jeudi 31 janvier 2019

Nokia 5.1 Plus, un smartphone qui a tout d'un grand

from Les dernières actualités de Futura-Sciences http://bit.ly/2GczCQc

Canadian Opposition leader promises to cut regulatory red tape

A Canadian government led by Andrew Scheer, the current leader of the Conservative Party of Canada, would repeal legislation currently before the Senate that hobbles resource development.

Speaking at Roundup 2019, Scheer said if a Conservative government is elected on October 21, they will "develop a process that aims to get things done in this country."

The four-day annual mineral exploration meet-up concluded on Thursday.

The Opposition leader reminded the audience of explorationists that 3,700 businesses across Canada are involved in mining, which is also the largest employer of indigenous people in the country.

Bills C-55, C-68 and C-69 "are an alphabet soup of regulatory burden," and Conservatives would repeal C-69 in particular, he said.

The bill would examine the rules around assessment of major projects in order to protect the environment, and pledges input from indigenous communities in the review process. Scheer called the bill "too flawed" and "a pipeline killer", referring to Kinder Morgan's decision last year to cancel the Trans Mountain pipeline project amid public opposition. The Canadian government later agreed to purchase the project for $4.5 billion.

Scheer warned if a Liberal government is re-elected, taxes will go up and regulations will become more stringent, crimping industry.

"We have to provide incentives to keep our industry competitive so that those jobs stay here in Canada and investment opportunities don't leave our country for others around the world." He bemoaned the fact that getting a mine from initial exploration to production can take up to 20 years, and named Australia as a jurisdiction he would like Canada to compete with and beat.

Scheer took three questions from the board of AMEBC, which organizes Roundup. The board of directors asked Scheer what the Conservative Party would do regarding the Species at Risk Act as it relates to the threatened southern BC mountain caribou; how the party would create more certainty around industry and indigenous groups with respect to resource development; and what the CPC would do to facilitate mineral exploration financing.

Scheer said the party supports the mineral exploration tax credits made permanent by the BC Premier on Monday, adding the industry should stay tuned for a CPC announcement regarding mining financing. The federal government committed to a five-year renewal of the Mineral Exploration Tax Credit (METC) in its fall economic statement.

"We do realize the value of those particular types of provisions in confronting the front-end development costs of mining more easy to bear and we'll have something very exciting to share in the short term about what a Conservative government would do to incentivize and facilitate that type of capital investment," he said.

The post Canadian Opposition leader promises to cut regulatory red tape appeared first on MINING.com.

from MINING.com http://bit.ly/2UzTOzz

Moody’s weighs in on Vale dam disaster

Potential liabilities from the collapse of a tailings dam at Vale’s Feijao iron ore mine in Brazil that has left at least 99 people dead and another 250 people missing has resulted in Moody’s Investors Service placing the company’s senior unsecured ratings on review for downgrade, along with the ratings on debt issues of Vale Overseas Ltd. and the senior unsecured ratings of Vale Canada Ltd.

“Although the disaster’s direct economic effect will be limited since the Feijao mine site accounts for less than 2% of Vale’s total 390 million tonne annual output of iron ore, we expect it to raise environmental, administrative, criminal and civil liabilities, on top of serious reputational risk for the largest iron ore producer globally,” Moody’s stated.

Moody’s noted that while Vale “has a good liquidity profile” with $6.1 billion in cash and $5 billion in committed credit facilities fully available, as at the end of September 2018, “any potential liabilities and sanctions against Vale and its executives, along with any other costs incurred because of the disaster at Brumadinho, will strain the company’s liquidity and its ability to meet its financial requirement”.

Even without knowing the full extent of the damage, the Feijao mine accident will have a profound effect on Vale

The collapse of the tailings dam at Feijao follows the dam collapse in 2015 at Vale’s Samarco mine that killed 19 people. Samarco was a joint-venture with BHP.

“Vale estimates that the environmental disruption at the Corrego do Feijao mine will be less than at Samarco because the tailings volume leaked was much smaller,” Moody’s writes. “However, the social damage from Feijao is far more serious.

“The financial penalties related to the dam collapse may prove even larger than those for Samarco, based on the number of fatalities … Samarco was also a 50-50 joint-venture with BHP but this accident will be Vale’s sole responsibility.”

The tailings spilled out with no warning to bury several Vale buildings — including a cafeteria, as employees were eating lunch — and then inundated part of the small southeastern city of Brumadinho.

Dead fish and trash extended more than 18 km downstream from the dam along the banks of the Paraopeba River, where Pataxo indigenous members live, catch fish and draw water for cultivation.

The dam was built in 1976 and was 86 metres high and had a crest length of 720 metres. Its waste disposal area was 249,500 sq. metres and the volume of the spill was 11.7 million cubic metres.

According to Moody’s, Brazilian courts have issued preliminary injunctions to block BRL11.8 billion ($3.1 billion) of Vale’s cash for possible penalties related to the disaster, while the Brazilian Institute of the Environment and Renewable Natural Resources (IBAMA) and the environmental agency of Minas Gerais state have sued Vale for another BRL350 million.

“Even without knowing the full extent of the damage, the Feijao mine accident will have a profound effect on Vale, which generated about US$36 billion in revenue for the 12 months through September 2018,” Moody’s wrote.

The United Nations has called for an official investigation into the disaster.

(This story first appeared in The Northern Miner)

Click here for complete coverage of the dam burst at Vale's Córrego do Feijão mine.

The post Moody’s weighs in on Vale dam disaster appeared first on MINING.com.

from MINING.com http://bit.ly/2Uu0hvH

EY appoints new global mining and metals leader

EY has announced the appointment of Paul D. Mitchell as the new EY global sector leader for mining and metals.

In his new role, Mitchell will be responsible for driving the EY mining and metals sector strategy, leading a network of over 5,000 industry professionals worldwide. He will focus on strategic thinking and digital transformation for clients, in this age of sector disruption. Mitchell will succeed Miguel Zweig, who has served as the sector leader since 2015 and is retiring from EY

Mitchell will continue to support EY clients to address their productivity challenges, to help manage their digital transformation journey and to navigate the future challenges of the sector. Mitchell will succeed Miguel Zweig, who has served as the sector leader since 2015 and is retiring from EY.

Mitchell is currently the EY global advisory leader for mining and metals, where he focuses on driving digital transformation, helping build capability and leading the alliance strategy for the sector. Mitchell has over 20 years of experience in providing mining and metals advisory services to clients around the globe in areas including developing corporate, operational and IT strategies, profit enhancement, performance improvement, post-merger integration, and financial and operational management. He joined EY in 2003 and leads teams of over 2,000 advisors across the globe. Mitchell will perform his new role in conjunction with his advisory leadership role.

The post EY appoints new global mining and metals leader appeared first on MINING.com.

from MINING.com http://bit.ly/2RXSIAA

Central bank gold buying surges to 50 year high

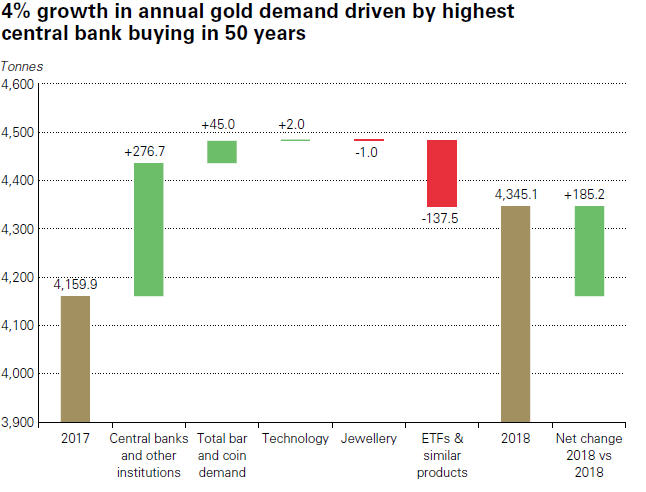

Against a backdrop of continued stock market volatility and geopolitical risk, gold demand surged in Q4 of 2018, according to a new report released today from the World Gold Council.

Annual gold demand increased 4% on highest central bank buying in 50 years. Gold demand in 2018 reached 4,345.1 tonnes, up from 4,159.9 tonnes in 2017. Central banks’ demand for gold soared to the highest level since the dissolution of Bretton Woods.

Central banks’ demand for gold soared to 651 tonnes in 2018, 74% higher year over year —the highest level since the dissolution of Bretton Woods and the US eliminated the gold standard.

Net purchases jumped to their highest since 1971, as a greater pool of central banks turned to gold as a diversifier.

Russia, Turkey and Kazakhstan remained key buyers throughout the year, while Russian gold production rose 10% year-over-year.

Central bank buying, Q4 2018, World Gold Council.

World Gold Council analysts assert that central banks reacted to rising macroeconomic and geopolitical pressures by actively increasing their gold reserves.

Stock market weakness in the fourth quarter helped fuel inflows into gold-backed exchange traded funds, which resulted in 3.4B of inflows. The report reveals annual inflows into gold-backed ETFs slowed to 68.9 tonnes, 67% lower than the 206.4 tonnes in 2017.

Sizable annual flows into European-listed funds (+96.8 tonnes) drove growth in the sector, the report reads. And while North American funds experienced heavy outflows for part of the year, strong global Q4 inflows propelled total assets under management to 2,440 tonnes by year-end, up 3% year -over-year from 2,371 tonnes. For the first time since 2012, the value of total gold-backed ETF holdings finished the year above $100B.

Read the full report here.

The post Central bank gold buying surges to 50 year high appeared first on MINING.com.

from MINING.com http://bit.ly/2TqwXGf

Brazilian prosecutors freeze over $219m in Vale’s assets

Brazil's Minas Gerais state labour prosecutors have frozen more than 800 million reais ($219 million) of Vale's funds as compensation for victims of last week’s tailing burst, which killed at least 99 people.

People located at and near Brumadinho, the town where the breach occurred, are now facing the dangers associated with having toxic elements in the Parapoeba river, which flows into Sao Francisco, a river that provides drinking water to communities in five of Brazil's 26 states.

Minas Gerais' government confirmed that tests of the Paraopeba River indicated it posed risks "to human and animal health."

Minas Gerais' government said on Thursday that initial tests of the Paraopeba River indicated the water of such body “poses risks to human and animal health,” and called locals to refrain from using the river’s water, whatever the purpose.

Additionally, the city of Mangaratiba, in Rio de Janeiro, has temporarily closed Vale's Ilha Guaíba (TIG) iron ore terminal. According to CBN radio, the company was also fined 20 million reais (about $5.5 million) for failing to submit environmental licenses.

The global community has been left with several unanswered questions, particularly about the causes of the dam breach and why Vale didn’t do anything earlier to prevent it. Reuters reported the iron ore producer had identified concerns around its tailings dams in 2009, but did not implement several steps that could have avoided or lessened the amount of damage.

Vale SA, the world's largest iron ore miner, has vowed to sacrifice production for safety to avoid another tailings dam failure. (Image: Screenshot from BBC News video.)

In the last 24 hours, UN experts and most news outlets have pointed their finger at the kind of dam chosen by Vale. The Brumadinho facility, which dates from the 1970s, was built using the “upstream construction” method. This is a design that has long been banned in earthquake-prone mining countries such as Chile and Peru because tailings are used to gradually build the embankment walls, making a dam susceptible to damage and cracks.

Brazil’s system of inspecting tailing dams involves the miners themselves paying independent consultants to inspect them and then submitting those reports to local officials.

While Brazil is not as earthquake-prone a nation as its western neighbours, it’s been shown that even small seismic activity can affect tailings dams such as the one near Brumadinho.

Lindsay Newland, executive director of World Mine Tailings Failures, an online database that aims at exposing the cause of those kind of disasters and to teach how to prevent them, argues there was no way Vale could have adopted a different technology to build its dams.

“The nature of the ore being produced at most of its mines was not amenable to dry stack, filter or thickening,” she said in an emailed statement. “That is a problem throughout Brazil and throughout the world's portfolio of 18,000 Tailing Storage Facilities (TSF),” she said.

Legislators, such as Minas Gerais’ own Joao Vitor Xavier have tried to pass legislation banning upstream dams. In July, his measure was defeated without mining companies bothering to join the debate, he told Bloomberg.

Newland says banning upstream dams is not the answer to failures' prevention. “It is meaningless to advocate (prohibition of upstream) as a risk reduction. There are as many as 12,000 existing such dams structures all over the world that are full of fines, which is the root cause for unstable conditions.”

Dirk van Zyl, a professor of mining engineering at the University of British Columbia and EduMine author, says that while dry-stack tailings are more stable, they can be as much as ten times more expensive.

“There are a lot of calculations people can use for the cost of a failure,” he said. “You not only have the real cash cost to the company, but you also open the whole discussion of what a human life is worth?,” he noted.

Click here for complete coverage of the dam burst at Vale's Córrego do Feijão mine.

The post Brazilian prosecutors freeze over $219m in Vale’s assets appeared first on MINING.com.

from MINING.com http://bit.ly/2UyCfQp

Facebook et Google espionnaient les ados avec leurs applications

from Les dernières actualités de Futura-Sciences http://bit.ly/2G1H4OJ

Non, un astéroïde ne va pas percuter la Terre le 1er février

from Les dernières actualités de Futura-Sciences http://bit.ly/2RXLvka

Citroën vous laisse personnaliser votre voiture en réalité augmentée sur Messenger

from Les dernières actualités de Futura-Sciences http://bit.ly/2GeQRk4

First Vanadium grows Nevada project with land buy

Canada’s First Vanadium (TSX-V: FVAN) is extending its Nevada-based Carlin project, considered the largest, highest grade primary vanadium deposit in North America, by acquiring the southern extension of the asset.

The strategic move, announced Thursday, gives the company mineral rights to an additional 200-metre strike length of Carlin.

Strategic move gives the company mineral rights to an additional 200-metre strike length of Carlin — the largest, highest grade primary vanadium deposit in North America.

Six vertical holes drilled by Union Carbide in the 1960's on this adjacent ground, known as Cole Creek, showed a southern continuance of the Carlin Vanadium deposit with thicknesses ranging from 10.67m to 28.96m (average 18.54m; 60.8ft) and grades ranging from 0.37% to 0.82% V2O5 (average 0.57% V2O5), the company said.

The news come at a time of high prices for silvery-grey metal, used to harden steel and in the making of so-called flow batteries, which are long-lasting, durable and can hold large amounts of energy.

More than 90% of the world's vanadium is currently used in steel manufacturing applications, but the metal’s importance to the energy sector is also growing rapidly, with more than 5% of global output used in energy storage.

Vanadium prices more than doubled in 2018, reaching historic peaks. Fastmarkets’ price assessment of ferro-vanadium, basis 78% min, free delivered duty-paid to consumer works in Europe stood at $126-128 per kg on November 23, 2018, the highest it has ever been. Year to date, the metal has averaged $76 per kg.

The post First Vanadium grows Nevada project with land buy appeared first on MINING.com.

from MINING.com http://bit.ly/2ShqRe6

Candente Gold recovers gold from tailings in Mexico while helping promote tourism

Since 2013, Candente Gold (TSXV:CDG) has been engaged with an agreement to reprocess the tailings deposit derived from the Mexico mine, which is part of the San Rafael Vein in the El Oro District, where the company has earned an undivided 100% interest from Goldcorp S.A. de C.V. El Oro is located in the state of Mexico in central Mexico.

In a press release, Candente explained that the agreement has to be ratified every three years, when the Municipality elects a new President and Council Members. Today, the Vancouver-based firm renewed the option of the New Tailings Agreement signed in 2017.

Such renewal, provides the Canadian miner with the right to recover all available gold and silver from the tailings deposit and pay to the Municipality of El Oro an 8% Net Profits Interest, while retaining the first $1.5M from the 8%NPI payable to the local government.

The interesting thing about the deal is that, according to Candente, it is directly related to a Tourism Agreement, which allows the Municipality to operate tourism activities in part of the San Juan tunnel and the Providencia Shaft, located within the El Oro property.

The tailings being processed are located several kilometres apart from the sightseeing areas and the miner says the tourism activities in these facilities does not impact the development of the tailings.

First discovered in the 1500s, the El Oro deposit became one of the most important gold-silver camps in Mexico in the late 19th and early 20th centuries when the San Rafael and Veta Verde veins produced over 8 million gold equivalent ounces.

In the early 1900s, Dos Estrellas Mining discovered the Veta Verde vein but the company filed for bankruptcy in 1938 following a tailings dam slide. From then on until the 1960s, the federal government handed over the district to the Workers Cooperative but production was mininal.

From 1969 on, different companies explored the area. Since 2007, Candente’s subsidiary, Minera CCM S.A. de C.V., decided to focus on other veins besides the two that had been developed over the years.

Initially, the company drilled 4,096m in 11 holes undernearh old mine workings in four veins. Now, its experts know that there are 50 veins in the area.

The post Candente Gold recovers gold from tailings in Mexico while helping promote tourism appeared first on MINING.com.

from MINING.com http://bit.ly/2G9E4PP

Chang'e 4 a eu plus froid que prévu sur la face cachée de la Lune

from Les dernières actualités de Futura-Sciences http://bit.ly/2Gb3cWg

Aussie and Canadian miner join forces in rare earths project

Canada's Avalon Advanced Materials (TSX: AVL) and Australia's Cheetah Resources announced this week that they have joined forces to work on the development of the rare earth resources on the Nechalacho project near Yellowknife, in Canada's Northwest Territories.

In order to move forward with such a plan, the companies signed a binding Terms Sheet under which Cheetah will acquire ownership of the near surface resources in the T-Zone and Tardiff Zones for a total cash consideration of C$5 million while Avalon will retain ownership of the resources in the Basal Zone that was the subject of its 2013 Feasibility Study.

Avalon will also continue to manage work programs on the property and retain its 3% NSR type royalty.

Nechalacho project in Canada's Northwest Territories. Photo by Avalon Advanced Materials.

In a press release, the miners said that once the formal agreement is completed, a new work program will be initiated focusing on the T-Zone rare earth resources.

The partnership -they explained in the media brief- came to be because Cheetah is focused on the small-scale development of rare earth resources enriched in the magnet rare earths, neodymium and praseodymium, and such an opportunity was recently recognized by Avalon in the T-Zone and Tardiff Zones.

According to Avalon, those areas appear to be well-suited for very low cost, pilot-scale development utilizing ore-sorting technology with minimal environmental impacts.

The 4,249-hectare Nechalacho project is located at Thor Lake, in the Mackenzie Mining District. Since acquiring the property in 2005, Avalon had performed 120,197 metres of diamond drilling in 559 holes.

Corporate information states that since mid-2018, the Toronto-based miner has been working on the possibility of developing Nechalacho as a near-term, small-scale producer of Nd-Pr rich concentrates for export, potentially involving low-cost mining, crushing and ore-sorting operation.

The post Aussie and Canadian miner join forces in rare earths project appeared first on MINING.com.

from MINING.com http://bit.ly/2TohVB9

Eldorado scraps mill at Turkish mine, to resume mining and heap leaching

Shares in Canada’s Eldorado Gold (TSX:ELD)(NYSE:EGO) jumped 12.6% in pre-market trading in New York on Thursday on the news that it will resume mining and heap leaching at its Kışladağ gold mine in Turkey.

The Vancouver-based miner noted it would halt a previously announced $520 million-project to build a mill on site. The facility would have made of Kışladağ a nine-year, 270,000-ounce-per-annum mine.

Facility would have made of Kışladağ, which is expect to churn out this year between 145,000 and 165,000 ounces of gold, a 270,000-ounce-a-year mine.

Ore extraction at the gold operation is expected to resume by the end of April, with production forecast to reach between 145,000 and 165,000 ounces this year. The figure represents nearly 40% of the company's total full-year guidance of 390,000-420,000 ounces

The decision to resume mining and heap leaching at Kışladağ, said the company, follows improved heap leach recoveries and a revised heap leaching plan, resulting in "favourable economics when compared to milling without the risks associated with the construction and financing of a $500 million project."

As operations ramp up in 2019, the miner foresees consolidated gold production climbing to 520,000-550,000 ounces in 2020 before dropping to 350,000-380,000 ounces the following year.

Last week, Eldorado announced it was getting closer to open its first mine in Canada, the Lamaque project in Val d’Or, Quebec, which it grabbed in 2017 through the acquisition of Integra Gold.

“Beyond completing remaining construction at Lamaque, Eldorado has no major capital projects under way and will remain focused on existing operations in order to realize the full potential from these assets,” president and chief executive officer George Burns said in the statement.

Lamaque, which gives Eldorado an operating asset in its home country, will be an underground gold mine with an annual average output of 117,000 ounces of the precious metal at all-in sustaining costs of $717 per ounce over seven years.

The post Eldorado scraps mill at Turkish mine, to resume mining and heap leaching appeared first on MINING.com.

from MINING.com http://bit.ly/2SgqgcE

Les sonars poussent les baleines au suicide

from Les dernières actualités de Futura-Sciences http://bit.ly/2DMExG6

SolGold wants Ecuadorian project for itself, plans buying minority shareholder

Ecuador-focused explorer SolGold (LON, TSX:SOLG) revealed Thursday plans to acquire Cornerstone Capital Resources (TSX-V:CGP), a Canadian firm which has a 15% interest in the miner’s coveted Cascabel copper-gold project, located 180 km north of the capital Quito.

The takeover would see Cornerstone’s investors receive 0.55 SolGold shares for each their shares, which SolGold said was a 20% premium.

"We are pleased to have reached the point where we feel an offer to combine SolGold and Cornerstone makes sense for Cornerstone shareholders," SolGold Chief Executive Nick Mather said in the statement.

"The combined entity will have tremendous economic upside, further de-risk the ownership structure and present a simplified and highly attractive value proposition for investors," he noted.

The company believes consolidating the ownership of Cascabel into one company makes "eminent" sense, and it said it has attempted to do this with Cornerstone in both 2017 and 2018.

It said the company had asked for far too much in return, including the removal of Mather as CEO and Brian Moller as chairman.

In its proposal to Cornerstone’s investors, SolGold used rather harsh words to refer to the targeted-company’s management. It said the firm has been "disingenuous" in promoting its stake in Cascabel without making clear it would need to cover its share of exploration financing at some point.

Cornerstone's communications frequently refer to the carried nature of its 15% interest ambiguously, leaving shareholders and the investing public to assume that the interest is ‘free-carried' through to the completion of a feasibility study on the Cascabel Project," SolGold said.

"This is not the case."

Ontario-based Cornerstone handed SolGold an initial 20% Cascabel, one of the few new copper bearing ones expected to come online in the near future, with an earn-in option over four years in 2012.

The asset now has a mineral resource of 2.95 billion tonnes at 0.52% copper, with $117 million spent on exploration.

Cascabel has attracted quite a few major miners and boosted SolGold’s position in the global market.

Australia’s largest gold producer, Newcrest Mining (ASX: NCM), upped its stake in SolGold in December to 15.33% from 13.83%, to secure a portion of the Cascabel.

The move further boosted Newcrest’s position in SolGold against No.2 shareholder, BHP, which in September had bought a 6.1% stake in the explorer.

Ecuador has gained ground as a mining investment destination in the past two years, thanks to a revised regulatory framework and a major investor engagement campaign.

Almost a year ago, Newcrest Mining (ASX:NMC) took a 14% stake in Lundin Gold, which expects to bring its Fruta del Norte gold and silver mine in southeastern Ecuador into production by the end of 2019.

Anglo American (LON:AAL) also landed in the South American country last year. Through a deal with Canadian Luminex Resources (TSX-V: LR), it plans to develop two copper and gold concessions there.

Currently, the nation’s emerging mining sector employs 3,700 people, but the government estimates the figure will rise to about 16,000 by 2020.

SolGold has a 100% interest in 12 copper-gold targets in Ecuador, which it says is under-explored compared with Chile, the world's top copper producer. The company also has assets in the Solomon Islands and Australia.

The post SolGold wants Ecuadorian project for itself, plans buying minority shareholder appeared first on MINING.com.

from MINING.com http://bit.ly/2HEMgKd

La nébuleuse d’Eta Carinae va bientôt disparaître derrière son étoile hypergéante

from Les dernières actualités de Futura-Sciences http://bit.ly/2G3oohI

Une énorme cavité s'est formée sous le plus dangereux glacier du monde

from Les dernières actualités de Futura-Sciences http://bit.ly/2FZWDGW

Des virus bactériophages géants dans le microbiote intestinal

from Les dernières actualités de Futura-Sciences http://bit.ly/2CTAc2a

Du jamais vu : un insecte préservé dans une opale

from Les dernières actualités de Futura-Sciences http://bit.ly/2G19GYC

Samsung va mettre 1 To dans un smartphone

from Les dernières actualités de Futura-Sciences http://bit.ly/2MKa8uB

La fonte des glaciers dans l'Arctique canadien dévoile des paysages invisibles depuis 40.000 ans

from Les dernières actualités de Futura-Sciences http://bit.ly/2MHGbLV

Des microplastiques retrouvés jusque dans les sources souterraines d’eau potable

from Les dernières actualités de Futura-Sciences http://bit.ly/2SfMM5j

mercredi 30 janvier 2019

Alzheimer : moins de déficit cognitif chez les personnes traitées contre l'hypertension

from Les dernières actualités de Futura-Sciences http://bit.ly/2MJfYwi

RMA cementing alliances in northwestern BC

A partnership of First Nations, exploration companies and provincial government representatives is working well, as the three groups work collaboratively to progress mineral exploration and mining in northwest British Columbia.

That was the message behind a panel discussion Tuesday at Roundup 2019, inside the Pan Pacific Hotel in Vancouver.

The four-day annual event is a chance for mineral explorers, mining company employees, members of government, mining suppliers, geologists and academics to exchange ideas, technologies and project updates.

At The Gathering Place, a room fronted with a traditional longhouse, a series of presentations centred around dialogue meant to foster mutually beneficial relationships between indigenous groups and the mining industry.

The last session of the morning featured an update on the BC Regional Mining Alliance (BCRMA). A panel hosted by Dave Nikolejsin, deputy minister of the Ministry of Energy, Mines and Petroleum Resource, included:

- Walter Coles Jr., President & CEO, Skeena Resources Ltd

- Chad Day, President, Tahltan Central Government

- Charlie Greig, Vice President, Exploration, GT Gold Corp

- Corinne McKay, Secretary-Treasurer, Nisga’a Lisims Government

- Rob McLeod, President & CEO, IDM Mining

- Ben Whiting, Vice President, Exploration, Dolly Varden Silver

Formed last May, the BCRMA is a pilot project between the province, the Tahltan Central Government (TCG), the Nisga’a Lisims Government (NLG), the Association for Mineral Exploration (AMEBC), and three junior resource companies: Dolly Varden Silver, Skeena Resources and GT Gold. A fourth company, IDM Mining, has since joined the alliance.

All four juniors are working in the "Golden Triangle", an area that was the site of three gold rushes and some of Canada's greatest mines including Eskay Creek, Snip and Premier. Snip and Eskay Creek were high-grade mines, with Snip producing at an unheard of, in today's terms, 27.5 grams per tonne during the 1990s. Eskay Creek at one time was Canada's highest-grade gold mine and the world's fifth largest silver producer.

The Golden Triangle however is remote, and when metals prices slumped, exploration activity dwindled. The BC government created renewed interest in the area with the building of new infrastructure – the 335-km Northwest Transmission Line, a three-dam hydroelectric facility, and the paving of the Stewart Cassiar Highway north from Hazelton. Glacial recession has also played a factor in uncovering prospective mineral terrain.

Tahltan President Chad Day said joining the Regional Mining Alliance was a way for the Tahltan to strengthen bonds with the Nisga’a Nation – who signed BC's first modern-day treaty in 2000. He noted that hundreds of Tahltan are working in mines and mineral exploration, bringing home an annual $20 million a year, not counting revenue sharing from mines and provincial tax credits.

He also sees RMA membership as "an opportunity to further increase capacity, by getting a more holistic understanding of the industry by being able to go to government, by being able to go with these exploration companies to understand the reality they face, when they need to go to the outside world to talk to investors, to live that lifestyle of a junior exploration company."

IDM Mining recently received an Environmental Assessment Certificate (EA) from the provincial and federal governments for its Red Mountain Gold Project.

"Working with Nisga’a as a third level of government throughout the process was wonderful to get all the impact, traditional knowledge and economic considerations so we're really happy to be part of it and we hope to continue for them to grow," said CEO Rob McLeod.

BC Premier John Horgan announced another $1 million for the BCRMA on Monday, speaking at the opening of Roundup.

The post RMA cementing alliances in northwestern BC appeared first on MINING.com.

from MINING.com http://bit.ly/2DMqdNF

First Cobalt tests feedstock for refinery

Toronto-based First Cobalt Corp. reports on the feedstock testing at its cobalt refinery in the town of Cobalt. Tests have assessed the suitability of cobalt hydroxide as a feedstock, and the results are promising.

The company says the refinery successfully leached 98% of the metal from the cobalt hydroxide with head grades in excess of 20% cobalt. Solvent extraction was then used to remove additional contaminants.

Additional cobalt extraction tests are underway and will be followed by sulphate crystallization to produce cobalt sulphate. The results are expected by the end of the quarter. If feed grades remain over 20% cobalt, bypassing the autoclave circuit may be possible and then refinery throughput would increase.

(This article first appeared in the Canadian Mining Journal)

The post First Cobalt tests feedstock for refinery appeared first on MINING.com.

from MINING.com http://bit.ly/2S0A8rM

Goldman says gold price will hit 6-year high in 2019

Goldman Sach’s head of commodities research Jeff Currie does not expect an early recovery in long-cycle investment and therefore prices of industrial metals due to a structural decline in demand from China, but he is very bullish on the gold price.

Speaking on Bloomberg Surveillance, Currie says gold will benefit from strong central bank buying and the wealth effect in India and China due to strengthening local currencies.

The last time gold topped $1,400 an ounce was briefly in early September 2013

On top of increased physical demand in the two top gold markets Currie says “recessionary fears are raising physical demand for gold” and central bank buying “alone” will push the price of gold to $1,425 an ounce.

Goldman’s target price for gold is $1,450 an ounce. That represents double digit gains from today’s price of $1,315 an ounce, already a seven-month high. The last time gold topped $1,400 an ounce was briefly in early September 2013.

Retail and institutional investors are also bullish with holdings of physically-backed exchange traded funds now the most valuable in seven years.

Holdings in global gold-backed ETFs and similar products rose by 69 tonnes to 2,440 tonnes in 2018, equivalent to $3.4 billion of inflows according to the World Gold Council.

This is the first time since 2012 that the value of total gold-backed ETF holdings has finished the year above $100 says the industry body.

Click here for video of conversation with Currie

The post Goldman says gold price will hit 6-year high in 2019 appeared first on MINING.com.

from MINING.com http://bit.ly/2GcdHsq

Expanded drilling at Gran Bestia boosts Lumina Gold’s Cangrejos project

Lumina Gold Corp. (TSXV: LUM) (OTCQX: LMGDF) has announced additional drill results from the Cangrejos project in Ecuador, as well as initial drilling of the Gran Bestia exploration target to the northwest of the resource. "The addition of Gran Bestia to Cangrejos is significant and could substantially increase the scale of the current inferred mineral resource estimate of 8.5 million ounces of gold," — CEO

Eight holes represent the most recent results from the 2018 drilling, which has totaled approximately 12,800 metres over 32 holes.

The results include three holes from Gran Bestia, which in addition to the five holes previously drilled by Newmont Mining confirm the existence of a satellite deposit not included in the current NI 43-101 resource estimate at Cangrejos. Lumina also completed seven holes and approximately 2,300 metres of geotechnical and metallurgical drilling.

"The addition of Gran Bestia to Cangrejos is significant and could substantially increase the scale of the current inferred mineral resource estimate of 8.5 million ounces of gold,” Lumina’s president and CEO Marshall Koval said in a statement. “The deposit has the potential to add to the 16 year mine life, increase the 373 koz of annual gold production or improve both. Additional drilling through the first half of 2019 will further enhance our understanding of the satellite deposit."

Two drill rigs are currently working at the Cangrejos Project, with two more expected to arrive at site in February, the company stated. In 2019, Lumina plans to drill approximately 7,000 metres in 23 holes for resource in-fill and exploration at the Cangrejos Deposit and approximately 5,200 metres in 13 holes at the Gran Bestia Deposit.

The Vancouver-based miner plans to release an updated resource estimate in the second half of 2019 that will incorporate all of the 2018 and 2019 drilling.

The post Expanded drilling at Gran Bestia boosts Lumina Gold’s Cangrejos project appeared first on MINING.com.

from MINING.com http://bit.ly/2HTeFMT

Fission Uranium advances PLS toward feasibility

Fission Uranium of Kelowna, B.C., is advancing the Triple R deposit at its Patterson Lake South property to the feasibility stage. 28 geotechnical holes are to be drilled as part of the resource development phase of work, which is set to begin the first week of February.

Fission laid out its program: 13 holes will be drilled in the Ring Dyke and Cuff-Off wall. Three holes will examine rock mechanics and resource expansion. Four holes will be used for hydrological pumping and monitoring. The potential for acid drainage from waste rock will be studied. A search will be made for suitable aggregate and clay sources for surface infrastructure construction. Additional environmental data will be collected. And finally, community and stakeholder relations will be advanced.

Uranium mineralization of the Triple R deposit has been traced along a 3.18-km strike length below 55 to 100 metres of overburden. It remains open in several directions.

Fission president, COO and chief geologist Ross McElroy noted that the pre-feasibility report on Triple R is due by the end of March this year.

(This article originally appeared in the Canadian Mining Journal.)

The post Fission Uranium advances PLS toward feasibility appeared first on MINING.com.

from MINING.com http://bit.ly/2G3gSDJ

Osisko Metals releases more high-grade drill results from Pine Point

Osisko Metals (TSXV: OM) has released new drill results from its high-grade, large tonnage and near-surface Pine Point zinc-lead deposit on the south shore of Great Slave Lake in the Northwest Territories.

Highlights include 12.74 metres grading 8.07% zinc and 6.80% lead from 16.31 metres downhole; 4.35 metres averaging 11.78% zinc and 6.01% lead from 20.90 metres downhole; six metres of 10.90% zinc and 4.28% lead from 15 metres; and 8.50 metres of 4.85% zinc and 0.78% lead from 18 metres.

Jeff Hussey, the company’s president and CEO, describes Pine Point as “unique among its peer group,” given that “nearly 90% of zinc mine production globally is sourced from underground mines, underscoring the rarity of open-pit zinc assets.”

The company released an inferred pit-constrained resource for the deposit in December 2018.

Pine Point contains 38.4 million inferred tonnes grading 4.58% zinc and 1.85% lead (6.58% zinc-equivalent) for 3.9 billion pounds of contained zinc and 1.6 billion pounds of lead.

More than 40,000 metres of additional drilling were completed following the cut-off date for the resource estimate.

A new resource estimate is planned in the second half of the year with the aim of converting a significant proportion of the current resource to the indicated category.

Osisko Metals will continue infill drilling in early 2019 and begin a substantial exploration program in mid-2019 to test the brownfield mineral potential along the entire 65 km Pine Point trend.

The K-32 pit is situated within the East Mill zone and measures 300 metres in strike length with an average mineralized north-south width of about 130 metres.

The project benefits from nearby infrastructure. It is accessible directly year-round by an all-weather highway from Hay River, and is 4.5 km east of an electrical sub-station along a main haul road. On-site infrastructure consists of roughly 100 km of intact haulage roads that link the mineralized zones, as well as the electrical substation located in the middle of the property.

At presstime, Osisko Metals was trading at $0.50 per share within a 52-week range of $0.46 and $0.82.

The junior has about 136 million common shares outstanding for a market cap of around $68 million.

The post Osisko Metals releases more high-grade drill results from Pine Point appeared first on MINING.com.

from MINING.com http://bit.ly/2UraPMb

U.N. calls for probe into Vale’s tailings as they head to large Brazilian river

United Nations human rights experts called on Wednesday for an urgent and impartial investigation into the collapse of Vale’s tailing dam in Brazil, who killed at least 84 people, as well as into the toxicity of the mining waste, which is now heading towards a river that provides drinking water to communities in five of the country's 26 states.

The tailings dam used at Vale’s Córrego do Feijão mine was built in the 1970s using the “upstream construction” method, which has long been banned in Chile, Peru and other neighbouring countries.

Baskut Tuncat, the U.N. expert on disposal of hazardous substances, asked President Jair Bolsonaro to prioritize safety evaluations of dams and change licencing procedures to prevent reoccurrence of this kinds of tragic incidents.

As grieving relatives bury family members and rescuers continue searching for 276 people who are missing, Brazilian authorities and companies involved with river water management are trying to stop the torrent of mining waste from reaching the Sao Francisco river. Currently, Associated Press reports, the potentially toxic mud has contaminated the smaller Parapoeba river, which flows into San Francisco.

Vale said on Tuesday it would halt 40 million tonnes of production — about 10% of its annual iron ore output — so that it can replace dams similar to the one that burst last week.

“This leaves a hole in the seaborne iron ore market,” BMO analyst Colin Hamilton wrote Wednesday. “2019 has gone from a year where we were looking to displace marginal tonnes to one where we will need to incentivize additional higher cost material to market.”

As a result, BMO has hiked its 2019 62%Fe iron ore price forecast to $78 a tonne from a previous $63 per tonne.

The tailings dam collapse, seen on Sunday, Jan.27 from Sentinel-2. (Image courtesy of @CopernicusEU and @ sentinel_hub. )

The global community has been left with several unanswered questions, particularly about the causes of the dam breach and why Vale didn’t do anything earlier to prevent it. Reuters reported the iron ore producer had identified concerns around its tailings dams in 2009, but did not implement several steps that could have avoided or lessened the mountain damage from Córrego do Feijão.

Vale will dismantle 10 dams that are similar to the one that collapsed on Friday, killing at least 84 people.

What is known is the tailings dam used at the mine was built in the 1970s using the “upstream construction” method. This is a design that has long been banned in earthquake-prone mining countries such as Chile and Peru because tailings are used to gradually build the embankment walls, making a dam susceptible to damage and cracks.

While Brazil is not as earthquake-prone nation as its western neighbours, it’s been shown that even small seismic activity can affect tailings dams such as the one near Brumadinho.

Vale estimates it would need about $1.3 billion to decommission its upstream dams, a process that would take place over the next three years.

Click here for more information about Vale.

The post U.N. calls for probe into Vale’s tailings as they head to large Brazilian river appeared first on MINING.com.

from MINING.com http://bit.ly/2Bdu70u

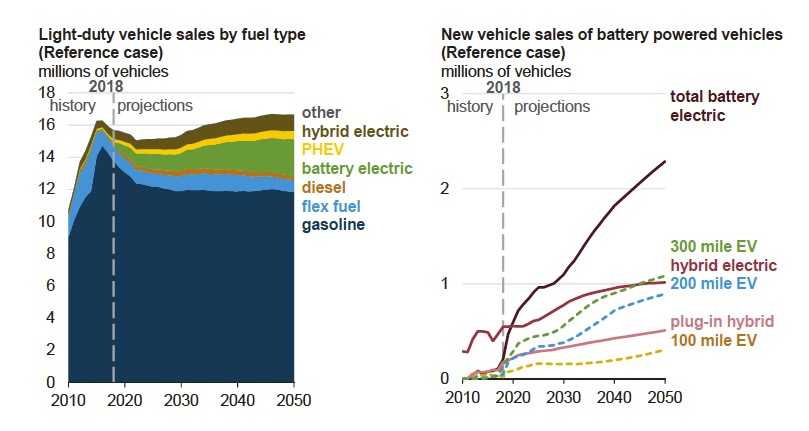

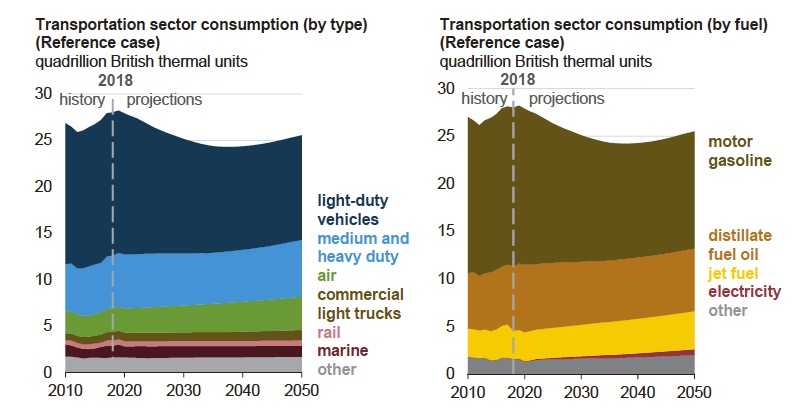

US govt study sees electric car sales stuck in slow lane

Increased demand for battery materials used in electric vehicles has reignited interest in the mining sector now that the China-induced supercycle in commodities demand is levelling off.

But if you rely on forecasts of EV take-up from the US Energy Information Administration, you may well wonder what the hype is about.

The EIA Energy Outlook 2019, released last week, foresees uptake of electric vehicles in the world’s second largest car market over the next 30 years that won’t rev mining investors’ engines.

According to the report, the combined share of sales attributable to gasoline and flex-fuel vehicles (gasoline blended with ethanol) declines from 93% in 2018 to 75% in 2050.

From EIA Energy Outlook, 2019.

The EIA predicts electricity usage in battery powered, plug-in hybrid and hybrid vehicles to increase by 11.3% through 2050. That’s impressive growth, but electricity usage by the country’s light-duty vehicle fleet would still constitute less than 5% of the total.

Usage of electricity by transit buses is expected to grow at a 9.4% clip and constitute 11% of the total, but for intercity travel, electricity doesn’t even feature in the projections.

According to the outlook, California’s zero-emission vehicle regulation, which nine additional states have adopted, requires a minimum percentage of vehicle sales of battery-powered and and plug-in hybrids.

From EIA Energy Outlook

In 2025, the year the regulation and new federal fuel economy standards go into full effect, projected sales of battery-powered and plug-in hybrids is expected to reach 1.3 million, or about 8% of projected total vehicle sales.

That’s a far cry from Chinese uptake of EVs. Last year around 1.1m so-called new energy vehicle were sold in the world’s largest auto market, up nearly 70% from 2017.

In terms of the transportation industry as a whole and not just cars, electricity’s share of fuel consumption in the US hardly registers.

The post US govt study sees electric car sales stuck in slow lane appeared first on MINING.com.

from MINING.com http://bit.ly/2ShEXMz

Iron ore prices are flying

Top iron ore producer Vale’s decision to decommission its upstream tailings dams following the deadly dam burst Friday at its facility in Córrego do Feijão, Brazil has lit a fire under iron ore prices.

The Chinese import price of 62% Fe content ore jumped 5% on Wednesday to trade at $82.53 per dry metric tonne according to data supplied by Fastmarkets MB. The price of the steelmaking raw material is now up more than 13% year to date. The index price for high-grade (65% Fe) Brazilian ore gained $5.40 to $97.60 a tonne.

Domestic Chinese prices also surged, with the most actively traded iron ore futures contract on the Dalian Commodity Exchange hitting its daily uplimit to finish Wednesday nearly 6% higher at 587 yuan ($87.40) per tonne, a 17 month high.

The last time benchmark iron ore was trading in triple digits was May 2014

Vale’s plans to halt production at 10 operations cutting its annual output by some 10% or 40m tonnes, upending a market that was expected to experience a year of gentle decline.

BMO Capital Markets, a Canada-based investment bank, says 2019 “has gone has gone from a year where we were looking to displace marginal tonnes to one where we will need to incentivise additional higher cost material:”

While Vale can make up some of the tonnes from other operations, BMO now forecasts the need for an additional 20m tonnes of such supply this year, as opposed to its previous analysis of 10m tonnes of ore being displaced:

“Iron ore remains an efficient market, and higher prices should bring this to market quickly. We expect an outsized spot reaction in the short term as the market adjusts to the lack of tonnes, before a moderation as equilibrium is reached towards mid-year.”

BMO raised its forecast for benchmark prices by 24% to $78 per tonne from $63 per tonne previously and its 2020-2021 price to $70 a tonne.

A similar disaster three years ago at Samarco, a Vale-BHP joint venture, in the same region of Brazil halted output and the Brumadinho disaster has made a restart at the pellet production plant less likely.

BMO says given Vale's dominant position in the global pellet market, this is an area which will be disproportionately hit with the bank upping its average Atlantic Basin pellet premium to $75 a tonne this year (from $59/t previously) and $55 tonne in 2020.

As for the "outsized" shorter term impact on spot prices, Reuters quotes Singapore-based analytics company Tivlon Technologies as saying prices will hit $120 a tonne by August, from a projected $95 a tonne by May. The last time prices were in triple digits was May 2014.

The post Iron ore prices are flying appeared first on MINING.com.

from MINING.com http://bit.ly/2DJ9ScC

Cette voiture électrique en plastique est ultra légère

from Les dernières actualités de Futura-Sciences http://bit.ly/2RWTUEp

L'Amérique du Nord balayée par une vague de froid polaire

from Les dernières actualités de Futura-Sciences http://bit.ly/2CSoBAr

La Terre aurait eu plusieurs pôles nord il y a un milliard d'années

from Les dernières actualités de Futura-Sciences http://bit.ly/2MJ0sR3

Near-record high vanadium prices boosts Bushveld Minerals 2018 results

Vanadium producer Bushveld Minerals’ (LON:BMN) revenue and earnings soared in 2018, the company said Wednesday, despite slightly missing production guidance due to repair work in the fourth quarter.

Revenue for the miner, which owns the Vametco, Brits, and Mokopane projects in South Africa, jumped to $192.2 million, significantly more than the $79.2 million recorded in 2017.

Profits from the miner’s Vametco open pit operation alone quadrupled last year as prices of the silvery-grey metal more than double in 2018. They were fuelled by a growing demand for the metal used to harden steel and in the making of so-called flow batteries, which are long-lasting, durable and can hold large amounts of energy.

Profits from the miner’s Vametco open pit operation alone quadrupled last year as vanadium prices more than double in 2018, fuelled by growing demand for the metal.

Those properties have positioned them as an alternative to lithium-ion batteries produced by companies such as Tesla for the storage of intermittent renewable sources of energy.

However, Bushveld's 2018 production was 2,560 tonnes, down slightly from 2,649 the previous year. This was also short of guidance, which stood in the range of 2,600 tonnes to 2,650 tonnes.

In an attempt to improve Vametco’s operational performance, Bushveld hired an external consultant to carry out a detailed review of the mine plant and it has already begun to act on some of the recommendations.

As a result, production should increase this year, and more detailed guidance will be given in the first quarter update in a couple of months’ time.

"We are benefiting from the high vanadium prices, nevertheless, we are mindful of the imperative to drive Vametco towards operational excellence and realise its true potential,” Chief Executive Fortune Mojapelo said in a statement.

Vametco currently has a 142.4 million tonne resource, but results from a recently-completed 13-drill hole program have provided “evidence of additional resources and reserves” and an updated resource estimate will be published later this quarter.

The post Near-record high vanadium prices boosts Bushveld Minerals 2018 results appeared first on MINING.com.

from MINING.com http://bit.ly/2Tm3NZ7

Arctique : des gènes de superbactéries résistantes aux antibiotiques retrouvés au Svalbard

from Les dernières actualités de Futura-Sciences http://bit.ly/2RtYWmO

La fonte des glaciers au Canada dévoile des paysages invisibles depuis 40.000 ans

from Les dernières actualités de Futura-Sciences http://bit.ly/2WxnkHN

Canadian miner Cordoba dealing with fraudulent transactions at Colombian subsidiary

Cordoba Minerals (TSXV: CDB), the Toronto-based miner developing the San Matías project in the department of Córdoba in northern Colombia, issued a media statement today detailing the reasons behind the lawsuits it filed in late 2018 and January 2019.

According to the press release, Cordoba was forced to present criminal charges before Colombian prosecutors against nine members of former management at its Colombian subsidiary, Minerales Cordoba S.A.S. The miner alleges breach of fiduciary obligations, abuse of trust, theft, and fraud.

In detail, the financial irregularities were discovered by the subsidiary’s new administration following the termination of the employment contract of its former president. The Canadian firm says misappropriated payments and other transactions were completed by different members of the previous leadership team.

Now, it is up to the Colombian prosecutor service to determine if any formal charges should be laid.

Cordoba Minerals revealed that it is also seeking civil damages against some of the individuals involved and that the monetary amounts alleged to have been taken are currently expected to be in and around $500,000.

“While the situation with former Colombian management is unfortunate, we are happy to see Cordoba taking prompt action to investigate and address the matter. Cordoba continues to have an exciting suite of projects that we are looking forward to advancing. We remain fully committed to Cordoba and are working with senior management and the board to identify and execute funding solutions during this time of general market weakness for junior exploration companies,” said Eric Finlayson, a member of the Board of Directors and President of High Power Exploration, a company that sold San Matías to Cordoba in 2017 and owns a 67% interest in the Ontario firm.

San Matías project area. Photo by Cordoba Minerals.

Finlayson also said that all of Cordoba’s mining titles, applications, and operations in the South American country remain in good standing.

San Matías comprises of a 20,000-hectare land package in a newly identified high-grade copper-gold district that Cordoba says is characterized by porphyry type and “carbonate replacement” type and/or “iron oxide copper-gold” type deposits formed in an accreted island arc setting.

Within the San Matías project area, there is the Alacrán copper-gold system where Indicated Mineral Resources are currently 36.1 million tonnes grading 0.57% copper and 0.26 g/t gold, and 31.8 million tonnes of Inferred Mineral Resources grading 0.52% copper and 0.24 g/t gold.

“Alacrán is approximately two kilometres southwest of the company’s Montiel porphyry copper-gold discovery, where drilling intersected 101 metres of 1.0% copper and 0.65 g/t gold (DDH-004), and two kilometres northwest of the Costa Azul porphyry copper-gold discovery, where drilling intersected 87 metres of 0.62% copper and 0.51 g/t gold (CADDH003),” the corporate website states.

The post Canadian miner Cordoba dealing with fraudulent transactions at Colombian subsidiary appeared first on MINING.com.

from MINING.com http://bit.ly/2FZokzn

Danakali’s potash project could be a game changer for Eritrea — UN

A United Nations report published Wednesday says Danakali’s (ASX, LON:DNK) Colluli potash has the potential to boost the economy of Eritrea, country that until two months ago was on the U.N.’s sanctions list.

The independent study, commissioned and funded by the U.N. Development Program (UNDP), assesses a wide range of econometric data and includes findings from talks with Eritrean government officials, relevant public institutions, and other Colluli stakeholders.

It also suggests that Colluli, which sits close to the Red Sea by Eritrea's eastern border, could “meaningfully” advance the north African nation’s sustainable development agenda.

“Colluli is much more than a great mining asset. Not only does it have outstanding grade, size, location and simplicity; Colluli’s products will also help farmers and support food security in Eritrea, across Africa and beyond,” executive chairman, Seamus Cornelius, said in a statement. “We appreciate the magnitude of the opportunity and the responsibility that comes with developing an asset of this significance.”

UNDP says the Colluli potash project has the potential to significantly boost Eritrea’s economy and advance the country’s sustainable development agenda.

In the initial phase of operation, Colluli would produce more than 425,000 tonnes a year of sulphate of potash (SOP), a premium grade of fertilizer. Annual output could rise to almost 850,000 tonnes if Danakali decides to go ahead with a second phase of development.

Colluli is being developed as a joint venture with the Eritrea’s state mining company and the Australian miner has already struck an offtake agreement with EuroChem, one of the world’s top fertilizer companies. Under the 10-year deal, EuroChem has agreed to buy at least 87% of Colluli’s output from the first phase of development.

Growing interest

The projects location has its pros and cons. On one hand, being so close to the Red Sea coast, makes it one of the world’s most accessible potash deposits, with mineralization beginning at 16 metres, which also makes it the world’s shallowest. Additionally, it proximity to ports will provide easy access to fast-growing Asian markets.

Colluli is also by the border with Ethiopia, with which Eritrea held one of Africa’s deadliest border war. Despite a peace deal signed in December 2000, the two sides remain on a war footing, with their massive armies still facing off.

Compensating for political issues, Colluli containing at least 1.1 billion tonnes of potash, enough for at least 200 years of production, though its mine life has been estimated so far in only 30 years.

When Canada’s Lundin Mining bid for fellow miner Nevsun Resources in May last year, its initial offer was structured to avoid taking Nevsun's Eritrean mine at Bisha because of rights concerns. It changed tack in July, as Ethiopia and Eritrea's rapprochement gained pace, offering to buy Bisha too.

But Nevsun rejected the bids, agreeing in September to a buyout by China's Zijin Mining.

Mining industry experts said the success of Bisha, which has produced gold, silver, copper and zinc since construction was completed in 2010, showed ventures in Eritrea can succeed.

The post Danakali’s potash project could be a game changer for Eritrea — UN appeared first on MINING.com.

from MINING.com http://bit.ly/2GcZ9bR

Cette IA peut lire vos pensées et parler à votre place

from Les dernières actualités de Futura-Sciences http://bit.ly/2HGrzgO

Canadian miner wants its uranium project in Niger to be powered with renewable energy

GoviEx Uranium (TSXV: GXU) is studying the possibility of powering its flagship Madaouela project in northern Niger using a dedicated and renewable hybrid solar power solution.

In a press release, GoviEx explained that management is working together with Windiga Energy, with whom they have signed a memorandum of understanding, to determine if such an idea would be feasible.

Windiga is Canadian energy developer focused on building, owning and operating renewable energy facilities and off-grid smart power systems in different parts of Africa.

According to GoviEx, both companies' goal is to reduce carbon dioxide emissions by more than 20,000 tonnes per year and provide sustainable, renewable power at approximately 25% lower cost than traditional coal-fired options currently available in Niger. Coal-fired power costs are currently forecast at approximately 4% of total life of mine operating costs.

"We are pleased to begin exploring cleaner energy alternatives to power our future development activities in partnership with Windiga. The benefits of renewable, lower-cost energy are obvious," said Govind Friedland, Chairman of the Vancouver-based miner.

Madaouela project. Photo by GoviEx Uranium.

Besides powering the Madaouela project, the plan is to provide electricity to the surrounding local community through a hybrid power plant combining photovoltaic solar panels and diesel generators with total installed capacity of at least 20 MW.

Madaouela sits on the southeast side of the mining town of Arlit. It was first discovered by the French Commissariat à l'Energie Atomique or CEA in the 1960s.

The 250-square-kilometre land pack had been explored by a series of different local and Asian companies until GoviEx Niger Holdings acquired it in 2007. On its website, GoviEx states that three primary mining targets are defined for future development: the Marilyn and Marianne deposits that are located adjacent to each other along a 6.5 km NE-SW strike length, the MSNE and Maryvonne deposits, and the Miriam deposit to the south of the Madaouela I license.

The post Canadian miner wants its uranium project in Niger to be powered with renewable energy appeared first on MINING.com.

from MINING.com http://bit.ly/2sRtzc2

Fortune Minerals commits to hire locally at Canada’s first primary cobalt mine

Fortune Minerals (TSX: FT) (OTCQX: FTMDF), the company behind what could become Canada’s first primary cobalt mine, has signed a socio-economic agreement with the government of the Northwest Territories (N.W.T.) in which it commits to hire and spend locally.

The 48-page document sets out targets for jobs, spending, education, and training in the Territories as the NICO cobalt, bismuth, gold, and copper project moves ahead.

According to the agreement, Fortune Minerals "shall use best efforts" to ensure 60% of the mine's workforce during operations are N.W.T. residents, with at least half of them being Indigenous. During construction, at least 35% of workers should be N.W.T. residents. Half of those should be Indigenous.

Fortune expects to begin construction this year, with commercial production starting in the early 2020s.

Preference will be given to Tlicho, Yellowknives Dene and North Slave Metis Alliance members, Fortune Minerals said.

This is the fifth socio-economic agreement currently active in the N.W.T. The others are with the Ekati, Diavik, Gahcho Kué, and Snap Lake mines.

The expected opening of NICO is one of the main reasons the Tlicho all-season road to the community of Whati from Highway 3 is being built.

Last year, Fortune anticipated construction of the mine would begin in 2019 and last for two years, allowing commercial production in the early 2020s. Concentrate will be shipped to a refinery the company plans to construct in Saskatchewan.

The Whati-based mine has a forecast productive life of around two decades.

Fortune also owns the Sue-Dianne copper-silver-gold deposit located 25 km north of the NICO project, which is a potential future source of incremental mill feed to extend the life of NICO’s mill.

The post Fortune Minerals commits to hire locally at Canada’s first primary cobalt mine appeared first on MINING.com.

from MINING.com http://bit.ly/2S2RCnu

Alexandre le Grand n’était peut-être pas mort !

from Les dernières actualités de Futura-Sciences http://bit.ly/2GaliHZ

Réchauffement climatique : les lacs pourraient arrêter de geler en hiver

from Les dernières actualités de Futura-Sciences http://bit.ly/2G9ZGLL

Une « rivière de poissons morts » en Australie – la catastrophe vue de l'espace

from Les dernières actualités de Futura-Sciences http://bit.ly/2BalfbQ

Transformer le Wi-Fi en électricité, c'est possible

from Les dernières actualités de Futura-Sciences http://bit.ly/2GaUhEb

Crise cardiaque : une mutation favorise l'arythmie

from Les dernières actualités de Futura-Sciences http://bit.ly/2sTph3E

Doogee sort un smartphone modulaire et tout-terrain pour les aventuriers

from Les dernières actualités de Futura-Sciences http://bit.ly/2ShqQaa

mardi 29 janvier 2019

Énergie noire : les quasars révèlent-ils une nouvelle physique ?

from Les dernières actualités de Futura-Sciences http://bit.ly/2TkpAjO

Rio Tinto on the lookout for BC porphyry deposit

British Columbia is known for its coal and copper-gold deposits, with a storied history of mining all three commodities. Now the second largest mining company in the world is hoping to add a BC copper porphyry deposit to its portfolio of development properties.

Rio Tinto’s (ASX, LON:RIO) Chris Welton said the London and New York-listed mega-miner is scoping out British Columbia for a copper play.

“We would like to be exploring in BC but we just need to find the right project. My exploration manager reminds me that to balance our portfolio in Canada, he wants a BC porphyry,” said Welton, Rio’s exploration director, the Americas region, responsible for “delivery of growth options through early stage greenfields exploration, brownfields exploration, advanced project execution and support for project acquisition throughout North and South America,” states his bio.

Welton was speaking at the opening ceremony of AMEBC’s 2019 Roundup, running Monday to Thursday at the Pan Pacific Hotel in Vancouver.

Porphyry deposits are sought after because they are usually low grade and large-scale, allowing for bulk mining and economies of scale. Copper porphyries typically contain 100 million to 5 billion tonnes of ore with grades between 0.2% and 1% copper. They Rio Tinto’s Bingham Canyon Mine in Utah produces an annual 300,000 tons of copper.

They are formed where one tectonic plate slips under another, pushing up magma. Metals precipitate out as the magma cools. Gold, copper, molybdenum, silver and lead are among the metals found in porphyries.

Some of BC’s largest copper and gold deposits are porphyries, including the Highland Valley Copper Mine, KSM, Prosperity and New Afton.

As part of his presentation, Welton gave some interesting advice to exploration companies hoping to attract the interest of a major mining company like Rio Tinto.

The company’s exploration arm, known as RTX, dedicates about half of its global exploration budget to copper, with the rest focused on eight commodities in 16 countries.

The 24-year Rio veteran said that contrary to popular belief, despite being a large company, Rio Tinto has a limited exploration budget.

If we keep the budget tight, keep the teams lean, and focus those now-scarce resources, and valued resources, on only the very best opportunities, this will make sure that as much of the budget as possible goes in the ground, and it will force the geologists or the exploration manager to only test those targets they believe will deliver results. Only then can we improve discovery rates,” he said.

Another important point: Juniors need to be thinking ahead. Way ahead. Welton noted that a greenfield program typically will take 15 years to make a discovery, and another 10 to 15 years to progress the discovery into a mine.

“Our portfolio today will be delivering metals and minerals to the market in 15 to 25 years time. As explorationists can we predict what the world will want in 15 years?” He gave the example of Rio’s Jadar lithium borate project in Serbia. Preliminary exploration took place in 1998, it wasn’t until 2004 that a discovery hole was drilled, and it took another four years until a JORC-compliant resource estimate was published.

“So we’re 14 years and counting since the discovery. Who could predict the hype around EVs (electric vehicles) and therefore the lithium sector eight years ago?”

To conclude, Welton addressed the question everyone in the audience wanted the answer to: What does a major mining company like Rio Tinto look for in a junior resource firm?

“Our focus is on optionality and upside,” Welton said, adding the company is “not interested in kicking tires or using project reviews to acquire data. We’re reviewing the project because we want to understand if we can add value to progress it.”

He also dismissed a common perception that a major wants to “squeeze the discover out of the project,” noting Rio is generally more interested in projects than companies.

“We rarely want to make placement in companies as you end up with two different parties with different priorities and that makes for conflict in the relationship,” he said. “Initially we seek to put as much money in the ground as possible.”

The post Rio Tinto on the lookout for BC porphyry deposit appeared first on MINING.com.

from MINING.com http://bit.ly/2CNX2ba

Global energy transition powers surge in demand for metals

By 2030, the amount of installed wind power globally will more than double, according to the International Energy Agency (IEA). Installed solar power will quadruple.

And the number of electric vehicles will increase 1,389% – to 125 million from three million – by 2030, and 3,333% in 2040 to 300 million, according to the IEA.

Given that each electric vehicle requires 83 kilograms of copper and each wind turbine contains about 3.5 tonnes of the metal, that represents a surging demand for copper – as well as other base metals – on a timeline that is shorter than what it typically takes to bring a new mine into production. A surging demand for copper – as well as other base metals –[is] on a timeline that is shorter than what it typically takes to bring a new mine into production.

Copper is just one of the base metals needed for things like wind turbines and electric cars, and it’s one of the metals for which there is no good substitute. Substantial amounts of iron and metallurgical coal are also needed to make the steel that goes into wind turbines and cars.

If, as the IEA predicts, there are 125 million electric vehicles (EVs) on the road by 2030, it will require roughly 10 million tonnes of copper – a 50% increase over current annual global copper consumption (20 million tonnes).

The additional wind turbines built by 2030 would require roughly two million tonnes of copper – about 10% of the world’s current production.

That’s not even taking into account how much copper would be needed for a quadrupling of solar power, and all the enhancements to the electrical grid and charging infrastructure for electric vehicles that will be required.

Given how much aluminum, metallurgical coal, copper, aluminum, zinc and rare earths are required for each wind turbine and each EV – and how much lithium and cobalt are needed for EV batteries – it begs the question: Will the transition to a low-carbon economy lead to “peak metals” (the point of maximum metal production)?

The targets that governments are setting for themselves for electric vehicle and renewable energy adoption will require a massive increase in mining, and there’s some question as to whether the new mines required can even be built in time to meet the demand according to the timelines being set.

A recent joint study by Metabolic, Copper 8 and Leiden Universityfor the Dutch government estimates that global production of some metals will need to increase 12-fold by 2050 if all signatories of the Paris Agreement live up to their commitments to decarbonizing their economies.

“The good news is that, for most metals, enough identified metal reserves are available for the energy transition,” the report concludes.

“However, the lead time for operating new mines is in the range of 10 to 20 years. Therefore, the ever more pressing question is whether we can make these metals available in the time that we have left to implement the energy transition: about three decades.”

Some government bodies responsible for energy security have already begun to ring alarm bells and are asking whether a shortage of certain critical metals will allow the energy transition to happen on the scale and timelines that many governments have set for themselves. One study raises concerns about the supply of silver, which is used in photovoltaic cells for solar power. Another raises concerns about lithium and cobalt, both of which are needed for lithium-ion batteries used in EVs.

One study raises concerns about the supply of silver, which is used in photovoltaic cells for solar power. Another raises concerns about lithium and cobalt, both of which are needed for lithium-ion batteries used in EVs.

More generally, a European Parliament report warns that “the supply of raw materials used in advanced and emerging technologies may not be able to keep up with the rapidly increasing demand.”

Some critical “energy metals” such as lithium and cobalt – both used in car batteries – are currently in adequate supply.

But more than half of the world’s cobalt comes from the Democratic Republic of Congo, where ethical concerns about child labour and impacts of artisanal mining on human health have earned cobalt the label “the blood diamond of batteries.”

Geologists generally agree that the earth’s crust theoretically contains enough base metals, such as iron and copper, to fuel the energy transition.

Moreover, metals like steel and copper can be – and are – recycled. So a 1,400% increase in EVs doesn’t necessarily mean an equivalent increase in copper demand, since some of that increased demand could be met from recycling.

But there’s no question that the world is going to need a lot more copper, steel, rare earths and several other critical energy metals over the next two decades. The increased mining required will have impacts on land, water, forests and Indigenous peoples.

“A major increase in virgin raw material extraction will have severe consequences for local communities and the environment, including large emissions of greenhouse gases,” the European Parliament report warns.

Even if there are sufficient theoretical amounts of base metals in the earth’s crust, there’s a big difference between what is theoretically retrievable and what is economically recoverable or politically viable.

Building a new copper mine is both expensive and politically risky. In B.C. alone, two new copper mine projects have failed the social-licence tests just in recent years.

And even when a deposit proves to be economically recoverable and can get all the permits it needs, it typically takes 10 to 20 years for a mine to go from discovery to production.

“Not all theoretical reserves are technically (or economically) extractable, and with ore grades declining, mining requires an increasing volume of water and energy,” the Dutch government study notes.

The report identifies five critical “energy metals” that may be in critically short supply – all of them rare-earth metals.

“The current global supply of several critical metals is insufficient to transition to a renewable energy system,” the report says. “Exponential growth in renewable energy production capacity is not possible with the present-day technologies and annual metal production.”

To meet its own renewable energy objectives for 2030, the Netherlands alone would need 2.4 million to 3.2 million tonnes of energy metals, and 8.6 million to 11.7 million tonnes by 2050.

The Dutch government’s target of 1.2 million EVs on the road by 2030 would require 146 tonnes per year of neodymium (used in magnets) alone. That is 4% of the world’s annual production of neodymium. It would also require a 25-fold increase in lithium and cobalt.

“If the rest of the world would develop renewable electricity capacity at a comparable pace with the Netherlands, a considerable shortage would arise,” the report warns.

“Scarcity will eventually lead to competition between different technologies; and therefore, between companies and countries. This is a serious risk for the transition towards a clean and sustainable energy supply, both within Europe and the rest of the world.”

The study points out that Europe is entirely dependent on other countries for the raw materials needed for its energy transition and suggests that European leaders consider developing a European mining industry.

One energy metal that no one seems to be paying attention to is uranium, said Marin Katusa of Katusa Research.

“I think uranium’s the one that nobody’s really talking about that is a serious issue,” he said.

While the deployment of new nuclear power has stalled in the western world, it is still being developed as a firm, low-carbon energy source in some countries.

But Katusa said the stockpiles of fissionable material are declining, Russia controls about half of the world’s enrichment and no new mines are going into production. He thinks that American power companies, which import 95% of their uranium, could find themselves running short of the uranium needed for existing plants.

Hadi Dowlatabadi, a professor at the Institute for Resources, Environment and Sustainability at the University of British Columbia, doesn’t think peak metals will be a thing.

For one thing, he doesn’t buy some of the projections for the electrification of transportation. He also thinks substitutions will be found for certain metals that become constrained by physical supply or price.

“For example, we will not be using lithium in stationary electricity storage,” he said. “It is far too expensive, and the chemistry does not allow long-term recharge-discharge.

“We will also not be relying on EVs for transportation when carbon-neutral hydrocarbon fuels are less expensive and widely available using the same infrastructure as [that] used for fossil energy.”