jeudi 31 mai 2018

Les animaux voient moins de détails que nous

from Les dernières actualités de Futura-Sciences https://ift.tt/2JjbGg8

Moteur à propulsion solide : premier essai pour Ariane 6 et Vega

from Les dernières actualités de Futura-Sciences https://ift.tt/2J46jOx

Mongolia listing boosts investors confidence in Erdene Resource

Shares in Canada’s Erdene Resource (TSX:ERD), one of the very few companies that has successfully navigated Mongolia’s ever-changing policies on foreign mining investment, were off to the races on Thursday after the miner announced it had received approval for a secondary listing on the Mongolian Stock Exchange (MSE).

The Halifax, Nova Scotia-based miner also said it had launched an offering of common shares to Mongolian residents, as well as a concurrent non-brokered private placement, which in combination are expected to raise up to $4.4 million.

The company’s stock was up 4.7% to 34 Canadian cents by 10:25 a.m. ET

More to come…

The post Mongolia listing boosts investors confidence in Erdene Resource appeared first on MINING.com.

from MINING.com https://ift.tt/2H7Rw3o

Emeralds and rubies producer Fura Gems changes look

Canada-listed Fura Gems (TSX-V:FUR), a new gemstone mining and marketing company headed by the former COO of Gemfields (LON:GEM), is changing its brand identity, including logo, tagline and social media.

The company, which began operations a year ago, said the move seeks to strengthen its communication with key stake holders and consumers.

The new logo, it said, was inspired by the Fura and Tena mountains of Colombia, while the colours represent the gemstones Fura mines — vivid green Colombian emeralds and intense red Mozambique rubies.

The new logo. (Image courtesy of Fura Gems via Instagram.)

Fura’s assets are all located in areas known for holding coloured gemstones deposits, including operating mines currently undercapitalized and that need to be modernized.

A good example of those assets, Fura Gems chief executive officer Dev Shetty told MINING.com earlier this year, is the company’s Coscuez emerald mine in Colombia, which it grabbed from Gemfields in October.

Located in the mountainous department of Boyacá, Coscuez is probably one of the best-known emerald deposits in the world, said Shetty, adding it’s known to have produced over 95% of Colombia’s emerald supply in the 1970s.

Fura kicked off initial production at the operation in March, yielding 1,720 carats of emeralds, including 826 carats of top quality ones. The output was obtained through a bulk-sampling program carried out within eight weeks of the completing the acquisition of the mine

In Mozambique, the company hold four licences in the area known as “the ruby belt” and it believes is in position to start mining those assets “very soon.”

The post Emeralds and rubies producer Fura Gems changes look appeared first on MINING.com.

from MINING.com https://ift.tt/2J0ZNvY

Kyrgyz Republic former PM who signed deal with Centerra charged with corruption

Kyrgyz Republic former Prime Minister Sapar Isakov, who last year signed a deal with Centerra Gold ending long-dragged disputes, has now been charged with corruption over a power plant project.

According to the State Committee for National Security, or GKNB, the recently fired politician is being investigated over his role in the overhaul of a power plant in the capital, Bishkek, Eurasianet reported.

Isakov made the decision of settling the government’s differences with Centerra only four days after being appointed as Prime Minister and, allegedly, without the parliament’s approval. In April, he told Kyrgyz Service, a subsidiary of Radio Free Europe and Radio Liberty, that international consultants had told him Kyrgyzstan had no chance of winning in court, so an agreement was the best option for the country.

While Isakov and Centerra called the agreement "strategic", some members of the parliament are saying the pact is rather sketchy as increased Centerra’s annual environmental contributions in exchange for the government dropping a $100 million lawsuit in a local court, the Kyrgyz new agency reported.

It’s believed that the former PM’s charges of corruption may put the pact between the Asian country and the Canadian miner in jeopardy. Centerra had not reply MINING.com’s request for comments on the matter by the time this story was published.

What it is known is that such settlement is currently being reviewed by Prime Minister Muhammedkaliy Abilgaziyev, who was appointed on April 20. Centerra has said it expected to sign it by June 22.

The wide-ranging arrangement would end a long-dragged dispute that crippled investor confidence in the impoverished Central Asian country and prevented Centerra from partaking in any profit from its majority-held and majority-operated Kumtor mine, resulting in the Canadian miner filing for international arbitration.

Other key terms of the deal include a comprehensive settlement and release of all outstanding arbitral and environmental claims, disputes, proceedings and court orders, and releases of the company and its Kyrgyz subsidiaries from future claims covering the same subject matter as the existing environmental claims arising from approved mine activities.

The pact would also provide for the termination of the Kyrgyz court order which, among other things, restricted subsidiary Kumtor Gold Company (KGC) to transfer cash to Centerra.

Under the terms of the settlement, the Kyrgyz government would also acknowledge there would be no future restrictions on the ability of KGC to distribute funds to Centerra.

Further, all restrictions would be lifted on the free movement of KGC's employees.

“While the agreement provides a pathway for the resolution of all outstanding matters affecting the Kumtor Project, there are no assurances that all of the conditions precedent to the completion of the settlement will be satisfied,” Centerra warned last month.

Kumtor, which lies near the Chinese border at an altitude of 4,000 metres, has produced around 11m ounces since inception and remaining reserves are pegged at 5.6m ounces.

The post Kyrgyz Republic former PM who signed deal with Centerra charged with corruption appeared first on MINING.com.

from MINING.com https://ift.tt/2kHbjOB

Record : l'arbre le plus vieux d'Europe pousse en Italie

from Les dernières actualités de Futura-Sciences https://ift.tt/2xu4VDd

Pluton serait-elle un agglomérat d'un milliard de comètes ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2J16Bd1

Un scooter autonome pour entraîner… les voitures autonomes

from Les dernières actualités de Futura-Sciences https://ift.tt/2LJsYBg

Vitamines et compléments alimentaires seraient inutiles

from Les dernières actualités de Futura-Sciences https://ift.tt/2JgjTl8

mercredi 30 mai 2018

Alzheimer : le nombre de cas ne devrait pas exploser

from Les dernières actualités de Futura-Sciences https://ift.tt/2J4O779

Electric vehicles on the road to triple by 2020 — IEA

The number of electric vehicles (EVs) on roads worldwide is set to more than triple by the end of the decade, growing to 13 million from 3.7 million last year, the International Energy Agency (IEA) said Wednesday.

According to Paris-based institution, the total amount of electric cars, including battery-electric, plug-in hybrid electric and fuel cell electric passenger light-duty vehicles, increased by 57% in 2017 from the previous year. And China accounted for 40% of that growth, it said.

The agency said that while sales of those vehicles are expected to increase by 24% each year on average through to 2030 more research, policies and incentives are needed to drive further uptake.

Battery costs remain a major component of the current price tag for EVs, so financial incentives such as rebates, tax breaks or exemptions will be needed to support electric car deployment.

As a result, EA's 22-year outlook leaves plenty of room for fossil fuel-powered vehicles. Forecasts put the world's total car count at roughly 2 billion somewhere in the 2035 to 2040 window.

“Dynamic market uptake of electric vehicles has occurred in recent years,” the IEA said in a report.

“Ongoing support and commitments for increased deployment of EVs from policy makers and the automotive industry suggest that this trend is not going to abate in the coming decade,” it added.

Policies in place today will make China and Europe the biggest adopters, in the IEA's view. In China, credits and subsidies will help EVs grow to account for more than a quarter of the car market by 2030. Meanwhile, tightening emissions standards and high fuel taxes in Europe will boost the vehicles to 23 percent of the market.

More to come…

The post Electric vehicles on the road to triple by 2020 — IEA appeared first on MINING.com.

from MINING.com https://ift.tt/2IUT3j4

Here’s what miners are getting wrong when it comes to digital transformation

While the global mining industry is quickly becoming more digitally mature, that transformation continues to centre on productivity and profitability, rather than a most needed focus on innovation, a new study shows.

According to Ernst & Young’s Digital Mining report, current digital solutions are merely functional or siloed and only address parts of the value chain.

Miners should adopt a progressive, multiyear strategy that also accounts for business risk and the primary drivers of value.

Focusing on productivity and profitability alone is not enough to generate competitive advantage, say the experts, noting that what companies need to do is adopt a more cohesive, end-to-end approach to integrate digital initiatives.

“Mining and metals continues to lag other sectors in the realm of digital effectiveness,” says Paul Mitchell, EY Global Mining & Metals Advisory Leader. “The value from digital will only be realized when companies change how they work, rather than succumbing to the lure of individual technology programs and pursuing local optimization, which is not necessarily transformational.

EY believes the best way for miners to transition their business into the digital age is to introduce a series of transformational waves, namely:

- Digital pre-start: building out connectivity to prepare for digital transformation, which typically involves investment in infrastructure, communications and data.

- Wave 1: activities that focus on the productivity or performance improvement agenda, and are typically operated within a single function. At this stage, digital can enable a mining operation to manage inherent variability and move toward manufacturing levels of productivity.

- Wave 2: these activities are broader and span the whole value chain and include initiatives to better manage margin through interactions with customers and suppliers.

- Wave 3: this stage refers to the rise of disruptive factors that may create significant changes in how the sector operates and may require a step change in business strategy

The report also highlights that, as the level of automation increases through Waves 1-3, mining companies will need to adopt new ways of working, which will likely lead to a shift in workforce demographics and the skillsets required across the sector.

EY’s wave approach to digital transformation. (From report: “Is riding the digital wave key to wiping out your competition?” — EY, May 2018.)

The experts warn miners that market leadership can be lost quickly if dominant players respond slowly or ineffectively to industry disruption and external changes. However, they add, the pathway through the waves of digital transformation should not be viewed as inflexibly sequential or static.

“We see the end-state vision for the mining sector as constantly changing and businesses will need to be ready to adapt and change course as required,” Mitchell says.

And while EY doesn’t believe the sector will see radical disruption, it notes that the opportunity for new entrants to alter the market structure by digitally surpassing existing leaders, poses a real threat.

The post Here’s what miners are getting wrong when it comes to digital transformation appeared first on MINING.com.

from MINING.com https://ift.tt/2JdJr2b

Tesla Model 3 : 975 kilomètres en une seule charge !

from Les dernières actualités de Futura-Sciences https://ift.tt/2kAzY75

The Moment, le premier film contrôlé par la pensée

from Les dernières actualités de Futura-Sciences https://ift.tt/2L6WQXf

Mountain Province finds 95-carat diamond in Canada’s far north

Mountain Province Diamonds (TSX, NASDAQ: MPVD) said Wednesday it had found a 95-carat gem diamond at its Gahcho Kué mine located in Canada’s Northwest Territories.

The white octahedron of "top clarity" is the largest gem quality diamond and fourth largest stone ever recovered from the mine, the company said.

Gahcho Kué, Canada's newest diamond mine and the world’s largest in the last 14 years, is a joint venture between De Beers and Mountain Province Diamonds (TSX:MPVD). It officially opened in September 2016, achieving commercial production last year.

The diamond was included in the fancies and specials parcel acquired by Mountain Province in the most recent Gahcho Kué production split.

It will be shown at the miner’s upcoming rough diamond tender with viewings to be held from June 11 through 22 in Antwerp, Belgium.

Gahcho Kué, co-owned by Mountain Province Diamonds and De Beers Canada, is located at Kennady Lake, about 280 km northeast of Yellowknife. (Image courtesy of De Beers Canada.)

The post Mountain Province finds 95-carat diamond in Canada’s far north appeared first on MINING.com.

from MINING.com https://ift.tt/2LI5Fb5

Spyce, le restaurant dont les cuisiniers sont des robots

from Les dernières actualités de Futura-Sciences https://ift.tt/2sp9vwR

L'astéroïde tueur de dinosaures aurait réchauffé le climat pendant 100.000 ans

from Les dernières actualités de Futura-Sciences https://ift.tt/2xqAXjB

mardi 29 mai 2018

Biggest electric vehicle battery IPO valuation cut in half

Increased demand for battery materials used in electric vehicles and energy storage is what's supposed to reignite interest in the mining sector now that the China-induced supercycle in commodities demand are levelling off.

Prices for lithium and cobalt have soared. Graphite and rare earth prices are making a comeback. Nickel, where EV-related demand is still tiny, has been caught up in the euphoria and longer term the bellwether metal for the industry, may benefit the most.

Mining and EV bulls had their confidence dented on Tuesday however after China's Contemporary Amperex Technology (CATL) slashed the price of shares it's offering to the public by more than half.

CATL, the world's top battery maker ahead of Panasonic-Tesla, said late Monday it plans to sell a 10% stake at 25.14 yuan a share, placing a value of roughly $8.5 billion on the company.

That's down from a goal of about $20 billion the company, based in Ningde in Fujian Province, had late last year. The reduced target is result of a decline in the company’s margins as Beijing scales back subsidies for electric vehicle purchases.

Prices for lithium ion cells have declined on average by around 16% annually since 2014

CATL also blames an unofficial cap imposed by Chinese authorities on price-earnings ratios in IPOs (no more than 23 times) to curb speculation on the country's sometimes wild equity markets. CATL is listing on the ChiNext board of Shenzhen Stock Exchange. Higher raw material input costs for batteries was not mentioned.

CATL, counts carmakers Volkswagen, Renault-Nissan, Hyundai and BMW as customers and is also supplying its cells to a slew of new cars being introduced by global auto majors in China. They include Toyota Motor Corp.’s ix4, a rebadged pure EV developed by its Chinese partner Guangzhou Automobile Group, Hyundai’s plug-in version of the Sonata, as well as the BMW’s 530Le sedan.

In the latest step in its global expansion, CATL opened an office in Yokohama, Japan. The battery maker is also exploring sites in Germany, Hungary and Poland for its first overseas plant and has said a decision on the location could be announced in June.

Simon Moores, Managing Director of Benchmark Mineral Intelligence, says the world's in the midst of a global battery arms race with a roster of new mega-factories coming on line in the next five years.

The research firm, which tracks the battery supply chain and supplies prices for cobalt, lithium and graphite used in EVs, forecasts capacity at megafactories to increase from 112 gigawatt hours last year to 441.5 GWh in 2023.

Prices for lithium ion cells have declined on average by around 16% annually since 2014 according to Benchmark calculations and should fall to $120–130 per kWh this year, bringing the costs of the technology closer to par with internal combustion engines.

While CATL is the biggest manufacturer of batteries when including all electric-vehicle types, Panasonic is the largest maker of batteries for the narrower category of regular-sized electric cars, also known as highway capable passenger electric vehicles, according to Bloomberg New Energy Finance.

(With Bloomberg)

The post Biggest electric vehicle battery IPO valuation cut in half appeared first on MINING.com.

from MINING.com https://ift.tt/2xpxNMX

Spirou, le spectromètre français, a collecté sa première lumière d'étoile

from Les dernières actualités de Futura-Sciences https://ift.tt/2IXXpBX

La plus petite maison du monde construite par des nanorobots

from Les dernières actualités de Futura-Sciences https://ift.tt/2H1spz4

Avanco axes Brazil copper mine production over truck drivers strike

Australia’s Avanco Resources (ASX: AVB) said Tuesday it had suspended plant operations and most mining activities at its Antas copper-gold asset in Brazil, as a result of a crippling nine-day strike that has led to major shortages and disruptions in Latin America’s largest nation.

The company had warned last week that operations at the open pit mine would be affected by the strike, as fuel and consumables failed to be delivered to site, while road blocks on highways prevented sending output to port.

In addition to activities at Antas being scaled back, Avanco also said it had suspended the drilling programme at its Pantera copper project, which it acquired in January from mining giant Vale (NYSE:VALE).

The company noted it had sufficient working capital to continue paying creditors, but said the impact of the strike on operating costs and production guidance for 2018 could be accurately determined at the moment.

Protesting drivers have been blocking roads across the country over a rise in diesel costs from 3.36 reais ($0.92) a litre in January to 3.6 reais ($0.96) before the strike. On May 26, it hit 3.8 reais ($1.02) per litre.

The post Avanco axes Brazil copper mine production over truck drivers strike appeared first on MINING.com.

from MINING.com https://ift.tt/2sin02d

Newmont sells its royalty portfolio to Maverix Metals for $17 million, stake in the junior

Newmont Mining (NYSE:NEM) has agreed to sell its full royalty portfolio to Canada’s Maverix Metals (TSX-V: MMX), a precious metals royalty and streaming junior firm, in a transaction that gives the US miner $17 million cash and a 28%-stake in the Vancouver-based miner.

The Greenwood Village, Colorado-based miner, the only gold company that forms part of the S&P500 index, has a portfolio of 54 precious metals and industrial minerals royalties, including the ones from TMAC Resources’ Hope Bay mine in Canada and Premier Gold’s McCoy Cove project in Nevada.

“Our strategic partnership and equity interest in Maverix generates value for both companies’ shareholders,” Randy Engel, Newmont’s Executive Vice President, Strategic Development, said in the statement. “Maverix’s management team has a strong track record of managing and growing high-quality royalty and streaming assets in favorable mining districts on four continents.”

Upon completion of the sale, Newmont will have 60 million common shares of Maverix, representing an ownership interest about 28%, as well as warrants for an additional 10 million common shares. The latter will be exercisable for five years from the date the Transaction closes at a price of $1.64 (Cdn $2.10) per common share, Maverix Metals said in a separate statement.

Over the past three years, Newmont has built new mines at Merian (in Suriname) and Long Canyon (in the US), and delivered profitable expansions at Tanami and Cripple Creek & Victor, also in the US.

Last year alone, it increased its exploration and advanced projects investments by about 25%, with roughly two-thirds of that amount going to fund more brownfield and greenfield exploration.

More to come…

The post Newmont sells its royalty portfolio to Maverix Metals for $17 million, stake in the junior appeared first on MINING.com.

from MINING.com https://ift.tt/2snUk7h

Main momifiée de bébé : le mystère résolu

from Les dernières actualités de Futura-Sciences https://ift.tt/2xoo2yO

Retour d’échantillons martiens : le scénario est connu dans ses grandes lignes

from Les dernières actualités de Futura-Sciences https://ift.tt/2sfULBo

World’s largest diamond miner De Beers to sell synthetic stones

Anglo American’s De Beers shocked the diamond market on Tuesday by announcing it will start selling jewellery containing man-made diamonds rather than precious stones recovered from the ground, for the first time in its 130-year history.

The historic shift for the world’s No.1 diamond producer, which vowed never to sell synthetic stones, will begin in the US in September. There the lab-made gems will be marketed through Lightbox, a fashion jewellery brand, which will sell them for a fraction of the price of real rocks.

The strategy will create a big price gap between mined and lab diamonds and pressure rivals that specialize in synthesized stones. A 1-carat man-made diamond sells for about $4,000 and a similar natural diamond fetches roughly $8,000. De Beers new lab diamonds will sell for about $800 a carat.

More to come…

The post World’s largest diamond miner De Beers to sell synthetic stones appeared first on MINING.com.

from MINING.com https://ift.tt/2J06MBm

Énergie : des niveaux records grâce à des champs magnétiques élevés ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2xmgYT7

Drones : ce système protège vos doigts des hélices

from Les dernières actualités de Futura-Sciences https://ift.tt/2IWGPCD

Moins de nutriments dans le riz à cause du réchauffement climatique

from Les dernières actualités de Futura-Sciences https://ift.tt/2L1mdJU

lundi 28 mai 2018

Early stage mining projects are located in mining-friendly jurisdictions

Story developed using data from Mining Intelligence. Learn more and schedule a demo.

On average, late stage mining projects (permitting through production stage) are located in regions that are less jurisdictionally attractive according to an analysis by MINING.com comparing property data from Mining Intelligence and the Fraser Institute's Investment Attractiveness Index.

Mining Intelligence tracks around 30,000 properties worldwide at various stages of development. As of May 2018, around 3,500 properties are at the advanced exploration stage, which is the pipeline for future mines.

Mining Intelligence data was paired with data from the Fraser Institute's 2017 annual study of Investment Attractiveness. For the Fraser Institute study, miners are polled on topics such as: how friendly a jurisdiction is to mining; what are the levels of taxation and regulation?; what is the quality of the infrastructure? When the study was run in 2017 the most attractive mining jurisdictions worldwide were the Republic of Ireland at 84% and Finland at 89%. Ranked near the bottom were Venezuela at 36% and Bolivia at 34%.

The Fraser Institute’s Average Investment Attractiveness Measure shows that activity at the earlier stages of a mine life is on average in more attractive mining jurisdictions compared to projects close to or in production.

“This is not a surprise,” says Katja Freitag, Managing Director of Mining Intelligence. “Exploring for and building a mine takes time. During this time, a lot can change that would make a country less attractive jurisdictionally. But once in the late stages of a project, or once a mine is operating, backing out is not always an option”.

The analysis does indicate that exploration efforts in the last few years that feed the future mine pipeline are being undertaken with jurisdictional attractiveness in mind.

“Demand for metals will ultimately determine where supply comes from. And unless a substitute can be found, supply will come from where the deposits are”, says Katja. “Now is the time for companies to invest in understanding and developing strategies that will help them navigate the challenges that make countries jurisdictionally less attractive so exploration can happen where the deposits are”.

Sign up for Mining Intelligence and get rich insights about miners, juniors and projects. Our online tool puts rich data at your fingertips.

The post Early stage mining projects are located in mining-friendly jurisdictions appeared first on MINING.com.

from MINING.com https://ift.tt/2kxUW6S

Vedanta’s troubles worsen as Indian state orders permanent closure of smelter

Authorities from the southern Indian state of Tamil Nadu have ordered the permanent closure of the country’s largest copper smelter, controlled by Vedanta Resources (LON:VED), after a new round of violent protests against the plant ended last week with police killing 13 people.

Locals disapprove the expansion of the group’s Sterlite Copper plant at Thootukudi, in Tamil Nadu, because they blame it of polluting their water and air since the smelter was established in 1996. They believe that enlarging the smelter would cause contamination to hit dangerous levels.

Tuticorin was closed down for about two months in 2013 due to violent protests against the copper plant. An environmental court later ruled the smelter could continue to operate but should take extra steps to prevent pollution.

Deadly protests last week over alleged pollution from the Tuticorin smelter have prolonged a shutdown of the 400,000 tonnes-a-year operation.

Vedanta, India’s largest miner and No. 1 iron ore exporter, has repeatedly said it not only implemented all of the authorities recommendations, but also adopted state-of-the-art technology to improve safety and energy conservation while reducing waste.

But protest continued. In light of last week’s deaths, the Madras High Court had already ordered an indefinite suspension of the plant’s planned extension, commanding an immediate electricity supply cut. The company replied to the measure by warning the shutdown was already causing a copper deficit and increased prices in India.

Vedanta’s shares, which are down more than 25% since the start of the year due to a series of bad news hitting its operations, dropped again Monday following the news and were trading at 728.20 p close to the end of the trading session in London.

The company, which earlier in the year was hit by an iron ore mining ban in its home country and a steel acquisition roadblock, is currently one of the biggest losers among the 10-member S&P BSE India metal index that’s slid 12%.

Chairman and founder Anil Agarwal said Monday Vedanta was a “victim of fake activism”.

“Anti-development associations . . . are time and again raking up the sentiments of the public for their vested interests that have now cost the lives of innocent people,” he told India’s Economic Times. “They wish to destabilise Indian industry.”

Vedanta’s Tuticorin smelter had an annual production capacity of 400,000 tonnes, which would have doubled with the now thwarted expansion plan.

With files from Bloomberg.

The post Vedanta’s troubles worsen as Indian state orders permanent closure of smelter appeared first on MINING.com.

from MINING.com https://ift.tt/2Jc3ONe

Le ruthénium aussi est ferromagnétique !

from Les dernières actualités de Futura-Sciences https://ift.tt/2GWc9zF

Alan Bean, le peintre astronaute, quatrième Homme sur la Lune, est décédé

from Les dernières actualités de Futura-Sciences https://ift.tt/2ITUlqm

Canadian junior Millbrook aims to lead Cuba's mining pack

Canada’s Millbrook Minerals has recently inked an historic deal with Cuban state mining company GeoMinera S.A. to explore and develop three former cobre-zinc-silver-gold producing assets in the country.

The agreement makes the Ontario-based privately held miner the first Canadian firm to sign a deal in Cuba since the mid 90’s. It also establishes it as the first company to sign an International Economic Association agreement (IEA) and one of the only three foreigners in active in the Cuban mining space — with Sherritt International and Trafigura being the other two.

Millbrook’s President Doug Hunter told MINING.com that while the IEA model was formally introduced in the updated Cuban Foreign Investment Law of June 2014, it had not been used used in the Cuban mineral resource space until now.

Millbrook’s focus is to develop three former copper-zinc-gold-silver producers found within the Los Pasos concession — San Fernando, Antonio and Los Cerros mines.

The idea, he says, is to develop a new pipeline of projects that can lead to production and marketing of metals, governed by a joint venture arrangement.

The deal came only four days after Miguel Mario Díaz-Canel Bermudez swore in as Cuba’s new President, the first one in nearly 60 years who is not a Castro.

When assuming in April, Díaz-Canel said he would work to implement a long-term plan laid out by the National Assembly and Communist Party to permit moderate growth of private enterprises such as restaurants and taxis.

But he also said it would leave the economy’s most important sectors – energy, mining, telecommunications, medical services and the production of rum and cigars – in the hands of the state.

“The development of the mining sector is a national economic priority for Cuba and the Los Pasos project is a key part of that strategy,” Gustavo Puentes Pereda, Director General of GeoMinera S.A., said while signing the agreement last month.

Millbrook’s focus is to develop three past producers found within the Los Pasos concession — San Fernando, Antonio and Los Cerros mines— while also advancing the 16 known additional exploration targets. Once and if the commercial viability of the deposits is confirmed, the Canadian miner and GeoMinera will form the agreed joint venture in charge of producing and marketing the metals to be extracted at the Los Pasos project.

Highly prospective, relatively unexplored

Rock sample from Millbrook Minerals’ Los Pasos property in Cuba. (Image courtesy of Millbrook Minerals.)

The asset, explains Hunter, is a highly prospective brownfield belt containing polymetallic volcanogenic massive sulfide ore deposits (VMS), which remains relatively unexplored.

The area correlates with similar Cretaceous volcanic arc rocks in the Dominican Republic, which host the Barrick’s and Goldcorp’s Pueblo Viejo, Perilya’s Cerro de Maimón and other large gold and silver enriched VMS deposits.

Hunter says the Los Pasos concession looks very similar in scale and mine potential to the Abitibi belt in Canada from Val D’Or to Noranda, as was the state of knowledge of Abitibi in the 1920s. That, he adds, opens up significant exploration potential and opportunity for new large-scale discoveries.

Once and if the commercial viability of the deposits is confirmed, Millbrook and Cuba's GeoMinera will form a joint venture.

“Along with our Cuban partners, we chose to focus on the Los Pasos because it’s among the most promising prospects in the country’s mineral resource development and the most advanced in brownfield state in order to get to production as quickly as possible,” adds Alastair McIntyre, who is in charge of Business Development. “Our intention is focus on these projects to understand the economics as quickly as possible.”

For its second exploration phase, Millbrook is targeting a $7-million program that would conclude with a preliminary economic assessment.

Other than the three former mines, which produced copper, zinc, as well as silver and gold, chairman and director Mark Entwistle told MINING.com the Los Pasos Formation hosts a precious metal-rich prospect, Santa Rosa. He also said there were more than 20 other documented mineral occurrences in the area.

Cuba hopes foreign investment will boost its economy, which only managed to climb out of a recession in the first half of 2017.

The country’s mining sector, though rather dormant, is full of potential. The island is the world’s sixth largest nickel producer and one of the top 10 cobalt and nickel mining countries.

It also holds significant deposits of other minerals, oil and over 240 projects hoping to attract capital and be developed, according to the latest report published by the U.S. Geological Survey.

The San Fernando mine (pictured) produced copper and zinc intermittently from 1827 to the late 1950s, when it shut down during the Cuban Revolution. It produced 200,000 tonnes copper-zinc ore from 10 underground levels accessed by a 173-metre shaft. (Image courtesy of Millbrook Minerals.)

The post Canadian junior Millbrook aims to lead Cuba's mining pack appeared first on MINING.com.

from MINING.com https://ift.tt/2JfxjOs

Fortescue goes ahead with $1.3bn iron ore project in Western Australia

Australian iron ore producer Fortescue Metals Group (ASX:FMG) is going ahead with its plans to build a new $1.3 billion mine in the Pilbara region, which will lift the grade of its ores and so satisfy the new demands of its biggest customer, China, which is increasingly asking for higher quality ore for steel mills to help cut smog.

The Eliwana iron ore mine will use the latest technology, including autonomous trucks, and extend Fortescue’s rail line 130km west from Solomon Hub.

The world’s No. 4 iron ore miner said its Eliwana project, the first new mine announced by the company in several years, included developing 143 kilometres of railway and a new dry ore processing facility capable of processing 30 million tonnes annually. It also said it would will use the latest technology, including autonomous trucks.

Production at the mine, the first one Fortescue builds in its so-called Western Hub area, is expected to begin in December 2020. Eliwana is set to yield higher quality ore, closer to the benchmark of 62% iron content, helping the company keep an annual production rate of 170 million tonnes for over 20 years.

“This project allows us to commence the supply of Fortescue Premium product to the market from existing operations in the second half of FY19 with volumes increased as Eliwana ramps up to full production,” Chief Executive Elizabeth Gaines said in the statement.

The project, which will replace the almost depleted Firetail mine, is expected to employ up to 1,900 people during construction and 500 full-time positions once at full tilt.

The post Fortescue goes ahead with $1.3bn iron ore project in Western Australia appeared first on MINING.com.

from MINING.com https://ift.tt/2GUDn9K

Surpoids : mâcher un chewing-gum ferait marcher plus vite

from Les dernières actualités de Futura-Sciences https://ift.tt/2GZdUfc

L’astéroïde 2015 BZ509 vient-il d'un autre système solaire ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2GUrIaN

Australie : la plus grande barrière du monde contre les chats

from Les dernières actualités de Futura-Sciences https://ift.tt/2LCbtmz

Informatique quantique : D-Wave promet des progrès dès cette année

from Les dernières actualités de Futura-Sciences https://ift.tt/2L3FEC6

dimanche 27 mai 2018

Scientists one step closer to producing more efficient lithium-ion batteries

Scientists from the U.S. Department of Energy’s Ames Laboratory discovered a first-of-its-kind copper and graphite combination that, they say, could have implications for improving the energy efficiency of lithium-ion batteries.

The discovery took place after they bombarded graphite in an ultra-high vacuum environment with ions to create surface defects. Copper was then deposited on the ion-bombarded graphite while holding it at elevated temperature, at 600-800 K. The synthetic route created multilayer copper islands that are completely covered by graphene layers.

“Copper is a highly conductive material but susceptible to oxidation. Being able to successfully embed it just underneath the surface of graphite protects the copper, and suggests a number of potential applications, including battery technology,” Research Assistant Ann Lii-Rosales said in a press release.

It took the work of almost a dozen researchers to get to this finding, with Lii-Rosales leading the way and publishing their results in a paper titled “Formation of Multilayer Cu Islands Embedded beneath the Surface of Graphite: Characterization and Fundamental Insights,” which was just published in the Journal of Physical Chemistry C.

In the same media statement, the scientists explained that this research is the continuation of a discovery from last year, when a team at the same lab encapsulated dysprosium, a magnetic rare-earth metal, underneath a single layer of graphene. Encouraged by their success, they began testing the possibilities of the method with other elements, including copper.

“We’re pretty excited by this because we didn’t expect it,” said Pat Thiel, Distinguished Professor of Chemistry and Materials Science and Engineering at Iowa State University, who also works at the Ames Lab. “Copper doesn’t seem to interact strongly or favorably with graphitic materials at all, so this was a big surprise. It really challenges us to understand the reasons and mechanisms involved.”

The post Scientists one step closer to producing more efficient lithium-ion batteries appeared first on MINING.com.

from MINING.com https://ift.tt/2JcfbVA

Gold mine in Oregon “worth building”

US-focused Paramount Gold Nevada (NYSE: PZG) announced this week that results from an independent Pre-Feasibility Study for its 100%-owned Grassy Mountain Gold project show that the operation has the potential to be profitable at a low gold price.

“The base case projects an after-tax Internal Rate of Return of 28% at $1,300 gold and the estimated Net Present Value exceeds $87 million at a 5% discount rate,” the miner stated in a press release.

The Grassy Mountain Gold project is located in Malheur County, Oregon, approximately 22 miles south of Vale. In detail, it is situated in the rolling hills of the high desert region of the far western Snake River Plain.

In the media brief, Paramount explained that the recently obtained PFS confirmed that it would be beneficial to move forward with the company’s plan to open an underground mining operation in the area.

“The PFS clearly shows that Grassy Mountain is a mine worth building. The results demonstrate a low-cost operation that would deliver exceptional cash-flows over its mine life at the current gold price. The scale and simplicity of the proposed operation is one that we are very confident Paramount can build and manage. The PFS also identifies significant opportunities for improving project economics and finding more ore to extend mine life,” Glen Van Treek, the firm’s President and CEO, stated in the document.

The study revealed that Grassy Mountain hosts a measured and indicated resource containing 1.06 million ounces of gold at 0.034 oz/ton (1.17 g/t), plus 3.3 million ounces of silver at 0.107 oz/ton (3.67 g/t).

Proven and probable reserves, on the other hand, contain 362,000 ounces of Au at 0.21 opt (7.20 g/T) plus 516,000 ounces of Ag at 0.30 opt (10.3 g/T);

With these results, annual average production is expected to be of 47,000 ounces of gold and 50,000 ounces of silver for 7.25 years.

Paramount Gold will now work towards acquiring the necessary permits to start production by 2021.

The post Gold mine in Oregon “worth building” appeared first on MINING.com.

from MINING.com https://ift.tt/2L1mKf3

Drôle de Tech : les grandes oreilles d’Alexa, Space Invaders avec le Tesla Roadster et une voiture autonome grillée

from Les dernières actualités de Futura-Sciences https://ift.tt/2J4AGrp

Hundreds protest in Veracruz against mining development

Hundreds of environmentalists, as well as members of religious organizations and Indigenous groups hailing from different communities in the Mexican municipality of Actopan, protested this week against mining development in the eastern Veracruz state.

The protesters issued a press release, held a conference at a church and then marched towards the City Hall with signs where they wrote slogans like “Open-pit mines in Actopan and Alto Lucero use poisonous cyanide” or “We are against the privatization of our water.”

In the statement made public on social media by the Veracruzan Assembly of Environmental Initiatives and Defense, those opposing mining activities said that their traditional ways of interacting with the environment should be respected by national, regional and local government officials. “We demand that they respect our human rights and put a halt, cancel or stop issuing mining permits in the region. These mining concessions affect residents’ individual and collective rights.”

Even though the document does not mention any specific project, local media report that the activists were expressing concerns about the use of cyanide at La Paila mine, part of the Candelaria Mining’s Caballo Blanco gold project.

Caballo Blanco is planned as a heap-leach, open-pit mining operation targeting approximately 100,000 ounces of gold production annually. At the moment, the Canadian miner is just waiting for the Mexican Environmental Authority to review an updated version of their Environmental Impact Assessment.

MINING.com asked Candelaria to comment on the protests but did not receive a response by publication time. However, in a video produced by local news site Primer Párrafo, the firm’s COO Armando Alexandri said that they are trying to engage with the local population by creating a mining forum where experts from both sides can present their cases and find common-ground solutions.

The protesters said that the company is acting unilaterally and plans to start works at the mine in July 2018. They also said they will not allow that to happen.

The post Hundreds protest in Veracruz against mining development appeared first on MINING.com.

from MINING.com https://ift.tt/2IPrxiJ

samedi 26 mai 2018

Science décalée : s’énerver plus pour vivre plus

from Les dernières actualités de Futura-Sciences https://ift.tt/2GShVC9

Notre top 5 de la semaine : sonde chinoise, tueur de lombrics et monstre du Loch Ness

from Les dernières actualités de Futura-Sciences https://ift.tt/2IOmkb2

vendredi 25 mai 2018

Pebble developer craters after copper giant pulls out

Shares in Northern Dynasty Minerals plunged on Friday after the company announced the end of a partnership with fellow Canadian company First Quantum Minerals to develop the controversial Pebble mining project in Alaska.

Vancouver-based Northern Dynasty said on Friday in a terse statement it was unable to reach an agreement on a proposed deal with First Quantum announced in December. Northern Dynasty stock is now worth $228m and has fallen by 77% in value since the agreement was signed. Northern Dynasty's previous partner on the project, Anglo American, dropped out in 2013.

The arrangement would have given a unit of Toronto-based First Quantum an option to earn a 50% interest for $1.5 billion in Pebble in return for $150 million paid over four years to fund permitting for the project, one of the richest copper-gold deposits ever discovered. Shares in First Quantum declined more than 4% on Friday affording the world's seventh largest copper producer a market value of $10.7 billion.

Effectively banned by the US Environmental Protection Agency under President Barack Obama, prospects for the development of Pebble brightened considerably after the election of Donald Trump

Effectively banned by the US Environmental Protection Agency under President Barack Obama, prospects for the development of Pebble brightened considerably after the election of Donald Trump’s and the appointment of Scott Pruitt as head of the EPA, seen as friendly to the extractive industries.

Northern Dynasty reached a key settlement in May last year with the EPA that ended a dispute over the agency’s decision to block construction. It came three months after Alaska’s Department of Natural Resources (DNR) granted Northern Dynasty’s subsidiary — Pebble Limited Partnership — a long-awaited land-use permit. In January, the US Army Corps of Engineers accepted Pebble’s wetlands-fill permit, which is required under the Clean Water Act and is a key authorization in the permitting process.

Earlier this month, opponents disrupted First Quantum’s annual general meeting in Toronto and took out a full-page ad in Canada’s Globe and Mail newspaper vowing to continue fighting the project. Critics have said the Pebble project located in Alaska's Bristol Bay region would harm indigenous communities and the world’s largest sockeye salmon fishery.

Northern Dynasty estimate that the Pebble operations will contribute of $49-$66 million to Alaskan state coffers and create 1,500 to 2,000 direct and indirect jobs.

Pebble's current resource estimate includes 6.5 billion tonnes in the measured and indicated categories containing 57 billion pounds copper, 71 million ounces gold, 3.4 billion lb molybdenum and 345 million oz silver; and 4.5 billion tonnes in the inferred category, containing 25 billion lb copper, 36 million oz gold, 2.2 billion lb molybdenum and 170 million oz silver. Palladium and rhenium also occur in the deposit.

The post Pebble developer craters after copper giant pulls out appeared first on MINING.com.

from MINING.com https://ift.tt/2IOoOX0

Une civilisation du végétal inconnue en Asie du sud-est ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2kr3g8a

Extinction des dinosaures : pourquoi certains oiseaux ont survécu

from Les dernières actualités de Futura-Sciences https://ift.tt/2J67xMs

Grace Follow On : 2 satellites pour surveiller l'eau de la Terre

from Les dernières actualités de Futura-Sciences https://ift.tt/2s8vQ2p

Maladie de Parkinson : les effets des pesticides

from Les dernières actualités de Futura-Sciences https://ift.tt/2xliQf9

The Pad : à Dubaï, un immeuble ultra-connecté inspiré de l'iPod d'Apple

from Les dernières actualités de Futura-Sciences https://ift.tt/2IK49mV

Barbecue : les cancérogènes passent aussi par la peau

from Les dernières actualités de Futura-Sciences https://ift.tt/2s7Q8Jn

Un ver plat envahit les sols

from Les dernières actualités de Futura-Sciences https://ift.tt/2xaIcft

jeudi 24 mai 2018

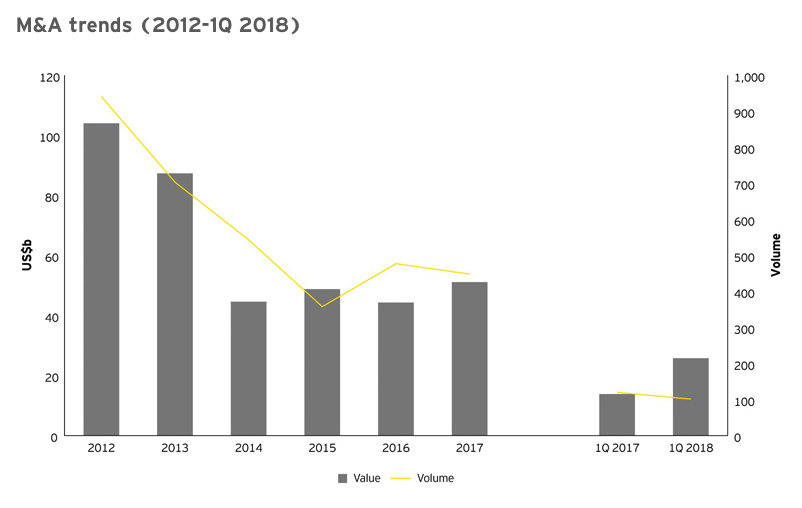

Mergers and acquisitions in Canada stage exceptional comeback in Q1

Canadian miners are definitively back in the mergers and acquisitions (M&A) game, with the value of such transaction hitting $25 billion during the first three months of the year, or 86% more than in the same period of 2017.

Deals involving critical materials for the making of batteries that power electric cars, particularly lithium and cobalt, led the pile.

Critical materials for the making of batteries that power electric cars, particularly lithium and cobalt, led the pile, with the transformational merger between two giant potash producers, PotashCorp and Agrium, being the top example, a study published Thursday by Ernst & Young reveals.

According to the experts, the buzz around new world critical minerals and battery technology, will put deals in lithium, copper and cobalt high on the agenda of management teams across the industry.

"The long-term outlook for copper and nickel remains positive, with prices slated to benefit from the growing adoption of electric vehicles and battery technology," Jay Patel, EY Canada Mining & Metals Transactions Leader said in a statement. "But it is likely that significant price increases won't come into play in the immediate future, as both markets currently face surplus conditions. In the meantime, companies should be actively reviewing their portfolios – keeping a keen eye on minerals and new technologies fit for future growth."

Courtesy of E&Y.

Reflecting the wait-and-see mood prevalent across the industry, activity in other commodities was generally slow to the point that the volume of transactions decreased by 16% to 101 deals in the first quarter of 2018, compared to Q1 2017.

As a result, the Canadian Mining Eye index — which tracks the performance of 100 Toronto Stock Exchange and TSX Venture Exchange mid-tier and junior mining companies — dropped 8% in the three months to March 2018.

Gold is shining

Gold, one of investors traditional choices, performed well in the period, EY says, with prices rising due to geopolitical risks and dollar weakness, offset partially by the recent US Federal Reserve rate hike of 0.25%.

Activity in the gold and coal sectors remained buoyant, representing around 15% of deals value. The bullion sector saw at least four transactions with deal value in excess of $200 million, the study shows, while there were consolidative deals in the coal sector in China, Australia and South Africa.

Courtesy of E&Y.

Assets in low-risk jurisdictions continued to attract more attention, with the exception of deals connected with commodities with limited geographical abundance, such as cobalt in the DRC. Over two-thirds of the transactions by volume were in Canada, Australia, China and South Africa.

The post Mergers and acquisitions in Canada stage exceptional comeback in Q1 appeared first on MINING.com.

from MINING.com https://ift.tt/2x6yGKs

Sibanye-Stillwater accuses union of following ‘agenda’ to harm reputation

Precious metals producer Sibanye-Stillwater (JSE:SGL) (NYSE:SBGL) blasted Thursday comments made by the Association of Mineworkers and Construction Union (AMCU) accusing the company of failing to take precautions two avoid injuries at its mines.

According to the union, a seismic event on May 22 caused a fall of ground at the company’s Ikamva mine, part of Kloof operations, leaving two employees injured. The AMCU also said the previous day a similar incident happened at the Manyano mine, also part of Kloof, where two workers were seriously hurt.

While Sibanye-Stillwater acknowledged the accidents, it said the AMCU’s insinuation that management wilfully put its employees at risk, is part of “a clear agenda” pursued by the union that consist of “… continually making mischievous allegations, and disseminating erroneous and clearly fake information to the media,” which is causing reputational damage for the company.

Chief executive Neal Froneman said the company had confidence in its seismic management systems. The company was “… committed to ensuring a safe working environment for employees and we will not knowingly allow mining to take place where conditions are unsafe” he said.

Safety has become a bone of contention between unions and the company, which has had at least six accidents at its operations this year, some of them with fatal consequences.

Earlier this month, thirteen gold miners were trapped underground at the firm’s Masakhane mine, seven of which died as a result of their injuries.

In February, nearly 1,000 miners got stuck underground for more than 24 hours at Beatrix gold mine, but were found unharmed.

A few days later, two miners died after a section of the Kloof gold operation collapsed. Later that month, another worker lost his life while clearing a blocked ore pass also at the company’s Driefontein gold operation.

South Africa is home to some of the world’s deepest and most dangerous operations. Mine fatalities increased last year for the first time in a decade as companies are having to go deeper in ageing shafts to access additional ore in a country that has been mined commercially for over a century.

The post Sibanye-Stillwater accuses union of following ‘agenda’ to harm reputation appeared first on MINING.com.

from MINING.com https://ift.tt/2IIAWIR

Pourquoi le cerveau de l'Homme est-il si gros ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2LoZokq

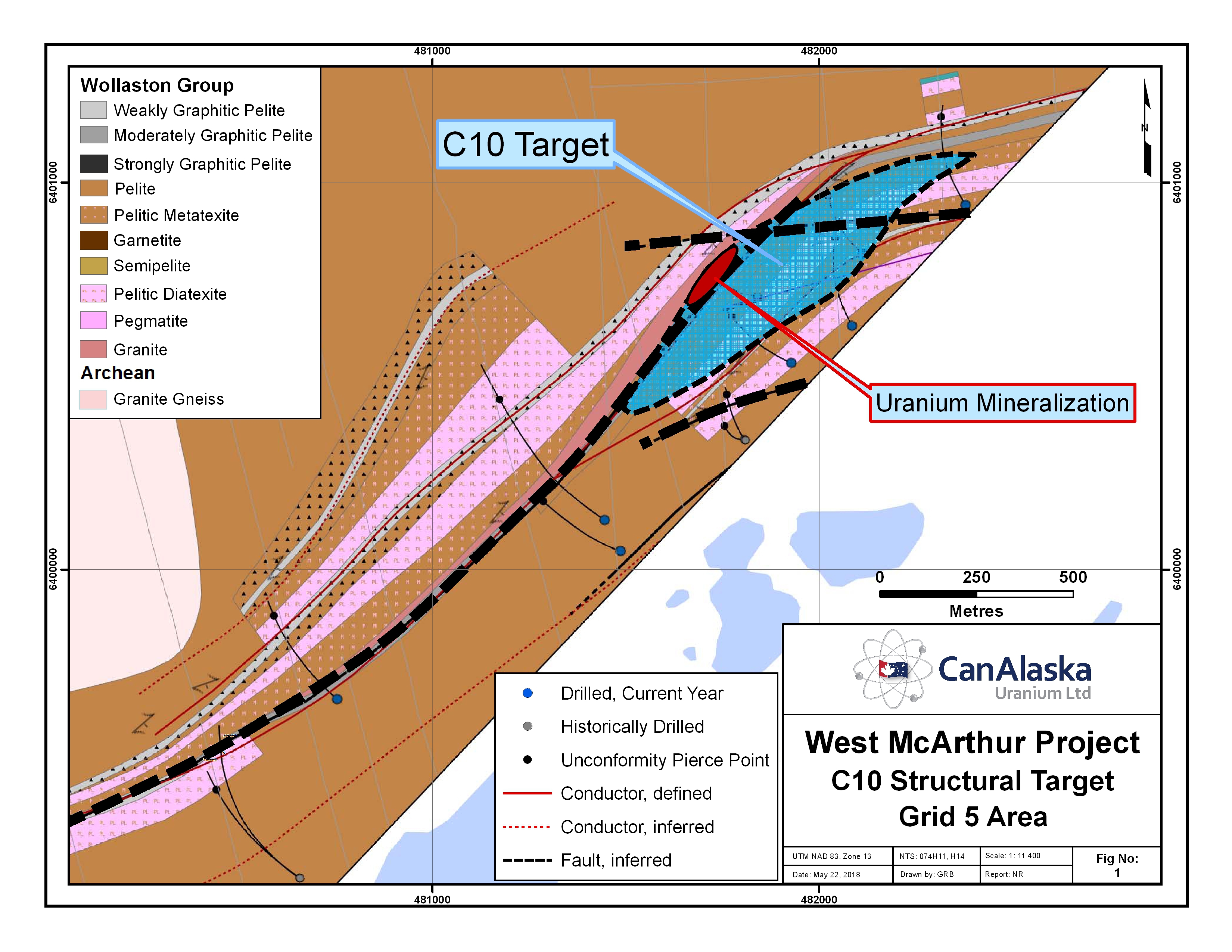

CanAlaska Uranium, Cameco make headway at West McArthur project

Canadian junior miner CanAlaska Uranium (TSX-V:CVV) provided Thursday an update on ongoing summer work at the West McArthur uranium project, being carried by partner Cameco Corporation (TSX: CCO; NYSE: CCJ), the world's top listed uranium producer.

Work at the asset, located immediately next to Cameco's Fox Lake uranium discovery, has been focused on evaluating the C10 corridor, which is highlighted by the NE-striking conductivity high in the southern part of the property, CanAlaska said.

The team has been working around the northeastern part of that corridor, where several ground-defined conductive responses of varying strength were identified and will continue to do so over the summer to explain and locate the conductor, the company said. The activities will allow a better interpretation of the fault location, it noted.

CanAlaska hopes West McArthur, located in the Athabasca Basin in Saskatchewan, turns to be as promising as the neighbouring Fox Lake, which has reported inferred resources of around 68.1 million pounds based on 387,000 tonnes at 7.99% uranium.

(Graphic courtesy of CanAlaska Uranium.)

Cameco is carrying out the current work as part of an option to earn a 60% interest in West McArthur. The company, said partner CanAlaska, plans borehole surveys and a 3D modeling of complex mineralized system at the asset in the coming months.

Since the Canadian uranium giant cut production in January, the International Energy Agency and the World Nuclear Association have been expecting a rise in demand for uranium, though it’s still relatively soft.

Reactors in Japan are still in the process of restarting after the 2011 Fukushima Daiichi nuclear disaster, while Belgium recently announced its intention to phase out nuclear power.

But there’s hope — 55 reactors are currently under construction globally, and China and India continue to lead that charge as both have aggressive growth policies reliant on nuclear power.

Prices for the commodity briefly picked up early this year, they are still hovering around $21 a pound, a far cry from the $60 per pound they hit in 2011.

The post CanAlaska Uranium, Cameco make headway at West McArthur project appeared first on MINING.com.

from MINING.com https://ift.tt/2sbrnMH

World's No. 1 diamond jewellery retailer joins De Beers tracking pilot

The world’s largest diamond jewellery retailer, Signet, has become the first chain to join De Beers' pilot of its end-to-end diamond blockchain program called Tracr, aimed at clearing the supply chain of imposters and conflict minerals.

Signet will work alongside the Tracr team to ensure the platform meets the needs of the jewellery manufacture and retail sectors, with the partnership initially focusing on the tracking of diamond jewellery and expanding the pilot’s scope to cater for smaller-sized goods.

“We are joining the Tracr pilot because we believe the project not only has strong potential to facilitate increased transparency and confidence within the industry, but it can also foster much-needed digital transformation,” Signet Jewelers chief executive, Virginia C. Drosos, said in a statement.

Tracr, expected to launch later this year, gives each diamond a unique ID that stores stones characteristics such as weight, colour and clarity.

Anglo American’s De Beers, the world’s biggest diamond miner by value, has led industry efforts to verify the authenticity of diamonds and ensure they are not from conflict zones where gems may be used to finance violence.

The pilot, announced in January, has an initial focus on large stones, but De Beers will extend its scope with the goal of making it the first industry-wide tracking system.

The blockchain platform is basically a shared database of transactions maintained by a network of computers on the Internet, a technology currently being employed in the bitcoin sector.

Tracr, expected to launch later this year, gives each diamond a unique ID that stores stones characteristics such as weight, colour and clarity. To support the process, the system will also be using stone photos and planned outcome images.

Earlier this month, De Beers announced it had successfully tracked 100 high-value diamonds from miner to retailer using Tracr. The event was the first time a gem’s journey had been digitally-tracked along the supply chain.

Despite the establishment of the Kimberley Process in 2003, aimed at removing those so-called conflict diamonds from the supply chain, experts say trafficking of precious rocks is still ongoing.

De Beers believes the development of a system like Tracr should help solve that problem.

The post World's No. 1 diamond jewellery retailer joins De Beers tracking pilot appeared first on MINING.com.

from MINING.com https://ift.tt/2x8nbC7

Smartphone : le code PIN piraté en filmant les yeux

from Les dernières actualités de Futura-Sciences https://ift.tt/2LtLpcW

Des missiles russes Satan à nouveau convertis en lanceurs ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2J5UWso

Hommes préhistoriques : en Asie du sud-est, une civilisation du végétal ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2IDCWGq

ChatterBaby, l'application qui traduit les pleurs des bébés

from Les dernières actualités de Futura-Sciences https://ift.tt/2s4ZPr6

mercredi 23 mai 2018

Freeport’s Grasberg jujitsu move will pay off

By David Fickling

(Bloomberg Opinion) — There’s a well-thumbed playbook for how deals involving gold mines in the remote jungles of Indonesia are meant to turn out.

The game plan isn’t so different to the plot of the recent Matthew McConaughey film “Gold” – a promise of great wealth turning to ruin with the protagonists ending up brawling in the mud surrounded by fraud, violence and shady political involvement.

For several years, Freeport-McMoRan Inc.’s tussle with Jakarta over the world’s biggest gold deposit and third-biggest copper reserve at Grasberg in the New Guinea highlands has seemed to be headed in a similarly disastrous direction.

Combined with the government’s existing stake and a relatively minor shift in Freeport’s holding, that should be enough to get Jakarta to the 51 percent it wants.

Indonesia’s government has been determined to convert its 9.36 percent stake into majority control, and has used every regulatory trick under the sun to threaten Freeport’s business and bring it to the table at a discount price – from export controls and mining contracts to last-minute environmental reviews.

This wrangle looks to be finally approaching an endgame. Rio Tinto Group is ready to accept a $3.5 billion deal that would transfer its 40 percent interest in the mine to state-owned PT Indonesia Asahan Aluminium, or Inalum, people with knowledge of the discussions told David Stringer and Danielle Bochove of Bloomberg News. Combined with the government’s existing stake and a relatively minor shift in Freeport’s holding, that should be enough to get Jakarta to the 51 percent it wants.

To understand why, look at Grasberg’s shareholder structure. Freeport controls 90.64 percent of the equity, and the Indonesian government the remainder. Rio Tinto’s stake is not in Grasberg itself, but in the project that will expand the underground mines into an operation producing about a billion pounds of copper and a million ounces of gold a year.

In practice, Rio Tinto tends to get almost nothing except for a share of capital expenditure

In practice, Rio Tinto tends to get almost nothing except for a share of capital expenditure – but if output goes over certain levels, it’s entitled to 40 percent of that – and after about 2023 it gets 40 percent regardless of any hurdle levels.

Rio Tinto has made no secret that it’s not wedded to this stake. Chief Executive Officer Jean-Sebastien Jacques has frequently acknowledged that Grasberg is a world-class deposit but not necessarily a world-class business (the former is defined by geology; the latter, by the political and economic risk involved in getting the metal out of the ground).

Having sold out of coal and with hopes to put its run of African scandals behind it, Rio Tinto is busy making itself over (not entirely convincingly) as the ESG play in the mining industry. Converting a politically risky asset targeted by environmental groups and independence fighters into $3.5 billion of cash to shower over Rio’s grateful shareholders seems like a no-brainer.

For Indonesia’s President Joko Widodo, the deal also makes sense. With provincial and presidential elections looming, he’ll have won symbolic control of a prized national asset at a price that looks much closer to the $8 billion equity value Jakarta has been putting out than the higher figures promulgated by Freeport.

What, though, of Freeport? The tiny sum it’s likely to receive for its sliver of equity next to the $3.5 billion going to Rio Tinto feels like a slap in the face, and might undermine the 13 percent run-up in its share price so far this month.

Look further out, though. Grasberg is still one of the world’s most magnificent mineral deposits, producing copper at negative cost as a result of revenues from the gold by-product alongside it.

Mining assets are valued in terms of discounted cash flows, and Grasberg’s current license runs until 2041. In the long term, Freeport retains operational control, and the difference between the 50.64 percent share of cash flows it would have received had it been able to hold its ground and the 49 percent share it will now get looks like a rounding error.

The value of globally unique deposits like this should be measured in decades, not years. By appearing to give way, Freeport has carried out the jujitsu move of finding strength in apparent weakness. A small sacrifice now over equity valuation will pay handsome dividends far into the future.

The post Freeport’s Grasberg jujitsu move will pay off appeared first on MINING.com.

from MINING.com https://ift.tt/2x3aKaJ

Stickman, le robot unijambiste de Disney, joue les trapézistes

from Les dernières actualités de Futura-Sciences https://ift.tt/2KMFCy8

AngloGold Ashanti to axe 2,000 jobs as it shrinks footprint in South Africa

South Africa's AngloGold Ashanti (JSE:ANG) (NYSE:AU), the world’s third-biggest producer of the precious metal, is cutting as many as 2,000 jobs at its domestic operations as part restructuring measures aimed at reducing losses.

The company, which is down to the Mponeng underground gold mine and a tailings treatment operation in its home country, said the measure would affect employees across the different categories and levels, including the region's executive committee and senior management.

After suffering heavy losses in South Africa, the Johannesburg-based miner said last year it would restructure its South African mines, which could lead to 8,500 workers, or around 30% of its workforce, being laid off.

Some of those job cuts were averted through the sale of its Moab Khotsong mine, as well as the Kopanang Mine and the West Gold Plant, both of which were bought for fellow miner Harmony Gold.

The Association of Mineworkers and Construction Union (AMCU) said in the notice given by AngloGold, the miner cited “uncontrollable factors” such as ore body depletion, increasing depths to mine, lower- grades, declining production, mounting electricity and labour costs and increased cost of borrowing capital as the reasons for the retrenchments.

More to come…

The post AngloGold Ashanti to axe 2,000 jobs as it shrinks footprint in South Africa appeared first on MINING.com.

from MINING.com https://ift.tt/2x5VwS9

Pollution étonnante : les déjections d'hippopotames tuent des poissons

from Les dernières actualités de Futura-Sciences https://ift.tt/2khz3by

Rio Tinto about to offload stake in Grasberg mine for $3.5 billion

World’s No.2 miner Rio Tinto (ASX, LON, NYSE: RIO) confirmed Wednesday is ready to sell its stake in the giant Grasberg mine to Indonesia’s state mining holding company Inalum for $3.5 billion, which could mark the end to a long-drawn-out, three-way dispute over the operation, the world’s second largest copper mine.

Discussions with Inalum and miner Freeport were ongoing, Rio Tinto said in a statement, “including as to price,” noting reports of a potential $3.5 billion purchase price.

No agreement had been reached and there was “no certainty that binding agreements will be signed,” it said.

More to come…

The post Rio Tinto about to offload stake in Grasberg mine for $3.5 billion appeared first on MINING.com.

from MINING.com https://ift.tt/2KPJL4f

Après le décès de Pierre Binétruy, la traque des ondes gravitationnelles continue

from Les dernières actualités de Futura-Sciences https://ift.tt/2IGVZja

Des déchets alimentent Perpignan en électricité et en chaleur

from Les dernières actualités de Futura-Sciences https://ift.tt/2IV86IX

Un médicament contre l'eczéma se révèle efficace contre l'asthme

from Les dernières actualités de Futura-Sciences https://ift.tt/2GGaNsA

Intelligence artificielle : des robots apprennent en observant les humains

from Les dernières actualités de Futura-Sciences https://ift.tt/2IFjvgz

mardi 22 mai 2018

Gem Diamonds finds ninth big diamond from Letšeng

Africa-focused Gem Diamonds' (LON:GEMD) has recovered a 115-carat diamond from the Letšeng mine in Lesotho.

The top white colour Type IIa gem was the ninth diamond of over 100 carats the company has found so far this year, exceeding the total number of precious stones over 100 carats dug up in 2017. Those recoveries include a massive 910-carat rock found in januaryu, the world's fifth biggest gem-quality diamond ever found.

Since acquiring Letšeng in 2006, Gem Diamonds has found now five of the 20 largest white gem quality diamonds ever recovered, which makes the mine the world’s highest dollar per carat kimberlite diamond operation.

At an average elevation of 3,100 metres (10,000 feet) above sea level, Letšeng is also one of the world’s highest diamond mines.

The biggest diamond ever found was the 3,106-carat Cullinan, dug near Pretoria, South Africa, in 1905. It was later cut into several stones, including the First Star of Africa and the Second Star of Africa, which are part of Britain's Crown Jewels held in the Tower of London. Lucara’s 1,109-carat Lesedi La Rona was the second-biggest in record, while the 995-carat Excelsior and 969-carat Star of Sierra Leone were the third- and fourth-largest.

The post Gem Diamonds finds ninth big diamond from Letšeng appeared first on MINING.com.

from MINING.com https://ift.tt/2s1Yp0J