mardi 31 juillet 2018

Harley-Davidson : bientôt une moto et un vélo électriques

from Les dernières actualités de Futura-Sciences https://ift.tt/2M4x9HO

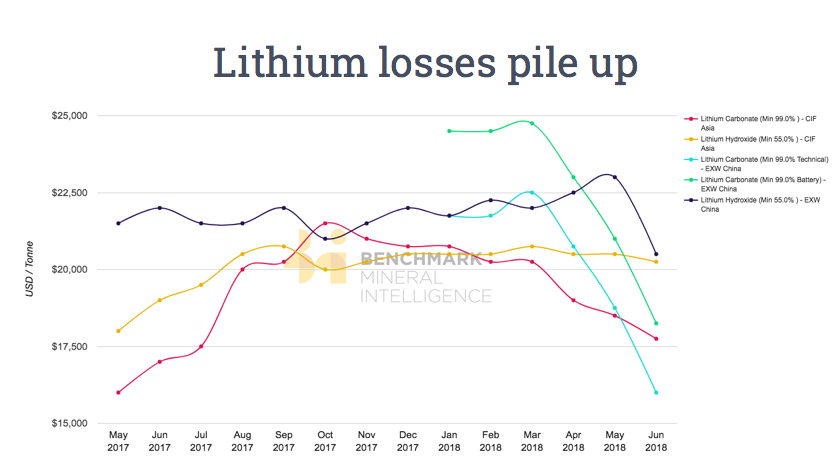

Falling Chinese electric car production wrenches lithium price

Changes to Chinese subsidies for hybrid and battery-powered vehicles – or new energy vehicles in local parlance – announced in February that came into effect mid-June are already having a dramatic impact.

According to data from China's Ministry of Industry and Information Technology, some 64,000 battery-electric vehicles (BEV) rolled off production lines in June 2018, a drop of 16% compared to May. June sales fell by 23% to 63,000 units. Plug-in hybrid sales increased 5% to 22,000.

Chinese BEV production peaked at more than 150,000 units in December last year. Global EV sales topped 1.2m in 2017 with BEVs making up two-thirds of the total and China accounting for more than half the market.

The new subsidy regime has impacted several leading battery producers in China according to the latest lithium research report from industry tracker Benchmark Mineral Intelligence. The country’s Optimum Nano last month announced that it would cease operations for at least the rest of the year while Yinlong New Energy has suspended production at many facilities due to slower sales.

Source: Benchmark Mineral Intelligence

Simon Moores, MD of Benchmark, says declining demand from Chinese battery producers have seen global lithium prices converge.

According to Benchmark data, ex-works prices in China for battery-grade lithium carbonate are down more than 26% since the start of the year to $18,250 a tonne (mid-price) in June.

In contrast FOB export prices from lithium brine operations in Chile and Argentina have been steadily rising since 2016 when prices were stuck below $5,000 a tonne and now trade near par to technical-grade material in China at just below $16,000.

Supply response

“Such a sustained rise, especially for a specialty commodity, is rare,” says Moores, adding that one “cannot have all this activity without a supply response.”

From an estimated 250,000 tonnes this year, global lithium production is set to double within three short years.

“The world’s automakers no longer worry about lithium. Supply is secure out to the mid-2020s,” says Moores.

While the brine majors in South America are expanding capacity (and for as little as $4,000 a tonne), the bulk of new supply will come from hard-rock mines in Western Australia and elsewhere.

Producing lithium from brine is a long and complex process. It's more straight-forward and quicker to build or expand a hard-rock lithium mine, but Moores warns that a spodumene mine does not a lithium operation make. Hard-rock miners and their customers face a long, costly and often bottlenecked chain from ore to battery grade lithium.

Moores expects a build-up of technical and industrial grade lithium inventories. Spodumene (6% concentrate goes for $915 a tonne) is already piling up and as for direct shipping ore, Benchmark research has found no evidence that Chinese processors have used the feedstock to produce battery-grade material that found its way into an electric vehicle.

Solid outlook

But it's early days for the lithium–EV story.

The industry is moving to solid state batteries that will utilize lithium metal. Solid state batteries – still five to seven years away from commercial deployment believes Moores – are safer, 70% more energy dense than lithium-ion and can be shaped.

And the kicker? Solid state batteries require around 20% more lithium says Moores: "There will be no price crash."

The post Falling Chinese electric car production wrenches lithium price appeared first on MINING.com.

from MINING.com https://ift.tt/2mZnaZe

McEwen Mining posts loss on strong investment to grow key assets

Canadian precious metals producer McEwen Mining (TSX, NYSE:MUX) posted Tuesday a $10.6-million net loss for the first half of the year following a $49-million investment in its Gold Bar, Black Fox and Los Azules projects during the period.

Net cash flow from the business, excluding project development costs, came at $18.7 million for the January-June period, and translated into 72,027 ounces of gold and 1,468,083 ounces of silver (91,602oz gold-equivalent oz), it said.

McEwen Mining is targeting commercial production at Gold Bar mine, in central Nevada, by the first quarter of 2019.

The Toronto-based miner expects to generate 128,000 ounces of gold and 3,225,000 ounces of silver (171,000oz Au-eq) this year. The company will include first production from its Gold Bar mine in the US in the first quarter next year. The Nevada-based operation is forecast to add production of 55,000 ounces, 74,000 ounces and 68,000oz ounces gold, respectively, in its first three years of operation.

The gold and silver miner is focused on building the mine’s heap leach pad and installing the crushing and processing facility in 2018’s second quarter. It says all major equipment and bulk materials are either purchased or on-site, and expects to finish construction in late 2018, with production starting in the first quarter of 2019.

Sustained growth

In the last three years, Rob McEwen — one of the gold’s industry’s best-known bulls — has been aggressively working on expanding his company, which already has producing mines in Mexico, Argentina and most recently also in Ontario, Canada.

His goal is to take McEwen Mining to the Standard & Poor's 500 Index, which groups the 500 largest companies that list either in the NYSE or NASDAQ.

Last year, the Canadian resources magnate McEwen told MINING.com he was giving himself two-to-three years to make that happen through a combination of organic growth in production as well as mergers and acquisitions.

Shortly after, it acquired junior exploration company Lexam VG, which gave McEwen access to mineral properties in advanced exploration stage in the heart of Timmins Gold Camp, northern Ontario. In October, it completed the acquisition of Black Fox mine and, by December, it announced it was speeding up exploration activities at its newly acquired properties near Timmins, Ontario.

The post McEwen Mining posts loss on strong investment to grow key assets appeared first on MINING.com.

from MINING.com https://ift.tt/2NZvhAB

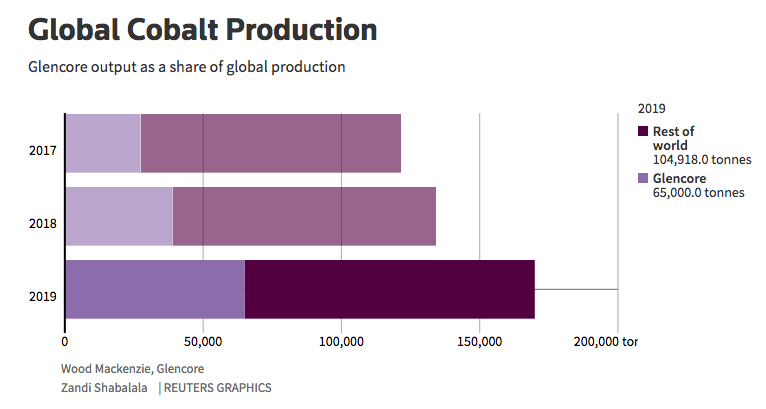

Glencore’s cobalt output up by almost a third thanks to Congo mines

Miner and commodities trader Glencore (LON:GLEN) reported Tuesday higher output from Katanga, its key copper and cobalt mine in the Democratic Republic of Congo.

The Swiss company it produced 696,200 tonnes of copper in the first half of the year, against 642,900 in the previous year, and 16,700 tonnes of cobalt, the key battery material in electric vehicles, up from 12,700 tonnes in the first half of 2017.

Glencore increased cobalt output by almost a third between Jan. and June, thanks to Katanga ramp-up.

Thanks to the ramp up of Katanga, Glencore increased cobalt production by almost a third, 31% to be exact, from January to June this year. The company’s activities in Congo, however, have been overshadowed by a dispute over a contentious mining code signed into law this year as well as a number of probes about possible corruption and money laundering.

In early July, the company revealed it had received a subpoena from by the US Department of Justice (DOJ) to produce documents related to the Foreign Corrupt Practices Act and US money laundering statutes. The records relate to the company’s business in Nigeria, DRC and Venezuela, from 2007 to the present.

The company's stock dropped as much as 13% in London after the subpoena became public, wiping more than 5.5 billion pounds ($7.3 billion) off its market value, or about half the $14.8 billion profit Glencore made last year.

The SOJ request came just weeks after Britain’s Serious Fraud Office said it was preparing a formal bribery probe into the company and its deals with Dan Gertler, Glencore’s former business partner in the DRC, where the firm is the top producer of copper and cobalt.

The news was followed by threats from a group of shareholders about imminent legal action against the company for causing them to lose money.

Source: Reuters.

In other commodities, Glencore said nickel’s first-half output was 21% higher than a year earlier, following expanded output at Koniambo in New Caledonia and a shutdown at Murrin in Australia the year before.

The firm’s total African copper production, including its operations in Zambia, increased by 75% to 194,600 tonnes in the six months to June, though sales of the red metal were down by 32,000 tonnes because of shipment timing,

Shares in the company were trading 3.46% higher to 336.2p by 4:03 p.m. London Time.

The post Glencore’s cobalt output up by almost a third thanks to Congo mines appeared first on MINING.com.

from MINING.com https://ift.tt/2voWJA3

Le scutoïde, cette nouvelle forme géométrique identifiée dans nos cellules

from Les dernières actualités de Futura-Sciences https://ift.tt/2v5gXPZ

Des start-up réinventent trois concepts :gyropode modulable, drone sauveteur et micro-écouteurs multifonctions

from Les dernières actualités de Futura-Sciences https://ift.tt/2M28iUS

Fresnillo soars despite profit drop on Silverstream revaluation

Shares in Mexico-focused precious metals miner Fresnillo (LON:FRES) shoot up almost 5% in afternoon trading in London after it announced a 12% increase in revenue to $1.12 billion in the first half of the year.

The miner, which is the world's largest primary silver producer and Mexico's second largest gold company, also raised its interim dividend by 0.9% to 10.7 cents a share.

Net profit, however, fell 25% due to the impact of a negative revaluation of its Silverstream contract, foreign-exchange headwinds and lower silver prices, it said.

Silverstream valuation had an adverse effect on profit before income tax, which came down 16.6% to $323 million.

Fresnillo booked a $21.8 million valuation loss related to its Silverstream indicator, which monitors total production levels at all of its mines and contributions from advanced development projects. This followed a decision to increase its reference discount rate to be in line with the London Interbank Offered Rate, or Libor.

The miner booked an $11.8 million foreign-exchange loss due to the marginal devaluation of the Mexican peso against the U.S. dollar. This compares to a $3.8 million foreign-exchange gain in the first half of 2017.

Fresnillo lowered its silver production guidance to between 65.5 million ounces and 67.5 million ounces, down from the 67 million to 70 million ounces it had expected before posting second-quarter results last week. It said the downward revision was driven mainly by issues associated with less availability of process water at San Julián.

The company, which floated in London in 2008, is 75% owned by Mexican billionaire Alberto Bailleres. The company’s flagship mine is Saucito, the world’s largest silver operation.

Shares in Fresnillo were still trading higher (4.68% to1,043.5p in London by 3:21 p.m. local time.

The post Fresnillo soars despite profit drop on Silverstream revaluation appeared first on MINING.com.

from MINING.com https://ift.tt/2vlYnlT

Cette IA peut cerner votre personnalité rien qu'en regardant vos yeux

from Les dernières actualités de Futura-Sciences https://ift.tt/2AnX9MK

De Beers ready to begin South Africa’s Voorspoed mine closure

De Beers, the world’s largest rough diamond producer by value, said Tuesday it had decided to proceed with the closure and rehabilitation of its Voorspoed diamond mine in South Africa.

The Anglo American unit, which is currently spending $2 billion on the Venetia underground diamond mining project in Limpopo, said the move followed an extensive disposal process, which involved a rigorous due diligence exercise on the bidders to acquire Voorspoed.

The company concluded there were no suitable potential buyers — company capable of exhibiting a record of success technically, financially, and socially to sustainably operate the mine, located in Kroonstad, Free State.

“We have reluctantly taken the decision to close the operation, in a responsible manner, as it is no longer economically viable for De Beers Consolidated Mines (DBCM) to operate the mine,” Phillip Barton, DBCM chief executive officer, said in the statement.

“We do not underestimate the impact this will have on Voorspoed Mine’s employees and we have put in place appropriate support structures,” he noted.

Diamond exploration in South Africa is at multi-decade lows due to increasing red-tape in the granting of prospecting licenses. De Beers itself, which will be down to a single mine in South Africa after the closure of Voorspoed, has 54 exploration applications stuck with the Department of Mineral Resources, some for two years.

Voorspoed, one of South Africa’s largest diamond mines, is not the only operation De Beers is planning to close. In November, the company announced it was shutting its Victor mine, the first and only commercial diamond operation in the Canadian province of Ontario, in early 2019.

De Beers is also said to have decided to close four mines in Namibia by 2022, Mineworkers Union of Namibia Oranjemund branch chairman, Mbidhi Shavuka, told The Namibian Sun (subs. required) last year.

The post De Beers ready to begin South Africa’s Voorspoed mine closure appeared first on MINING.com.

from MINING.com https://ift.tt/2ACqrrl

Antibiotiques : l’huile essentielle de cannelle contre les bactéries ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2mXtdgP

Des sacs plastiques qui se dissolvent dans l'eau

from Les dernières actualités de Futura-Sciences https://ift.tt/2M4kvZa

Très brillante, Mars est au plus près de la Terre ce soir depuis 15 ans

from Les dernières actualités de Futura-Sciences https://ift.tt/2LCBntT

Un curieux dauphin hybride repéré près d'Hawaï

from Les dernières actualités de Futura-Sciences https://ift.tt/2AxL9sm

Le satellite Tess débute sa chasse aux exoplanètes

from Les dernières actualités de Futura-Sciences https://ift.tt/2KerIUR

lundi 30 juillet 2018

Uniti One : la microvoiture électrique sort sur la route pour la première fois

from Les dernières actualités de Futura-Sciences https://ift.tt/2An8RHG

Lucapa’s mine in Lesotho continues to yield special diamonds

Australia’s Lucapa Diamond (ASX:LOM) announced Monday the recovery of yet another special diamond from its 70 per cent-owned Mothae diamond mine in Lesotho.

The 11.88-carat diamond was recovered from the North zone and, according to Lucapa, it is the first of its kind recovered from that section of the Mothae kimberlite pipe.

In a press release, the miner said that this recovery means that special diamonds can be found in all of the zones sampled at Mothae, the largest one being an 89-carat gem recovered in May from the South-East zone.

“To have already recovered Special sized diamonds from early sampling tonnages in all three of these areas (…) adds to our excitement as we advance construction of our new 150 tph plant, which remains on track for commercial diamond production later this year,” Lucapa Managing Director Stephen Wetherall said in the media statement.

The Mothae kimberlite pipe is located within 5 kilometres of Gem Diamonds’ (LON:GEMD) Letšeng mine, the highest $ per carat kimberlite diamond mine in the world.

In Wetherall’s view, the results from Mothae complement the high-value production from the Lulo mine in Angola, whose output was of 5,058 carats in the second quarter of 2018.

The post Lucapa’s mine in Lesotho continues to yield special diamonds appeared first on MINING.com.

from MINING.com https://ift.tt/2vlsV7s

Russian scientists discover new mineral

An iron meteorite that was found in 2016 in Buryatia, southern Russia, provided the keys for the discovery of a new mineral called ‘uakitite,’ which is associated with sulfides, schreibersite and magnetite.

The discovery was made by researchers from the Ural Federal University, Novosibirsk State University and the Geological Institute at the Siberian Branch of the Russian Academy of Science.

Given that the fragments found in the meteorite were extremely small, the scientists decided to obtain data on its crystal structure by using electron diffraction instead of a traditional X-ray analysis.

They found that temperatures of over 1000 degrees centigrade in the meteorite formed troilite-daubreelite associations, one of whose early minerals is uakitite. “It forms isometric (cubic) crystals (in daubreelite) or rounded grains (in schreibersite). The size of uakitite grains is usually less than 5 μm,” reads an abstract presented by the researchers at the 81st Annual Meeting of the Meteoritical Society.

Structurally, the new mineral is related to carlsbergite CrN and osbornite TiN.

The physical properties of uakitite were difficult to assess due to the tiny sizes of the grains, however, the researchers state that they know it has a yellow and transparent phase with metallic lustre, Mohs hardness is 9-10, it has a light gray colour with a pinky tint in reflected light and its density is calculated 6.128 g/cm3.

The post Russian scientists discover new mineral appeared first on MINING.com.

from MINING.com https://ift.tt/2LFxK6D

Copper price bears shrug $280B China stimulus package

Copper was trading down for a third day on Monday as metal traders in New York shrug off the increasing likelihood of a strike at the world's largest copper mine and the impact of fiscal stimulus in top metal consumer China.

Copper touched $2.76 or $6,080 a tonne on the Comex market, down a stomach churning 17% or $1,270 a tonne since hitting four-year highs early June.

Labour action in Chile and Peru was flagged at the beginning of the year as a catalyst for a higher copper price in 2018, but so far talks have been uncharacteristically smooth, with most agreements reached during early negotiations.

Together with Escondida, the Chilean operations have a capacity of 3m tonnes per year or roughly 15% annual global output

However, a strike at Chile's Escondida, responsible for nearly 5% of primary global copper supply, now looks all but certain. A 44-day strike in February-March last year crippled production at Escondida, which part-owner operator BHP expects will produce more than 1.2m tonnes in 2018.

Reuters reports the union at Escondida is expected to overwhelmingly reject the final contract offer from the Anglo-Australian miner.

Union members have until Wednesday to finish voting on the company's proposal, when the union will conduct an official count. After that, either party can call for a period of government-mediated arbitration that could last as many as 10 days.

"Half our members have voted," said union spokesman Carlos Allendes. "We hope for positive and overwhelming results, with around 80 percent rejecting the offer from Escondida."

Upcoming contract negotiations could also lead to outages at Chile's state-owned Codelco operations which includes the Andina, El Teniente, Salvador, Ministro Hales and Gaby mines and the Caletones smelter.

Together with Escondida, the Chilean operations have a capacity of 3m tonnes per year or roughly 15% annual global output. Chile introduced new labour laws in April last year which most industry analysts consider worker-friendly.

BHP, which owns 57.5% of the mine, has spent nearly $8 billion expanding the mine (including a $3.4bn water plant) in the past five years to maintain output above one million tonnes.

Beijing boost

A week ago Chinese authorities announced a set of measures to ease fiscal and monetary policy conditions in an effort to soften the economic impact of trade tariffs imposed by the US.

The threat of an all-out trade war between the world's largest economies has been the main reason for copper's recent weakness. Copper is seen as a barometer of economic activity given the metal's widespread use in industry and infrastructure. China consumes half the world's copper.

China's State Council will speed up issuance of $200 billion special bonds for local governments to support infrastructure projects this year

Ratings agency Moody's in a research note said Bejing's announcements represent "a significant change towards more accommodative policy" and points out that the measures constitute more than $280 billion in stimulus measures:

In particular, the State Council said it would focus on deeper tax and fee cuts, including by making more companies eligible for additional tax deductions on research and development (R&D) spending. The government expects the latter measure to cut tax by RMB65.0 billion ($9.5 billion) in 2018.

It additionally said it would aim to speed up issuance of a planned RMB1.35 trillion of special bonds for local governments to support infrastructure projects this year and delivery of loans to small businesses through the state financing guarantee fund.

Also on Monday, the PBOC made a record injection of RMB502.0 billion into the financial system via its medium-term lending facility, which provides loans to commercial banks.

Performance enhancing

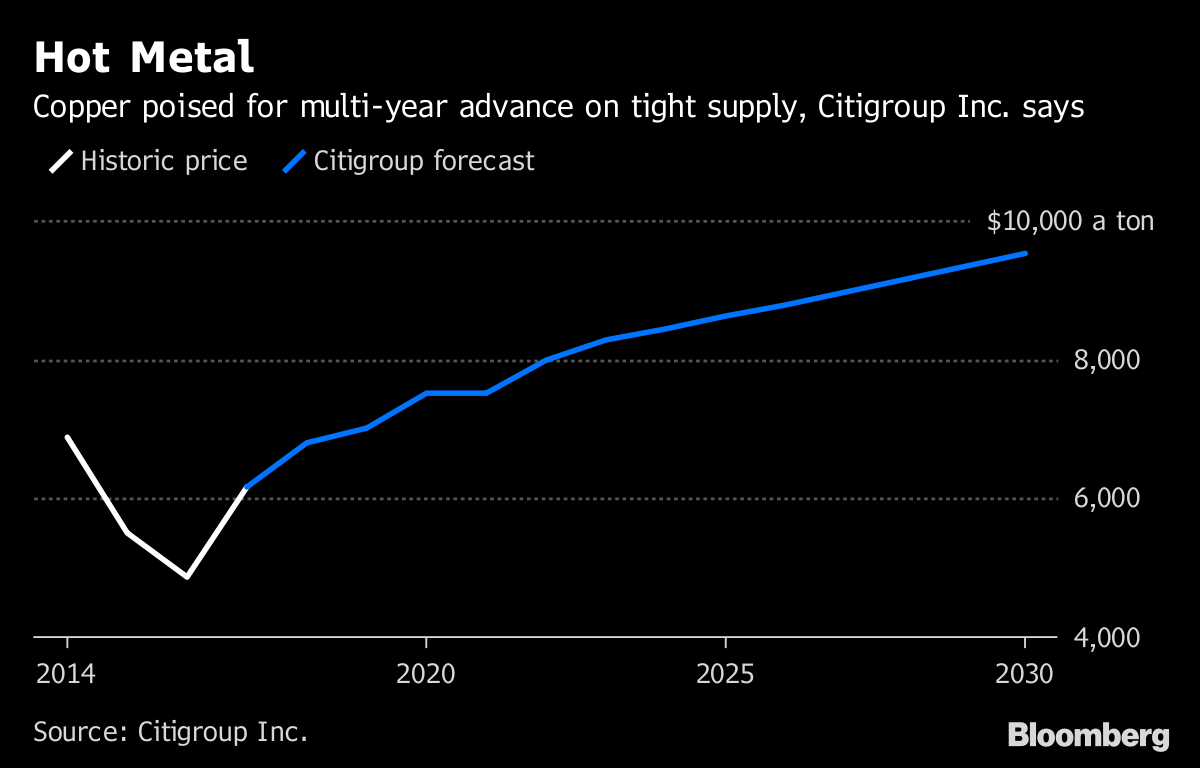

In a recent widely-quoted research note Citigroup argued for a rosy longer term outlook for copper telling investors in the sector to "prepare for a decade of Dr. Copper on steroids”:

“We look beyond the potential trade war to longer-term copper market fundamentals and we find that current prices of $6,200 a ton are nowhere near high enough to enable the market to clear.”

“Copper is set to outperform most other commodities under our coverage over the coming decade on a lack of mine supply growth.”

The bank sees average annual prices at $8,000 a tonne in 2022, passing $9,000 a tonne by 2028 under its baseline scenario according to a Bloomberg report.

Citigroup added a note of caution for the near term in its report, noting that if a full-blown trade war materializes, copper will fall “materially lower before it goes higher again.”

The post Copper price bears shrug $280B China stimulus package appeared first on MINING.com.

from MINING.com https://ift.tt/2LIQ3XR

US State Department sees ‘minimum’ impact from Keystone XL new route

TransCanada Corp. won a small, but important battle Monday after the U.S. State Department released a somewhat positive review for the company’s proposed $8 billion Keystone XL oil pipeline, , predicting “moderate” environmental impacts from its construction and operation.

The alternate route approved by Nebraska regulators is expected to have minor to moderate effects on three of the eight environmental categories the U.S. State Department assessed.

In its 300 page draft report, the department says that some of the most important consequences from the pipe’s alternate route, approved by Nebraska regulators in November, include injuries to wetlands and vegetation, but adds much of the impact will be temporary.

The news sparked environmentalists' outrage. The Sierra Club, for one, accused the US administration of cutting the permitting process short.

“Once again, the Trump administration is attempting to take a shortcut around the legally required review process on Keystone XL, putting our communities at risk for the sake of propping up the Canadian tar sands industry,” Kelly Martin, director of the Sierra Club Beyond Dirty Fuels Campaign said in an emailed statement.

“Keystone XL was a bad idea when it was proposed a decade ago, it was a bad idea when former President Obama rejected it, and it’s an even worse idea now,” Martin noted.

The State Department is expected to open a 30-day public comment period on the draft assessment before making it final.

Primary construction of Keystone XL is expected to start in 2019. Once completed, the pipeline will run about 1,200-mile (1,900-km) from Hardisty, Alberta, to Steele City, Nebraska, carrying crude from the oil-rich, but landlocked Canadian province with U.S. refineries.

The post US State Department sees ‘minimum’ impact from Keystone XL new route appeared first on MINING.com.

from MINING.com https://ift.tt/2AlxXq4

Randgold to revise full-year forecast as readies Tongon mine for restart

Randgold Resources’ (LON:RSS) said Monday it was seeking to restart mining and processing operations at its Tongon gold mine in the Ivory Coast, where production was halted two weeks ago due to a strike.

The Africa-focused gold producer said it has engaged in talks with the interested parties, based on a recently reached agreement with workers leaders, union representatives, local authorities and the government’s mining and labour ministries.

Full-year output forecast revision comes on the back of the latest stoppage at Tongonand the time it will take to bring it back on line and at full tilt.

“Given the ongoing social issues that have intermittently affected the mine’s operations over the past two years, and after the latest work stoppage which halted production two weeks ago, we have engaged with government who have taken measures to secure the assets and are dealing with the situation,” chief executive Mark Bristow said in the statement.

He added the mine had reached an agreement with unions earlier this month, thanks to a government-led process. At the time, the parts committed to work as usual through a negotiation period.

The talks were progressing well until July 13, when unions made new demands that were outside the existing multi-party agreement as well as Ivorian labour law, subsequently abandoning the negotiations and halting the mine’s operations.

“At that stage Tongon was recovering from a stumbling start to the year and was on track to achieve its revised production guidance,” Bristow said.

As a result of the latest stoppage and the time it will take to bring the operation back on line and at full tilt, Randgold said it would have to review its 290,000-ounce gold output forecast for the year.

Tongon, which produced 288,680 ounces of gold last year, was also hit by on-and-off strikes in April.

Two of Randgold's gold mines in neighbouring Mali have also been hit by strikes this year and a long-running dispute with the government over a claim of as much as $200 million in back-taxes.

The post Randgold to revise full-year forecast as readies Tongon mine for restart appeared first on MINING.com.

from MINING.com https://ift.tt/2mTl4Kz

Éclipse de Lune du 27 juillet : les plus belles images

from Les dernières actualités de Futura-Sciences https://ift.tt/2v124hw

Océans : les zones marines sauvages ont quasiment disparu

from Les dernières actualités de Futura-Sciences https://ift.tt/2NWEWb1

Codelco's Chuquicamata copper mine hit by strike, blockage

Unionized workers at Codelco's Chuquicamata copper mine in Chile downed tools on Monday saying they had “exhausted” all instances for dialogue with management.

Access to Chuquicamata, the state miner's second largest copper mine by output, has been blocked since early hours, as unions No. 1, 2, and 3, as well as Antofagasta Union No. 1 demand Codelco to re-hire two workers "unjustified layoff" earlier this year, local radio station Bio Bio reports (in Spanish).

More to come…

The post Codelco's Chuquicamata copper mine hit by strike, blockage appeared first on MINING.com.

from MINING.com https://ift.tt/2Ouhnrl

Virgin Galactic : le SpaceShipTwo Unity réussit son troisième vol d'essai supersonique

from Les dernières actualités de Futura-Sciences https://ift.tt/2OuECl9

Caterpillar soars after record profit, says tariffs will wipe out up to $200M

Shares in Caterpillar (NYSE:CAT), the world's No.1 heavy machinery maker, jumped over 3% in premarket trading Monday after it posted record second quarter earnings per share Monday, while also bumping up its full-year profit forecast.

The Deerfield, Illinois-based company reported an adjusted profit of $2.97 a share in the three months to June 30, compared with $1.49 a share last year. For the whole year, Caterpillar now expects adjusted profit per share to be in a range of $11.00 to $12.00 in 2018, compared with $10.25 to $11.25 projected earlier.

The giant machinery maker, which attributed the positive results to robust global demand for its equipment, also gave a figure to how much tariffs will affect its bottom line. It said it expected them to wipe out between $100 million and $200 million in the second half of the year, so would it would to offset the hit by raising prices.

The estimate comes after the US administration slapped tariffs on $34 billion of Chinese goods earlier this month. The country has also implemented tariffs on steel and aluminum imports from Mexico, Canada and the European Union. They have retaliated against those levies with tariffs of their own.

More to come…

The post Caterpillar soars after record profit, says tariffs will wipe out up to $200M appeared first on MINING.com.

from MINING.com https://ift.tt/2v2o0c9

Sibérie : des vers ressuscitent du sol gelé après 42.000 ans

from Les dernières actualités de Futura-Sciences https://ift.tt/2LL0nhT

SpaceX veut récupérer la coiffe du Falcon 9 mais il n'y arrive pas

from Les dernières actualités de Futura-Sciences https://ift.tt/2LyU3uG

L'ordinateur quantique de Feynman avec des ions arrive en chimie

from Les dernières actualités de Futura-Sciences https://ift.tt/2LxTlOc

dimanche 29 juillet 2018

Des sacs plastique biodégradables faits à partir de calcaire

from Les dernières actualités de Futura-Sciences https://ift.tt/2LXWRgN

Environmentalists worried about prospecting in New Zealand’s South Island

Environmentalists in New Zealand are expressing concerns about the possibility of government accepting applications to prospect for minerals on conservation land across the Nelson and Marlborough regions.

Interviewed by the news site Stuff, a representative for the Royal Forest and Bird Protection Society of New Zealand said that the government is creating “concerning expectations,” especially for foreign companies, with its decision to lift a three-year moratorium for prospecting permits on 7,828 square kilometres across the areas located on the northern part of the South Island.

The permits would allow miners to carry out to low-impact activities such as aerial surveys, geological mapping and hand sampling in areas within the Mount Richmond Forest Park, which is situated on an ultramafic mineral belt that has unusual geology and provides habitat for a number of threatened species. Exploration would also be allowed at the Kahurangi and Nelson Lakes national parks and the Howard Conservation area.

But for Debs Martin, the representative for the Society, opening up that possibility is ‘crazy’ and a total contradiction of a statement made by Prime Minister Jacinda Ardern back in November saying that there would be no new mines on conservation land.

Approached by Stuff, Conservation Minister Eugenie Sage said that the timing of the moratorium ending was "unfortunate," but she added that a prospecting permit issued by the Petroleum and Minerals division of the Ministry of Business, Innovation and Employment does not guarantee that her office would grant access to conservation land.

The post Environmentalists worried about prospecting in New Zealand’s South Island appeared first on MINING.com.

from MINING.com https://ift.tt/2mTC17C

India’s state-owned miner to start digging for local gold

India’s National Mineral Development Corporation beat giants Adani and Vedanta in an e-auction for a gold mine located in the Chittoor district of the southeastern state of Andhra Pradesh.

According to the Press Trust of India, this is the first time the state-owned company takes on gold mining in the country.

The Chittoor mine site is called Chigargunta-Bisanatham and it extends for 263.01 hectares. Government officials told the news agency that it has estimated reserves of 1.83 million tonnes containing 5.15 grams of gold per tonne.

Chigargunta-Bisanatham will be an underground mine and it would mark the first time the NMDC develops this type of operation. First production is expected two years after the permitting process is done.

Initial investment is estimated about $4.5 billion. India’s federal government would get 38.25 per cent revenue on sale value.

In recent years, the Mineral Corporation has been focusing efforts on gold mining. It is currently developing the Bulyang Ombe gold mine in central Tanzania and at the same time its Australian subsidiary, Legacy Iron Ore, is exploring as many as 17 gold tenements in the Western Australian region.

The post India’s state-owned miner to start digging for local gold appeared first on MINING.com.

from MINING.com https://ift.tt/2OmjqO5

Science décalée : l’homme qui faisait de la bière dans ses intestins

from Les dernières actualités de Futura-Sciences https://ift.tt/2Or0PAg

Pebble’s Draft Environmental Impact Statement to be ready in January

The U.S. Army Corps of Engineers announced that a Draft Environmental Impact Statement for Northern Dynasty Minerals’ (TSX: NDM) Pebble mine will be completed in January 2019.

During a press conference held this week at its Alaska division, representatives for the Corps said that the document will be open for public comment for 90 days rather than the usual 45 days.

Prior to this, a “scoping report” will be published in August 2018. The report is a compilation of the 175,000 comments gathered during the Draft Environmental Impact Statement scoping sessions that ended June 29.

Right before the scoping sessions were finalized, Alaska Governor Bill Walker asked the Army Corps to suspend the process. He said that, as it stands today, Pebble is not a “feasible and realistic” project.

However, the Corps was unable to comply with his request because Pebble Partnership, the subsidiary of Vancouver-based Northern Dynasty that is making the proposal for the mine, has not submitted a feasibility study or evidence that the project is viable.

Shane McCoy, the Army Corps’ Alaska district Pebble program manager, explained in this week’s media event that a demonstration of economic feasibility is not a requirement of the National Environmental Policy Act, which focuses on the environmental effects of a proposed action.

McCoy also said that once an Environmental Impact Statement process is launched it cannot be suspended unless that is asked for by the proponent or if the company is unable to supply additional information requested by the Corps.

Pebble is the world’s biggest undeveloped copper-gold-molybdenum porphyry deposit. It is located in Alaska’s Bristol Bay region, which also hosts the largest sockeye salmon fishery on the planet.

Given its location, Pebble has drawn opposition from environmentalists, some native groups and fishers. Their strong stands led operators to redesign the project by reducing its development footprint by less than half the size previously envisaged, banning the use of cyanide, and restricting primary activities in the Upper Talarik watershed, among other measures.

Within this context, the approval process for the project has been dragging on for over a decade.

By 2020, however, Pebble should be getting a Record of Decision clearing the way for federal permits to be issued, McCoy said.

Such schedule is based on the current plan laid out by Pebble, considering it has not yet filed applications for state permits.

The post Pebble’s Draft Environmental Impact Statement to be ready in January appeared first on MINING.com.

from MINING.com https://ift.tt/2mQxLWn

Selling autonomous trucks moves from push to pull: Caterpilllar

Autonomous trucks are no longer an up-sell, says Caterpillar's Craig Watkins, commercial manager for a surface mining technology.

The technology has gained traction and customers are asking for them, said Watkins during an interview with MINING.com at the CIM Convention 2018 held this past May.

"One of the key changes that's happened over the last year or so is that we have gone from a push scenario where we've been trying to educate the industry of the value and the benefit of automated hauling solutions," says Watkins.

"We’ve crested that hill and we're starting to get a lot of pull. [Customers] are getting a better grip on the economics of it, and so they're starting to pull hard."

Interview was edited for clarity:

Caterpillar's Craig Watkins, commercial manager for a surface mining technology

MINING.com: Can you tell me about the state of autonomous trucks at Caterpillar?

Craig Watkins: Velocity. The momentum is growing very rapidly right now. One of the key changes that's happened over the last year or so is that we have gone from a push scenario where we've been trying to educate the industry on the value and benefit of automated hauling solutions and now we’ve crested that hill a little bit and we're starting to get a lot of pull. People are understanding the benefits. They’re seeing what other companies are realizing in terms of benefits. They’re getting a little bit of a better grip on the economics, and they're starting to pull hard.

MINING.com: What are the benefits? What are companies seeing?

Craig Watkins: Utilization. You get a lot more utilization out of the equipment, on average about two and a half hour per day of increased utilization. That’s not necessarily unique to us. How much more am I going to produce because of automation? It’s not only more but consistency in production. When you remove variation you become more predictable. You don’t have to have spare trucks, an extra digger or wheel loader on standby. You can optimize your capital.

MINING.com: Have the benefits changed in the minds of the customer? Safety used to the main driver.

Craig Watkins: No, safety is still one of the major benefits. Safety comes with it because you’re removing people from the environment and exposure to heavy equipment. You can’t have a safety incident when you have no people involved. The safety aspect is table stakes. It’s just a requirement and it always has been.

The safety aspect is table stakes. It’s just a requirement and it always has been.

Back in the day safety was the benefit that you got. We’ve matured now. In addition to safety we’re driving faster than the average-staffed fleet. We’re moving more material, and [the equipment is] being utilized more. That safety factor has always been there. It's improved in the sense that one of the metrics that we keep track of is how many people per truck it takes to staff. If you think about a manually-operated truck, you need about four-and-a-half people. That’s the metric that we’ve used to help articulate not only the safety component but also the economics behind labour. Within the last month we've dropped below 0.8 people per truck. Where you once had a truck operator you now have a controller, a builder, a pit tech and somebody taking care of the wireless infrastructure. We've gone from four and a half people to 0.8 people. [Mines with automation] are starting to look at shifts differently. People now have a little bit more family and life balance.

You now get a [change to the] workforce. More people are getting higher education. Fewer people want to operate a mechanical piece of equipment for 12-hours a day. So the migration to automation is in line with the education level that people are attaining, and I think that fundamental change is underway. Every one of us needs to be more productive and produce more so we can have a better quality of life.

As automation [gains more market penetration], standard considerations for mine planning changes. What size diggers do I need? What size trucks do I need? What is the haul road layout going to be? What’s is the ore profile?

One of the components that [miners are considering] is: do I have manually-operated equipment or do I have automated equipment? Do I start a migration from manual to automated? A lot of activity we have underway is at greenfield sites that are two- or three-years out. At brownfield operations it is a little bit different, because we have equipment that is at its half-life or mid-life. The equipment isn't current models, but operators still want to automate them. We got a lot of pull in both of those types of operations. The 793D, for example, is not necessarily autonomy-ready, but we have a lot of market pull to automate it. There’s a lot of customers that operate these models and are still going to have him for a few years.

Rollin' without a driver. Photo courtesy of Caterpillar.

MINING.com: Are there late adopters and early adopters for mine automation?

Craig Watkins: Western Australia and iron ore mining is the leader. That's where all the development has been. The oil sands have been really heating up, and we’re also working on deep pit operations. There's a new challenge with every one of those. With the oil sands you deal with tree roots and spring thaw. It's different dynamics with bigger trucks. That stuff is not too bad for us to figure out and overcome. It’s more around understanding what's a rut and what’s an obstacle. The strongest emerging pull right now is the oil sands. Deep pit in South America is also really starting to pull hard.

The strongest emerging pull right now is the oil sands. Deep pit in South America is also really starting to pull hard. We've got to address the positioning challenge [with underground]. When you use satellite-based positioning and you get into deep pit environments, you can mask a lot of the satellites. A lot of our energy and investments is in making sure this equipment all has solid positioning all the time, no matter the condition. We’ve evolved through the years where we just aren’t reliant on satellites to help us understand where we are. That reduces our reliance on the infrastructure and it further increases the availability of the equipment or the utilization of it. That’s where the pull is. We are now putting strategies in place to automate the entire hauling fleet and develop a roadmap.

No drivers in the autonomous truck and remotely controlled dozer. Photo courtesy of Caterpillar.

MINING.com: What changes are you seeing at mines now that there is more autonomy?

Craig Watkins: The journey is just starting. At green fields miners are starting to think about strip ratio and building roads: "Can we build narrower roads? My roads are costing me a million dollars per kilometer. Can I get a little tighter when building the new road?"

We did a massive project that almost lasted us a whole year last year with a big multinational miner where they came to us and asked us to help build their new mine. We had representatives from the drill product group, the truck product group and then some supporting teams and data analytics all working through their mine plan and design. In an environment where its normally "400-tonne trucks, rope shovels and git'r done", we've shifted the paradigm. We showed them the benefit of going with much smaller trucks. The mine is still a few years out. We will see where we end up on that one but that will be a big success story. That will be the first example of where we all went in together and we completely wiped the canvas clean and said here’s the capability we have and here’s the capability we know we will have by this time so lets design and build the mine around that.

MINING.com: Are the vehicles going to be changing their configuration now there won’t be humans in them?

Craig Watkins: No, not yet. I don't think the markets ready. We are reducing the weight on trucks, but the cabs are not leaving the vehicles just yet.

MINING.com: If automation is coming to mines, what’s the human resources challenge? Who are the people mines must hire? What is the skill set?

Craig Watkins: The best people you can get are those with operational experience. People who have gotten their boots on the ground, seen the interactions and understand the environment.The best people you can get are those with operational experience. People who have gotten their boots on the ground, seen the interactions and understand the environment.

They seem to be the strongest resources you can get. We try and up-skill a lot of equipment operators. It's not like people are coming out of school with an education in fleet management systems or in automated haulage systems. You've really got to focus on the application then look at the individual talents to try and bring the right people in. I think everybody is kind of experimenting a fair bit. Then you've got the social license to operate. You need to manage all that. The community has got to be involved in the whole process. There haven’t been any real show stoppers for us. You know if we can all be at home with our families and still do our jobs then there is a lot more pull for that. I don’t think people like spending time away as much as they used.

Creative Commons image of push and pull handle courtesy of Alan Levine

The post Selling autonomous trucks moves from push to pull: Caterpilllar appeared first on MINING.com.

from MINING.com https://ift.tt/2mTbHKQ

Drôle de Tech : un drone ramollo, un robot centaure et les oreillettes de M. Spock

from Les dernières actualités de Futura-Sciences https://ift.tt/2NTl1cS

samedi 28 juillet 2018

Vous vous endormez au volant ? La faute aux vibrations naturelles de la voiture

from Les dernières actualités de Futura-Sciences https://ift.tt/2mQQhOc

vendredi 27 juillet 2018

Workers at First Quantum's mine in Spain go on strike

Spanish media report that 85 per cent of the 800 workers at First Quantum Mineral's Cobre Las Cruces mine in Spain went on strike in demand for the payment of 'toxic bonuses' (hazard pay) for subcontractors.

What they call 'toxic bonuses' are additional payments for work that is particularly risky.

According to EFE news agency, the spokesperson for the Comisiones Obreras union, Juan Antonio Caravaca, said the strike began early on Friday and no major incidents were reported except for the detention of some administrative staff along the road that leads to the mine.

The protest action, which on Friday was accompanied by a picket line at the entrance of the mine, is supposed to last for four days and is to be joined by both permanent staff and the workers of at least eight subcontractor companies.

MINING.com reached out to First Quantum Minerals for comment but did not receive an answer by publication time.

Cobre Las Cruces, operated by a local subsidiary of FQM, is a copper mining complex with an open pit mine and hydrometallurgical processing plant.

The 946-hectare site straddles the municipalities of Gerena, Guillena and Salteras, located in the southern Spanish province of Seville, and it sits on top of the Iberian Pyrite Belt. Reserves are estimated at 17.6 million tonnes of ore grading 6.2% copper.

According to the company's website, expected annual production averages 72,000 tonnes of copper, equivalent to 25% of Spanish internal demand.

The post Workers at First Quantum's mine in Spain go on strike appeared first on MINING.com.

from MINING.com https://ift.tt/2OrX4uC

CAT sales in the oil and gas industry grow

Caterpillar (NYSE:CAT), the world's No.1 heavy machinery maker, announced today that its worldwide machine retail sales rose 25 per cent Y/Y for the rolling three-month period ending in June.

The positive results were driven by the company’s energy and transportation retail sales, which grew 14 per cent in the latest rolling three-month period. Such hike was mostly driven by a 30 per cent increase in sales in the oil and gas sector, a major consumer of reciprocating engines, turbines, diesel-electric locomotives, among other products. In the same segment, power generation sales grew by 12 per cent.

Sales in the mining sector, however, showed a decrease. In a statement, the Illinois-based firm reported declines of 4 per cent in the industrial segment, a consumer of equipment such as electric rope shovels, draglines, large wheel loaders, mining trucks, rotary drills, etc.

In terms of regions, CAT indicated that sales in the Asia Pacific region surged 37 per cent during the period, 29 per cent for Latin America, 22 per cent for North America and 19 per cent for Europe and the Middle East.

The post CAT sales in the oil and gas industry grow appeared first on MINING.com.

from MINING.com https://ift.tt/2K3HJwN

South African diamond fetches half a million dollars

A 42.26-carat diamond recovered by Canadian junior Tango Mining (TSXV: TGV) fetched almost half a million dollars at the Kimberley Diamond Exchange, the company announced today.

In detail, the gem was sold on tender for $11,267 per carat.

The unnamed diamond was recovered from run of mine gravel at the company’s Oena mine, an 8,800-hectare operation located on the lower Orange River, Northern Cape Province, South Africa.

According to Tango, Oena is known for producing high quality and large sized diamonds, the largest one weighing 79 carats. Since the company acquired the mine via the purchase of a controlling interest in African Star, the site has yielded 2019 carats, including production from both ROM material as well as pan tailings and bantam material.

In a press release, the Vancouver-based miner said that Oena diamonds have been sold at an average price of $1,290 per carat.

The post South African diamond fetches half a million dollars appeared first on MINING.com.

from MINING.com https://ift.tt/2mQ8xYk

An 85.7 gram gold nugget found in Scotland

An amateur prospector working an unnamed Scottish river has found a huge gold nugget, says the Guardian.

At 85.7g (3.02oz), the nugget is believed to be the UK's largest. The prospector, who asked to remain anonymous, found the nugget nearly two years ago in a river. The exact location is not identified for fear it could be over run.

The prospector found the nugget by lying in the river and using a snorkel.

"I was following a crack in the bedrock and found around 2g in fine gold,” the unidentified prospector told the Guardian.

“This then led to a pocket, where I uncovered the nugget. I called over my friend to have a look and we both assumed it to be around 5-7g in weight. It wasn’t until I removed it that we realised just how big it was."

Read the full story at the Guardian.

The post An 85.7 gram gold nugget found in Scotland appeared first on MINING.com.

from MINING.com https://ift.tt/2LNLw6w

Anglo American approves $5 billion copper project in Peru

The Quellaveco copper project, 60% owned by Anglo American and 40% by Mitsubishi, in Peru was approved yesterday.

The estimated capital cost ranges between $5.0 to $5.3 billion.

The company expects a post tax IRR of greater than 15% with a four-year payback and an EBITDA margin of more than 50%.

The company believes it can expand Quellaveco beyond its current 30-year reserve life as well as to increase throughput above the initial capacity of 127,500 tonnes per day.

First production of copper is expected in 2022, ramping up to full production in 2023. During the first ten years of full production Quellaveco is expected to produce approximately 300,000 tonnes per year at a cash cost of $1.05 per pound of copper.

Written with material from Anglo American's news release.

The post Anglo American approves $5 billion copper project in Peru appeared first on MINING.com.

from MINING.com https://ift.tt/2LQrlkT

Une étoile aurait semé la pagaille aux confins du Système solaire

from Les dernières actualités de Futura-Sciences https://ift.tt/2LIXHRG

Test de QI : l'Assistant Google fait mieux qu'Alexa, Cortana et Siri

from Les dernières actualités de Futura-Sciences https://ift.tt/2Af7F98

Burton Richter, l'un des découvreurs du quark charmé, est décédé

from Les dernières actualités de Futura-Sciences https://ift.tt/2AhraxS

Éclipse totale de Lune : ne manquez pas ce soir la plus longue du siècle !

from Les dernières actualités de Futura-Sciences https://ift.tt/2uTuKce

Très brillante, Mars est au plus près de la Terre depuis 15 ans

from Les dernières actualités de Futura-Sciences https://ift.tt/2AfOI67

Les produits sans gluten seraient bien plus mauvais que les autres

from Les dernières actualités de Futura-Sciences https://ift.tt/2NR8SFF

jeudi 26 juillet 2018

Cameco extends shutdown of Saskatchewan uranium operation

Canada’s Cameco (TSX:CCO) (NYSE:CCJ), the world’s largest publicly traded uranium producer, announced this week the extended shutdown of the McArthur River and Key Lake operation, located in northern Saskatchewan.

“Due to continued market weakness, in July 2018, Cameco made the decision to extend the planned 10-month production suspension of this operation for an indeterminate duration,” the company’s website reads.

This decision implies the firing of about 550 employees at the mining sites, while another 150 were laid off from the corporate head office in Saskatoon. A reduced workforce of some 200 people will remain at McArthur River and Key Lake to keep the facilities in a state of safe care and maintenance.

“It was a difficult decision to make, because of the impact it will have on our employees, their families, and other stakeholders, but we must take this action to ensure the long-term sustainability of the company,” Cameco’s President and CEO, Tim Gitzel, said in a media statement.

As a result of the layoffs, management expects to incur between $40 million and $45 million in severance costs in the third quarter.

Gitzel said that this resolution reflects the impact of a weak uranium market that is not giving any signs of improvement. “We will not produce from our tier-one assets to deliver into an oversupplied spot market. Until we are able to commit our production under long-term contracts that provide an acceptable rate of return for our owners, we do not plan to restart,” he wrote in the statement.

The prairie firm is also dealing with growing uncertainty given U.S. President Donald Trump’s threats to extend tariffs to uranium imports.

Joint venture partner Orano agreed to extend the suspension, the press release reads. In exchange, Cameco agreed to extend its repayment of up to 5.4 million pounds of uranium concentrates.

It was in late-2017 when the Saskatchewan-based miner announced the initial suspension of activities at the world’s largest high-grade uranium operation. Back then, the company cited a six-year-long rout in the prices for the radioactive metal.

The post Cameco extends shutdown of Saskatchewan uranium operation appeared first on MINING.com.

from MINING.com https://ift.tt/2AfJ5VI

Eldorado expects higher gold production in 2018

Canada’s Eldorado Gold (TSX:ELD)(NYSE:EGO) increased its full-year production guidance to 330,000-340,000 ounces of gold at $580-$630 per ounce from the previous 290,000-330,000 ounces of gold predicted for 2018.

In a press release, the Vancouver-based miner said that the expected growth would be driven by Kisladag, its flagship gold mine in Turkey, which saw increased production due to improved leach kinetics and placement of ore in early 2018 on an inter-lift liner.

“Since start-up of the Kisladag operation in 2006 approximately 145 million tonnes of material has been placed on the leach pad, at an average grade of 1.01 g/t. Production from leach operation has totaled approximately 2.88 million ounces of gold and the remaining book inventory is 61,100 ounces of gold. This leaves approximately 1.77 million ounces of contained gold in the pad. Historically this gold has been deemed not recoverable based on past metallurgical test work. However, we have progressed efforts to profitably extract a small portion of this contained gold. Based on the results of those efforts to date, the Kisladag production guidance for 2018-2020 is being increased by 40,000-45,000 ounces,” the media brief explains.

Gold production also grew at Eldorado’s Efemcukuru mine in western Turkey and Olympias in northern Greece, the latter accomplishing its first year of commercial production and yielding decreasing operating costs compared to the first quarter of 2018.

The rise of the production guidance also includes 3,134 pre-commercial ounces from Lamaque, the company’s underground gold project in Val-d’Or, Quebec, whose development is said to be moving ahead of schedule.

For the second quarter of 2018, the company reported 94,224 ounces of gold sold, a hike of 37,000 ounces when compared to the second quarter of 2017.

Despite these positive production results, Eldorado announced that consolidated operating costs in the quarter were higher year on year due to increased costs on a per ounce basis at Kisladag.

While cash operating costs averaged $484 per ounce in the second quarter of 2017, for the same period of 2018 the average was of $587 per ounce.

The post Eldorado expects higher gold production in 2018 appeared first on MINING.com.

from MINING.com https://ift.tt/2LqQNl0

Peruvian mining society says Anglo-Mitsubishi project marks a new era for the country

The president of Peru’s National Society of Mining, Petroleum, and Energy, Pablo de la Flor, issued a statement today saying that Anglo American (LON:AAL) and Mitsubishi’s joint venture to develop the Quelleveco project marks a new era for the country’s mining industry.

According to de la Flor, the project located in the southern Moquegua region will create 9,000 jobs during its construction phase and additional 2,500 jobs once it goes into production. “It is a project that will inject some energy into the local economy and will have a positive impact throughout Moquegua and southern Peru,” he wrote in the brief.

De la Flor also said that with an investment of over $5 billion, Quelleveco will create positive cash flow for the country’s coffers, both at national and local level, through taxes, royalties and mining cannons.

The president of the mining society emphasized that investment in the Andean country will grow as long as the government is able to maintain a stable legal environment and enforce the rule of law.

Quellaveco, which is 60 per cent owned by Anglo and 40 per cent owned by Mitsubishi, has all the permits needed for its development but has been stalled since 2013.

The project is valued at $2.74 billion and has the capacity to generate over 225,000 tonnes of copper a year. Potential first production is expected to take place in 2022.

Peru is the world's number two producer of the red metal behind Chile.

The post Peruvian mining society says Anglo-Mitsubishi project marks a new era for the country appeared first on MINING.com.

from MINING.com https://ift.tt/2LOlg8z

Western Australia lithium producer approves $382 million expansion

Talison Lithium plans to double its production at its Greenbushes facility in Western Australia through a $382 million expansion to around 1.95 million tons per year, according to a report by XINHUANET.com.

Work is expected to start early 2019.

"Greenbushes is a truly world-class mining operation with the capacity for significant expansion to underpin the lithium supply needs of our shareholders," Talison chief executive Lorry Mignacca said in a statement.

Currently the Greenbushes Lithium Operations has two processing plants, one producing technical-grade lithium concentrates and one producing chemical-grade lithium concentrate. Ore containing Li2O is fed into the processing plants which upgrade the lithium mineral, using gravity, heavy media, flotation and magnetic processes, into a range of lithium concentrates.

The project is located 250KM north of Perth.

Written with material from Talison Lithium's website. Creative Commons image of battery courtesy of jcw1967

The post Western Australia lithium producer approves $382 million expansion appeared first on MINING.com.

from MINING.com https://ift.tt/2mMDbSl

Newmont trades up on earnings beat

Unlike the other two gold majors Newmont had a quarter to trumpet with a second quarter coming in at $144 million or 26 cents per diluted share.

Newmont Mining (NYSE:NEM) was up 2.14% to $38.27 per share. Analysts expected 24 cents a share.

Yesterday Barrick reported a net loss of US$94 million or 8 cents per share in its 2Q, and Goldcorp also reported a net loss of $131 million or 15 cents per share.

Newmont reported an all-in sustaining cost of $1,024 per ounce of gold. The company generated $545 million in adjusted EBITDA, down 22 percent from the prior year quarter.

The company maintained corporate-level production, unit cost and capital outlook for 2018.

Newmont also announced a partnership with Teck to develop NOVAGOLD's Galore Creek in British Colombia.

Written with material from Newmont Mining news release.

The post Newmont trades up on earnings beat appeared first on MINING.com.

from MINING.com https://ift.tt/2JYfHTk

Gravity : la relativité générale d’Einstein vérifiée près de notre trou noir supermassif

from Les dernières actualités de Futura-Sciences https://ift.tt/2LEBiVD

Newmont buys a $100 million stake in BC's Golden Triangle

Newmont Mining acquired a 50 per cent interest from in the Galore Creek Partnership from NOVAGOLD Resources Inc.

Newmont will also partner with Teck Resources which owns the remaining stake.

The partnership encompasses several staged payments. There will a contingent investment of $275 million, with an initial payment of $100 million; a payment of $75 million on the earlier of prefeasibility study completion or three years from closing; and a payment of $25 million on the earlier of completing a feasibility study or five years from closing. A final $75 million payment would be contingent on a final decision to develop the project.

Galore Creek is located in northwestern British Columbia, Canada, approximately 150 kilometers northwest of Stewart and within the traditional territory of the Tahltan Nation.

A 2011 prefeasibility study put the project at a measured and indicated resource of 9 billion pounds of copper, 8 million ounces of gold, and 136 million ounces of silver.

Grades are 0.50 percent copper, 0.30 grams per tonne gold, and 5.20 grams per tonne silver.

Galore Creek is located in northwestern British Columbia, Canada, approximately 150 kilometers northwest of Stewart.

The post Newmont buys a $100 million stake in BC's Golden Triangle appeared first on MINING.com.

from MINING.com https://ift.tt/2LRYGMr

Cameco lays off 700 staff

Due to the weak uranium market Cameco says it will suspend operations at McArthur River and Key Lake and permanently lay off 550 site employees and 150 corporate staff the company said in its 2Q.

The news bumped Cameco's stock (CCO.TO) five per cent on Thursday send it to $14.97 a share.

Cameco reported net losses of $76 million and adjusted net losses of $28 million in its 2Q filed yesterday.

A reduced workforce of approximately 200 employees will remain at the McArthur River and Key Lake sites to keep the facilities in a state of safe care and maintenance.

As a result of the layoffs at the two sites and corporate office, we expect to incur between $40 million and $45 million in severance costs in the third quarter.

A reduced workforce of approximately 200 employees will remain at the McArthur River and Key Lake sites to keep the facilities in a state of safe care and maintenance.

Before Cameco put McArthur River and Key Lake in suspension the mine produced 7.2 million lbs over six months in 2017. Average grade is 9.63% U3O8 and proven and probable reserves of 250.7 million lbs.

The post Cameco lays off 700 staff appeared first on MINING.com.

from MINING.com https://ift.tt/2LNeW15

Samsung développe un écran de smartphone Oled flexible et « incassable »

from Les dernières actualités de Futura-Sciences https://ift.tt/2LoMZAO

Admirez Pluton dans ses véritables couleurs

from Les dernières actualités de Futura-Sciences https://ift.tt/2NMEM6d

Biométrie : œil vivant ou mort, ce scanner d'iris sait faire la différence

from Les dernières actualités de Futura-Sciences https://ift.tt/2OkxabV

Découvrez Futura sur Instagram

from Les dernières actualités de Futura-Sciences https://ift.tt/2LCKaLD

Ces composites élastomères bougent sous l’effet de la lumière

from Les dernières actualités de Futura-Sciences https://ift.tt/2uRUBRV

Exobiologie : une carte pour chercher la vie sur Europe

from Les dernières actualités de Futura-Sciences https://ift.tt/2Llllo2

mercredi 25 juillet 2018

CityHawk, le taxi volant qui carburera à l'hydrogène

from Les dernières actualités de Futura-Sciences https://ift.tt/2JXCGxI

Vale's Q2 capex reaches lowest level since '05

Vale announced an adjusted EBITDA of US$3.9 billion in Q2 with iron ore production of 96.8 tonnes and sales of 86.5 tonnes.

Iron ore production was 4.9 tonnes higher than the same period a year ago. Vale's net operating revenues were US$8.616 billion.

Vale said capital expenditures have reached the lowest level for a second quarter since 2005, totaling US$705 million with US$205 million in project execution and US$500 million in sustaining capital.

The company benefited from the devaluation of the BRL against USD.

Voisey Bay announced a underground mine expansion project to be funded through its cobalt streaming deal announced in June.

Vale concluded negotiated new freight terms and lowered its shipping costs by US$5 per tonne.

The post Vale's Q2 capex reaches lowest level since '05 appeared first on MINING.com.

from MINING.com https://ift.tt/2JVcV0Y

Goldcorp reports net loss of $131 million in Q2

Goldcorp reported a net loss of $131 million or 15 cents per share in its second quarter.

Goldcorp attributed the loss to non-cash foreign exchange losses primarily arising on deferred tax balances.

The company reconfirmed 2018 guidance for gold production of 2.5 million ounces, plus or minus 5 per cent, and a all-in-sustaining-cost of $800 per ounce, plus or minus 5 per cent.

Gold production was at 571,000 ounces with all-in sustaining costs of $850 per ounce. The same quarter a year ago Goldcorp produced 635,000 ounces at AISC of $800 per ounce.

Written with material from Golcorp news release.

The post Goldcorp reports net loss of $131 million in Q2 appeared first on MINING.com.

from MINING.com https://ift.tt/2mHUeVq

Barrick Gold reports Q2 loss of US$94 million

Barrick reported a net loss of US$94 million ($0.08 per share), and adjusted net earnings of $81 million ($0.07 per share) for the second quarter of 2018.

Barrick (NYSE:ABX) traded down -1.18% to US$11.68 as of 5:42 p.m. EDT.

Barrick said earnings and cash flow impacted by planned maintenance activities at Barrick Nevada and Pueblo Viejo. The company says it remains on track to meet full-year gold production guidance, with higher production and lower costs expected in the second half of 2018.

Gold production in the second quarter was 1.07 million ounces, at a cost of sales applicable to gold of $882 per ounce, all-in sustaining costs of $856 per ounce, and cash costs of $605 per ounce.

Copper production was 83 million pounds, at a cost of sales applicable to copper of $2.45 per pound, all-in sustaining costs of $3.04 per pound, and cash costs of $2.10 per pound.

Written with material from Barrick news release.

The post Barrick Gold reports Q2 loss of US$94 million appeared first on MINING.com.

from MINING.com https://ift.tt/2Ah2THY

Mars : un lac d'eau liquide découvert sous sa surface !

from Les dernières actualités de Futura-Sciences https://ift.tt/2uQ0D5E

BHP final pay offer to Escondida workers falls short of union demands

Unionized workers at Chile's Escondida copper mine, the world's largest, are discussing the final wage offer presented Wednesday by majority owner and operator BHP (ASX, NYSE:BHP) (LON:BLT), which looks shy of what employees wanted.

The company has offer workers a signing on bonus of $27,000, up from an earlier offer of $23,000, plus a 1.5% salary increase, but still well under the bonus up to $43,000 and 5% increase demanded by Escondida unionized staff, local paper La Tercera reported (in Spanish).

BHP is hoping to avoid a repeat of last year's damaging 43-day strike, which rattled the global copper market and translated into roughly $1bn lost revenue for the company.

The union, representing about 2,500 mineworkers, has five days to approve or discard the deal. A rejection would trigger five days of government mandated mediation, which can be extended by another five days.

BHP is hoping to avoid a repeat of last year's damaging 43-day strike, which rattled the global copper market and translated into roughly $1 billion lost revenue for the company.

Escondida — responsible for about 5% of the world’s total copper output — failed to produce more than 120,000 tonnes of the red metal due to last year’s strike, which became the longest private-sector mining strike in Chile’s history.

While majority-owned and operated by BHP, Rio Tinto and Japanese companies such as Mitsubishi Corp also hold stakes in Escondida mine.

More to come?

Chile is the world's biggest copper producer, and sales of the metal make up for about 60% its export earnings.

In the next six months, copper forecasters will keep a close eye on the Chilean mining sector as prepares for another busy round of labour talks.

From the 32 contracts set to expire in 2018 at the country’s mines, there are still a dozen to be negotiated before year-end.

The twelve key talks coming up in Chile that will keep copper enthusiasts on their toes. (Data: Chile's Gov't. | Graph: MINING.com.)

The nation’s labour laws have changed recently – in April 2017 – and the ramifications are not fully understood. What is clear is that unions are empowered and this has influenced negotiations. They are better prepared from a legal and economic point of view.

While copper prices dropped recently to a 1-year-low and are hovering around $2.80 per pound, they are still higher than during the previous negotiations, which puts more pressure on companies to reach an early solution.

The post BHP final pay offer to Escondida workers falls short of union demands appeared first on MINING.com.

from MINING.com https://ift.tt/2uQXUJ3

Wheaton closes streaming deal with gold miner Sibanye

Canada’s Wheaton Precious Metals (TSX:WPM), the world's No.1 silver streaming company and Sibanye’s (JSE: SGL) (NYSE:SBGL) closed Wednesday a deal through which Weathon buys buy all gold production from Stillwater and East Boulder mines in Montana.

Wheaton has bought all of Stillwater's gold production for the life of the mine and, initially, also 4.5% of its total palladium output.

The Vancouver-based firm has paid the South African precious metal miner $500 million in cash upfront, which will be followed by subsequent payments equal to 18% of the spot gold and palladium prices until the reduction of the advanced payment to nil. After that, Wheaton will pay Sibanye 22% of the spot gold and palladium prices.

The transaction, said Sibanye, immediately reduces the company’s leverage and net debt.

Wheaton's estimated proven and probable gold reserves have now increased by 410 thousand ounces and its inferred gold resources by 920 thousand ounces.

For the first time, the Canadian firm has estimated proven and probable palladium reserves of 610 thousand ounces and inferred palladium resources of 430 thousand ounces.

Wheaton's announcement follows a similar deal it signed last month with Brazil's Vale (NYSE: VALE) to buy cobalt mined after 2021 as a by-product from its Voisey’s Bay mine, in Canada's northern Labrador region.

The post Wheaton closes streaming deal with gold miner Sibanye appeared first on MINING.com.

from MINING.com https://ift.tt/2LOfmnX