dimanche 30 septembre 2018

Phobos et Deimos, les lunes de Mars, seraient bien nées d'un impact

from Les dernières actualités de Futura-Sciences https://ift.tt/2xQEOnY

Pink diamond breaks world record

A fancy pink diamond weighing 5.03 carats sold this week for more than $2.9 million, setting a new auction world record of $583,551 per carat for a diamond of its kind.

The rock was auctioned at a sale organized by Bonhams London Fine Jeweller, which beat Sotheby’s Geneva previous record of $528,021 per carat for a fancy pink.

According to Emily Barber, Director of Jewellery at Bonhams UK, the stone’s features explain why it sold at such a high price. “This was due to a number of factors: its size – it's exceptionally rare to see a pink over five carats on the market today; its even colour saturation and its extraordinarily elegant cut.”

In Barber’s view, with Western Australia’s Argyle mine forecast to cease operations by 2020 after 50 years of activity, the future of pink diamond mining is uncertain because there are no other known deposits with such a consistent production. Thus, she says the gems have started to increase in value.

“They are highly desirable to discerning collectors given their rarity and limited supply. A diamond like this would definitely be one of the most prized pieces in an important jewellery collection,” the executive added.

The post Pink diamond breaks world record appeared first on MINING.com.

from MINING.com https://ift.tt/2zGGodj

Peru expects $58 billion in mining investments

Peru's Minister of Energy and Mines, Francisco Ísmodes, said this week that his office expects mining investments to reach $58 billion in coming years.

In an interview with the state-run newspaper El Peruano, Ísmodes said that the goal for the next three years is to get at least 36% of that capital actually invested.

The minister also said that the Martín Vizcarra administration expects Peru's share in the global mining exploration realm to grow to 8% from the current 7% by 2021.

According to the government official, the recently-created Directorate for Mining Promotion and Sustainability will be in charge of identifying the regions with the highest potential for resource exploration. The unit is also responsible for connecting the ministry to provincial governments and consult with communities about future projects and their impacts.

In that sense, Ísmodes mentioned the positive work already carried out by AngloAmerican (LON:AAL) at its Quellaveco copper mine in the Moquegua region, as well as by Minsur at its giant copper mine Mina Justa in Ica. He said he was also pleased with the signing of an agreement with Southern Copper (NYSE: SCCO) for the construction of the Michiquillay project in the Cajamarca region.

The minister also announced the launching of the Centre for Convergence and Good Practices, which will be in charge of mediating between different stakeholders in order to make sure that all extractive activities are conducted following high environmental protection standards and making use of the most advanced technology available.

The post Peru expects $58 billion in mining investments appeared first on MINING.com.

from MINING.com https://ift.tt/2NSP9tB

Baby girl survival rates in India fall when gold prices go up: study

A study conducted by Sonia Bhalotra, Professor of Economics at the University of Essex, shows that when world gold prices go up, fewer girl babies in India survive the first month of life.

In a piece published in The Conversation, Bhalotra writes that the relationship between gold prices and girls survival rates is explained by the fact that gold is often part of bridal dowries in India – "so when gold prices go up, the cost of raising girls rises and families tend to neglect or abort them."

To reach this conclusion, the researcher and her team merged monthly data on international gold prices between 1972 and 2005 with monthly birth cohort data, and analysed whether gold price changes influenced the sex ratio at birth and the survival of a newborn girl up to the age of one month.

"Using this large dataset with more than 100,000 births, we found that in months where the gold price went up, the chances of a girl surviving through the neonatal period were significantly lower than for boys. In fact, gold price inflation was correlated with an improved survival chance for boys," Bhalotra states.

In her study, the economist shows how between 1972 and 1985 there was a 6.3 per cent increase in the monthly price of gold and a 6.4 per cent corresponding increase in girl neonatal mortality was observed. During the same period, however, there was no significant corresponding change in male neonatal mortality.

Another set of data children born between 1986 and 2005, when ultrasound technology became widely available. "For potential births after 1986, we found that a 2.6% increase in the price of gold during pregnancy was accompanied by a statistically significant 0.3 percentage point decline in the probability that a girl rather than a boy would be born," Bhalotra writes.

The researcher explains that even though dowries are forbidden in India since 1961, the practice is still common. Since the cost of a dowry is about six times the average annual household income, families need to start saving as soon as a girl is born.

To read more about this study visit The Conversation.

The post Baby girl survival rates in India fall when gold prices go up: study appeared first on MINING.com.

from MINING.com https://ift.tt/2zHjHWB

Patient hors norme : son petit doigt est gonflé, c'est la tuberculose

from Les dernières actualités de Futura-Sciences https://ift.tt/2IrDEmQ

Metallurgical coal prices starting to slip: Fitch

A report by Fitch Research predicts that metallurgical coal prices will decline from their current high levels over the next 18 months.

Thus, the report suggests miners' focus would probably be on cost controls.

According to the market researcher, global costs in the metallurgical coal sector increased by 18% in 2017 and continued to rise in 2018 but there were specific situations that prompted such a rise. "Severe weather has played a role in Australia, causing supply-chain disruption that led to demurrage penalties and increased storage costs for unshipped coal. However, costs have also been pushed up globally by higher oil prices and attempts by mining companies to maximise production to take advantage of high prices," the report states.

In the view of Fitch's analysts, profitability has not been undermined because coking coal prices are currently sufficiently high to counterbalance cost inflation. "CRU estimates that the seaborne industry generated an average cash margin of 40% in 2016-2017, and profitability has remained very strong this year," the document reads.

Fitch's experts believe that the metallurgical coal market is unlikely to become oversupplied in the near term. Therefore, prices are unlikely to fall deep into the cost curve, the same way they did between 2014 and 2016.

This state of affairs may benefit mining service companies and earthmoving equipment manufacturers as miners continue with new projects and increase production.

The market researcher highlights that, however, caution should be exercised as prices have already eased off from their peak of $260/tonne in 4Q16, and are likely to decline further as supply constraints continue to ease. "Fitch's current assumptions are that hard coking coal prices will average USD185/tonne this year and USD140/tonne thereafter. These declines could put pressure on some less competitive mining companies to reduce costs to protect margins," the market analysis states.

The post Metallurgical coal prices starting to slip: Fitch appeared first on MINING.com.

from MINING.com https://ift.tt/2Oh9LLB

Drôle de Tech : la nouvelle montre Apple Watch peut conduire en prison, un robot éplucheur de laitue et des Mercedes qui choisiront les parkings les plus sûrs

from Les dernières actualités de Futura-Sciences https://ift.tt/2Iq1OOw

samedi 29 septembre 2018

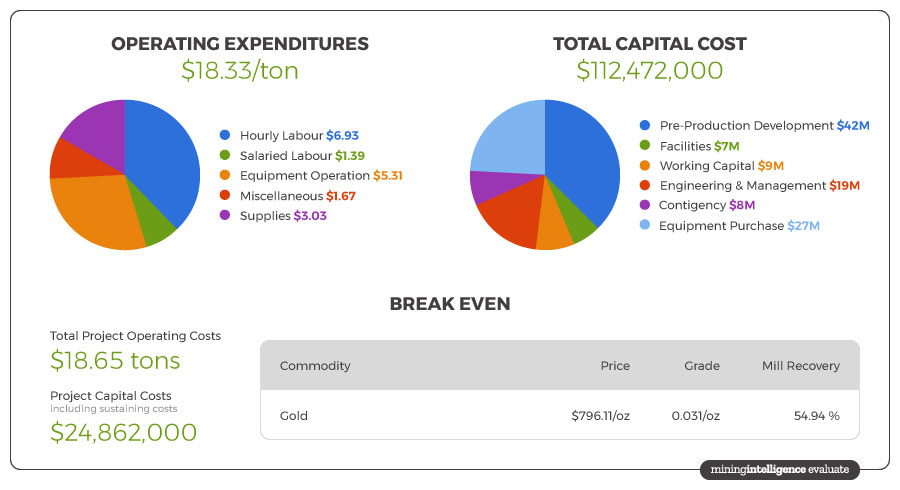

Realistic mine project cost estimates and evaluations

No mine stays constant over time. Grades can change or stripping ratios can increase as the pit gets deeper. Projects have ramp-up periods where production rates increase or decrease as the mine nears the end of its life.

Mining Intelligence’s Surface Evaluation Application recognizes this reality. We have built a solution that allows you to divide your project timeline into individual phases. You get to determine the number of phases. Then for each phase, you input its length, grade, stripping ratio, production rate, and additional parameters that characterise it. This allows for transparency on how capital costs, operating costs, and overall project economics change as your project evolves over multiple phases through time.

The countdown is on. Mining Intelligence’s Surface Evaluation Application launches in 4 days and will allow you to estimate the costs for countless surface mining and mineral processing projects. This cloud-based application combines engineering-based estimating procedures with cost data from Mining Intelligence’s Mining Cost Service.

Sign up now for a one-week free trial

The post Realistic mine project cost estimates and evaluations appeared first on MINING.com.

from MINING.com https://ift.tt/2RaxMCy

Science décalée : la licorne existe, nous l'avons rencontrée

from Les dernières actualités de Futura-Sciences https://ift.tt/2Rbxdsf

Électroménager, meubles, vêtements : leur impact sur l'environnement

from Les dernières actualités de Futura-Sciences https://ift.tt/2OZo5VQ

Notre top 5 de la semaine : Galilée le rusé, Hayabusa-2 la talentueuse et la vie martienne toujours mystérieuse

from Les dernières actualités de Futura-Sciences https://ift.tt/2xH6tHV

Médecine : des études cliniques ne sont jamais publiées pour des raisons inavouables

from Les dernières actualités de Futura-Sciences https://ift.tt/2DFQnUo

Le glyphosate serait bien un tueur d’abeilles

from Les dernières actualités de Futura-Sciences https://ift.tt/2xNbfDM

Comment piloter un drone par les seuls mouvements des yeux

from Les dernières actualités de Futura-Sciences https://ift.tt/2xYOoEq

La dépendance aux drogues est-elle influencée par un rétrovirus venu de nos ancêtres ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2zEEWbp

vendredi 28 septembre 2018

Rocketing vanadium price primed for 'Elon Musk moment'

Spiking cobalt and lithium demand from booming sales of electric vehicles grabs all the headlines, partly thanks to Tesla CEO Elon Musk’s propensity to make news, but another battery metal has actually experienced more action this year.

Vanadium is primarily used to strengthen steel (today it makes up more than 90% of the market) and prices for ferro-vanadium hit decade highs this month.

Vanadium pentoxide (V2O5) which makes its way into so-called vanadium redox flow batteries used in energy storage systems breached $20 a pound for the first time since 2005 this month. That’s a four-fold increase from the start of 2017.

Simon Moores of Benchmark Mineral Intelligence, a battery materials research and price discovery provider based out of London, says the recent success of lithium ion batteries being deployed in increasing larger systems that are exceeding 1GWh has brought to light the huge potential of the market for all types of battery technologies.

Vanadium flow batteries have lifespans of over 20 years without capacity loss, are non-flammable and can operate at any temperature. Another advantage over lithium ion is that this type of battery can be charged and discharged simultaneously making it highly suitable for large-scale storage from renewable sources such as solar and wind when connected to an electricity grid. Main downside is low energy density which means comparatively large installations needed.

“If a vanadium battery producer steps forward with bold plans to produce vanadium flow at mass scale, giving the industry its Elon Musk or lithium ion moment, the potential for the technology to be the second most deployed ESS battery in the world is there,” says Moores.

“Raw material self sufficiency is a critical component to this. At least a third of the cost of a vanadium flow battery is vanadium pentoxide which makes up the liquid electrolyte.

“If companies are thinking of creating the Gigafactory of vanadium flow batteries, they will either need to own a mine or implement a new pricing system where the fully recyclable vanadium in the battery is leased."

Should all the supply chain challenges be solved, Benchmark believes 25% of the energy storage market is up for grabs in 2028. Benchmark forecasts that the energy storage market will then be between 100GWh to 120GWh in size.

The amount of V2O5 in a single MWh is just under 10 tonnes. South Africa, China and Russia produce more than 80% of the world’s vanadium, mostly as a byproduct of magnetite mining and in the steelmaking process. Only around 80,000 tonnes of vanadium was produced last year.

The post Rocketing vanadium price primed for 'Elon Musk moment' appeared first on MINING.com.

from MINING.com https://ift.tt/2xJkPYa

SolGold loss almost doubles as its goes all in at Ecuador projects

Shares in Ecuador-focused explorer SolGold (LON, TSX:SOLG) dropped Friday in Toronto after the company reported an annual loss that almost doubled the one registered in 2017.

For the 12 months to June, SolGold's pre-tax loss was A$15.3 million, compared to $8.3 million it recorded a year before.

The stock fell 3.2% in Toronto to 60 Canadian cents by 10:05 local time, despite the company also saying it had successfully raised £45 million (about A$81m) during the year, which left it with a cash balance of A$81.8 million, compared to A$89.3 million the previous year.

In the past year the company has been advancing its 85%-owned Cascabel copper-gold project, in northern Ecuador, one of the very few new ones expected to come online in the near future.

Early this month, world’s largest miner BHP bought a stake in SolGold, securing access to the SolGold’s flagship Cascabel copper-gold project.

SolGold’s progress over the last 12 months has focussed on making the resource at Alpala, particularly the high grade portion, larger and higher in grade.

“We have been receiving and announcing some very encouraging extensions and infills to the high grade model and the overall resource at Alpala, chief executive Nicholas Matter, said in the report. “Ultimately this will add significant value to the project and we expect with the early outcomes from the Preliminary Economic Assessment (PEA) that the share price will appreciate to close the value price gap,” he said.

Matter added that the company’s vision was to add Cascabel-like projects to its portfolio, all through the spine of Ecuador along the gold-rich Northern Andean Copper Belt, renowned for also hosting almost half the world’s copper known reserves.

Early this month, world’s largest miner BHP (ASX, NYSE:BHP) (LON:BLT) bought a 6.1% stake in SolGold, securing access to the explorer’s flagship project.

According to Colin Hamilton, director of commodities research at BMO Capital Markets, the current copper pipeline is the lowest seen this century, both in terms of number and capacity.

The company's Cascable project is one of the very few new copper mines expected to come online in the near future.

“After delivery of Cobre Panama (with the main ramp early next year) we are left with a gap until we see the next batch of 200ktpa-plus projects in 2022-23. This is when the likes of Kamoa, Oyu Tolgoi Phase 2, and QB2 are likely to offer meaningful supply growth,” Hamilton said in April.

Prices for copper, however, have dropped almost 20% in London so far this year, due to a combination of factors, including a strengthening dollar, mounting trade disputes and emerging market turmoil.

Attracting majors

Ecuador has gained ground as a mining investment destination in the past two years thanks to a revised regulatory framework and a major investor engagement campaign that has already attracted around 420 applications for concessions in less than a year.

In February, Australia’s Newcrest Mining (ASX:NMC) took a 14 percent stake in Lundin Gold, which expects to bring its Fruta del Norte gold and silver mine in southeastern Ecuador into production by the end of next year.

This week, another big miner, Anglo American (LON:AAL), landed in the South American country. Through a deal with Canadian Luminex Resources (TSX-V: LR), the company will develop two copper and gold concessions in the South American country.

Currently, the nation’s emerging mining sector employs 3,700 people, but the government estimates the figure will rise to about 16,000 by 2020.

The post SolGold loss almost doubles as its goes all in at Ecuador projects appeared first on MINING.com.

from MINING.com https://ift.tt/2NOcWL9

Chinese interested in buying Rio’s Namibian uranium business

Rio Tinto (ASX, LON:RIO), the world’s second largest miner, has been talking to China National Nuclear Corporation (CNNC) about selling the state-owned miner its stake in Namibia’s Rössing uranium mine.

While the mining giant has not officially acknowledged the negotiations with CNNC, Namibia’s energy minister Simeon Negumbo confirmed them to local paper The Namibian.

Rio has close to a 69 percent interest in the mine, the world's longest-running open pit uranium operation, while the rest is held by the Iranian Foreign Investment Company (15 percent), the Industrial Corporation of South African (10 percent), the government of Namibia (3 percent) and local interests (3 percent).

More to come…

The post Chinese interested in buying Rio’s Namibian uranium business appeared first on MINING.com.

from MINING.com https://ift.tt/2InAaC1

Record : un Airbus A350 réalisera les vols commerciaux les plus longs au monde

from Les dernières actualités de Futura-Sciences https://ift.tt/2QgoRhI

Renault annonce un système de stockage d'électricité géant

from Les dernières actualités de Futura-Sciences https://ift.tt/2xFgLIz

Congo-owned Sokimo may hinder transfer of Kibali mine to Barrick

Congo's Société Minière de Kilo-Moto SA, better known as Sokimo, warned Friday that if Randgold Resources transfers to Barrick its stake in Kibali gold mine, in which the state miner has a 10% interest, it would be forced to “assert its rights”.

Canada's Barrick Gold (TSX, NYSE:ABX) agreed to buy Randgold Resources (LON:RRS) this week in a $18.3 billion share deal, which will create the world's largest gold company by value and output. Kibali, one of Africa's biggest gold mines, was flagged as one of the five “tier-one” considered key to the business case of the proposed merger.

While Sokimo did not clarify its plans, it did say the proposed merger was another example of large groups imposing themselves in the countries where they operate.

While Sokimo did not clarify its plans, it said in a statement quoted by Jeune Afrique (in French) it had learned of the tie-up through the press. It added the proposed business combination was “another illustration of control transfer deals between large global groups, conceived and structured to impose themselves, without any prior discussion, in the countries from which the resources that make up their wealth are extracted.”

The same kind of strong nationalist language was used by Congo's other state miner, Gecamines, against Freeport after the US company announced in 2016 the sale of its stake in the Tenke copper mine to China Molybdenum. Gecamines received $100 million in a settlement.

Kibali, a joint venture between Randgold (45 percent), AngloGold (45 percent) and Sokimo, produced 596,225 ounces of gold last year at a total cash cost of $773 per ounce. Gold sales amounted to $754.9 million (100% basis) resulting in a profit from mining activity (before interests, tax and depreciation) of $287.7 million.

The operation, which cost $2.5 billion to develop, is expected to generate 730,000 ounces of gold this year.

The post Congo-owned Sokimo may hinder transfer of Kibali mine to Barrick appeared first on MINING.com.

from MINING.com https://ift.tt/2P3tuLy

Bébé peut-il dormir dans la chambre des parents ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2xMol3Y

Astéroïde ‘Oumuamua : Gaia précise son origine

from Les dernières actualités de Futura-Sciences https://ift.tt/2Io1yje

Plus de deux heures d'écran affecte les capacités intellectuelles des enfants

from Les dernières actualités de Futura-Sciences https://ift.tt/2zBDmXQ

jeudi 27 septembre 2018

L'axe de rotation de la Terre dérive : découvrez pourquoi

from Les dernières actualités de Futura-Sciences https://ift.tt/2xIGNuq

Komatsu to build $285-million headquarters in Milwaukee

Japanese heavy equipment maker Komatsu Mining said Thursday it will build a $285 million state-of-the-art headquarters and manufacturing campus in Milwaukee, US, which has the potential to bring about 440 jobs to Wisconsin's largest city.

The company, which last year took over local mining equipment maker Joy Global, reached an agreement with the state's economic development agency, which provide it with $59.5 million in state income tax credits over the next 12 years.

Project is expected to be completed in 2022.

Komatsu, the world's No. 2 manufacturer of mining equipment after Caterpillar, intends to build a new corporate headquarters, manufacturing and training facilities at the former Solvay Coke site along the Milwaukee riverfront on Greenfield Avenue. The 54-acre site, to be called the South Harbour Campus, is near the location of the company's original machine shop off South First Street.

The planned campus would include about 170,000 square feet of office space, a 20,000-square-foot museum and training building, and 410,000 square feet of manufacturing space, consolidating two of Komatsu's current Milwaukee-area facilities into a central location.

The project is expected to be completed in 2022.

The post Komatsu to build $285-million headquarters in Milwaukee appeared first on MINING.com.

from MINING.com https://ift.tt/2IlyI33

Battery Minerals hits construction milestones at Montepuez project

Australia’s Battery Minerals (ASX:BAT) said Thursday development of its $51-million Montepuez graphite project, in Mozambique, has achieved key construction milestones.

The East Africa-focused explorer said that both a permanent 100-person accommodation camp and the tailings storage facility were well advanced. It added it expected to commission the water treatment facility, electrical fit-out and sewage system in early November.

The company has appointed Origin Capital as financial adviser to advance its funding strategy and seek for potential debt providers.

To support this process, a due diligence review of the Montepuez project – including a site visit and technical assessment – will be conducted.

Company wants to make sure the mine is in production when the demand and price of graphite takes off, as predicted.

“We want to ensure that we are in production when the demand and price of graphite takes off,” managing director David Flanagan said in the statement.

“Graphite market experts continue to forecast strong demand and price growth on the back of the lithium battery boom,’” he said, adding he believed Montepuez was able to capitalize on the lithium battery boom due to the operation’s low-cost base, simple processing route and offtake agreements.

Battery minerals, in particular lithium and cobalt, have attracted lots of investors and media attention this year. But graphite, one of three naturally occurring carbons on Earth, seems to have been overlooked.

There is as much as 40 times the amount of graphite in a lithium-ion battery as lithium. This is one of the key drivers for the increasing demand for the mineral, which is expected to jump by as much as 200 percent by 2020. Only between Dec. 2016 and Dec. 2017, prices for the metal climbed 25% rise on the back of surging demand.

Graphene, a recently developed “super-mineral” that comes from graphite, is believed to be able to dramatically improve battery technologies.

Less than a year ago the Samsung Advanced Institute of Technology announced that its researchers had developed a “graphene ball,” a material that would allow lithium-ion batteries to charge five times faster and have 45 percent more capacity. That alone could have big impact on both consumer electronics and the automotive industries.

Initially set to produce 50,000 tonnes of graphite a year, Montepuez is expected to ramp up to over 100,000 tonnes per annum by 2020.

The post Battery Minerals hits construction milestones at Montepuez project appeared first on MINING.com.

from MINING.com https://ift.tt/2N6Sekt

Chile greenlights Latin America’s largest desalination plant

After more than a year of evaluation, Chile’s environmental authority has approved the development of what it would be Latin America’s largest desalination plant, to be built in the country’s dry Atacama region.

The Energy and Waters of the Pacific (ENAPAC ) project, developed by Trends Industrial, was mainly designed to supply water for industrial use, particularly in the mining sector, and implies an initial investment of about $500 million.

The solar-powered desalination plant will have a maximum capacity of 2,630 liters of water per second and comprises five pumping stations — one at the intake, one at the treatment plant, two on the piping route, and one at the reservoir.

The financial optimum for the project will be for solar to provide 80 per cent of the power, while the remainder will come from the grid during the cheaper, off-peak hours (Chile’s energy pricing changes hourly).

Trends is already in talks with copper and lithium miners present in the area. “We are sure that the environmental approval will speed up these conversations and agreements," chief executive Rodrigo Silva told local paper El Diario (in Spanish).

Miners operating in the dry, but copper and lithium-rich Atacama region have significant opportunities to increase their extraction, but the lack of available water to support operations has held them back. At the same time, they are under increasing pressure to avoid using freshwater sources, needed by local communities for drinking and sanitation.

ENAPAC project is part of list of projects created by the country’s Ministry of Economy to help drive large investment initiatives in the midst of the government's efforts to boost economic growth.

The post Chile greenlights Latin America’s largest desalination plant appeared first on MINING.com.

from MINING.com https://ift.tt/2QaThSg

Hayabusa 2 : les rovers sauteurs photographient la surface de l’astéroïde Ryugu

from Les dernières actualités de Futura-Sciences https://ift.tt/2R3Ozac

De la chaleur s'échappe de la Terre, mais jusqu'à quand ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2N7DD8g

Avec Soyouz, il vous en coûtera de 150 à 180 millions de dollars pour tourner autour de la Lune

from Les dernières actualités de Futura-Sciences https://ift.tt/2N2t1HW

Freeport, Rio formally yield control of giant Grasberg mine to Indonesia

Freeport McMoRan (NYSE:FCX) and Rio Tinto (LON:RIO) signed Thursday a final $3.9 billion agreement that gives Indonesia a majority stake in their Grasberg copper mine, the world's second-largest, and which would be transferred to the state-owned mining company PT Indonesia Asahan Aluminium (Inalum).

The "definitive" and "binding" agreement ends a long-drawn-out, three-way dispute over the mine, centred on bringing Indonesian ownership up to 51%, a main requisite set by the government to allow Freeport-McMoRan (NYSE:FCX), operator of Grasberg, to keep doing so.

It could also bring closure to years of disagreements between the Phoenix, Arizona-based copper miner and the country’s government, which last year curbed output at the mine, impacting metals prices worldwide.

As announced earlier this year, the deal sees Indonesia — through Inalum — becoming the majority stakeholder at 51%. The government, in turn, will issue a special mining license to Freeport allowing ore extraction until 2041.

The deal is considered a victory for President Joko Widodo, who faces re-election in 2019 and who has insisted that mining companies must divest majority stakes in order to continue operating in the country.

Grasberg, the world’s second-largest copper mine and fourth largest gold operation, is transitioning to an underground operation, set to reach full capacity by 2022, when it will produce 160,000 tonnes per day of ore.

The additional Deep Mill Level Zone block cave mine, currently under construction, is projected to contribute an additional 80,000 tonnes per day of ore once at full capacity, expected in 2021.

More to come…

The post Freeport, Rio formally yield control of giant Grasberg mine to Indonesia appeared first on MINING.com.

from MINING.com https://ift.tt/2NKAoZN

Vie sur Mars : elle aurait pu être présente dans ses profondeurs

from Les dernières actualités de Futura-Sciences https://ift.tt/2On6TNj

Galilée : on a découvert la lettre originelle raturée pour rassurer l'Inquisition

from Les dernières actualités de Futura-Sciences https://ift.tt/2DyUgdF

Toyota imagine une voiture volante avec des rotors intégrés aux roues

from Les dernières actualités de Futura-Sciences https://ift.tt/2xSCwE6

mercredi 26 septembre 2018

Make sound mine project investment decisions in a risky business

Every investment carries a certain level of risk that can impact the return. For mining projects, the actual return on investment may differ substantially from that estimated during earlier project phases. While this could be due to unexpected changes in the political or social context, it may also be due to inaccurate deposit parameter assumptions, such as grades and ore reserves, or errors in estimating capital costs, operating costs, mineral revenue, and operating productivity. Getting a good sense of how these risks affect the value of a mining project is vital to make sound investment decisions.

So how do you get to the point where you can confidently invest more money in your project? With Mining Intelligence’s Surface Evaluation Application you can perform break even and Monte Carlo risk analyses to identify potential pitfalls associated with a project, such as lower than expected recovery or increases in operating costs. Take the application’s capabilities further and run sensitivity analyses on key parameters, such as grade and commodity price. You will be able to observe how changes to these values affect net present value, rate of return, cashflow, and payback period.

This cloud-based application also allows you to save multiple “clones” of a surface mining and mineral processing project, enabling you to easily compare various project scenarios.

All of this will guide you towards investing in the most promising projects quickly and consistently. Get ready, Evaluate launches in 5 days.

Sign up now for a one-week free trial

The post Make sound mine project investment decisions in a risky business appeared first on MINING.com.

from MINING.com https://ift.tt/2zwRzp4

Trevali’s Santander zinc mine in Peru hit by blockade

Canada’s Trevali Mining (TSX:TV) revealed Wednesday it had temporarily halted operations at its Santander zinc mine in Peru, as a small group of locals blocked access to the installations, claiming that the company had failed to satisfy its investment obligations.

As a result of the protest, the Vancouver-based firm was also unable to receive a scheduled delivery of supplies to the mine,mine is located approximately 215 km northeast of capital Lima.

“It is unfortunate that a small group of individuals chose to act in this manner instead of through open dialogue,” president and chief executive Mark Cruise said. “We have enjoyed tremendous support from the local communities at Santander over the years and will continue to work diligently with the community to strengthen our commitment to a mutually beneficial relationship.”

The illegal action, which began more than three weeks ago, saw a group of locals spend seven days blocking the only access to the mine in protest for what they call “repetitive abuse” to community members and increasing pollution of their land and only water source, local paper La República reported.

They had said they were ready to stay there indefinitely, but Trevali said barricades have been lifted that it expected to resume production within the week.

The miner’s shares dropped on the news, trading almost 7% lower in Toronto at 71 Canadian cents by noon local time.

Besides the Santander mine, the company owns the Caribou mine, in Canada, the Rosh Pinah mine, in Namibia and the Perkoa mine, in Burkina Faso.

The post Trevali’s Santander zinc mine in Peru hit by blockade appeared first on MINING.com.

from MINING.com https://ift.tt/2N3zvWU

Quebec lithium project receives positive definitive feasibility study

Sayona Mining touted its Authier lithium project in Canada after receiving a positive definitive feasibility study released Monday.

Australian-based Sayona Mining says if the project becomes a mine, it could create 150 construction jobs and 160 positions for operators.

Other highlights of the DFS were the following:

- Pre-tax NPV of C$184.8 million and IRR 33.7% (real terms at 8% discount rate)

- Annual average concentrate production of 87,400 tonnes at 6% Li2O

- Average annual revenue of C$80 million

- Mine gate cash costs of C$416/t and FOB Port cash costs of C$482/t (US$366/t)

- Initial capital expenditure of C$89.9 million

- Updated Ore Reserve of 12.10 Mt @ 1.00% Li2O (Proven Reserve 6.10Mt @ 0.99% Li2O and Probable Reserve 6.00 Mt @ 1.02% Li2O) delivers a mine life of 18 years.

The Authier project is 45 kilometres southeast of Val d'Or.

To drive the project forward, the company hired a new vice president of corporate affairs, Alexis Segal. Segal previously worked at Rio Tinto in largely the same role. Sayona announced Segal's hiring yesterday.

Creative Commons image of greenlight courtesy of Tawheed Manzoor

The post Quebec lithium project receives positive definitive feasibility study appeared first on MINING.com.

from MINING.com https://ift.tt/2xGh1H3

Les pilotes de chasse du futur auront un tableau de bord obéissant au regard

from Les dernières actualités de Futura-Sciences https://ift.tt/2xP5AfD

Récif artificiel : le fiasco des pneus en mer dans les Alpes-Maritimes

from Les dernières actualités de Futura-Sciences https://ift.tt/2R0Km7i

Un serpent à deux têtes très rare découvert en Virginie

from Les dernières actualités de Futura-Sciences https://ift.tt/2xFcFQs

Canada’s Maxtech Ventures to expand footprint in Brazil with manganese JV

Shares in Canada’s Maxtech Ventures (CNSX: MVT) shot up more than 13% on Wednesday morning as the company said it plans to expand its footprint in Brazil, where is developing its flagship Brasnorte manganese project, by entering into a joint venture with a local company in Santana do Pirapama, in Minas Gerais state.

The Vancouver-based miner said it has signed a non-exclusive letter of interest to form a JV on claims where manganese mineralization has been proven. Together with its potential partner, Maxtech has already filed for a trial mining license (Guia), while they assess the asset.

At its Brasnorte manganese project, in the state of Mato Grosso, the current focus is on four claims where assays showed high-grade manganese between 51.4% to 55.9%, it said.

Miner has signed a non-exclusive letter of interest to form a JV with an undisclosed local company on claims where manganese mineralization has been proven.

Maxtech noted its in-country asset and exploration management team is going to Cuiabá to meet with the Departamento Nacional de Produção Mineral (DNPM) to discuss the final stages of approval of Brasmorte’s trial license. As soon as it gets that permit, the company will apply for environmental and operating licenses that it needs to further advance exploration and trial production initiatives.

At its vanadium assets, the firm's Brazilian based geologist and his vanadium experienced research team will be traveling to Bahia beginning the next stage of research on the claims.

There are additional areas of interest in the area which Maxtech is presently investigating, said the company.

“Manganese and vanadium are globally high-value strategic metals," Peter Wilson, chief executive at Maxtech said in the update. "We will continue to build on our strategic metal asset base in Brazil as opportunities arise."

Brazil’s vast resource-rich landscape and newly revised mining regulations are attracting increased foreign investment in the exploration and production of manganese and vanadium, considered leading-edge metals for making the batteries used in electric vehicles (EVs) and large energy-storage systems.

Traditionally used in the production of steel, manganese is now a key ingredient in batteries for portable devices, EVs and other renewable-energy applications, including electricity grid storage such as Tesla’s (NASDAQ:TSLA) Powerwall batteries.

The metal is also used in nickel-metal hydride (NiMH) batteries and lithiated manganese dioxide (LMD) batteries.

Vanadium has also emerged as high-performing energy material. While lithium-ion batteries are popular in EVs, the longer lifecycle and unlimited rechargeability of vanadium redox flow batteries (VRFBs) makes them ideal for large-scale energy-storage systems.

Brazil is home to the world’s third-largest manganese reserves (116 million tonnes) and is the fifth-largest producer with output of 1.2 million tonnes of the metal last year.

Shares in Maxtech were trading 13.64% higher at 25 Canadian cents at 10:02 a.m. EDT

The post Canada’s Maxtech Ventures to expand footprint in Brazil with manganese JV appeared first on MINING.com.

from MINING.com https://ift.tt/2OTCYcf

Yukon nickel project waits for better metal prices

Nickel Creek says it won't complete its preliminary economic assessment until improved financial market conditions and a stronger commodity price market, the company said in a news release yesterday.

The stock traded down to 11 cents. A week ago the stock was at 14 cents.

Nickel Creek, formerly Wellgreen Platinum, is a nickel and platinum group metal project three-hours west of Whitehorse. It is located close to the Alaska Highway.

The company decided to stop work on the PEA after its Phase II Metallurgical Program:

The Company has analysed the impact of this new relationship on the Project. The nickel recovery correlation to sulphur results in a reduction in the average nickel recoveries to levels below those observed in our Phase II Metallurgical Program. By applying the nickel sulphur recovery formula discussed above, the Company estimates that the Project's 2017 stated mineral resource tonnage would be reduced by approximately 10% using a nickel price of US$8.25 per pound (see table below). Given this new understanding, combined with current and projected long term commodity prices and financial market conditions, the Company believes it wouldn't be prudent to complete a PEA until the emergence of improved financial market conditions and a stronger commodity price environment, and notionally not until nickel prices settle in the range of at least US$9.00 to US$11.00 per pound. Any decision at that time will need to factor in all relevant considerations, including but not limited to commodity pricing, mine plan, capital and operating costs, metal recoveries and capital market conditions.

Going forward the company says it will ". . . maintain environmental baseline activities, consider optimization alternatives and investigate other opportunities."

Creative Commons image of pedestrian wait signal courtesy of Leo Hidalgo

The post Yukon nickel project waits for better metal prices appeared first on MINING.com.

from MINING.com https://ift.tt/2QYAgDX

First Quantum, Panama Gov’t study ruling that cast doubts on giant copper mine

Canadian miner First Quantum Minerals (TSE:FM) is facing legal uncertainty around its massive $5.48 billion project in Panama, the largest copper mine coming to market over the next couple of years.

The Central American country’s Supreme Court ruled Monday that Law 9, which was used to grant a mining concession to Minera Petaquilla (now known as Minera Panama) in February 1997, was unconstitutional.

According to La Prensa, one of the country’s major newspapers, the ruling stated that Panama’s National Assembly approved a contract between the state and the mining company that didn’t follow the correct legal process and therefore contravened the constitution.

The country' Supreme Court ruled Monday that Law 9, used to grant the mining concession for Cobre Panama copper project, was unconstitutional.

Minera Panama, First Quantum’s local subsidiary, said in a statement Tuesday the ruling only affected the enactment of Law 9, but not the mining concession contract itself, “which remains in effect, and therefore allows continuity of development of Cobre Panama.”

The country’s Ministry of Commerce and Industries, however, told La Prensa on Wednesday the situation was “complex” and needed to be examined.

“We are looking into whether the ruling has any impact on Minera Panama,” minister Augusto Arasomena, a lawyer by profession, said. “We don’t want to jump to conclusions.”

The news comes just ahead of the Toronto-based miner, which gained control over the Cobre Panama project in 2013 with the acquisition of rival Canadian copper miner Inmet Mining, begins ramping up construction towards production.

BMO Capital Markets said in a note Wednesday it expected the project to continue moving forward as the mining concession contract is still in place. “In our view, [the ruling-triggered worries] just highlight one of the challenges in building a large project in a non-mining jurisdiction,” Colin Hamilton, director of commodities research, wrote.

“We model 160,000 tonnes of copper from Cobre Panama next year, rising to 281,000 tonnes in 2020. While viewed as unlikely, were there to be any delays to the ramp-up our copper deficit over these years would be exacerbated,” Hamilton noted.

Last year, First Quantum spent close to $1 billion to advance construction at the project, located about 120 km west of Panama City, and 20 km from the Caribbean Sea coast.

Ruling only affects the enactment of Law 9, not the mining concession contract itself, says the company.

The company plans to invest a further $830 million this year and $110 million in 2019, when the mine is expected to reach full capacity of 380,000 tonnes of copper annually.

Once that happens, First Quantum’s total production will surpass 900,000 tones a year, making the company one of the world’s top six copper producers.

Panama will also reap the benefit from the operating open-pit mine, as it is expected to generate around $2 billion worth of annual exports during its 34-years of life. That, according to Christie, is equivalent to around 4% of the Central American nation’s current GDP.

Cobre Panama is already generating some benefits for the country’s economy, as it currently employs over 12,600 people, 1,500 of which are from the nearby villages and towns, the company said. The project is the largest single private sector investment in Panama's history.

First Quantum, which has operating mines in Australia, Zambia, Mauritania, Turkey, Spain and Finland, is also developing two other projects in Latin American — Haquira in Peru and Taca Taca in Argentina – but it hasn’t decided which one will develop first.

The post First Quantum, Panama Gov’t study ruling that cast doubts on giant copper mine appeared first on MINING.com.

from MINING.com https://ift.tt/2R0Schl

Le premier tramway autonome testé en Allemagne par Siemens

from Les dernières actualités de Futura-Sciences https://ift.tt/2OgjdOY

Ariane 5 : (re)découvrez le centième vol

from Les dernières actualités de Futura-Sciences https://ift.tt/2DtbF7s

La Voie lactée résonne encore d'une rencontre galactique

from Les dernières actualités de Futura-Sciences https://ift.tt/2xCeC0c

Alpes-Maritimes : le fiasco du récif artificiel

from Les dernières actualités de Futura-Sciences https://ift.tt/2Q9poSf

Maladie de Lyme : trop d'antibiotiques prescrits

from Les dernières actualités de Futura-Sciences https://ift.tt/2Ogkju8

Faire voler un drone avec les yeux, c'est possible

from Les dernières actualités de Futura-Sciences https://ift.tt/2Ob4BAv

mardi 25 septembre 2018

Nuages de Magellan : il y en avait peut-être un troisième il y a des milliards d'années

from Les dernières actualités de Futura-Sciences https://ift.tt/2zuJ4e2

Blackham secures $23 million for Wiluna gold project

Australia’s Blackham Resources (ASX: BLK) today announced it has finalized a $23 million funding deal with New York- based fund manager, Lind Partners. The deal follows the the decision to restart open pit mining at Blackham’s historic Wiluna hub.

The Wiluna mining centre is located northeast of Perth. Over 4 million ounces of gold has been produced from 20 open pits and 3 underground mines, including the Golden Age mine, which is currently a source of high grade free milling ore.

After paying down debt owed to Orion Fund JV, Blackham plans to re‐direct cash flows to expand its reserves and finalize the Wiluna expansion feasibility study.

“Blackham has significantly boosted its gold production since January 2018. The current financing from Lind will remove short term debt service payments, improve our balance sheet and allow us to reallocate operating cash flows to expand production levels,” Blackham’s managing director, Bryan Dixon, said in a statement.

As part of the agreement, Blackham will issue 72 million options to Lind Partners, with an exercise price of 8 cents and an expiry of 5 years from issue.

The post Blackham secures $23 million for Wiluna gold project appeared first on MINING.com.

from MINING.com https://ift.tt/2OLrKXb

Capital raising drops

The strength of equity markets is a barometer of investor confidence. The amount of capital raised through equity placement directly reflects the sentiment in the mining industry. Although 2018 is not over yet, it is a good time to take a sneak peek at the current trends in mining equity capital raisings.

The following is a snapshot of the capital raised by mining and exploration companies in Q2 2018 compared to previous quarters. The data from Mining Intelligence represents companies listed on the following stock exchanges: TSX (+TSX-V), ASX, LSE (+LSE-AIM), NYSE and JSE. Only completed placement offerings were considered. Companies representing extractive and oil sands industries have been excluded from this report.

The graph shows that the value of mining capital raised at major exchanges nosedived for the third consecutive quarter. In the first half of 2018, capital raised through equity placements was 18% lower than that in the corresponding period of 2017. In Q2 2018, the mining capital raisings value was at its lowest level in two years. The volume of transactions also decreased.

Uncertainty caused by escalating global trade tensions is a key factor adversely impacting both the amount of capital raised by mining and mineral exploration companies as well as the number of placement offerings completed.

While most mineral commodities markets are in a decline and struggling, one particular sector is still thriving. With the continuing buzz around green energy, electric vehicles and battery technology, the capital raised in Q2 2018 through equity placements by companies focused on lithium, cobalt and other new world critical minerals hit a record level and exceeded US$800 million. This accounted for more than 40% of total mining capital raised during this period at major exchanges.

This impressive growth in the battery metals sector was mainly because of two major equity offerings completed in the second quarter of 2018.

The first is unique and unprecedented for the lithium market. Nemaska Lithium’s overall C$1.1 billion (US$849 million) financing package was completed in Q2 2018. Approximately US$356 million was raised through public and private placement offerings. This comprehensive project financing package will fund the construction, commissioning, working capital and reserve funds for the Whabouchi lithium mine and the Shawinigan electrochemical plant in Canada.

The second major completed equity offering was Cobalt 27 Capital’s bought deal that raised aggregated gross proceeds of approximately C$300 million (~US$225 million). The net proceeds will be used to fund Cobalt 27 Capital’s acquisition of a US$300 million cobalt stream from Vale’s Voisey’s Bay Mine, including from the proposed Voisey's Bay Mine expansion, commencing January 1, 2021.

As more and more players in the mining and metals industry consider investing in the future supply of mineral commodities used in battery technology, it is likely that companies developing lithium and cobalt assets will remain the preferred targets for investors and outperform their struggling peers from other mining markets in the future.

Sign up for Mining Intelligence and get rich insights about miners, juniors and projects. Our online tool puts rich data at your fingertips.

Creative Commons image of plane crash courtesy of Alexander Waltner

The post Capital raising drops appeared first on MINING.com.

from MINING.com https://ift.tt/2DwekgJ

Denison Mines flags first deposit for ISR mining in the Athabasca basin

Denison Mines (TSX: DML) named the in-situ recovery (ISR) mining method for the development of the Phoenix deposit Saskatchewan Wheeler River uranium project, in the heart of the Athabasca basin.

Canada’s Athabasca Basin has become the prime destination for high-grade uranium, with grades in excess of 100x global averages, Canada’s Athabasca Basin has become the prime destination for high-grade uranium, with grades in excess of 100x global averages

and the moves makes it the first deposit identified for ISR mining in the area.

The PFS also discusses co-developing the Phoenix and Gryphon deposits. While the Phoenix deposit is designed as an ISR operation, the Gryphon deposit is designed as an underground mining operation at Denison's 22.5% owned McClean Lake mill. Taken together, the project is estimated to have mine production of 109.4 million pounds of Uranium over a 14-year mine life.

Denison’s PFS produces a combined pre-tax project NPV of $1.41 billion – a nearly 275% increase from the $513 million pre-tax project NPV estimated in 2016.

"The selection of ISR mining for the high-grade Phoenix deposit is a defining moment for our company and a potentially transformational development for the future of uranium mining in the Athabasca Basin- bringing the world's lowest cost uranium mining method to the jurisdiction hosting the world's highest-grade uranium deposits," David Cates, Denison’s, president and CEO said in a statement.

The post Denison Mines flags first deposit for ISR mining in the Athabasca basin appeared first on MINING.com.

from MINING.com https://ift.tt/2QYvQgb

End-to-end mine project cost estimation made easy

Over the past months, our team of experienced mine cost estimators, together with InfoMine’s developers and designers, have built the latest innovation in mine project evaluation: the Surface Evaluation Application. This cloud-based application combines engineering-based estimating procedures with cost data from Mining Intelligence’s Mining Cost Service. The application helps you estimate the scoping-level end-to-end mining and mineral processing capital and operating costs associated with your project.

We know that it takes an iterative process and years of experience to build credible models that estimate reliable mine project costs. Not only is a good understanding of mining and processing required, but strong modelling skills are essential as well. Let our years of experience and innovative Surface Evaluation Application help your team get dependable estimates quickly and consistently.

Using one seamless application, you will be able to enter surface mining, processing, and economic information all as a single project. Through an engineering-based approach, the application uses your inputs to estimate end to end capital and operating costs, as well as economic indicators such as net present value, cash flows, and more. All results are presented in an easy to read and downloadable format.

Reserve your spot now for a free trail before October 1, 2018.

Sign up now for a one-week free trial

The post End-to-end mine project cost estimation made easy appeared first on MINING.com.

from MINING.com https://ift.tt/2OPmEcB

Parker Solar Probe : première lumière pour la sonde qui va frôler le Soleil

from Les dernières actualités de Futura-Sciences https://ift.tt/2DsUKSH

Anglo American becomes latest top miner to land in Ecuador

Diversified miner Anglo American (LON:AAL) has become the latest major miner to set foot in Ecuador by entering into an earn-in joint venture (JV) agreement with Canadian precious and base metals firm Luminex Resources (TSX-V: LR) which spun out of Lumina Gold (TSX-V: LUM) in August.

The deal gives Anglo the right to earn a 60% ownership interest in a JV company, which indirectly holds three copper and gold concessions — Pegasus A, Pegasus B and Luz — in return for an investment of $50 million plus a $7.3 million payment over a seven-year period.

Anglo will have the right to earn an additional 10% ownership interest in the venture simply by funding all the required work up to a decision to construct a mine at the properties, taking its aggregate ownership to 70%.

Deal with Luminex gives Anglo the right to earn a 60% ownership interest in a JV company, which indirectly holds three copper and gold concessions in Ecuador.

Luminex will fund its 30% pro rata share of expenses related to the development and construction of a mine at the properties.

Preparations are under way to continue exploration activities on the properties with Anglo American acting as manager and operator, the Vancouver-based company said.

During the first year of the agreement, Anglo will undertake an airborne magnetic ZTEM survey over the three concessions.

“Highly prospective” location

Ecuador has gained ground as a mining investment destination in the past two years thanks to a revised regulatory framework and a major investor engagement campaign

In February, Australia’s Newcrest Mining (ASX:NMC) took a 14 percent stake in Lundin Gold, which expects to bring its Fruta del Norte gold and silver mine in southeastern Ecuador into production by the end of next year.

Earlier this month, world’s largest miner BHP (ASX, NYSE:BHP) (LON:BLT) bought a 6.1% stake in SolGold (LON:SOLG) (TSX:SOLG) to gain access to the explorer’s Cascabel copper-gold project in the country's north.

Currently, the nation’s emerging mining sector employs 3,700 people, but the government estimates the figure will rise to about 16,000 in the 2017-2020 period.

Luminex Resources was formed earlier in August after Lumina Gold carried out a strategic reorganization, which saw it spinning out all of its concessions and properties, except the Cangrejos gold-copper project, to its shareholders through the new company.

The post Anglo American becomes latest top miner to land in Ecuador appeared first on MINING.com.

from MINING.com https://ift.tt/2OWYdda

Drogues : un rétrovirus HK2 associé à la dépendance ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2xO3217

Cano Cristales, la rivière arc-en-ciel, un reportage d'Olivier Grunewald en Colombie

from Les dernières actualités de Futura-Sciences https://ift.tt/2OKG5TL

Créer une antenne radio grâce à un spray, c'est possible

from Les dernières actualités de Futura-Sciences https://ift.tt/2QVExrN

Christie’s to auction largest, finest pink diamond in its history

The largest and finest fancy vivid pink diamond ever offered at auction by Christie's it’s about to go under its hammer in Geneva, with experts expecting it to fetch a record price of between $30 million and $50 million.

The rectangular cut diamond, named Pink Legacy, was once part of the Oppenheimer collection, Christie’s said, referring to the family who built De Beers into the world’s No. 1 diamond producer.

It’s rated “vivid”, which is the highest rating for a diamond’s colour. At 18.96 carats, is also the largest fancy vivid pink diamond Christie’s has ever offered and it would lead its Magnificent Jewels auction in November.

“To find a diamond of this size with this colour is pretty much unreal,” Rahul Kadakia, International Head of Jewellery at Christie’s said in a statement. “You may see this colour in a pink diamond of less than one carat. But this is almost 19 carats and it’s as pink as can be. It’s unbelievable.’

Scientists classify diamonds into two main “types” — Type I and Type II. In the latter, the diamond has a particularly rare, almost homogenous colour. “Pink diamonds fall under the rare Type IIa category of diamonds,” Kadakia said. “These are stones that have little if any trace of nitrogen, and make up less than two per cent of all gem diamonds. Type IIa stones are some of the most chemically pure diamonds often with exceptional transparency and brilliance.”

The Pink Legacy will be shown in Hong Kong, London and New York before being auctioned in Geneva on Nov. 13. (Image from video, courtesy of Christie’s.)

Pink Diamonds have been fetching record prices at auctions. The 59.6-carat Pink Star diamond, in fact, sold for $71.2 million in April last year, becoming most expensive gem ever sold that way.

In November, another pink rock —set in a ring embellished with smaller diamonds — sold for about $32 million at Christie’s in Hong Kong after a three-minute contest.

The Pink Legacy will be shown in Hong Kong, London and New York before being auctioned in Geneva on Nov. 13.

The post Christie’s to auction largest, finest pink diamond in its history appeared first on MINING.com.

from MINING.com https://ift.tt/2O9nLXr

Glencore to double size of $1B share buyback program

Miner and commodities trader Glencore (LON:GLEN) is increasing the size of its buyback program announced in July by purchasing another $1 billion of stock from now until the end of February 2019.

The Swiss company had announced plans to buy back as much as $1 billion of its shares after the US government investigation into bribery and corruption sent the stock down more than 15 percent since the start 2018.

Before that, it had faced challenges linked to its business in the Congo, where it operates giant copper and cobalt mines.

Moves follows a growing number of world’s top miners returning more money to investors this year.

The second buyback this year is a sign that the company’s management will “work to address any discount in the valuation, including the potential for further buybacks,” RBC Capital Markets said in a note. “At $9 billion of net debt at the half year, and the high free cash yield, the company continues to have more firepower for buybacks.”

Giving back

Glencore’s move falls in line with what an increasing number of top miners have been doing lately, that is, handing money back to shareholders. The trend follows a recovery from the commodity rout of 2015-16 and increasing pressure from investors to not buy assets that may never deliver returns.

Less than a week ago, world’s second largest miner Rio Tinto (ASX, LON:RIO) unveiled a $3.2 billion share buyback following an asset-sale spree. Previously, BHP paid out a record dividend and promised it would give its shareholders most of the $10.5 billion it obtained from the sale of its US shale oil and gas assets.

Glencore said it has almost completed its first buyback, acquiring $940 million of its own stock after the shares fell to a 14-month low in September as part of a wider commodity sell off.

The firm’s shares rose as much as 3.5 percent on Tuesday to 341.70 pence on the news by 1:35 p.m. London time.

The post Glencore to double size of $1B share buyback program appeared first on MINING.com.

from MINING.com https://ift.tt/2pAlk2w

Ariane 5 : le centième lancement

from Les dernières actualités de Futura-Sciences https://ift.tt/2xQS6zN

Iridium Next, le nec plus ultra de la télécommunication spatiale

from Les dernières actualités de Futura-Sciences https://ift.tt/2IfEIKH

Un nanofiltre pour purifier l’eau 100 fois plus vite

from Les dernières actualités de Futura-Sciences https://ift.tt/2OOAYSL

Ces planeurs robotisés volent comme des aigles en jouant avec les courants

from Les dernières actualités de Futura-Sciences https://ift.tt/2Ig24zu

lundi 24 septembre 2018

LHC : des nouvelles de la chasse aux leptoquarks

from Les dernières actualités de Futura-Sciences https://ift.tt/2OM2YX7

Great Panther acquires Brazil gold mine for $105 million

Great Panther Silver (NYSE: GPL) acquired Brazilian gold miner Beadell Resource in an all-share deal for $105 million.

The combined entity will have three producing mines in three mining jurisdictions, and an advanced stage project.

Great Panther, which expects to produce 4 million silver-equivalent ounces of production in 2018, will add 130,000 gold ounces of production expected from Beadell in 2018.

The acquisition wasn't warmly received. Great Panther stock price declined 5% to $1.16 a share.

The CEO of the combined entities lauded the deal.

“This is a transformational transaction for the shareholders of Great Panther and Beadell," James Bannantine, president and CEO of Great Panther, said in a release.

"Great Panther has grown and optimized its operations in Mexico, acquired and advanced its Coricancha project in Peru, and is now positioned to add a sizeable producing mine in Brazil with exceptional exploration potential.”

Dr. Nicole Adshead-Bell, CEO and managing director of Beadell will join the Board of Directors of Great Panther on completion of the transaction.

Beadell operates the 100% owned Tucano Gold Mine in Amapá State, northern Brazil. The Tucano is part of an approximate 2,500 square kilometre land package located in the under-explored 'Birimian age' greenstone terrane. Beadell remains on track for completion of a Tucano plant upgrade by early November 2018.

Image of panther and ball courtesy of Elijah van der Giessen

The post Great Panther acquires Brazil gold mine for $105 million appeared first on MINING.com.

from MINING.com https://ift.tt/2zqKMgk

Are bigger mines always better?

Typically, bigger mines with high production rates have lower operating costs. But is bigger always better? Building a big mine can require significant capital expenditures. These will impact the overall economics of a project.

On October 1, 2018, Mining Intelligence will launch the Surface Evaluation Application. This cloud-based application is the latest innovation in mine project evaluation. It helps you perform scoping-level capital and operating cost estimates and economic evaluations for open pit mining and mineral processing operations quickly and consistently using an engineering-based cost estimating method.

The application allows you to run multiple scenarios to see how production rates impact not only the mine life, but also capital costs, operating costs, payback period, net present value, and other economic indicators. For many projects, there is a best fit or “sweet spot” that maximizes the profitability of a potential mine based on production rates. The Surface Evaluation Application reveals where the best fit is so you can make design decisions earlier in the project timeline, thereby saving you money and time.

Sign up now for a one-week free trial

The post Are bigger mines always better? appeared first on MINING.com.

from MINING.com https://ift.tt/2PYrcO3

Lynas shares collapse on rumours of review in Malaysia

Shares in rare earths producer Lynas Corporation (ASX:LYC) fell Monday after the Australian miner responded to media reports indicating the new Malaysian government was set to launch an official review of the company’s refinery, located in the province of Kuantan.

While the Sydney-based miner had received no official notification as of Monday, it said the rumours “raised concerns,” adding that the renewal of certain operating approvals had been taking longer than normal in recent times.

Local media reported the newly-elected coalition government would launch a three month evaluation of Lynas' rare earths processing operations.

The company’s statement triggered a massive sell-off, with the stock losing 23% of its value to A$1.61, its lowest in a year, and closing more than 18% down at A$1.72.

According to Malaysian paper The Star Online, Fuziah Salleh, a government politician and a long-standing critic of Lynas’ plant, will chair the committee in charge of reviewing the refinery, which activists say is environmentally hazardous.

The facility — known as the Lynas Advance Material Plant (LAMP) — was the centre of relentless attacks from environmental groups and local residents while under construction in 2012. They feared about the impact the low-level radioactive waste the refinery generates could have on the health of those living nearby and the environment.

Lynas say its operations have already been extensively scrutinized, adding it will advocate for a "transparent, impartial and scientific" review provided the chair of the proposed committee is Salleh.

The company is the only major rare earths miner outside China. The metallic elements, crucial in the production of magnets, are extracted in Western Australia, but processed in Malaysia.

The post Lynas shares collapse on rumours of review in Malaysia appeared first on MINING.com.

from MINING.com https://ift.tt/2Q1mcbA

Hayabusa-2 : les deux rovers sauteurs débutent l’exploration de l’astéroïde Ryugu

from Les dernières actualités de Futura-Sciences https://ift.tt/2Dsgqy4

Une batterie au lithium qui digère le CO2

from Les dernières actualités de Futura-Sciences https://ift.tt/2PZGlhU

Pollution : les moustiques disséminent du plastique dans notre environnement

from Les dernières actualités de Futura-Sciences https://ift.tt/2O3Arzc

Barrick to buy Randgold for $18.3B forming giant global gold miner

Canada's Barrick Gold (TSX, NYSE:ABX), the world’s largest bullion producing by value, is about to become even bigger as it has agreed to buy Randgold Resources (LON:RRS) in a $18.3 billion share deal.

The new Barrick company, valued at $24 billion including debt, would be now the world's top gold miner by value and output in an industry under investor pressure to put capital to good use.

It will be listed in New York and Toronto and own five of the world's 10 lowest cost gold mines

Randgold’s shareholders will own 33.4 percent of the combined firm, with the rest controlled by Barrick’s investors.

More to come…

The post Barrick to buy Randgold for $18.3B forming giant global gold miner appeared first on MINING.com.

from MINING.com https://ift.tt/2NyGWKN

Un robot méduse pour détecter les récifs coralliens en danger

from Les dernières actualités de Futura-Sciences https://ift.tt/2xIlR60

Ariane 5 : la grande histoire du lanceur

from Les dernières actualités de Futura-Sciences https://ift.tt/2IajMV3

Votre intestin est directement relié à votre cerveau

from Les dernières actualités de Futura-Sciences https://ift.tt/2zqA2i7

dimanche 23 septembre 2018

Physique quantique : l'expérience des doubles fentes de Feynman réalisée avec des positrons

from Les dernières actualités de Futura-Sciences https://ift.tt/2OLq2oX

Anglo-Australian miner wants to explore the Pyrenees

Anglo-Australian company Apollo Minerals broke the silence regarding a project it is planning to advance in Spain and to talked to local media about its short-term plans.

In the wake of some criticism expressed by people in the town of Isìl i Alòs, Apollo sent a communiqué to La Vanguardia newspaper detailing its strategy regarding a possible gold/tungsten project near the French border.

In detail, the company wants to carry out a six-hole drill program to explore for gold and tungsten in a 27.5-square-kilometre terrain that belongs to the community of Isìl i Alòs.

A request to do so was already submitted to the Catalunya government and, according to the miner, the proposal includes a series of activities to recuperate the area that gets damaged, although the impact of prospecting is expected to be very low.

In this first phase, Apollo wants to hire local experts to analyze the resource at the site and determine whether it is feasible to extract it both sustainably and profitably.

The post Anglo-Australian miner wants to explore the Pyrenees appeared first on MINING.com.

from MINING.com https://ift.tt/2Nvmf2u

From uranium to cobalt: A Canadian's miner strategy to diversify

Forum Energy Metals (TSXV: FMC) is expanding its portfolio. From focusing on copper and uranium in Saskatchewan, the Vancouver-based miner now wants to work on extracting a wider array of products, from precious metals to minerals aimed at supplying the EV market.

This week, Forum announced that it has executed a formal agreement to acquire, for a total of $75,000, the Quartz Gulch cobalt property located in the Idaho Cobalt Belt and the Juneau-Standard gold/silver/copper/cobalt property in Grant County, Oregon from Lumina Cobalt Corp.

In a press release, the Canadian miner explained that the Quartz Gulch claim block consists of 127 claims totaling 10.65 square kilometres, located approximately five kilometres to the southeast of the past producing Blackbird cobalt mine and eCobalt Solutions' Idaho Cobalt Project, the only permitted cobalt mine development in North America.

According to Forum's research, previous work carried out by Noranda at Quartz Gulch revealed that the site is prospective for stratabound cobalt mineralization and cobalt hosted in quartz-tourmaline breccias. To confirm such results, Forum says it plans to conduct initial exploration of the property this fall.

In Oregon's Grant County, on the other hand, the Canadian company plans to purchase the Juneau- Standard Gold/Silver/Copper/Cobalt.

This block consists of 155 claims totaling 9.43 square kilometres surrounding patented claims in the Juneau-Standard, Quartzburg historical mining camp.

"Numerous mines in the district were known for their high-grade gold/silver/copper/cobalt veins, the largest of which were the Standard and Keystone Mines," Forum's statement reads. "It appears that mineralization is within a series of vein and breccia systems that are zoned with a copper-rich zone and a gold-cobalt rich zone. The Keystone Mine was mined primarily for its gold and silver mineralization."

Based on the fact that Lumina geologists prospected the property and sampled historical mine dumps which resulted in gold grades ranging from 0.125 to 548 grams gold per tonne, Forum plans to conduct initial exploration of known veins and to identify new zones within the property this fall.

The post From uranium to cobalt: A Canadian's miner strategy to diversify appeared first on MINING.com.

from MINING.com https://ift.tt/2NyJmJt