samedi 29 février 2020

Ce poisson peut mettre sa vie en suspens plusieurs mois !

from Les dernières actualités de Futura-Sciences https://ift.tt/2I2yEG3

Cette comète créera-t-elle la surprise au printemps ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2vcsP6b

Prothèse de main : vers des mains robotiques plus intelligentes ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2VySS2a

DS présente Aero Sport Lounge, un SUV électrique dérivé de la Formule E

from Les dernières actualités de Futura-Sciences https://ift.tt/32CJfAI

Mars tremble : révélations sur les entrailles de la Planète rouge

from Les dernières actualités de Futura-Sciences https://ift.tt/2T49ddj

vendredi 28 février 2020

Entrez dans l’hôpital du futur

from Les dernières actualités de Futura-Sciences https://ift.tt/2voSDMc

Lydian wins another favorable court ruling in Armenia

Lydian International made further progress in the proposed restart of its controversial Amulsar gold project this week, as the Administrative Court of Armenia has ruled in favor of the company and invalidated eight out of ten findings made by Armenia’s environmental and mining inspection body in August 2018.

The latest court decision comes just one week after the company was granted a water permit by the ministry of environment for the project. The permit would allow Lydian to draw water from the Arpa River at a rate of 11 l/s.

At that time, the inspection body completed its investigation at the Amulsar project and declared that Lydian was in breach of ten Armenian legislative requirements, including that the company had engaged in illegal mining activities during the construction phase of the project. Lydian vigorously disputed the findings and alleged that the head of the inspection body was biased.

“This is yet another instance where the judiciary in Armenia have recognized Lydian’s legal compliance”

The Investigative Committee of Armenia commenced a criminal case against Lydian in August 2018 based on the inspection body’s findings. The Administrative Court decision establishes that Lydian’s construction activities at the project did not constitute illegal mining. The company has continuously maintained that there was never any proper basis for commencing the criminal investigation.

The court also invalidated a decision by the former head of inspection, Artur Grigoryan, who rejected an administrative appeal brought by Lydian before the inspection body. The court found that Grigoryan had been actively engaged in anti-Amulsar activities prior to his appointment to the inspection body, which raised reasonable doubts on his objectivity when rejecting Lydian’s administrative appeal.

Other findings invalidated by the Administrative Court included allegations of newly found “red listed” plant and animal species, illegal disturbance of agricultural land, and non-permitted atmospheric emissions. Those findings were determined to be baseless, Lydian asserted.

The remaining two findings the Administrative Court did not invalidate were recommendations to improve documentation and annual statistical reporting.

The inspection body has 30 days to appeal the Administrative Court ruling.

“This is yet another instance where the judiciary in Armenia have recognized Lydian’s legal compliance. In several previous rulings, Armenian courts have found that Lydian’s legal rights to operate have been unlawfully impeded,” Lydian president and CEO Edward Sellers said in the company’s official statement.

“Lydian has suffered serious financial losses as a result of illegal activities that the government of Armenia has not curtailed. The actions and inactions of the government continue to negatively impact all of Lydian’s stakeholders, including hundreds of employees, contractors and suppliers, as well as thousands of shareholders and investors.”

from MINING.COM https://ift.tt/2VvRNbm

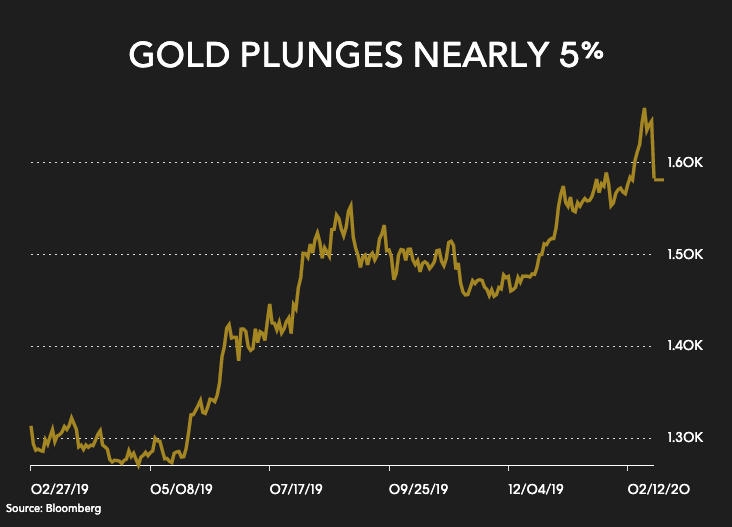

Gold price extends losses – down $78

Gold’s reputation as a safe haven in times of financial turmoil was tarnished on Friday as the growing panic about the spread of coronavirus infections outside China saw the precious metal suffer one of its worst one-day drops on record.

Gold gapped down at the open on the Comex market in New York and kept declining to trade near its low of $1,564.00 an ounce mid-afternoon, down $78 or 4.8% compared to Thursday’s close.

More than 68m ounces of gold for delivery in April had changed hands by mid-afternoon. On Monday gold hit a seven-year high within shouting distance of $1,700 an ounce and remains up more than $40 year to date.

The carnage

Today was the biggest intra-day drop in the price since April 15, 2013 when gold was also trading in the mid-$1,500s. Gold ended that day more than $87 below the previous closing – and never recovered on its way to $1,050 an ounce three years later.

In that session 10 million ounces traded within 30 minutes described as a “shock and awe” trading strategy by a short seller.

Gold hit a record $1,909 an ounce intra-day on 23 August 2011, but the next day suffered one of its few triple digit one-day losses when it plummeted $105, ending the week down more than 10% from the all-time high.

Adjusted for inflation, gold’s highest price point ever was on January 21, 1980 when the precious metal hit $850 only to plunge the very next day to $737.50, a 13% fall.

The biggest fall in percentage terms came in February 1983, when the yellow metal fell from $475 to $408.50 over two days, a 14% decline.

from MINING.COM https://ift.tt/2PAkPTr

Nevsun loses attempt to stop Canadian lawsuit over alleged forced labour in Eritrea

Nevsun Resources (TSX, NYSEMKT:NSU) has lost its bid to have Canada’s Supreme Court throw out a lawsuit by workers who say they were forced to work at the company’s copper-zinc Bisha mine in Eritrea, East Africa.

In its judgment, the Canada’s top court determined that the plaintiffs’ claims may continue, Nevsun said. The miner added that the question of whether the claimants will be allowed to sue the company for breach of customary international law will be determined by the trial judge.

The legal action, filed in November 2014, alleges the Vancouver-based company developed its flagship gold mine in partnership with the military dictatorship of Eritrea. Central to the case are allegations that Nevsun engaged Eritrean state-run contractors and the country’s military to build the mine’s facilities and that the companies and military deployed forced labour under objectionable conditions.

More to come…

from MINING.COM https://ift.tt/2PxNRmp

Dix minutes dans la nature pour diminuer le stress des étudiants

from Les dernières actualités de Futura-Sciences https://ift.tt/2I2U59I

Nefertiti repose-t-elle à côté de Toutankhamon ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2I4Sf8p

Les goélands préfèrent la nourriture touchée par les êtres humains

from Les dernières actualités de Futura-Sciences https://ift.tt/2VuhIQH

Mining tycoon Andrew Forrest ups stake in Fortescue

Mining billionaire and philanthropist, Andrew Forrest, has swooped down on more than 22 million shares in the company he founded, Fortescue Metals Group (ASX: FMG), the world’s fourth largest iron ore miner.

Forrest, who paid A$242.9 million ($160.2 million) for the shares, now has a 35.3% stake in the company, which last week reported its profit had more than tripled in the six months to December, exceeding market expectations.

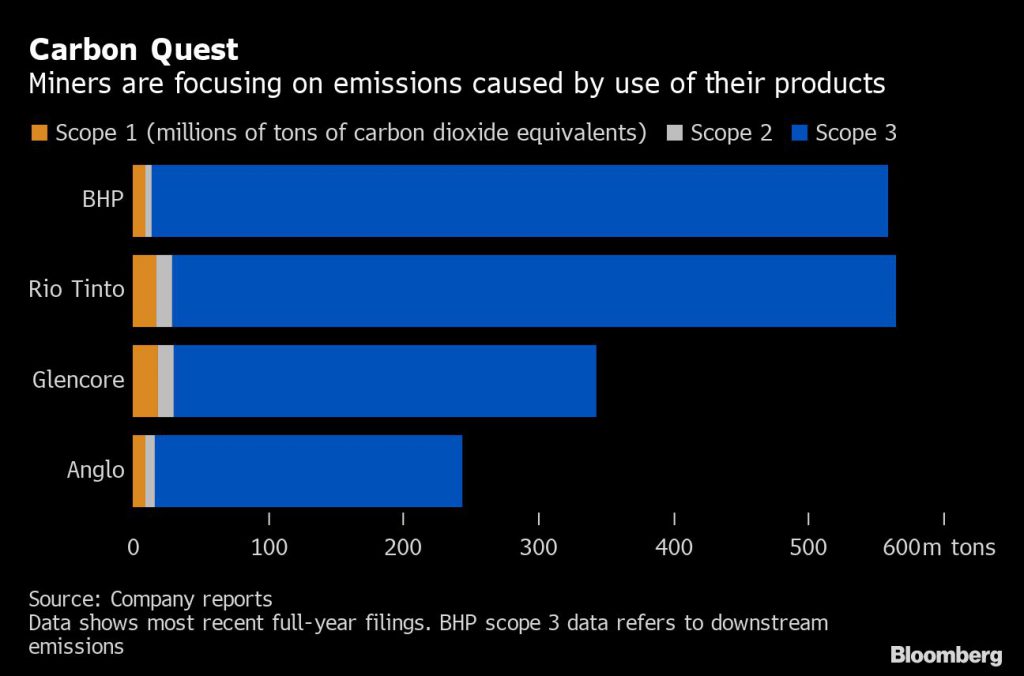

He bought 22.1 million shares on top of the 1.09 billion he already owned, which represented a 35.3% stake.

The mining magnate said his decision was partly driven by Fortescue’s commitment to community and environmental responsibility, which comes amid growing investors and public pressure for miners to lower emissions.

“The company believes carbon neutrality must be achieved as soon as possible and is investing in practical initiatives that reduce or eliminate emissions, like solar and hydrogen energy, that are and will make a real difference to carbon reduction,” he said in a statement on Friday.

Forrest highlighted the company’s efforts to move away from diesel for power generation. Unlike BHP, however, Fortescue has refused to set a target to reduce so-called “Scope 3” emissions — those produced when customers burn or process a company’s raw materials.

The world’s major iron ore producers are responsible for some of the largest volumes of end-use emissions globally, equivalent to those of the very biggest independent oil companies.

Producing a tonne of steel from iron ore releases almost as much carbon as burning a tonne of coal for energy. Globally, the steel industry accounts for about 2.8 billion tonnes of annual emissions, compared to 10.1 billion tonnes for thermal coal.

from MINING.COM https://ift.tt/399tp3c

C'est la plus puissante explosion observée dans l'Univers depuis le Big Bang !

from Les dernières actualités de Futura-Sciences https://ift.tt/2PzAAtP

Le grand astéroïde Vesta a eu une activité volcanique durant 30 millions d'années

from Les dernières actualités de Futura-Sciences https://ift.tt/2TphUOh

Admirez l’astéroïde Bennu en 3D

from Les dernières actualités de Futura-Sciences https://ift.tt/2PyCB9p

Full Metal interested in GSP’s Olivine Mountain property

Full Metal Minerals (TSXV: FMM) and GSP Resource (TSXV: GSPR) entered into an agreement pursuant to which Full Metal has the option to earn a 60% interest in GSPR’s Olivine Mountain property located in British Columbia’s Similkameen Mining Division.

According to GSP, following a 2018 airborne magnetic and TEM survey, and a 2019 exploration drilling campaign, several surface showings and targets within the property were identified and remain untested and warrant future exploration work

In a press release, the miners said that Full Metals may exercise the option by incurring in exploration expenditures of $500,000, making cash payments totalling $500,000 and issuing 250,000 common shares over the four-year option term.

Following the exercise of the option, Full Metal and GSPR will continue under a joint venture with the former holding a 60% interest and the latter holding a 40% interest.

The 3,021.87-hectare Olivine Mountain property is located approximately 25 kilometres northwest of Princeton, British Columbia.

According to the current owner, the property is underlain by rocks of the Tulameen Mafic/Ultramafic Complex which hosts two adjacent magnetite deposits, Lodestone Mountain and Tanglewood Hill, both less than a kilometre outside of Olivine Mountain’s boundary, and hosted within same geological formations found within the property.

Potential target metals include copper, nickel, platinum-group metals, cobalt, and gold.

from MINING.COM https://ift.tt/2ToPqEr

Yamana, Goldspot application of AI at Chilean mine pays off

GoldSpot Discoveries (TSXV: SPOT) issued a statement commending Yamana Gold (TSX: YRI; NYSE: AUY) for using machine learning technology to improve exploration targeting and contribute to meaningful increases in mineral resource inventory at its El Peñón mine in northern Chile.

In late 2018, Yamana partnered with GoldSpot to complete an exhaustive evaluation of historical mine data compiled by El Peñón, including extensive collections of geophysical data, drill information, and surface and sub-surface geochemistry and geology.

El Peñón is a high-grade, underground gold-silver mine with a 4,200-tonne-per-day agitated leaching /counter current decantation and Merrill-Crowe plant

GoldSpot worked closely with staff at El Peñón to create a predictive lithological map to identify new drill targets. The study provided a number of site-specific vein targets on surface and in the sub-surface core mine area that are being prioritized through follow-up sampling and mapping for drill testing in early 2020.

Recently, Yamana reported that El Peñón’s mineral reserves both replaced 2019 depletion and further increased such mineral reserves by 15% and 21% for gold and silver, respectively, as the result of positive infill drilling and mine design optimization. Measured and indicated mineral resources increased by 66% while silver increased by 70% compared to the prior year, due to the positive exploration results from numerous secondary vein structures in the east mine.

“The collaborative AI process undertaken with GoldSpot has allowed Yamana’s exploration team to leverage many years of multidisciplinary exploration data and is playing a significant role in the current exploration targeting process at El Peñón,” Henry Marsden, senior VP of Exploration at Yamana, said. “We are pleased with the progress that our partnership with GoldSpot has yielded so far and look forward to continued success.”

from MINING.COM https://ift.tt/2vq8Xwb

iPad Pro : Apple devrait présenter un clavier avec trackpad

from Les dernières actualités de Futura-Sciences https://ift.tt/2T5TD0Y

Newcrest extends footprint by Telfer mine with Antipa deal

Australia’s largest gold producer, Newcrest Mining (ASX: NCM) has inked a A$60 million ($40m) deal with Antipa Minerals (ASX: AZY) to explore the southern portion of the junior’s ground in the Paterson Province, the country’s new copper-and-gold hot spot.

Under the farm-in agreement, Newcrest will spend A$6 million exploring Wilki within the first two years, with Antipa to manage those activities.

Within five years of the deal, Newcrest can choose to spend a further $10 million on exploration, which will give it a 51% stake in the project, located close to its aging Telfer copper-gold mine.

The Wilki gold-copper asset is also close to numerous prospects discovered recently by juniors, including Rio Tinto’s touted Winu project.

The property is also close to numerous copper prospects discovered recently by juniors, including Rio Tinto’s (ASX, LON, NYSE: RIO) touted Winu project, said to have the potential to become the company’s next major copper mine.

Winu, expected to begin production in 2023, is not the only copper asset Rio is looking at. The world’s no. 2 miner is also working with Antipa Minerals in their joint Citadel project, located immediately next to Winu.

In January, Rio earned an initial 51% interest in the project after investing A$11 million and has now moved to the next stage, which will see spending an additional A$14 million to increase its stake to 65%.

The company has also applied for nearly 30 exploration licences in the Paterson province, known for its copper and gold reserves, but whose sandy soil and remote location has deterred explorers.

Rio’s move has sparked a stampede into adjacent lots by other explorers, who see the miner’s aggressive activity as an indicator of a highly promising find.

Newcrest’s initial exploration activity at Wilki is slated to start within the next four to six weeks and will include a field reconnaissance program, aerial electromagnetic, induced polarization and reverse circulation, as well as diamond core drilling.

Analysts see Newcrest’s renewed interest in the area as a sign that its time at Telfer might be coming to a close, as the gold major has been boosting its ground holdings and exploration efforts in the region.

from MINING.COM https://ift.tt/2I3a7R1

Le grand astéroïde Vesta avait une activité volcanique durant 30 millions d'années

from Les dernières actualités de Futura-Sciences https://ift.tt/2uH9dXu

Plongez dans les plus belles photos sous-marines de l'année

from Les dernières actualités de Futura-Sciences https://ift.tt/3aeaLHz

Patient bizarre : elle urine de l'alcool

from Les dernières actualités de Futura-Sciences https://ift.tt/2T6rGG7

Citroën Ami : 100 % électrique, très abordable, sans permis... Voici la 2 CV du XXIe siècle

from Les dernières actualités de Futura-Sciences https://ift.tt/32GJ9bC

Amarrage historique entre deux satellites à 36.000 km d'altitude !

from Les dernières actualités de Futura-Sciences https://ift.tt/2PuUbLq

Les ours polaires s’entre-dévorent pour survivre dans l'Arctique russe

from Les dernières actualités de Futura-Sciences https://ift.tt/2Too29v

jeudi 27 février 2020

Pourquoi certaines gouttes d’eau rebondissent et d’autres pas ?

from Les dernières actualités de Futura-Sciences https://ift.tt/32zstCy

ICA creates global standard for responsible copper

The International Copper Association (ICA) has announced its creation of the ‘Copper Mark,’ a global standard to ensure responsible production and trading of copper.

The ICA’s more than 500 global program partners bring together the copper industry to develop and defend markets for copper and to make a contribution to society’s sustainable-development goals.

Inspired by the United Nations Sustainable Development Goals, the Copper Mark is to be launched this year.

“For the copper industry, as well as for other extractive industries, proving responsible business practices is no longer a ‘nice to have’ but a commercial imperative”

Michèle Bruelhart, executive director, the Copper Mark

“For the copper industry, as well as for other extractive industries, proving responsible business practices is no longer a ‘nice to have’ but a commercial imperative,” Michèle Bruelhart, executive director of the Copper Mark said in a media statement.

“Businesses are expected to look beyond shareholder profit, and to make purpose and responsibility key parts of their mission and operations.”

The Copper Mark uses an existing tool, the Risk Readiness Assessment, to address 32 issue areas across environmental, social and governance (ESG) topics.

“In doing so, the Copper Mark seeks to improve practices across the spectrum of producers globally and covering all major areas of responsible production,” Bruelhart said.

The project’s next major milestone will be seen this year, with the launch of its formal application process. The organisation will begin accepting applications from copper producers (including mines, smelters and refiners) this year, while applications from copper fabricators are planned to be accepted within two to three years.

“The new measure seeks to monitor the performance of copper mines and refineries around the globe, assessed against responsible production criteria. Unlike other sustainability programs currently in place, the Copper Mark targets copper specifically,” said GlobalData’s Mining Technology writer Scarlett Evans.

“Copper has gained a reputation as the material of our future, and with countries doubling down on their eco-efforts, demand is set to spike in the coming years. Holding such powerful sway over the global energy sector, the need to legitimise the metal’s supply chain has never been more urgent.”

from MINING.COM https://ift.tt/2TltBWv

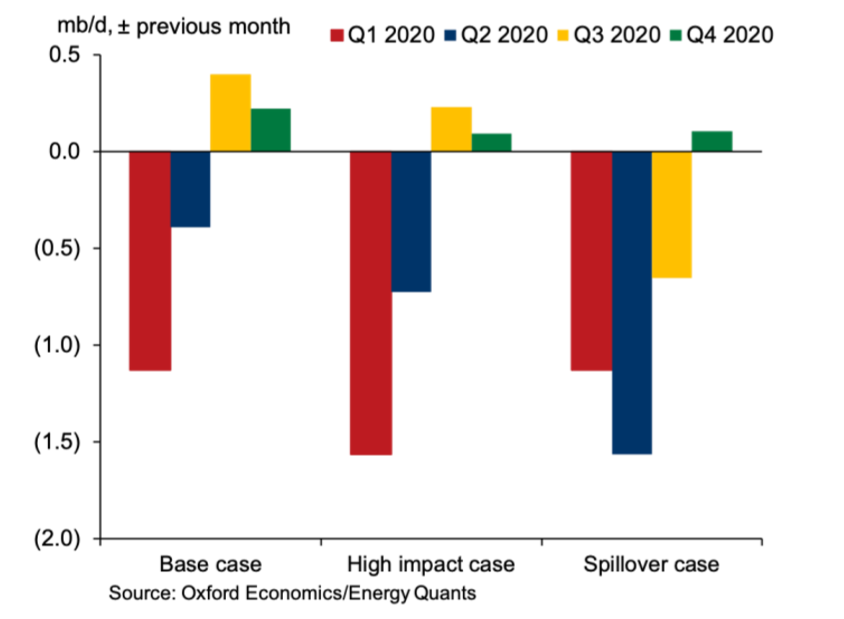

Crude market hit by coronavirus demand shock – report

The impact of the coronavirus has sent shockwaves across the oil market, says Oxford Economics, an independent global advisory firm.

In its latest publication, Oxford has lowered its year-over-year global demand growth forecast in 2020 to 0.72 mb/d from 1.09 mb/d previously. However, it still foresees a “fairly balanced” market for the year.

On the supply side, the firm expects the current OPEC+ output cut agreement to be extended to year-end, Libyan and Venezuelan outlooks to deteriorate further, and US shale output to slow.

Demand should recover sharply in the second half of 2020 as the knock-on effects on fundamentals from the coronavirus outbreak are confined to the first half. For 2021, the global balance remains unchanged at 0.2 mb/d surplus.

Given the current state of the crude market, Oxford estimates Brent to average $62.2/b in 2020 and $66.7/b in 2021, but demand-side risks that can drag prices down to the low $50/b range remain elevated in the near-term.

At their meeting next month, OPEC+ producers need to weigh with extreme caution the likelihood of severe demand risks materializing if the coronavirus is not contained soon, Oxford cautioned.

If OPEC+ were to delay their response to the second half of 2020, this would require the group to nearly double the recommended cut of 0.6 mb/d to sustain prices in the low $60/b range for the rest of the year.

from MINING.COM https://ift.tt/3a9SQBD

Un ancien tatou de la taille d'une voiture découvert en Argentine

from Les dernières actualités de Futura-Sciences https://ift.tt/2TnOTCy

Mars 2020 : faut-il avoir peur d'une contamination par un virus martien ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2T5oef0

Que nous réserve le Find X2, le nouveau smartphone d'Oppo ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2I1d5Wi

Canada backs Zijin’s acquisition of Continental Gold

Canadian miner Continental Gold (TSX: CNL) said on Thursday the country’s government had approved its C$1.4 billion ($1bn) takeover by Zijin Mining, China’s No.1 gold producer.

The deal, announced in December, has also received all three of the required regulatory approvals from China and is expected to close in the next ten days, The Toronto-based company said.

The takeover gives Zijin access to Continental’s main asset, the Buriticá gold project in north-western Colombia.

Takeover boosts China’s No.1 gold producer reserves of the metal to more than 2,000 tonnes, with output growing by nearly 20%.

The asset has measured and indicated gold reserves of 165.47 tonnes and an inferred reserve of 187.24 tonnes. Expected to begin operations next year, the mine will churn out 250,000 ounces of gold per annum on average over a 14-year productive life.

The acquisition of Continental is expected to boost Zijin’s gold reserves to more than 2,000 tonnes, with output growing by nearly 20%.

The Chinese gold, copper and zinc miner has been expanding its footprint by acquiring assets from Africa to Australia.

In November, Zijin announced it was buying partner Freeport McMoran’s copper-gold assets in Serbia for up to $390 million, substantially boosting its resources of both metals.

In 2018, it spent $1.26bn for a 63% in Serbia’s largest copper mining and smelting complex RTB Bor.

It also trumped Lundin Mining’s (TSX:LUN) earlier hostile bid for Canada’s Nevsun Resources, gaining access to yet another Serbian asset — the Timok copper and gold project. With the move, it also secured ownership of the Vancouver-based miner’s flagship operation, the Bisha copper-zinc mine in Eritrea.

The transaction increases the already large list of mergers and acquisitions to have swept the sector in the past year, kicked off by the highly publicized multi-billion mergers of Barrick – Randgold and Newmont – Goldcorp.

from MINING.COM https://ift.tt/386gs94

La sonde MMX rapportera des échantillons de Phobos, une lune de Mars

from Les dernières actualités de Futura-Sciences https://ift.tt/2vl1779

Fjordland, CanAlaska to join forces on nickel project in Manitoba

Fjordland Exploration (TSXV: FEX) executed a non-binding letter of intent with CanAlaska Uranium (TSXV: CVV) to be granted the option to acquire up to an 80% interest in CanAlaska’s wholly-owned Hunter and Strong properties, part of CanAlaska’s North Thompson nickel project in Manitoba, Canada.

Under the terms of the agreement, Fjordland can earn its interest by incurring in exploration expenditures that total $9 million, issuing 8,500,000 shares and making cash payments of $150,000 over a period of 66 months.

It is contemplated that a Joint Technical Operating Committee consisting of geologists from CanAlaska’s shareholder HPX, CanAlaska itself and Fjordland will be formed to plan and oversee exploration activities

The 18,685-hectare Hunter and Strong claim group is located 25 kilometres north of the Thompson mine operated by Vale S.A. Canada and 285 kilometres north of the city of Winnipeg.

In a media brief, the companies explained that CanAlaska has been exploring the Thompson Nickel Belt for the past several years and in 2017 commissioned Condor Geophysical Consulting to reprocess historic 2007 VTEM airborne surveys.

According to the miners, the review demonstrated 14 potential Ni-Cu-PGE exploration targets, of which six are considered a priority and had never been drilled by the former tenure holder, Falconbridge Nickel.

“The North Thompson Nickel Belt project meets Fjordland’s long-standing exploration criteria in that the high-quality work done to date clearly demonstrates large scale, drill-ready targets in a well-documented geologic setting,” Richard Atkinson, Fjordland’s president, said in a statement.

from MINING.COM https://ift.tt/2wSjG33

Mag One emerges as upcoming ‘green’ magnesium producer – report

Market analyst Roskill issued a report this week stating that Canada’s Mag One is rapidly emerging as “another upcoming ‘green’ magnesium producer, joining the ranks of Latrobe Magnesium (LMG) and Alliance Magnesium (AMI).”

According to Roskill, such an evaluation is based on the fact that Mag One has an exclusive worldwide licence for the Tech Mag technology, owned by Tech Magnesium, and the right to acquire full ownership.

Mag One has said that it will have a very low carbon footprint of 5-8t CO2/t Mg, compared to 18t CO2 for electrolysis and 26t CO2 for the Pidgeon process

With this technology, the Vancouver-based company is planning to kickstart a magnesium oxide and magnesium metal operation, which will be extracted from tailings (serpentine). To do so, the firm has signed exclusive agreements to source tailings from two former asbestos mines in Québec.

Mag One aims to move to production during 2020 at a plant in Asbestos, a town in southeastern Québec, that will produce 30ktpy of MgO (98.5% purity), 33ktpy of high-purity amorphous silica, and 5.2ktpy (dry basis) of iron-nickel residue.

The proposed plant will use the company’s proprietary pyrometallurgical process based on high-purity MgO to produce 99.9% magnesium metal in repeatable 5ktpy modules. The maximum production capacity seems likely to be less than 20ktpy as this is the limit below which environmental evaluation is not required.

Magnesium is 75% lighter than steel and 33% lighter than aluminium, qualities that make it desirable for automakers aiming to decrease the weight of their vehicles without sacrificing strength.

Also playing in favour of Mag One is the fact that, in Roskill’s view, it is doing well when it comes to finances.

“The company received a boost in January when it signed a definitive earn-in and operating agreement with Vancouver-based Blue Lagoon Resources to form a joint venture,” the report reads. “Blue Lagoon may acquire up to a 75% equity interest in Mag One by purchasing C$5.25M (US$3.96M) of shares in Mag One Operations. The funds invested by Blue Lagoon will enable Mag One to move from testing to larger-scale pilot plant demonstration. Also in January, it received a show of confidence in the form of an initial purchase order from steel giant Tata.”

from MINING.COM https://ift.tt/2vc3jxW

Rio Tinto to begin copper production at Winu in 2023

Rio Tinto (ASX, LON, NYSE: RIO) plans to ramp up development of its Winu copper-gold project in Western Australia, with first production expected in 2023.

The world’s No. 2 miner continues drilling and geophysical testing at the asset, which could be its next major copper project, and is progressing discussions with land owners to keep moving forward.

Chief executive officer Jean-Sébastien Jacques said on Wednesday that the company’s job was to create options, which it could progress to meet market demand.

“A great example of one is Winu, our copper opportunity in Western Australia,” he said.

The Winu copper-gold-silver discovery is about 130 km. from Newcrest’s Telfer copper-gold mine in the East Pilbara. It’s also close to numerous copper prospects discovered recently by juniors, and 350 km southeast of Port Hedland, the world’s largest bulk export port.

Rio has been investing heavily in copper in the past two years as it believes the market will soon go into deficit amid expectations that bigger power grids around the world and an electric-vehicle boom will boost demand, while supplies will remain constrained.

Chile, the world’s largest copper mining nation has echoed the company’s outlook. In January, the state copper commission, Cochilco, said the anticipated global shortage of the metal would materialize this year, reaching about 22,000 tonnes. The agency cited a consumption increase paired with falling volumes of copper scrap processing as the most obvious causes.

Chief financial officer, Jakob Stausholm, confirmed on Wednesday Rio’s focus on the red metal, noting that most of the exploration expenditure was going towards the commodity.

In the past, analysts have questioned the mining giant’s ability to scale up its copper business quickly without making an expensive acquisition, especially after facing challenges at key assets.

Rio had to delay first production from the $5.3 billion underground expansion of its Oyu Tolgoi copper-gold-silver mine in Mongolia. Originally scheduled for early 2020, it’s now expected to happen in the third quarter of 2021.

Rio also decided to sell its interest in the Grasberg mine in Indonesia, the world’s second-biggest copper mine, as part of a deal that put an end to years of disagreements between operator Freeport McMoRan (NYSE:FCX) and the country’s government.

The company seems be more interested in new discoveries. Last year, it invested a further $302 million to advance its Resolution copper project, in the US state of Arizona and has been advancing several other copper projects, such as the Citadel project with Antipa Minerals (ASX:AZY) in Western Australia, and Berenguela, in south-eastern Peru. It has also applied for exploration permits in northern Chile.

from MINING.COM https://ift.tt/2wKYGLo

Non, boire du lait de vache n'augmente pas le risque de cancer du sein

from Les dernières actualités de Futura-Sciences https://ift.tt/32xdfhv

Comment les tempêtes solaires perturbent les baleines

from Les dernières actualités de Futura-Sciences https://ift.tt/32vjGSl

Découverte d'un ancien fleuve gigantesque

from Les dernières actualités de Futura-Sciences https://ift.tt/2TmKiRc

Des interactions inconnues entre atomes observées pour la première fois !

from Les dernières actualités de Futura-Sciences https://ift.tt/32uzxQW

L’astrophysicien Jean-Claude Pecker nous a quittés

from Les dernières actualités de Futura-Sciences https://ift.tt/2PvHgcf

Volkswagen ID.3 : son lancement reporté à cause de bugs logiciels ?

from Les dernières actualités de Futura-Sciences https://ift.tt/3c7t5E5

Covid-19 : la prudence est de mise avec le médicament anti-paludisme

from Les dernières actualités de Futura-Sciences https://ift.tt/2Tlr9PK

Promo VPN : profitez d'une remise exceptionnelle de 81 % cette semaine avec PureVPN !

from Les dernières actualités de Futura-Sciences https://ift.tt/38agWes

Mars : sa formation aurait été plus longue que prévu

from Les dernières actualités de Futura-Sciences https://ift.tt/385OxpM

Aidez les astronomes à percer les secrets des trous noirs supermassifs

from Les dernières actualités de Futura-Sciences https://ift.tt/2Vqqgb7

Un nouvel « état » de la lumière découvert

from Les dernières actualités de Futura-Sciences https://ift.tt/2HZX0jF

Une faille dans les puces Wi-Fi touche des milliards d’appareils

from Les dernières actualités de Futura-Sciences https://ift.tt/3cdET7K

Voici le premier animal qui vit sans oxygène

from Les dernières actualités de Futura-Sciences https://ift.tt/2Pu7RXn

Étrangeté du vivant : voici la grenouille la plus étrange du monde

from Les dernières actualités de Futura-Sciences https://ift.tt/2wcITVG

mercredi 26 février 2020

Partager son stress renforcerait les liens sociaux

from Les dernières actualités de Futura-Sciences https://ift.tt/3a1fSe6

Un poisson capable de mettre entre parenthèses son vieillissement

from Les dernières actualités de Futura-Sciences https://ift.tt/2wHjmUz

Plus d’ambition en matière de sauvegarde des océans, demandent les chercheurs

from Les dernières actualités de Futura-Sciences https://ift.tt/2VoDipv

Après sa « mini Porsche » électrique, e.GO dévoile un mini SUV électrique

from Les dernières actualités de Futura-Sciences https://ift.tt/37WoJw8

Baleines échouées : les tempêtes solaires seraient responsables

from Les dernières actualités de Futura-Sciences https://ift.tt/32vCYHm

Barrick urges AJN to drop plans to buy interest in Kibali mine

Barrick Gold (TSX: ABX) (NYSE: GOLD) is formally asking Canadian junior AJN Resources to give up plans to acquire a 10% interest in its Kibali gold mine in the Democratic Republic of Congo.

The world’s second-largest gold miner and AngloGold Ashanti, which each own 45% of the mine, said they had not been consulted about the transaction even though the stake’s owner Société Minière de Kilo-Moto (SOKIMO) is not allowed to transfer or sell its Kibali shares without their approval.

The two partners said the announced sale, announced earlier this month, undervalues the asset, which last year beat production guidance of 750,000 ounces of gold by a substantial margin, delivering 814,027 ounces.

“Barrick won’t support the sale for reasons of valuation as well as process,” chief executive, Mark Bristow, told Reuters on Wednesday.

Already one of the world’s most highly automated underground gold mines, Kibali continues its technological advance with the introduction of truck and drill training simulators and the integration of systems for staff safety tracking and ventilation demand control.

The simulators, Barrick said in January, will also be used to train operators at the company’s Tanzanian mines.

(With files from Reuters)

from MINING.COM https://ift.tt/2wKeNsE

Voici la nouvelle Twingo Z.E. 100 % électrique

from Les dernières actualités de Futura-Sciences https://ift.tt/2vifx84

Devenez chasseur de trous noirs supermassifs avec le Lofar Radio Galaxy Zoo

from Les dernières actualités de Futura-Sciences https://ift.tt/2w3IyEG

Une année sur cette exoplanète dure 18 heures seulement !

from Les dernières actualités de Futura-Sciences https://ift.tt/2Tf1jg8

Perth Mint Gold Token starts trading on cryptocurrency exchange

The Perth Mint Gold Token (PMGT), the world’s first sovereign gold digital token, started trading this week on the KuCoin cryptocurrency exchange.

Each token is underpinned 1:1 by Perth Mint digital GoldPass certificates which represent physical gold held in storage at the organization. In addition, the weight and purity of every ounce of gold anchoring PMGT is assured by the Mint’s sovereign owner, the Government of Western Australia.

The Perth Mint is the world’s largest refiner of newly mined gold

“With zero fees for custody, storage, insurance and management, PMGT is a cost-effective gold asset and a competitive alternative to traditional gold products, like gold ETFs, banked gold transfers and more,” the Mint said in a press release. “PMGT is also fungible with traditional gold markets, for example, CME gold futures and the interbank Loco London Swap market.”

According to the WA institution, the amount of gold backing each PMGT can be verified in real-time against the gold holding balance of InfiniGold’s GoldPass accounts published by The Perth Mint. This can be done without having to wait for monthly audits to see that the tokens are 100% fully backed.

“As The Perth Mint is the largest refinery of newly mined gold in the world, we’ve got an unprecedented depth of liquidity to bring to the market with the Perth Mint Gold Token,” said Andreas Ruf, CEO of InfiniGold, the commodities digitisation company who developed the GoldPass. “We haven’t simply purchased a couple of gold bars, put them in a vault and then tokenised them. We can tap into billions of dollars worth of gold stored at The Perth Mint.”

from MINING.COM https://ift.tt/2HXpc6L

Rio Tinto’s $1bn spend to reach zero emissions “not enough” — analysts

Rio Tinto (ASX, LON, NYSE: RIO) will spend $1 billion over the next five years to reduce its carbon footprint and have net zero greenhouse gas emissions by 2050, but some analysts say the announcement is a minor step towards helping the mining industry achieve climate goals.

Delivering full-year results for 2019, in which the company recorded its highest profit in eight years, chief executive officer Jean-Sébastien Jacques said the world has got to a point where is necessary to sacrifice growth to meet climate targets.

“The challenge for the world, and for the resources industry, is to continue the focus on poverty reduction and wealth creation, while delivering climate action,” Jacques said. “This will require complex trade-offs.”

The $1billion earmarked to achieve zero emissions represents only 16% of Rio’s 2019 dividend or just under 5% of its $21.2bn earnings for the same year.

Julian Kettle, Wood Mackenzie vice chairman of metals and mining

Rio’s boss, at the helm since 2016, said that lower consumption, growth and returns are some of the sacrifices consumers, governments and shareholders must all be willing to make. This is especially true for the natural resources industry, which has come under increasing pressure to curb emissions.

“There are no easy answers,” Jacques told investors. “There is no clear pathway right now for the world to get to net zero emissions by 2050. The ambition is clear but the pathway is not.”

For Julian Kettle, Wood Mackenzie vice chairman of metals and mining, Rio’s plans to decarbonize its globe-spanning operations are a “small but significant” step in the right direction.

“Setting Rio Tinto’s $1bn in context, this represents just 16% of the dividend it distributed in 2019 or just under 5% of its reported EBITDA of $21.2bn for the same year,” Kettle said.

“Put another way, on a 100% basis, Rio Tinto reported iron ore production of 327Mt in 2019. A $1bn dollar green investment, while laudable, could be funded by a 30c/tonne rise in the iron ore price. The industry needs to do much more,” he noted.

The no emissions goal would be easier to achieve for Rio Tinto than other global miners, such as rival BHP (ASX, LON, NYSE: BHP) because the world’s second largest mining company does not mine coal or oil.

Unlike BHP, however, Rio has not set a target to reduce so-called “Scope 3” emissions — those produced when customers burn or process a company’s raw materials.

The company argues any targets on its Scope 3 emissions would be impossible to meet because it has no control over how steelmakers use the iron ore it mines.

Last year, Rio inked a preliminary deal with China’s largest steel producer, Baowu Steel Group, to develop new ways to cut carbon emissions along the steelmaking supply chain.

Coronavirus cloud

The group’s results, the best underlying earnings since 2011, were partially clouded by warnings of the effect the coronavirus epidemic may have in the business as more supply chains disruptions and potential delays to projects in Australia are expected.

Rio said its products were continuing to reach customers, but it was seeking ways to adjust to the impact of Covid-19 virus will have over global demand for commodities in the months to come.

The next six months could bring some challenges,” Jacques said. “Today our iron ore books are full, but we are likely to see some short-term impacts.”

China, where the virus originated, is one of Rio Tinto’s main customers. The company is anticipating an impact in its iron ore shipments to the regions during the first quarter.

from MINING.COM https://ift.tt/2Pp6NUk

Max transfers rights in PGE project to new Colombian subsidiary

Max Resource (TSXV: MXR) announced that it established a wholly-owned subsidiary named PGE Americas Metals Corp. and transferred all of its rights in the PGE Chocó project in northern Colombia.

In a press release, Max explained that this is the first step towards building a portfolio of PGE assets with a targeted focus on palladium, platinum and rhodium in order to capitalize on technology metal deficits.

Colombia was the world’s main source of platinum until 1820 and was the largest producer between 1917 and 1923

“Current demand for palladium, platinum and rhodium outstrips supply and increasingly stringent environmental regulations are forcing automakers to use more of these metals,” Brett Matich, CEO of the Canadian company, said in the media brief. “We are adopting a sum of the parts strategy in creating a PGE metals subsidiary and consequently compounding shareholder value.”

The PGE Chocó project is located 120 kilometres southwest of the city of Medellín, within a historical PGE region whose records state that one million ounces of platinum were produced.

In addition to this, a 2019 field program carried out by Max yielded highlight concentrate values of 114 g/t platinum.

from MINING.COM https://ift.tt/2HUQQkD

Cette constante de la physique reste inchangée, même aux abords d’un trou noir supermassif

from Les dernières actualités de Futura-Sciences https://ift.tt/2Pqyaxu

Decathlon : à fond la fuite… de données personnelles !

from Les dernières actualités de Futura-Sciences https://ift.tt/37W4gHO

Eaux usées traitées : pourquoi cette nouvelle ressource est à utiliser

from Les dernières actualités de Futura-Sciences https://ift.tt/3cd7KsH

Pour éviter tout piratage, mettez vite à jour Chrome !

from Les dernières actualités de Futura-Sciences https://ift.tt/3ccQeES

DS Aero Sport Lounge, un SUV électrique dérivé de la Formule E avec 650 km d’autonomie

from Les dernières actualités de Futura-Sciences https://ift.tt/2VuO0uZ

Mars : le Japon met le cap sur la lune Phobos avec Martian Moons Exploration

from Les dernières actualités de Futura-Sciences https://ift.tt/3c69W5k

Découverte d'une algue d'un milliard d'années qui pourrait être l'ancêtre commun de toutes les plantes

from Les dernières actualités de Futura-Sciences https://ift.tt/2v9nSem

La date de la fin de la formation de Mars remise en cause

from Les dernières actualités de Futura-Sciences https://ift.tt/2w4WVZd

Covid-19 : le virus pourrait infecter « jusqu'à 70 % de la population mondiale », selon ce chercheur d'Harvard

from Les dernières actualités de Futura-Sciences https://ift.tt/2SXPex1

Arctique : la plus grande réserve de graines au monde s'enrichit

from Les dernières actualités de Futura-Sciences https://ift.tt/3ceN6Zx

L’« Arche de Noé végétale » s’enrichit avec un nouvel arrivage de graines

from Les dernières actualités de Futura-Sciences https://ift.tt/2SXVTY6

mardi 25 février 2020

L’hôpital du futur s’imagine « smart » et décentralisé

from Les dernières actualités de Futura-Sciences https://ift.tt/2HUYdIX

JPMorgan Chase to stop lending to coal companies

JPMorgan Chase will no longer lend to coal companies, and will limit financing to companies drilling in the arctic, the company announced Tuesday at its annual investor day in San Franciso.

The bank remained the largest funder of fossil fuels despite long-standing climate protests, and faced years of criticism from environmentalists for its relationships with fossil-fuel companies, scrutiny it has sought to avoid at events like its annual shareholder meeting.

JP’s announcement follows similar commitments made by some European banks and by Goldman Sachs, the first U.S. bank to announce such limits on fossil fuel funding.

The bank faced years of criticism from environmentalists for its relationships with fossil-fuel companies, scrutiny it has sought to avoid at its annual shareholder meeting

This year, JPMorgan is facing climate-related shareholder proposals, including a resolution from climate change advocacy group As You Sow requesting that the company measure and reduce its carbon-intensive lending in line with the Paris 1.5 degree goal.

“As climate change increasingly impacts the economy, investors are asking their companies to take greater responsibility for transitioning their businesses to thrive in a low-carbon economy. JPMorgan Chase is a lynchpin in that transition,” Danielle Fugere, president of As You Sow said in a media release.

JPMorgan said it will facilitate $200 billion of transactions in 2020 that “support climate action” and advance the United Nations’ sustainable development goals.

Those transactions are expected to be a mix of loans, underwriting, advisory services and investments, and will include $50 billion of financing for green initiatives, Reuters reported.

(With files from Reuters)

from MINING.COM https://ift.tt/32qWZ1u

Anglo Pacific sees ‘mildly positive impact’ of coronavirus

Immediate impact of the coronavirus has been mildly positive as Chinese steel smelters have continued producing whilst there has been a slowdown in domestic coal and iron ore production, said Anglo Pacific (LSE: APF, TSX: APY) chief executive officer Julian Treger on Tuesday.

The company has released a new corporate presentation for the BMO Capital Markets Metals and Mining conference in Miami.

Anglo Pacific said spot prices for its commodities have held up well in 2020. Coking coal, wich makes up the the majority of earnings, is up 14%, with iron ore and pellets broadly unchanged and copper down around 7%.

The company said “very little” of the coking coal from Kestrel mine in Queensland and the thermal coal from Narrabri, New South Wales, goes to China.

“We continue to monitor the ever-evolving situation.” concluded Julian Treger.

On Monday, Anglo Pacific said it would no longer be investing in thermal coal assests, in a move to greener commodities.

from MINING.COM https://ift.tt/2ved7Hq

Russia pushes to end partial ban on diamond exports from CAR

Russia, this year’s chairing country of the Kimberley Process, a certification scheme established to prevent the trade of conflict diamonds, has vowed to work on lifting all remaining sanctions to exports of precious stones from Central African Republic (CAR).

The country partially resumed diamond shipments in 2016, following a three-year ban that tried preventing armed groups from financing one of the bloodiest conflicts the region has seen in recent years by illegally selling gems dug up in CAR.

“Current restrictions have increased the amount of diamonds sold illegally, generating profits for middlemen rather than local communities.”

Alexey Moiseev, chairman of the Kimberly Process

The chairman of the Kimberly Process, Alexey Moiseev, said that current restrictions have increased the amount of diamonds sold illegally, generating profits for middlemen rather than local communities.

Moiseev, who is also Russia’s minister of finance added he didn’t believe in opening “all the country’s gates” to diamond exports, as some still don’t comply with the basic conditions imposed by the industry body.

Since the 2013 full ban on diamond trade was lifted, CAR has been divided into so-called green areas, from where exports are allowed, and red areas (in the country’s north and east, controlled by anti-governmental armed groups) where the ban is still active.

In 2012, the country ranked 12th among the world’s largest diamond producers. The country exported 378,000 carats of diamond in 2012, worth around $167.05 per carat, about $63 million.

While most of CARS neighbours produce far greater volumes, diamonds found in the country are mostly gem-quality, ranked by experts among the world’s top five.

As an example, neighbouring Democratic Republic of Congo exported 19.5 million carats that same year, but they were worth only $13.41 per carat.

from MINING.COM https://ift.tt/3c7SBJq

Bon plan high-tech : les meilleures offres ordinateurs, smartphones, tablettes et TV chez Cdiscount

from Les dernières actualités de Futura-Sciences https://ift.tt/2ve6SmY

Mars : où et comment le rover Mars 2020 va chercher des traces de vie

from Les dernières actualités de Futura-Sciences https://ift.tt/2HWXk2F

RoboTire, le robot qui pourrait changer vos pneus en 10 minutes

from Les dernières actualités de Futura-Sciences https://ift.tt/2PnYto0

Covid-19 : le virus pourrait infecter 70 % de la population mondiale

from Les dernières actualités de Futura-Sciences https://ift.tt/2w6xtCw

Australie : un cinquième des forêts ont disparu dans les incendies

from Les dernières actualités de Futura-Sciences https://ift.tt/2Theop5

Alexa, Google Home et Siri vous écoutent sans vous prévenir

from Les dernières actualités de Futura-Sciences https://ift.tt/2TihQjm

Australian miners form Broken Hill Alliance

Impact Minerals (ASX: IPT) signed a non-binding MoU with Castillo Copper (ASX: CCZ) and Squadron Resources, both also holders of large tenement packages around the Broken Hill mine, to form the new Broken Hill Alliance.

In a press release, the companies said that Impact will contribute the rights to silver-lead-zinc Broken Hill-style mineralisation and other associated styles of mineralisation to the Alliance.

The MoU is an initial six-month agreement to market the Alliance’s ground holding to potential strategic partners, with the marketing to be led by Castillo. If a suitable partner is found, then the three parties will form a special purpose vehicle which will acquire the relevant tenements and metal rights from the three parties in return for equal shareholdings (33.3% each) in the new SPV company.

“With palladium and rhodium yet again reaching record prices late last week and now being well funded following our recent successful capital raising, we are gearing up to return to exploration at our unique Broken Hill project where our previous drilling there has delivered exceptional grades of all six platinum group metals (palladium, platinum, rhodium, ruthenium, osmium and iridium), not to mention gold, nickel and copper as well,” Mike Jones, Impact Minerals’ managing director, said in the media brief.

The Broken Hill Ni-Cu-PGE project is located 20 kilometres east of the Broken Hill silver-lead-zinc mine in New South Wales, in southern Australia, and consists of one Exploration Licence covering 200 square kilometres in the richly mineralised Curnamona Province.

from MINING.COM https://ift.tt/38Y1vap

Firestone to delist, axe board size on tough diamond market

Africa-focused Firestone Diamonds (LON:FDI) has decided to leave the London Stock Exchange and reduce the size of its board in an attempt to reduce costs and ride out a lingering weakness in the global diamond market.

Shares in the company, currently traded on the AIM exchange — the LME’s submarket for juniors — , have collapsed in recent years. From 56.8p a piece in October 2016, the stock has fallen to just 0.30p as of Tuesday at 12:15 pm local time, leaving it with a market cap of £2.7 million ($4.7 million).

Firestone’s investors are expected to vote on the delisting on March 13. The miner, which has been on the AIM since 1998, needs over 75% of voting shareholders to approve the motion for it to go ahead.

The company, which began mining at Liqhobong, Lesotho, almost four years ago, said it become clear in 2017 that it wouldn’t achieve the anticipated average value per carat.

Shortly after kicking off operations at Liqhobong, Firestone realized t it wouldn’t achieve the anticipated average value per carat, which made paying debt difficult.

As a result, the 75%-owned subsidiary operating the mine ran into problems paying back debt to South Africa’s Absa Bank Ltd. A fundraise and debt restructuring occurred in 2017, including a standstill agreement lasting until mid-2019 during which Firestone’s subsidiary only paid back interest on debt.

“The board still believes the diamond market has the potential to improve but that it will take longer than had been previously anticipated, and therefore everything possible needs to be done to ensure the company can survive the current downturn using its existing cash resources,” the miner said.

The news came on the same day Firestone reported diamond recoveries of 138,000 carats in its financial second quarter ended December, down 31% from the first quarter.

Firestone said the slump was the consequence of power disruptions at its only operating mine, Liqhobong. That led to shutting down the processing plant for most of October. The mine then ran on generator power until the start of December, at a marginally lower capacity.

Owing to the costs associated with renting and operating the generators, the company’s operating costs for the quarter under review were $1.1-million higher year-on-year.

Firestone estimated the total impact of the power disruption on the business was $4.6 million.

As a result of lower second-quarter output, the miner cut guidance for its 2020 year, ending June, to between 720,000 and 750,000 carats. It had previously estimated to produce between 820,000 to 870,000 carats.

Global crisis

The company is just one of the many diamond miners and traders affected by ongoing weak market conditions. Producers of small stones have been hit the hardest, due to an oversupply in that segment that has dragged prices down.

Increasing demand for synthetic diamonds has also weighed on prices. Man-made stones require less investment than mined ones and can offer more attractive margins.

Big companies have not been immune to the downward trend. De Beers, the world’s No. 1 diamond miner, reported last week its worst set of earnings since Anglo American (LON:AAL) acquired it in 2012.

The company said demand for rough diamonds from polishers and cutters was weak last year due to the impact of US-China trade tension and the closure of US retail outlets. Many companies in the so-called midstream are struggling to obtain financing, it said.

Increasing demand for synthetic diamonds has also weighed on prices. Man-made diamonds require less investment than mining natural stones and can offer more attractive margins.

Industry consultant Bain & Co., however, believes that while glut that’s depressing the diamond market will probably be cleared early this year, it will take at least another 12 months for the market to fully recover.

“The industry’s first and strongest opportunity to rebalance and regain growth will be 2021,” said Bain in a report released in December, adding that supply could fall 8% that year.

from MINING.COM https://ift.tt/3afcNr5

Cette exoplanète gravite dans l'enfer de son étoile en 18 heures seulement !

from Les dernières actualités de Futura-Sciences https://ift.tt/2VnN7UD

L'exercice fonctionnel : un espoir pour les patients atteints de fibromyalgie ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2SYy6Y3

Ivanhoe says development of Kakula copper mine ahead of schedule

Canada’s Ivanhoe Mines (TSX: IVN) announced that that the underground development at its Kakula copper mine in the Democratic Republic of Congo continues to advance ahead of schedule and that initial production is expected in Q3-2021.

In a press release, co-chairs Robert Friedland and Yufeng “Miles” Sun said that more than eight kilometres of underground development have been completed, which is 1.7 kilometres ahead of plan. They also said that this month, the mining team is on pace to set a new monthly development record of 1,310 metres of advancement ─ 380 metres ahead of plan for the month.

The Kamoa-Kakula Project is a joint venture between Ivanhoe Mines (39.6%), Zijin Mining Group (39.6%), Crystal River Global Limited (0.8%) and the DRC government (20%)

The underground development work at Kakula is being performed by mining crews operating large-capacity, semi-autonomous mining equipment, such as jumbo drilling rigs and 50-tonne trucks.

According to Friedland and Sun, mine access drives 1 and 2 − interconnected, parallel tunnels being developed from Kakula’s main northern declines that will provide access to high-grade ore zones are also being quickly done.

The development ore is being transported to the surface and stored on pre-production stockpiles, which are expected to grow to approximately 1.5 million tonnes of high-grade ore and an additional 700,000 tonnes of material grading approximately 1% to 3% copper prior to the start of initial production by the end of next year.

“Based on the results of the February 2019 Kakula pre-feasibility study, Kakula’s average feed grade over the first five years of operations is projected to be 6.8% copper, and 5.5% copper on average over a 25-year mine life,” the media brief states.

The document also explains that in parallel to the construction of Kamoa-Kakula’s phase 1 Kakula mine, work is progressing on the independent Kakula definitive feasibility study and an updated integrated development plan for the entire Kamoa-Kakula mining complex, which is expected to be issued in mid-2020.

Located within the Central African Copperbelt, approximately 25 kilometres west of the town of Kolwezi, Kamoa-Kakula is a very large, near-surface, flat-lying, stratiform copper deposit with adjacent prospective exploration areas.

It is estimated that the deposit contains 1.34 billion indicated tonnes grading 2.72% copper for 80.7 billion pounds of copper, as well as 315 million inferred tonnes at 1.87% copper for 13 billion pounds copper.

from MINING.COM https://ift.tt/2HWnyCe

Des centaines de disques protoplanétaires autour de jeunes étoiles observées dans Orion

from Les dernières actualités de Futura-Sciences https://ift.tt/2SWgxaQ

Le plus bel immeuble d'habitation du monde est à Montpellier

from Les dernières actualités de Futura-Sciences https://ift.tt/2HZKDE1

Xiaomi imagine une carte SIM hybride qui se transforme en carte mémoire

from Les dernières actualités de Futura-Sciences https://ift.tt/3a4XYas

Covid-19 : l'OMS évoque un risque de « pandémie ». Les marchés financiers sont fébriles

from Les dernières actualités de Futura-Sciences https://ift.tt/2TdsyaV

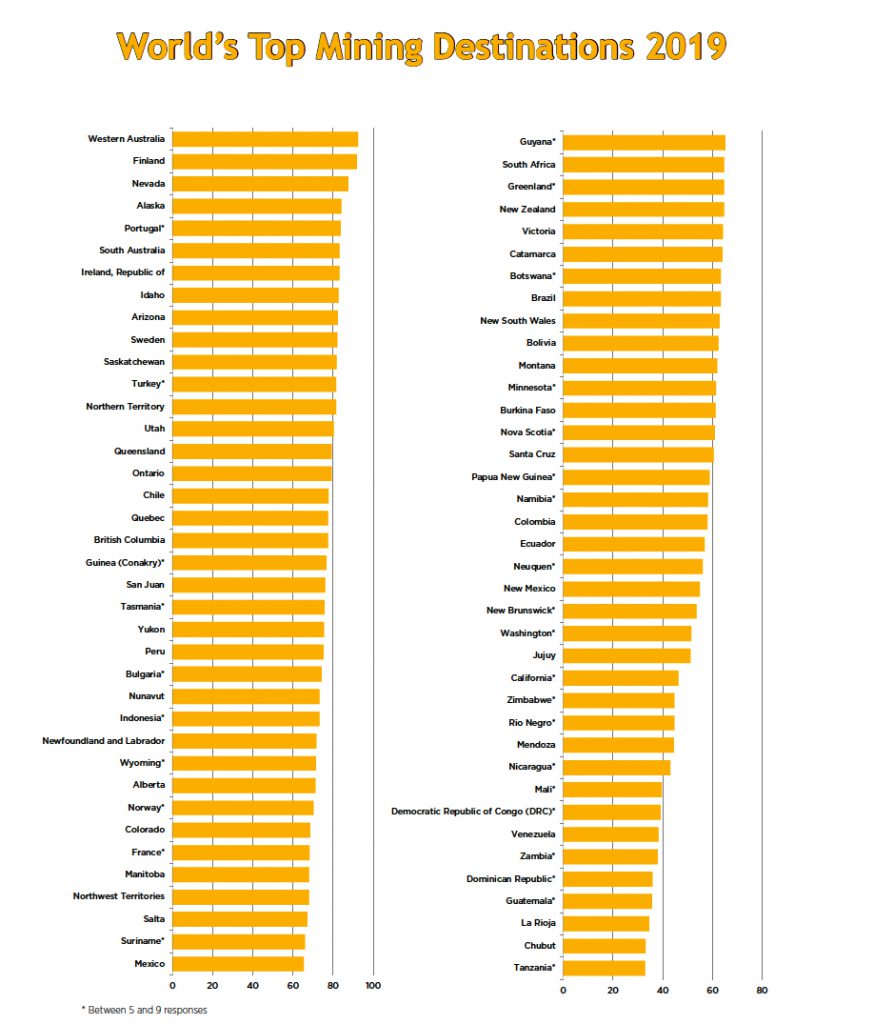

Western Australia emerges a new top mining destination

Resources-rich Western Australia has been picked the most attractive region for mining investment in 2019, the latest annual survey of mining executives released Tuesday by the Fraser Institute shows.

The Aussie state, which is home to almost 130 export-oriented mining projects and hundreds of smaller quarries and mines, producing over 50 different commodities, had ranked second in 2018.

Finland moved into second place this year, after ranking 17th in 2018.

Finland, another country usually located among the top destination, moved into second place this year, after ranking 17th in 2018.

United States’ Nevada moved down two spots from first in 2018 to third in 2019.

Rounding out the top 10 are Alaska, Portugal (fifth in 2019, versus 46th in 2018), South Australia, Ireland, Idaho, Arizona and Sweden.

The ranking takes both mineral and policy perception into consideration as well as permit times. This year’s is based on 263 responses covering 76 jurisdictions.

When it comes to the ten least attractive jurisdictions for investment, the mining executives interviewed chose Tanzania, Chubut (Argentina), La Rioja (Argentina), Guatemala, Dominican Republic, Zambia, Venezuela, the Democratic Republic of Congo (DRC), Mali and Nicaragua in that order.

In terms of geographical region, Europe emerged this year as the most attractive mining investment destination, showing a 20% increase in interest from investors, followed by Australia and Canada.

The Maple Leaf country had held the top spot in 2017 and 2018, but its relative investment attractiveness last year fell by almost 11%.

from MINING.COM https://ift.tt/32AaHPX

A-t-on découvert la « grande comète de 2020 » ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2wDUHQK

Vu de l'espace : les îles Canaries disparaissent sous une tempête de sable

from Les dernières actualités de Futura-Sciences https://ift.tt/2w1R7zO

La vie en altitude a créé une nouvelle espèce de loup

from Les dernières actualités de Futura-Sciences https://ift.tt/37WYbLh

lundi 24 février 2020

L'exercice fonctionnel : un espoir pour les patientes atteints de fibromyalgie ?

from Les dernières actualités de Futura-Sciences https://ift.tt/3a2TYXK

Wanted ! Futura recherche un journaliste H/F scientifique spécialisé en astronomie

from Les dernières actualités de Futura-Sciences https://ift.tt/2vbt0hX

Mars : d'où viennent les centaines de séismes détectés par InSight ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2T9bbIs

Tremblements de Mars : que nous révèlent les derniers résultats d'Insight ?

from Les dernières actualités de Futura-Sciences https://ift.tt/38VGw7V

La Terre se serait formée plus vite qu’on ne le pensait

from Les dernières actualités de Futura-Sciences https://ift.tt/2wLsckt

Sayona submits bid for North American Lithium

Emerging lithium miner Sayona Mining (ASX: SYA) announced on Monday that the company has submitted a bid for Québec’s North American Lithium (NAL). The bid was lodged before the stated deadline on February 21.

Sayona believes its bid for the NAL assets had the unique advantage of being able to combine lithium produced from the company’s Authier project with the lithium at the NAL site, facilitating a significant improvement in plant performance and economics.

In 2018, NAL produced 114,000 tonnes of spodumene against a nameplate capacity of 180,000 tonnes. The operation also has the potential to produce battery-grade lithium carbonate with the necessary investment.

Production at NAL was halted early last year, and in May the Québec Superior Court ended creditor protection, inviting bids for the company’s assets.

Sayona’s Authier project, on its own, is expected to produce 87,400 tonnes of spodumene per year over a mine life of 18 years, with the project expected to cost C$83.6 million to develop.

“Today’s submission is an important step not only for Sayona and NAL, but also for the Québec government’s plans to develop a sustainable and profitable lithium industry,” Sayona MD Brett Lynch stated in a media release.

from MINING.COM https://ift.tt/2v2nKNK

Fresnillo to kick off production at Juanicipio ahead of schedule

Mexico-focused precious metals miner Fresnillo (LON:FRES) said on Monday that it expected to begin production at its 56%-owned Juanicipio silver and gold project in Zacatecas in mid-2020, at an additional cost of $45 million.

The project, in which Canada’s MAG Silver (TSX: MAG) holds a 44% interest, is now expected to reach 85% of planned capacity in the fourth quarter of 2021, compared to previous guidance of 65%.

Bringing the mine’s production date forward means that Fresnillo will have to spend $440 million, 11% more that the $395 million estimated in January 2018 .

Juanicipio, located only eight kilometres from the company’s Fresnillo mine, is expected to produce 11.7 million ounces of silver and 43,500 ounces of gold annually over an initial operational life of 12 years.

Fresnillo, which cut its full-year production forecasts four times last year, has been striving to cut capital investment and costs after core profits almost halved in the first six months of 2019.

The company, one of the 100 business with the highest market capitalization listed on the London Stock Exchange, is the world’s largest primary silver producer and Mexico’s second largest gold miner.

Fresnillo, which floated in London in 2008, is 75% owned by Mexican billionaire Alberto Bailleres. The company’s flagship mine is Saucito, the world’s largest silver operation.

from MINING.COM https://ift.tt/2HPj7Jv