jeudi 30 avril 2020

Soleil : notre étoile est moins active que ses semblables

from Les dernières actualités de Futura-Sciences https://ift.tt/2yWMpEQ

Belarus scores potash contract with Chinese consortium

Belarusian potash marketer BPC, the world’s largest exporter of fertilizers, has inked a deal with a consortium of Chinese companies who agreed to buy the commodity for $220 a tonne, a $70 per tonne decline on the previous contract.

Supply contracts to China and India traditionally are benchmarks for the fertilizers market. Last year, however, Beijing did not any deals due to the oversupply of stocks.

“Although this underlines the magnitude of spot price erosion since 2018, it nevertheless sets a new floor for the market, CRU senior potash analyst, Humphrey Knight, told MINING.COM.

“Suppliers will now hope this finally brings stability to weak spot prices and ultimately tightens global product availability, Knight said.

BPC noted the difficult macroeconomic conditions in which negotiations took place, citing sharp devaluations in local currencies, historic collapses in oil prices and other commodities, and the ongoing effects of covid-19.

Stockpiles first

Potash stockpiles are at record high and exporters will likely want to clear them as soon as possible, the expert said. This means it will be months before China requires significant fresh supply and, as a result, spot prices will respond in late 2020.

BPC, the trading division of state-owned miner Belaruskali, controls more than 20% of the global market.

The consortium of Chinese buyers includes state-owned Sinochem’s fertilizer arm, Sinofert, China National Agricultural Means of Production Group and state-owned CNOOC.

from MINING.COM https://ift.tt/3aSTjbk

NIU lance ses scooters électriques NQi GTS et UQi GT en France

from Les dernières actualités de Futura-Sciences https://ift.tt/2yV9VC7

Le fossile d’un mammifère étrange retrouvé à Madagascar

from Les dernières actualités de Futura-Sciences https://ift.tt/2VQ9KkF

Très rare naissance d'un bébé singe au zoo de Besançon

from Les dernières actualités de Futura-Sciences https://ift.tt/3f7zRv2

Endeavour Silver to reopen Mexican mines amid lockdown extension

Canada’s Endeavour Silver (TSX: EDR) (NYSE: EXK) anticipates reopening its three Mexican mines on May 18, despite the country’s government extending the suspension of all non-essential activities until May 30.

The reason for the expected early resumption of operations, the silver miner said, is that President Andres Manuel Lopez Obrador said he would allow the restart of certain activities, including mining, in areas with low numbers of coronavirus cases.

Endeavour’s Guanacevi, Bolanitos and El Compás mines are all located in municipalities with low or no transmission of covid-19, the company said.

Guanacevi, Bolanitos and El Compás mines are all located in municipalities with low or no transmission of covid-19, says Endeavour.

“We look forward to bringing our mines back to production in a safe and orderly manner,” chief executive, Bradford Cooke, said in the statement. “Naturally, we will continue to apply all aspects of our coronavirus plan to maintain the health of our people and the local communities.”

The Vancouver-based silver producer has also filed a new shelf prospectus in the united States, hoping to ease needed financing to construct the Terronera project, which could become its next core asset.

Potentially Endeavour’s fifth and largest mine, Terronera is located in San Sebastian, a historic silver mining district in Mexico, 40 km northeast of Puerto Vallarta, in the Jalisco State.

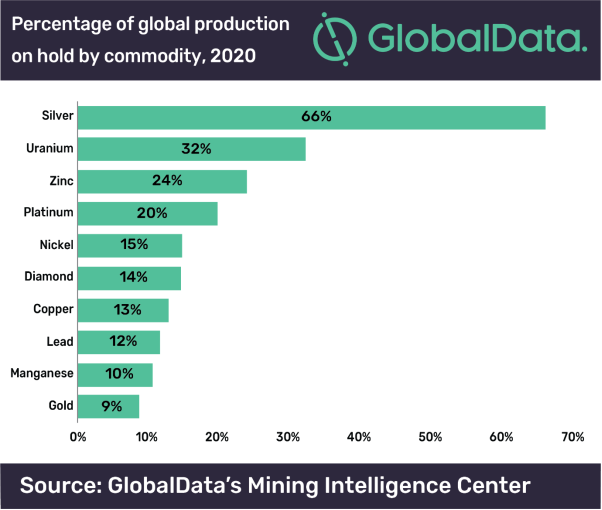

Hardest hit commodity

Silver has been the commodity hardest hit by mine closures mandated by governments to top the spread of the coronavirus pandemic.

Mexican industry leaders have been pushing for an exclusion to the temporary halt of non-essential activities. They argue that mining should be allowed to continue due to its importance to national supply chains and the wellbeing of host communities.

“To define the mining sector as non-essential, is not only to economically affect thousands of workers, but also to leave 656 communities alone where we operate and to whom we provide basic health services,” Fernando Alanís, president of the Mexican mining chamber (Camimex), said in March via Twitter.

Mexico is facing in 2020 one of the deepest recessions in its history as an already weak economy can barely cope with the impact of the coronavirus outbreak.

The country’s economy is forecast to contract 6.7% this year, deeper than during the devastating Tequila Crisis of the mid 1990s, the latest Citibanamex analysts survey shows.

Mexico is responsible for nearly 23% of world production of silver, churning out more than 200 million ounces last year, up from 196.6 million ounces in 2018.

It also has major copper and zinc mines, operated by Grupo Mexico and Southern Copper, and produces a significant amount of gold, making the mining sector responsible for about 4% of the nation’s gross domestic product.

from MINING.COM https://ift.tt/2YjNvoP

Remdesivir : pas d'efficacité spectaculaire

from Les dernières actualités de Futura-Sciences https://ift.tt/2xlsO0C

Insolite : des scientifiques ont gratté des liaisons chimiques

from Les dernières actualités de Futura-Sciences https://ift.tt/3bSOEHZ

La microgravité a des effets positifs sur les cellules cardiaques

from Les dernières actualités de Futura-Sciences https://ift.tt/2SompJg

Rise Gold one step closer to reopening historic gold mine in California

Rise Gold (CSE: RISE) announced that it is one step closer to the reopening of the historic, past-producing Idaho-Maryland gold mine, located in California.

In a press release, the US company reported that the Nevada County Board of Supervisors unanimously approved the contract for Raney Planning & Management to prepare the environmental impact report and conduct contract planning services on behalf of the County for the project.

Idaho-Maryland was reportedly the second-largest gold mine in the United States in 1941

According to Rise, this is a critical milestone in the processing of the Use Permit application. Thus, Raney will begin work immediately to review the technical studies submitted by the miner and kickstart the preparation of the draft EIR.

Once a final EIR is submitted to the County, its members certify the environmental document and consider approval of the Use Permit and Reclamation Plan at a public hearing. Rise expects the entire process to be finalized by sometime between December 2020 and May 2021.

The Idaho-Maryland project is Rise Gold’s main asset. It is located in the Grass Valley mining district of northern California and was one of the most productive and best known gold mines in the United States, with gold production dating back to 1863.

The mine was active for almost a century and during that period it produced over 2.4 million ounces of gold at an average mill head grade of 17 gpt gold.

from MINING.COM https://ift.tt/2WbGsfl

Royal Road continues to negotiate with informal miners in Colombia

Royal Road Minerals (TSXV: RYR) announced that it has entered into formalization agreements and related earn-in option and royalty agreements with the proprietors of the La Candelaria and San Miguel informal gold mines in Colombia.

In a press release, the miner said the deal was inked by its wholly-owned subsidiary, Exploraciones Northern Colombia or ENC, under the framework of the Colombian government’s National Policy for Mining Formalization.

Unlike the majority of gold deposits in the region, the La Candelaria and San Miguel gold mines are hosted in a silicified and folded sedimentary succession

This is the second deal of its kind that Royal Road signs in the span of a week. All properties are located in the municipality of Los Andes-Sotomayor, Nariño district, within concession contract HH2-12001X held by AngloGold Ashanti, pending assignment to ENC.

Under the terms of the agreement, specific portions of the area held under concession by ENC will be returned directly to informal miners so that new concession contracts over such returned areas may be granted, enabling legal and responsible mining operations to take place.

In exchange, ENC will receive a quarterly royalty equivalent to 3% of the doré extracted from the formalized concessions and has been granted the sole and exclusive right to carry out all exploration activities on the formalized concessions and the right to acquire 70% of the formalized concessions, subject to the completion of certain exploration milestones.

“The Company has now executed four formalization agreements over promising gold operations in Nariño and there will be more to follow,” Tim Coughlin, Royal Road’s president and CEO, said in the media brief. “The cash we anticipate earning from royalties due as part of this process will, of course, be significant.”

from MINING.COM https://ift.tt/3cTQ3hw

Codelco raises $800 million to face crisis

Chile’s Codelco, the world’s largest copper producer, has raised $800 million worth of bonds boosting it cash reserves to face market uncertainty and carry a multibillion-dollar upgrade of its aging mines.

The state-owned miner said it received more than 320 orders, worth $10.6 billion, the highest ever for a Codelco bond and about 13 times the size of the offering.

“Demand was so strong that the issuer was able to tighten pricing significantly and pay zero in new issue concession,” chief financial officer, Alejandro Rivera, said in a statement.

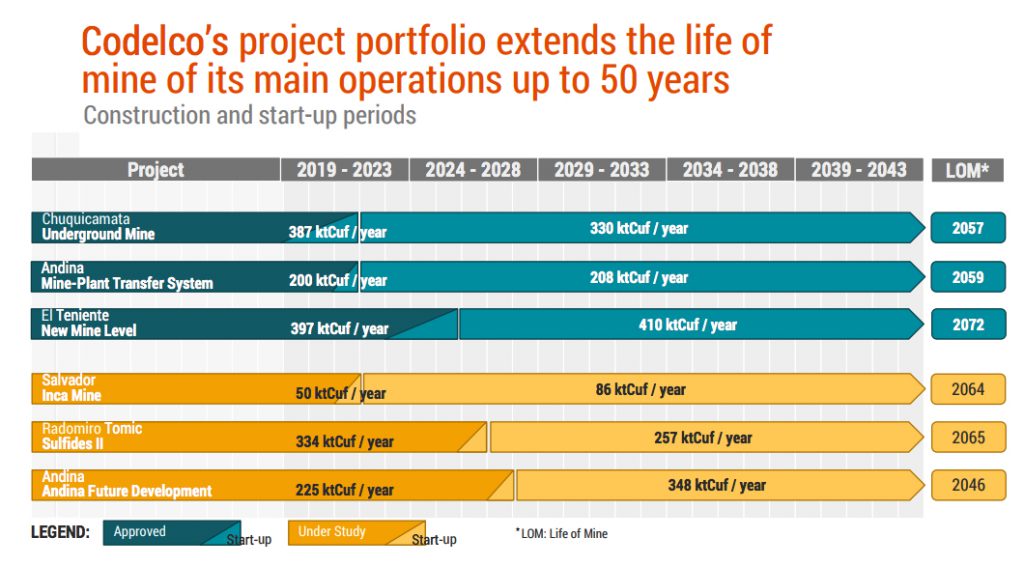

Through bond issues, Codelco is seeking to get cash to reduce debt and finance structural projects expected to be the miner’s cornerstone operations for the next 50 years.

The executive noted the move would help the company reduced debt and secure financing for its sprawling 10-year, $40 billion mines overhaul.

Codelco has already finished one of its most ambitious projects — the $5.6 billion conversion of its giant Chuquicamata open pit mine into an underground operation.

Ongoing major mine overhauls include a $5.5 billion new level at the El Teniente underground mine, the company’s largest and the world’s No. 6 by reserve size, slated to begin operations in 2023.

It also involves converting the El Salvador mine to an open pit mine from an underground operations. The $1 billion project, known as Rajo Inca, is expected to extend the productive life the mine by 40 years and increase output by 30% from current levels.

Salvador is Codelco’s smallest division by production. Last year, it churned out 50,600 million tonnes of copper, down 16.8% from 2018.

In the copper giant’s pipeline of so-called structural projects there is also the $1.3 billion expansion of the Andina mine. The operation accounted for roughly 11% of Codelco’s output in 2018.

Codelco operates seven mines and four smelters, all in Chile. Its assets account for 10% of the world’s known proven and probable reserves and about 11% of the global annual copper output, with 1.8 million tonnes of production.

from MINING.COM https://ift.tt/3aPwNAq

Avec le confinement, les émissions de CO2 du secteur de l'électricité ont chuté en Europe

from Les dernières actualités de Futura-Sciences https://ift.tt/2KONzVw

Covid-19 : les ordinateurs du Cern se mobilisent avec Folding@home

from Les dernières actualités de Futura-Sciences https://ift.tt/2zEEdJG

Le Fairphone 3 décide de se passer de Google

from Les dernières actualités de Futura-Sciences https://ift.tt/2VOBnKH

Le système LB-1 ne comprendrait finalement aucun trou noir

from Les dernières actualités de Futura-Sciences https://ift.tt/2YjreHO

Aux Émirats, l’insecte ravageur menace toujours les palmiers

from Les dernières actualités de Futura-Sciences https://ift.tt/3aPXPaD

La reconnaissance faciale de l'iPhone va s'adapter au port d'un masque

from Les dernières actualités de Futura-Sciences https://ift.tt/3bSvFx3

La Tesla Model S en tête des voitures électriques ayant la meilleure autonomie

from Les dernières actualités de Futura-Sciences https://ift.tt/2ye5xOv

Ovni : le Pentagone rend publiques trois vidéos de « phénomènes aériens non identifiés »

from Les dernières actualités de Futura-Sciences https://ift.tt/2VP4jlV

Coronavirus : un désinfectant qui protège les surfaces pendant 3 mois

from Les dernières actualités de Futura-Sciences https://ift.tt/3f4cjqP

La technologie jette un nouvel éclairage sur « La jeune fille à la perle »

from Les dernières actualités de Futura-Sciences https://ift.tt/2SfWPpZ

Amazon Prime Video : profitez d'un essai gratuit FilmoTV de 30 jours

from Les dernières actualités de Futura-Sciences https://ift.tt/2Sieayj

mercredi 29 avril 2020

Microbiote : quels sont les liens existant avec des maladies ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2WfCK48

Des signes d'une nouvelle physique avec une variation d'une constante fondamentale ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2SkepZV

How to trace mineral projects from valuation to production

Following a recent Edumine four-day short course, “Valuation of Mineral Projects Based on Technical and Financial Modelling” in POHTO’s Oulu facility in Finland, one of the delegates raised an interesting point that has wide relevance to active operations.

The Valuation course covers project appraisal as a forward-looking perspective at the pre-production stage. As a manager on an active operation the delegate, in his daily work, has to deal with multiple development scenarios which are an inherent part of mine planning.

The delegate asked about the utility of applying the principles of discount cash flow modelling at the pre-funding stage, which allows comparison between development scenarios in an active operation based on the performance indicators of NVP, IRR and pay-back.

Where the development of a new mine is going to cost over $2B, this is the domain of the large international mining companies that will use their corporate cost of capital for evaluation studies and act essentially as their own investment bank

These would provide a snapshot of the value derived from a given period of production where there is a simple relationship between the amount of ore produced and the capital cost. In an active operation though, an investment in a particular element, for example footwall pre-production development and drill hole sampling, might be part of the normal cycle of mining as production proceeds. There is no fixed end point which can be incorporated into a DCF model. Other performance indicators, such as cash costs and tonnage of ore delineated, then become more relevant in ranking development decisions. He pointed out that the scenarios are seldom so marginal that DCF modelling is likely to expose a feature that would not already be apparent from normal mine planning.

The Valuation course may add more content around the boundary condition that applies to the normal allocation of sustaining capital in pre-production development on an active mining operation with a defined mine life, compared to the creation of what is essentially a new mine, albeit exploiting the same deposit.

In the former case this is part of routine mine planning with costs met from cash flow. There is no merit in setting up a DCF model if for no other reason than that the time span is seldom more than five years whereas the optimum period for applying the technique at a 10% discount rate is about 15 years. The main flexibility is around allocation of cost between capital expenditure and operating costs. In accounting terms, it is best if this can be allocated to operating costs to allow immediate tax relief. Tax relief on capital cost is obtained through depreciation where benefit is deferred.

With the development of a new mine in the Valuation course I use a hypothetical case study, the objective of which is to evaluate the different alternatives available to a mining company operating in the Peruvian Andes following the discovery of an undeveloped deposit close to its operating mine.

This grants them options such as the opportunity to extend mine life, increase annual production and to introduce a drastic change in the mineral processing method. I then go on to point out that using debt also means that the full Capex of $460M does not have to be met from the cash flows of the parent company generated from their existing operations. These can then be distributed as dividends.

This in turn enhances share price and allows the equity portion of the capital requirements to be raised through a rights issue. Equity investors also have the comfort that in order to secure this level of debt the bankers would have undertaken a rigorous technical review of the project. The role of independent engineers instructed by the banks ensures better planning and better management at the EPC stage.

The case studies in the Valuation course also covered the transition from surface to underground which often involves significant capital investment ($2.6B in the case of Venetia). These are manifestly new mines that will exploit deep extensions of the same deposit.

In summary, a medium sized company considering developing essentially a new mine (albeit on the same deposit) at a cost of around $500M should consider the use of project finance.

The banks will be very comfortable as operating cost estimates will be well constrained and production will be undertaken by experienced operators. Where the development of the new mine is going to cost over $2B then, this is the domain of the large international mining companies that will use their corporate cost of capital for evaluation studies and act essentially as their own investment bank. Lending to subsidiaries on a rolling basis ensures they manage the corporate gearing that supports their share price and sets the corporate cost of capital. This does impact on mine planning where a major pit push back is proposed.

Pit optimisation algorithms have to assume a discount rate fixed by the parent company. The operation cannot therefore use a gearing optimisation approach where the subsidiary cannot act as an independent company and raise fresh equity and secure debt from an independent investment bank. They must use the parent’s corporate cost of capital.

This must impact on stripping ratios and may even sterilize some ore — a source of some frustration to planning departments on mines. In some cases, the discount rate they are required to use in mine planning is well above the corporate cost of capital which means a much more conservative stripping ratio is generated.

The next delivery of the Valuation course will be in Vancouver from March 31 – April 3, 2020 inclusive.

Learn more here.

(By Dennis Buchanan, Director of the MSc in Metals and Energy Finance, Department of Earth Science and Engineering, Imperial College, London.)

from MINING.COM https://ift.tt/2RzVclF

Drones de livraison : pas l'option la plus efficace sur le plan énergétique

from Les dernières actualités de Futura-Sciences https://ift.tt/2Wb12wk

« La science à l'ère du sensationnel », un live Facebook à ne pas manquer !

from Les dernières actualités de Futura-Sciences https://ift.tt/2zHEYln

Ils ont gratté des liaisons chimiques comme on gratte les cordes d’une guitare

from Les dernières actualités de Futura-Sciences https://ift.tt/35fnpVr

Vale mulling offers for New Caledonia nickel assets

Vale (NYSE: VALE), the world’s top producer of nickel and iron ore, has received non-binding offers for its operations on the Pacific island of New Caledonia, it said in a conference call on Wednesday.

The Brazilian mining giant said it expected to have “relevant news” on the topic within a month or two.

Vale put its New Caledonia nickel assets on the block in December. The decision came after it had to write down $1.6 billion in the fourth quarter related to the ailing mines, the world’s biggest nickel operations.

That announcement came less than a year after it had unveiled plans to invest $500 million in the nickel mine after failing to find a partner for the operation.

Last week Vale axed its 2020 production forecast for the metal to 180,000 to 195,000 tonnes from 200,000 to 210,000 tonnes, excluding its unit in New Caledonia.

Delivering first quarter results, the miner said its near-term view for nickel has changed as a result of the covid-19 pandemic.

Vale believes the nickel market will enter a surplus in 2020, compared with its previous view of continued deficits, but said its long-term outlook remained positive due to factors including demand for nickel in the batteries that power electric vehicles (EVs).

“Vale’s cut to production has supported the [nickel] market, but mines closing production is not too new as we knew some mines would shut,” Commerzbank analyst, Daniel Briesemann, said in a note last week. “The negative impact of the virus is more severe for the demand side, and the market could be well oversupplied this year.”

More to come…

from MINING.COM https://ift.tt/3cZg3ba

Pandémie : que vaut l'urgence contre la méthode scientifique ?

from Les dernières actualités de Futura-Sciences https://ift.tt/3f3itHK

Condor Gold lands enviro permit for Mestiza pit

Nicaragua-focused Condor Gold (LON:CNR) (TSX:COG) has been granted an environmental permit for the development and exploitation of the Mestiza gold asset, a complementary open pit to the company’s flagship La India gold project, in the country’s west.

The high-grade Mestiza deposit hosts more than 100,000 ounces of contained gold resources and is one of the two satellite pits to the fully permitted La India, which is slated to produce 80,000 to 100,000 ounces of the precious metal per year.

“When added to the high-grade La India open pit, Condor has just over 1 million ounces of gold open pit mineral resources, including mineral reserves permitted for extraction,” the company’s chief executive, Mark Child, said in the statement.

He noted that Mestiza has double the gold grade compared to La India. It is also located within easy trucking distance (less than 4km) to the firm’s planned and already permitted processing plant. The facility will have a capacity of up to 2,800 tonnes per day.

With the Mestiza and America feeders in operations, Condor Gold would be able to churn out bout 120,000 ounces annually during a seven-year mine life.

The miner staked concessions in Nicaragua, Central America’s largest country, in 2006. Since then, mining has significantly taken off in the country due to the arrival of foreign companies with the cash and expertise to tap into its reserves.

Last year, the government of Nicaragua granted Condor Gold the 132.1 km2 Los Cerritos exploration and exploitation concession, which expanded the La India project concession area by 29% to a total of 587.7 km2.

Condor also attracted a partner — Nicaragua Milling. The privately held company, which took a 10.4% stake in the company in September, has operated in the country for two decades.

from MINING.COM https://ift.tt/2xYZ3TP

Bon Plan : Profitez de 40% de réduction sur la suite de sécurité AVG Internet Security

from Les dernières actualités de Futura-Sciences https://ift.tt/3aIq0s4

Comète Atlas : de nouvelles photos de sa fragmentation par Hubble

from Les dernières actualités de Futura-Sciences https://ift.tt/2xjqMhv

Los Andes Copper receives drilling approval for Vizcachitas project

Los Andes Copper (TSXV: LA) announced that it has received approval from Chile’s Regional Environmental Committee for drilling to be carried out at the company’s Vizcachitas project.

According to the Canadian miner, this approval contemplates up to 350 drill holes to be completed on up to 124 platforms over the next four years. This is the required drilling needed to complete the pre-feasibility study at Vizcachitas, which is currently underway.

Vizcachitas is one of the largest copper deposits in the Americas not controlled by big companies

The permit also covers further exploration drilling and any other drilling that the project may require as its development advances.

Vizcachitas is a copper-molybdenum porphyry deposit located 120 kilometres north of Santiago. It sits on the same mineral belt as Antofagasta’s Los Pelambres, Codelco’s Andina and El Teniente, as well as Anglo American’s Los Bronces mines.

The project has measured resources of 254.4 million tonnes having a grade of 0.439% copper and indicated resources of approximately 1.03 billion tonnes having a grade of 0.385% copper.

Los Andes Copper plans to build a 110,000-tonne-per-day operation.

from MINING.COM https://ift.tt/2zHdV9P

GoldON allowed to drill at West Madsen project

GoldON Resources (TSXV: GLD) reported that it has received an exploration drilling permit for the West Madsen gold property located in Ontario, Canada.

At present, the company has the right to earn a 100% interest in the property through an option agreement with Great Bear Resources (TSX-V: GBR).

West Madsen is located in Ontario’s Red Lake Gold District and comprises two claim blocks measuring 6 kilometres by 3 kilometres in size, for a total area of 3,860 hectares

In a press release, GoldON said it is evaluating drill bids and will finalize the drilling recommendations and budget once all bids are received.

“We are thrilled to be preparing for our initial drilling campaign before the first anniversary of optioning the West Madsen project,” Mike Romanik, GoldON’s president, said in the media brief. “The Ontario government has deemed mining and exploration an essential business and we will be commencing the drill program as soon as logistically possible.”

According to the executive, the focus of the program will be initial drill testing of four of six main drill targets that trend along in an east-west direction and run sub-parallel to magnetic lineaments on Block A of the property.

“These lineaments are interpreted to represent the contact between the Balmer and Confederation assemblages which is a geological/structural contact that is similar to the adjacent Pure Gold Mining property where development of the Red Lake Gold Mine is on track and first gold production is anticipated in late 2020,” Romanik said.

from MINING.COM https://ift.tt/2W8S96f

Un bug dans macOS fait perdre beaucoup d'espace sur le disque dur

from Les dernières actualités de Futura-Sciences https://ift.tt/2YgjAh7

L’année 2020 sera-t-elle la plus chaude jamais enregistrée ?

from Les dernières actualités de Futura-Sciences https://ift.tt/3bNSnGH

Les auteurs d'un ransomware s'excusent et livrent les clés de déchiffrement aux victimes

from Les dernières actualités de Futura-Sciences https://ift.tt/2yPCz7R

Lunar Flashlight : une mission pour sonder la glace des cratères lunaires

from Les dernières actualités de Futura-Sciences https://ift.tt/35lXziz

Cette nouvelle maladie infantile a-t-elle un lien avec le coronavirus ?

from Les dernières actualités de Futura-Sciences https://ift.tt/3aOQKXO

Il contrôle un drone avec les muscles de son bras

from Les dernières actualités de Futura-Sciences https://ift.tt/3f3RqMe

Covid-19 : six nouveaux symptômes, signes d'une possible infection

from Les dernières actualités de Futura-Sciences https://ift.tt/3f33E88

Immunité collective : les habitants de Stockholm protégés d'ici mai ?

from Les dernières actualités de Futura-Sciences https://ift.tt/3aQyGg2

Covid-19 : six nouveaux symptômes caractéristiques de l'infection

from Les dernières actualités de Futura-Sciences https://ift.tt/2Yf3Z1x

Architecture : quatre balades virtuelles pour s'évader durant le confinement

from Les dernières actualités de Futura-Sciences https://ift.tt/3cX4xNt

mardi 28 avril 2020

Sur Terre ou dans l'espace, la microgravité a des effets positifs sur le cœur

from Les dernières actualités de Futura-Sciences https://ift.tt/2YfpNdb

Tocilizumab : que peut-on en attendre ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2zyGypu

Chasseurs de science : écoutez le nouveau podcast Futura !

from Les dernières actualités de Futura-Sciences https://ift.tt/2y79k08

Coronavirus : la densité urbaine n’est pas un facteur de propagation

from Les dernières actualités de Futura-Sciences https://ift.tt/2W9osBZ

Papua New Guinea lashes out at Barrick for halting Porgera

Papua New Guinea is threatening to take immediate control of Barrick Gold’s (TSX: ABX) (NYSE: GOLD) Porgera mine after the company’s local unit halted operations over the weekend following news that the mining lease would not be renewed.

Barrick, the world’s second largest gold miners, and its joint venture partner, China’s Zijin Mining, had applied in June 2017 for a twenty-year renewal of the mine lease, which expired in August.

Since then, the company has faced backlash from landowners and residents over what they claim are negative social, environmental and economic impacts from the mine.

Negotiations with Porgera’s operators were complicated further by a split among the landowners.

Prime Minister Marape warned Barrick his government would be forced to take immediate control of the mine if it were to be closed during the transition period.

The mine manager, Barrick Niugini Limited, halted operations on Saturday because it said the government had not given it any formal notification on the lease renewal rejection. It also said it had not received any detail over the imminent change of hands.

Prime Minister James Marape said in a Facebook post late on Monday that he would be “forced” to take immediate control of the mine if it remains closed during the transition period.

“My letter will ask Barrick to continue operating the mine when we go through this phase, but if you sabotage or close the mine, you leave me no choice but to invoke orders to take over the mine for the sake of land owners and provincial government,” he said.

“Work with me for your ease of business during this transition and exit phase,” Marape said. “You never know, negotiations may buy you extra operation time”.

The company said last week it would pursue all legal avenues to prevent what it calls the “nationalization without due process” of Porgera.

Tier One Potential

Barrick’s president and chief executive officer, Mark Bristow, had said last month that Porgera had “tier one potential” but faced many challenges in the form of “legacy issues and an unruly neighbourhood.”

The gold mine, located in PNG’s northern highlands region, is a joint venture between Barrick and Zijin Mining. Each own 47.5% of the mine, with the remaining 5% held by landowner group Mineral Resources Enga.

Porgera contributes to about 10% of the nation’s exports and employs over 3,300 Papua New Guinea nationals.

The open pit and underground gold mine sits at an altitude of 2,200-2,600 metres in Enga province, and is about 600 km northwest of Port Moresby.

Barrik said it would pursue all legal avenues to prevent what it calls the “nationalization without due process” of Porgera.

“We don’t have many details on the implications of this decision yet, including the timing of transition,” Jackie Przybylowski of BMO Capital Markets said in a research note last week.

“Barrick has warned that it will pursue all legal avenues to challenge the government’s decision and to recover any damages. We expect that discretionary spending, such as development capex, will be minimized through the current period of uncertainty,” Przybylowski noted.

The mining analyst also said that “while removing Porgera from Barrick’s portfolio would have a negative financial impact, it would improve the ESG performance of the company’s portfolio going forward.”

“On its website, Barrick reports allegations of human rights violations in the region,” she pointed out, “including allegations of ‘extreme’ violence linked to local police forces or private security forces acting on behalf of the joint venture.”

Other mining companies operating in PNG, including Australia’s Newcrest (ASX: NCM), have not been impacted by the decision regarding Porgera.

The miner has “welcomed” the Prime Minister’s support for its Wafi Golpu gold and copper asset, adding that its special mining lease at the Lihir operations remaining in good standing with a lease renewal not expected until 2035.

from MINING.COM https://ift.tt/3bNftgx

La comète Borisov a dégazé 230 millions de litres d’eau extrasolaire

from Les dernières actualités de Futura-Sciences https://ift.tt/3bLuvn5

DJI Mavic Air 2, la nouvelle référence des drones grand public ?

from Les dernières actualités de Futura-Sciences https://ift.tt/3bGkCad

SARS-CoV-2 : des mutations ont-elles augmenté sa virulence ?

from Les dernières actualités de Futura-Sciences https://ift.tt/3bJt0FS

Romios acquires claims next to Newmont’s Arseno Lake deposit

Romios Gold Resources (TSXV: RG) acquired by staking 81 mining claims totalling 1,576.5 hectares in Ontario.

In a press release, the miner said the claims cover the on-strike continuation of the mineralized iron formation and coincident shear zone that host the Arseno Lake zinc-lead-silver-gold prospect in the northwestern part of the province.

Romios’ new claims are located 32 kilometres northwest of the company’s 2019 gold-copper discovery on their Lundmark-Akow property and 58 kilometres northwest of Newmont’s Musselwhite gold mine

According to Romios, this prospect was discovered by Northern Dynasty Explorations in 1987 and is currently held by Newmont Corp (NYSE: NEM, TSX: NGT). However, little work of any material significance has been done on the property since 1988.

“Romios’ new claims flank Newmont’s Arseno Lake claims on both the east and west sides, 2 kilometres and 3 kilometres respectively from the centre of the historic prospect,” the media brief states. “The westernmost drill hole completed by Northern Dynasty intersected 3.2 m grading 4.8% zinc, 1.1 % lead and 2.4 oz/t silver. This hole is 1.8 kilometres from the western block of Romios’ new claims and no holes were drilled farther west even though the untested horizon carries on westward for at least 3.4 kilometres and possibly as much as 8 kilometres.”

In the view of the Toronto-based company, the potentially significant gold overprint of the Arseno Lake horizon has been underexplored and can now be readily assessed through relatively inexpensive means such as modern soil sampling and advanced analytical techniques.

from MINING.COM https://ift.tt/2W4Dg58

Talga Resources to provide graphene for Bentley’s e-axle

Australia’s Talga Resources (ASX: TLG) announced that it will be part of the OCTOPUS project, an initiative whose goal is to deliver the ultimate single unit e-axle solution designed specifically to meet Bentley Motors’ performance specifications.

Within the project, Talga has to develop and provide graphene materials for the high-performance electric motor windings. The main objective is to deliver an aluminium-based solution aimed at outperforming, and ultimately replacing, the copper windings currently used.

Talga owns multiple natural graphite deposits in Norrbotten County, north Sweden. Its flagship Vittangi project hosts the highest grade JORC/NI 43-101 resource in the world with a total resource 12.3Mt @ 25.5% graphite using a 17% cutoff

“The improved motor windings form part of the project’s aim of developing next-generation, lightweight, high-performance component systems that integrate the latest advanced materials and manufacturing techniques,” the West Perth-based company said in a media statement. “The components are to be tested at sub-system and system level for an integration route into future e-axle designs.”

The e-axle concept combines electric motor, power electronics and transmission into a compact, electric drive solution for hybrid and battery-only electric vehicle applications. Bentley and other automotive manufacturers are focused on the e-axle concept as a way to reduce vehicle weight and improve performance.

Funding for Talga’s participation in this project will be provided by the IDP15: The Road to Zero-Emission Vehicles competition, which is organized by the Office for Low Emission Vehicles and Innovate UK.

from MINING.COM https://ift.tt/2KDGQOc

Mongolia cancels Tavan Tolgoi’s $1bn IPO plan

Mongolia has cancelled an executive order to fund its giant Tavan Tolgoi coal project through an international initial public offering (IPO), citing “political distortions” and the current dire state of global financial markets.

Erdenes Tavan Tolgoi (ETT), the state-owned company that holds the license to the deposit, had been working with an adviser for preparations of the planned IPO, which included a listing in the Hong Kong Exchange (HKEX).

Planned Hong Kong IPO could have raise more than $1 billion

The stock market launch, which could raise more than $1 billion, was meant to help fund the massive project and related transportation infrastructure to deliver 30 million tonnes of coking coal a year to markets in China and beyond.

The cancelled plan was at least the third effort to raise money to develop the Tavan Tolgoi mine after international partnerships failed in 2011 and 2015. Mongolian lawmakers in 2018 approved a plan to sell up to 30% of Tavan, which is the country’s second largest mining investment after Rio Tinto’s Oyu Tolgoi copper-gold-silver operation.

Tavan Tolgoi, which means “five hills”, is located near Mongolia’s southern border with China. It has estimated reserves of more than 7 billion tonnes of coal, more than one-third of which is high-grade hard coking coal, according to its website.

from MINING.COM https://ift.tt/2xeLq2f

Starship : SpaceX pressurise le prototype SN4 sans le faire exploser !

from Les dernières actualités de Futura-Sciences https://ift.tt/2zE2qzX

Un éclairage durable grâce à des plantes ?

from Les dernières actualités de Futura-Sciences https://ift.tt/3aFoDdz

Apple imagine des vitres teintées intelligentes pour la voiture de demain

from Les dernières actualités de Futura-Sciences https://ift.tt/2VKAUct

Quand les makers rebattent les cartes de l’industrie

from Les dernières actualités de Futura-Sciences https://ift.tt/2W4KWUR

AlloCovid : une intelligence artificielle au bout du fil pour diagnostiquer les malades au Covid-19

from Les dernières actualités de Futura-Sciences https://ift.tt/2YcTw6w

Chloroquine : l'anti-viral qui paralyse la recherche médicale mondiale

from Les dernières actualités de Futura-Sciences https://ift.tt/3bFaU81

La génétique révèle une nouvelle espèce de tortue matamata

from Les dernières actualités de Futura-Sciences https://ift.tt/2SdENo2

Méthanisation : comment une station d'épuration transforme ses déchets en énergie verte ?

from Les dernières actualités de Futura-Sciences https://ift.tt/351IS43

lundi 27 avril 2020

Voici l’endroit le plus dangereux de l’histoire de la Terre

from Les dernières actualités de Futura-Sciences https://ift.tt/35cD4F9

MAS Gold reports encouraging results for Point

MAS Gold has announced the results of initial flotation and metallurgical tests on material from the Point gold area, which lies within the Preview North property in the La Ronge gold belt in Canada’s Saskatchewan province.

Flotation test work suggests average gold recoveries of over 88% with a target grind size of less than 75 microns.

Flotation test work suggests average gold recoveries of over 88% with a target grind size of less than 75 microns

“Achieving preliminary flotation gold recovery test results of greater than 88% from our Point gold deposit is very encouraging, especially as these results closely match the better than 89% flotation recoveries previously reported for our North Lake gold deposit,” Ron Netolitzky, the company’s president and CEO, said in a release.

“Although more metallurgical studies are required, the similarity of the North Lake and Point metallurgical recoveries suggest the possibility of the Point deposit as a source of high-grade, gold mineralized feed that could be co-mingled with material from our North Lake deposit for processing at a centralized mill, further supporting our hub-and-spoke mining and processing thesis for our properties in the La Ronge gold belt.”

The testwork results indicate that flotation followed by cyanidation and on-site production of gold-silver doré would be the likely optimal option for the Point deposit; this same flow sheet was brought forward for North Lake material.

MAS holds a total of 338 sq. km of ground within four properties in Saskatchewan’s La Ronge belt. In March, the company released a maiden mineral resource for the North Lake deposit, with 14.1 million tonnes grading 0.92 g/t gold for a total of 417,000 oz.

Both North Lake and Point are located within the Preview North area.

(This article first appeared in the Canadian Mining Journal)

from MINING.COM https://ift.tt/2W3m1AX

Specialized Wi-Fi network supports mine operations

RCT Connect, a new specialized Wi-Fi network developed by RCT, is the first-ever mining communications system created specifically to support all underground autonomous mining equipment.

RCT Connect is flexible, designed to engage with any third-party systems and, according to RCT, can enhance the performance of any mining automation and control solution available in the market.

Since its launch in 2019, it has been deployed in multiple active mines worldwide, with positive feedback from site personnel.

Brendon Cullen, RCT’s automation and control product manager, said RCT Connect is the best underground communications network option available.

“The system is inexpensive and very user friendly so it can be set up quite easily by mine site technicians who do not need specialized training in order to establish and maintain this technology.”

“RCT Connect is designed to be agnostic and so can integrate with all of the commercially available automation and control solutions offered by global manufacturers.”

Cullen added that this network is designed for stable performance with low and consistent latency between operator stations in secure locations and machines within production areas.

As underground mining operations evolve, customers will be easily able to scale RCT Connect to suit their needs. The network can be adjusted to suit various tramming distances and can ensure effective machine operation over short as well as longer runs.

Cullen added that a key aspect of RCT Connect is its smart roaming feature, which is always searching for new wireless access points as underground mining equipment moves.

“Many commercially available communications networks are configured to access certain nodes for too long and as mobile mining equipment continues to traverse a site it can result in communication failures,” he said.

RCT is a technology company that designs, manufactures and delivers technology and service solutions to support clients around the world in multiple sectors, including mining, industrial, agricultural and civil.

(This article first appeared in the Canadian Mining Journal)

from MINING.COM https://ift.tt/2W2GqX0

Earthwave introduces FleetWatcher app

Earthwave Technologies, a manufacturer of wireless telematics platforms for the heavy construction industry, has launched the App as a Device (AaaD) platform, which delivers tracking ability through a smart mobile device.

Available for Android or Apple, FleetWatcher AaaD can serve as a FleetWatcher device and perform most of the tracking functionality of a permanent transponder.

The new app provides current FleetWatcher customers with driver and equipment assignment support as well as driver safety reporting

The ability to gather data through a smart phone equipped with the FleetWatcher AaaD program gives users more options for collecting the data used by the FleetWatcher Materials Management Solution (MMS) platform.

The new app provides current FleetWatcher customers with driver and equipment assignment support as well as driver safety reporting.

“We are excited to release this new functionality. It’s just another ‘device’ in our tool chest that collects data utilized with our MMS,” Larry Baker, Earthwave president, said in a release.

“We have developed this in answer to the requests of the market, but I believe the wholesale adoption of smartphone technology for the purpose of tracking trucks is a couple of years out. It works in some cases. Like any other technology, it will be an evolutionary process.”

Ideal for Android and Apple devices, FleetWatcher Driver is available from Play and App stores for download and installation.

Earthwave Technologies manufactures construction-specific wireless telematic products that provide visibility to all of the components used within the process.

(This article first appeared in the Canadian Mining Journal)

from MINING.COM https://ift.tt/2W3m4wD

In global electricity slump, coal is the big loser

As silent factories and deserted offices hobble demand for electricity worldwide, the biggest loser is coal.

In the US, coal’s share of power generation has dropped more than 5 percentage points since February on the nation’s biggest grid while output from natural gas plants and wind farms held steady.

In Europe, it’s down 2 points. Even in China and India, where coal still dominates, it’s losing market share during the pandemic.

It comes down to cost. Coal power is more expensive than gas and renewables in many places and, hence, is the first fuel priced out of the market when demand falls.

Its plunging use amid the lockdowns is a boon for efforts to fight climate change

Its plunging use amid the lockdowns is a boon for efforts to fight climate change, hastening a shift that was already underway to weed out the dirtiest fossil fuel.

“It’s accelerating coal’s demise,” said Hannah Newstadt, a power market analyst for Genscape Inc.

In the US, coal is now supplying just 14% of power on the grid serving 65 million people from Illinois to New Jersey.

That’s down from almost 20% in February, according to a Bloomberg analysis of data from the grid operator, PJM Interconnection LLC.

It’s the only major fuel to slump.

Coal miners are already feeling the pain. While output has been sliding for years, the decline has been exacerbated since states began shutting down wide swaths of their economies.

Production at mines has plunged 21% in the past three weeks.

On Thursday, Arch Coal Inc., the second-biggest US miner, reported its biggest quarterly loss since 2016, suspended its 2020 forecast and said it initiated a “voluntary separation” program to slash staff by 30%.

While many utilities are still contractually obligated to buy the fuel, many shipments are just piling up on the ground at power plants, unused.

“U.S. coal production is in free-fall,” Mark Levin, an analyst with Benchmark Co., wrote in a research note Tuesday.

In Europe, coal’s share of power generation has dipped to 12%, from 14% a year ago, according to data from Wartsila Oyj, the Finnish energy technology company.

The decline is particularly sharp in Germany, where electricity from hard coal and lignite, sometimes called brown coal, plunged to 18% of net generation in the first two weeks April. One year ago, they accounted for 35%.

They just can’t compete with gas. During the last week of March, the short-run marginal cost of coal-fired generation was 31.80 euros ($34.33) to 33.50 euros per megawatt-hour, according to BloombergNEF analyst Jahn Olsen.

Gas plant costs topped out at 25.30 euros per megawatt-hour. Part of the reason coal is so much more expensive in Europe is generators need to buy about double the carbon-dioxide permits to burn it compared to gas.

In India, coal’s share of the power mix slipped to 65% from 71% in the month since Prime Minister Narendra Modi announced lockdowns to contain the outbreak.

The country’s coal imports for power plants in March fell 28% from a year earlier.

The share from from renewables, nuclear and hydropower rose. And in China, thermal power output, which is mostly from coal, slumped 8.2% in the first quarter while solar and wind gained.

Coal had struggled to compete for years. But it’s gotten even tougher as gas prices have plunged about 35% since early November.

When it comes to renewables, power producers don’t want to cut wind and solar when demand ebbs because they have no fuel costs. And nuclear plants are like massive locomotives that can’t suddenly speed up or slow down.

So when output has to change, coal typically draws the short straw.

“It’s going to be the first one they turn off,” Bloomberg Intelligence analyst Kit Konolige said.

Coal plants aren’t the only ones getting squeezed. In regions with little or no coal power — including New York, New England and California — gas plants are bearing the brunt of lockdowns. And in Europe, Electricite de France and Vattenfall are shutting down reactors this summer because of low demand and slumping prices.

But coal is getting hit hardest.

“You have coal looking very much like the energy market’s loser,” Carlos Perez Linkenheil, a senior analyst at Berlin-based Energy Brainpool, said in an interview.

(By Will Wade, Chris Martin and Mathew Carr)

from MINING.COM https://ift.tt/2VJbpZh

MAG Silver stock skyrockets on Sprott investment

MAG Silver Corp. (TSX: MAG) announced on Monday it has arranged a non-brokered private placement with mining investor Eric Sprott, offering approximately 4.53 million common shares of the company at a price of C$13.25 per share for gross proceeds of C$60 million.

Shares of MAG skyrocketed more than 17% during Monday’s morning session to a six-month high of C$16.08 per share. The Vancouver-based silver miner has a market capitalization of C$1.39 billion.

MAG intends to use the net proceeds of the financing for its Juanicipio project in Mexico, as well as working capital and general corporate purposes.

Juanicipio is a joint venture project in which MAG owns a 44% interest, with Fresnillo, the world’s largest silver miner, holding the remaining 56%. The property is located in Zacatecas state, 8 kilometres away from the Fresnillo underground mine which has been producing silver for more than five centuries.

Fresnillo, as operator, is currently constructing and developing the surface and underground infrastructure on the property to support a 4,000-tonne-per-day mining operation.

Earlier this year, Fresnillo brought forward the anticipated production start date of the silver-gold project to mid-2020. Once operational, the mine is expected to produce 11.7 million ounces of silver and 43,500 ounces of gold annually over an initial 12-year mine life.

from MINING.COM https://ift.tt/2S6TnxR

Une étoile géante rouge a survécu à un trou noir en devenant naine blanche

from Les dernières actualités de Futura-Sciences https://ift.tt/2ScfyTr

Les dessous de la découverte des 19 nouveaux astéroïdes interstellaires

from Les dernières actualités de Futura-Sciences https://ift.tt/2W8zPui

Zijin axes expected gold output after losing PNG mine

Zijin Mining, China’s No.1 gold producer and second largest copper miner, has revised down its gold production guidance for 2020 after Papua New Guinea (PNG) refused to extend the mining lease for the Porgera mine it operates with Barrick Gold (TSX: ABX) (NYSE: GOLD).

Zijin had forecast gold production for the year of 44 tonnes, rising to 42-47 tonnes in 2021 and 49-54 tonnes in 2022.

Following PNG’s decision, the miner now expects to maintain gold production levels in 2020 “about the same as” last year’s, when it churned out 40.8 tonnes of gold.

The gold producer said it planned to speed up the upgrade and construction of its Longnan Zijin project in China and boost production at other mines in its portfolio in order to offset the loss of Porgera.

Zijin’s share of the mine’s gold production in 2019 was 8.827 tonnes.

The company also said its joint venture with Barrick would “pursue all legal avenues” to fight PNG’s move and “to protect its legitimate interests and recover any damages.”

Looking into acquisitions

Since the mining lease for Porgera expired in August last year, Barrick led attempts to renew it, but faced backlash from landowners and residents over what they claimed were negative social, environmental and economic impacts from the mine.

Negotiations were complicated further by a split among the landowners.

The manager of Porgera, Barrick Niugini Limited, applied for a permit extension in June 2017 that would have renewed its rights for 20 years and had been engaging with the government on the matter since then, Barrick said on Friday.

In response to a request from PNG’s Prime Minister James Marape, the world’s second largest gold miner proposed in 2019 a benefit-sharing arrangement. The deal would have delivered more than half the economic benefits to PNG stakeholders, including the government, for 20 years, according to Barrick.

Zijin, which has a portfolio of producing and developing assets in its home country, Australia, Russia, Mongolia, Serbia and Kyrgyzstan among other countries, said it would pay attention to market opportunities and consider mine acquisitions to boost output.

from MINING.COM https://ift.tt/2KCvfPp

Confinement : spectaculaire rassemblement de flamants roses en Inde

from Les dernières actualités de Futura-Sciences https://ift.tt/2Yb6py0

WatFly Atlas, l’avion électrique façon Star Wars

from Les dernières actualités de Futura-Sciences https://ift.tt/35kNVgl

Le trou dans la couche d’ozone de l’Arctique s’est refermé

from Les dernières actualités de Futura-Sciences https://ift.tt/2YbpTTs

Une faille inquiétante dans presque tous les antivirus

from Les dernières actualités de Futura-Sciences https://ift.tt/3eUca9b

Australian miners can source equipment, spare parts to continue operating amid covid-19 pandemic

The Australian Competition and Consumer Commission has given interim authorization to the Minerals Council of Australia, the Australian Aluminium Council and state resources bodies to jointly source safety equipment and spare parts for the operation of machinery and mining equipment.

According to the Minerals Council, the decision implies that more than 280 resource companies operating Down Under have the green light to work together on this specific issue so that they can continue operating during the covid-19 pandemic. They can also provide assistance, where possible, to local communities and health facilities.

“Without these critical inputs of services and supplies, mining operations will be hampered and not be able to support jobs, exports, families, communities and small businesses which depend on the industry,” Tania Constable, CEO of the MCA, said in a media statement. “When Australia emerges from the covid-19 pandemic, a strong resources sector, a safe and healthy workforce and thriving regional communities will ensure Australia’s economic recovery is delivered speedily and widely.”

from MINING.COM https://ift.tt/2KFDsm1

Nano One’s cathode materials get thumbs up from automakers

Nano One Materials (TSX-V: NNO) announced that its high-performance lithium-ion battery cathode materials, which are produced at a low cost using proprietary technology, tested positively in solid-state batteries for electric vehicles.

The largest single challenge for those working on solid-state batteries is being able to design a stable and commercially viable interface between the solid electrolyte and the solid cathode and anode materials on either side of this electrolyte

In a press release, the company said that it is working with various automotive manufacturers to evaluate its One-Pot process and coated lithium nickel manganese oxide cathode materials or LNMO.

According to Nano One, the coated LNMO, also referred to as high voltage spinel, stabilizes the interface between cathode and electrolyte because it does not expand and stress the cathode-electrolyte interface like other cathode materials, and also because the coating protects the cathode from side-reactions with the electrolyte while allowing the rapid transfer of lithium ions between the electrolyte and the cathode.

“In comparison to other cathode materials, HVS is faster charging and operates at higher voltage enabling increased power and energy densities,” the Canadian firm said in the media brief. “HVS is also free of cobalt and the associated supply chain risk.”

In the view of Stephen Campbell, CTO of Nano One Materials, the main goal behind all the research on solid-state batteries is to replace flammable liquid electrolytes with solid materials that improve safety, power and energy density of batteries.

from MINING.COM https://ift.tt/2ScvJjm

Silvercorp to buy Guyana Goldfields in C$105m-deal

Canada’s Silvercorp Metals (TSX, NYSE: SVM) is buying Guyana Goldfields (TSX: GUY) in a C$105 million ($75m) cash and stock deal that creates a diversified precious metals producer with two silver mines in China and a gold operation in Guyana.

The Vancouver-based miner will give Guyana’s shareholders the option to receive C$0.60 per share in cash or 0.1195 of a share in the company, to a maximum cash consideration of C$33.2 million ($24m).

The C$0.60/share price represents a 71% premium to the 20-day volume weighted average price of the target company as of Friday’s close.

Guyana has been under investor pressure due to the poor performance of its flagship and only operating mine, Aurora, following a resources review.

The mid-tier gold producer shocked the market in March last year by announcing the amount of gold in proven and probable reserves at Aurora had declined by almost 1.7 million ounces, compared to estimates published in 2018.

The news triggered a bitter battle for control of the company led by founder and former chairman Patrick Sheridan, which was settled in April 2019. The deal included the appointment of an interim director and chief executive, who was replaced in January by Alan Pangbourne, Guyana’s current president and CEO.

More to come…

from MINING.COM https://ift.tt/35kBvFf

Soignants : leur santé mentale à rude épreuve

from Les dernières actualités de Futura-Sciences https://ift.tt/3eTinSU

Masques artisanaux : quels sont les tissus les plus efficaces ?

from Les dernières actualités de Futura-Sciences https://ift.tt/3aHKeSX

Cette zone du cerveau influencerait votre réponse aux champignons hallucinogènes

from Les dernières actualités de Futura-Sciences https://ift.tt/2W0S190

Des étudiants s’attaquent au problème de la pollution de l’eau potable

from Les dernières actualités de Futura-Sciences https://ift.tt/2xaXUb9

Les galaxies en rotation seraient apparues plus tôt que prévu dans l'Univers

from Les dernières actualités de Futura-Sciences https://ift.tt/3eU8jcn

Application StopCovid : la France fait bande à part et ça pose problème

from Les dernières actualités de Futura-Sciences https://ift.tt/2VXmnZY

Les populations d'insectes ont décliné de 25 % en 30 ans

from Les dernières actualités de Futura-Sciences https://ift.tt/3cTxWbg

Vénus : le mystère de la super-rotation de son atmosphère enfin résolu ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2Y7WNEn

New York : 14 % de la population aurait été infectée par le coronavirus

from Les dernières actualités de Futura-Sciences https://ift.tt/3eVUdqQ

Vers un vaccin universel contre Ebola ?

from Les dernières actualités de Futura-Sciences https://ift.tt/3eU4JPC

Ebola : vers un vaccin universel ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2yRoOVV

dimanche 26 avril 2020

Comment les grosses galaxies deviennent encore plus grosses

from Les dernières actualités de Futura-Sciences https://ift.tt/2VExXtV

UN tribunal rules against Canada’s Edgewater in legal battle with Spain

The United Nations Commission on International Trade Law (UNCITRAL) ruled against Canadian company Edgewater Exploration (TSX-V: EDW) in its long-standing legal battle with Spain related to the Corcoesto gold project in the northwestern region of Galicia.

This week, UNCITRAL dismissed Edgewater’s pretensions to recover the $35 million it had invested in Corcoesto prior to the project being denied permission by the Galicia Regional Government, known as Xunta.

“The company’s wholly-owned subsidiary, Corcoesto S.A. had commenced arbitration in 2016 under the Spain-Panama bilateral investment treaty and the UNCITRAL Arbitration Rules (1976). Following a hearing in Paris, France during April 2018, the Tribunal rejected, unanimously, four jurisdictional objections by Spain but upheld, by majority in a 2 to 1 decision, one jurisdictional objection by Spain and dismissed the claim on that basis. The dissenting arbitrator opined that the majority’s decision erred in both law and fact and that the Tribunal did have jurisdiction and should have decided the merits of the claim,” the Vancouver-based miner said in a media statement.

Edgewater added that the recent dismissal of the entire claim is a disappointment and that the company and its subsidiary are “considering avenues for legal redress, including an annulment proceeding in the French courts.”

This is how it all started

After purchasing the Corcoesto project in 2010 and having its environmental impact declaration approved by the Xunta in 2012, Edgewater completed a series of drilling programs, and technical studies designed to advance the project, upgrade and expand the mineral resources, and evaluate the economics.

Gold at Corcoesto was first exploited by the Romans. In the last decades, Sagasta Gold, Aurifera Gallega, Rio Tinto Minera, Rio Narcea Gold Mines and Kinbauri Gold have been active in the area

The plan forecasted a 9.9-year mine life and a total output of a little over 1 million ounces of gold. The heap-leach, open-pit operation would use cyanide to extract the yellow metal, something that caused alarm among environmentalist groups.

According to the EID, the operation’s annual waste production would be 2.1 million tonnes, of which 2 million tonnes would be floatation waste and 100,000 tonnes would be leaching. The estimated total of waste production was to be 17,080,751 tonnes during the mine’s working life.

Following the approval of the proposal, the Xunta went back on its decision and said it would not green-light the mining project unless the Canadian company fulfilled a number of environmental, technical and financial requirements not contemplated in its plan.

A legal battle ensued. In 2015, the Galicia government announced that the mining concession had expired and it would not be reopening the adjudication process, something that Edgewater considered illegal and a violation of international law.

Later on, the Galician Superior Tribunal of Justice ruled that the mine could not go forward because the project lacked financial and technical solvency, a decision that was backed by Spain’s Supreme Tribunal in 2019.

The latter decision was the one that led Edgewater to seek arbitration from UNCITRAL.

from MINING.COM https://ift.tt/2VF4SPl

Science décalée : comment garer une voiture avec 12 neurones

from Les dernières actualités de Futura-Sciences https://ift.tt/37cX1vZ

Six workers at Fortuna Silver Mines’ Peruvian operation test positive for covid-19

Six workers at Fortuna Silver Mines’ (NYSE: FSM) Caylloma operation in southern Peru tested positive for covid-19 and have been isolated in a special area while being monitored by medical personnel.

The information was made public by Fortuna’s wholly-owned subsidiary, Minera Bateas. According to the miner’s communiqué, following the identification of the six cases, all workers and subcontractors currently active at Caylloma went through a rapid testing process to rule out additional infections.

Located at an elevation of 4,500 meters, Caylloma is the sixth-highest mine in the world

The company also said that it has followed up with those who may have been in contact with the people infected and has proceeded to disinfect the areas where the testing took place.

Since mid-March, Minera Bateas has been operating only with essential personnel at Caylloma, having demobilized non-critical staff to comply with the regulatory framework issued by the Ministry of Energy and Mines and the Interior Ministry amidst the covid-19 pandemic.

The subsidiary of Canada’s Fortuna Silver Mines has also banned the movement of people in and out of the operation, while those who are allowed to return to their homes are tested before they do so.

Workers still active at Caylloma are drawing ore from coarse ore stockpiles. According to Fortuna, the mine produced 249,111 ounces of silver in the first quarter of 2020, 17% above budget. Average head grade for silver was 70 g/t.

Lead and zinc production, on the other hand, was 7,722,793 pounds and 11,821,186 pounds, 17% and 3% above budget respectively. Average head grades for lead and zinc were 2.96% and 4.58%.

Caylloma is a gold, lead, silver, and zinc mine located approximately 225 kilometres northwest of the city of Arequipa. Its mill operates at a rate of 1,430 tpd with production sourced primarily from the silver-polymetallic Animas Vein.

The deposits in the Caylloma Mining District have been mined intermittently for over 500 years since the times of the Inca Empire.

from MINING.COM https://ift.tt/2YdYDTY