mardi 31 décembre 2019

11 actualités marquantes en 2019 vues depuis l’espace

from Les dernières actualités de Futura-Sciences https://ift.tt/36f1bCL

Dixie Gold’s shares soar on Red Lake acquisition

Shares in Dixie Gold (TSX V: DG), formerly Clean Commodities Corp. skyrocketed 80% Tuesday, following the announcement that it had acquired a district-scale exploration project in the developing Dixie Gold District near Red Lake, Ontario.

As a result, Dixie Gold has become one of the largest mineral claim owners in the emerging mining exploration camp with the new project located adjacent to both Great Bear Resources’ and BTU Metals’ properties.

The Red Lake Gold project is approximately 21,258 hectares and covers 1,044 mining claims

The Red Lake gold project held by Dixie Gold represents a district-scale exploration project at approximately 21,258 hectares (52,507 acres) and covers 1,044 mining claims.

“Our new project successfully positions Dixie Gold as a significant participant in one of Canada’s newest exploration camps,” chairman and CEO Ryan Kalt said in the media release. “We are looking forward to commencing gold and VMS exploration work at our new project in the Dixie district during 2020.”

At market close Tuesday, Dixie Gold’s shares had been traded over 3.6 million times. The average daily trading volume is 96, 987. The company has a C$4.6 million market capitalization.

from MINING.COM https://ift.tt/2SOqs2u

Joe Biden tells coal miners to learn to code

Democratic presidential hopeful and former US vice president Joe Biden told unemployed miners, particularly those in the coal sector, to learn to code so that they can access the jobs of the future.

According to Washington Post reporter Dave Weigel, at a rally in Derry, New Hampshire, Biden said that if miners are able to go down 3,000 feet or throw coal into a furnace, they surely have the ability to learn how to program.

Biden riffing on how Obama put him in charge of judging the "jobs of the future" suggests re-training miners as coders.

— Dave Weigel (@daveweigel) December 30, 2019

"Anybody who can go down 3000 feet in a mine can sure as hell learn to program as well."

This sort of "just transition" stuff was murder on Clinton in 2016…

Biden’s comments come at a moment when natural gas has taken a good share of the market previously dominated by coal and when coal generation continues to go down. At the same time, coal exports from the US to Asia and Europe are experiencing a series of roadblocks imposed by towns and cities that decided to put limits on how much of the fossil fuel is shipped from their ports.

The former vice president’s remarks were not entirely well-received, even within his own party. People like Brianna Wu, candidate for the House of Representatives in MA District 8 and a software engineer, tweeted that Biden’s comment seems to be tone-deaf to the needs of mineworkers who have lost their jobs.

According to the U.S. Bureau of Labor Statistics, 53,300 people were employed in coal mines in September 2019, way below the 79,400 people employed in the sector a decade ago.

It is not the first time that Joe Biden makes comments that pose questions about his connection with the reality of unemployed Americans.

Following a presidential debate on December 19, the Washington Examiner published an op-ed titled “Is Joe Biden trying to lose the Rust Belt?”. This, after the Democratic candidate did not elaborate on how, if elected, his government would provide opportunities to blue-collar energy and mine workers to transition to high-paying jobs as the US is pushed to move toward a green economy.

from MINING.COM https://ift.tt/37qBzCS

Red Pine secures C$3.78m financing, welcomes Alamos as shareholder

Red Pine Exploration (TSXV: RPX) announced Tuesday it has closed a private placement of approximately 25.9 million flow-through (FT) units and 82.1 million non-flow-through (NFT) units of the company — both at a price of C$0.035 per unit — for aggregate gross proceeds of C$3.78 million.

Each FT unit comprises one flow-through common share of the company and one-half of one non-flow-through common share purchase warrant. Each NFT unit comprises one common share (issued on a non-flow-through basis) and one whole warrant. A full warrant is exercisable for one common share at a price of C$0.05 per share for a period of 24 months following the offering closing date.

Among the participants of the offering was Toronto-based gold producer Alamos Gold (TSX: AGI), which subscribed for nearly 53 million NFT units for a total investment of C$1.85 million. Alamos now owns 11.1% of Red Pine’s issued and outstanding common shares on an undiluted basis and 19.99% on a partially diluted basis. Alamos did not hold any common shares of Red Pine prior to the offering.

“The addition of Alamos as a strategic investor is a major step in validating the Wawa gold project as a top-tier exploration property,” Red Pine CEO Quentin Yarie commented on the latest investment boost.

The Wawa property — covering 6,519 hectares within McMurray Township, approximately two kilometres southeast of Wawa, Ontario — has hosted numerous gold mines with past production of over 120,000 ounces. A recent technical report pegs indicated resources at 1.2 million tonnes grading 5.31 grams gold per tonne for 205,000 ounces of gold.

The project is 60% owned by Red Pine, with Citabar LP holding the remaining 40% interest.

from MINING.COM https://ift.tt/2rIPxAV

Mars 2020 : tour d’horizon de l’ambitieuse mission de la Nasa

from Les dernières actualités de Futura-Sciences https://ift.tt/2SHuHgA

Mendoza’s legislature kills controversial mining law

It took less than 24 hours to effectively abolish a controversial mining law that sparked massive protests in the province of Mendoza in Argentina’s western-central region.

After announcing his decision to annul the law late last week, Mendoza’s governor Rodolfo Suárez presented a formal request before the legislature on Monday. Right away and with 34 votes in favour and 2 against, the Senate approved the annulment.

Mendoza has 19 mining proposals waiting for approval. Most of them focus on copper extraction but there are also gold, silver, lead, zinc and uranium projects on the drawing board

In the Lower Chamber, however, it took a bit longer and there were four negative votes and one absentee. Despite the lengthy discussion, before the end of the day, Law 9209 which modified Law 7722 and allowed for the use of cyanide and sulfuric acid in mining operations was abolished.

This means that, on publication in Mendoza’s Official Bulletin on Tuesday, December 31, 2019, Law 7722 will be reinstalled.

According to some MPs interviewed by local media, annulling the law was the right thing to do as people from all around the province clearly and loudly expressed their rejection to the possibility of allowing mining companies to use toxic chemicals.

Talking to Los Andes newspaper, MP Guillermo Mosso said that even though he voted negative, he understands Suárez’s decision and respects him for pushing for a peaceful solution to the issue. Explaining how he voted, Mosso said that he still believes that it is important to allow mining operations in Mendoza to promote social development and that authorities and stakeholders need to find ways to reconcile mineral extraction with water preservation and agriculture.

Similarly, the Association of Metallurgical Industries of Mendoza issued a communiqué saying that abolishing the law seems to go against the urgent need to diversify Mendoza’s economy. In the group’s view, it is possible to advance large-scale mining projects in a responsible manner with the highest quality standards of environmental protection.

But the thousands that protested on the streets of different towns and cities across the province for over a week seem to think otherwise. Concerned citizens, left-wing parties and environmental organizations said they worried about the possibility of cyanide and sulfuric acid contaminating the province’s waterways and water supply.

“This is an unprecedented and historic achievement. People in Mendoza protected their province’s water,” Enrique Viale, the spokesperson for Greenpeace Argentina, said in a media statement. “The regulation was approved in a moment when Mendoza is experiencing the worst drought ever registered.”

from MINING.COM https://ift.tt/2ZDamKw

Abeilles : deux nouveaux pesticides désormais interdits en France

from Les dernières actualités de Futura-Sciences https://ift.tt/36h39Co

Dix ans de changement climatique vus du ciel

from Les dernières actualités de Futura-Sciences https://ift.tt/2QdxjRw

Ces espèces que vous ne reverrez plus, déclarées éteintes entre 2010 et 2019

from Les dernières actualités de Futura-Sciences https://ift.tt/2ZGqISY

Scientists develop new system to remove contaminants from nuclear wastewater

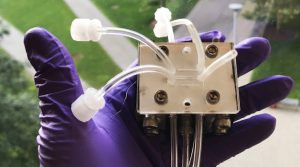

Researchers at the Massachusetts Institute of Technology developed a method to reduce the volume of contaminated water that needs to be disposed of in nuclear plants.

In a paper published in the journal Environmental Science and Technology, the scientists explain that the mechanism concentrates the radioactive isotopes that contaminate the water used for cooling the plants and allows for the rest of the water to be recycled through the plant’s cooling system.

The method makes use of a process called shock electrodialysis, which uses an electric field to generate a deionization shockwave in the water. The shockwave pushes the electrically charged particles, or ions, to one side of a tube filled with charged porous material, so that concentrated stream of contaminants can be separated out from the rest of the water.

During the course of their experiments, the group discovered that two radionuclide contaminants—isotopes of cobalt and caesium— can be selectively removed from water that also contains boric acid and lithium. After the water stream is cleansed of its cobalt and caesium contaminants, it can be reused in the reactor.

For their tests of the system, the researchers used simulated nuclear wastewater based on a recipe provided by Mitsubishi Heavy Industries, which sponsored the research. In the trials, after a three-stage separation process, they were able to remove 99.5% of the cobalt radionuclides in the water while retaining about 43% of the water in cleaned-up form so that it could be reused. As much as two-thirds of the water can be reused if the cleanup level is cut back to 98.3% of the contaminants removed.

“No other practical, continuous, economic method has been found for separating out the radioactive isotopes of cobalt and caesium, the two major contaminants of nuclear wastewater,” said Martin Bazant, senior author of the study, in a media statement. “Not only is the new system inexpensive and scalable to large sizes but, in principle, it also can deal with a wide range of contaminants. It’s a single device that can perform a whole range of separations for any specific application.”

According to Bazant and lead author Mohammad Alkhadra, while the method could be used for routine cleanup, it could also make a big difference in dealing with more extreme cases, such as the millions of gallons of contaminated water at the Fukushima Daichi power plant in Japan, where the accumulation of that contaminated water has threatened to overpower the containment systems designed to prevent it from leaking out into the Pacific ocean.

from MINING.COM https://ift.tt/37rCZwS

Le volcan Anak Krakatau est entré en éruption !

from Les dernières actualités de Futura-Sciences https://ift.tt/39sZjYS

Cinq mystères du corps humain révélés en 2019

from Les dernières actualités de Futura-Sciences https://ift.tt/2MKi3cL

Le plus ancien lemming du monde découvert dans le permafrost par une collégienne

from Les dernières actualités de Futura-Sciences https://ift.tt/2SBRLgC

Le premier stade entièrement en bois sera construit en Angleterre

from Les dernières actualités de Futura-Sciences https://ift.tt/35aMkrD

Vers une solution pour le problème à trois corps

from Les dernières actualités de Futura-Sciences https://ift.tt/2MHsCgP

Kia Imagine : une version grand public du véhicule 100 % électrique dés 2021

from Les dernières actualités de Futura-Sciences https://ift.tt/2tgzwTm

Deux à cinq heures d’activité physique par semaine réduiraient les risques pour sept cancers

from Les dernières actualités de Futura-Sciences https://ift.tt/2tkQfVG

lundi 30 décembre 2019

Armée américaine : les 10 meilleures inventions de 2019

from Les dernières actualités de Futura-Sciences https://ift.tt/2szvIfU

Anaconda updates resource at Goldboro in Nova Scotia

Anaconda Mining (TSX: ANX; US-OTC: ANXGF) has updated the mineral resource at its wholly owned Goldboro gold project in Nova Scotia.

Measured and indicated resources now stand at 4.1 million tonnes grading 5.3 grams gold per tonne for 698,600 contained oz. gold. Inferred resources add 3 million tonnes grading 7.09 grams gold per tonne for 685,100 contained oz. gold.

The updated resource represents a 6.9% increase in the combined open-pit and underground grade in the measured and indicated categories, and boosts combined open-pit and underground ounces 15.9%.

Inferred ounces rose 51.2% in the combined open-pit and underground resource.

The updated resource represents a 6.9% increase in the combined open-pit and underground grade in the measured and indicated categories

In addition, the latest resource expands the deposit 375 metres east, and incorporates 21 new mineralized zones.

Kevin Bullock, Anaconda’s president and CEO, says the global resource of almost 1.4 million oz. gold makes Goldboro “the largest single deposit in the province,” and notes the numbers will “add a positive economic benefit to the ongoing feasibility study.”

Anaconda plans to complete the feasibility study before year-end, and permitting is underway. “Pending permits and the feasibility, we should be able to break ground mid next year,” Bullock says, noting that construction of the processing plant and associated infrastructure of the open-pit mine will take 14 months.

Anaconda acquired the project from Orex Exploration in March 2017.

Goldboro, 175 km northeast of Halifax, hosts three mineralized zones: West Goldbrook, Boston–Richardson and East Goldbrook.

Gold mineralization on the property was first discovered in 1862 by Howard Richardson of the Geological Survey of Canada. Richardson Gold Mining Co. began production from the belt in 1893. Government records show that total gold recovery from 1893 to 1910 was 54,871 oz., with an average recovered grade of 4.11 grams gold per tonne. Intermittent work between 1910 and 1981 included metallurgical test work, reprocessing of mine tailings, shaft sinking and cross-cutting.

A 2018 preliminary economic assessment (PEA) forecast a mine life just under nine years. The study estimated life-of-mine production of 375,931 oz. gold, or 41,000 oz. gold a year, at all-in sustaining costs of $640 per ounce.

The company will transition mining from Pine Cove to Argyle next year, after discovering more near-surface ore

The PEA forecast preproduction capex of $47 million to build an open-pit operation before underground development and production. The study envisioned a conventional truck-and-shovel, 600-tonne-per-day, open-pit mining operation at a single pit in the first three years, during which time it would build underground access, sublevels and ventilation.

“There may be a period of time where there is both [open-pit and underground mining] for several months, but it transitions from open pit to underground in year three,” Bullock says.

In addition to the Goldboro project, Anaconda has been operating the Pine Cove open-pit mine since 2010. The Pine Cove mine is part of the Point Rousse project, 6 km northeast of the town of Baie Verte in Newfoundland. Point Rousse, which had record production of 20,149 oz. gold last year, covers three prospective gold trends: Scrape, Goldenville and Deer Cove. These trends have 20 km of cumulative strike length and include three deposits: Pine Cove, Stog’er Tight and Argyle.

The company will transition mining from Pine Cove to Argyle next year, after discovering more near-surface ore. The Argyle deposit is located within 4.5 km of the Pine Cove mill. Mining at Stog’er Tight was completed earlier this year.

Bereket Berhe, an analyst at M Partners, has a “buy” rating on the company, with a 12-month target price of 70¢ per share.

“Given the quality of its Goldboro project and its producing asset, [Anaconda] is currently undervalued,” Berhe wrote in a recent research note.

Michael Curran, an analyst at Beacon Securities, has a “buy” rating on the company, with a 12-month target price of 90¢ per share.

“We consider Anaconda Mining to be an attractive investment for the successful delivery of production growth over the next few years,” Curran said in a research note.

Curran regards Nova Scotia and Newfoundland as among the lower-risk jurisdictions in the mining industry. The company has 134 million common shares outstanding for a C$27-million market capitalization.

(This article first appeared in The Northern Miner).

from MINING.COM https://ift.tt/2Qt95le

Safety Commission files charges against Baffinland for worker’s death

The Workers’ Safety and Compensation Commission filed 16 charges in the Nunavut Court of Justice against Baffinland Iron Mines Corporation accusing the company of failing to keep safe a main road used to haul iron ore, which caused the death of a 63-year-old truck driver.

The accident took place in December 2018, when Tony Anker was fatally injured at the Mary River mine site, near the Hamlet of Pond Inlet in the northern part of Canada’s Baffin Island. The worker died while operating a Cat 745C Articulated Truck.

According to the Commission, the death was caused by Baffinland’s failure to keep the road safe, which constitutes a violation of the Nunavut Mine Health and Safety Act.

In a press release, the organization states that it is accusing the company of “failing to supervise, instruct and train as is necessary to protect the health and safety of workers and failing to provide and maintain healthy and safe worksites.”

According to a report by public broadcaster CBC, court documents state that Baffinland did not display correct signage about speeds, gear selection and payloads along the main work road at Mary River.

The allegations have yet to be proven in court. Baffinland told CBC that they are false and that it plans to defend itself.

The first court date is scheduled for January 9, 2020.

from MINING.COM https://ift.tt/35fCIfn

Tudor Gold gets boost from Sprott investment

Vancouver-based miner Tudor Gold (TSXV: TUD) announced Monday that it has completed a non-brokered private placement of approximately 4.2 million common shares at a price of C$0.70 per share for aggregate gross proceeds of C$2.93 million.

Nearly all the common shares offered under the placement (approximately 4.1 million shares) were acquired by Eric Sprott, who now owns or controls 20.2 million common shares and 11.5 million common share purchase warrants, representing 14.1% of the issued and outstanding common shares on a non-diluted basis, and 20.5% on a partially diluted basis, assuming the exercise of the warrants.

Shares of Tudor Gold jumped by as much as 28% on the latest investment boost. The company’s market capitalization stands at C$101.5 million.

Proceeds from the sale of the shares will be used to fund exploration on the company’s Treaty Creek project. Treaty Creek is currently 60% owned by Tudor Gold, with American Creek Resources and Teuton Resources each holding a 20% interest carried through to a production decision.

The 17,913-hectare property lies within the Golden Triangle of British Columbia, and borders Seabridge Gold’s KSM property to the southwest and Pretium Resources’ Brucejack property to the southeast. The past-producing Eskay Creek mine also lies 12 km to the west.

from MINING.COM https://ift.tt/35bFqCu

Plan to protect land around AngloGold Ashanti’s copper project in Colombia fails

The mayor of the Jericó municipality in Colombia’s Antioquia department said on Monday that his office’s proposal to modify the Territorial Planning Structure to protect the area surrounding the Quebradona mining project failed today at city council.

Talking to Caracol Radio, Mayor Jorge Pérez said that both the federal government and Quebradona’s owner AngloGold Ashanti (JSE:ANG) (ASX:AGG) (NYSE:AU) put enough pressure on city councillors to drive them to forfeit their votes on the matter.

According to Pérez, his proposal entailed protecting 60% of the soil around Quebradona, allowing only agricultural activities in the area and banning mining operations. To approve it, quorum at city council was needed but it wasn’t reached because many councillors didn’t show up for Monday’s session.

Since the matter will not be voted on again, the Mayor said it is considered closed.

Both the local executive and environmentalist groups have expressed concern over the possibility of AngloGold Ashanti’s project polluting the town’s aquifers. A number of legal procedures have been filed against Quebradona but most of them have failed to move forward.

Through its subsidiary Minera de Cobre Quebradona, AngloGold Ashanti has invested $65 million in advancing the 7,500-hectare project, which is estimated to host some 5 million tonnes of copper reserves, as well as smaller quantities of gold, silver and molybdenum.

from MINING.COM https://ift.tt/2F5BxnR

Réchauffement climatique : le coût exorbitant des catastrophes naturelles en 2019

from Les dernières actualités de Futura-Sciences https://ift.tt/2tjE76Y

Great Panther’s Mexican subsidiary lands seven-figure contract

Great Panther Mining (TSX: GPR) announced that its Mexican subsidiary Minera Mexicana El Rosario entered into a $10-million concentrate prepayment agreement with IXM Group, one of the world’s largest physical metal traders, headquartered in Geneva, Switzerland.

The deal entails that IXM’s subsidiary in Mexico commits to purchase 100% of the gold-silver concentrates produced from the Guanajuato Mine Complex in 2020 and 2021. As part of this commitment, the Swiss company agreed to advance a $10-million prepayment to MMR on December 30, 2019.

GPR shares were up by 1.52% on Monday following the announcement

In a press release, Great Panther explained that the prepayment will be repaid on December 31, 2020, and will bear interest at an annual rate of 3-month USD LIBOR plus 5%. There is no hedging of the price of gold or silver associated with the off-take or prepayment agreement.

“We are pleased to be partnering with IXM in Mexico for our GMC concentrates over the next two years,” Jeffrey Mason, the Canadian miner’s interim president and CEO, said in the media brief. “Securing the sale of this off-take at competitive market terms, while strengthening our balance sheet with $10 million at an attractive cost of capital, positions us well to achieve our strategic objectives as we move into 2020.”

The Guanajuato Mine Complex is Great Panther’s largest operation in Mexico and includes production from the San Ignacio mine, which is processed at the Cata processing plant. It is located within the central Guanajuato District – historically one of the country’s most prolific mining districts, with past production of over one billion ounces of silver and four million ounces of gold since the 16th century.

from MINING.COM https://ift.tt/2ZBONtM

L’étoile Bételgeuse perd de son éclat : va-t-elle exploser en supernova bientôt ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2u4WMUJ

Alrosa unearths 191-carat diamond at Botuobinskaya pipe

Just before the end of the year, the world’s top diamond producer by output, Alrosa (MCX: ALRS), unearthed a large 191-carat rough diamond at its Botuobinskaya kimberlite pipe in Yakutia, eastern Russia.

The Botuobinskaya pipe is famous for a large proportion of gem-quality and near-gem-quality transparent crystals

Even though Alrosa experts are still conducting mineralogical analyses on the stone, preliminary results suggest that the diamond is about 2 billion years old.

“This is a true sign to find such a large and high-quality diamond just around the end of the year,” Evgeny Agureev, the company’s deputy CEO, said in a media statement. “Nature has already endowed us in 2019. For example, a heart-shaped diamond was mined at the Udachnaya pipe just before Valentine’s Day. Surely, such findings are very remarkable.”

Discovered in 1994, the Botoubinskaya pipe, together with the Nyurbinskaya pipe, is operated by Alrosa’s Nyurba Mining and Processing Division. The unit, however, was established back in 2000 and mining at the deposit began in 2015.

from MINING.COM https://ift.tt/37oUiP8

Biodiversité : ces espèces que vous ne reverrez plus, déclarées éteintes

from Les dernières actualités de Futura-Sciences https://ift.tt/358uSE0

Lithium-ion batteries could become self-healing

Engineers at the University of Illinois have developed an electrolyte that could help manufacturers produce recyclable, self-healing commercial batteries.

In a study published in the Journal of the American Chemical Society, the researchers explained that they have created a solid polymer-based electrolyte that can self-heal after damage—and the material can also be recycled without the use of harsh chemicals or high temperatures.

In their paper, the experts wrote that their invention came to be as a response to the push to replace the liquid electrolytes in lithium-ion batteries with solid materials such as ceramics or polymers. This, in the face of the issue related to batteries developing dendrites or branchlike structures of solid lithium after going through multiple cycles of charge and discharge.

The team probed the conductivity of the new material and found its potential as an effective battery electrolyte to be promising

Dendrites reduce battery life, cause hotspots and electrical shorts, and sometimes grow large enough to puncture the internal parts of the battery, causing explosive chemical reactions between the electrodes and electrolyte liquids.

“Solid ion-conducting polymers are one option for developing non-liquid electrolytes,” Brian Jing, one of the study’s co-authors, said in a media statement. “But the high-temperature conditions inside a battery can melt most polymers, again resulting in dendrites and failure.”

To address this issue, the researchers developed a network polymer electrolyte in which the cross-link point can undergo exchange reactions and swap polymer strands. In contrast to linear polymers, these networks actually get stiffer upon heating, which can potentially minimize the dendrite problem. Additionally, they can be easily broken down and resolidified into a networked structure after damage, making them recyclable, and they restore conductivity after being damaged because they are self-healing.

“Most polymers require strong acids and high temperatures to break down,” said Christopher Evans, the lead author for the paper. “Our material dissolves in water at room temperature, making it a very energy-efficient and environmentally friendly process.”

from MINING.COM https://ift.tt/35bnnMw

Long March 5 : avec le lancement réussi, la Chine vise la Lune et Mars

from Les dernières actualités de Futura-Sciences https://ift.tt/356ptgD

Réchauffement climatique : ses impacts sur la santé dans le sud-est de la France

from Les dernières actualités de Futura-Sciences https://ift.tt/2Q6D43k

Australie : 3 millions d’hectares en feu et au moins un tiers des koalas victimes des incendies

from Les dernières actualités de Futura-Sciences https://ift.tt/2FhEEcJ

Apollo : la Nasa sort du frigo des échantillons lunaires intacts

from Les dernières actualités de Futura-Sciences https://ift.tt/2F8NTLF

Les gants Teslasuite permettent de ressentir les objets virtuels

from Les dernières actualités de Futura-Sciences https://ift.tt/2Q82oGl

dimanche 29 décembre 2019

Du « super corail » pour sauver les récifs

from Les dernières actualités de Futura-Sciences https://ift.tt/2Q9gF5w

Science décalée : des perroquets accros à l'opium saccagent des champs de pavot en Inde

from Les dernières actualités de Futura-Sciences https://ift.tt/2XO81va

Judge reopens investigation against Grupo Mexico’s subsidiary for toxic spill

A federal judge ordered Mexico’s General Prosecutor to reopen a criminal investigation against Buenavista del Cobre, a subsidiary of mining giant Grupo Mexico (BMV:GMEXICOB), responsible for the 2014 spill of close to 40,000 cubic meters of wastewater into the Bacanuchi River, a tributary of the Sonora River located in the northwestern state of the same name.

According to court documents accessed by Reforma newspaper, Judge Jesús Alberto Chávez Hernández’s appeal nullifies a couple of decisions made by the Prosecutor’s office back in 2017 and in 2018, which called for the investigations to cease and be archived.

Buenavista is located about 40 kilometres from the U.S. border and it is undergoing an expansion process that will turn it into the third-largest copper mine in the world

Chávez Hernández’s move follows a challenge against those decisions introduced by a number of Sonora residents and by the Mining, Metallurgical, Siderurgical and Similar Workers Union, known as Los Mineros. Both groups claim they are victims of the spill.

Also, in early December, Mexico’s Federal Attorney for Environmental Protection accused Grupo México of not fulfilling a number of commitments related to clean-up, restoration and reparation after the spill, an allegation that the company denies.

Following the spill, Grupo México created a $106 million fund to cover the damages caused by the toxic leak that started at the Buenavista copper mine, reached waterways along a 420-kilometre stretch, affected seven municipalities and left 22,000 people without drinking and irrigation water.

The total estimated cost for the environmental damage, however, was estimated by the Federal Attorney for Environmental Protection (Profepa) in more than $133.7 million.

from MINING.COM https://ift.tt/2SE84JB

Le radiotélescope MeerKAT révèle des jeunes étoiles dans des galaxies lointaines

from Les dernières actualités de Futura-Sciences https://ift.tt/355qNR1

Massive protests force Argentinian governor to abolish mining law

Following a week of protests, the governor of Argentina’s central province of Mendoza, Rodolfo Suárez, announced that he will send a bill to the legislature to abolish Law 9209, which allowed for cyanide and sulfuric acid to be used in mining operations and which modified its predecessor Law 7722.

The new law was swiftly approved last week and it sparked massive, daily protests across the province. Some rallies caused transit disruptions on roads that connect Argentina with neighbouring Chile.

Seven wine-producing towns within the Mendoza province said they would suspend their annual vintage festivals if Law 9209 wasn’t abolished

Protesters, many of them from left-wing opposition parties and environmental organizations, argued that the new law threatened the province’s waterways and water supply.

After a week of unrest, on December 26th, Suárez said that the legislature was not going to work on the regulations that would make the law effective until a social consensus was reached. In a press conference reported on by local media, the governor said he was even thinking about the possibility of calling a referendum on the law.

But Suárez’s attempt to save 9209 didn’t work as rallies continued to take place with 10,000 people marching on Thursday, according to Clarín newspaper. Thus, his office announced that a bill to abolish the law will be sent to the provincial legislature this Monday.

The governor, however, said he still believes that allowing mining activities is key for Mendoza’s economic development. At present, the province has 19 mining proposals waiting for approval. Most of them focus on copper extraction but there are also gold, silver, lead, zinc and uranium projects on the drawing board.

from MINING.COM https://ift.tt/2Q4lFZc

Scientists find new mineral in meteorite sample

Researchers from the California Institute of Technology, the University of California and Maine Mineral & Gem Museum found a rare form of iron-carbide mineral that has never before been seen in nature. They named it edscottite.

The mineral was retrieved from the 210-gram, black-and-red Wedderburn meteorite, which was found in 1951 in the Australian town of the same name located in the southeastern state of Victoria. Ever since it fell from the sky, the alien rock has been studied by scientists and discoveries are frequently done.

Edscottite was named after Edward R.D. Scott, a meteorite expert who had identified a formula for the mineral back in the 1970s

Previous analyses had already detected traces of gold, iron, kamacite, schreibersite, taenite, and troilite. Edscottite, however, was recently found after the US researchers received a sample of the meteorite from the Museums Victoria collection.

To uncover the presence of the mineral, the experts led by Caltech mineralogist Chi Ma used an electron microscope and associated probe. In a paper published in the journal American Mineralogist, they explain that edscottite does not occur naturally on Earth but has been produced as a byproduct of smelting and in science labs. Until now, it had been called Fe5C2.

The fact that it was found in the meteorite allows edscottite to be officially recognised by the International Mineralogical Association and get a name, as only minerals that form naturally are accepted by the official body.

It is believed that edscottite could have formed in the core of a planet with a lot of heat, as the meteorite it came from is likely to have been part of a much larger body that experienced a collision and broke into pieces.

from MINING.COM https://ift.tt/367pbHT

Voici la version boostée du ciseau moléculaire CRISPR

from Les dernières actualités de Futura-Sciences https://ift.tt/37cWkC7

samedi 28 décembre 2019

Science décalée : les hommes mangent plus pour impressionner les femmes

from Les dernières actualités de Futura-Sciences https://ift.tt/2zTuJ83

Exoplanètes : un astronome décrypte la future mission HabEx

from Les dernières actualités de Futura-Sciences https://ift.tt/2QvqiKZ

Surprise : le dragon de Komodo est venimeux !

from Les dernières actualités de Futura-Sciences https://ift.tt/2MzAT68

Exoplanètes : un astronome décrypte la futur mission HabEx

from Les dernières actualités de Futura-Sciences https://ift.tt/2ZDBxoM

Comment réduire le temps passé en salle d'attente chez le médecin ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2sVYKWO

vendredi 27 décembre 2019

Innovation hub for mining and energy opens in Perth

Mining and energy companies in Australia looking to develop innovative solutions to market challenges now have a cutting edge location in Accenture’s new Innovation Hub in Perth.

Both the mining and energy sectors are currently facing a world of disruption. Technology has brought dynamism for both, as artificial intelligence (AI), Internet of Things (IoT) and data analytics among others start to play a key role in large-scale operations.

Sustainability is another major disruptor reshaping the face of the two industries. The mining and energy sectors are emission heavy, and the economic drive towards sustainability is forcing many companies to reexamine their operations. In the mining sector, pressure to become sustainable has pushed many to phase out diesel machinery, among other fundamental changes.

Specifically in the energy sector, disruption has further come in the form of three Ds – decarbonisation, digitalisation and decentralisation. Innovation is critical in this scenario, and Accenture has stepped in to facilitate problem-solving through its new Perth Innovation hub.

The new hub joins three other Innovation Hubs in Australia – situated in Sydney, Melbourne and Canberra – and becomes part of a global network of more than 100 Accenture Innovation Hubs. The facility is equipped with state-of-the-art technological implements so as to enable experimentation.

from MINING.COM https://ift.tt/2SzDbGm

Canada snapshot: Projects to watch in BC, Yukon and NWT

The natural endowment of Canada’s British Columbia province, the Yukon and Northwest Territories continues to drive mineral exploration and development. Here are eight companies active in the region:

American Creek Resources

American Creek Resources (TSXV: AMK) is exploring for gold and silver in British Columbia’s Golden Triangle area. The company holds interests in three projects within this district, Treaty Creek, Electrum and Dunwell.

Treaty Creek, where American Creek Resources holds a 20% interest (60% Tudor Gold (TSXV: TUD) and 20% Teuton Resources (TSXV: TUO)) encompasses the hydrothermal system host to Seabridge Gold’s (TSX: SEA, NYSE: SA) KSM deposit and Pretium Resources’ (TSX: PVG, NYSE: PVG) Brucejack project. According to AMK, this project is potentially host to up to 7 km of mineralization at depth. Drill highlights from the 2019 program at this property include 0.73 gram gold per tonne over 839 metres, including a section of 1.05 grams gold over 329 metres and 1 gram gold over 336 metres. These results are from the Goldstorm zone, one of four areas of mineralization identified on the property.

Electrum is located between the historic Silbak Premier mine (Ascot Resources (TSX: AOT)) and Pretium Resources’ (TSX: PVG, NYSE: PVG) Brucejack mine. There has been minimal exploration conducted on this property, which appears to be host to a low sulphidation epithermal system with high-grade electrum (a gold-silver alloy) in quartz veins. AMK holds a 40% interest in this project with Tudor Gold, its joint venture partner, at a 60% stake.

At Dunwell, located between Ascot Resources’ Premier and Red Mountain projects, the historic Dunwell mine produced a total of 45,657 tonnes between 1926 and 1937 at a head grade of 14.3 grams gold-equivalent. In addition to mineralization at the historic mine site, the company has identified additional gold showings along a three-km strike length.

Beyond the Golden Triangle, the company holds five additional properties in its B.C. portfolio. Gold Hill is within the headwaters of the Wild Horse River and includes the area believed to be the source of gold recovered during historic placer mining downstream and also features a series of underground workings. Follow up work is also planned for the Austruck Bonanza, Ample Goldmax, Silverside and Glitter King projects.

American Creek has an approximate market capitalization of $24 million.

Garibaldi Resources

Garibaldi Resources (TSXV: GGI) is focused on exploration at its properties in British Columbia and Mexico.

The company’s flagship 63 sq. km Nickel Mountain project is located 6 km southwest of Eskay Creek in B.C.’s Golden Triangle district.

Nickel Mountain is host to the historic E&L deposit, which features the first nickel-copper rich massive sulphide zones discovered in the Eskay camp. E&L was originally discovered in 1966 and was held by Silver Standard (TSX: SSRM, NASDAQ: SSRM) between 1958 and 2014.

Drill results from this project released in December returned strong copper and precious metal grades: one hole intercepted 7.94% nickel, 5.85% copper, 0.16% cobalt, 7.05 grams palladium per tonne, 2.73 grams platinum per tonne, 1.75 grams gold per tonne and 15.81 grams silver per tonne over 4.43 metres within a wider 15-metre intercept grading 5.25% nickel and 3.21% copper. These results are from the upper part of the Lower Discovery Zone (LDZ).

At E&L, Garibaldi has identified five zones of mineralization, which are open for expansion. Based on field work completed up to December 2018, the company has confirmed that the Nickel Mountain gabbroic complex strikes for over 3 km and extends for at least 1 km across. Geophysical surveys have identified conductors across a trend of at least 6 km at Nickel Mountain.

In December 2017, Garibaldi released assays from a hole drilled 200 metres east of the historic E&L deposit, which returned a 16.8-metre interval grading 8.3% nickel and 4.2% copper within a 40.4 metre interval of 3.9% nickel and 2.3% copper starting at 100 metres. According to the company, this drillhole suggests a high-quality discovery with a very pure style of mineralization, which is desirable from a processing perspective.

Garibaldi acquired an option to purchase a 100% interest in the E&L deposit and surrounding claims in 2016 and commenced exploration efforts later that year.

In addition, the company holds the King, PSP, Red Lion and Grizzly properties in B.C.

In Mexico, Garibaldi holds four additional exploration-stage projects in the country’s Sinaloa, Sonora and Chihuahua states.

Garibaldi Resources has a market capitalization of approximately $113 million.

GT Gold

GT Gold (TSXV: GTT) is an explorer working on advancing the Saddle North and Saddle South discoveries at its 468 sq. km Tatogga property within B.C.’s Golden Triangle district.

Saddle North, first identified and drilled by the company in 2017, is a copper-gold porphyry with drilling to date tracing mineralization over approximately 700 metres of strike, for 1,400 metres to 1,600 metres down plunge and over thicknesses of 200 metres to 560 metres. It remains open with GT identifying a higher-grade core zone that strikes over 200 metres to 400 metres and is 40 metres to 450 metres thick.

In December, the company released the most recent intercepts from infill work on this core area: highlights include 2.05 grams gold-equivalent over 124 metres and 1.47 grams gold-equivalent over 21 metres.

Saddle South is an epithermal gold-silver system that was first drill tested by the company in 2017. Drilling to date has traced mineralization over 1,300 metres of strike, over a width of up to 300 metres and down to a depth of over 600 metres; it remains open. This discovery features near-surface, high-grade mineralization over 1,000 metres of strike. Saddle South intercepts include 18.08 grams gold and 313.38 grams silver over 2.13 metres and 187.5 grams gold and 53.6 grams silver over 0.74 metres.

In November, the company announced an $8.3 million investment by Newmont-Goldcorp (TSX: NGT, NYSE: NEM) whereby the major increased its stake in the company from 9.9% to 14.9%. GT’s current cash balance is about C$18 million.

GT is working on a geological model for Saddle North, expected to feed into a maiden resource estimate, which is scheduled for release in the second quarter of 2020. This will be followed by a preliminary economic assessment, anticipated by the end of 2020.

In addition to the Saddle discoveries, the company has identified the Quash Pass target, located about seven km to the south-west of Saddle that features geochemical and geophysical anomalies up to six km long with a similar strike direction to the Saddle system. Initial drilling of this target is planned for next year.

GT Gold acquired Tatogga in 2016.

GT Gold’s current market capitalization stands at about C$123 million.

Metallic Minerals

Metallic Minerals (TSXV: MMG) is focused on advancing its exploration-stage silver projects in the Yukon. The company’s 166 sq. km Keno Silver project, within the Keno Hill Silver District, is located adjacent to and on strike with Alexco Resources’ (TSX: AXU) property whose holdings include four high-grade deposits.

The greater Keno Hill Silver District has produced over 200 million oz. of silver over the last 100 years with eight past producing mines at the 35-km long Keno project. The deposits in the district feature high-grade silver-bearing veins with additional lead and zinc. Of the 12 mineralized trends identified, 10 continue into its under-explored eastern flank where Keno is situated.

To date, three targets at the project have been drilled with a further 16 undrilled targets and prospects. Several of the targets are on extensions of trends associated with deposits at the Alexco property.

In August, Metallic provided an exploration update for the central part of the Keno property: in addition to samples from two targets yielding in excess of 1,000 grams silver, the company has identified two new silver-zinc-lead soil anomalies extending over kilometers. Structural analysis of local geology has also highlighted additional prospective corridors.

In April, the company released an update for the eastern part of the property and announced that it has identified a total of eight targets featuring silver-zinc-lead soil anomalies and high-grade silver surface samples within favorable host rock.

Diamond drill highlights from the 2017 exploration program included 2.8 metres of 312 grams silver-equivalent as well as 1.76 metres of 560 grams silver-equivalent from the Homestake target. Caribou intercepts included 2.65 metres of 972 grams silver-equivalent and 1.6 metres of 2,851 grams silver-equivalent.

Also in the Yukon, Metallic holds the 44 sq. km McKay Hill project, 50 km north of Keno Silver. It sits within a silver-lead-zinc rich belt running from Alaska to southern Yukon and includes the Keno Hill Silver district. This past-producing asset features 37 vein structures identified to date. Recent rock and soil sampling has revealed six targets over an area of 3 km by 1.5 km.

Metallic is planning for its 2020 field season. In October, the company closed a $2.75 million non-brokered private placement with Eric Sprott, who now holds an estimated 13% of the company’s shares.

In September, the company announced that it entered into an option agreement to acquire 100% of the La Plata silver-gold-copper property in Colorado. This property features a porphyry system rich in precious metals with additional silver and gold epithermal prospects.

Metallic Minerals has a current market capitalization of approximately $22 million.

Nighthawk Gold

Nighthawk Gold (TSX: NHK) is focused on advancing the Colomac gold project, located within the company’s 899 sq. km Indin Lake property in the Northwest Territories.

Colomac currently consists of five deposits with total inferred resources of 50.3 million tonnes grading 1.62 grams gold per tonne for a total of 2.6 million ounces. Six zones within the nine-kilometre Main Sill area of the Colomac deposit contribute 48.6 million tonnes to the current resource inventory. The Main Sill unit is up to 160 metres wide at depth with mineralization intercepted down to 800 metres thus far. Colomac is situated within a 16-kilometre underexplored host formation with two additional undrilled parallel sills.

In December, Nighthawk reported results from three of the Main Sill zones with drilling extending mineralization at depth and increasing its width. Additional shallow high-grade intercepts suggest a new style of mineralization for the project. Notable intercepts included 1.89 grams gold per tonne over 110.5 metres and 4.41 grams gold over 11.2 metres.

In May, the company released its best hole to date: an intercept of 13.49 grams gold over 56 metres from zone 1.5 at Colomac.

Open pit mining of the Colomac deposit took place between 1989 and 1991 as well as between 1994 and 1997. Nighthawk resumed exploration at the property in 2009.

Beyond Colomac, Nighthawk has identified a number of targets at Indin Lake: four along the northwestern edge of the property and three along its southeastern boundary.

Notably, four distinct gold deposit settings have been identified at Indin Lake: Colomac Main is hosted by a differentiated mafic sill while three other targets appear to be structure-related lode gold deposit types. Three further targets are iron-formation hosted while one target is hosted in a brecciated intrusion.

Nighthawk has drawn parallels between the setting of the Colomac deposit and the 10-kilometre strike of prospective host rock at the Kalgoorlie gold camp in Australia: both are of Archean age with gold hosted by mafic intrusions and occurring in more silica-rich fractions. The company is using this analogy in generating drill targets.

The company has identified a number of targets beyond Colomac for follow-up that potentially could be used to supplement a future Colomac mill or grow to emerge as stand-alone projects.

Nighthawk’s shareholders include Kinross Gold (TSX: K, NYSE: KGC) with a 9.9% interest and Osisko Gold Royalties (TSX: OR, NYSE: OR) with an 8.6% stake in the company.

An updated resource for Colomac is expected next year and will incorporate 50,000 metres of drilling completed in 2018 and 2019.

The company has a market capitalization of approximately C$107 million.

Seabridge Gold

Seabridge Gold (TSX: SEA, NYSE: SA) holds the KSM, Iskut and Courageous Lake projects in B.C. and the Northwest Territories.

The KSM deposit, located within B.C.’s Golden Triangle, is the world’s largest undeveloped gold-copper project by reserves. Reserves for the asset total 2.2 billion tonnes grading 0.55 gram gold per tonne, 0.21% copper, 2.6 grams silver per tonne with additional molybdenum for a total of 38.8 million oz. of gold, 10.2 billion lb. copper and 183 million oz. of silver.

In March, Seabridge released updated resources for the Iron Cap deposit at KSM, which is closer to infrastructure than the other deposits at the site. The company sees potential to include Iron Cap early on in the mine plan; it plans to complete an updated PEA for the project.

Preliminary feasibility study results for the project were released in September 2016 and outlined an open pit and block cave operation extracting ore from the Mitchell, Iron Cap, Sulphurets and Kerr zones. Over a 53-year mine life, the first seven would see average annual production of 933,000 oz. of gold and 205 million lb. copper with additional silver and molybdenum. The analysis suggested a $1.5 billion base-case net present value (NPV) estimate at a 5% discount rate; total costs were estimated at $673 per oz. of gold produced with a $5 billion capital outlay.

Seabridge also released the results of a PEA in October of 2016, which examined the option of developing inferred resources at the Deep Kerr and Iron Cap Lower zones. The PEA placed a greater emphasis on block cave mining with reduced surface impacts from the open pits. This iteration would see total costs of $358 per oz. with higher peak throughputs, $5.5 billion in initial capital and a resulting $3.4 billion base-case NPV at a 5% discount rate.

The company also holds the Courageous Lake property in the Northwest Territories with reserves of 91.1 million tonnes grading 2.2 grams gold for a total of 6.5 million oz. of gold. A preliminary feasibility study completed on this project in 2012 outlined an open pit producing an average of 385,000 oz. of gold annually at cash operating costs of $780 per ounce. The associated capital cost stands at $1.5 billion. Additional exploration is ongoing at this site.

In 2017, Seabridge acquired the Snowstorm gold project in Nevada; it is located at the intersection of three gold belts in the district and on strike with several gold mines. A drill program is upcoming for this property.

In June of 2016, Seabridge acquired SnipGold, adding the Iskut project to its holdings. Iskut is located 30 km from KSM and features measured and indicated resources of 187 million tonnes grading 0.12% copper, 0.36 gram gold and 2.19 grams silver. Additional inferred resources stand at 5 million tonnes. Exploration is ongoing at this past-producing site.

Seabridge Gold has a market capitalization of approximately $1.1 billion.

Skeena Resources

Skeena Resources (TSXV: SKE) is focused on advancing its project portfolio in B.C.’s Golden Triangle district.

Its flagship Eskay Creek project is located 83 km northwest of Stewart and covers an area of 51 sq. km. In November, Skeena released the results of a PEA for Eskay. The study suggested an open pit operation producing gold and silver in concentrate that would be sold to third party smelters. The study outlined life of mine average annual gold-equivalent production of 306,000 oz. at all-in sustaining costs of US$757 per oz. with pre-production capital outlays of $303 million. The associated after-tax net present value estimate, at a 5% discount rate, came in at $638 million with a 51% internal rate of return.

Current Eskay Creek pit-constrained resources, released at the end of February 2019, stand at 12.7 million tonnes in the indicated category at a head grade of 5.8 grams gold-equivalent for a total of 2.3 million gold-equivalent ounces. Inferred resources total 14.4 million tonnes at 2.9 grams gold-equivalent for a further 1.3 million gold-equivalent ounces. Underground resources add 218,000 indicated and 78,000 inferred gold-equivalent ounces.

Eskay Creek produced 3.3 million oz. gold and 160 million oz. silver between 1994 and 2008 from underground operations with average head grades of 45 grams gold and 2,224 grams silver.

In December of 2017, Skeena signed an option agreement with Barrick Gold (TSX: ABX, NYSE: GOLD) to acquire a 100% interest in Eskay Creek by spending a minimum of $3.5 million on exploration, paying $10 million and reimbursing Barrick for reclamation costs and a bond for a total of up to $7.7 million. Under the terms of the agreement, Barrick retains a back-in right to purchase a 51% interest in the property, exercisable for a 12-month period following the announcement of a resource of at least 1.5 million gold-equivalent oz. on the property.

In addition, Skeena holds the Snip property in its portfolio, acquired from Barrick in 2017. The 19-sq.-km property hosts the historic Snip mine, which produced 1 million oz. of gold between 1991 and 1999 at a head grade of 27.5 grams gold.

The company’s GJ project is 30 km west of Imperial Metals’ (TSX: III) Red Chris mine and features two porphyry deposits located 14 km apart. A PEA for the project released in April of 2017 outlined an open pit operation with a 25-year life and a $216 million capital outlay returning a pre-tax net present value estimate of $546 million, at an 8% discount rate. Skeena is currently seeking a partner to advance this asset to the pre-feasibility stage.

Skeena Resources has a market capitalization of approximately C$76 million.

Stratabound Minerals

Stratabound Minerals (TSXV: SB) is focused on its 84 sq. km Golden Culvert project within the Hyland Gold Belt in the Yukon. The belt is also host to Golden Predator’s (TSXV: GPY) 3 Aces project and Goldstrike Resources’ (TSXV: GSR) Plateau gold project.

Golden Culvert features a 24 km long mineralized trend; soil sampling has identified a 3 km long, 250 metre wide anomaly with gold grades in excess of 30 parts per billion within this trend.

Within this soil anomaly, exploration work completed to date has traced gold mineralization along a 570-metre strike. Mineralization at the site appears to consist of quartz vein and breccia structures that control the gold emplacement; gold may be localized in shoots within the veins.

Over the course of its 2019 exploration program, the company traced the Main Vein structure along 1.9 km of strike within the 3-km soil anomaly; it remains open. Stratabound also discovered a new structure, 7.1 km north of the Main Vein that outcrops at surface. This vein features a similar dip and strike as the Main zone structures to the south and is located at the edge of a historic gold in soil anomaly. The 7.1 km strike length between the veins remains unexplored.

In October, Stratabound released trenching results from Golden Culvert that returned 24.41 grams gold over 6 metres and included a higher-grade section of 95 grams gold over 1.5 metres. This intercept is from a newly discovered, parallel vein structure at the Main zone. The 2019 exploration efforts at the Main zone widened the mineralized corridor to 130 metres from 50 metres previously by identifying four new gold-bearing veins.

Stratabound has the option to acquire a 100% interest in Golden Culvert by making total payments of $1.72 million over five years and spending a total of $700,000 on exploration; it has now met the spend requirement. In December, the company announced a restructuring of the option agreement payments, deferring some payments to later years. Half of the payments may be made in shares.

Also in December, the company closed a non-brokered private placement for gross proceeds of $200,000 with Jerritt Canyon Canada, a private company that operates the Jerritt Canyon mine in Nevada.

In New Brunswick, Stratabound holds a 100% interest in the Captain copper-cobalt deposit. In addition, in December, the company announced that it has signed an option agreement to acquire a 100% interest in the McIntyre gold project located 80 km west of Bathurst. There are currently two known gold occurrences at this site that are located 1.5 km apart; diamond drilling has started with a focus on testing previously-identified gold mineralization along 300 metres of strike.

Stratabound has a current market capitalization of approximately C$5.7 million.

(This article first appeared in The Northern Miner).

from MINING.COM https://ift.tt/2Q3JLn1

Leo DiCaprio slams Brazilian government for failing to protect Indigenous land against illegal mining

Actor Leonardo DiCaprio published a social media post slamming the Brazilian government for its lack of protection of Indigenous territories against artisanal mining.

In his post, DiCaprio criticizes that Brazilian authorities are turning a blind eye to the massive influx of gold miners into the Yanomami Park, a 9 million-hectare indigenous reserve spanning the northern states of Roraima and Amazonas.

Based on information and images provided by Brazil’s Social Environmental Institute, the celebrity activist said gold panners are contaminating rivers with mercury and spreading malaria.

“The invasion comes after the budget for Amazon law enforcement operations in Brazil was slashed, leaving protected areas vulnerable to exploitation,” DiCaprio’s post reads. “The last time there was an invasion of this scale was during the 1980s, when around one-fifth of the indigenous population died from violence, malaria, malnutrition, mercury poisoning and other causes.”

According to internal government data collected by opposition party Socialism and Liberty and made public by Reuters, the budget for the Brazilian Institute of Environment and Renewable Natural Resources, known as Ibama, was cut by 25% this year. Ibama is the Ministry of the Environment’s administrative arm, which means it is under the supervision of Minister Ricardo Salles who, since 2017, is the subject of a probe by São Paulo state prosecutors for allegedly altering the management plan for a protected area in the Tietê River with the intention of benefiting mining operations.

On top of this, Brazilian President Jair Bolsonaro said earlier this month that a controversial bill allowing mining, agriculture and cattle farms on protected Indigenous reserves was ready to be sent to Congress for consideration.

Such statements and the general stand of Bolsonaro’s administration towards Indigenous peoples and the environment has resulted in some 20,000 illegal miners entering Yanomami territory, a full report published by the Social Environmental Institute states.

The situation has started to spark conflicts across the board. Latentes, a journalistic project to map conflict areas in Brazil, found that 200 conflicts are brewing in Indigenous land.

But the Yanomami and the Ye’kwana are aiming for a peaceful approach to deal with Bolsonaro. Following a meeting of 120 leaders from 26 regions, the Social Environmental Institute reports that the northern tribes sent a letter to the executive and judicial powers outlining problems caused by illegal mining.

Among the issues they denounced are polluted rivers and the scarcity and contamination of fish, lack of game meat, people getting sick with cancer, the return of malaria which, in 2019, caused six deaths along the Uraricoera River, and the lack of social and healthcare services.

In their manifesto, the Yanomami and the Ye’kwana wrote that, based on what happened 30 years ago due to the lack of protection of Indigenous territories, they fear that a new massacre could be looming and this is what they want to avoid by protesting peacefully and presenting their demands to Bolsonaro.

from MINING.COM https://ift.tt/2SxWXCe

Regulus secures C$11.5m financing, shares up 5%

Regulus Resources (TSXV: REG) has closed its previously announced bought deal financing, including the exercise in full of the underwriter’s option.

Under the public offering, the company issued 7.78 million units at C$1.06 per unit, with each comprising one common share and one half of one common share purchase warrant, for aggregate gross proceeds of approximately C$8.25 million.

An additional 3.07 million units were sold to certain funds managed by Route One Investment Co. LP, the company’s largest shareholder, for gross proceeds of C$3.25 million. Together with the public offering, the company raised total gross proceeds of C$11.5 million.

Net proceeds of the financing will be used to fund exploration and development activities at the company’s flagship AntaKori copper-gold-silver project in Peru.

Located nearly 4,000 metres above sea level in the Yanacocha-Hualgayoc mining district, the AntaKori property comprises a 212-hectare concession, with an additional 49 hectares pending to be added to the project portfolio.

Shares of Regulus Resources were up over 5% during Friday’s session. The Vancouver-based miner has a market capitalization of C$108.3 million.

from MINING.COM https://ift.tt/2Q1gKIi

Alrosa, ZCDC sign final agreements to form Zimbabwean JV

The world’s top diamond producer by output, Alrosa (MCX: ALRS), and the Zimbabwe Consolidated Diamond Company announced this week the signing of a number of agreements to finalize the creation of a joint venture for prospect and exploration work for primary diamond deposits in Zimbabwe.

Alrosa says its Zimbabwean operations will follow responsible business practices established by the Responsible Jewellery Council, the World Diamond Council and the Diamond Producers Association

In a press release, the state-owned companies said they have signed a shareholder agreement and a JV establishment agreement. The documents state that Alrosa owns 70% of Alrosa (Zimbabwe) Limited JV while the ZCDC gets 30%.

“We are focused toward productive prospecting and exploration for primary diamond deposits in the Republic of Zimbabwe. Signing current agreements allows us to form the company’s administration and to initiate procedures required to get necessary permissions and licenses,” Sergey Ivanov, CEO of the Russian miner, said in the statement. “Getting authorization and first prospecting special grants, [means the] JV will be ready to operate.”

Initially, the new firm will concentrate its efforts on the licenses ZCDC has in the Chimanimani region. However, the idea is to eventually expand its reach to cover the entire country.

from MINING.COM https://ift.tt/2EUMOYf

Japanese-Chilean miner files legal complaint against Chilean senator

Atacama Kozan, a Chilean-Japanese mining company that operates its namesake copper mine in the Copiapó province in northern Chile, filed a legal complaint denouncing being the victim of fraudulent transactions carried out by Chilean senator Rafael Prohens.

According to court documents obtained by local Radio Bío Bío, in the $2.7-million legal complaint, Prohens is accused of taking part in a scheme that asked the company for excessive amounts of money to provide water to its operations. However, the resource was not properly supplied.

Atacama Kozan is located in the Tierra Amarilla sector and produces around 52,800 tonnes of copper concentrate per year

Instead, the company says that the money was used to finance the senator’s 2017 political campaign, which helped him land his current post as a legislator in the Upper Chamber for the Atacama region.

The complaint describes that it all started in 2014 when Atacama Kozan signed a contract with a farm called Agrícola Doña Berta which was represented by Prohens and which was supposed to be in charge of supplying water to the mine at a price of $1.17+tax per cubic metre. A measuring device was to be installed at the intake so that it was clear how much water was being sold, but the mechanism was never set up. Yet, the miner continued to make payments to the farm.

The court document states that since there wasn’t a clear measure of how much water was being provided, there isn’t a straight record of where the payments ended up. This includes an advance payment requested by Doña Berta for $500,000.

Besides Senator Prohens, Bío Bío reports that Atacama Kozan has presented legal actions against two former employees, one that was in charge of signing the initial water contract, and another one who was in charge of supervising that water was being supplied in accordance to the law, fair prices and what was agreed upon, something he is accused of failing to do.

from MINING.COM https://ift.tt/2F0tB7v

Sphinx unfazed by sinking zinc

Zinc prices have fallen 32% from a high of US$1.63 per lb. in early 2018 to US$1.15 per lb. today. But Jeremie Ryan, CEO of Sphinx Resources (TSXV: SFX), is rolling with the punches.

“Price fluctuations are part of our business,” he says. “If you want to operate in this industry you need to work around them.”

Sphinx Resources is leveraging several plays in the Pontiac region of southwestern Quebec, but its most promising zinc property is Calumet-Sud, a joint venture with SOQUEM, a subsidiary of Investissement Québec and a leading player in mineral exploration in the province.

Calumet-Sud is adjacent to the site of the former New Calumet mine, which produced 3.8 million tonnes at a grade of 5.8% zinc, 1.6% lead, and 65 grams silver per tonne between 1944 and 1968.

All 29 holes along a 1,500-metre zone in the company’s early 2019 drill program returned zinc mineralization. Highlights included 4.9% zinc over 2 metres from 70 metres downhole, including 8.5% zinc over 1 metre in drill hole 1926. Drill hole 1905 cut 2.63% zinc over 1 metre starting from 5 metres’ depth, while drill hole 1917 returned 1.36% zinc over 6 metres from 73 metres, and drill hole 1911 cut 12.75% zinc over 1 metre from 41 metres.

While promising, Ryan admits the initial drill results suggest that Calumet-Sud would not be economic at today’s metal price. Nevertheless, he plans to “drill for bulk” near the initial drill holes to keep his options open in case the zinc market changes.

Ryan’s priority is to get government approval for more drilling. “We have approvals from the farmers that own the properties, but we need permission from the [Commission de protection du territoire agricole du Québec], as well,” hesays. “We filed a revised claim in June, and are currently waiting for an answer.”

Michel Gilbert, who recently took over as president of SOQUEM, Sphinx Resources’ joint-venture partner, isn’t phased by current low zinc prices, either. “It’s always better to do exploration when prices are low, because there is less competition,” he says. “The mining industry operates on very long cycles, so short-term fluctuations are less of a concern than they would be in other industries.”

Quebec Premier François Legault, whose Coalition Avenir Québec government took office in October 2018, has made the development of the province’s mining sector a priority. SOQUEM, a division of Ressources Québec, which invested in more than 20 projects last year, should be a beneficiary.

“We are looking to foster diversification of Quebec’s mining base outside of the Abitibi region,” SOQUEM’s Gilbert says. “We have been investing a lot in the James Bay area. But the Pontiac region, where Calumet-Sub is located, is also promising, as there used to be considerable mining done there in the 1940s and 1950s.”

Gilbert, a mining geologist, says SOQUEM encourages the exploration of sedimentary exhalative deposit zinc opportunities, such as those in Calumet-Sud, which are relatively underexplored in a province better known for volcanogenic massive sulphide-type deposits, such as those in the Matagami Camp.

Ryan took over as CEO of Sphinx Resources in December 2018. He has been investing in mining companies for more than three decades. Today, he is a major shareholder in the company, where zinc properties are concentrated along a 40 km long, northwest-trending corridor in the Pontiac municipal regional county. “I have lived in the area and done business here for many years,” Ryan says. “That gives me several advantages, particularly on the social-licencing front.”

There are plenty of people cheering Ryan on in his efforts. The Pontiac region has seen a paper mill and associated sawmills close during the last couple of years, and jobs are scarce. “Locals want us to do business here,” Ryan says. “I met with the city council and they were highly enthusiastic.”

Ryan’s connections paid off recently when he was able to recruit Lawrence Cannon — a retired federal cabinet minister, ambassador to France and longtime friend — to sit on Sphinx’s board. Cannon, who has connections in the province dating back to his time as former prime minister Stephen Harper’s Quebec lieutenant, has taken on the chairman’s role at the company, as well.

“Quebec is a great place to do business,” Ryan says. “It always does well on the Fraser Institute [mining jurisdiction study] and offers significant advantages, including tax credits and low after-tax costs for flow-through shares.”

The big question though remains low zinc prices, which show few signs of a short-term bounce back, he says.

Recent data from the International Lead and Zinc Study Group show output currently exceeds demand, with the global zinc market registering a deficit of 134,000 tonnes during the first half of 2019.

Unless that trend reverses, Ryan says, things are unlikely to bounce back anytime soon.

Ever the entrepreneur, he has been finding ways to keep busy while he awaits developments on the zinc front.

In June, Sphinx Resources bought 42 claims in Calumet North from Ressources Tranchemontagne, and Ryan got to work, commissioning flyovers, soil sampling, mapping and induced polarization.

Initial results look promising from 56 grab samples collected in September on the latest stripped exposure of the Shae zone. In October the company announced it traced a 10-metre-wide, copper-gold zone grading up to 3.8 grams gold per tonne and 11.8% copper.

“We will know a lot more once our drilling campaign gets underway next year,” Ryan says. “But we are quite hopeful.”

(This story first appeared in The Northern Miner)

from MINING.COM https://ift.tt/2tbwi3b