dimanche 31 mai 2020

Science décalée : l'eau des WC révèle le niveau de vie

from Les dernières actualités de Futura https://ift.tt/35QYRlt

Australian miners join forces to explore Coates Ni-Cu-PGE project

Lithium Australia (ASX: LIT), Australian Vanadium (ASX: AVL) and private company Mercator Metals formed an alliance to undertake exploration activities targeting nickel-copper-platinum group elements mineralization at the Coates Mafic Intrusive Complex in Western Australia.

According to the companies, their tenements – which adjoin each other and are known as ‘the Coates project’ – cover the mafic-ultramafic rock sequences containing the Coates Gabbro and provide the required continuity for efficient exploration.

The companies said the discovery of Ni- Cu-PGE at the Julimar project has generated a lot of interest in the Western Yilgarn region

In a media statement, the miners said that one of the things that inspired them to form this alliance was Chalice Gold Mines’ recent discoveries of Ni-Cu-PGE mineralization at its Julimar project, located 29 kilometres north-northwest of the Coates project and which is hosted in a similar geological environment.

Although each party will be responsible for its own costs, including rents and rates, and has to keep its tenement in good standing, the strategic alliance is intended to streamline exploration processes through the shared use of personnel and capital.

The press brief states that exploration will begin with compilation and data-sharing of historical information that can assist in targeting potential hosts for Ni-Cu-PGE mineralization.

Following this initial phase, a laterite-sampling and geological-mapping field exercise will be completed, in order to develop an up-to-date geochemical and geological map.

Jointly, the companies are evaluating the use of ground electro-magnetic geophysical surveys to delineate any sulphide-rich horizons at the Coates project prior to drilling, which would potentially take place in the September quarter.

from MINING.COM https://ift.tt/2ZVfbkQ

Five mines in Europe take part in €7-million digitization project

Sixteen organizations across the European Union have joined forces in Dig_IT, a consortium that is going to administer €7-million destined for a project titled A Human-centred Internet of Things Platform for the Sustainable Digital Mine of the Future.

The goal of the project is to digitize processes and operations at different mine sites in the continent, namely La Parrilla tungsten open-pit mine in Spain; the Marini Marmi underground marble mine in Italy; the Titania ilmenite open-pit mine in Norway; the Sotkamo underground silver mine in Finland; and the Hannukainen open-pit iron ore, copper and gold mine in Finland, which is in the process of being reopened.

Dig_IT funds come from Horizon 2020, an EU research and innovation program with nearly €80 billion available in funding, whose goal is to secure Europe’s global competitiveness

Under the management of the Aragón Technological Institute, the project’s objectives are to be achieved by developing an internet-of-things industrial platform or IIoT that integrates and analyzes data from workers, machinery, surrounding environment and markets.

“At a human scale, the platform will gather workers’ biometric information, their location and the environmental conditions in their work areas. At a machinery level, it will monitor the operation, position, and state of the equipment, vehicles and tools employed at the mining operation. To analyze the surrounding environment, it will register the environmental conditions, for example, the quality of the air and water, the temperature, and also the conditions of the terrain, that is, seismic conditions and slope stability,” project coordinator María García Camprubí said in a media statement.

According to García Camprubí, the tool will also incorporate market data such as supply-demand information and commodity prices.

The project coordinator explained that this is not a ‘big-data’ initiative. Rather, the focus will be on the quality of the data and their correct interpretation in real-time to optimize mining processes and operations. To achieve this objective, the consortium will rely on digital technologies, data analysis methodologies, process modelling, generation of digital twins, telecommunications and sensor development.

García Camprubí said special emphasis will be placed on the creation of digital twins to tackle equipment predictive maintenance, soil stability, and air and water quality. Although each area will be addressed by a different institution, the resulting models will be processed with Caelia Twinkle, a digital twin-building kernel for real-time computer-aided engineering, which will allow integrating the digital twins into each mine’s IIoT platform.

from MINING.COM https://ift.tt/3gFVDGY

Coronavirus : 8 passagers sur 10 testés positifs durant cette croisière étaient asymptomatiques !

from Les dernières actualités de Futura https://ift.tt/2Mi4lgK

Grenouilles de verre : leur technique de camouflage décrite pour la première fois !

from Les dernières actualités de Futura https://ift.tt/2AjbAlR

C'est une première : un œil bionique pour retrouver la vue

from Les dernières actualités de Futura https://ift.tt/2Xjpduc

Une collision de galaxies pourrait être à l'origine du Système solaire

from Les dernières actualités de Futura https://ift.tt/2XgdvAt

Le record de vitesse du débit Internet est pulvérisé avec 44,2 térabits par seconde

from Les dernières actualités de Futura https://ift.tt/2XKaM1o

Ces poules se souviendraient de l'environnement de leurs lointains ancêtres

from Les dernières actualités de Futura https://ift.tt/36MaY45

How to detect unreliable cryptocurrencies

Researchers at the University of Vaasa in Finland developed a model to detect unreliable cryptocurrencies.

In an article published in the journal Applied Economics, the scholars explore the factors that help predict whether a cryptocurrency, of the thousands currently available, will eventually go bust.

The first factor is the performance on the Initial Coin Offering or the the first day coins are made public. According to the researchers, coins achieving the most long-term success also had the best first-day performances.

The study shows that 79% of all defaulted cryptocurrencies are developed by anonymous developers. Yet, 58% of new coin developers choose to remain anonymous

The second factor is a coin’s pre-mining activity which takes place prior to the ICO launch. The study’s findings indicate that even if excessive pre-mining doesn’t necessarily guarantee failure, it raises suspicions of a potential bait-and-switch – often referred to as ‘pump and dump’.

The third factor is developer anonymity, meaning that most defaulted cryptocurrencies are created by anonymous developers.

The fourth factor is rewards and supply matter, as there appears to be a correlation between longevity and two other factors: lower minimum rewards and coin supply.

“This [last] result is rather puzzling when considering how critical coin mining is to the sustainability of any cryptocurrency,” the experts said in a media statement. “Specifically, without mining, a cryptocurrency network could not be maintained.”

To reach these conclusions, scholars Klaus Grobys and Niranjan Sapkot examined all available 146 Proof-of-Work-based cryptocurrencies that started trading prior to the end of 2014 and tracked their performance until December 2018. They found that about 60% of those cryptocurrencies were eventually in default.

“Our study is a first attempt to reveal potential links between factors that could relate to coin success or failure,” Grobys said in the release. “The links that we established in our study are not necessarily causal and much more research needs to be done on this issue.”

from MINING.COM https://ift.tt/2TWUqRP

Exobiologie : calculer les probabilités que la vie émerge sur des jumelles de la Terre

from Les dernières actualités de Futura https://ift.tt/2TQDsVf

Ce sont les abeilles les plus gourmandes qui deviennent reines

from Les dernières actualités de Futura https://ift.tt/2XgGl3N

SpaceX : les images du lancement réussi de Crew Dragon

from Les dernières actualités de Futura https://ift.tt/3cjLcWa

SpaceX : revivez le lancement réussi du premier vol habité de Crew Dragon

from Les dernières actualités de Futura https://ift.tt/2XjxSNl

Le premier vol habité de Crew Dragon est reporté au 30 mai

from Les dernières actualités de Futura https://ift.tt/2MgUDv2

Space X : revivez en images le décollage de la capsule Crew Dragon

from Les dernières actualités de Futura https://ift.tt/3gO57QC

Des boules de mousse se déplacent en troupeau en Alaska

from Les dernières actualités de Futura https://ift.tt/2ZSvIWE

La langouste émet des sons qu'on entend à 3 km à la ronde

from Les dernières actualités de Futura https://ift.tt/36rumDq

samedi 30 mai 2020

Google prépare le paiement par la voix

from Les dernières actualités de Futura https://ift.tt/2MfB8mw

« Objectif Mars » : ils ont testé la nouvelle attraction du Futuroscope… en plein confinement !

from Les dernières actualités de Futura https://ift.tt/3eEWIx3

Des bactéries de synthèse peuvent-elles aider à traiter le Covid-19 ?

from Les dernières actualités de Futura https://ift.tt/2zzL1sB

Le confinement pourrait faire 75.000 morts « de désespoir » aux États-Unis

from Les dernières actualités de Futura https://ift.tt/2YUIWBz

Photos inédites de tapirs nageant dans une rivière au Brésil

from Les dernières actualités de Futura https://ift.tt/3cijjgY

Une sonde spatiale part sur les traces de la comète Altas

from Les dernières actualités de Futura https://ift.tt/36HLPaK

Météo-France prévoit un été plus chaud et sec que la normale

from Les dernières actualités de Futura https://ift.tt/2XKMmod

SpaceX : ne manquez pas le premier vol habité de Crew Dragon ce soir !

from Les dernières actualités de Futura https://ift.tt/3eCQ9Lr

Mars : découvrez le premier engin qui volera dans le ciel martien

from Les dernières actualités de Futura https://ift.tt/3cnWhGG

Le SUV électrique Mazda MX-30 entre en production

from Les dernières actualités de Futura https://ift.tt/3bSkiUX

Espace : qui sont les deux astronautes du premier vol habité de SpaceX ?

from Les dernières actualités de Futura https://ift.tt/2AhEbrx

French Days Cdiscount : les meilleurs bons plans sur les ventilateurs

from Les dernières actualités de Futura https://ift.tt/3chrTMY

vendredi 29 mai 2020

La sonde Solar Orbiter va passer à travers la queue de la comète Altas dès dimanche

from Les dernières actualités de Futura https://ift.tt/2MaLRyy

Mars : ce que le rover Curiosity a découvert sur le climat passé de la Planète rouge

from Les dernières actualités de Futura https://ift.tt/2M6zCTI

Chez les chimpanzés, chacun sa technique pour pêcher les termites

from Les dernières actualités de Futura https://ift.tt/36ICT55

Inca One to launch online bullion store

Canada’s Inca One Gold (TSXV: IO) announced that it will launch an online bullion store so that collectors and investors can purchase gold directly from the company.

In a press release, the gold producer said its bullion store will initially offer 1-ounce gold coins and will add additional products, including silver options in the future. The inaugural Peruvian-themed coins will be stamped and minted by Inca One.

Inca One expects the online bullion store to provide increased margins from direct sales

“Upon the onset of the global pandemic, Inca One recognized the immediate need for precious metal investors to purchase gold and silver bullion. As a result, the company views this as an ideal opportunity to begin selling its gold and silver directly to the retail bullion investor,” the media brief states. “We will be offering bullion from Peruvian small-scale miners who have had their ore processed at one of our gold-ore processing facilities.”

Inca One operates two, fully-permitted, gold ore processing facilities in the Arequipa region of southwestern Peru. Chala One is a mineral processing facility with a permitted capacity of 100 tonnes per day, and Kori One is a gold ore processing facility featuring a carbon-in-leach gold circuit, with a maximum permitted capacity of 350 tonnes per day.

from MINING.COM https://ift.tt/3eucKcJ

Japan Gold allowed to expand Sanru gold project in northern Hokkaido

The Japanese Ministry of Economy, Trade and Industry accepted Japan Gold’s (TSXV: JG) new prospecting rights applications covering extensions to its Japan Gold epithermal-gold project.

In a press release, Japan Gold said the 24 new applications total 7,711 hectares and cover prospective tertiary geology along the eastern side of Sanru while Irving Resources’s Omu project is located to the north.

The Sanru project now comprises 31,822 hectares and is one of the projects included in the Barrick Alliance to be covered by regional exploration programs in the next 12 months

With these additions, the Sanru Project now comprises 31,822 hectares and is one of the projects included in the Barrick Alliance to be covered by regional exploration programs in the next 12 months.

“This new acquisition continues our ongoing evaluation of the prospective geology in Japan,” John Proust, Japan Gold’s chairman and CEO, said in the media brief. “The decision to further extend the Sanru project was based upon the favourable structural controls on mineralization, host rock geology and the proximity of the Omui mine close by to the north.”

Sanru is located in the Kitami Region of northern Hokkaido and covers a total of five known mine workings that are inferred to be fault-controlled with potential to host similar mineralization as exploited in the Sanru mine, the second-largest historical gold producer in the area with 225,000 ounces of gold averaging 7.4 g/t and 1.4 million ounces of silver produced between 1925 and 1974.

from MINING.COM https://ift.tt/2AgWhdp

Roman-era warships found at Serbian coal mine

A coal mine in eastern Serbia has grabbed headlines in recent weeks after workers bumped into three shipwrecks estimated to have been buried for at least 1,300 years.

The largest of what appears to be an Ancient Roman warship fleet is nearly 50 feet long with a flat bottom. It would have carried a crew of 30 to 35 sailors and traces of repairs to the hull indicate it must have had a lengthy career.

The two smaller vessels, each carved from a single tree trunk, match descriptions of boats used by Slavic groups to ferry across the Danube River and attack the Roman frontier.

The ships had been buried in an ancient riverbed under several metres of mud and clay, now part of the Kostolac coal mine. The operation, east of the Serbian capital of Belgrade, is located near what it was Viminacium city, which was a base for Roman warships on the Danube.

Once a provincial capital with an estimated 40,000 inhabitants in the 4th century AD, Viminacium was larger than Pompeii.

All three shipwrecks have been transported to an archaeological park nearby. Further excavation work has been put on hold due to the coronavirus pandemic.

This is not the first time the Kostolac coal mine yields evidence of ancient human and animal activity. In 2012, archeologists found bones corresponding to at least five woolly mammoths, which disappeared about 10,000 years ago.

from MINING.COM https://ift.tt/2M9zUZV

Sur Android, la réalité augmentée permet d'afficher les limites de distanciation physique

from Les dernières actualités de Futura https://ift.tt/3deGxpN

De la salive de tique comme traitement anti-inflammatoire ?

from Les dernières actualités de Futura https://ift.tt/36GVm1I

MINING PEOPLE: Freeman Gold, Medallion Resources, Reunion Gold, Solstice, Xanadu Mines

Stuart Moller is now VP of exploration with FenixOro Gold; Moller is also a director of the company.

Will Randall is now president, CEO and a director of Freeman Gold, replacing Howard Milne, who will continue as a consultant to the company.

Derrick Townsend will provide consulting services to Golden Pursuit Resources, including shareholder communications, market intelligence and corporate development initiatives.

Mark Saxon is now president and CEO of Medallion Resources. Don Lay, the company’s current president and CEO, will transition to a strategic advisor role and remain on the board of directors.

Steve Dawson is now VP of corporate development with Tri Origin Exploration.

Andrew MacRitchie is now CFO of Virginia Energy Resources, succeeding Karen Allan.

Munkhsaikhan Dambiinyam has been named COO of Xanadu Mines and will be based in Mongolia; Munkhsaikhan has been the company’s CFO since May 2018. The company’s executive team will now include Andrew Stewart as CEO, Spencer Cole as CFO, Ganbayar Lkhagvasuren as an executive director and Mat Brown as chief geologist.

Board moves include:

Bond Resources has appointed new members to its board, following its acquisition of MJ Mining. These include Scott Brison and Valery Zamuner with Gary Arca and Cynthia Avelino stepping down as directors. Arca continues to serve as CFO, and Avelino will be the company’s secretary.

Mario Grossi has stepped down from the board of Foran Mining – he has joined the company’s technical committee.

Hugh Maddin is now a director of Makara Mining.

Michael Neumann has retired from the boards of New Age Metals and El Nino Ventures.

Murray John is joining the board of Prime Mining with Bruce Durham stepping down as a director.

Leanne Baker, Chantal Gosselin, Robert Leckie, Peter Nixon and Catherine Stevens will be retiring from the board of Reunion Gold. New director candidates include Adrian Fleming and Rick Cohen.

Kevin Reid, Michael Gentile and Blair Schultz are now on the board of Solstice Gold with Marty Tunney and Chad Ulansky stepping down as directors. Tunney will continue as president of the company and Ulansky will be a consultant to Solstice.

Paul Fisher has resigned from the board of Victory Nickel.

(This article first appeared in the Canadian Mining Journal)

from MINING.COM https://ift.tt/3cdgZbo

C'est un trou dans la couche d’ozone qui serait responsable de l'extinction massive du Dévonien

from Les dernières actualités de Futura https://ift.tt/2XfNul0

Proxima b est confirmée ! Il y a bien une exoterre dans la zone habitable de l’étoile la plus proche de nous

from Les dernières actualités de Futura https://ift.tt/3gveCUJ

Bacanora Lithium to reopen plant at Sonora project

Exploration and development company Bacanora Lithium (LON:BCN) announced it expects to reopen the Hermosillo pilot plant at its flagship Sonora lithium project in Mexico next month.

Despite the coronavirus pandemic, the company said it was continuing to progress all feasible workstreams, with significant attention focused on completing work at Sonora.

Bacanora also said the project review by strategic partner Ganfeng Lithium is now scheduled for the third quarter of the year. Previously it was expected to be completed in the first six months of 2020.

Bacanora expects to kick off site works in the first half of 2021 and to begin lithium deliveries to its offtake partners in 2023

The delay may not impact the overall project timeline, Bacanora said. However, Ganfeng’s timing of an engineering, procurement and construction proposal for the production of downstream battery-grade lithium products from the Sonora plant is also under review.

The company said it anticipates lithium demand to grow by 800% by 2030, thanks to increased electric vehicles (EV) demand.

“Whilst demand for internal combustion vehicles has been significantly impacted by the spread of covid-19 and a general economic slowdown, electric vehicle demand in Europe increased over 50% during first quarter [of] 2020,” Bacanora said in a media release.

Bacanora now expects to kick off site works in the first half of 2021. This would allow the miner to begin lithium deliveries to its offtake partners, Ganfeng Lithium and Hanwa Corp, in 2023.

The company, however, has yet to secure full financing for construction of project, which is expected to produce 35,000 tonnes of lithium per year.

from MINING.COM https://ift.tt/2XbecLw

iPhone piraté : le frère de Pablo Escobar réclame 2.6 milliards de dollars à Apple

from Les dernières actualités de Futura https://ift.tt/3eHBCy7

Mars : ce que le rover Curiosity a appris sur le climat passé de la Planète rouge

from Les dernières actualités de Futura https://ift.tt/2XUzyvV

Des centaines de vélos électriques Jump en parfait état passés au broyeur

from Les dernières actualités de Futura https://ift.tt/2ZMTXp9

Étrangeté du vivant : une guêpe aussi belle qu'inquiétante

from Les dernières actualités de Futura https://ift.tt/3dchTpS

Coronavirus : ce que nous révèle le récit d’une croisière sur l’épidémie

from Les dernières actualités de Futura https://ift.tt/2AlyN6C

Une lance en bois vieille de 300.000 ans découverte en Allemagne

from Les dernières actualités de Futura https://ift.tt/2ZMCDR9

L'été sera chaud, l'été sera sec, prévoit Météo-France

from Les dernières actualités de Futura https://ift.tt/2TPPCO0

Bon plan fête des mères : idées de cadeaux à moins de 30 €

from Les dernières actualités de Futura https://ift.tt/2yHa2kX

Crier des injures améliorerait la tolérance à la douleur

from Les dernières actualités de Futura https://ift.tt/2Ajt1mh

jeudi 28 mai 2020

Photovoltaïque : la filière appelle à la ré-industrialisation écologique

from Les dernières actualités de Futura https://ift.tt/2XJt1Ed

MINING.COM launches MINING.COM MINUTE

MINING.COM has launched MINUTE.COM MINUTE, a weekly roundup video of the biggest stories from the global mining and metals industry. The videos will be available on the website and on MINING.COM social media.

from MINING.COM https://ift.tt/2XzJB9m

Ce Cessna Caravan 208 va devenir aujourd'hui le plus gros avion 100% électrique à voler

from Les dernières actualités de Futura https://ift.tt/3gq8Of7

Réchauffement climatique : les espèces marines gagneraient la course

from Les dernières actualités de Futura https://ift.tt/3gyzUR0

Coronavirus : des malades faiblement touchés ont développé des anticorps

from Les dernières actualités de Futura https://ift.tt/3guxR0z

Pacific Empire to become sole owner of Jean Marie project in British Columbia

Pacific Empire Minerals (TSXV: PEMC) announced it has entered into an option agreement to acquire a 100% interest in the Jean Marie project in central British Columbia, Canada.

To become the sole owner of Jean Marie, Pacific Empire has to make a total cash payment of $675,000, issue 1,500,000 shares and commit $2.7 million to advance the project in the course of five years.

Based on the presence of hydrothermal breccias with well-mineralized porphyry clasts, Pacific Empire believes there is strong potential for two or more copper ± molybdenum ± gold ± silver deposits to exist at depth along the Jean Marie fault

Jean Marie is a 6,300-hectare copper-gold-silver-molybdenum porphyry project located 50 kilometres west of Centerra Gold’s Mt. Milligan copper-gold mine.

Historical work conducted on the property includes over 10,000 metres of drilling and dozens of ground-based geophysical and geochemical surveys, with the majority of exploration being completed by Cominco Ltd. between 1970 and 1974. Historical drilling highlights include drill hole J97-11 which intercepted 184 m @ 0.33% Cu, including 27 m @ 1.2% Cu, and the presence of three discrete zones, each with indicators showing higher grade potential.

“The presence of several mineralized zones and exploration targets along and adjacent to the Jean Marie fault is highly encouraging and suggests there is a mineralized system of significant size on the property,” Brad Peters, Pacific Empire’s president and CEO, said in a media statement.

from MINING.COM https://ift.tt/2BbUDtZ

Aftermath Silver to become majority owner of Cachinal project in Chile

Aftermath Silver (TSXV: AAG) announced that it has reached an agreement to acquire from SSR Mining its 20% interest in the Cachinal silver-gold project in Chile.

To go ahead with the deal, Aftermath has to pay SSR Mining C$700,000. On completion of the transaction, the buyer will own 99.9% of the shares of Minera Cachinal SA, which owns Cachinal. One share will remain held by a Chilean national as per Chilean business law requirements.

Aftermath is planning to complete an updated NI 43-101 technical report once covid-19 travel restrictions are lifted in Chile

“With full ownership of the project, we will concentrate on delivering solid exploration results for our shareholders as soon as the covid restrictions allow,” Ralph Rushton, president of Aftermath Silver, said in a media statement.

The Cachinal silver-gold project is located in Chile’s Antofagasta region, in a nearly flat plain at an elevation of around 2,700 metres above sea level, 16 kilometres north of Austral Gold’s Guanaco gold-silver mine.

According to Aftermath, the property hosts a low-sulphidation epithermal deposit. Shallow drilling has defined the current mineral resources principally to a depth of 150 metres below surface, which provides sufficient evidence to interpret the presence of high-grade shoots within the vein system extending below the base of a potential open pit.

from MINING.COM https://ift.tt/2yD3zYe

Lithium prices to jump as pandemic hinders expansions

Prices for lithium, one of the key ingredients for the batteries that power electric vehicles (EVs) and high tech devices, are expected to climb in two years, when shortages in the market caused by curtailed production and halted expansions start to emerge.

Car sales, EVs included, have plummeted this year as global economic growth projections have already proved wrong as the coronavirus pandemic has hit global markets.

In Western Europe alone, where EVs sales were supposed to soar this year, the acquisition of new car fell by 90% in April.

But demand is set to pick up, says Benchmark Mineral Intelligence, a battery supply chain researcher and price discovery company. And what that happens “the supply side won’t be able to react quickly enough,” Simon Moores, managing director at BMI, told Reuters.

The London-based company, which also tracks battery megafactory (>1Gwh capacity) construction around the globe, believes that when demand comes back, lithium prices would bounce after 2022.

Before coronavirus, lithium prices were in free fall due to an avalanche of new supply. The glut, worsened by Beijing’s cut in government subsidies for purchasers of EVs in China — the world’s largest market — made majors tame their growth plans.

BMI had forecast supply at 572,000 tonnes for 2023, but now sees that number at 543,000 tonnes, with a shortfall of 8,000 tonnes. The company believes the deficit in later years to grow significantly.

For this year, BMI sees global lithium output reaching 324,000 tonnes, with demand for the metals slightly lower, at 315,000 tonnes

Guilty of charge

Chile’s SQM, the world’s second-largest producer of the metal, pushed back a key expansion at its Atacama salt flat operations from the end of 2020 to late 2021.

Australia’s Wesfarmers (ASX: WES) delayed a final investment decision on the Mount Holland project in Western Australia by a year to early 2021.

Albemarle (NYSE: ALB), the world’s leader, has also had to adjust plans. It postponed last year a project to add about 125,000 tonnes of processing capacity. It also revised a deal to buy into Australia’s Mineral Resources’ (ASX: MIN) Wodgina lithium mine and said it would delay building 75,000 tonnes of processing capacity at Kemerton, also in Australia.

The lithium giant showed further signs of distress early this month. It cut its 2020 budget and pulled its annual forecast amid the global spread of the coronavirus.

That was one of the first signs that the lithium industry is beginning to feel the pain of falling EVs sales, which are projected to slide further for the rest of the year.

China’s Tianqi Lithium Corp., the country’s top producer of the battery metal, also postponed commissioning the first phase of its flagship plant in Kwinana, as it struggles to pay back debt.

from MINING.COM https://ift.tt/2yEtSNJ

Les formes en toupie de Ryugu et Bennu expliquées par Patrick Michel, spécialiste des astéroïdes

from Les dernières actualités de Futura https://ift.tt/2U2PdrV

Vélos, trottinettes électriques, etc : découvrez les bons plans des French Days Fnac jusqu’à -200 € !

from Les dernières actualités de Futura https://ift.tt/2Xa0oRm

Des lunettes intelligentes à tout faire : surveiller le cerveau, détecter une chute, jouer aux jeux vidéo...

from Les dernières actualités de Futura https://ift.tt/3eoKIQ3

Fujifilm transforme son appareil photo en webcam

from Les dernières actualités de Futura https://ift.tt/2XBtl7P

Africa faces a ‘triple whammy’ from covid-19

Sir Paul Collier, Professor of Economics & Public Policy at the Blavatnik School of Government, University of Oxford, is widely recognized among the world’s leading experts on African and resource-rich economies.

His latest book is The Future of Capitalism: Facing the New Anxieties (2018). He is also a member of Critical Resource’s Senior Advisory Panel.

Collier addresses the ramifications of the unfolding covid-19 crisis – an example of ‘radical uncertainty’, with multiple variables and unpredictable outcomes – on less developed economies, in particular in Africa.

Key points raised

- African economies will suffer a ‘triple whammy’ due to a sharp drop in commodity prices, a fall in remittances from diaspora communities and the substantial impact of reduced travel and tourism.

- The large drop in foreign exchange earnings will further erode the ability to conduct effective deficit financing or design stimulus packages. Many African countries will be forced to devalue their currencies to manage the fall-out, and the impacts will be felt for years to come.

- The ESG agenda will continue accelerating and the risk of divestment by investors in the resources sector will intensify.

- Companies’ response to this crisis has thus far been disappointing – there will be growing scrutiny in their home countries and where they operate.

- Despite short-term pressures, the long-term route to economic survival for resource companies is to preserve and strengthen their reputations as responsible operators. They will be defined by their engagement with and contributions to the needs of local communities and host countries.

from MINING.COM https://ift.tt/36EDeFV

Étonnant : ces boules de mousse avancent en troupeau

from Les dernières actualités de Futura https://ift.tt/2TJHtuI

Exceptionnel : la vidéo du dernier tigre de Tasmanie

from Les dernières actualités de Futura https://ift.tt/3dgUeEQ

Les astronomes ont découvert une nouvelle classe d’explosions cosmiques

from Les dernières actualités de Futura https://ift.tt/2ZJdcji

Découverte de magnifiques mosaïques romaines à Negrar di Valpolicella

from Les dernières actualités de Futura https://ift.tt/3c7jiMV

5 °C à 15 °C : la température préférée du coronavirus

from Les dernières actualités de Futura https://ift.tt/36ISQrV

SpaceX : le lancement de Crew Dragon est reporté à samedi à cause de la météo

from Les dernières actualités de Futura https://ift.tt/3dbQYu2

L'Inde subit sa pire invasion de criquets depuis 30 ans

from Les dernières actualités de Futura https://ift.tt/3esC3w0

Coronavirus : une IA pour évaluer l'efficacité des politiques sanitaires

from Les dernières actualités de Futura https://ift.tt/3etT88y

French Days Cdiscount : les meilleurs bons plans pour votre jardin et extérieur

from Les dernières actualités de Futura https://ift.tt/3cdDEUO

La peur modifie l’ADN dans le cerveau des souris

from Les dernières actualités de Futura https://ift.tt/3eiZhVg

mercredi 27 mai 2020

Lundin to raise C$50 million in bought deal financing

BMO Capital Markets will buy 4.15 million common shares of Lundin Gold (TSX: LUG) at C$12.05 per share in a bought deal financing that will raise C$50 million for the Vancouver-based gold miner. The deal includes an overallotment option for up to 15% of the offering.

Newcrest Mining (ASX: NCM), which owns 32% of the company, and Orion Mine Finance, which has an 11% stake, have exercised their rights to participate in the offering. The company says it also expects the Lundin Family trust to participate in the financing to maintain its collective holdings, which currently stand at 27%.

The proceeds will be used to study increased throughput and resource expansion at the company’s flagship Fruta del Norte gold mine in south-eastern Ecuador, potential costs related to Covid-19 and for general working capital purposes.

“We have been able to open-up some logistical corridors on May 15 to transport some concentrate we had at the site out to the port,” Ron Hochstein, Lundin Gold’s president and CEO said in an interview. “We’re now preparing ourselves for starting up operations again.”

Hochstein noted that the company only had about one month’s worth of commercial production before it had to suspend operations on March 21 due to the coronavirus pandemic. “We were already at around 3,500 tonnes per day but we saw there were some great opportunities to increase throughput to at least 4,000 tonnes per day or even more as well as the potential to increase resources at the project,” he said.

Fruta del Norte, one of the largest gold deposits in Ecuador, is located in the Zamora-Chinchipe Province, approximately 139 km east-northeast of Loja, the country’s fourth-largest city.

The project currently contains indicated resources of 23.8 million tonnes grading 9.61 grams gold per tonne

The project currently contains indicated resources of 23.8 million tonnes grading 9.61 grams gold per tonne and 12.9 grams silver per tonne for 7.35 million oz. contained gold and 9.89 million oz. of silver. Inferred resources add 11.6 million tonnes grading 5.69 grams gold and 10.8 grams silver for 2.13 million oz. of gold and 4.05 million oz. of silver.

Bryce Adams, an analyst at CIBC, says the financing deal “adds [a] buffer to the balance sheet during the coronavirus shutdown,” and is “a prudent top-up given a formal re-start plan has not yet been tabled.”

The analyst maintains an outperformer rating on the company and forecasts a 12- to 18-month price target of C$14.00 per share.

At press time in Toronto, Lundin Gold was trading at C$11.99 per share within a 52-week trading range of C$5.22 and C$13.49.

The company has around 224 million common shares outstanding for a C$2.69-billion market capitalization.

(Carl A. Williams – This article first appeared in The Northern Miner on March 27)

from MINING.COM https://ift.tt/2X8ZMeF

Vale told to fork out $1.5bn for dam burst damages

A judge in the Brazilian state of Minas Gerais has partially granted an injunction sought by prosecutors by ordering Vale (NYSE: VALE) to set aside 7.9 billion reais (about $1.5 billion) to pay potential fines related to the tailings dam collapse that killed 270 people last year.

The figure adds to the 1 billion reais ($260m at the time) frozen funds a federal court ordered Vale to pay affected communities shortly after the deadly incident.

About $48 million reais ($10.4 million) were released to the company in March this year to fund a probe into the causes of the dam collapse.

The town of Brumadinho, where Vale’s Córrego do Feijão iron ore mine is located, suspended this month Vale’s licence to operate on concerns workers were not respecting social distancing rules.

It also halted ongoing work to repair the mine’s tailings storage facility.

The iron ore giant faces multiple legal actions over the incident, the deadliest in Brazil’s mining history. They include allegations that Vale was aware of the dam’s unstable condition years before the accident happened.

In January, state prosecutors charged Fabio Schvartsman, the chief executive at the time of the burst, and 15 other people with homicide. Schvartsman left his position at the company in March 2019.

They also charged Vale and its German contractor, TUV SUD, with environmental crimes, as the burst unleashed an avalanche of muddy mining waste that polluted the nearby town of Brumadinho, water streams and agricultural land.

Tailings in the spotlight

The tragic incident has triggered over the past year several criminal investigations, including a global inquiry into the status of 726 tailing dams.

It has also put the safety of those structures under the microscope.

The International Council on Mining and Metals (ICMM), a London-based industry group representing 27 major mining companies, formed an independent panel of experts in charge of developing global standards for tailings facilities.

The Church of England, which invests in mining companies through its pensions for retired clergy, along with its partners, launched a global inquiry in April 2019 into the mining waste storage systems of more than 700 resources companies.

It now asks companies to disclose data on tailings dams on a regular basis.

Switzerland-based Responsible Mining Foundation (RMF) published a study in early April this year, showing that investor-led action had resulted in improved transparency regarding the state of such facilities.

The vast majority of miners, however, have yet to demonstrate they are reviewing how they effectively manage tailings-related risks.

The non-profit, funded by the Dutch and Swiss governments and some small philanthropic organizations, said that while a global standard on tailings management is a welcome initiative, it could be significantly strengthened to become significant in terms of tailings safety.

from MINING.COM https://ift.tt/2B2o4yl

Ce taxi volant se transforme en voiture autonome

from Les dernières actualités de Futura https://ift.tt/36xAZUQ

Bon plan French Days Amazon : les aspirateurs robots Ecovacs jusqu’à -25%

from Les dernières actualités de Futura https://ift.tt/2M4AAzW

Virgin Orbit : retard à l'allumage pour le lanceur aéroporté

from Les dernières actualités de Futura https://ift.tt/2ZTn0aL

Extinction des dinosaures : c'est le pire des scénarios qui s'est produit !

from Les dernières actualités de Futura https://ift.tt/3c57laI

Deuxième vague en Chine : le coronavirus est-il en train de changer ?

from Les dernières actualités de Futura https://ift.tt/2ZNNjix

Quaterra’s Groundhog prospect in Alaska may be similar to massive Pebble project – report

Quaterra Resources (TSXV: QTA) published a report that, according to the company, supports its assessment of the Groundhog prospect in Alaska as a possible copper-gold porphyry system hosting mineralization similar to that in Northern Dynasty’s (TSX: NDM) massive Pebble project.

Groundhog is located some 300 kilometres southwest of Anchorage. It is a 54,880-acre property that covers the northern extension of a 10-kilometre wide north-northeast trending structural zone that hosts a number of porphyry copper-gold prospects, including the Pebble project, which is approximately five kilometres south of the Groundhog claim boundary.

Quaterra has to provide $5 million over six years in exploration spending in order to earn a 90% interest in Groundhog from Chuchuna Minerals

According to the independently-prepared report, mapping, limited drilling and geochronology have demonstrated that similar-aged rocks in a similar structural setting to that in Pebble occur at Groundhog.

“We are pleased to have affirmation of Groundhog as a possible copper-gold porphyry system hosting mineralization similar to Pebble and to have been provided with a roadmap for its exploration going forward,” Quaterra’s president and CEO, Gerald Prosalendis, said in a media statement. “This year’s program will involve the 3D inversion of last year’s ZTEM geophysical survey as recommended by the report. This will enable refinement and selection of high-priority targets for ground-based IP and drilling possibly next year if circumstances and the availability of funds enable it.”

from MINING.COM https://ift.tt/2X7kzzu

Seabridge Gold completes acquisition of 3 Aces gold project

Seabridge Gold (TSX: SEA) (NYSE: SA) completed the acquisition of a 100% interest in the 3 Aces gold project in the Yukon territory, northwestern Canada.

To seal the deal with Golden Predator Mining, Seabridge has to issue 300,000 common shares and agree on potential future cash payments totalling $2.25 million.

3 Aces is on the eastern margin of the Selwyn Basin, a thick package of sedimentary rocks extending across the Yukon which hosts several enormous base metal deposits

In detail, the acquisition agreement provides for payments to Golden Predator of $1 million upon confirmation of a 3 Aces NI-43-101 compliant mineral resource of 2.5 million ounces of gold and a further $1.25 million upon confirmation of an aggregate mineral resource of 5 million ounces of gold. The agreement also grants Golden Predator a 0.5% net smelter royalty on the project.

“We think 3 Aces is a worthy addition to the three outstanding exploration opportunities we already own in British Columbia, Nevada and the Northwest Territories,” Seabridge Gold chairman and CEO, Rudi Fronk, said in a media statement. “Golden Predator has done an excellent job of demonstrating the exploration potential at 3 Aces, confirming the project’s positive metallurgy and establishing excellent relationships with local First Nations and communities.”

According to Fronk, the company’s current plan is to assemble and evaluate the wealth of data developed by GPY for the targets in the Central Core Area of the project with a view to initiating an aggressive drill program next year.

3 Aces is a district scale, orogenic-gold project consisting of 1,536 claims covering approximately 350 square kilometres in the southeastern part of the Yukon.

from MINING.COM https://ift.tt/2AgvqOh

Pandemic to worsen copper glut during next 18 months

A global copper surplus currently in the making is expected to get worse in the next 18 months as market disruptions have created greater uncertainty in the factors affecting supply and demand for the metal, a market’s insider report shows.

According to the International Wrought Copper Council (IWCC), which represents copper and copper alloy producers, supply is expected to surpass demand by 285,000 tonnes this year as a result of coronavirus-related disruptions. The figure would likely rise to 675,000 tonnes in 2021, the industry body said.

IWCC expects global copper surplus to hit 285,000 tonnes this year and 675,000 tonnes in 2021.

Unlike gold, considered a safe haven asset, copper remains largely ruled by laws of supply and demand. With mines shutting down or curtailing operations and global economic growth projections being tossed aside amid the coronavirus pandemic, both supply and demand of the red metal continue to be severely affected.

On May 19 prices for the metal hit their lowest since January 2016, with three-month copper futures on the London Metal Exchange (LME) touching $4,371 per tonne. That’s down from a high of around $6,340 per tonne in mid-January.

Plot twist

“These are unprecedented times and the copper industry is not immune from the impact of the COVID-19 pandemic,” the IWCC said.

The report confirms a plot twist for copper, which was supposed to thrive this year amid a projected supply deficit.

Demand for the metal, widely used in construction and increasingly in the electric vehicles (EVs) sector, is forecast to fall by 5.4% this year, the IWCC said. The industry body, however, believes demand could rebound by 4.4% in 2021.

Refined copper production is forecast to be 24.3 million tonnes in 2021, against demand of 23.625 million tonnes.

Refined copper production this year is forecast to be 22.91 million tonnes against demand of 22.625 million tonnes. In 2021 output is seen climbing to 24.3 million tonnes, with demand at 23.625 million tonnes.

In China, the world’s largest consumer of the metal, refined copper demand will slide 2.8% to 11.87 million tonnes this year. In 2021, however, should rise by 2.6% to 12.175 million tonnes in 2021, according to the IWCC.

In Europe, refined copper consumption is seen falling 6.4% in 2020 before climbing 5.4% to 2.927 million tonnes next year.

In North America, including the United States, Canada and Mexico, refined copper demand this year is expected to slip 6.9% to 2.223 million tonnes before registering a 5.3% upturn in 2021.

IWCC based its estimates on publicly available information and input from the International Copper Study Group (ICSG), a global research and marketing body.

from MINING.COM https://ift.tt/3caxAwe

Coronavirus : les patients ne sont plus infectieux après 11 jours

from Les dernières actualités de Futura https://ift.tt/2M3DswO

Test du DJI Mavic Air 2 : Futura a trouvé le drone de loisir de référence

from Les dernières actualités de Futura https://ift.tt/2XDdAgN

La mise à jour de Windows 10 pourra bloquer l'installation de logiciels indésirables

from Les dernières actualités de Futura https://ift.tt/2ZN6BEJ

SpaceX : suivez en direct le vol historique de la Nasa de ce soir

from Les dernières actualités de Futura https://ift.tt/3d2r77X

SpaceX : Crew Dragon ouvre une nouvelle ère du transport spatial

from Les dernières actualités de Futura https://ift.tt/2XDbnSe

Cette sucette électronique permet de créer n'importe quel goût

from Les dernières actualités de Futura https://ift.tt/2ZGRagY

SpaceX : gros plan sur les deux astronautes du vol historique de Crew Dragon

from Les dernières actualités de Futura https://ift.tt/3gsEPDe

La voiture électrique en pole position du plan de relance de l’automobile en France

from Les dernières actualités de Futura https://ift.tt/2B3y4rb

Attention, la vitamine D n'est pas un traitement efficace contre le coronavirus

from Les dernières actualités de Futura https://ift.tt/3eiuuYs

Bons plans French Days : les meilleures promotions Cdiscount sur les smartphones

from Les dernières actualités de Futura https://ift.tt/3d5Nqtj

SpaceX : comment suivre en direct le vol habité historique de la Nasa ce soir

from Les dernières actualités de Futura https://ift.tt/2ZFuhdX

Avis défavorable pour l’hydroxychloroquine en France

from Les dernières actualités de Futura https://ift.tt/3enPpcI

Cet anticorps est capable de détecter la maladie d'Alzheimer

from Les dernières actualités de Futura https://ift.tt/3gqKLwE

mardi 26 mai 2020

Metso introduces new crushing and screening plant concepts

Metso has introduced two new solutions for crushing and screening plants: flexible FIT stations and smart Foresight stations. These two units are intended to provide significant resource and time savings for mines.

“We have the experience in delivering crushing and screening plants with over one hundred installations globally. We also understand the needs of customers today in the evolving industry.” Guillaume Lambert, VP of crushing systems at Metso, said in a release.

“That is why we are using our legacy and expertise to introduce these modularized crushing stations that focus on capex reduction and shorter lead times,”

Unique benefits

The new stations offer flexible solutions, which bring ease of maintenance and time savings for operations. The flexible FIT stations and smart Foresight stations provide unique benefits:

TheFIT stations are designed with a focus on speed and flexibility. There are two stations to select from: a recrushing station and a jaw station.

The steel structures are supplied in modules that fit easily into containers for transportation.

This also reduces on-site welding requirements and allows for quicker startup. Container delivery reduces delivery time by up to 25%; erection time is also reduced by up to 15%.

The Foresight stations are equipped with smart automation technology, which includes Metso’s Metrics and VisioRock, level sensors and crusher variable-frequency drive (VFD).

These features enable optimized crusher speeds, preventative maintenance and optimized production levels of up to 6,000 tons per hour. The cone crusher station features a scalping screen.

Both stations come with Metso equipment and technology for maximum productivity.

Metso offers equipment and services for the sustainable processing and flow of natural resources in the mining, aggregates, recycling and process industries.

(This article first appeared in the Canadian Mining Journal)

from MINING.COM https://ift.tt/2ZBXCWJ

Hydroxychloroquine : le HCSP et l’ANSM disent « non »

from Les dernières actualités de Futura https://ift.tt/3cZHli9

Pourquoi le champ magnétique terrestre s'affaiblit-il au-dessus de l'Atlantique Sud ?

from Les dernières actualités de Futura https://ift.tt/3eeSuf8

Xiaomi lance en France son vélo électrique pliant Mi Smart Electric Folding Bike

from Les dernières actualités de Futura https://ift.tt/3d3DKzN

Le robot Boston Dynamics devient berger en Nouvelle Zélande

from Les dernières actualités de Futura https://ift.tt/3d4UQNE

Taseko begins Yellowhead copper project talks

Canadian base metals producer Taseko Mines (TSX: TKO) has inked a deal with a British Columbia-based indigenous nation regarding the company’s intentions to kick off the regulatory approval process for its Yellowhead copper project.

The agreement, the Vancouver-based miner said, represents its commitment to recognize and respect local communities’ inherent rights to govern its lands.

It also highlights “the importance of assessing the project in accordance with the Nation’s values, laws, and community aspirations to make an informed decision on the project,” Taseko said.

Mining executives across the globe have stepped up efforts in the past years to gain and maintain social support for its projects and operations.

Mining executives across the globe have stepped up efforts in the past years to gain and maintain social support for its projects and operations. The concept, frequently called “social licence to operate” (SOL), is now at the centre of most business strategies, as the mining and metals sector faces greater scrutiny from end consumers, demanding a transparent, ethical supply chain, as well as a lower carbon footprint.

The International Council on Mining and Metals (ICMM) has responded accordingly, releasing last year a new version of its guidelines on handling grievances in mining-affected communities amid increased pressure for miners to carry out socially-responsible investments and operations.

Originally published in 2009, the new version outlines good practices on how mining and metals companies should design effective mechanisms to handle and resolve community concerns and objections. It also provides practical tools to support companies with implementation.

Updated figures

Taseko recently completed a new development plan and updated study for Yellowhead, located 150 km northeast of Kamloops, BC.

The update added 100 million tonnes to reserves and improved the economics and pegs pre-production capital costs for an operation with a 25-year mine life at C$1.3 billion.

Yellowhead now contains reserves of 817 million tonnes grading 0.29% copper equivalent (or 0.28% copper, 0.03 g/t gold and 1.3 g/t silver).

Taseko also owns the operating Gibraltar mine and is advancing the Florence copper project in Arizona. In December, it announced a truce in a long-dragged battle with the Tsilhqot’in First Nation, by beginning talks with the group, mediated by the province, regarding its New Prosperity project in B.C.

The company acquired Yellowhead in 2014 in an all-stock transaction valued at C$13 million.

from MINING.COM https://ift.tt/3gnl6Vx

Les fonds marins ne sont pas épargnés par la montée des températures

from Les dernières actualités de Futura https://ift.tt/3d5wZx8

Bientôt le paiement par la voix avec l'Assistant Google

from Les dernières actualités de Futura https://ift.tt/3c7W6Ot

Le Système solaire pourrait être né de la collision d'une autre galaxie avec la Voie lactée

from Les dernières actualités de Futura https://ift.tt/2M1ch5O

USA Rare Earth finishes Phase 1 testing for Texas project

USA Rare Earth, the funding and development partner of the Round Top Heavy Rare Earth project in West Texas, together with Texas Mineral Resources, announced Tuesday that it has successfully completed its Phase I bench scale testing at Inventure Renewables laboratory in Tuscaloosa, Alabama.

USA Rare Earth, which has ambitious plans to establish a domestic rare earths supply chain, is also purchasing the equipment necessary to build the only rare earth magnet production facility in the Americas.

This milestone, it said, demonstrates the ability to load and concentrate rare earths (REE’s) in the presence of high concentrations of non-REEs, including other critical minerals like lithium.

“This is an important step towards USA Rare Earth’s objective to build the first rare earth and critical minerals processing facility outside China and to bring the Round Top project into full commercial production,” said Pini Althaus, CEO of USA Rare Earth in a media release.

These results provide the baseline for initiating the Pilot Plant operation at USA Rare Earth’s rare earth and critical minerals processing facility in Wheat Ridge, Colorado.

The first of three Continuous Ion Exchange (CIX) Pilot Plant units was delivered in early March and is planned to be commissioned in early June as covid-19 related travel restrictions are relaxed, the company said.

from MINING.COM https://ift.tt/3gqyU1B

Sienna to acquire EMX’s Ni-Cu-Co-PGE project in Finland

EMX Royalty (TSXV: EMX) and Sienna Resources (TSXV: SIE) announced that the latter will enter a two-year option period to acquire EMX’s Kuusamo Ni-Cu-Co-PGE project in Finland in exchange for a royalty, satisfying work commitments, and making payments of cash and equity to EMX.

Sienna can earn a 100% interest in Kuusamo by issuing 500,000 shares of SIE to EMX upon execution of the amendment agreement and spending a minimum of C$250,000 on exploration and project advancement over the next two years, among other conditions

The deal is part of an amendment to the option agreement signed between both companies back in December 2017, which referred to the Slättberg Ni-Cu-Co-PGE project in southern Sweden.

“Sienna and EMX have been working together to advance the Slättberg Ni-Cu-Co-PGE project in southern Sweden, a relationship that will now extend to Finland,” the firms said in a media statement.

The Kuusamo battery metals project is comprised of two exploration reservation properties located adjacent to and near EMX’s Kaukua PGE royalty property, which is being advanced by Palladium One Mining.

Kuusamo hosts similar styles of mineralization located within the same mafic intrusive complex and along trend of the mineralization at Kaukua. According to EMX, both properties show Ni-Cu-Co-PGE enriched sulfide horizons near the base of a mafic intrusive complex.

from MINING.COM https://ift.tt/36tsYAj

Minerals Council of Australia proposes roadmap for post-covid-19 recovery

The Minerals Council of Australia is calling on the federal government to adopt a series of measures that, in the group’s view, would guarantee the recovery of the mining sector once the covid-19 pandemic comes to an end.

In a document titled Immediate Reform Priorities to Accelerate Economic Recovery, the MCA proposes targeted reforms that include lower taxes, faster project approvals, modern skills and flexible workplaces.

The MCA document states the government also has to focus on skills and training needs, including retraining and reskilling entrants from other industries affected by covid-19

“Our world-leading minerals companies are hampered by regulatory duplication and overlap, while projects take too long to be approved – denying regional communities jobs and investment,” the Council’s report reads. “Expediting environmental assessments and approvals, reforming greenfields agreements and expanding incentives for exploration will also help realise and refresh the potential pipeline of new and expanding mining projects.”

According to the MCA, Australia’s company tax rate of 30% is too high, not internationally competitive and could put at risk mining investment.

“A potential mining investment pipeline of up to $100 billion of coal, iron ore, base metal, critical minerals and gold projects as well as tens of billions of spending to sustain the Australian mining industry cannot be taken for granted,” the document states. “With other mining nations significantly hampered by the covid-19 pandemic while Australian minerals companies continued to operate, Australia’s competitors will waste no time in attempting to increase their share of the recovery.”

The Council’s paper highlights the fact that growing economies of highly populated nations such as India and Southeast Asia will recover and continue to grow with their expanding housing, infrastructure and manufacturing needs supporting higher demand for industrial metals such as steel, copper and aluminium. In their view, those are markets that the country’s mining sector could be targeting.

from MINING.COM https://ift.tt/3glR0BD

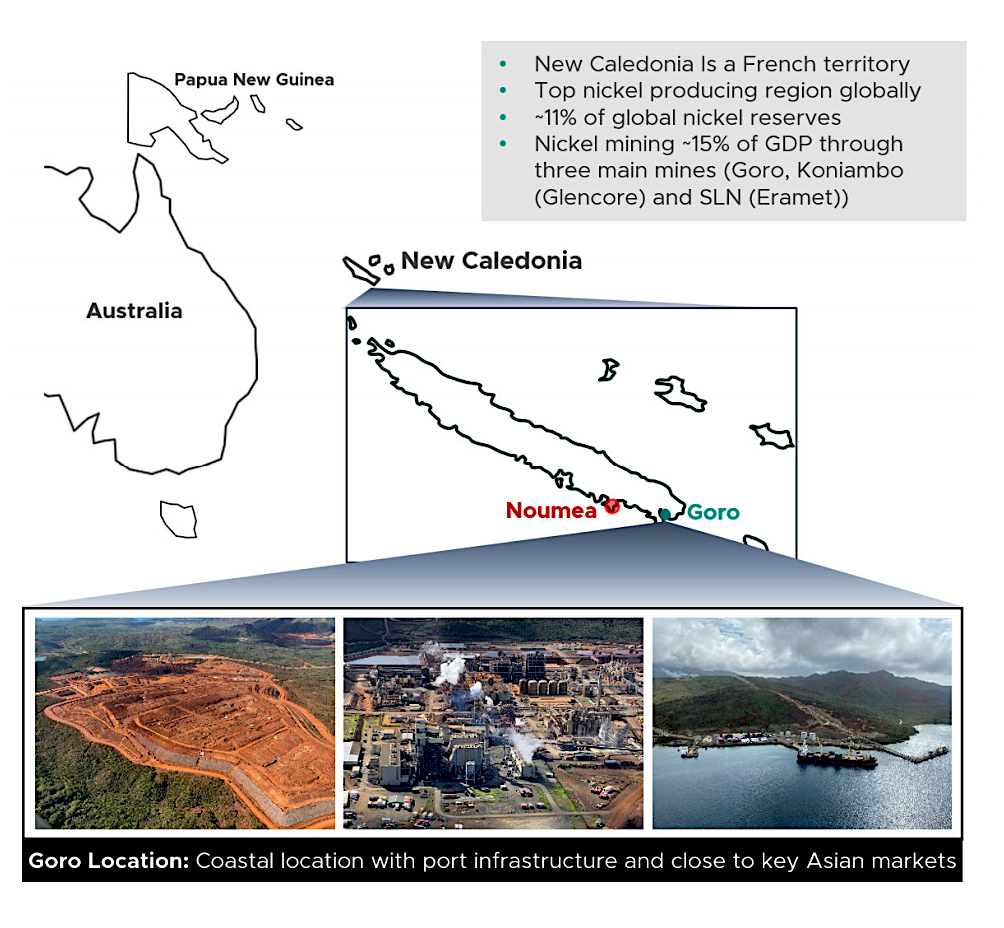

New Century eyes Vale’s New Caledonia mine

Australia’s New Century Resources (ASX: NCZ) has confirmed rumours of talks with Vale (NYSE: VALE) to buy the Brazilian miner’s nickel and cobalt operations on the Pacific island of New Caledonia.

The Melbourne-based zinc producer said on Tuesday it had entered into a 60-day exclusivity period with Vale to complete due diligence and negotiate the acquisition of 95% of Vale Nouvelle Calédonie (VNC).

VNC owns and operates the troubled Goro nickel-cobalt mine on the French territory, which has proven a financial burden for Vale since it began operations, two years behind schedule, in 2010.

The Goro nickel-cobalt mine has proven a financial burden for Vale since it began operations in 2010.

The Rio de Janeiro-based miner first announced its intention to exit operations in New Caledonia in December. The decision came after it had to write down $1.6 billion in the fourth quarter related to the ailing mines, the world’s biggest nickel operations.

Vale cut in April its 2020 nickel production guidance to 200,000-210-000 tonnes per year from 240,000 tpy to account for the anticipated loss of VNC’s 60,000-tpy output.

Shortly after, the miner revealed it had received non-binding offers for VNC, which includes the Goro mine, a processing plant and the port of Prony.

The companies didn’t disclose financial details of the deal, but Vale had previously said it would book a $400 million impairment on any sale.

New Century noted if the transaction goes through, the financial terms would include a fiscal package to help with transitioning VNC’s operations from Vale Canada.

Major nickel-cobalt player

Australian nickel miner IGO Ltd (ASX: IGO), which became New Century’s top shareholder in April after taking an 18.4% stake, was supportive of the deal and intended to discuss MHP offtake arrangements in the future, it said.

Both Vale and New Century also plan to consult France’s government, as New Caledonia is among the nation’s territories, to confirm its continued financing support for the mine.

Goro’s acquisition, New Century said, would make it a major supplier of nickel and cobalt sourced from outside the DRC.

Goro’s acquisition, New Century said, would make it a major supplier of nickel and cobalt sourced from outside the Democratic Republic of Congo. The African country is currently the world’s biggest supplier of cobalt for the electric vehicles (EVs) sector.

While the ailing mine has the capacity to produce 60,000 tpy of nickel in the form of nickel oxide, it churned out just 23,400 tonnes of nickel in 2019. That’s slightly over a third of its annual capacity.

The operation has never fully mastered the challenging high-pressure-acid-lead (HPAL) technology used to convert ore to nickel oxides, leaving VNC unable to produce preferential battery material nickel sulfate.

Vale believes the nickel market will enter a surplus in 2020, compared with its previous view of continued deficits. Its long-term outlook, however, remains positive due to factors including demand for nickel in the batteries that power EVs.

from MINING.COM https://ift.tt/2Xud4S5

Insolite : ils rechargent une Tesla Model X en pédalant

from Les dernières actualités de Futura https://ift.tt/2TIMZ0C

Le Système solaire est peut-être né de la collision de la Voie lactée avec une autre galaxie

from Les dernières actualités de Futura https://ift.tt/2X1X4rg

Voici l'animal le plus « humain » jamais créé

from Les dernières actualités de Futura https://ift.tt/3ei3nwP

La comète Swan passe au plus près du Soleil le 27 mai. Comment l'observer ?

from Les dernières actualités de Futura https://ift.tt/2XztA36

Ces crustacés miniatures défient les lois de la physique

from Les dernières actualités de Futura https://ift.tt/2M14l4A

Ce poisson préhistorique mangeait déjà comme les requins modernes

from Les dernières actualités de Futura https://ift.tt/2Xwv2Dy

Bientôt disponible sur iOS et Android, l'application StopCovid se dévoile en images

from Les dernières actualités de Futura https://ift.tt/2X3667G

Comment le coronavirus a stoppé net l'épidémie de grippe

from Les dernières actualités de Futura https://ift.tt/2ZEletY

Quelles sont les chances que la vie émerge et se développe sur une planète comme la Terre ?

from Les dernières actualités de Futura https://ift.tt/3c9yQ2Y

Covid-19 : le placenta des femmes enceintes présente des lésions

from Les dernières actualités de Futura https://ift.tt/3ej4a0p

Jupiter : un nouveau modèle de la formation de ses quatre plus grandes lunes

from Les dernières actualités de Futura https://ift.tt/2X06HXu

lundi 25 mai 2020

Arctique : la vague de chaleur et la fonte précoce des glaces inquiètent les scientifiques

from Les dernières actualités de Futura https://ift.tt/36sVjXn

SpaceX ouvre une nouvelle ère du transport spatial avec Crew Dragon

from Les dernières actualités de Futura https://ift.tt/3c3fwUR

Une très rare galaxie « anneau de feu » découverte aux confins de l'univers

from Les dernières actualités de Futura https://ift.tt/2ZB2D1S

Les chats survivent mieux aux morsures de serpents que les chiens, et voici pourquoi

from Les dernières actualités de Futura https://ift.tt/3cWK8IV

La Chine va lancer sa première mission d'exploration de Mars en juillet

from Les dernières actualités de Futura https://ift.tt/2ARoesj

44,2 térabits par seconde : le nouveau record de vitesse du débit Internet

from Les dernières actualités de Futura https://ift.tt/3elv3AL