lundi 30 septembre 2019

Journée mondiale du chocolat : ouvrir les yeux sur les conditions précaires des producteurs

from Les dernières actualités de Futura-Sciences https://ift.tt/2nmck3c

NextSource announces updated FS for Madagascar graphite project

Toronto-based NextSource Materials (TSX:NEXT) has published results of an updated feasibility study for its flagship Molo graphite project in Madagascar, showing increased project build cost due to equipment inflation.

An update on the feasibility study published in 2017, the new FS takes into account updated mine capital equipment and mining costs, as well as current 12-month rolling flake graphite pricing on a free-on-bard (FOB) China basis supplied by commodities research firm Benchmark Minerals Intelligence.

To maintain a first-mover competitive advantage and to appropriately plan for future market demand, the FS was designed to provide a flexible mine development approach that comprises an all-modular build solution, the company says.

NextSource currently has an offtake agreement in place with a Japanese trader and is in the process of formalizing an additional sales agreement with a European trader. The FS was undertaken to include two phases in order to account for offtakers’ demand for the company’s SuperFlake graphite concentrate.

NextSource currently has an offtake agreement in place with a Japanese trader and is in the process of formalizing an additional sales agreement with a European trader

Phase 1 of the project will consist of a fully operational and sustainable graphite mine with a permanent processing plant capable of processing 240,000 tonnes of ore and producing about 17,000 tonnes of high-quality SuperFlake annually. The updated build cost of the fully modular process plant increased from the $18.4 million reported in the 2017 FS to $21 million.

Phase 2 incorporates the processing of 240,000 tonnes of ore for each of the first two years and then ramping up to 720,000 tonnes a year in the third year to accommodate additional sales, resulting in a total of 45,000 tonnes of SuperFlake concentrate being produced annually over a 30-year mine life.

Costing for Phase 2 is based on the addition of two modules of the beneficiation plant with a proportional increase in mining and infrastructure costs. The capital mine cost for Phase 2 will be $39.1 million, for a total project cost (Phase 1 and Phase 2) of $60.1 million.

In addition, the company notes that discussions with buyers have indicated their preference is to purchase Molo graphite concentrate at the local Madagascar port at FOB China prices.

As such, the FS operating costs (opex) include the all-in FOB cost to ship concentrate to the local Port of Fort Dauphin. The project’s Phase 1 opex is currently estimated at $565.93/t and Phase 2 at $514.17/t.

Shares of NextSource Materials were up over 14% on Monday. The graphite miner has an approximate market cap of C$20.3 million.

from MINING.COM https://ift.tt/2n1GKb9

Water from near-Earth asteroids could fuel space mining

Scientists planning to start mining the moon as early as 2025 may soon shift their attention to other celestial bodies as a new study suggests that there are about 1,000 asteroids closer to our planet than the lunar surface and which contain large amounts of the most precious resource: water.

While most of those space rocks are only a few feet in size, at least 25 of them are large enough to be able to serve as a stand-alone water reservoir. Together, the potential of these “hydrated” asteroids is unparalleled as they should be enough to fill nearly 320,000 Olympics-size swimming pools — significantly more than the amount of water locked up at the lunar poles, according to the study.

If there was a way to successfully establish refueling stations on these orbiting asteroids, says asteroid researcher and lead author of the paper, Andrew Rivkin, human space exploration could unlock a “level-up” moment. There would be no need to send fuel from Earth anymore, he says.

Asteroids orbiting Earth have enough water to fill up 320,000 Olympics-size swimming pools. This is significantly more than the amount of water detected on the moon’s poles.

“It’s easier to bring fuel from asteroids to geosynchronous orbit than from the surface of the Earth,” Rivkin says. “If such a supply line could be established, it could make asteroid mining very profitable.”

So far there are at least two asteroid mining companies — Planetary Resources and Deep Space Industries — and the US National Aeronautics and Space Administration (NASA) looking into the feasibility of the extraterrestrial endeavour.

In 2015, former US President Barack Obama signed a law that grants US citizens rights to own resources mined in space. The ground-breaking rule was touted as a major boost to asteroid mining because it encourages the commercial exploration and utilization of resources from asteroids obtained by US firms.

Shortly after, Luxembourg launched an official initiative to promote the mining of asteroids for minerals. The tiny European country, which has been studying possible involvement in the sector since 2013, aims to become Europe’s centre for space mining.

Canada is also eying the moon. Last year, Northern Ontario-based Deltion Innovations partnered with Moon Express, the first American private space exploration firm to have been granted government permission to travel beyond Earth’s orbit, on future opportunities in outer space.

Some of the space ventures in the works include plans to mine asteroids, track space debris, build the first human settlement in Mars, and billionaire Elon Musk’s own plan for an unmanned mission to the red planet.

Geologists as well as emerging companies, such as US-based Planetary Resources, a firm pioneering the space mining industry, believe asteroids are packed with iron ore, nickel and precious metals at much higher concentrations than those found on Earth, making up a market valued in the trillions of dollars.

from MINING.COM https://ift.tt/2mmRlwV

Cigarettes électroniques : des métaux toxiques trouvés dans les vapeurs des nouveaux modèles

from Les dernières actualités de Futura-Sciences https://ift.tt/2n7PvQP

De quoi est faite la comète interstellaire Borisov ? Premiers résultats

from Les dernières actualités de Futura-Sciences https://ift.tt/2mYc3Ug

« Nous allons trouver de la vie sur Mars », mais…

from Les dernières actualités de Futura-Sciences https://ift.tt/2oCyiiN

Cornish Lithium gets $1.7 million funding boost for UK project

Cornish Lithium, a start-up hoping to lead the development of an industry for the battery metal in the UK, has raised £1.4 million (about $1.7m) through a crowdfunding campaign launched in July, which will allow it to expand its ongoing drilling work in the ancient mining region of Cornwall, south-west England.

The company, the first British miner to raise money for a project through an Internet-based platform, said the backers included Norwegian shipping magnate Peter Smedvig, senior mining executives and about 1,200 individual investors, mostly locals.

Cornish Lithium owns exploration rights across more than 300 square miles of Cornwall, where it’s using data collected by planes, drones and satellites to map out mineral-rich geological structures in the area.

The company will kick off its first test in October, which consist of drilling into geothermal faults, pump out the water and then filtering the output to extract lithium, a key ingredient in the batteries that power electric cars and high-tech devices.

In the upcoming exploration phase, Cornish Lithium has decided to also begin exploring for lithium in hard rock form for the first time, having discovered evidence that it was mined on the surface during World War II.

Additionally, the miner plans to explore for other metals used in car batteries such as cobalt and copper.

A year ago, the company said it needed about £5 million ($6.3m) to go ahead with its plans. Since then, it has secured £2m from private backers and it’s already aiming at listing on the London Stock Exchange within three years.

Cornish Lithium has also expanded and consolidated the areas over which it has rights to explore for lithium and other minerals. Its team has assembled a vast amount of historical data and reconstructed it in 3D digital format, enabling a totally new understanding of the geological potential of Cornwall’s mineral deposits.

Jeremy Wrathall, the company’s boss and former head of mining research at Investec Plc, has repeatedly said he believed his company has undertaken the largest, single unified exploration project in the history of the UK.

Most lithium is produced in South America, Australia and China, but the UK government has recently designated it as a metal of strategic importance to the country.

“The Government is concerned about the raw materials supply for the car industry,” Wrathall told This Is Money over the weekend. “Brexit highlights the need to create new industries in the UK, and one that supports our car industry.”

Wrathall believes that the lack of exploration in Cornwal for over 30 years means that one of the most highly mineralized areas in Europe has remained untouched by modern exploration techniques.

from MINING.COM https://ift.tt/2n6scXC

Une batterie souple et élastique pour les smartphones pliables

from Les dernières actualités de Futura-Sciences https://ift.tt/2mo90V0

La supercar hybride Koenigsegg Regera bat le record du 0-400 km/h

from Les dernières actualités de Futura-Sciences https://ift.tt/2nSsUI9

Si la planète 9 est introuvable, c'est peut-être parce que... c'est un trou noir !

from Les dernières actualités de Futura-Sciences https://ift.tt/2nPhYen

British Columbia’s municipalities to work with resource industry on climate change

The Union of British Columbia Municipalities endorsed resolution B135, a motion put forward by the city of Fort St. John, calling for municipalities to work collaboratively with industry to address the challenges posed by climate change and recognizing the importance of the resource industries working in the Canadian western province.

Back in February, Fort Saint John City Council passed its resolution for consideration at municipal associations in response to a growing number of municipalities across British Columbia sending letters to energy companies demanding they help pay for the costs of climate change.

A growing number of municipalities across British Columbia were sending letters to energy companies demanding they help pay for the costs of climate change

Among those municipalities was Port Moody whose Council was calling on the province to pass legislation holding energy companies financially liable for costs related to climate change. Similarly, Victoria City Council was calling for a class-action lawsuit.

The former proposal was recently dismissed by UBCM delegates, while the latter was withdrawn by Victoria Mayor Lisa Helps back in April.

“These are historic votes of confidence in the ability of British Columbians to work together to resolve the challenges presented by climate change, and a rejection of divisive legal action,” said in a media statement Stewart Muir, executive director of Resource Works, a non-profit organization researching and promoting natural resources in B.C.

According to Muir, the vote promotes more positive interactions between authorities and resource companies. “[It sends] a strong message that B.C.’s mayors and councillors get that launching legal action against energy companies is not just ineffective grand-standing, but can prove costly and acrimonious. Instead, B.C.’s municipalities are ready to sit at the table with all stakeholders, including oil and gas companies, to move together towards a low-carbon future.”

from MINING.COM https://ift.tt/2nUgK18

Chandrayaan-2 : la Nasa n'a toujours pas retrouvé la sonde Vikram perdue sur la Lune

from Les dernières actualités de Futura-Sciences https://ift.tt/2owZrDK

Rio Tinto cancels plans to sell or take public its Canadian iron ore unit

Rio Tinto (LON, ASX, NYSE:RIO), the world’s second-biggest producer of iron ore, is said to have cancelled plans to sell its Iron Ore Company of Canada (IOC) business after failing to settle on a suitable price with potential buyers.

The miner, which owns 58.7% of IOC, had also explored and listing the unit on the Toronto Stock Exchange, but earlier this year told the banks leading the process to stop it, the Wall Street Journal reported.

This was not the first time Rio attempts to offload its interest in IOC, one of Canada’s largest iron ore producers. In 2013, then chief executive Sam Walsh tried, but failed to sell it as part of a massive assets disposals the company went through at a time of slumping iron ore prices.

The IOC’s mine plant in Newfoundland and Labrador produces relatively unpolluting iron ore concentrate, which command a premium. The company also runs a concentrator, a pelletizing plant, which produces small balls of iron ore used in the production of steel.

Additionally, IOC operates port facilities located in Sept-Îles, in the province of Quebec and runs a 418-kilometre railroad that links the mine to the port.

Japan’s Mitsubishi Corp and Canada’s Labrador Iron Ore Royalty Co also have stakes in IOC — 26.2% and 15.1% respectively.

Iron ore, which accounts for most of Rio’s profit, has provided healthy margins for years.

from MINING.COM https://ift.tt/2owgrKk

Planète CAVEM : l'eau dans tous ses états depuis la Méditerranée jusqu'au robinet

from Les dernières actualités de Futura-Sciences https://ift.tt/2LwVqbq

McDonald va recruter via les enceintes connectées Google et Amazon

from Les dernières actualités de Futura-Sciences https://ift.tt/2mkCUcK

Antibiorésistance : un mécanisme de protection des bactéries dévoilé

from Les dernières actualités de Futura-Sciences https://ift.tt/2n5SpFN

Lorenzo, l'ouragan le plus puissant jamais observé au nord de l'Atlantique, s'approche de l'Europe

from Les dernières actualités de Futura-Sciences https://ift.tt/2mkdwns

Réchauffement climatique : 15 actions de lutte récompensées par l'ONU

from Les dernières actualités de Futura-Sciences https://ift.tt/2n2Ud29

SpaceX : Elon Musk fait l’éloge de Starship et promet la Lune et Mars

from Les dernières actualités de Futura-Sciences https://ift.tt/2mdBVuJ

SpaceX : l'assemblage du prototype MK1 du Starship est terminé !

from Les dernières actualités de Futura-Sciences https://ift.tt/2owCl07

SpaceX : assemblage terminé du prototype MK1 du Starship

from Les dernières actualités de Futura-Sciences https://ift.tt/2n0N1nb

Voici comment les bactéries deviennent résistantes aux antibiotiques

from Les dernières actualités de Futura-Sciences https://ift.tt/2mXSyek

dimanche 29 septembre 2019

Journée mondiale de la mer : retour sur l'année écoulée

from Les dernières actualités de Futura-Sciences https://ift.tt/2nOo2DW

La désintégration d’un astéroïde a modifié la vie sur Terre il y a 466 millions d’années

from Les dernières actualités de Futura-Sciences https://ift.tt/2mhEETZ

L'antibiorésistance augmente chez les animaux d'élevage. Les scientifiques s’inquiètent

from Les dernières actualités de Futura-Sciences https://ift.tt/2lFrjog

Saturne : finalement ses anneaux seraient plus vieux que les dinosaures

from Les dernières actualités de Futura-Sciences https://ift.tt/2n8Czdg

Le robot Atlas se prend pour un gymnaste

from Les dernières actualités de Futura-Sciences https://ift.tt/2mLkT7y

samedi 28 septembre 2019

Vénus aurait été habitable jusqu'à un grand bouleversement il y a 715 millions d'années

from Les dernières actualités de Futura-Sciences https://ift.tt/2mjIUSR

Toutankhamon : son sarcophage sera restauré pour la première fois depuis 3.000 ans avant son exposition en 2020

from Les dernières actualités de Futura-Sciences https://ift.tt/2mnJteJ

vendredi 27 septembre 2019

Près de la moitié des arbres en Europe sont menacés d'extinction

from Les dernières actualités de Futura-Sciences https://ift.tt/2o4bloz

SpaceX prouve l'efficacité des parachutes de la capsule habitée Crew Dragon

from Les dernières actualités de Futura-Sciences https://ift.tt/2m7PGeB

Magecart : les nouvelles armes des pirates pour voler les données bancaires

from Les dernières actualités de Futura-Sciences https://ift.tt/2ndu4gT

US steps up efforts to limit China’s control of critical minerals

The US government is stepping up efforts to break China’s dominance over supplies of critical minerals for range of modern life’s aspects including electric vehicles (EVs), green technologies and military applications by launching a plan to boost lithium, cobalt and rare earths mining across the globe.

The Energy Resource Governance Initiative (ERGI) initiative, which so far involves Australia, Botswana and Peru, seeks to promote responsible mining of 15 materials expected to be in high demand as the adoption of technologies such as EVs, battery storage and wind turbines continues to rise.

“We want to ensure that these important mineral commodities remain free from international coercion and control,” US secretary of state, Mike Pompeo, said in a meeting held this week’s at the United Nations General Assembly.

“The work that we’re doing here is absolutely essential – it’s essential to ensuring secure and reliable energy supplies for every nation,” he noted.

Pompeo said the Trump administration will also work on bilateral agreements, such as the one it recently signed with Canada, aimed at strengthening cooperation on critical minerals.

Washington has also gained the support of Australia, which has committed to facilitate potential joint ventures to improve rare earth processing capacity and reduce reliance on Chinese rare earths.

In early September, Canberra identified 15 rare earth and critical mineral projects it aims to champion as part of the joint effort with the US to challenge China’s dominance in the market.

The announcement followed a move by Australia’s Lynas Corp (ASX: LYC), the world’s largest rare earths miner outside China, which signed in July a deal with its partner, Texas-based Blue Line, to build a heavy rare earths separation facility in the US. Such facility should begin operations by 2021.

The US has also signed a memorandum of understanding to assist Greenland in the exploration and development of the island’s resources — in particular, its rare earth minerals.

Washington has grown more concerned recently about its dependence on mineral imports after Beijing suggested using them as leverage in the trade war between the world’s two largest economies.

China accounts for almost 80% of the global mined supply of rare earths, a group of 17 chemical elements used in everything from hi-tech consumer electronics to military equipment.

The nation has used its rare earths dominance to make a political point in the past. It blocked exports to Japan after a maritime dispute in 2010, though the consequent spike in prices triggered a race to secure supplies elsewhere.

Beijing has also been secure supplies of other critical minerals and battery metals such as lithium, cobalt and nickel, buying up stakes in mining projects in countries from Australia to South America and Greenland.

from MINING.COM https://ift.tt/2m9fmri

Chikungunya : la clé du développement d'un traitement identifiée ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2nhH2tV

Bullseye to explore pre-WWII gold shafts in Western Australia

Bullseye Mining announced that it is planning to use modern-day exploration techniques to discover what lies underneath the historic Gold Shafts atop of the Hurleys gold deposit in Western Australia.

According to the miner, the shafts have been lying abandoned since the Second World War, with only occasional small-scale prospecting by those fascinated with the sheer dearth of hard, physical work and preservation shown by the mid-century Gold Rush prospectors.

The company expects to encounter some remaining shallow gold mineralisation at the shafts

These ‘trenches’ are located within a 5-kilometre radius of Bullseye’s flagship North Laverton Gold Project or NLGP on the Dingo Range Greenstone Belt. They became a significant drill target during the company’s latest drilling campaign.

“The Bullseye exploration team expects to encounter some remaining shallow gold mineralisation at Hurleys and wants to test for any deeper in-situ gold mineralisation that may be present, that the earlier prospectors were unable to access,” the company explained in a press release. “Gold mineralisation at Hurleys has been encountered by Bullseye at shallow depths with results including 6 metres @ 2.94 g/t gold, 12m @ 3.30g/t gold, 8m @ 3.60g/t gold and 9m @ 2.27g/t gold.”

The plan is to include the gold mineralisation at Hurleys into the NLGP mining reserves to extend its life of mine.

Bullseye said it will also continue to do extensive drilling at and around the NLGP, in parallel to advancing the design and development of its on-site NLGP gold production plan.

from MINING.COM https://ift.tt/2n8Vd4K

Ximen gets permit to explore Providence claim in British Columbia

Ximen Mining (TSX-V:XIM) announced that it received an exploration permit for its Providence claim located in southern British Columbia.

The Greenwood mining camp is located in southern British Columbia and has produced 1.4 million ounces of gold, 10 million ounces of silver and 0.7 billion pounds of copper

In a press release, Ximen said that the approval allows it to carry out its plans for additional exploratory work on the property, which include detailed rock sampling, trenching and diamond drilling. The targets include gold-silver in quartz veins and copper-gold-silver skarn deposits.

According to the Vancouver-based miner, the Providence claim covers 190 hectares in the Greenwood Mining Camp and adjoins the Gold Drop property currently optioned and being drilled by GGX Gold (TSX.V: GGX).

“The Providence property covers five historic past-producing mines for silver, gold, lead and zinc. The most significant of these is the Providence mine, which operated intermittently from 1893 to 1973, and produced a total of 183 kilograms of gold (5,884 ounces), 42,552 kilograms of silver (1,368,079 ounces), 183 tonnes of lead, 118 tonnes of zinc from 10,426 Metric tonnes of material,” the media brief states.

from MINING.COM https://ift.tt/2mirO80

Une étoile déchiquetée par un trou noir observée en direct par Tess

from Les dernières actualités de Futura-Sciences https://ift.tt/2mh1H16

Avec Horizon, Facebook va ouvrir un monde en réalité virtuelle inédit en 2020

from Les dernières actualités de Futura-Sciences https://ift.tt/2mjhCMp

Les sachets de thé libèrent des milliards de micro particules de plastiques dans votre tasse

from Les dernières actualités de Futura-Sciences https://ift.tt/2m8Ay0z

Océan et cryosphère : que retenir du rapport spécial du Giec ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2mgBnnO

Incendie de Lubrizol à Rouen : quels sont les risques de pollution chimique ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2lEP6ok

Bons plans maison du week-end : cuisines, meubles design et déstockages

from Les dernières actualités de Futura-Sciences https://ift.tt/2n8cU4o

La première preuve que les bébés buvaient du lait animal au Néolithique

from Les dernières actualités de Futura-Sciences https://ift.tt/2nIyRak

La fertilité des souris reste intacte après un long séjour dans l’espace

from Les dernières actualités de Futura-Sciences https://ift.tt/2mfdop2

Trois trous noirs sur le point d’entrer en collision

from Les dernières actualités de Futura-Sciences https://ift.tt/2m6CRBh

La fertilité des souris reste intacte après un long séjour dans l’espace

from Les dernières actualités de Futura-Sciences https://ift.tt/2nJzmRv

En vidéo : une pieuvre change de couleur pendant son sommeil

from Les dernières actualités de Futura-Sciences https://ift.tt/2mer040

Ikea Place : une app en réalité augmentée pour décorer son intérieur

from Les dernières actualités de Futura-Sciences https://ift.tt/2lxYJVH

L'ouragan Lorenzo, l'un des plus impressionnants observé au-dessus de l'Atlantique

from Les dernières actualités de Futura-Sciences https://ift.tt/2lCyyNM

Expérience des moustiques génétiquement modifiés : les premiers résultats

from Les dernières actualités de Futura-Sciences https://ift.tt/2nK7yfW

Réchauffement climatique : l'inaction aura un coût élevé

from Les dernières actualités de Futura-Sciences https://ift.tt/2mfaNvg

jeudi 26 septembre 2019

SpaceX qualifie les parachutes de sa capsule habitée Crew Dragon

from Les dernières actualités de Futura-Sciences https://ift.tt/2mdvFTF

Les immeubles connectés sont la nouvelle cible des hackers

from Les dernières actualités de Futura-Sciences https://ift.tt/2n4dwYG

Alacer Gold announces positive drill results for Çöpler Saddle

Colorado-based miner Alacer Gold (TSX:ASR) (ASX:AQG) announced on Thursday new exploration results for the Çöpler Saddle shear zone, which borders the western flank of the company’s flagship Çöpler gold mine in eastern Turkey.

The initial testing of the Saddle zone consisted of 50 diamond drill holes with a strike length of more than 2 kilometres. All holes were outside of the Çöpler resource shells and planned mining areas.

The reported drill holes intersected oxide and sulphide gold mineralization, some with impressive grades and thicknesses. Notable results include: 9.65 g/t Au (oxide) over 22.6 metres; 4.74 g/t Au (oxide and sulphide) over 40.8 metres; 39.45 g/t Au (oxideand sulphide) over 5.7 metres; and 7.2 g/t Au (oxide) over 7.8 metres.

“The Çöpler Saddle is shaping up to be another outstanding near-mine exploration project and an important component of our short-term strategy to identify additional oxide ore that we can convert quickly into production by leveraging our existing infrastructure,” Alacer Gold CEO Rod Antal commented in Thursday’s press release.

“With Ardich already shaping up to be a major discovery, and now with the Saddle showing potential, albeit at an earlier exploration stage, our short-term strategy is rapidly becoming a reality,” Antal added.

Shares of Alacer Gold opened 3.6% higher on Thursday. The gold miner has a market cap of approximately C$1.66 billion.

from MINING.COM https://ift.tt/2n3vRVW

First bitumen test shipment on its way from Alberta to China

A test shipment of bitumen oil from Alberta is on its way to China, but it didn’t get to a British Columbia port by pipeline – it was moved by train through Prince Rupert in a semi-solid form commonly known as neatbit.

Melius Energy in Calgary is not the first company to propose moving bitumen through BC in a semi-solid form by train, but it appears to be the first to actually land a potential customer in China and start shipping semi-solid bitumen by train.

It has sent its first container, containing 130 barrels of bitumen, to China in a test shipment, and is currently building a new demonstration plant in Edmonton that turns diluted bitumen into a solid called TrueCrude.

Using existing rail infrastructure, Melius says it could potentially move 120,000 barrels per day of pure bitumen in 100-unit trains through the Port of Prince Rupert.

“Prince Rupert is expanding and they’re looking for lot of containers to move through there,” said Yuri Butler, Melius’ manager of logistics and supply. “That’s one of the reasons we’re excited about working with Prince Rupert is they’re looking for a lot of containers. We’re looking to export a lot of containers. Right now there’s a lot of containers coming into Prince Rupert, but there’s not necessarily a lot leaving.”

Melius says it could potentially move 120,000 barrels per day of pure bitumen in 100-unit trains through the Port of Prince Rupert

Moving bitumen in semi-solid form addresses environmental concerns associated with moving diluted bitumen by rail, pipeline and oil tanker.

The concern is that an oil spill on either land or at sea could have serious environmental impacts. Shipping it in a solid, non-flammable form addresses those concerns. Should a container of TrueCrude ever crack open and end up in the ocean, it would float in one large block that could easily be recovered, the company says.

Bitumen is a thick, tarry form of oil that has to be diluted with lighter oils – condensate – in order to transport it in liquid form. Melius developed a process, called BitCrude, whereby the diluent is taken back out of the diluted bitumen. The diluent can be recycled back to dilbit producers.

The pure bitumen is heated so it can be poured into modified shipping containers, where it then solidifies when it cools. It is then shipped by train and put onto container ships. When it reaches its destination, the bitumen is heated to allow to flow into a refinery.

Melius is currently building a demonstration diluent recovery plant in Edmonton. Butler said the plants could be built and sold as turn-key operations to oil producers in Alberta.

Melius says transporting bitumen by train and container ship is cost competitive with pipeline and oil tanker transport. For one thing, there are no capital costs associated with the transportation, since the railway lines already exist.

“We’re moving on existing rail lines, it’s a safe product and we can efficiently move volume at scale,” Butler said.

There are also economies of scale associated with moving products by container ship, as opposed to oil tanker, since there are so many containers ships plying the ocean.

There is a huge demand in China for bitumen, largely because China’s Belt and Road project will require so much asphalt

“When you ship in a container, your costs to ship that container are very competitive because there’s so much volume of containers moving,” Butler said.

He said there is a huge demand in China for bitumen, largely because China’s Belt and Road project will require so much asphalt.

Because of its high asphaltene content, bitumen is a highly desired feedstock for making asphalt. Roughly half of a barrel of bitumen can be turned into asphalt, with the rest being turned into other petroleum products.

“The demand from Asia right now for heavy crude oil is growing and it’s almost insatiable, especially with what’s happening with Venezuela, and Iran and Saudi Arabia,” Butler said.

“They’re looking for supply, and right now they’re struggling to find it. Whereas here in Alberta we have quite a bit of supply and we’re trying to export it to the U.S., where we’re fighting to get a low dollar. If we can get this to the China, we can get a much better dollar and sell our premium product at a premium price.”

(This article first appeared in Business in Vancouver)

from MINING.COM https://ift.tt/2looNm4

Access to water one of miners’ biggest challenges ahead — study

Stricter environmental regulations and changing climate patterns resulting in the worst droughts in more than half a century, have multiplied the mining industry’s challenges to secure water supplies, Moody’s Investors Service says in a new report.

Despite successful efforts to manage water usage more efficiently, increasingly tougher environmental rules are hiking miners’ costs and risks, particularly to those operating in arid regions or close to populated communities.

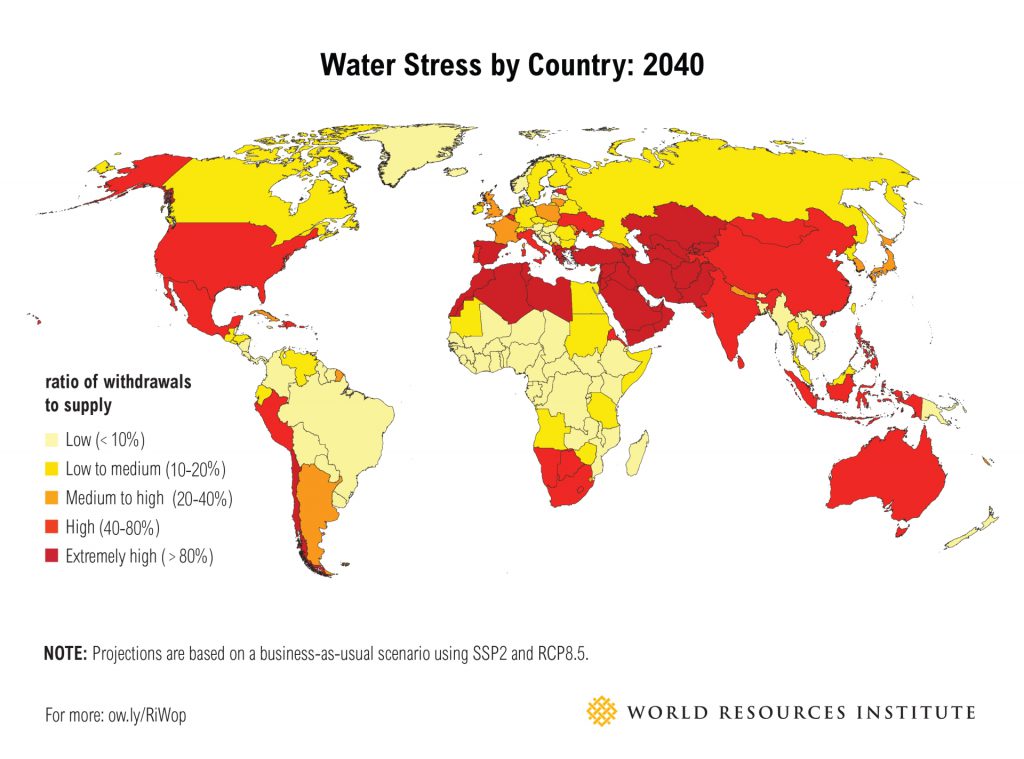

“Many countries, including Peru, Chile, Australia, South Africa and Mongolia, have large mining operations exposed to decreasing water availability,” Moody’s senior vice president, Carol Cowan, says. “In the next 20 years, all of these countries will be in the high to extremely high ratio of water withdrawals to supply, which will make it difficult for companies to secure reliable sources.”

Squeezing water rights

Chile, the world’s largest copper producer and No.2 global source of lithium, is just one of many jurisdictions where miners will soon have to deal with broader water use restrictions.

The nation’s water authority DGA announced earlier this year that it would more than double the number of so-called prohibition areas across the country to at least 70 from 30. No new licenses will be awarded within prohibition zones and any extension to existing mining permits will need to be approved by environmental authorities.

At the same time, companies’ demand for water is expected to jump 12% though 2029 as ore grades decline, forcing miners to process more material to maintain production levels.

Miners have responded by building large desalination plants, which is expected to more than triple seawater use in the country, Chile’s copper commission (Cochilco) predicts.

Miners’ hurdles are exacerbated when using the ground and surface water that local communities rely on. This has resulted in social unrest and prompted stricter norms and permitting processes.

Protests have occurred in Peru, Chile, Mexico, Armenia, Australia and the US over the last few years, causing delays in the construction of new mines or expansion of existing ones in many of those cases.

Large miners better prepared

In Moody’s opinion, higher capital spending and operational costs associated with securing reliable water supply will be better managed by large, globally diversified firms.

World’s No. 1 miner BHP already gets more than 40% of the water it needs from the ocean. The miner spent $3.43 billion on a desalination plant for its Chilean Escondida mine, which includes two pipelines to transport the water 3,200 meters above sea level.

The miner has also committed to stop using fresh water drawn from the surface and underground in Chile by 2030.

Southern Copper’s long delayed $1.4-billion Tía Maria mine includes plans for a desalination plant that would cost about $100 million. The facility is expected to ease protesters concerns about the project’s use of local surface and ground water.

Other companies are more focused on using recycled water by capturing what is used in the various parts of the process, such as in tailings dams, treating it and reusing.

“With water levels expected to continue depleting, smaller mining companies with limited financial flexibility may face increased costs related to water procurement over time,” Cowan says.

Other than their high cost, desalination plants pose and additional worry to miners associate to the waste they generate. That product, brine, is usually pumped back into the reservoir where the water was taken from. This causes an imbalance in the overall water composition which is harmful to the environment within the sourcing body.

from MINING.COM https://ift.tt/2lSoznL

C’est confirmé : la Terre était déjà habitée il y a 3,5 milliards d’années

from Les dernières actualités de Futura-Sciences https://ift.tt/2mUBHbW

Facebook Horizon : un monde en réalité virtuelle inédit s'ouvrira en 2020

from Les dernières actualités de Futura-Sciences https://ift.tt/2lZUGBO

En vidéo : une pieuvre change de couleurs pendant son sommeil

from Les dernières actualités de Futura-Sciences https://ift.tt/2lkFY83

Regardez comment un trou noir déforme l’espace-temps

from Les dernières actualités de Futura-Sciences https://ift.tt/2noQFaj

HySafe believes hydrogen could replace diesel at mine sites

Experts are discussing the possibilities of using hydrogen to replace diesel as the baseload fuel on remote mining sites.

But according to the president of the International Association for Hydrogen Safety, Stuart Hawksworth, in order for that goal to become a reality, hydrogen needs to be seen as safe.

Hydrogen is seen as a fuel with export potential as many cities seek to increase renewables in their total energy mix

Talking at the International Conference on Hydrogen Safety taking place in Adelaide, South Australia, Hawksworth said that it is essential that the lessons learned from safety incidents are shared collaboratively and on an open international stage.

These types of discussions -he said- have allowed for hydrogen technologies and hydrogen fuel applications to emerge in the past two years as a source of clean energy.

“It has so many wide-ranging applications, and in a country like Australia, offers such game-changing scenarios as potentially replacing diesel as the baseload fuel on remote mining sites,” the executive said. “It is also being eyed for its future use in fueling defence and space breakthroughs – two sectors close to Australia and South Australia’s technological and industrial heart.”

The year 2019, in particular, has seen increased interest in the development of mechanisms to amplify the use of hydrogen as an energy source, with researchers developing different kinds of sensors capable of detecting leaks in seconds and avoiding the risk of fires.

from MINING.COM https://ift.tt/2mRehnY

Scania develops biofuel-powered, self-driving truck

Equipment and services company Scania announced that a multidisciplinary team is working on developing a cabless self-driving vehicle that would ease the workload at mines and large closed construction sites.

In a press release, Scania’s president and CEO, Henrik Henriksson, said that the AXL concept truck is steered and monitored by an intelligent control environment that sits on the front module, which replaces the traditional cab.

“In mines, for example, the autonomous operations are facilitated by a logistics system that tells the vehicle how it should perform,” Henriksson explained.

The executive also said that the combustion engine that powers the concept vehicle uses renewable biofuel. It’s “an example of how traditional and new technology is mixed,” he added.

Stockholm-based Scania decided to carve a mining niche into a new area, Scania Mining, back in 2012. The centenary company has said that its goal is to bring together products and solutions from other divisions and gear them strictly towards mining.

from MINING.COM https://ift.tt/2lOGmw5

Lucara on a roll — finds blue, pink diamonds at Botswana mine

Canada’s Lucara Diamond (TSX:LUC) continues to find gem-quality, coloured diamonds at its Karowe mine, in Botswana, which in April yielded the 1,758-carat Sewelô (meaning “rare find”) diamond, the largest ever recovered in the African country.

The Vancouver-based miner has now recovered a 9.74 carat blue and a 4.13 carat pink diamonds from direct milling of the South Lobe, the area that yielded the famous “Lesedi La Rona” in 2015.

The announcement comes on the heels of last week’s display of a 123 carat gem quality, top white, Type II diamond, found at the same section of the mine.

It also follows the recent sale of a 2.24 carat blue for $347,222 per carat.

Karowe, which began commercial operations in 2012, has this year yielded 22 diamonds larger than 100 carats, eight of them exceeding 200 carats.

Since the start of the year, the miner has sold 19 diamonds each with an individual price in excess of $1 million at its quarterly tender sales. This includes seven diamonds that fetched more than $2 million each, and one diamond that carried a final price tag of over $8 million.

“Lucara is extremely pleased with the recovery of these rare, sizeable, fancy coloured diamonds, which have the potential to contribute meaningful value to our regular production of large, high-value type IIa diamonds,” chief executive, Eira Thomas, said in the statement.

The precious rocks will be put up for sale in December, during the company’s fourth-quarter tender.

Lucara, which has focused efforts on the prolific Botswana mine this year, is close to completing a feasibility study into potential underground production and life-of-mine expansion at Karowe.

from MINING.COM https://ift.tt/2lOGcEZ

Amazon Echo : Alexa s’invite dans une bague, des lunettes et… un four !

from Les dernières actualités de Futura-Sciences https://ift.tt/2loXEj6

Les sachets de thé libèrent des microplastiques dans votre tasse

from Les dernières actualités de Futura-Sciences https://ift.tt/2mQpSUg

EDF Pulse 2019 : électricité solaire pour tous, batteries virtuelles, moteur photovoltaïque et borne de recharge mobile

from Les dernières actualités de Futura-Sciences https://ift.tt/2PHdh3O

Comment le T-Rex broyait-il ses proies ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2lXPTAH

Le manque de sommeil entraînerait rapidement une prise de poids

from Les dernières actualités de Futura-Sciences https://ift.tt/2mR9kvn

Nouvelle physique : la masse des neutrinos est mieux déterminée avec Katrin

from Les dernières actualités de Futura-Sciences https://ift.tt/2mR9i6J

Le premier astronaute des Émirats arabes unis rejoint l'ISS

from Les dernières actualités de Futura-Sciences https://ift.tt/2mUVZBW

Nouvelle physique : la masse des neutrinos est mieux déterminée

from Les dernières actualités de Futura-Sciences https://ift.tt/2noXKHX

Réchauffement climatique : quelques chiffres qui donnent à réfléchir

from Les dernières actualités de Futura-Sciences https://ift.tt/2mUGn1l

SpaceX : Elon Musk dévoile des photos du prototype MK1 du Starship

from Les dernières actualités de Futura-Sciences https://ift.tt/2lTT50m

EDF Pulse 2019 : batteries pour engins de chantier, premiers secours connectés, capteurs auto-alimentés et catalogue intelligent

from Les dernières actualités de Futura-Sciences https://ift.tt/2ZBlHNN

L’ADN n’est pas lié par des liaisons hydrogène

from Les dernières actualités de Futura-Sciences https://ift.tt/2lRJVBv

mercredi 25 septembre 2019

La luminosité d’une pièce influence notre perception de la température

from Les dernières actualités de Futura-Sciences https://ift.tt/2le2G1D

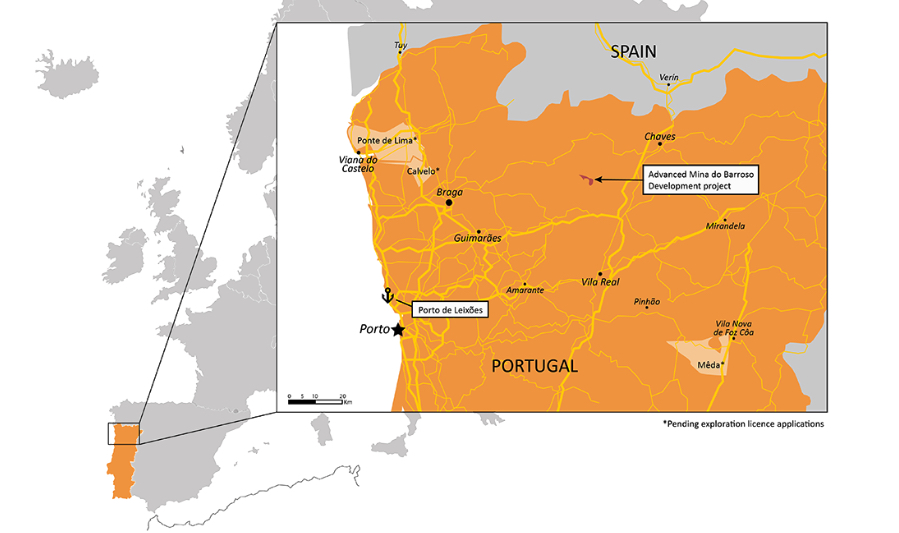

Savannah Resources to extract quartz, glass-making ceramic at lithium mine in Portugal

Multi-commodity developer Savannah Resources (AIM:SAV) is looking into maximizing value at its Mina do Barroso lithium project in Portugal by identifying other products present in the concession.

Unveiling a maiden resource for elements other than lithium, the London, England-based company said that the Grandao deposit, which is part of its lithium project, contains 4.79 million tonnes of quartz and 6.11 million tonnes of feldspar.

The co-products can be used in industries such as glass-making and ceramics, Savannah said, generating “significant” extra income for the company.

Co-products will initially be sold to ceramics industry customers in Portugal and in neighbouring and Spain.

“They will not only help our bottom line but will help to reduce the volumes of materials that will need to be emplaced as waste on site thereby reducing our environmental footprint and costs,” chief executive, David Archer, said in the statement.

Mina do Barroso, arguably one of the most advanced lithium mining concessions in Europe, is expected to become the continent’s first significant producer of spodumene, a hard-rock form of lithium.

Savannah, which acquired a majority stake in the project in May 2017, has maintained a fast paced development approach since.

The company estimates the whole project, in northern Portugal, holds a resource estimate of 20 million tonnes with over 200,000 tonnes contained Li20.

Additionally, metallurgical test-work results have produced an “excellent” 6% Li20 low impurity concentrate, which according to Archer, is “ideal” for the EV battery industry, further validating the project.

Mina do Barroso open pit mine is set to initially produce 6% Li2O spodumene concentrates destined to China.

Portugal produces about 11% of the global lithium market, but its output is entirely used to make ceramics and glassware. That’s why Europe relies on lithium imports from Latin America’s “Lithium Triangle,” as well from Australia and China.

from MINING.COM https://ift.tt/2l2J6oW

Réchauffement climatique : le Giec dresse un tableau sinistre des océans et de la cryosphère

from Les dernières actualités de Futura-Sciences https://ift.tt/2lK7Qmd

Rio Tinto strikes deal with Chinese customers to cut steel-making emissions

The world’s No. 2 producer of iron ore, Rio Tinto (ASX, LON:RIO), has inked a preliminary deal with two Chinese partners to develop new ways to cut carbon emissions along the steelmaking supply chain amid increasing pressure from stakeholders to make mining a more environmentally-friendly activity.

Rio said it will work with China’s largest steel producer, Baowu Steel Group, and Tsinghua University to address the steel industry’s carbon footprint and curb its “scope 3” emissions – those made by its customers.

“The materials we produce have an important role to play in the transition to a low carbon future and we are committed to partnering with our customers and others to find the most sustainable ways to produce, process and market them,” chief executive Jean-Sébastien Jacques told a steel conference on Wednesday in Qingdao, China.

In March, the Anglo-Australian miner rejected proposals to set scope 3 emissions targets from its customers, saying they were primarily caused by its customers over which it had “very limited control”.

Rio Tinto’s change of hearts follows a pledge in July by its rival, BHP, to spend $400 million over five years to reduce greenhouse gas emissions from its operations and mined commodities.

It also follows Australia’s Prime Minister’s challenge to China to do more to cut its emissions.

Asked if the move was a business decision or was made based on other considerations, Jacques said it was all about business. “It’s nothing more than that. We want to achieve the best supply chain for the steel industry. It’s not about ideology,” he said.

Highly polluting steel

The production of steel is one of the largest sources of carbon emissions, responsible for between 7% and 9% of the world’s carbon emissions, Rio said.

The traditional method of making iron and steel by smelting raw materials at extremely high temperatures has not changed much in more than 150 years. Large blast furnaces rely on metallurgical coal to reduce iron ore into liquid metal, which is refined into steel.

The company noted the partnership will also look at emissions from distribution, an area where emissions can be quickly reduced by changing from ships using bunker fuel – heavy, carbon-intensive oil – to natural gas. Rio has reported that its scope 3 emissions, most of them from steel making, totalled 536 million tonnes of carbon dioxide equivalent gases last year compared to 28.6 million tonnes across scope 1 and 2.

from MINING.COM https://ift.tt/2nfXjQj

Les moustiques génétiquement modifiés donnent naissance à de robustes progénitures

from Les dernières actualités de Futura-Sciences https://ift.tt/2lJ5nIJ

L'IMC ne prédit pas le risque cardiovasculaire chez les diabétiques

from Les dernières actualités de Futura-Sciences https://ift.tt/2mAUaKD

Spot, le robot-chien de Boston Dynamics, est enfin commercialisé

from Les dernières actualités de Futura-Sciences https://ift.tt/2mGsVxY

Déboucher une bouteille de champagne produit une onde de choc

from Les dernières actualités de Futura-Sciences https://ift.tt/2lEMff2

Xiaomi Mi Mix Alpha : découvrez son étonnant écran « surround »

from Les dernières actualités de Futura-Sciences https://ift.tt/2l3tP7n

MGX ships commercial rapid lithium recovery system to the US

MGX Minerals (CSE: XMG) shipped this week what it calls ‘the world’s first commercial rapid lithium recovery system.’

The shipment was made from Calgary in western Canada to Towanda on the eastern side of the United States, where it landed at Eureka Resources’ Standing Stone advanced wastewater treatment facility.

The technology is applicable to oil and gas produced water, natural brine, lithium-rich mine brine and industrial plant wastewater

Back in June, MGX and Eureka formed a joint venture whose focus is on fast-tracking the deployment of the system. At present, the JV is working to commission it with the hope of beginning commercial extraction in 2019’s fourth quarter.

“Eureka’s Standing Stone facility, which originally opened in 2013, provides regional energy producers with advanced wastewater treatment services for raw oil and gas brines,” the companies said in a press release. “Post-concentration lithium values in the range of 1,000ppm have been reported by Eureka and verified by MGX from produced water from within the Marcellus Shale.”

The plan is to apply MGX’s rapid lithium extraction technology there, as it is able to enhance the quality of lithium extraction and recovery across a range of brines as compared with traditional solar evaporation.

According to the Canadian company, its solution eliminates or greatly reduces the physical footprint and investment needed for large, multi-phase, lake-sized, lined evaporation ponds.

Once the mechanism is completely functional at Standing Stone, MGX said the idea is to scale up lithium output, deploy additional systems to other Eureka facilities, and identify new installation sites at third-party treatment facilities.

from MINING.COM https://ift.tt/2lv04wI

Alrosa’s Diamond Inspector excels at detecting fake stones

Russian miner Alrosa (MCX:ALRS), the world’s top diamond producer by output, announced that its $6,000 portable Diamond Inspector showed high results in a series of tests performed by independent laboratory UL Verification Services in Boston.

The device is aimed at cracking down on dishonest suppliers that mix lab-made stones with mined diamonds.

Alrosa’s efforts to ensure the authenticity of its diamonds complement rival De Beers’ initiative to create the first industry-wide blockchain platform

In a media statement, Alrosa said the tests were held in July 2019 as a part of the ASSURE Program of the Diamond Producers Association, whose objective is the development and application of unified standard evaluation of the effectiveness of tools and special equipment for diamond identification.

For the Inspector tests, almost 1,400 samples were included among them natural I/II type diamonds, synthetic diamonds grown by using advanced technologies, and non-diamond imitations.

The mechanism, which analyzes both loose and mounted stones in 45 seconds, was able to detect natural diamonds 96.4% of the time, while it accurately identified all the synthetic diamonds and all the non-diamond imitations ran by it.

According to Alrosa, the Inspector was also able to analyze stones in a size range from 0.03 to 10 carats and a color range from D to J, that is, colorless and near-colorless gems.

The device was developed by the diamond miner together with specialists from the Federal State Budgetary Institution Technological Institute for Superhard and Novel Carbon Materials. A joint venture, Diamond Scientific and Technological Center LLC, is in charge of its production and commercialization.

from MINING.COM https://ift.tt/2mGG1eE

BHP tried swaying Anglo’s Mark Cutifani to be its CEO

World’s largest mining company BHP (ASX, NYSE: BHP) is said to have approached Anglo American’s chief executive, Mark Cutifani, in more than one opportunity, asking him to consider going for the top job at the company.

BHP favours an internal hire, but is also open external candidates, people familiar with the matter told Bloomberg. So far, the 60-year-old Australian mining veteran has declined the offers, they added.

More to come…

from MINING.COM https://ift.tt/2l6tq4f

Xiaomi : découvrez l'étonnant écran « surround » du Mi Mix Alpha

from Les dernières actualités de Futura-Sciences https://ift.tt/2n62oKJ

Nouveau rapport du Giec : un tableau sinistre des océans et de la cryosphère

from Les dernières actualités de Futura-Sciences https://ift.tt/2lrOhPH

Sibanye to axe more than 5,000 jobs in Marikana restructuring

South Africa’s Sibanye-Stillwater (JSE:SGL) (NYSE:SBGL) is letting go 5,270 workers at its Marikana platinum mine, as the company restructures the loss-making operation.

The Johannesburg-based precious metals miner, which took possession of Marikana through a recent merger with struggling rival Lonmin, said the goal was to return the mine to profit and ensure the sustainability of the remaining shafts.

“Overall, the outcome will be a more sustainable business which is able to secure employment for the majority of the Marikana workforce for a much longer period,” he said in a statement,” chief executive, Neal Froneman, said in a statement.

The number of jobs losses are significantly higher than the 3,000 originally estimated as a result of the Sibanye-Lonmin business combination, which created the world’s largest platinum producer and the second-biggest palladium miner.

The company, however, said the cuts less than what Lonmin had communicated in 2017 and that they would be subject to a consultation process aimed at mitigating retrenchments and seeking options to the closure or downscaling of operations at the affected shafts.

Job cuts in Africa’s most industrialized economy are politically sensitive, with the unemployment rate hitting a 11-year high of 29% in the second quarter of the year, affecting mostly poor, black workers.

The Marikana mine, located near Rustenburg, about 112km from Johannesburg, was the scenario of an infamous workers massacre. The bloody shootings took place in August 2012 and are considered the most lethal use of force by South African security forces against civilians since 1976.

from MINING.COM https://ift.tt/2n3Zh63

Tesla promet 1,6 million de kilomètres avec cette batterie

from Les dernières actualités de Futura-Sciences https://ift.tt/2naSQyh

Le Machu Picchu est construit à l’intersection de failles tectoniques

from Les dernières actualités de Futura-Sciences https://ift.tt/2lF1ynQ

EDF Pulse 2019 : greffe de foie, pansement intelligent, radiothérapie personnalisée et rééducation connectée

from Les dernières actualités de Futura-Sciences https://ift.tt/2mzdRCq

L'IMC ne prédit pas le risque cariovasculaire chez les diabétiques

from Les dernières actualités de Futura-Sciences https://ift.tt/2n97u9n

Laurent Ballesta rejoint l’équipe des parrains de Futura

from Les dernières actualités de Futura-Sciences https://ift.tt/2lCnwI6

Astéroïdes : la Nasa agrandit son arsenal de détection des géocroiseurs

from Les dernières actualités de Futura-Sciences https://ift.tt/2lB5Exj

Les chats s'attachent bien plus aux humains qu'on ne le pensait

from Les dernières actualités de Futura-Sciences https://ift.tt/2mYffyy

Antibiorésistance : un extrait de thé vert pour lutter contre une superbactérie

from Les dernières actualités de Futura-Sciences https://ift.tt/2lBumxJ

mardi 24 septembre 2019

Samsung dévoile le capteur photo équipé des pixels les plus fins au monde

from Les dernières actualités de Futura-Sciences https://ift.tt/2n4g74T

Vale to restart Onça Puma nickel complex

Brazil’s Vale (NYSE: VALE) has begun working on the resumption of operations at its $3 billion Onça Puma nickel mining complex, as the country’s Supreme Court suspended injunctions against the miner earlier this month.

Nickel mining at Onça Puma, in Brazil’s northern Pará state, has been halted since September 2017 as the company failed to undergo a requested environmental impact on local indigenous communities affected by pollution caused by the mine.

The complex, which also had to suspend nickel processing in June this year, produced a record of 7,100 tonnes of nickel in the third quarter of 2017, up 29% compared with the prior three-month period and up 7.6% from the third quarter of 2016, Vale said at the time.

Mining has been halted since September 2017 as Vale failed to undergo a requested environmental impact on local indigenous communities affected by pollution caused by the operation.

The world’s largest nickel producer has been in disagreement with the Xikrin and Kayapó tribes since 2012, when the Federal Prosecution Office (MPF) started a public civil action against Vale and the state of Pará.

The authority contended that operations at the nickel complex had contaminated the nearby Cateté River and that the state should not have granted Vale licences for the mine.

Nickel prices climbed around 75% in the first half of 2018, prompting investment in related projects. Vale itself decided last year to move ahead with construction of an underground mine at its Voisey’s Bay nickel mine, located in Canada’s Atlantic province of Newfoundland and Labrador.

It also suspended the sale of a stake in another of its nickel mines — New Caledonia, located on the remote South Pacific island.

Prices have fallen since and remain volatile because of oversupply, despite the metal’s key role in lithium-ion batteries that are used in electric cars.

The nickel sector is becoming a two-tiered market, with a weaker outlook for materials bound for the stainless steel industry and robust demand growth in the electric vehicles (EV) sector that will support prices, according to Goldman Sachs Group.

Brazil holds nearly 13% of the world’s nickel reserves and Onça Puma accounts for about 11% of Vale’s nickel production.

In a separate statement, Vale announced Tuesday that it would invest R$190 million (around $46m) in plans to reconstruct and develop the communities of Macacos (Nova Lima), Barão de Cocais, and Itabirito, which were impacted by a deadly dam burst at the company’s Córrego do Feijão mine in January. The accident unleashed a torrent of thick mine waste, killed more than 250 people and cost Vale criminal charges.

The miner said the funds will be allocated mainly to construction and refurbishment of public facilities, cleaning and dredging of watercourses, construction of schools, as well as improvement of social and health programs.

from MINING.COM https://ift.tt/2mPyfiF

Le robot Atlas est capable d’un enchaînement de gymnastique

from Les dernières actualités de Futura-Sciences https://ift.tt/2kV8du0

Une pandémie mondiale tuerait jusqu'à 80 millions de personnes si elle survenait demain

from Les dernières actualités de Futura-Sciences https://ift.tt/2kPLxv7

Play Pass : la réponse de Google à Apple Arcade

from Les dernières actualités de Futura-Sciences https://ift.tt/2msN4HG

BMW plancherait sur deux berlines 100 % électriques

from Les dernières actualités de Futura-Sciences https://ift.tt/2mmIhYu

Germany’s K+S cuts potash output for the year on weak demand

German potash producer K+S AG (FRA:SDF1) is cutting down production of the fertilizer ingredient by up to 300,000 tonnes before the end of the year as China’s ban on the commodity imports has worsened global market conditions.

“In the current weak market environment, which is further intensified by the continuing Chinese import bans on the standard potassium chloride product, adjusting production is a difficult decision, but the right one,” K+S executive, Alexa Hergenroether, said in the statement.

The company, with operations in the home country and Canada, said the effect of the measure on its earnings before interest, taxes, depreciation and amortization (EBITDA) was expected to be about €80 million ($88m).

K+S AG is the last company to react to market weaknesses. Larger Canadian rival Nutrien (TSX:NTR), created by the merger of Potash Corp. and Agrium, will also cut output by about 700,000 tonnes by taking production downtime at its Allan, Lanigan and Vanscoy mines starting in November.

Belarus, one of the world’s largest potash exporters, warned earlier this month that it was planning to cut production of the crop nutrient by almost a third within the next three to four months due to weak global demand.

Russian producer Uralkali last week followed up with plans to scale back potash output by 350,000-500,000 tonnes.

In August, potash major Mosaic Co. said it would indefinitely shutter its Colonsay mine east of Saskatoon, resulting in around 350 layoffs.

from MINING.COM https://ift.tt/2mtnhiD