There are REEs in them thar hills

There are REEs in them thar hills

Privately-held SRE Minerals on Wednesday announced the discovery in North Korea of what is believed to be the largest deposit of rare earth elements anywhere in the world.

SRE also signed a joint venture agreement with the Korea Natural Resources Trading Corporation for rights to develop REE deposits at Jongju in the Democratic People’s Republic of Korea for the next 25 years with a further renewal period of 25 years.

The joint venture company known as Pacific Century Rare Earth Mineral Limited, based in the British Virgin Islands, has also been granted permission for a processing plant on site at Jongju, situated approximately 150 km north-northwest of the capital of Pyongyang.

The initial assessment of the Jongju target indicates a total mineralisation potential of 6 billion tonnes with total 216.2 million tonnes rare-earth-oxides including light REEs such as lanthanum, cerium and praseodymium; mainly britholite and associated rare earth minerals. Approximately 2.66% of the 216.2 million tonnes consists of more valuable heavy rare-earth-elements.

According Dr Louis Schurmann, Fellow of the Australasian Institute of Mining and Metallurgy and lead scientist on the project, the Jongju deposit is the world's largest known REE occurrence.

The 216 million tonne Jongju deposit, theoretically worth trillions of dollars, would more than double the current global known resource of REE oxides which according to the US Geological Survey is pegged at 110 million tonnes.

Minerals like fluorite, apatite, zircon, nepheline, feldspar, and ilmenite are seen as potential by-products to the mining and recovery of REE at Jongju.

Further exploration is planned for March 2014, which will includes 96,000m (Phase 1) and 120,000m (Phase 2) of core drilling, with results reported according to the Australia's JORC Code, a standard for mineral disclosure similar to Canada's widely used National Instrument 43-101.

An industry in turmoil

The majority of the 17 rare earth elements – used in a variety of industries including green technology, defence systems and consumer electronics – were sourced from placer deposits in India and Brazil in the late 1940s.

During the 1950s, South Africa mined the majority of the world's REEs from large veins of rare earth-bearing monazite.

From the 1960s to 1980s, rare earths were supplied mainly from the US, mostly from the massive Mountain Pass mine in California, which was eventually mothballed in 2002.

China then took over the industry completely, producing more than 95% of the world's REEs centred in Inner Mongolia and also becoming the top consumer ahead of Japan and South Korea.

Worries about China's monopoly of production sent prices for all rare earths into the stratosphere from 2008 onwards with some REEs going up in price twenty-fold or more.

That reignited interest in the sector with dozens of explorers active around the globe making major discoveries from Canada and Greenland to Madagascar and Malawi.

Molycorp's (NYSE:MCP) Mountain Pass is almost back to full production, Lynas Corp's (ASX:LYC) Mount Weld mine in Australia and plant in Malaysia opened last year, while Saskatoon-based Great Western Minerals (CVE:GWG) is recommissioning the Steenkampskraal mine in South Africa with Chinese backing.

Prices have now come back down to earth with most REEs dropping in price by 70% or more after peaking in 2011.

For instance, the most abundant and cheapest of these, cerium oxide which is used to polish TV screens and lenses is now trading at $8.50 from all-time highs of $118 in the September 2011. The price for cerium oxide was $4.56 in 2008.

The reversal in europium oxide – the priciest of the widely-used heavy REEs used in medical imaging and the nuclear and defence industries – has also been dramatic.

The price of europium increased more than 10-fold from $403 in 2009 to an average of $4,900 in the third quarter of 2011.

It is now worth $1,110 a kilogram in the export market, while Chinese domestic europium is another $500 cheaper at $630/kg.

Image of mural of Kim Il Sung and Kim Jong Il at the crater lake of Baekdusan by yeowatzup

The post FLASHBACK: Largest known rare earth deposit discovered in North Korea appeared first on MINING.com.

from MINING.com http://bit.ly/1bu3bp6

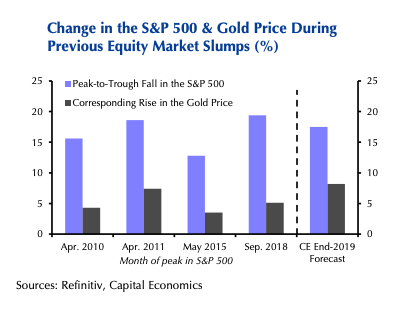

Trump's plan to impose a 5% tariff on all Mexican goods to force the country to do more to stem immigration coupled with a Chinese threat to blacklist foreign companies in retaliation to punitive US tariffs on its exports rattled markets and hurt the dollar.

Trump's plan to impose a 5% tariff on all Mexican goods to force the country to do more to stem immigration coupled with a Chinese threat to blacklist foreign companies in retaliation to punitive US tariffs on its exports rattled markets and hurt the dollar.

There are REEs in them thar hills

There are REEs in them thar hills