the final development stages of a processing plant at its La India gold project, said pre-tax loss dropped to £3 million in 2017 from £7.7 million a year earlier.

Shares in Condor Gold, which has not generated any revenue in the past two years, were down on the news, trading 2.15% lower to 45.5p at 2:55 p.m. GMT

The company highlighted its submission last month of an amended Environmental and Social Impact Assessment (ESIA) for the processing plant at La India, which eliminated the need to resettle about 1,100 people.

The Nicaragua-focused miner has not generated any revenue in the past two years, but narrowed pre-tax loss to £3 million in 2017 from £7.7 million a year earlier.

The new document, part of the company’s application for an environmental permit, included a redesigned open pit, the relocation of the processing plant 1,200 meters from the village and the possible elimination of the southern waste dump, among other changes

Chief executive Mark Child had previously said La India’s permitting progress had been frustrated by administrative delays.

Condor Gold initially staked concessions in Nicaragua, Central America’s largest country, in 2006. Since then, mining has significantly taken off in the country thanks to the arrival of foreign companies with the money and knowledge to tap into its reserves.

According to an independent study published last year, by exploiting just 0.3% of Nicaragua's land area, the mining sector has been able to double gold production and increase silver output by up to seven times in the last 11 years.

Today, gold is the nation’s third largest export, Child said in an interview with MINING.com earlier this year.

Aware of the country's potential, the company has invested $45 million there to date, completed over 70,000 meters of drilling on its flagship La India asset, and produced two PEAs and a PFS.

In addition to permitting a base case, Condor Gold’s strategy is to prove a major gold district of 4 to 5 million ounces of gold.

According to a 2014 prefeasibility study, La India holds an open pit constrained probable gold reserve of 6.9-million tonnes, grading 3 g/t gold for 675,000 ounces of the precious metal, producing 80,000 ounces annually for seven years.

The project contains a mineral resource in the indicated category of 9.6-million tonnes grading 3.5 g/t gold for 1.08-million ounces of the metal and an inferred resource of 8.5-million tonnes grading 4.5 g/t for 1.23-million ounces of gold.

The firm also has three other concessions, where exploration is actively taking place. In November, the team struck it lucky as it discovered another vein on the 313 km² concession package, covering 98% of the historic La India Gold Mining District.

Nicaragua’s gold production is supplemented by small scale artisanal mining of placer and alluvial placer gold, particularly in the regions that form what is known as the “mining triangle”: Siuna, Rosita and Bonanza, where small-scale gold extraction has been the dominant trade since 1880.

The post Condor Gold raises £2.5 million as 2017 loss narrows appeared first on MINING.com.

from MINING.com https://ift.tt/2G5QMMG

Ordinateur quantique : les anyons seraient observables dans le graphène

from Les dernières actualités de Futura-Sciences http://ift.tt/2IL3d28

Companies now looking for electric battery metals in the garbage

Soaring cobalt and lithium prices are not just spurring an exploration frenzy as more and more companies want a piece of the attractive batteries metals pie, but they are also pushing some companies to look for them where others have not.

Australian Neometals (ASX:NMT), which is building a plant to recover raw materials including lithium, cobalt, nickel and copper from expired batteries in Canada, is one of those firms.

The Perth-based miner, which only last week acquired a lithium project near Kalgoorlie, in Western Australia, for $2.5 million, expects to demonstrate that recycling the currently coveted metals from used electric vehicle batteries can be even more profitable than mining them.

Neometals, which is building a plant to recover raw materials including lithium, cobalt, nickel and copper from expired batteries in Canada, is one of them.

“The world needs recycling to stop us drowning in batteries, and it also has the potential to produce components at a lower cost,” chief operating officer Mike Tamlin told Bloomberg. “What we are hoping to prove in the pilot plant is that it does provide a better net margin.”

Neometals is not alone. An increasing number of firms are looking at extracting lithium and cobalt from used mobile phones, laptops and other high tech gadgets.

China’s Tianqi Lithium Industries, which kicked off last year construction of an A$400 million ($310 million) processing plant in Australia and which it aims to open later this year, is also considering research and development work on recycling.

Last month, Samsung SDI, South Korea’s leading battery maker, unveiled plans to do just that and also to develop lithium-ion batteries with minimum content of the metal, or no cobalt at all, as a way to offset soaring prices for the silver-grey commodity.

The company, an affiliate of Samsung Electronics, has already started tweaking the recipe for its electric vehicles (EV) batteries and says is ready to produce one with nickel content above 90%, but that is only 5% cobalt.

And once cobalt supplies from phones stabilize, Samsung SDI said it might follow Toyota Motor and Panasonic in extracting materials from used hybrid electric vehicles.

Taken from Neometals presentation, March 22, 2018.

Cobalt prices went ballistic last year, with the metal quoted on the London Metal Exchange ending 2017 at $75,500 per tonne, a 129% annual surge sparked by intensifying supply fears and an expected demand spike from battery markets.

If anything, prices for the metal are expected to rise even further this year, as the Democratic Republic of Congo, responsible for more than half the world’s supply, recently hiked its taxes and royalties on the metal.

Cobalt demand from the electric vehicles industry is also forecast to grow from to 95,000 tonnes by 2026 from 12,000 tonnes last year, according to consultancy CRU.

BMW, for one, recently said it believes its needs for car-battery raw materials will grow 10-fold by 2025 and that it had been surprised by "just how quickly demand will accelerate".

Recycling the 1.6 billion used mobile phones said to be wasting away in people’s drawers, could provide cobalt to meet demand from millions of electric vehicles, according to Belgium-based Umicore, one of the largest producers of cathodes for electric car batteries.

The post Companies now looking for electric battery metals in the garbage appeared first on MINING.com.

from MINING.com http://ift.tt/2G7jhJP