jeudi 31 octobre 2019

Ces robots-cubes s'assemblent tout seuls

from Les dernières actualités de Futura-Sciences https://ift.tt/2qb2eDm

Ce sont les rivières atmosphériques qui font fondre l'Antarctique

from Les dernières actualités de Futura-Sciences https://ift.tt/2NuBxl3

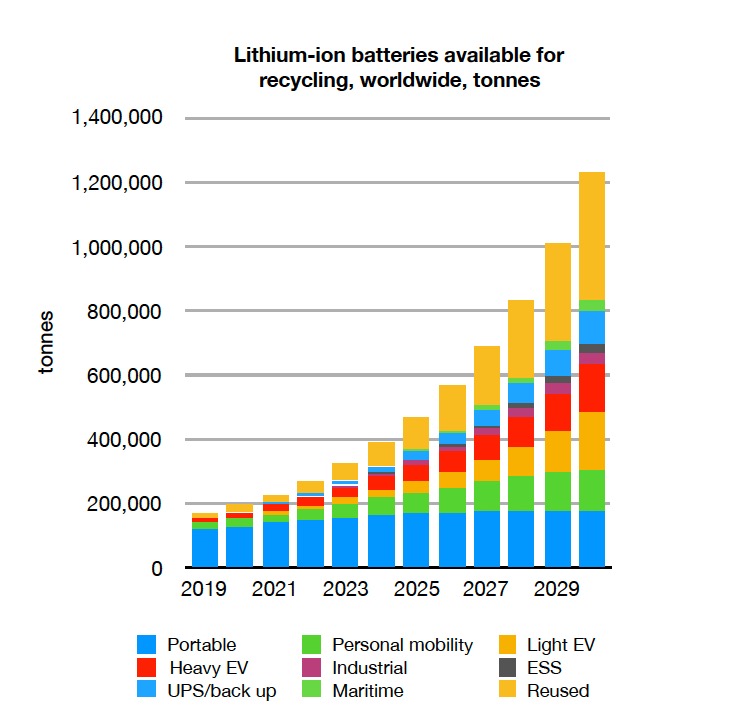

Recycled lithium batteries market to hit $6 billion by 2030 — report

Electric vehicles (EVs) are catching on faster than even their most ardent supporters ever expected, which inevitably means the pile of spent lithium-ion batteries that once powered those cars is also rising fast.

China alone is forecast to generate around 500,000 tonnes of battery waste by 2020, a number that would hit 1.2 million tonnes per year by 2030, when considering global consumption, London-based Circular Energy Storage (CES) said Thursday.

Some companies, such as giant tech Apple, are grabbing the bull by the horns by trying to re-use as many minerals contained in discarded batteries as possible.

125,000 tonnes of lithium, 35,000 of cobalt and 86,000 of nickel could be recovered by 2030 from waste batteries.

Circular Energy Storage

CES sees a profitable business on battery recycling. According to the consultancy, recycled material and second life batteries can generate a market worth more than $6 billion, based on current metal prices.

The experts believe the amount of lithium and cobalt from recycled materials will be equivalent to about a half and a quarter respectively of today’s markets for the mined commodities.

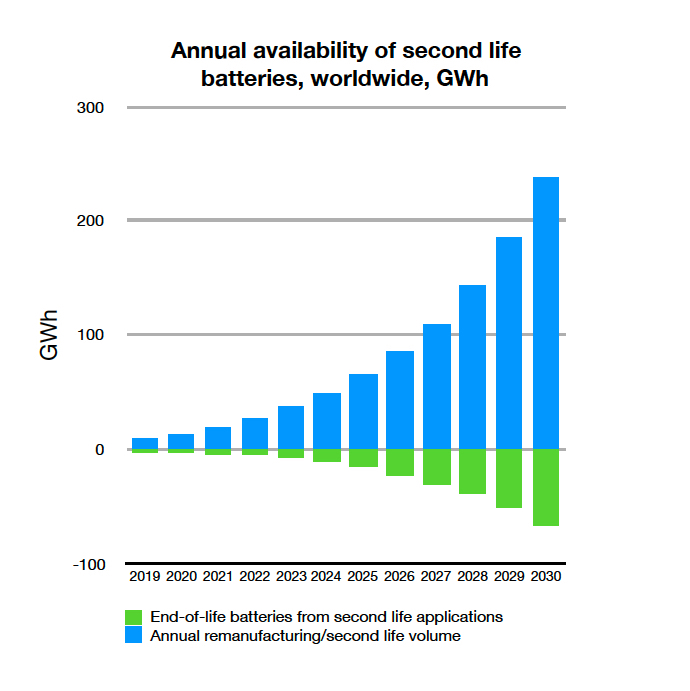

By 2030, they says, batteries with a capacity of close to 1,000 GWh will have become available for a second life, adding significant capacity to markets for backup power, stationary energy storage and EV charging.

“While the industry tend to focus on the electric cars we expect more batteries from heavy use applications such as electric buses, trucks, fork lifts, e-bikes and scooters,” says Hans Eric Melin, manager director at Circular Energy Storage and the author of the study. “However, the geographical differences are huge, both regarding volume and the characteristics of the waste stream”.

In North America and Europe, recycling is seen as a waste disposal activity that companies should be paid to carry out. In China, the largest producer and consumer of lithium-ion batteries, competition has become so intense in that recyclers are willing to pay to get their hands on dead batteries.

This appetite means China’s grip on lithium-ion (Li-ion) recycling is set to grow. American and European recycling companies have good processes, but might struggle to find the volumes of used batteries needed for profitable operations.

One of the reasons, says Linda L. Gaines of Argonne National Laboratory, is that the Western world lacks a clear path to large-scale economical recycling, battery researchers. As a consequence, manufacturers have traditionally focused on lowering costs and increasing battery longevity and charge, instead of trying to improve batteries’ recyclability. And because researchers have made only modest progress in that field, relatively few Li-ion batteries end up being recycled.

CES estimates that as much as 125,000 tonnes of lithium carbonate equivalent (LCE), 35,000 tonnes of cobalt and 86,000 tonnes of nickel could be recovered by 2030 from waste batteries. To this, between 400,000 and 1 million tonnes of production scrap might be added, depending on efficiency and production volume, it says.

“Together, processed volumes of waste lithium-ion batteries and scrap materials will make up a market worth more than $6 billion,” the consultancy predicts.

An even larger market is the market for remanufactured and second life batteries. CES anticipates that 75% of light, heavy and utility vehicle batteries will either be remanufactured for use in its original applications, or repurposed to be used in other stationary energy storage systems.

from MINING.COM https://ift.tt/2r33adF

Singles' Day : une journée de plus en plus populaire en France ?

from Les dernières actualités de Futura-Sciences https://ift.tt/34jnWUw

Érosion des sols : les activités humaines y contribuent depuis 4.000 ans

from Les dernières actualités de Futura-Sciences https://ift.tt/2N4B6Pw

Étrange : un requin blanc qui nage sur le dos !

from Les dernières actualités de Futura-Sciences https://ift.tt/2q45L6x

Ce gel protège les arbres des incendies

from Les dernières actualités de Futura-Sciences https://ift.tt/2qas22s

Petra Diamonds opens tailings to artisanal miners in South Africa

South Africa’s Petra Diamonds (LON:PDL) is opening up some of its tailings at Koffiefontein mine to small scale operators, in an effort to tackle illegal activities and solve some issues cause by artisanal miners.

“Petra believes that there is a space for artisanal small scale miners to co-exist with formalized, large-scale mining, since small and artisanal miners (ASM) can often profitably recover diamonds from resources that would be unprofitable, or at best marginal, for a larger operator due to the capital and overhead costs involved,” the company said on Thursday.

Petra believes there is space for artisanal small-scale miners to co-exist with formalized, large-scale mining.

The initiative, the diamond miner said, comes after extensive consultation and cooperation with relevant shareholders. Those include South Africa’s Department of Mineral Resources and Energy (DMR&E) as mining sector regulator, the Letsemeng Local Municipality as elected representatives of the community, and the community itself.

This is not the first time Petra allows artisanal miners to use its tailings. It previously carried out a similar exercise at Kimberley, in Northern Cape, where small scale miners to operate “the floors” of the property — an area previously worked by Kimberley’s founding miners.

That project, kicked off in 2017, wasn’t a complete success. Its then joint venture partner, Ekapa Mining reported a year later it was still spending R3 million (about $198,000) a month in security to keeping individual out of its operating boundaries. Petra sold its stake in the Ekapa partnership last year.

Applying lessons learned at Kimberly, Petra intends to help regulate artisanal miners so that they would comply with the Kimberley Process Certification Scheme and other global standards.

“We regard this initiative as yet another milestone in the Petra legacy and we welcome the Koffiefontein Community Mining Primary Cooperative as partners in our industry to complement our own operations and extract optimal benefit from the diamond reserves in Koffiefontein,” chief executive Richard Duffy said in the statement.

The company acquired Koffiefontein in 2007 and the asset has generated $28.9 million in revenue for the first nine months of 2019, an increase of 6% year on year.

from MINING.COM https://ift.tt/32470Qt

Les forêts tropicales, un puits de carbone six fois plus important que prévu

from Les dernières actualités de Futura-Sciences https://ift.tt/2WukVhp

Nos 5 bons plans tech pour Halloween 2019

from Les dernières actualités de Futura-Sciences https://ift.tt/2C0sjb6

Android : un virus d'un nouveau genre, impossible à supprimer !

from Les dernières actualités de Futura-Sciences https://ift.tt/2C4E1Bj

Wealth granted access rights to Valsequillo silver project in Mexico

Wealth Minerals (TSXV: WML) reported that it was able to negotiate surface access rights to the Valsequillo silver project located in the Mexican state of Chihuahua.

In a press release, Wealth explained that it has the option to acquire a 100% interest in the 2,840-hectare property by making payments to the underlying arm’s length vendors in the aggregate amount of $6 million over a 90-month period.

The property is unexplored by modern methods. Wealth believes that it can be rapidly and cost effectively brought to the drill stage now that surface access rights have been secured

Valsequillo is located approximately 40 kilometres southeast of the city of Hidalgo Del Parral within the Altiplano Polymetallic Belt of north-central Mexico.

“Valsequillo has been an asset on our books for some time, but only recently have we been able to agree on terms with the surface rights owners to allow access to the property and carry on exploration where we left off in 2012,” Henk van Alphen, Wealth’s CEO, said in the media brief. “It is a highly prospective silver target and in a geological setting similar to other familiar Mexican silver occurrences.”

According to van Alphen, initial reconnaissance work carried out by Wealth on the property in 2012 identified two significant north-northwest trending structural corridors outlined by extensive artisanal workings that follow en-echelon and segmented precious and base-metal bearing quartz-sulphide veins within a broad hornfels gossan.

“The mineral-alteration systems identified to date remain open for expansion in all directions,” the executive said.

from MINING.COM https://ift.tt/2PFY6WC

About a tenth of the world’s tailing dams have had stability issues

A global inquiry into mining waste storage systems of more than 700 resources companies, launched in April after the collapse of a dam in Brazil that killed hundreds, shows about a tenth of the structures have had stability issues.

The research, led by the Church of England (CoE) and fund managers, reveals that at least 166 of 1,635 dams holding mining waste — tailings — have had safety issues in the past.

The group noted it’s unclear how severe those issues had been and the miners said the problems had been addressed.

The results of the inquiry are only partial, as they only reflect disclosures from less than half of the 726 companies contacted following the collapse of Vale’s Brumadinho dam in January, which killed at least 250 people.

Companies addressed included major industry names such as BHP, Rio Tinto, Anglo American, Glencore and Vale itself, which were asked to publicly disclose their dams’ size, construction methods and safety records.

All the major listed miners have already replied. Three of them did so shortly after the inquiry was launched, unveiling they owned tailings dams considered high or extreme-risk in the event of a catastrophic failure. High-risk indicates dams that would have an immediate impact upon failure, and could cause the deaths of at least 10 people, while extreme-risk dams could cause the deaths of 100 or more people if they fail.

The facilities in question included four “extreme-risk” dams at BHP’s Olympic Dam mine, Mount Whaleback mine, Pilbara mine and Leinster mine. Two tailings dams at Rio Tinto’s Andoom and Torro mines in Queensland have been deemed ‘high-risk’, along with two dams at Glencore’s Mount Isa mining complex.

While those high-risk facilities made the headlines in Australian media, the risk assessment for these dams related to the damage in case of failure, not the likelihood that they will collapse.

Currently there are no set of universal rules defining exactly what a tailings dam is, how to build one and how to care for it after it is decommissioned.

There are about 3,500 tailings dams around the world. Unlike the ones used to build reservoirs or hydroelectric projects, tailings dams are not usually made from reinforced concrete or stone. They are mostly constructed from the waste material left over from mining operations, which — depending on the type of mine — can be toxic.

Only three countries in the world ban upstream dams — Chile, Peru, and now Brazil. Chile, the world’s No.1 copper producer, also regulates the minimum distance between dams and urban centres. But the nation still has 740 tailings deposits, only 101 of which are active, with the rest abandoned or inactive, according to data from mining agency Sernageomin.

The results of the inquiry come as global investors are increasingly focused on ensuring mining companies reduce their environmental footprint, improve their governance and reduce the number of fatalities. Other than CoE, the group carrying out the inquiry (representing more than $13.5 trillion assets under management) includes Swedish Pension funds, Dutch funds APG and Robeco, the UK’s LGPS Central fund, New Zealand Super, and BMO Global Asset Management.

from MINING.COM https://ift.tt/2PJQMJZ

Des lunettes connectées qui favorisent la concentration

from Les dernières actualités de Futura-Sciences https://ift.tt/2BWxgl1

Code promo Apple : Découvrez les AirPod Pro

from Les dernières actualités de Futura-Sciences https://ift.tt/2BZkP8o

Nasa : festival d'horreurs et de citrouilles pour Halloween

from Les dernières actualités de Futura-Sciences https://ift.tt/31ZFnrB

Voici des robots-cubes qui s'assemblent tout seuls

from Les dernières actualités de Futura-Sciences https://ift.tt/2JFlznk

Plus de pollen = moins de crimes et de violences domestiques

from Les dernières actualités de Futura-Sciences https://ift.tt/2JwVyqb

Science décalée : les films d’horreur font perdre plus de calories

from Les dernières actualités de Futura-Sciences https://ift.tt/32Y7OHT

Voiture électrique : charger sa batterie en 10 minutes, c’est possible

from Les dernières actualités de Futura-Sciences https://ift.tt/2BYR33C

Samsung donne un aperçu du design du Fold 2

from Les dernières actualités de Futura-Sciences https://ift.tt/2PCmoAX

Voici la première doudoune en soie d'araignée

from Les dernières actualités de Futura-Sciences https://ift.tt/34gjJ44

Additifs alimentaires : faut-il faire peur pour vendre des produits bio ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2WsYaKV

mercredi 30 octobre 2019

Wesdome extends Eagle River 303 lens

Toronto-based Wesdome Gold Mines says that recent drilling at the Eagle River gold mine has extended the high-grade 303 lens another 300 metres down plunge, and the mineralization remains open. The 303 lens was first discovered in 2015 at the mine 50 km west of Wawa.

The 303 lens was initially outlined from the 750-metre level to the 1,000-metre level, and recent drilling has traced it down plunge to the 1,300-metre level. The mineralization consistently returns high grades and widths.

All assays were cut to 140.0 g/t and true widths were estimated. Here are some of the best results

- Hole 925-E-104: 92.8 g/t gold over 11.1 metres core length (37.2 g/t cut, 6.4 metres true width);

- Hole 925-E-106: 70.0 g/t gold over 11.5 metres core length (48.1 g/t cut, 7.4 metres true width); and

- Hole 925-E-87: 72.2 g/t gold over 10.8 metres core length (42.8 g/t cut, 5.4 metres true width).

The drill results will be incorporated into a new resource estimate by the end of the year.

Wesdome president and CEO Duncan Middlemiss said exploration continues with five underground and one surface drill. Besides the 303 lens, the 7 East and 311 West zones are being tested. Another target is the new Falcon zones on the surface, that he says exhibit good potential in a location near the mine infrastructure.

The Wesdome gold mine has produced 1.1 million oz. of gold in its 30 years of continuous operation.

(This article first appeared in the Canadian Mining Journal)

from MINING.COM https://ift.tt/34j4irE

Inmarsat, Glass Terra team up on monitoring solution

Inmarsat, the world leader in global, mobile satellite communications, will collaborate with geo-spatial internet of things (IoT) specialist Glass Terra to integrate Inmarsat’s tailings dam monitoring solution with Glass Terra’s IoT light detection and ranging (Lidar) capabilities. The combined solution will provide complementary real-time technologies to deliver transparency to tailings facility management in Australia.

Uniting Inmarsat’s instrument monitoring and Glass Terra’s IoT Lidar solution will enable technicians and audit, store or monitor the structural integrity of tailings dams, as well as piezometric pressure, water quality and flow rate in real-time, to allow for more informed and safer tailings management.

To achieve this, Glass Terra will provide Lidar scanning devices to build a three-dimensional picture of the dam and detect whether there has been any soil slippage or movement in the embankment. Inmarsat will deploy its instrument agnostic solution, which visualises key data on its cloud dashboard via its highly reliable broadband global area network (BGAN) satellite connectivity, allowing miners to proactively manage their tailings facilities.

Sophia Li, CCO of Glass Terra, said, “Real-time monitoring of tailings facilities’ embankments enables prompt reporting. Investigation and mitigation of high potential incidents can enhance the safety of tailings facilities and the safety of our community, improve the protection of our environment, and advance the social performance of the global mining industry.”

Commenting on the relationship, Joe Carr, director of mining innovation at Inmarsat, said, “We are excited about the collaboration between Inmarsat and Glass Terra, a project that will mark the first time Lidar and real-time instrument monitoring have been used in tandem like this. It represents a step change in terms of the detailed data picture that engineers will be able to access, increasing their ability to manage mine tailings facilities effectively. Satellite connectivity-enabled tailings monitoring solutions, such as those delivered by Inmarsat, can play a pivotal role in providing this kind of transparency at closed mine sites where there is no connectivity infrastructure, as well as at active mines in remote areas.”

(This article first appeared in the Canadian Mining Journal)

from MINING.COM https://ift.tt/2prli0f

First Cobalt samples high-grade surface samples at Iron Creek

Toronto-based First Cobalt Corp. announced high assay results from surface samples taken at its Iron Creek project 40 km southwest of Salmon. The results came from a target 1.5 km to the south of the main project.

First Cobalt traced a surface outcrop across a 295-metre strike length. High-grade values include 10.7 metres of 0.24% cobalt, including 1.5 metre of 0.48% cobalt, and 7.6 metres of 0.26% cobalt. The new Ruby zone is geologically similar to other mineralization found at Iron Creek. The company has not determined whether the new zone is a structural offset of Iron Creek or a separate stratigraphic unit.

The Ruby zone was previously sampled on surface, but two diamond drill holes were abandoned at depth. Noranda drilled the second hole in 1978 and did find chalcopyrite stringers in the footwall of the cobalt-bearing horizon, but that is all that is known of what lies below the surface.

A new resource estimate for Iron Creek is expected before the end of the year. The 2018 estimate used a cut-off between 0.03% and 0.18% cobalt and found 29.6 million inferred tonnes grading 0.08% cobalt (45.4 million lb. contained) and 0.30% copper (175.4 million lb. contained). That is a cobalt equivalent grade of 0.11%.

Both an underground development or one with surface and underground production are under consideration.

(This article first appeared in the Canadian Mining Journal)

from MINING.COM https://ift.tt/2JBqZiX

Mining’s unlikely heroines – Greta Thunberg and AOC

Exponential expansion of global mining is the dirty little secret – and glaring blind spot – of Green New Deal evangelists and zero-carbon climate warriors

Leftwing darling Alexandria Ocasia Cortez’s proposed Green New Deal, despite its flimsy 14 pages total, is nothing if not all-encompassing and vaulting in its ambition. The bill was also crucial to Ocasia Cortez’s rapid ascent to acronym status and anointing as the queen of green.

Thanks to her How Dare You tour, 16-year old Greta Thunberg is now the undisputed leader of the growing ranks of school-bunking climate crisis warriors all over the world.

The footslogging Greta groupies are beginning to resemble the disastrous 1212 children’s crusade – with higher ground now doing service for holy land

The Greta show arrived in MINING.COM’s hometown of Vancouver last week to take Make-Love-Not-CO2 youths (and second-life hippies) on yet another march and bridge-blockade. The footslogging Greta groupies are beginning to resemble the disastrous 1212 children’s crusade – with higher ground now doing service for holy land.

Much of the response to AOC and Thunberg (who seem to get on like a house on fire if the Guardian is to be believed) on the right has been mocking and dismissive, accusing the pair of swapping hamburgers for pie in the sky.

This is a mistake.

Red turns green

Some estimates put the green economy in the US at $1.3 trillion in annual revenue already – that’s 7% of GDP – with a workforce of 9.5m Americans.

Within the Green New Deal is a goal of “meeting 100% of the power demand in the United States through clean, renewable, and zero-emission energy sources”. AOC has no deadline of course, but no doubt Greta would want that for the whole world before she hits drinking age.

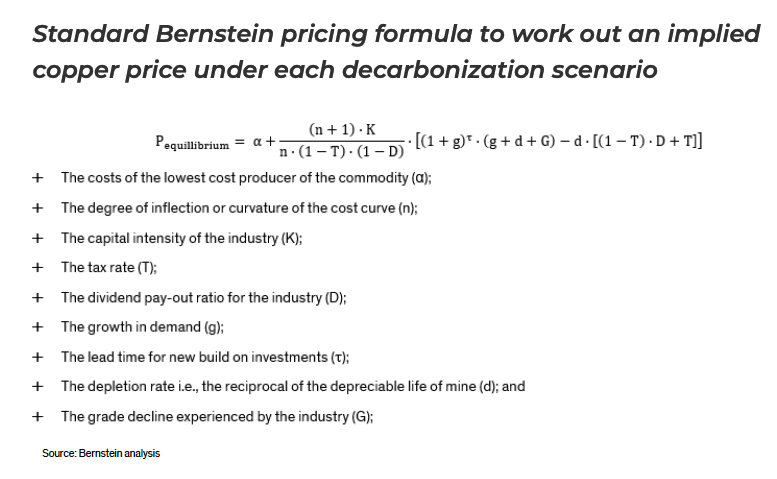

A seminal paper by Bernstein’s European mining and metals team led by Paul Gait outlines just how fundamental a restructure of the global industrial economy is necessary to bring this – or even a fraction of this – about.

And all of it to the great benefit of mining.

Copper and the Green Economy – Thoughts from [Bernstein’s] decarbonisation conference has only been passed around in mining circles for a few weeks, but the “Greta scenario” outlined in the research has already become shorthand for what a brave new world of mining may look like.

If the first industrial revolution was powered by dark satanic mills, copper’s red hot smelters will drive the green revolution

The required copper price of $20,000 a tonne ($9/lbs or more than three times today’s level) under Bernstein’s Greta scenario of full decarbonisation by 2025, certainly is a headline grabber.

Equally eye-popping is another possible scenario sketched in the report: when the target date is pushed out to 2070 it would require investment in copper roughly equal to the total known reserve base of 647 million tonnes.

Keep in mind those are the additional tonnes just for renewable energy networks and electric cars that comes on top of the 20 million tonnes of annual copper consumption in other industrial sectors.

If the first industrial revolution was powered by dark satanic mills, copper’s red hot smelters will drive the green revolution.

This is still your great-great-grandfather’s copper mine

The Green New Deal is full of big numbers.

Here’s another one: Producing that amount of copper would require blasting, crushing and grinding 130 billion with a B tonnes of rock at current ore grades.

And those grades will only continue to fall over the next 50 years, not least because the average weighted age of the world’s 20 largest copper mines is 91 years.

Climate changes is pitting generations against each other (Google “OK Boomer” for more). Ageing copper mines puts a whole new spin on it.

How soon is now?

Even Bernstein’s base case of gradual decarbonisation according to the 2015 Paris agreement targets (more honoured in the breach than the observance, particularly in North America) requires a 50% lift in the price of copper to incentives new mines.

Yet when I checked this morning, copper was languishing not far off two-year lows despite Chile doing a Hong Kong (Chile is not the Saudi Arabia of copper, it’s the Saudi-Iran-Iraq-Emirates of copper), deepening deficits, dwindling ranks of explorers and a dearth of major projects.

When we highlight the impact of decarbonisation on copper prices there is absolutely no sense in which this can be taken to imply that we ‘cannot afford’ to deliver a green economy

Paul Gait – BERNSTEIN

A tenth of the world’s copper mines are already under water and that’s in no small part due to weak prices of copper byproduct crucial to any green new deal like cobalt, still two-thirds off its peak despite closure of world’s biggest Cu-Co mine.

It’s not going well for other essential green energy raw materials either. Inventors of the lithium-ion battery won a Nobel this month. Lithium prices are down 58% in the last 18 months. If you’re picking up flake graphite, it’s down 20% from last year. Nickel nerds are happy, but for how long?

The powder is staying dry

Unsurprisingly AOC and the Green New deal does not once mention mining. AOC accepted an invitation from a congressman to visit a working Kentucky coal mine, but the stunt fell through – because… wait… there are no coal mines left in the district.

Thunberg’s only mining pronouncements have been in support of German coal and Turkish gold protests.

It’s not just the green lobby – and wittingly or unwittingly their donors – that have a blind spot when it comes to mining.

Investors are shunning the sector too. And overwhelmingly in favour of fossil fuel.

Private capital dedicated to natural resource investment have assets under management of $689 billion according to a Preqin report. Mining’s share? $19.9 billion.

According to the private capital tracker, the 216 funds currently raising funds for investment in energy assets – almost all of it destined for North American oil and gas – bagged $7.9 billion during during the third quarter to add to the $191 billion on hand.

The 15 funds looking for mining and metals investors could not raise a cent in the third quarter and dry powder (money ready to be invested) is less than $5 billion, which would not cover the outlay for a single large-scale copper mine.

TikTok, time’s up

Public markets are hardly more accommodating.

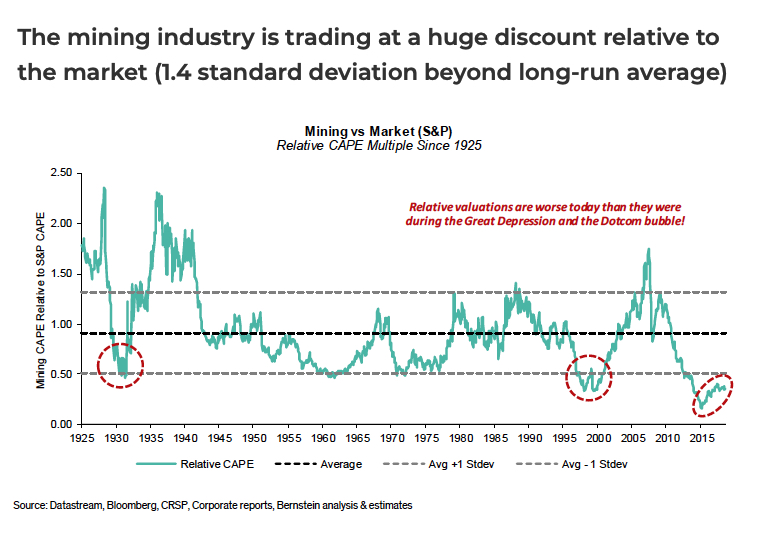

In an earlier report Bernstein applied a measure – the Cyclically Adjusted PE (CAPE) multiple – to the mining sector going back a century to establish the relative valuation to equities.

The chart shows that the much-admired mining industry rerating since end-2015 is more akin to a death rattle than a recovery.

We live in a world where TikTok (ask your tween) is valued at twice as much as Glencore, the world’s largest commodities trader with annual revenues of $220 billion.

And we’ve been here before, laments Gait:

Of course, the misallocation of capital to non-productive, pseudo-economic activities also occurred during the previous period of blatant relative undervaluation – the dotcom bubble – and is parallel to what we are seeing today.

Cutting emissions doesn’t cut it

Virtue signalling by touting desalination plants, solar-powered ops and electric dump trucks does not provide green credentials any more. To be frank, projects like these are now most often undertaken because it’s cheaper or there’s no alternative.

Sprinkling protect-the-planet messaging in marketing and making (often tenuous) claims about the clean-tech properties of products don’t cut it either.

If this was a successful strategy, platinum miners would be stocking Sierra Club’s board and environment-sensitive investors would be lining up to give uranium explorers money.

(Climate activists’ opposition to nuclear power leads to cognitive dissonance on the left and popular and shows like HBO’s Chernobyl, which remained mostly unmolested by science over its five episodes, means the error won’t be corrected soon.)

I feel the earth move

Every tonne of copper embedded in the global economy has the potential to remove ~500 tonnes of CO2 per annum, according to Bernstein.

The math may be hard, but the message cannot be simpler.

There is no green economy without copper (and nickel, cobalt, vanadium, praseodymium… go down the periodic table if you must).

Big Mining has failed to grasp the opportunity presented by climate change.

At the moment mining is lumped together with oil and gas as just another “extractive” industry “exploiting” natural resources.

Going all in on the green economy and decarbonisation requires siding with the greens against fossil fuels.

It means selling global mining as the solution to climate change because mining metals is the only path to green energy and green transport.

(Big Mining’s biggest blunders usually have to do with oil anyway… ask BHP and Freeport).

There are other ways mining will benefit from a wholehearted embrace of climate change goals.

Attracting young workers to the industry is a serious and growing problem for miners, but what Gen Z or Millennial would say no to travelling the planet (by sailboat or solar plane where possible of course) and fighting global warming at the same time.

Mining monopsony

A concerted and concentrated effort to decarbonise the planet rapidly will also reduce the mining industry’s reliance on China as virtually the sole driver of global metal demand and spread it more evenly across the world.

The first signs of a more diverse demand base can be seen in the shift to electric vehicles (itself the biggest change in the auto industry in 100 years) as battery megafactories spring up in Europe and giant solar farms and storage centers spread across South America and Africa.

And given rising tensions, there is probably greater willingness in the West to ensure that during the upheaval, developed economies do not cede yet another sector of the global industrial economy to China, or large swathes of mining rights such as central Africa.

There is probably greater willingness in the West not to cede yet another sector of the global industrial economy to China, or large swathes of mining rights such as central Africa

But can we afford it?

Even those who admire the ideals of the climate change kids criticise their new deals and wish lists as unaffordable.

It is not surprising that a report on mining that opens with a quote from Thomas Hobbes would possess a deep moral core and towards the end Gait tackles the issue:

It is, however, important to remember that when we highlight the impact of decarbonisation on copper prices there is absolutely no sense in which this can be taken to imply that we ‘cannot afford’ to deliver a “green economy” (and the resulting transformation of industrial and economic processes).

The market capitalisation of such entities as Facebook or Netflix imply that there is more than enough money, more than enough capital to deliver whatever economic transformation is required. The fact that our revealed preference (amusing cat videos) is at variance with our stated preference (a sustainable economic future for our children) should not be erroneously taken to infer that there is some financial constraint on the ends we choose to pursue.

from MINING.COM https://ift.tt/2JyZeYz

Rapid EV adoption could drop Canadian oil demand by 250,000 barrels per day — report

A new study by EY that contrasts the impact of different scenarios for electric vehicles in Canada says the most rapid adoption — with EVs representing 30% of Canada’s vehicle stock in 2030, compared to less than 3% today — would reduce domestic oil demand by approximately 252,000 barrels per day.

Canada currently produces about 4.7 million barrels per day, according to the Canadian Energy Regulator. In 2018, approximately 1.6 million barrels per day per consumed by domestic refineries.

Already, Canada is the 10th fastest adopter of EVs in the world, with sales growing 165% year-over-year in 2018, EY said.

EY found that rapid adoption could also cause an 11% spike in Canadian electricity demand, requiring utilities to make significant investments in existing grid infrastructure

“Electric vehicles have the potential to profoundly reshape everything from local transit to global commerce, and Canada’s energy players are not going to be immune from this impact,” EY Canada oil and gas leader Lance Mortlock said in a statement.

Rapid EV adoption could trigger convergence of oil and gas and power and utilities companies in the marketplace, EY said.

“Diversifying portfolios will be crucial for oil and gas companies in a rapid-adoption future,” Mortlock said. “To stay relevant and ensure profitable revenue streams, they’ll need to invest more in clean energy, petrochemical products and access to tidewater to enter new markets.”

EY found that rapid adoption could also cause an 11% spike in Canadian electricity demand, requiring utilities to make significant investments in existing grid infrastructure to allow consumers to charge cars at home and in public spaces. Distribution network upgrades would also be required to improve power transmission across the country, including to rural areas.

“A dramatic increase in electricity demand would likely result in new power and utilities players coming to market,” said Daniela Carcasole, EY Canada power and utilities leader.

“This could open up a number of collaboration opportunities for existing companies — either through M&A or joint ventures with hotels, restaurants, technology companies and retail stores to offer easy and convenient vehicle charging to consumers.”

Availability of charging infrastructure, price premiums, battery performance, subsidies and time to complete the charge remain key barriers deterring Canadians from purchasing an EV. But even a moderate adoption scenario — with 6.5 million EVs on Canadian roads by 2030 — would require a 5.5% increase in electricity demand, EY said.

(This article first appeared in JWN Energy)

from MINING.COM https://ift.tt/3489HSy

Pan Am Silver reports high-grade results from La Colorada drilling

Pan American Silver (NASDAQ, TSX: PAAS) has released results from 14,300 metres of drilling completed during Q3 2019 on the La Colorada skarn discovery in Mexico. Preliminary metallurgical testing of samples indicates high recoveries across all metals can be expected, the company added.

Shares of Pan American Silver were up more than 3% at midday during Wednesday’s trading session. The Vancouver-based precious metals miner has a market capitalization of C$4.5 billion.

“The most recent drill results feature some of the highest grade intercepts we have seen to date, with widths up to 379 metres,” Christopher Emerson, Pan American’s VP Business Development and Geology commented. Standout results from drilling at La Colorada include 253 metres grading at 67 g/t silver, 3.84% lead and 6.56% zinc.

The company expects to complete more than 50,000 metres of drilling this year. The plan is to provide an initial resource estimate of the skarn discovery by year-end 2019.

Pan American Silver first announced the La Colorada discovery in October 2018. Additional drill results were provided by the company in February, May and August of this year.

from MINING.COM https://ift.tt/36mCggP

Plaques tectoniques : on sait quelles forces font bouger la surface de la Terre

from Les dernières actualités de Futura-Sciences https://ift.tt/2prlRXY

Peru lets Southern Copper keep building $1.4bn Tia Maria copper mine

The Peruvian government confirmed on Wednesday it had given Southern Copper (NYSE:SCCO) permission to resume construction at its $1.4 billion Tia Maria project, in the southern Islay province of the Arequipa region.

The world’s fifth largest copper producer by output had to cancel work in August, after authorities suspended the construction licence to evaluate objections from residents and regional authorities related to where the plant would be built.

Southern Copper, a subsidiary of Grupo Mexico, has experienced several setbacks since it first announced its intention to develop Tía María in 2010.

The construction plan has been halted and readjusted twice, in 2011 and 2015, due to fierce opposition by locals who are worried about its environmental impacts and the possibility of an open-pit mine damaging crops and water supplies.

In July, residents of Valle del Tambo, the closest town to the Tía María site, staged weeks-long protests and carried out a general strike to express their rejection of the project. They were later joined by a number of regional unions.

Southern executives, however, are hopeful that the project will be developed by 2020. Once completed, the mine is expected to produce 120,000 tonnes of copper a year for an estimated 20-year lifespan.

from MINING.COM https://ift.tt/2N24Nkq

Une anomalie dans la dualité électromagnétique

from Les dernières actualités de Futura-Sciences https://ift.tt/2Wq9kjy

Antarctique : on sait pourquoi les plateformes de glace fondent rapidement

from Les dernières actualités de Futura-Sciences https://ift.tt/2PtBjgG

Danakali earmarks $1.8m to take Eritrean potash project off the ground

Australia’s Danakali (ASX, LON:DNK) is moving its world-class Colluli potash project in Eritrea, Africa, closer towards development after raising $502,000 from investors in the quarter ended in September, which added to two other major credits received in the period.

Delivering quarterly results, the Perth-based company said it has $4.9 million in working capital, adding that it plans to spend $1.8 million from now until the end of December, directing $1.4 million construction of the mine.

Colluli has the potential to produce 944,000 tonnes of SOP, a premium grade fertilizer, over its 200-year plus mine-life.

Colluli, a 50:50 joint venture between Danakali and the Eritrean National Mining Corporation (ENAMCO), has been called “a game changer” for Eritrea’s economy, as it’s expected to become one of the world’s most significant and lowest cost sources of sulphate of potash (SOP), a premium grade fertilizer.

“The government will benefit from the longer-term development of the project, and the expected significant boost to royalties, taxation and exports, and from jobs and skills and economic development of the region,” chief executive, Niels Wage told MINING.COM in July.

The development of the Colluli potash projects coincides with the move towards diplomatic relations between the once feuding countries of Eritrea and Ethiopia, which officially declared peace in July last year.

A United Nations report published in January suggested that Colluli could significantly boost the economy of Eritrea, a country that, until last year, was on the UN’s sanctions list.

The document estimated that Colluli would contribute 3% of the country’s GDP by 2021 and 50% of the nation’s exports by 2030, while providing 10,000 direct and indirect local jobs.

It also identified how the mine could help Eritrea advance its sustainable development agenda, which are 13 priority Sustainable Development Goals (SDGs). These include: no poverty, zero hunger, quality education, gender equality, clean water and sanitation, sustainable economic growth and decent work, industry, innovation and infrastructure, reduced inequalities, climate action, peace, justice and strong institutions and partnerships for the SDGs.

In the initial phase of operation, Wage said, Colluli would produce more than 472,000 tonnes a year of SOP. Annual output could rise to almost 944,000 tonnes if Danakali decides to go ahead with a second phase of development, as the project has a possible 200-year plus mine-life.

The asset has the potential to produce other fertilizer products, such as Sulphate of Potash Magnesium (SOP-M), muriate of potash (MOP) and gypsum, along with rock salt. There is also potential for kieserite and mag chloride to be commercialized with minimal further processing required.

from MINING.COM https://ift.tt/32ZTYEX

Fold 2 : Samsung dévoile le design de son prochain smartphone pliable

from Les dernières actualités de Futura-Sciences https://ift.tt/2puf5kf

Sous-estimée, la montée des eaux va menacer 300 millions de personnes d’ici 2050

from Les dernières actualités de Futura-Sciences https://ift.tt/2q8ogqh

Alto collects ‘pristine’ gold at Ontario property

Alto Ventures (TSXV: ATV) collected ‘pristine’ grains of gold at its Mud Lake property in Ontario.

According to the miner, out of 40 surface glacial till samples gathered, 38 were processed and 37 contained one or more of the pristine grains.

Pristine grains are delicate pieces of free gold

“Pristine grains are delicate pieces of free gold that are generally interpreted to have been derived from sources close to the sampling sites,” Alto said in a media statement. “Four samples contain over 50 gold grains each including numerous pristine grains; one sample collected in 2019 contains 429 gold grains of which almost 96% of the gold grains are described as pristine.”

According to the company, the samples were collected during the 2018 and follow-up 2019 field seasons.

“To date, there are 12 known surface gold occurrences associated with the northeast striking Mud Lake Shear Zone which has been traced for six kilometres on the property,” the press release states. “Historical results include 50.6 g/t Au and 19.81 g/t Au in surface grab samples as well as 3.39 g/t Au over 6.1 metres and 7.25 g/t Au over 1.0 metre in separate drill holes.”

Alto reported that samples that contain high gold grain counts cluster near the southwest corner of the property and bring focus to the southwest end of the Mud Lake Shear Zone where past exploration was limited only to trenching.

Mud Lake is located approximately 25 kilometres northeast of the town of Beardmore, Ontario. Gold mineralization in the area is associated with quartz and quartz-carbonate veins that occur as shear-parallel en-echelon veins.

from MINING.COM https://ift.tt/2MW6oIe

Australia to review environmental protection act

The Australian government just launched an independent review of the Environment Protection and Biodiversity Conservation Act, a process whose outcome may impact the mineral resources sector.

According to the Ministry of Environment, the idea of the review is “to tackle green tape and deliver greater certainty to business groups, farmers and environmental organisations.”

The idea of the review is to tackle green tape

In a media statement, the government body acknowledged that the complexities of the Act are leading to unnecessary delays in reaching decisions and to an increased focus on process rather than outcomes.

“Delays in EPBC decisions are estimated to cost the economy around $300 million a year and frustrate both business and environmental groups,” the media brief reads. “The Act has been a world benchmark in environmental protection but needs to be adapted to changes in the environment and economy.”

The review will be conducted over the course of the next year and will be led by Graeme Samuel, a Professorial Fellow at Monash University’s Business School and School of Public Health and Preventative Medicine. Samuel will be supported by a panel of experts who will help him draft a report for the Minister of Environment within the next 12 months.

In response to this announcement, Tania Constable, CEO of the Minerals Council of Australia, issued a communiqué deeming the review necessary.

“Australia’s world-leading minerals industry is committed to the protection of our unique environment,” Constable wrote. “Yet, regulatory complexity and duplication – including overlapping state and federal laws – delay minerals projects and reduce global competitiveness without improving environmental protection.”

In the executive’s view, reforms that boost environmental protection in the country need to be sensible “to enhance business confidence and unlock minerals investment.”

from MINING.COM https://ift.tt/31XM1yN

Europe-led global certification scheme for raw materials expected in 2020

A group of European bodies and companies have joined efforts to create the first global certification scheme ensuring consistent standards of environmental, social and economic impact throughout the entire raw materials value chain, to be launched next year.

CERA (CErtification of RAw Materials), conceived in 2015 by German engineering and consulting firm DMT Group, counts with the support of the UN Economic Commission for Europe, the European Commission’s Joint Research Centre (JRC), EIT RawMaterials, Volkswagen, Fairphone and research institutions from across Europe.

Companies are under pressure from consumers and investors to prove that minerals are sourced without human rights abuses but tracking raw materials throughout their journey is challenging.

There currently are at least 40 different certification methods for the mining industry alone and the number increases exponentially when considering the entire value chain. Some are specific to a geographic region, process or humanitarian concern, while others tackle a single mineral.

An additional barrier for the current certifications to work, is that most of them are complex, expensive and inconsistent, says Andreas Hucke, CERA Project Director, Head of Raw Materials Sustainability at DMT.

“This resulting in different approaches to how sustainability and ethics are defined from country to country, mineral to mineral, and company to company,” Hucke says. “CERA solves those problems”.

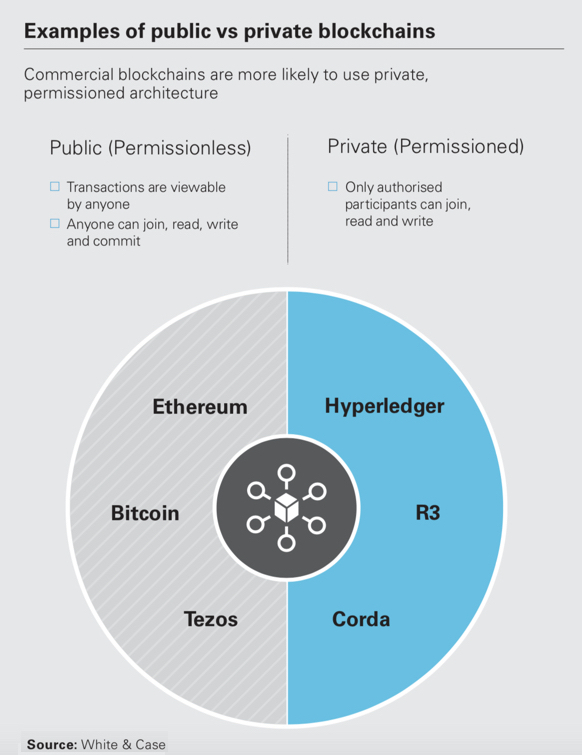

The certification process will be carried out using a private blockchain while its verification and search will be available on a public blockchain. The technology, the same that’s behind cryptocurrency bitcoin, provides a shared record of data held by a network of individual computers rather than a single party.

Formal CERA pilot projects addressing sustainability in the exploration, extraction and processing of lithium and cobalt will commence in late 2019.

There are several other blockchain projects focused on proving the authenticity of commodities and products.

Responsible-sourcing group RCS Global is helping IBM develop a cobalt traceability solution for Volkswagen, Ford and others.

World’s No. 1 diamond producer by value, De Beers, is in the advance stages of testing its Tracr platform, which allows tracing gemstones throughout the entire value chain — from mine to buyer.

Current regulations includes the EU’s Conflict Minerals Regulation, a law covering the sourcing of tantalum, tin, tungsten and gold – or ‘3TG’, which will come into force next year. Those rules are based on the Organization for Economic Co-operation and Development’s (OECD) guidance for sourcing minerals from conflict-affected and high-risk areas. It requires companies to prove they are investigating due diligence within their supply chains. The law is restricted, however, to those four commodities.

Other metals are covered by the Responsible Raw Materials Initiative (RRMI), an industry-led due diligence process supported by tech giants such as Apple, Microsoft, Samsung and electric car developers Renault, Ford and General Motors. Abiding by such initiative, however, is voluntary.

In the next weeks, CERA will be identifying pilot project partners for Chain of Custody, set to begin in 2020. It will receive applications from 2020 and issue first certificates in 2021.

from MINING.COM https://ift.tt/2BX92am

L'intelligence artificielle s'invite dans vos toilettes

from Les dernières actualités de Futura-Sciences https://ift.tt/32UOcV3

Des filaments froids à l’origine des galaxies ? On en parle avec Romain Teyssier

from Les dernières actualités de Futura-Sciences https://ift.tt/346wI8q

Santé dans nos assiettes : un avocat par jour préviendrait du mauvais cholestérol

from Les dernières actualités de Futura-Sciences https://ift.tt/2WoFDPK

Le télescope spatial eRosita révèle les beautés cachées de notre univers

from Les dernières actualités de Futura-Sciences https://ift.tt/2NnoUZc

Record : un éclair de 500 km de long

from Les dernières actualités de Futura-Sciences https://ift.tt/330JwNh

Le trafic Internet mondial en temps réel modélisé par un superordinateur

from Les dernières actualités de Futura-Sciences https://ift.tt/2WmARm2

Des polymères qui se dégradent dans le corps et l’environnement

from Les dernières actualités de Futura-Sciences https://ift.tt/2otaXjU

mardi 29 octobre 2019

Palladium One secures $3.2 million financing as metal price hits record high

Palladium One Mining (TSXV: PDM) announced Tuesday that it will undertake a private placement offering to raise up to C$3.2 million, which will be used for exploration activities on its palladium-dominant LK project in central Finland and its Tyko sulphide nickel project in Ontario.

The offering comprises up to 53 million units of Palladium One at C$0.06 a unit, with an over-allotment allocation of up to 15% of the total offering. Canadian mining investor Eric Sprott is expected to participate in the offering in an amount equivalent to providing a 19.99%, non-diluted ownership interest in the company’s issued and outstanding common shares.

Shares of Palladium One jumped more than 14% at market open, at one point trading at a two-month high of C$0.085. The company has a market capitalization of approximately C$3.1 million.

The financing announcement comes as price of palladium metal reached a record high of $1,808/oz a day earlier, due to persistent supply deficits and as a direct consequence of higher demand from stricter auto emission standards and the migration away from diesel-powered vehicles.

According to Palladium One president and CEO Derrick Weyrauch, the company is now “well-positioned as a strategic metal provider for cleaner air.”

“The proceeds will allow us to focus on increasing our existing palladium mineral resources at our LK project through new discoveries and step-out and infill drilling,” he added.

After closing the financing, the plan is to conduct high-resolution IP geophysics and then initiate a 5,000-metre diamond drill program as soon as practical. Planning is underway, the company says.

from MINING.COM https://ift.tt/2NqhNyX

Arpanet a 50 ans ! Son inventeur Leonard Kleinrock revient sur l’évolution d’Internet

from Les dernières actualités de Futura-Sciences https://ift.tt/2Nl0z6l

Galantas Gold suspends blasting at Irish mine, to cut jobs

Shares in Galantas Gold (TSX, LON:GAL) plummeted in London on Tuesday after it announced it had temporarily suspended blasting operations at its Irish gold mine as insufficient supervision has not allowed the company to expand operations as planned.

All blasting in North Ireland must be overseen by police, but the lack of needed supervision have resulted in a financial burden, which had proved a “significant drain” on the company’s financial resources, Galantas said.

As a result, the gold miner has started consultations to reduce employee numbers at its Omagh mine and save costs.

The firm, which kicked off the mine’s expansion in 2017 after the open-pit site was exhausted, is currently seeking strategic alternatives. Those include reviewing its licenses and operations, as well as considering a joint venture or other options with third parties for alternative financing structures.

“The company expects it will have to raise funds within the next 6 months and will update the market in due course,” Galantas Gold said.

The Canada-headquartered junior plans to continue with some operations at Omagh, which Northern Ireland’s only producing gold mine.

Shares in the company closed on Tuesday 47% lower, at 1.92 pence in London. They have fallen 30.5% so far this year and are still almost 20% less than what they were trading at three years ago at 9.75 pence each.

Northern Ireland holds the world’s seventh richest undeveloped seam of gold, but political violence kept most investors away for about three decades.

from MINING.COM https://ift.tt/36g4l9w

EDF Pulse Lab’, le tiers lieu de la transition énergétique

from Les dernières actualités de Futura-Sciences https://ift.tt/2NkCsVe

Lamborghini va tester des matériaux dans la Station spatiale

from Les dernières actualités de Futura-Sciences https://ift.tt/2pnZwdQ

Peste porcine : l'épidémie continue de s'étendre. Déjà 300 millions de cochons tués

from Les dernières actualités de Futura-Sciences https://ift.tt/31WyIPd

Uber Eats : un nouveau design pour ses drones de livraison alimentaire

from Les dernières actualités de Futura-Sciences https://ift.tt/32Xt28O

Méditation à l’école : rencontre avec les réalisateurs du film Happy

from Les dernières actualités de Futura-Sciences https://ift.tt/2WnMPvt

SolGold strikes again in Ecuador’s Andean copper belt

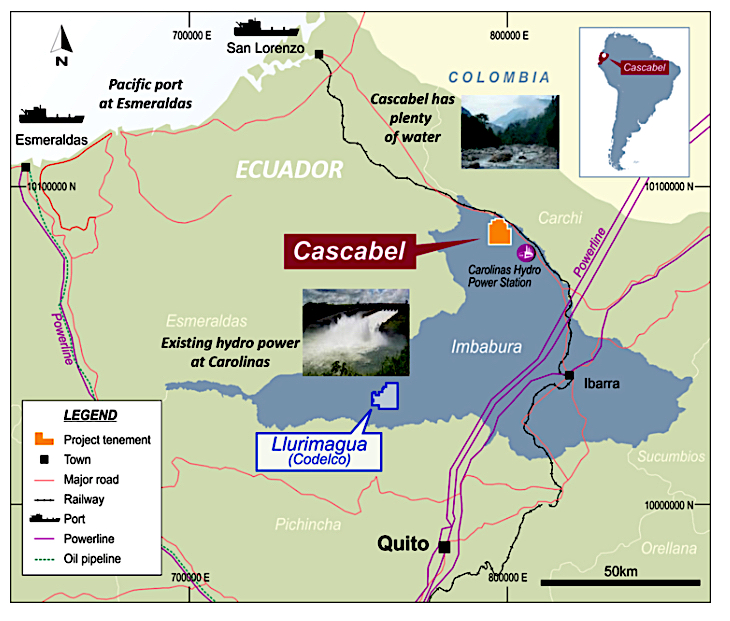

Australia’s SolGold (LON, TSX:SOLG) has announced improvements in copper and gold recoveries at its Alpala deposit in northern Ecuador, which could add $8.7 billion of revenue over the life of its planned Cascabel copper-gold mine.

The Primary Economic Assessment initially indicated total revenues of $74bn over the life of the mine, but metallurgical test work being conducted ahead of a prefeasibility study, due out in the March quarter of 2020, has raised expectations.

The fresh results point to the recovery of an additional 4.4m ounces of gold, 24m ounces of silver and 354,000 tonnes of copper.

Improvements in copper and gold recoveries at its Alpala deposit in Ecuador could add $8.7bn of revenue over the planned mine life.

The news back a preliminary study published by Ecuador’s Energy Ministry in June, which suggests the Alpala mineral deposit could become “the largest underground silver mine, third-largest gold and sixth-largest copper in the world.”

Ecuador has attracted a flurry of interest from big miners eager to increase their exposure to copper. The highly conductive metal is in demand for use in renewable energy and electric vehicles, but big, new deposits are rare.

Diversified majors particularly favour such large-scale, long-life projects as SolGold promises.

BHP (ASX, NYSE:BHP), the world’s largest mining company, last year acquired a 6.1% stake in SolGold, as a way of boosting its exposure to copper.

The move pushed Australia’s largest gold producer, Newcrest Mining (ASX: NCM), to up its holding in the company, consolidating its position as SolGold’s top shareholder.

Projects in Ecuador’s had faced potential delays and halts due to growing local opposition to the extraction of the country’s resources. Worries were partly cleared up after the country’s Constitutional Court rejected in September a request to make mining permits subject to popular approval.

The Andean nation is moving forward with plans to move from an explorers hotspot to mining exporter as its only large-scale copper mine readies to ship its first large cargo in November.

Ecuador plans to attract $3.7 billion in mining investments over the next two years, significantly up from the $270 million it received in 2018.

from MINING.COM https://ift.tt/31UwZdc

InSight : la « taupe » est ressortie de son trou creusé dans le sol de Mars

from Les dernières actualités de Futura-Sciences https://ift.tt/2plNYHS

L’Homme moderne est-il né au Botswana ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2MWMpZX

Copper Mountain mine’s mineral reserve expanded

Copper Mountain Mining (TSX: CMMC, ASX:C6C) announced that, following its 2019 exploration and development drilling, it has expanded its namesake mine’s mineral reserve and mineral resource, while at the same time optimizing the mine plan.

The Copper Mountain mine is a conventional open-pit, truck-and-shovel operation located 20 kilometres south of Princeton in southern British Columbia, Canada.

Copper Mountain says it will continue to drill the resources at the mine as significant potential exists to further expand all the deposits at a low conversion and discovery cost

The updated mine plan and mineral reserve and resource resulted in a 12% increase in proven and probable mineral reserve to 477 million tonnes for contained metal of 2.47 billion pounds of copper and 1.55 million ounces of gold at average grades of 0.23% Cu and 0.10 g/t Au.

Total measured & indicated mineral resource at a 0.10% Cu cut-off grade was estimated in 598.8 million tonnes with 0.23% copper, 0.10 g/t gold, 0.73 g/t silver.

At the same time, the life of mine strip ratio was reduced to 1.58 from 1.81 and the mine life was increased by 4.5 years to 31 years at current planned production levels.

“We continue to grow the size and quality of the Copper Mountain mine mineral reserves. Over the last year we have integrated the New Ingerbelle pit and now we have increased and integrated the CMM North pit as well as optimized the CMM Main pit,” Gil Clausen, the company’s president and CEO, said in a media statement.

According to Clausen, the North pit brings low cost production given it is mineralized from surface and adjacent to the Copper Mountain mine’s mid-grade and low-grade stockpiles and the primary crusher.

“Notably, the North pit requires zero initial capital to develop and has a low strip ratio of 0.85 waste tonnes to ore tonnes, which, when combined with the new design optimizations of the established pits, decreases total life of mine strip ratio for the entire operation to 1.58 from 1.82,” the executive explained.

from MINING.COM https://ift.tt/2Pufz4C

Apple sort les écouteurs AirPods Pro

from Les dernières actualités de Futura-Sciences https://ift.tt/2BOzAuy

US top private coal miner Murray Energy files for bankruptcy

Murray Energy, the US largest privately owned coal producer led by outspoken Donald Trump’s ally Robert Murray, has filed for chapter 11 protection, as the fossil fuel’s role in the country’s energy mix continues to weaken.

The Ohio-based miner, the eighth coal company to go under over the past year, said it had reached a restructuring agreement with lenders, noting it would finance operations with available cash and a $350 million debtor-in-possession financing facility.

As part of the arrangement, lenders are creating a new entity called Murray NewCo, which will acquire all assets belonging to Murray Energy — one of the most powerful and well-connected companies in the coal industry.

Robert Murray, the self-proclaimed king of the coal industry, is stepping down from its chief executive position, but he will remain as the company’s chairman. Former chief financial officer, Robert Moore, is taking over, the company said.

“Although a bankruptcy filing is not an easy decision, it became necessary to access liquidity and best position Murray Energy and its affiliates for the future of our employees and customers and our long term success,” Robert Murray said in the statement.

Unlike many of its peers, Murray Energy was able to overcome the shrinking demand from utilities by focusing on exports. However, those shipments have shrank because of declining global prices.

US coal exports are estimated to have dropped to 20.9 million tonnes in the third quarter, according to the country’s Energy Information Administration (EIA). That represents a 28% fall compared to the same period of 2018. The EIA expected coal exports to keep their downward trend, slipping to 17.3 million by the end of 2020.

The company’s collapse is yet another sign of a dying industry, despite Trump’s rescue attempts. Right after taking office, he slashed environmental regulations and even installed a former coal lobbyist to lead the EPA.

The deregulatory push, however, has been unable to offset market forces. Coal just can’t compete with cheap natural gas and the falling cost of solar power, wind and other forms of renewable energy.

Internal demand for the fossil fuel has hit a decades-low, with power plants expected to consume less coal next year than at any point since President Jimmy Carter was in the White House, according to government forecasts released in early October.

Murray, who began working in coal mines at 16 to support his family and went onto founding his own company in 1988, has been an outspoken advocate of coal.

He challenged President Barack Obama’s clean-air rules and even called him the “greatest destroyer the US has ever had.”

In 2017, Murray filed a defamation lawsuit against John Oliver, HBO and CNN owner Time Warner (now called WarnerMedia), alleging “character assassination” during an episode of “Last Week Tonight.” That lawsuit was dismissed last year.

Murray has also been skeptic of climate change, arguing that any threats have been exaggerated.

from MINING.COM https://ift.tt/36ejGYn

Airpods Pro : Apple met de la réduction de bruit dans ses écouteurs

from Les dernières actualités de Futura-Sciences https://ift.tt/36eivrV

Cet astéroïde serait la plus petite planète naine du Système solaire

from Les dernières actualités de Futura-Sciences https://ift.tt/2MWbcxl

On peut lire votre exposition au soleil dans votre microbiote

from Les dernières actualités de Futura-Sciences https://ift.tt/2NlofHx

Desi : un télescope inédit doté de 5.000 yeux pour traquer l’énergie noire

from Les dernières actualités de Futura-Sciences https://ift.tt/3307isU

Windows 10X : découvrez les secrets du futur Windows dédié au double écran

from Les dernières actualités de Futura-Sciences https://ift.tt/348m8Ob

Pourquoi les voitures autonomes vont conduire à plus d'embouteillages

from Les dernières actualités de Futura-Sciences https://ift.tt/349PQCn

Un astéroïde serait bien à l'origine du cataclysme survenu il y a 12.800 ans

from Les dernières actualités de Futura-Sciences https://ift.tt/2Nk6A2Z

Avec le concept LF-30, Lexus livre un aperçu de sa première voiture électrique et autonome

from Les dernières actualités de Futura-Sciences https://ift.tt/2WsgjIL

lundi 28 octobre 2019

Premier Gold’s El Niño mine achieves early commercial production

Premier Gold Mines (TSX: PG) reported Monday that the El Niño underground mine, located at its South Arturo property in Nevada, has achieved commercial production ahead of schedule and on budget. High-grade ore is now being processed at the Goldstrike facility located 8 km to the south.

The South Arturo mine is a joint venture with Newmont Goldcorp and Barrick, with Premier owning a 40% stake.

Additionally, new definition and step-out drilling results from Premier’s ongoing 2019 campaign are showing better outcomes than projected. According to the company, initial production supports this and emphasizes the continued opportunity to expand high-grade mineralization on the property.

“Based on current projections, overall gold production from South Arturo is expected to surpass expectations, which called solely for pre-production ore for the year,” the Ontario-based miner said.

Production guidance at South Arturo was previously set at between 5,000 and 10,000 oz for 2019.

from MINING.COM https://ift.tt/2BOHaFg

Nasa : le rover Viper va partir à la recherche de l’eau sur la Lune

from Les dernières actualités de Futura-Sciences https://ift.tt/32VMAu3

Sennheiser lance une promotion spéciale sur ses casques audio

from Les dernières actualités de Futura-Sciences https://ift.tt/2NwKEC7

Voici à quoi ressemblera un employé de bureau dans 20 ans

from Les dernières actualités de Futura-Sciences https://ift.tt/2BOhzwa

Argentina’s President-elect Fernandez a boon for miners, despite expected protectionism

Argentina’s centre-left Peronist movement has been voted back into power, as electorate grappling with an economic crisis rejected President Mauricio Macri’s austerity policies, opening the door to potential protectionist measures.

With more than 98% of polls counted, Alberto Fernández (60) had a 48.1% of votes on Sunday night compared to 40.4% for Macri, which was thought to be a safer bet for miners due to his market-friendly policies.

In 2017, Macri unveiled a federal mining agreement, an initiative to standardize regulations and taxation of the industry across the country’s 23 provinces.

But two provinces refused to sign on (Chubut and La Pampa), and it is now uncertain whether the proposed agreement will receive the necessary approval from all provincial legislatures to become legally binding.

Fernández’ victory is not necessarily a return to Argentina’s recent past, some analysts say.

Although he is a Peronist, a political movement that has come to represent the working class, and worked as cabinet chief for both Cristina Fernández and her husband and predecessor Nestor Kirchner, that does not mean he will govern just as they did, Michael Shifter, the head of the Inter-American Dialogue, a Washington-based think tank, told The Independent.

During his campaign, Fernández met with representatives from 24 mining companies with projects in the country and told them he considered mining an opportunity, rather than a problem.

He also promised to revisit the country’s controversial glacier protection law, and said that his technical team — led by economist Guillermo Nielsen — is working on a regime to guarantee clear rules for 10 years within the natural resources sector.

Argentina has reserves of lithium, copper, gold and silver, but the country has not seen a significant new mining project since 1997, when work started on Glencore’s Alumbrera gold and copper mine.

According to the Argentine Chamber of Mines, the country’s current pipeline of mine projects is worth almost $29 billion, some of them already in progress.

In March, Yamana Gold, Goldcorp and Glencore revealed they were studying a plan to jointly develop the Agua Rica gold and copper project in the country’s northwest.

Canada’s First Quantum Minerals is also mulling a $3 billion investment in Taca Taca, another gold and copper project in Salta province.

Barrick Gold, in turn, is considering shifting ownership of the Lama property at the Pascua-Lama project in Chile to nearby Veladero in Argentina. The planned mine at Pascua Lama has been delayed by legal and environmental disputes over Barrick’s initial plans to operate an open-pit mine at the site.

The lithium card

Fernández’s economic agenda includes a 10-year growth plan for the mining industry, led by the lithium sector.

Argentina has three lithium projects consolidated and in production — NRG Metals’ Hombre Muerto and Lithium Americas’ Cauchari-Olaroz in Catamarca province, and Orocobre’s Olaroz in Jujuy. A further 23 exploration projects are advancing to production.

According to a report by the Inter-American Development Bank (IDB), the country has 13% of the global lithium reserves, while annual production currently stands at 30,400 tonnes.

The South American nation is the world’s third biggest lithium producer, hoisting 25% of the resources in the so-called lithium triangle (Chile, Bolivia and Argentina).

Argentina needs foreign investment and jobs that properly run and managed mining projects could bring in. The country is facing an economic crisis, with the central bank recently hiking interest rates to ease inflation and save the Argentinean peso, the worst-performing currency in emerging markets.

from MINING.COM https://ift.tt/34ak5sV