samedi 30 novembre 2019

Science décalée : les petits garçons préfèrent les poupées aux camions

from Les dernières actualités de Futura-Sciences https://ift.tt/2ClUYFJ

Voici le seul endroit connu sur Terre où la vie n’existe pas

from Les dernières actualités de Futura-Sciences https://ift.tt/37RTtzq

Les États-Unis veulent limiter l'accès aux données scientifiques

from Les dernières actualités de Futura-Sciences https://ift.tt/2R8huMH

Black Friday SFR : l'iPhone 11 Pro Max à 599 €

from Les dernières actualités de Futura-Sciences https://ift.tt/35NpgzS

Ordinateurs portables : les promos Cdiscount du Black Friday

from Les dernières actualités de Futura-Sciences https://ift.tt/2R3pUVF

Amazon Echo : Alexa va désormais exprimer des émotions

from Les dernières actualités de Futura-Sciences https://ift.tt/33xOzEB

Quelle est la meilleure façon de tenir un volant ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2qYl1Ti

vendredi 29 novembre 2019

Un trou noir de 68 masses solaires défie l'astrophysique

from Les dernières actualités de Futura-Sciences https://ift.tt/37NaquY

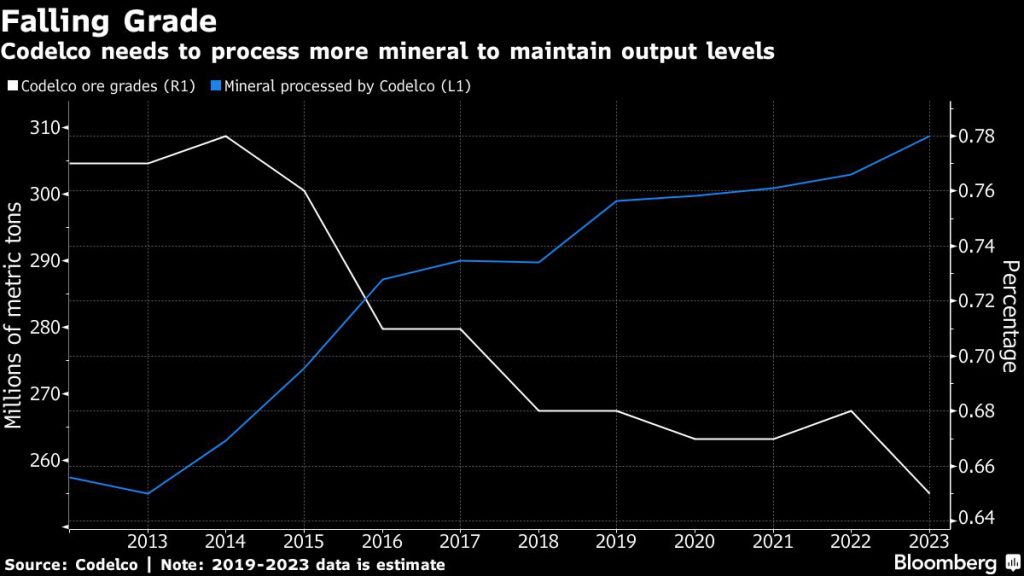

Chile’s Codelco to cut spending by $8bn through 2028 as profit halves

Chile’s Codelco, the world’s largest copper producer, will scale back its ambitious $40 billion, 10-year plan aimed at upgrading aging mines after reporting on Friday a 57% drop in pre-tax earnings to September due to a combination of factors including heavy rains, a long-dragged strike at its Chuquicamata mine and lower metal prices.

The company, which may lose its crown as the No.1 copper producer due citizen uprising threatening Chile’s economy, said it would cut spending through 2028 by $8 billion or 20%.

Codelco, which turns over all its profits to the state, will also have to find a way to generate $1 billion more a year in gross earnings from 2021 onwards. The company is expected to provide the government with most of the funds needed to fulfill a long list of spending demands and so quell ongoing protests.

“We are in a crucial moment in our history,” chief executive officer, Octavio Araneda, said in a statement. “Our obligation is to transform ourselves in order to continue contributing to the progress of Chile for at least 50 years more.”

Araneda, who took the post as Codelco’s leader in July, was faced with the immediate challenge of investing billions just to keep up production levels at a time of thin margins in the global copper business.

The wave of protests and riots affecting all sectors of Chile’s economy has placed an extra layer of stress to Araneda’s already difficult task.

While Codelco’s production has not been significantly affected by the more than six weeks of unrest shaking the country to the core, the company noted it has felt an impact in inventories due to a delay in ports, where workers have gone on strike several times since late October in solidarity with anti-inequality demonstrators.

The copper giant recently kicked off a $5.6 billion underground expansion of its giant Chuquicamata open pit mine, in northern Chile.

The next major mine overhaul is a new level at El Teniente underground mine, the company’s largest and the world’s No. 6 by reserve size. The project , expected to be completed in 2023, would extend the mine-life by 50 years.

Codelco holds vast copper deposits, accounting for 10% of the world’s known proven and probable reserves and about 11% of the global annual copper output with 1.8 million tonnes of production.

Production decline, together with lower copper prices and higher costs, saw the company’s annual profits drop by a third last year to $2 billion, not counting paper losses worth almost $400 million, as it wrote down the value of its assets, including its Ventanas smelter and the open pit at its Salvador division.

from MINING.COM https://ift.tt/33sY0F7

Les médicaments à éviter : la liste noire de la revue Prescrire

from Les dernières actualités de Futura-Sciences https://ift.tt/2OzjgVD

Les meilleures offres du Black Friday Samsung 2019

from Les dernières actualités de Futura-Sciences https://ift.tt/2XZjRmx

Pourquoi Twitter suspend sa suppression de millions de comptes ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2Y3di2j

Lucara bets on diamond market recovery, plans mine expansion

Canada’s Lucara Diamond (TSX:LUC) doesn’t seem deterred by weak conditions affecting the market as it plans to boost sales returns by targeting higher grade areas of its Karowe mine in Botswana.

Delivering production guidance for 2020, the Vancouver-based miner says it expects to recover between 370,000 and 410,000 carats at Karowe next year and have an annual revenue of between $180 and $210 million.

Lucara forecasts the income will come from selling “special” diamonds — 10.8 carats and larger, excluding truly unique finds such as the 1,109-carat Lesedi la Rona and the 813-carat Constellation.

“Building on the strong operating performance achieved in 2019, Lucara will continue to focus in 2020 on optimising the base business, growing our digital sales platform Clara Diamond Solutions by adding third-party production to the platform,” president and chief executive officer, Eira Thomas, said in a statement.

Lucara has set aside $53 million for early work related to the planned underground extension for Karowe, with a final investment decision to be made in the second half of next year.

Pre-production costs for the project, which would increase the operation’s productive life for 20 years until 2040, have been pegged at $514 million.

The extension will allow Lucara to exploit the highest value part of the orebody first, generating over $5.25 billion in gross revenue.

The company expects to get its investment back in under three years. In the meantime, it has moved to preserving cash by suspending dividends for future quarters.

Karowe is one of the world’s most prolific sources of large, high value type IIA diamonds. Since beginning commercial operations in 2012, it has produced 2.5 million carats, becoming the only mine in recorded history to have produced two 1,000+ carat diamonds.

from MINING.COM https://ift.tt/2q3dbHD

Mars : les tempêtes globales seraient responsables de la perte de l’eau

from Les dernières actualités de Futura-Sciences https://ift.tt/2OvKdJD

Marshall lance ses promos du Black Friday 2019

from Les dernières actualités de Futura-Sciences https://ift.tt/2XX62F6

Ce béton se nettoie tout seul

from Les dernières actualités de Futura-Sciences https://ift.tt/33rRHlb

Et si vous profitiez du Black Friday tout en faisant un geste pour la planète ?

from Les dernières actualités de Futura-Sciences https://ift.tt/37Lcio2

Vue de l'espace, une nouvelle île apparaît dans le Pacifique

from Les dernières actualités de Futura-Sciences https://ift.tt/2q6nvP8

L’autisme, bientôt mieux détecté grâce à cette application simple et efficace

from Les dernières actualités de Futura-Sciences https://ift.tt/2XZb1W7

Black Friday 2019 : nos meilleurs bons plans tech

from Les dernières actualités de Futura-Sciences https://ift.tt/35Md7Lz

La plus importante migration animale dévoilée par un laser depuis l’espace

from Les dernières actualités de Futura-Sciences https://ift.tt/2L4r7bo

C'est officiel : Thomas Pesquet retournera dans l'espace

from Les dernières actualités de Futura-Sciences https://ift.tt/2L45Tus

L’ESA annonce un budget record et des ambitions renforcées !

from Les dernières actualités de Futura-Sciences https://ift.tt/35JidYT

Black Friday 2019 : les meilleures promos smartphones

from Les dernières actualités de Futura-Sciences https://ift.tt/35KK8Yo

Grippe : une nouvelle piste pour un vaccin universel ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2rErC5u

Un dinosaure baptisé d'après la série Game of Thrones

from Les dernières actualités de Futura-Sciences https://ift.tt/2OtJd8U

Bon plan : le Roborock S5 Max est à prix réduit pendant le Black Friday

from Les dernières actualités de Futura-Sciences https://ift.tt/34yxonM

jeudi 28 novembre 2019

L'hibernation des astronautes ne sera bientôt plus de la science-fiction

from Les dernières actualités de Futura-Sciences https://ift.tt/34wazAT

L'armée américaine sera composée de cyborgs en 2050

from Les dernières actualités de Futura-Sciences https://ift.tt/2OxewzX

Black Friday Cdiscount 2019 : top départ à 18 h !

from Les dernières actualités de Futura-Sciences https://ift.tt/2Dtq0he

En 2050, l'armée américaine sera composée de cyborgs

from Les dernières actualités de Futura-Sciences https://ift.tt/2ryyqBz

Admirez la Lune, Vénus et Jupiter réunis dans le ciel ce soir

from Les dernières actualités de Futura-Sciences https://ift.tt/2QWinbj

Les bons plans HP du Black Friday 2019

from Les dernières actualités de Futura-Sciences https://ift.tt/2R0TUl2

Changement climatique : la moitié des points de non-retour atteints plus vite que prévu

from Les dernières actualités de Futura-Sciences https://ift.tt/2ry0t3V

Oz Minerals kicks off construction at $35 million mine in Brazil after Vale deals

Australian copper-gold miner OZ Minerals (ASX:OZL) has pulled the trigger on its $35 million underground copper-gold mine in Brazil’s minerals-rich Carajás region, following a series of inter-linked strategic agreements with Vale (NYSE: VALE), the country’s largest miner.

Since taking over Avanco Resources last year, Oz has been working towards transforming the small open-cut Pedra Branca mine into a larger underground operation.

The goal, it has repeatedly said, is to develop a hub-and-spoke mining complex around the Antas mine’s concentrate processing facility

The Adelaide-based company envisions a one-million-tonne-a-year underground operation with a mine life of eight years, expected to have an annual production of about 18,000 tonnes of copper and 11,000 ounces of gold.

Decline construction will start in December and first development ore from expected in mid-2020, the company said.

Pre-concentrate ore from the Pedra Branca mine will be trucked 75 km to the existing Antas plant, marking the first spoke in Oz Minerals’ Carajás Antas hub.

The decision to go ahead with the mine construction comes as the Australian company inked a number of agreements with Vale, securing new momentum to its low-key, relatively low-cost entry into the copper and gold mining sector in the South American country.

The deals will allow Oz Minerals to accelerate progress and simplify activities thanks to the Brazilian mining giant’s extensive support network.

The multilayered plan will see Vale initially transporting Pedra Branca’s output to Antas, then marketing the concentrate produced from that ore.

“The Vale Carajás concentrate sales agreement utilizes Vale’s extensive in-country transport infrastructure, which provides logistics and marketing cost savings, and simplifies our activities in the region,” Oz Minerals’ Brazilian boss, Carlos González, said in the statement.

The deal also contemplates the option to process the mine’s production at a Vale facility that is much closer to the mine than Antas. That alternative would be triggered if the plant fills up with production from other mines closer to it than Pedra Branca.

The immediate advantage is a capital and risk profile reduction of OZ Minerals’ first international endeavour, while offering new medium-term opportunity and long-term upside.

Another plus is that Oz will have the option of acquiring Vale’s share in two copper exploration projects in the region, one of which is at a relatively mature stage.

The Aussie miner also announced it would exercise its option to purchase the Pantera advanced exploration project, which it acquired as part of the takeover of Avanco last year.

At around 1,800km2, Carajás is the second largest land holding in a region known for iron oxide copper-gold deposits of which Vale’s 200ktpa Salobo is the prime example.

It has similar geology to South Australia, where copper mines such as Oz’s Prominent Hill, and the soon to start producing Carrapateena, as well as BHP’s Olympic Dam are located.

from MINING.COM https://ift.tt/35GE2br

L'égalité des genres protégerait la santé des hommes

from Les dernières actualités de Futura-Sciences https://ift.tt/2L1Ctx6

Canadian miners sign deal on Old Gold Bar project in Nevada

Vancouver-based Ely Gold Royalties (TSXV: ELY) announced that it has signed a definitive purchase agreement for the sale of 100% of its Old Gold Bar project to McEwen Mining Nevada, a wholly-owned subsidiary of Toronto-based McEwen Mining (NYSE: MUX) (TSX: MUX).

In a press release, the firms involved in the transaction explained that to go ahead with the deal, McEwen will issue to Ely Gold 53,600 shares of its common stock in exchange for 100% ownership in the patented and unpatented claims where the project sits.

In addition, McEwen will reimburse Nevada Select, Ely’s US subsidiary, $38,096.57 for the 2020 claim fees and taxes, while Nevada Select will retain a 2% net smelter return royalty.

The Old Gold Bar project consists of 12 patented mining claims and 310 unpatented mining claims located in Elko County, Nevada.

The claims include the historic Gold Bar mine and mill, which produced 286,354 ounces of gold from 1986 to 1994 from the open-pit mine and the millsite deposit. The latter is considered a faulted offset of the historic Gold Bar mine and is located to the northwest of the open pit.

According to Ely, Fremont Gold optioned the property in 2017, completed a soil sampling program based on a new structural interpretation and identified coincident gold and mercury geochemical anomalies to the southeast of the historic Gold Bar mine.

“Fremont drilled two reverse-circulation drill holes at Gold Bar, totaling 492 metres. Results include 25.9m @ 4.66 g/t Au within a longer interval of 41.2m @ 3.08 g/t in hole GBR-1 at the historic Millsite deposit and 6.1m @ 1.22 g/t Au in hole GBR-2 immediately west of the historic open pit,” Ely’s media brief explains.

from MINING.COM https://ift.tt/34uNzlZ

Environmental watchdog greenlights Metso’s emissions targets

The Science Based Targets initiative or SBTi, a collaboration between CDP, the United Nations Global Compact, the World Resources Institute and the World Wide Fund for Nature, approved Metso’s greenhouse gas emission targets.

According to Metso, its commitments involve a 25% reduction in carbon emissions in production by 2030, something the company plans to achieve by investing in renewable energy and improving the energy efficiency of the production processes.

The SBTi champions science-based target setting as a way of boosting companies’ competitive advantage in the transition to the low-carbon economy

“Metso demands sustainability not only of its own production but also 30% of its suppliers in terms of spend are required to set science-based emission targets by 2024. By streamlining transportation routes and optimizing warehouse locations, Metso aims for a 20% reduction in transportation emissions by 2025,” the industrial machinery firm said in a media statement.

Metso also reported that through extensive research and development work, it has been able to reduce the energy consumption in customer processes and it plans to continue on this path in order to achieve, in five years, a 10% reduction in GHG emissions in the most energy-intensive customer processes.

More ambitiously, the Finnish company plans to offset flight emissions by 100% by 2021 and continue to find new ways to decrease emissions, for example, in offices.

“We are extremely happy about the ratification of our science-based CO2 emissions targets,” Metso’s president and CEO, Pekka Vauramo, said in the press brief. “Our Climate Program is an important step in our goal of reducing greenhouse gas emissions. It is also an essential element in Metso being a responsible and trusted partner to our customers. We aim to improve our customers’ productivity in a sustainable manner, and we involve all our stakeholders in reaching this goal.”

from MINING.COM https://ift.tt/2OQCYuR

La capsule Orion est prête pour ses essais de vide thermique

from Les dernières actualités de Futura-Sciences https://ift.tt/2rydkDn

Pirelli va connecter ses pneus à la 5G

from Les dernières actualités de Futura-Sciences https://ift.tt/37Lw3vK

Black Friday : de la tradition au plus grand évènement commercial

from Les dernières actualités de Futura-Sciences https://ift.tt/37Hm4aF

La première carte des pays producteurs d'alimentation durable

from Les dernières actualités de Futura-Sciences https://ift.tt/2qSDgJN

Un bébé à deux têtes et trois bras est né en Inde

from Les dernières actualités de Futura-Sciences https://ift.tt/2Os6lVl

Des images magnifiques du 250e lancement d'Ariane

from Les dernières actualités de Futura-Sciences https://ift.tt/2OU6FLA

Un moteur électrique inédit propulsé à l'iode

from Les dernières actualités de Futura-Sciences https://ift.tt/2pY4Zs1

Un mystérieux chien-loup congelé intrigue les scientifiques

from Les dernières actualités de Futura-Sciences https://ift.tt/2pXCgnc

Nouvelles images de la comète interstellaire Borisov

from Les dernières actualités de Futura-Sciences https://ift.tt/2OVeH7b

Tabac : comment l'aversion naturelle se transforme en addiction

from Les dernières actualités de Futura-Sciences https://ift.tt/35DIW9l

Néonicotinoïdes : interdits depuis 2013, ces pesticides continuent de décimer les abeilles

from Les dernières actualités de Futura-Sciences https://ift.tt/37MMx6C

Urgence climatique : le mot de l'année 2019

from Les dernières actualités de Futura-Sciences https://ift.tt/2rwlxIc

mercredi 27 novembre 2019

Sentinel 6 : découvrez la nouvelle famille de satellites météo

from Les dernières actualités de Futura-Sciences https://ift.tt/37LrSAb

Trouver un smartphone pas cher le jour du Black Friday

from Les dernières actualités de Futura-Sciences https://ift.tt/2R2GFk5

Proxima, l'histoire d'une mère célibataire astronaute qui s'apprête à quitter Terre et fille

from Les dernières actualités de Futura-Sciences https://ift.tt/34sAlWG

Impressionnant : des cordes magnétiques géantes dans le halo d’une galaxie

from Les dernières actualités de Futura-Sciences https://ift.tt/35DONeM

Spot, le robot-chien entre dans la police

from Les dernières actualités de Futura-Sciences https://ift.tt/2pWvApv

Jouets connectés : cette smartwatch peut espionner vos enfants

from Les dernières actualités de Futura-Sciences https://ift.tt/2qRGHjN

Anglo American sells stake in Australian coal mine for $141m

Anglo American (LON:AAL) said on Wednesday it had sold its minority stake in the Grosvenor coking coal mine in Australia for about $141 million to a consortium of Japanese companies.

The diversified miner, which has consistently been offloading coal operations since 2014, said its 12% interest has been acquired by a group that includes Nippon Steel Corp, Mitsui & Co Ltd, Nippon Steel Trading Corp, Shinsho Corp, JFE Mineral Co Ltd.

The consortium already owned a 12% of Anglo’s next-door Moranbah North coal mine, which provides the processing infrastructure for Grosvenor, located in the Bowen Basin, central Queensland.

“The alignment of ownership interests across the Moranbah-Grosvenor operation is an important step forward as we unlock the considerable additional value that we see,” Seamus French, CEO of bulk commodities at Anglo American, said in the statement.

Grosvenor coking coal mine is being acquired by a consortium of Japanese companies that includes Nippon Steel Corp, Mitsui & Co Ltd, Nippon Steel Trading Corp, Shinsho Corp, JFE Mineral Co Ltd.

French said the move would facilitate the delivery of value creation opportunities, including expanding the existing plant and speeding up various processes.

While the company is moving away from thermal coal, metallurgical or coking coal appears to be one of its key commodities moving forward.

Despite a slight production drop from 23-25 million tonnes to 22-24 million tonnes expected next year, Anglo recently increased its metallurgical coal guidance for 2022 to an estimated 26-28 million tonnes.

Top mining companies have been reducing or eliminating their exposure to coal on environmental grounds. Rio Tinto (ASX, LON: RIO), the world’s second largest miner, fully exited the coal sector in March 2018, with the sale of its Kestrel coal mine in Australia to private equity manager EMR Capital and Indonesia’s Adaro Energy for $2.25 billion.

Rival BHP (ASX, NYSE:BHP) took a step in the same direction in July, revealing it had been mulling options to divest its thermal coal business, which includes assets in Australia and Colombia.

Shareholders at world’s largest mining company, however, don’t seem too keen to ditch coal. Last week, Australian investors voted against a plan that would have seen BHP leave lobby groups that promote policies at odds with the goals of the Paris climate accord. The agreement, signed in 2016 by almost 200 nations, aims at reducing emissions of gases that contribute to global warming.

Australia’s South32 (ASX, LON, JSE:S32), which spun out of BHP in 2015, is another company to have recently kissed the fossil fuel goodbye. In early November, it sold its thermal coal operations to Seriti Resources and two trusts, for 100 million rand ($6.78 million) upfront.

from MINING.COM https://ift.tt/2QRzRpg

Les autres espèces humaines ont-elles été victimes d'Homo sapiens ?

from Les dernières actualités de Futura-Sciences https://ift.tt/34qtk8J

Green Friday ou Black Friday : lequel vous rendra le plus heureux ?

from Les dernières actualités de Futura-Sciences https://ift.tt/34scma6

Les promos Xbox du Black Friday Microsoft 2019

from Les dernières actualités de Futura-Sciences https://ift.tt/2XQq04x

NioCorp engages key players to keep Elk Creek project environmentally friendly

NioCorp Developments (TSX: NB) partnered with DuPont Clean Technologies (NYSE: DD) to have the latter provide its MECS sulfuric acid technology for the Superalloy Materials Project in southeast Nebraska.

Also known as the Elk Creek project, the operation is aimed at producing niobium, scandium, and titanium, all considered critical minerals by the U.S. government.

Elk Creek is one of the few new mines to have reached the funding and construction stage in the United States

Scandium is a superalloy material that can be combined with aluminum to make alloys with increased strength and improved corrosion resistance. It is also a component of advanced solid oxide fuel cells. Titanium, on the other hand, is used in various superalloys and is a key component of pigments used in paper, paint and plastics and is also used for aerospace applications, armor and medical implants.

At the mine site where these minerals are to be extracted, the MECS sulfuric acid plant will be designed to maximize energy recovery and emissions control.

“Emissions control is a fundamental part of what we do, so we are delighted to assist NioCorp in achieving its environmental goals,” Eli Ben-Shoshan, president of DuPont Clean Technologies, said in a media statement.

Besides DuPont, NioCorp has engaged Pennsylvania-based Veolia Water Technologies in the project.

Veolia will conduct engineering and procurement activities related to the project’s water treatment plant.

from MINING.COM https://ift.tt/34nSLrO

Aurania finds evidence of highly sought-after gold lost city in Ecuador

Canadian junior Aurania Resources (TSX-V: ARU) said on Wednesday it had found vestiges of an old road at the very centre of its flagship asset, The Lost Cities – Cutucu project, which it believes provides solid field evidence of it project being at one of Ecuador’s lost gold mining centres.

The road, the company said, was discovered by its field teams while searching for “Sevilla de Oro”, which was one of two gold producing cities described in historic manuscripts from Ecuador, Peru, Spain and the Vatican.

Those records talk about Spanish settlers operating two gold mines between about 1565 and 1606. The path discovered by Aurania’s exploration teams is thought to be the one that linked “Sevilla de Oro” to the other gold mining centre — “Logroño de los Caballeros” — described in the historic manuscripts.

Chairman and chief executive, Keith Barron, believes searching for Ecuador’s lost gold production centres will help the company zone in on potentially significant gold deposits.

“We always presumed that ingots would have been transported by horse or donkey along a well-travelled route from the mines,” Barron, who led the team that discovered Fruta del Norte in 2006, said. “It appears that we have come across one of these trails, though it is cut by more recent landslides at both ends.”

He noted that a planned survey applying laser light (LiDAR) should pick up the continuations of the trail and its termination at the historical mine sites.

“We do not anticipate the discovery of any ruined buildings, though the discovery of dressed stone along the trail is perhaps significant and suggests that the Spaniards attempted to build a stone Caja Real (royal treasury) as they had done in other locations in Ecuador, but that the dressed stone was dropped on the road along the way,” Barron said.

The finds, believed to be a portion the north-south road, are over a distance of 2.5km and show it was an engineered structure cut into embankments with its downslope edges lined with blocks of shale which prevented erosion. The throughway is well drained and has a surface of packed shale, Aurania said.

The company noted it would continue exploring indications of a mineralised system near the road, focusing on an extensive area of quartz-sericite-pyrite alteration, which is typically found over and adjacent to porphyry systems.

Since its inception in 2001, the precious metals and copper-focused explorer has worked to position itself as a serious company and not a treasure hunter.

“We are geologists in the mineral exploration business, optimistic by nature but also conservative and skeptical,” the company says on its website. “Nothing swashbuckling about us!”

Aurania’s main asset, Cutucu, is located in the Jurassic Metallogenic Belt in the eastern foothills of the Andes mountain range of southeastern Ecuador.

The exploration project is perhaps the only one to have ever brought together professional historical archival research with modern geological, geochemical and geophysical exploration techniques in a geographical area of high discovery potential.

More to come …

from MINING.COM https://ift.tt/2pRG5u2

La Grande Tache rouge de Jupiter ne va pas disparaître

from Les dernières actualités de Futura-Sciences https://ift.tt/34r0o0y

Des exoplanètes pourraient se former autour des trous noirs géants

from Les dernières actualités de Futura-Sciences https://ift.tt/37HaEUv

Poisson-clown : adieu à Nemo qui n’a pas la capacité génétique pour s’adapter

from Les dernières actualités de Futura-Sciences https://ift.tt/35AY1Zh

Adieu Nemo : les poissons-clowns ne peuvent pas s’adapter au changement climatique

from Les dernières actualités de Futura-Sciences https://ift.tt/2QX6TEk

Uber favoriserait le binge drinking

from Les dernières actualités de Futura-Sciences https://ift.tt/37FvfbG

Trois trous noirs supermassifs sur le point de fusionner au centre de cette galaxie

from Les dernières actualités de Futura-Sciences https://ift.tt/37DwCHP

Ariane a réussi son 250e lancement !

from Les dernières actualités de Futura-Sciences https://ift.tt/2qOOqzd

Black Friday ou Green Friday : lequel vous rendra le plus heureux ?

from Les dernières actualités de Futura-Sciences https://ift.tt/34kGsMN

Intoxication au mercure : peut-on encore manger du poisson ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2qSoSB8

Le Cern fête les 60 ans de son synchrotron à protons

from Les dernières actualités de Futura-Sciences https://ift.tt/2QSLYSP

mardi 26 novembre 2019

La France reste peu préparée face aux risques industriels

from Les dernières actualités de Futura-Sciences https://ift.tt/2KX9Scd

Villes intelligentes : à quoi ressembleront les villes du futur ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2qMEIgM

InSight fête son premier « atterriversaire » sur Mars

from Les dernières actualités de Futura-Sciences https://ift.tt/2qMHx1l

Le cœur d'une baleine écouté pour la première fois

from Les dernières actualités de Futura-Sciences https://ift.tt/2KVBrTf

Black Friday Apple : les offres à ne pas manquer

from Les dernières actualités de Futura-Sciences https://ift.tt/35CWKkw

L’étoile à neutrons de la supernova 1987A enfin retrouvée ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2KSWrK7

Un algorithme pour éviter que les robots ne s'en prennent aux humains

from Les dernières actualités de Futura-Sciences https://ift.tt/34pzUwy

Trous noirs supermasssif : des exoplanètes pourraient se former autour

from Les dernières actualités de Futura-Sciences https://ift.tt/2DjRxBO

Austral Gold to become sole owner of Casposo mine in Argentina

Austral Gold (ASX: AGD) (TSXV: AGLD) entered into a share purchase agreement this week with Troy Resources (ASX: TRY) to acquire the remaining 30% interest in the Casposo silver-gold mine located in western Argentina.

In a press release, the Sydney-based miner revealed that it agreed to pay $200,000 for the outstanding common shares of Casposo Argentina, a wholly-owned subsidiary of Troy that owns the mine.

The Casposo operation consists of an underground mine and a processing plant

“We are pleased to own 100% of Casposo and to continue with the exploration program that was launched last month,” Austral Gold’s CEO, Stabro Kasaneva, said in the media brief. “We are also assessing opportunities to consolidate surrounding projects and source ore from third parties. All these initiatives are part of our business strategy to consolidate mineral resources with the goal of recommencing mining operations at Casposo.”

The Casposo mine is a low-sulphidation epithermal gold and silver deposit located 10 kilometres NW of the township of Calingasta, in the San Juan province.

The entire underground operation covers some 100.21 square kilometres and sits on the eastern border of the Cordillera Frontal.

Total measured and indicated resources have been estimated at 1,415,000 tonnes at 238Ag g/t; 3.00 Au g/t; 5.94 AuEq g/t.

from MINING.COM https://ift.tt/2qM1DsB

Ivanhoe, Congolese authorities discuss Kamoa-Kakula project

Executives from Canada’s Ivanhoe Mines (TSX:IVN) met with high-ranking government officials in Kinshasa to provide updates on the development progress at the Kamoa-Kakula and Kipushi joint-venture mining projects.

In a press release, the miner reported that its team met with Prime Minister Sylvestre Ilunga Ilukamba, Mines Minister Willy Kitobo Samsoni, and Minister of Portfolio Clément Kuete Nymi Bemuna, who were formally appointed in August in a new coalition government led by President Felix Tshisekedi.

Kamoa-Kakula has been independently ranked as the world’s largest, undeveloped, high-grade copper discovery by Wood Mackenzie

“The DRC government is both our regulator and a key shareholder, held through the Minister of Portfolio, in the Kamoa-Kakula copper project,” Ivanhoe’s president, Tony Giardini, said in the media brief. “The discussions with respect to Kamoa-Kakula were extremely productive and both parties are working hard to ensure that the project starts producing copper as scheduled in the third quarter of 2021.”

The Kamoa-Kakula Project is a joint venture between Ivanhoe Mines (39.6%), Zijin Mining Group (39.6%), Crystal River Global Limited (0.8%) and the DRC government (20%).

Located within the Central African Copperbelt, approximately 25 kilometres west of the town of Kolwezi, Kamoa-Kakula is a very large, near-surface, flat-lying, stratiform copper deposit with adjacent prospective exploration areas.

It is estimated that the deposit contains 1.34 billion indicated tonnes grading 2.72% copper for 80.7 billion pounds of copper, as well as 315 million inferred tonnes at 1.87% copper for 13 billion pounds copper.

The Kipushi project, on the other hand, is a joint venture between Ivanhoe Mines (68%) and Gécamines (32%).

It is a high-grade zinc-copper-germanium-silver mine that both companies hope to restart soon.

from MINING.COM https://ift.tt/2KV7AKt

Pour limiter le réchauffement climatique, il faut réduire les émissions de CO2 de 7,6 % par an

from Les dernières actualités de Futura-Sciences https://ift.tt/2sc7GH9

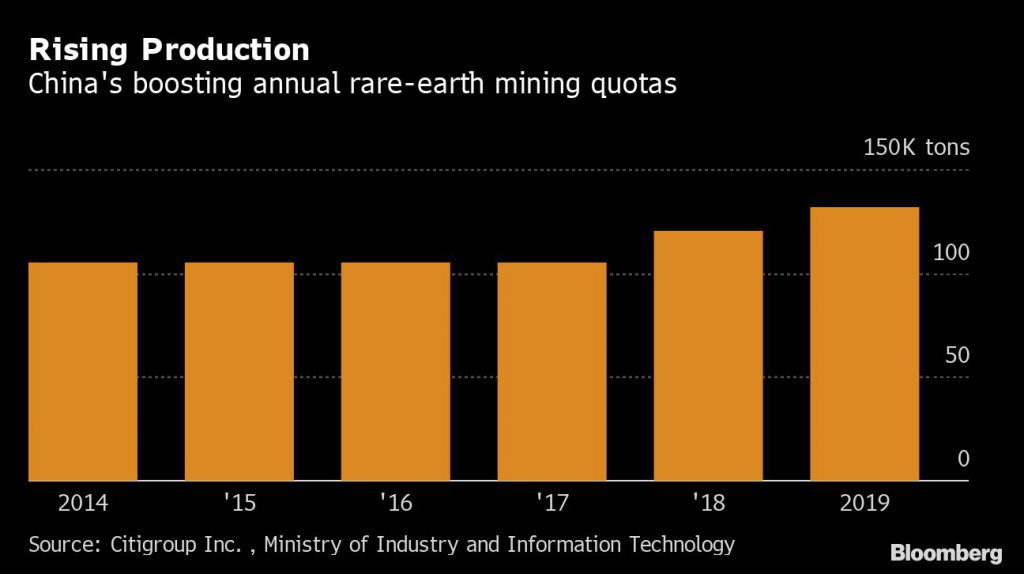

Lynas close to securing funding for rare earths plant in the US

Australian rare earths miner Lynas Corp (ASX: LYC) and its United States-based partner Blue Line Corporation are fine-tuning funding plans to build a rare earths plant in Hondo, Texas.

Lynas, which controls just over 10% of the global rare earths market, signed in May a memorandum of understanding with Texas-based Blue Line to set up a rare earths separation facility in the south-central state.

Funding details are expected to be unveiled by the end of February, chairman Mark Harding said at the company’s general meeting held on Tuesday.

The facility would be the world’s only large-scale producer of separated medium and heavy rare earth products outside of China, which currently accounts for 70% of global production. Beijing also controls 90% of a $4 billion global market for materials used in magnets and motors that power phones, wind turbines, electric vehicles and military devices.

Lynas, the only major rare earths producer outside China, currently ships the ore it mines in Western Australia to its processing plant in Malaysia. The facility not only does not have heavy rare earths separating capacity, but also continues to face challenges rooted in concerns expressed by the Malaysian government over low-level radioactive waste produced at the plant.

The company’s six-year-old facility in the country — known as the Lynas Advance Material Plant (LAMP) — has been the cause of ongoing tension between Kuala Lumpur and the Sydney-based miner.

LAMP was the centre of relentless attacks from environmental groups and local residents while under construction in 2012. They feared about the impact the low-level radioactive waste the refinery generates could have on the health of those living nearby, and to the environment.

Scrutiny escalated last year, with the Malaysian government setting a committee to review Lynas’ operations. Chief executive Amanda Lacaze raised concerns about the impartiality of a couple of committee members, as both are known for being long time opponents of having the refinery located in Malaysia.

In December, the country ordered Lynas to remove 450,000 tonnes of radioactive waste stockpiled at its processing plant by Sept. 2., when the company’s licence was up for renewal.

The miner was granted six-month licence renewal — shorter than the usual 3 years — under a number of conditions, including identifying Malaysia-approved site for a permanent disposal of low-level radioactive waste Lynas generates. Alternatively, the company would have to secure official written approval from a recipient country willing to take the waste, said the country’s Atomic Energy Licensing Board (AELB), an agency under the Ministry of Energy, Science, Technology, Environment and Climate Change.

With Washington and Beijing locked in trade talks, there were fears that China may restrict access to the materials. Instead, the nation has been bulking up, threatening efforts in the US and elsewhere to undercut the Asian giant’s dominance in the rare earths market.

Last year, the world’s second largest economy produced about 120,000 tonnes of rare earths, while the totals of the next two leading producers — Australia and the US — were 20,000 and 15,000 respectively.

Not so rare

Despite their name, the 17 minerals grouped under the rare earths label are not rare. According to the US Geological Survey (USGS), they are roughly as common as copper. But, because rare earth ores oxidize quickly, extracting them is both difficult and extremely polluting.

In the past three months, The Trump administration has stepped up efforts to ensure the supply of critical minerals from outside China. As part of those initiatives, it recently signed a memorandum of understanding with Greenland to conduct a hyper-spectral survey to map the country’s geology.

Washington has also gained the support of Australia, which has committed to facilitate potential joint ventures to improve rare earth processing capacity and reduce reliance on Chinese rare earths. The mineral agencies of the both countries signed last week a research agreement to quantify their reserves of critical mineral reserves.

from MINING.COM https://ift.tt/2KTqHEO

De l'eau dans les oreilles ? Ne secouez pas la tête !

from Les dernières actualités de Futura-Sciences https://ift.tt/2KTAVF6

Samsung pourrait abandonner son lecteur d'empreintes

from Les dernières actualités de Futura-Sciences https://ift.tt/2Omv2CQ

Starlink : les satellites de SpacceX gâchent une pluie d'étoiles filantes et agacent les astronomes

from Les dernières actualités de Futura-Sciences https://ift.tt/37GRxtt

Découvrez les promotions du Black Friday Cdiscount

from Les dernières actualités de Futura-Sciences https://ift.tt/2DkJKUg

Plus de 40 % des Français se sentent stressés au travail

from Les dernières actualités de Futura-Sciences https://ift.tt/2QSQf96

Identifier un suspect avec 1 cm de cheveu et sans ADN, c'est possible !

from Les dernières actualités de Futura-Sciences https://ift.tt/2QROwkk

Le safran améliore l'efficacité des antidépresseurs

from Les dernières actualités de Futura-Sciences https://ift.tt/2qL99E5

L’océan pourrait fournir six fois plus de nourriture

from Les dernières actualités de Futura-Sciences https://ift.tt/2pWjHjq

Iman, la dernière rhinocéros de Sumatra en Malaisie, est morte

from Les dernières actualités de Futura-Sciences https://ift.tt/33lEz14

Manger bio est-il vraiment meilleur pour la santé ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2OMINcK

lundi 25 novembre 2019

Le réchauffement climatique rend El Niño de plus en plus puissant

from Les dernières actualités de Futura-Sciences https://ift.tt/35AX4A5

Interview: Tocqueville’s Hathaway sees ‘tremendous opportunity’ in gold equities

John Hathaway, chairman of Tocqueville Management Corp. and co-manager of the Tocqueville Gold Fund, joined Anthony Vaccaro, The Northern Miner Group publisher, at the November 2019 Precious Metals Summit in Zurich to discuss the state of the gold investment space. The following is an edited transcript of the interview. The full video is available here.

Anthony Vaccaro: You have had 25 years as a leading investor in the precious metal space and your investment career started in the 1970s. What can history teach us about where we are in the gold equity cycle?

John Hathaway: Gold stocks have been laggards since 2011 [compared to the S&P 500 Index], and by a huge factor. That suggests to me that we are more in a buying range than not. On the other side of it, stocks look very high. They are expensive. They have been driven by monetary policy and zero interest rates, etc. This is the widest gap between the gold mining complex and the S&P 500 in about 25 years. And to me, it smells of opportunity.

AV: My understanding is right now market breadth is extremely narrow, but price averages are near all-time highs. That is a bit anomalous. Are there other points in history where you have seen this happen, and how did that play out?

JH: Yes. In the early 1970s, there was a phenomenon of the Nifty Fifty, which were the 50 stocks anointed by JP Morgan. In those days, I worked with a firm called Spencer Trask, which was one of the gurus behind these growth stocks. The investment thesis was that it never mattered what you paid for growth because growth would always bail you out.

And, in fact, we called them “desert island stocks” because you could go to a desert island for 20 years, and you would come back, and your portfolio would be just fine. They were also called “one-decision stocks,” because all you had to do is buy them. The problem was it was the wrong decision. You should never have owned them in the first place.

Back then it wasn’t at the scale that we have today. But there was a kind of a mania and the market averages were propped up by these 50. They were such stalwarts as Avon Products, Polaroid, Eastman Kodak and Simplicity Pattern. Those four come to mind. Most of them are not even around today. So had you been on a desert island and then come back, even 10 years later, your portfolio would have been obliterated.

This is not to disparage Amazon or Facebook or any of these investment darlings, but what we’re seeing today in market behaviour is investors crowding into a smaller and smaller number of stocks. And we’re starting to see them come apart one by one. Amazon is still doing OK. Google is probably doing OK, and Facebook, in terms of stock performance. But we’re starting to see, one by one, they’re getting picked off. And certainly, you see the unicorns like WeWork getting obliterated, and Uber and so forth.

It’s very similar to what we saw in the behaviour of the market in 1974. History rhymes and there’s a repeat factor. And that’s where we are today. Beneath the surface, you see a lot of termites at work. And the market breadth isn’t that great. This quarter, FactSet is reporting a decline across the board in earnings, a little over 2%.

AV: Another metric that has come up is on initial public offerings (IPOs). Roughly 75% of IPOs this year have had negative earnings. The number was very high last year. Again, with this idea of history rhyming, when is the last time we have seen those levels of negative earnings?

JH: It’s reminiscent of the dot-com bubble. I love the metrics, like WeWork’s metric was “community-adjusted earnings before interest, taxes, depreciation and amortization (EBITDA),” whatever that is.

AV: What is that?

JH: I don’t know. Even the SEC wouldn’t let that go through. This is reminiscent of the dot-com bubble.

AV: A big topic here is generalist investors and what it’s going to take for them to come back to gold. Some leading luminaries in the investment space are saying positive things about gold, such as Ray Dalio, David Rosenberg and Rick Reade from Blackwater. But we still haven’t seen that move in terms of a healthy revaluation of gold equities. Why not?

JH: I can think of a couple of reasons. One is that there is probably still a hangover from the bad experience investors have had, going back to the peak in 2011, about corporate governance and capital allocation decisions. The industry is far better today on those counts than it was in 2010 and 2011.

A second thing is that these stocks have been in hibernation for a long time. And we’re [Tocqueville] probably one of the last men standing in terms of active management in this space. Exchange-traded funds (ETFs) and passive management have been a factor. One of the things it suggests to me is that the flows in and out of the precious metal stocks are enabled and abetted by the availability of an instrument like GDX [VanEck Vectors Gold Miners ETF].

And so investors, if they are generalists who want exposure here, don’t have to do any homework on the underlying companies. And what we have noticed as generalist investors, as value investors, is a huge valuation gap between the big-cap names such as Newmont, Barrick, Newcrest and Agnico. Those are four that come to mind. They probably account for 35–40% of the weighting in GDX.

There are obviously other names represented, but if you go down the scale to the mid- and smaller-cap companies, it is not hard to find companies with valuations that are in the single digits in terms of multiple enterprise value to EBITDA, many of them generating free cash flow. I’ve been doing this now for 20-plus years, and I don’t remember any time when you could find those kinds of values.

There was a time in the late 1970s when you could find very good quality companies trading at single-digit price-to-earning multiples with dividend yields that were 3% to 5%. We don’t have that in the gold mining space, but you’re beginning to see companies pay dividends. But the value proposition today, the big cap stocks to me are cheap relative to gold. But beneath the surface, the mid- to smaller-cap stocks are even cheaper.

And, again, it spells tremendous opportunity. If I were a generalist, which I’m not now, but I would have looked at this. But the problem is that gold has gotten a stigma. And certainly, to be supportive of it within an investment discussion in a large generalist firm, you immediately isolate yourself. If you recommend a stock like Facebook to your peers and clients, and the stock goes down, you’re fine because everybody else is doing it. But if you recommend — let’s take one of our favourites — Torex to your peers and colleagues and it goes down, you could be out of a job. Because gold is the third rail of investment ideas. And all of this feeds into why the stocks are cheap and why the opportunity today, as a generalist contrarian, is the best I have seen it since I have been at this.

If you look at the earnings revisions this year for the largest 20 S&P companies, on the left-hand side of the chart, at the beginning of the year, it’s a steady path downward. But if you look at the earnings revisions for the gold mining firms, it’s a steady path from the left-hand side of the page to the right-hand side upwards. And they kind of cross over.

Earnings for gold mining companies are going up. The gold price is higher. Costs have been relatively contained. And the sell-side analysts have generally been scrambling to up their estimates. It’s a phenomenon where nobody seems to take notice. I mean, even though the stocks are up, well into the 20% to 30% area, they’re still way behind where they ought to be, given where the gold price is.

AV: If the general investors don’t take notice, then rival executives might be taking notice. Let’s turn to mergers and acquisitions (M&A). Fifty percent of iron ore production comes from just four companies. Fifty percent of copper production comes from just 10 companies. But 45% of gold production comes from 25 companies. When you hear stats like that, is there still more M&A needed in the gold sector?

JH: The M&A that we’ve seen lately has been mergers of equals. Barrick gets together with Randgold. Newmont gets together with Goldcorp. I’m not saying they’re equal, but they are big mergers with not a lot of incremental value add for the shareholders of either company, and it will all work out over time.

Once the dust settles when these large companies sort out their portfolios and probably divest a couple of their mines or reconfigure into different companies, you will see M&A where you have a good deal of accretion not only for the company being bought, but for the acquiring company.

Mine lives in the mining industry are the lowest in three decades. And so they’re running out of headway for future production. We have seen big cutbacks in exploration and development. The spend is down. You certainly see within the mining companies a lot of termination and cutbacks on mining, on exploration.

We also have seen that it’s so much harder today to put a new mine into production because of barriers from environmental, social and corporate governance kinds of things, and the reluctance of investors to fund the business. Because most of the funding now comes from streaming companies and very little in the way of bought deals, like what I remember 15 years ago. The capital just isn’t there to build a couple of billion-dollar new mines. We’re on a glide path lower, in terms of production for the industry.

At some point there will be a wake-up call, and that will come about because of higher prices in the metal. And these companies know it. Any CEO of a large company would agree with everything I have said. But they are still hiding under their desks and looking at life with a rearview mirror in terms of taking advantage of the situation. This is the time to be a buyer. They’re very good at selling low and buying high. Don’t write that down [audience laughs]. But today you can buy an existing property that’s producing earnings and cash flow at a 35% discount to what it would cost you to start from scratch. This, obviously, is going to vary across the board, but it’s that kind of discount.

M&A would be, obviously, accretive, the premium, to the target company. But it could also be accretive to the shareholders of a major making that acquisition. This is a time to be a buyer. But what are they doing? They’re assuming reserves at US$1,200 an ounce, and very little makes sense at US$1,200 an ounce. They’re not going to make any acquisitions. And then they will bump it up. And sooner or later, the investors, shareholders and the investment banking world will be all over them to make deals, and they’ll cave in at higher prices.

Our strategy has been to position these — in many cases — single-asset companies that are penalized because of the headline risk for a single-asset company. The best example today is Semafo in Burkina Faso. It’s a terrible situation, but it’s a great mine. The company generates free cash. They have to fix it, and it will get fixed. But, in fact, if Semafo was held in a larger company that had seven or eight mines, sure it would hurt the stock, but it wouldn’t get the sort of dramatic, drastic reaction by investors to these, admittedly, very, very bad events.

We see many opportunities like this and they’re not necessarily in a difficult place like Burkina Faso. They’re in the U.S., Canada, Mexico. Almost any place I mention — other than the U.S., Canada or Australia — will be thought of as having some sort of headline risk. And if you’re a single-asset company outside of those three jurisdictions you’re penalized. And there are some companies, even in good jurisdictions, which have the same discount.

When you look at when gold was trading below US$300 there were different issues, the hedging was one thing. There was similar value — but not as good as there is today. And investor interest was absolutely zero when we started our gold fund in 1998, as it is today. There are many things that can change. But what you can see for sure is that the valuations back in 1998–1999 — and the valuations today — will change for the better right across the board, big companies, small companies. And we can only guess at what the reasons are.

But you have to start with the premise that the gold price is on a rise to higher levels, and I’m not talking about US$1,700 or US$1,800. Most people think in those terms, but I was on a panel with David Rosenberg at the Precious Metals Summit in Beaver Creek, and David thinks, “Look, bonds have hit a cycle high, stocks have hit a cycle high in terms of valuation, and gold hasn’t.” Would it surprise him for gold to hit US$3,000? He said, “Absolutely not.” And he is not a gold bug. He is a very rational economic analyst, and he is looking at all the things that I can see and he sees them more clearly than I do, as to where we’re headed from a macro point of view. And the outcome to me is very, very friendly for the gold price.

I wish I had a time frame, but it’s years, it’s not tomorrow. Generalist investors will come back because the space will do well in terms of earnings and cash flow. And then they will discover, “Well, gee, these companies have been adding value, even though it isn’t reflected in their share price.” And then you’ll see the sell-side get more on their side and they will abandon their role as handmaids to the investment bankers and actually pick stocks — which they are not doing now. And so all of these things will take place over a period, maybe even a full decade. But we’re in an upcycle in this space and we’re still at the very early stage where people are super skeptical, and maybe largely because it’s the third rail of investment ideas.

AV: Your fund has held Newmont. What are your feelings about the merger with Goldcorp, the deal logic there and how it has played out?

JH: I like Newmont. We have always held it. We have funds that require daily liquidity, and so we need to have some measure of names like Newmont that are liquid because you have to worry about the potential for redemptions. We don’t own Barrick right now, but I would consider that to be one if we had inflows, which we haven’t.

But our weightings in something like Newmont are a fraction of what they are for GDX. We have no weighting in Barrick. On the other hand, our weighting in Torex or Detour Gold is something like four, five, maybe even six times of its weighting in GDX. We’re so skewed to the mid and smaller-cap names, where the value exists and where you would potentially get much more of a lift from a better assessment by the mainstream investor of investing in precious metals.

Sure, Newmont would be a good stock, and it will be. And Barrick will be good, and Newcrest. And we own Newcrest probably more than the other two, and Agnico and so forth. But where you really stand to get outsized returns is beneath the surface. And again we’re one of the very few firms that’s doing that. Now that we are joining Sprott, we have amplified research ability to due diligence, a lot of these kinds of things. We’re going get even more skewed towards that strategy.

AV: We have seen Barrick and Kirkland Lake increase their dividend. Newmont not yet. Is that the sort of thing that we’re going to see more of to get the love back?

JH: Absolutely. And they can because they’re generating cash. Two years ago nobody would have dreamed, particularly in the executive suites of the gold mining industry, that we would even be at US$1,400, much less knocking on the door of US$1,500. And the industry has tamped down operating costs. The all-in sustaining cost of mining has been relatively flat for the last three or four years. And when you get a break out in the gold price, your margins go wide and you start to gush cash. And they’re starting to bump dividends — exactly what they should do.

AV: You have alluded to some of your larger positions: Detour, Torex, Wesdome, Pan American Silver, MAG Silver. Can you talk a little bit about the key factors that led to those investment decisions?

JH: Every one was different. In our mind, Detour was a very underperforming asset, and we got involved in a proxy battle with the incumbent board. Paulson & Co. led the charge. We maintained cordial relations with the outgoing group. But it was clear to us that the asset was underperforming. And by the way, that’s a trophy asset. It’s a 20-plus-year mine life in Canada. Low grade to be sure, but a big land package and the possibility for much more discovery.

The headquarter count, at the time of the changeover of the board, was something like 40 to 50 people. This is in Toronto, very nice offices in Toronto — that always makes me suspicious. They’re down to 15. They brought in a good new board. They have a new CEO who is a tough-as-nails operating guy. They were paying hundreds of millions to outside contractors. Now they have cut way back on that. And the operating costs of the asset have gone down substantially. They are generating free cash, and their debt has paid down substantially.

We’re only halfway there … in terms of where they could get. Just internal things like better equipment availability and less turnover of key mine people. It just all adds up. On its own the stock has the potential to double from here without a takeout. But sure as shooting, going back to this wind down of reserves and industry production, that is a trophy asset, and it’s beyond me why somebody hasn’t figured it out by now. But they will, and I’m happy to own it without a takeover right now because there’s enough on the way of internal improvements that will carry the stock higher. But our exit strategy here, maybe two, three years out, is going to be a takeover at a big premium to where the stock is trading, hopefully, twice where it is now.

AV: What about Pan American Silver?

JH: Terrific company, smart management. They’re generating free cash and paying a dividend … there are three things.

First, they had a big discovery at La Colorada, an existing mine, but a different mining structure, a different geological structure. It will be a separate mine. They will announce preliminary reserves I think in December. And that’s here and now, but I don’t think sell-side investors have figured it out. I don’t think even most investors have. But this is like another mine, and it’s right on an existing asset that they own. Even they didn’t know about it two years ago. So that’s a big plus.

Then they took over Tahoe, a silver mine [Escobal] in Guatemala, which had been operating, but then was shut down because Tahoe’s management lost the social licence. Lots of bad things about Guatemala, but not beyond being fixed. And that mine could generate, I believe in terms of tax revenue to the government, 5% of gross domestic product. It’s too big for the Guatemalans not to have a self-interest. And Pan American management is essentially Latin-based, even though they’re from Vancouver. They’ll do a way better job working with all the local, federal and state authorities in Guatemala, and the community. The community actually wants this to happen to get it back and running.

And last there’s their asset in Argentina. Of course, it’s Argentina, so you’re not paying anything for it. But one day Argentina won’t be as bad as it is now. That’s another blockbuster type of development that might be five, seven, 10 years away, or maybe never. But it’s there in the portfolio, and it would move the needle dramatically.

So here’s a stock that trades at a low valuation. It’s not a takeover candidate. I think of this more as a management group, which is very skilled. They’re zigging while everybody else is zagging. They’re taking advantage of the landscape, as they did with Tahoe, to take advantage of a distressed situation. They knew it would be a while before they could get Guatemala back up and running. But part of our thesis is that not only will companies be taken over, but there are smart management groups that will take advantage of a situation when very few other people are.

from MINING.COM https://ift.tt/2KR9JqQ

Endeavour announces 32% resource increase at Houndé

Africa-focused gold producer Endeavour Mining (TSX: EDV) announced on Monday a one-million-ounce indicated maiden resource for the Kari West and Kari Center discoveries at its Houndé mine in Burkina Faso.

As a result, measured and indicated resources at Houndé have increased by 32% from 3.1 million ounces (44.7Mt at 2.18 g/t Au) to 4.1 million ounces (64.1Mt at 2.01 g/t Au), excluding 2019 depletion. This resource increase is in addition to the previously announced indicated maiden resource at Kari Pump, increasing the total indicated resource for the discoveries at the Kari anomaly to two million ounces.

The maiden resource delineated at Kari West and Kari Centre exceeded the company’s expectations, says Patrick Bouisset, executive vice president of exploration and growth at Endeavour Mining.

“Due to a low strip ratio of roughly 6:1, we were able to delineate more ounces, increasing the total for Kari West and Kari Centre to one million ounces at a grade of 1.61 g/t Au based on a cut-off grade of 0.5 g/t Au,” Bouisset stated in Monday’s press release.

“The resources at Kari West and Kari Centre were both discovered at an industry-leading low cost of $15/oz, underscoring why investment in exploration continues to be a key strategic priority for Endeavour as we build a sustainable business and deliver long-term value for our shareholders,” president and CEO Sébastien de Montessus added.

Endeavour has drilled over 350,000 metres in the Kari area in less than two years, successfully delineating two million ounces during that time span. The company intends to begin another 145,000-metre drill campaign shortly, which will focus on extending the mineralization of the Kari discoveries and testing other nearby targets located within 10 km of the processing facility.

from MINING.COM https://ift.tt/2OIBbIj

BHP becomes Ecuador-focused SolGold’s largest shareholder

World’s largest miner BHP (ASX, LON, NYSE:BHP) has increased its stake in Australian miner SolGold (LON:SOLG) (TSX:SOLG) to 14.7% from 11.1%, which boosts its exposure to copper, one of the key metals for the world’s green initiatives.

The mining giant said on Monday it had paid 17.1 million pounds ($22 million) to raise its interest in SolGold, a move that makes it the Ecuador-focused company’s top shareholder. Such position was held until today by Australia’s largest gold producer, Newcrest Mining (ASX: NCM).

The deal, which also gives BHP options to purchase another 19.25 million shares by 2024, stipulates that it won’t acquire further shares for two years without SolGold’s consent.

SolGold’s flagship project may become one of the largest copper-gold porphyry systems ever discovered.

The rising mine developer has attracted a flurry of interest from big industry actors eager to increase their exposure to copper. The highly conductive metal is in high demand for use in renewable energy and electric vehicles, but big, new deposits are rare.

SolGold’s Cascabel copper-gold project is one of those exceptional finds as it has the potential to become one of the largest copper-gold assets ever discovered with an estimated productive mine-life of 55 years.

Recent recoveries at the project, located in in northern Ecuador, could add $8.7 billion of revenue over the life of Cascabel, the company said in October.

SolGold is also studying 13 other priority targets in the Andean nation, according to a presentation delivered this month.

From Hotspot to Producer

Ecuador, the new darling of copper prospectors, expects to attract $3.7 billion in mining investments over the next two years, up significantly from the $270 million it received in 2018.

The country is moving forward with plans to move from an explorers hotspot to mining exporter as its only large-scale copper mine readies to ship its first large cargo this month. The $1.4 billion Mirador open-pit mine, which opened in July, is owned by a joint venture of Tongling Nonferrous Metals Group and China Railway Construction (EcuaCorriente),

Canada’s Lundin Gold (TSX:LUG), which has been developing its Fruta del Norte gold-silver project for almost two years, has produced its doré and gold concentrate, and is on track to beginning commercial activities in the second quarter of 2020.

Other than Cascabel, another three major copper projects are due to be in production by 2024: Lumina Gold’s (TSX-V:LUM) (OTC:LUMAF) Cangrejos and Codelco-Enami Ecuador’s Llurimagua mine.

from MINING.COM https://ift.tt/2QMXLSC

Les données de 4 milliards de comptes personnels sont stockées sur ce serveur

from Les dernières actualités de Futura-Sciences https://ift.tt/2Dj9bWc

Black Friday Canon : les promos de l'édition 2019

from Les dernières actualités de Futura-Sciences https://ift.tt/37vEhbj