vendredi 31 juillet 2020

« Les super-propagateurs », qui sont-ils et comment influencent-ils la diffusion du coronavirus ?

from Les dernières actualités de Futura https://ift.tt/2BLhGMK

Des bactéries de 100 millions d'années ont été « ressuscitées » par des scientifiques

from Les dernières actualités de Futura https://ift.tt/3hVjCSh

Glencore’s strong H1 performance boosted by oil trading

Glencore Plc (LON: GLEN) said trading profit will be at the top end of its target this year but posted lower production figures for its first half.

The company made nearly $1 billion in earnings before interest and taxes in oil trading in the first six months of 2020, similar to what it made in the whole of 2019, Bloomberg reported last week.

In March and April, as oil prices plunged, traders were able to buy and store huge amounts of cheap crude before selling it on later for higher prices.

“Our marketing business has risen to the challenge, delivering robust counter-cyclical earnings,” Glencore CEO Ivan Glasenberg said in a statement Friday.

“A very strong first-half performance allows us to now raise our full year 2020 EBIT expectations to the top end of our $2.2-$3.2 billion guidance range.”

The company reported copper production of 588,100 tonnes in H1, 74,900 tonnes (11%) lower than H1 2019, mainly reflecting Mutanda mine in DRC being on care and maintenance, expected lower grades at Antapaccay in Peru and the short-term impact of Antamina’s covid-19 related demobilisation in Peru. The impact was partly offset by stronger milling throughput at Collahuasi mine in Chile.

Company plans to cut coal production after prices tumble

“Iam particularly pleased to report a strong operational performance at Katanga, with its ramp-up on track to achieve design capacity by the end of the year.” said Glasenberg.

Glencore’s zinc production was 550,100 tonnes, in line with H1 2019, reflecting stronger grades at the Canadian mines and the various temporary covid-19 related suspensions at Antamina and other South American operations.

Nickel production of 55,200 tonnes was in line with H1 2019, reflecting a strong period of operations at Murrin mine in Western Australia.

Coal production of 58.1 million tonnes was 10.1 million tonnes (15%) lower than H1 2019, mainly reflecting the covid-19 related asset suspensions in Colombia.

Dividend

Glencore warned its net debt, which is already the highest among mining companies, would be higher in the first half of the year.

In March, it deferred a decision to pay a $2.6 billion dividend until interim results next week.

“While we expect our operating cash flow to remain solid, we are ready to adapt to changing market conditions.” said Glasenberg.

“I suspect the company will be under a degree of pressure to pay dividend given the payouts from Rio Tinto and Anglo American,” said BMO Capital Markets analyst Edward Sterck.

Glencore’s stock was down 1.1% on the LSE on Friday (3:13PM BST). The company has a $30.6 billion market capitalization.

from MINING.COM https://ift.tt/3giCeLJ

Chilean watchdog charges BHP for water misuse at Escondida

Chile’s environmental watchdog said on Friday it would charge BHP’s Escondida copper mine, the world’s largest, for water misuse since 2005.

The Superintendency of the Environment (SMA) said the operation has caused a decrease in the water table levels greater than 25 cm, which is the allowed limit in the Atacama desert, the world’s driest, where Escondida is located.

The regulator said the charge against BHP’s copper mine could result in the revocation of its environmental permit, closure or a fine.

More to come …

from MINING.COM https://ift.tt/2Pg7puY

L’une des plus puissantes tempêtes solaires est survenue lors d'un des plus faibles minimums d'activité du Soleil

from Les dernières actualités de Futura https://ift.tt/2BJxtvs

Diamond Princess : un seul passager serait à l'origine des 700 contaminations

from Les dernières actualités de Futura https://ift.tt/2BPAESy

e-cigarette : ce marqueur biologique peut dire si vous avez plus de chances de vapoter

from Les dernières actualités de Futura https://ift.tt/33bmczk

Le plus petit dinosaure du monde était en fait… un lézard

from Les dernières actualités de Futura https://ift.tt/3jRBoHQ

British Columbia First Nations show support for Benchmark Metals’ Lawyers project

Benchmark Metals (TSXV: BNCH) announced that it has received support from the Tsay Keh Dene Nation, Kwadacha Nation, and Takla Nation to advance its flagship Lawyers project in British Columbia, Canada.

In a media statement, Benchmark said that management signed a trilateral agreement with the partner First Nations, which is vital to building and maintaining community support for the project.

According to the miner, its own commitment requires that Lawyers is developed in a sustainable manner that provides social and economic opportunities while maintaining inherent rights to ancestral lands.

The Tsay Keh Dene Nation, Kwadacha Nation and Takla Nation showed support for the gold-silver project

“We are very pleased to be working cooperatively, clearly demonstrating the capability and strength of support from our Partner Nations. It shows what can be done when companies and indigenous groups build relationships and work together,” Benchmark’s CEO, John Williamson, said in the brief. “These supportive relationships bode well for continued success to advance the Lawyers gold-silver project along the permitting path for a mining decision. Benchmark is rapidly advancing the project with near-term drill results and milestone events in the context of a surging gold sector.”

The 140-square-kilometre Lawyers property is located in the Golden Horseshoe of north-central British Columbia and sits on the prolific metal-endowed Stikine Terrane.

Exploration on the Lawyers property and the surrounding area began in the late 1960s and peaked in the 1980s, identifying numerous showings, prospects and deposits culminating in the development of the Lawyers gold-silver mine that operated from 1989-1992 and produced 171,200 oz gold and 3.6 million oz silver over the four-year period. The deposit was never fully mined, or the surrounding area thoroughly explored for gold-silver mineralization.

from MINING.COM https://ift.tt/3hSSXWb

Ariana grows resources of Salinbas project in Turkey

Ariana Resources (AIM: AAU) announced that resources for its Salinbas project in northeastern Turkey increased to 1.5Moz up from c.1Moz that the company previously reported.

In a press release, the miner said the estimate is split between the high-grade Salinbas deposit and the low-grade, high-tonnage Ardala porphyry complex.

According to Ariana, the Salinbas deposit comprises 8.4Mt @ 2.21g/t Au + 16.9 g/t Ag for 0.6Moz gold and 4.6Moz silver, while the Ardala porphyry comprises 66.4Mt @ 0.44g/t Au for 0.9Moz, plus 3.3Moz silver, 110,000t copper and 4,200t molybdenum, which includes a higher grade core of 32.5Mt @ 0.51g/t Au, 0.21% Cu, 0.01% Mo.

The project area is right at the heart of a major copper-gold province

“This new resource estimate represents a major increase in the resource, confirming the project as having multi-million ounce, multi-commodity potential and indicates further growth opportunities,” Kerim Sener, the company’s managing director, said in the press brief. “The prospectivity of this region is attested by the presence of several other major copper-gold systems in the immediate vicinity, such as the >4Moz Hot Maden deposit, located just to the south of our project licences, and the scale of the alteration systems encountered within our property in the vicinity of the porphyry centres at Ardala and Hizarliyayla.”

According to Sener, the project area is right at the heart of a major copper-gold province that -in his view- shows potential for >10Moz across the circa 100-kilometre long and 10-kilometre wide Artvin-Yusufeli Gold Trend.

from MINING.COM https://ift.tt/3fgfsTn

Russian billionaire Abramovich sells out in $1.4 bn gold deal

Russian billionaire Roman Abramovich is selling his stake in local mid-sized gold miner Highland Gold (LON: HGM), the latest in a series of mining deals involving the precious metal, which is trading at record highs.

Abramovich and other investors holding 40.06% of the Russia-focused gold miner have agreed to sell their shares to Fortiana Holdings Limited in a deal that values Highland at about $1.4 billion.

Fortiana, a Cyprus-registered company of Russian businessman Vladislav Sviblov, will make an offer to the rest of Highland’s shareholders at the same price of 3-pounds-per-share ($3.94), a 3.8% premium to Thursday’s closing price.

Highland Gold is one of Russia’s top 10 gold producers, operating several mines in the country’s Far East.

The agreement follows Fortiana’s sale last month of about 5% in another Russian gold miner, Petropavlovsk. Selling that interest gave the company cash to pursue other investment opportunities, it said at the time.

Spot gold has climbed about 29% this year on the back mixed factors, including haven demand, a weakening US dollar, negative real yields and a flood of monetary and fiscal stimulus.

Even with the likelihood of gold price volatility in the near term, investment demand should hold up over a longer time period, the World Gold Council said Thursday.

Abramovich sold last year a stake in Nornickel, Russia’s biggest mining company. The deal was the largest share sale by a Russian company since Magnit PJSC’s accelerated bookbuilt offering in November 2017.

Fortiana’s acquisition of a stake in Highland Gold is expected to close in the fourth quarter of 2020.

(With files from Reuters and Bloomberg)

from MINING.COM https://ift.tt/2P9gi9O

e-cigarette : ce marqueur biologique peut dire si vous êtes plus à risque de vapoter

from Les dernières actualités de Futura https://ift.tt/33dMMYA

En vidéo : le plus petit dinosaure du monde était en fait… un lézard

from Les dernières actualités de Futura https://ift.tt/3hXnK4n

Comment créer des photos en mesurant le temps

from Les dernières actualités de Futura https://ift.tt/3jY8GFm

Des gants anti-coronavirus qui se désinfectent en 30 secondes

from Les dernières actualités de Futura https://ift.tt/313lHoy

Airbus : le prototype de drone hélicoptère effectue son premier vol libre autonome

from Les dernières actualités de Futura https://ift.tt/312zKul

Vidéo : le lancement vers Mars de la mission historique Perseverance

from Les dernières actualités de Futura https://ift.tt/30fIG0v

Y a-t-il de la vie sous la surface de Mars ?

from Les dernières actualités de Futura https://ift.tt/2Eu1XTc

L'Antarctique est le meilleur endroit sur Terre pour observer l'Univers

from Les dernières actualités de Futura https://ift.tt/2D3lN7q

Une potion médiévale de 1.000 ans comme traitement antibiotique ?

from Les dernières actualités de Futura https://ift.tt/3ggNica

BlackTea, une mobylette électrique vintage à moins de 3.000 euros

from Les dernières actualités de Futura https://ift.tt/318jrw4

L'Antarctique est le meilleur endroit sur Terre pour observer le cosmos

from Les dernières actualités de Futura https://ift.tt/3jZ08hB

jeudi 30 juillet 2020

On aurait enfin découvert l'origine des mégalithes de Stonehenge

from Les dernières actualités de Futura https://ift.tt/2BO6K0Y

Biodiversité : une bonne nouvelle pour les tigres en Thaïlande !

from Les dernières actualités de Futura https://ift.tt/2EAkz48

Cet amas globulaire unique en son genre a été déchiqueté par la Voie lactée

from Les dernières actualités de Futura https://ift.tt/3jUiqAr

En vidéo : explorez le cratère Jezero où Perseverance va rechercher des traces de vie

from Les dernières actualités de Futura https://ift.tt/3gkGtqc

Les urines sont plus fiables que les mots pour les scientifiques

from Les dernières actualités de Futura https://ift.tt/2XbI5L6

En vidéo : revivez le lancement vers Mars de la mission historique Perseverance

from Les dernières actualités de Futura https://ift.tt/311VBC7

Le déclin des abeilles met en péril les cultures agricoles

from Les dernières actualités de Futura https://ift.tt/30ep6RW

Interview : la lutte contre les moustiques est-elle sans fin ?

from Les dernières actualités de Futura https://ift.tt/339aipD

Un trou de ver avalant un trou noir serait détectable par Ligo et Virgo

from Les dernières actualités de Futura https://ift.tt/30fn0S9

BootHole, une faille redoutable qui affecte les ordinateurs équipés de Windows et Linux

from Les dernières actualités de Futura https://ift.tt/2D1IlWg

Conico to take control of Longland Resources’ projects in Greenland

Australia’s Conico Ltd. signed a conditional binding term sheet to acquire 100% of England registered Longland Resources Ltd in consideration for 120 million shares in Conico.

The main asset behind this purchase is Longland’s 100% interest in the Ryberg project in Greenland, which covers an area of 4,521 square kilometres containing the Sortekap gold prospect and the Miki Fjord & Togeda Cu-Ni-Co-PGE-Au magmatic sulphide prospects.

According to the companies, the project sits on a newly discovered Archaean greenstone belt containing orogenic, quartz vein-hosted gold mineralisation, and where limited surface sampling to date grades up to 2.7g/t gold.

The main asset behind this purchase is Longland’s 100% interest in the Ryberg gold project

“The scale of the discovery may be significant as it represents geology never seen before (revealed by ice retreat),” Conico said in a press release. “Mineralisation remains open in all directions.”

The miner reported that mineralisation occurs over a strike length of >50km with surface samples grading up to 2.2% Cu, 0.8% Ni, 0.1% Co, 3.3g/t Pd and 0.15g/t Au.

Longland also has an exclusive application for the Mestersvig project containing the historic Blyklippen Pb-Zn mine and Sortebjerg Pb-Zn prospect. Blyklippen produced 545,000 tonnes @ 9.3% Pb and 9.9% Zn between 1956-1962. The Mestersvig project application has progressed to the ‘license pending’ stage and, in the company’s view, granting is imminent.

“The acquisition of Longland gives Conico exposure to a dominant licence area in East Greenland, a location deemed to be highly prospective for precious and base metals. There is renewed interest in Greenland as a world-class mineral province, with new shipping routes, and hosting the world’s largest REE deposit (Kvanfjeld) outside of China,” Guy Le Page, a director at Conico, said in the media brief. “The company’s intention is to accelerate exploration in Greenland commencing with a proposed field programme for 2020. The objective is to generate drill targets at the Sortekap gold prospect, discover additional magmatic sulphide occurrences, and upon the successful grant of the Mestersvig Pb-Zn licence, conduct the first-ever high-resolution gravity survey to identify extensions to the old mine.”

from MINING.COM https://ift.tt/30d8NFl

B2Gold produces special gold bar to help save Namibian rhinos

B2Gold (TSX: BTO) launched a campaign to help support the conservation and protection of critically endangered black rhinos.

In a press release, the Canadian miner said that the Namibian Rhino Gold Bar initiative will support community-based rangers and trackers who protect rhinos in an area of 25,000 square kilometres with no national park status in the southern African country.

Through the campaign, B2Gold plans to donate 1,000 ounces of gold valued at approximately $1.9 million from its Otjikoto Mine in north-central Namibia.

There are fewer than 5,630 black rhinos left in the wild in Namibia

“B2Gold has produced 1,000 limited-edition Namibian Rhino Gold Bars in various sizes. To celebrate the launch of the campaign in North America, 400 one-ounce gold bars will go on sale on Kitco Metals’ retail website on July 31,” the media brief reads. “Each one-ounce bar is available for purchase at the spot price of gold plus a 15% conservation premium.”

The 15% premium will support rangers, trackers, and black rhino conservation and protection. It will be used to fund the future production of more gold bars, or gold medallions, the second limited edition of which will be distinctly different from the first mintage, so that this initiative remains self-sustaining.

Proceeds from the sale of the first 600 gold bars to Namibian and African purchasers have been managed and distributed by the Rhino Gold Bar Advisory Committee which includes representatives from B2Gold, Save the Rhino Trust Namibia, Integrated Rural Development and Nature Conservation, the Namibia Chamber of Environment, and the Namibia Ministry of Environment, Forestry and Tourism.

Some context

“Due to poaching, driven by the illegal rhino horn trade, over 1,000 wild rhinos are killed for their horns in Africa each year. The northwest of Namibia is home to the last and largest population of free-roaming black rhinos in the world, but with fewer than 5,630 black rhinos left in the wild, the need for rhino conservation and protection has never been so critical,” B2Gold reports. “At the current rate, it is predicted that black rhinos will be extinct within a decade.”

According to the company, the ripple effects of the covid-19 pandemic have further increased the risks that the animals face, particularly because job losses have led many people to move from urban to rural areas and poaching has increased.

At the same time, Save the Rhino Trust Namibia and Integrated Rural Development and Nature Conservation have had their budgets slashed as international donours have had to pass along cuts to their own budgets due to the pandemic.

Given this situation, B2Gold said that some funds have been allocated to help counteract the impact of the pandemic by providing salaries to keep rhino rangers and trackers in the field for the next 12 months; maintaining adequate patrol levels to diminish the threat of poaching and sustain population growth; raising awareness about the importance of black rhino conservation to reinforce community support; and upgrading communication systems to ensure the rapid response of rhino rangers and trackers during a crisis situation.

from MINING.COM https://ift.tt/39RSMrD

Rio Tinto set on building long-delayed Simandou

Rio Tinto (ASX, LON,NYSE: RIO) is suddenly in a rush to develop the giant and controversial Simandou iron ore project in Guinea, as half-year earnings support an investment case for the steel-making material.

Iron ore took, once again, the lion’s share of the second-biggest miner’s profits for the six month to June 30. The commodity has defied predictions for a fall, climbing 19% this year to above $110 a tonne on the back of strong Chinese demand and supply disruptions in Brazil.

“Under all scenarios Simandou will be developed, with or without Rio Tinto,” chief executive Jean-Sébastien Jacques told Bloomberg News. “There is a huge incentive for the Chinese to make it happen now,” he said, referring to the industrial activity increase in the Asian giant.

Beijing is actively pushing forward with the project and a decision should come soon, sources familiar with the process told MINING.COM.

The state-owned Assets Supervision and Administration Commission (SASAC), which oversees the largest government-owned enterprises in China, is currently fine-tuning details. That includes how the project will be funded, the sources added.

Jacques noted the company has been working with its Chinese partners to try determining the costs of developing their half share of Simandou.

The deposit is comprised of four blocks. Blocks 1 and 2 are controlled by a consortium backed by Chinese and Singaporean companies. Rio Tinto owns 45.05% of Blocks 3 and 4, with China’s Chinalco holding a 39.95% and the Guinean government a 15%.

Disputed riches

For over a decade, it seemed that Guinea’s crown jewel deposit would never be mined, as it was caught up in wrangles between companies that held rights to it and authorities in the West African nation.

In 2008, one of Guinea’s former dictators stripped Rio Tinto’s rights over two of the four blocks the deposit had been divided on and handed them to Israeli billionaire Benny Steinmetz’s BSG Resources (BSGR).

The world’s No. 1 iron ore miner was able keep the two southern blocks, but only after paying $700 million to the government in 2011. That guaranteed Rio tenure for the lifetime of the Simandou mine.

That deal came under scrutiny in 2016, forcing the company to fire two senior managers over a questionable $10.5 million payment made to a consultant who helped the company secure the two blocks and alerted authorities, including the US Department of Justice and the UK’s Serious Fraud Office.

Several investigations over bribery and corruption followed, until a settlement between Steinmetz and Guinea was reached early last year, ending the bitter and long-dragged out dispute involving Rio Tinto, Vale and BSGR.

As part of the agreement, Steinmetz’s company agreed to walk away from the asset, but retained the right to mine the smaller Zogota deposit.

Major new source

Simandou could dampen iron ore prices once it reaches full production. The deposit is not just massive — it holds two billion tonnes of iron ore — but the output is expected to have some of the highest grades in the industry.

Developing the rich ore under a jungle-covered mountain range presents additional challenges.

The financial burden of building a 650-km (400-mile) railroad stretching across Guinea to ports has always been a roadblock for developers. Estimates peg the cost at as much as $13 billion. With Chinese funding, the project becomes much more feasible.

China’s resource dependence on Guinea has increased in recent years. In 2017, Beijing agreed to loan President Condé’s administration $20 billion over almost 20 years in exchange for bauxite concessions.

The country is also the world’s top iron ore consumer, with its demand set to hit 1.225-billion tonnes by the end 2020, according to a government think tank.

Analysts say Guinea’s population has so far seen little benefit from Chinese investment.

from MINING.COM https://ift.tt/2DoAoKr

Incroyable : des chercheurs ressuscitent un microbe vieux de 100 millions d'années

from Les dernières actualités de Futura https://ift.tt/30aLM5G

En vidéo : comment va se dérouler le voyage de Perseverance vers Mars ?

from Les dernières actualités de Futura https://ift.tt/2Dg93KH

Yamaha dévoile un VTTAE avec assistance automatique

from Les dernières actualités de Futura https://ift.tt/2Xauggd

L'avion électrique à décollage vertical conçu par la Suisse prend son envol

from Les dernières actualités de Futura https://ift.tt/39EhU4V

En vidéo : Virgin Galactic dévoile la cabine de SpaceShipTwo

from Les dernières actualités de Futura https://ift.tt/2Xa0KqQ

Virgin Galactic dévoile la cabine de SpaceShipTwo

from Les dernières actualités de Futura https://ift.tt/2PeCI9v

Le coronavirus est resté caché plus de 40 ans dans les chauves-souris avant d'émerger

from Les dernières actualités de Futura https://ift.tt/339vCva

Événement : suivez le lancement de Perseverance en direct sur Futura à 13 h 40

from Les dernières actualités de Futura https://ift.tt/2PaA3O9

Un mystérieux nuage allongé apparaît dans le ciel de Mars

from Les dernières actualités de Futura https://ift.tt/2XaexxI

Cette baisse du CO2 éclairerait sur notre futur climat

from Les dernières actualités de Futura https://ift.tt/311lCS7

mercredi 29 juillet 2020

Ce veau génétiquement modifié transforme les femelles en mâles

from Les dernières actualités de Futura https://ift.tt/39H4jJT

Chile Chamber of Mines, unions reject Codelco’s privatization

Chile’s chamber of mines and unionized workers have rejected a proposal put forward by extreme-right parliament members to sell state-owned Codelco, the world’s largest copper miner, in order to finance the country’s response to the coronavirus pandemic.

The plan, laid out in an internal memo to members of the Independent Democratic Union (UDI) party, triggered stern criticism from both sector representatives and unionized workers.

“Codelco is Chile’s most important company in terms of contribution to the government’s coffers and the country’s pride,” Manuel Viera, President of the Chilean Mining Chamber, told local media.

He said it was “inconceivable” and “irresponsible” to turn to the mining industry whenever the country has a problem, adding that the sector shouldn’t be seen as a “milking cow”, but rather as an engine of development.

The Federation of Copper Workers (FTC), which groups together Codelco’s unions, threatened with a country-wise strike, should the government decide to entertain the idea of selling the company.

The UDI internal document highlighted that Codelco, nationalized in 1971 by the socialist president Salvador Allende and which now turns over all of its profits to the state, had a market value of about $50.5 billion in 2014.

“Privatizing the company would generate a very relevant income for the state, which could be used for social benefits. Moreover, privatization could continue generating income for the state through the collection of taxes and royalties,” the memo said.

This is not the first time Codelco faces privatization attempts. During his first term (2010-2014), President Sebastián Piñera said that taking the company private was necessary to increase its efficiency and competitiveness.

He noted at the time that the state-owned copper producer ‘s operational costs represented almost 47% of its total costs,. In contrast, BHP’s Escondida copper mine costs represented about 19% of the total expenses at the time.

Plans at risk

The coronavirus pandemic has affected Codelco’s ambitious 10-year, $40 billion mines overhaul to keep up production rates.

The miner has already finished one of its biggest projects — the $5.6 billion conversion of the Chuquicamata open pit mine into an underground operation.

In June, however, closed Chuquicamata’s smelter and refinery to prevent a further spread of covid-19 among its staff. The company has so far registered a total 3,215 confirmed cases and nine deaths due to the pandemic.

Chile’s mining minister, Baldo Prokurica, said earlier this month that the government would prioritize the health of workers in its vital mining sector, even if it affected production.

The country has been one of the hardest hit in Latin America. It has confirmed 349,800 cases and more than 9,000 deaths, according to consolidated figures from the World Health Organization and Johns Hopkins University.

Codelco has also placed on the back burner a $5.5 billion new level at the El Teniente underground mine. The operation, the company’s largest and the world’s no. 6 by reserve size, was originally slated to kick off mining at the new section in 2023.

Work at all of Codelco’s Northern District projects including Gaby, Ministro Hales and Radomiro Tomic have now been temporarily suspended.

Plans on pause involves converting the El Salvador mine to an open-pit mine from underground operations. The $1 billion project, known as Rajo Inca, is expected to extend the productive life the mine by 40 years and increase output by 30% from current levels.

Salvador is Codelco’s smallest division by production. Last year, it churned out 50,600 million tonnes of copper, down 16.8% from 2018.

In the copper giant’s pipeline of structural projects there is also the $1.3 billion expansion of the Andina mine. The operation accounted for roughly 11% of Codelco’s output in 2018.

Codelco operates seven mines and four smelters, all in Chile. Its assets account for 10% of the world’s known proven and probable reserves and about 11% of the global annual copper output, with 1.8 million tonnes of production.

from MINING.COM https://ift.tt/2CYmIWQ

Comment participer virtuellement au lancement de Perseverance proposé par la Nasa ?

from Les dernières actualités de Futura https://ift.tt/2X3BuCs

Mission Alpha : Thomas Pesquet sera le premier Européen à monter à bord de Crew Dragon

from Les dernières actualités de Futura https://ift.tt/30Xd2nr

Bons plans soldes : Cdiscount lance sa 3ème démarque

from Les dernières actualités de Futura https://ift.tt/30W9W2Z

Perseverance, à la recherche de la vie sur Mars

from Les dernières actualités de Futura https://ift.tt/39H5cSP

L'instrument SuperCam a été conçu pour « chercher des traces de vie éteintes sur Mars »

from Les dernières actualités de Futura https://ift.tt/2DjFU0R

Cet hydrogel est capable d'apprendre et d'oublier comme un cerveau humain

from Les dernières actualités de Futura https://ift.tt/39Ki0rO

Le CBD aiderait à se détacher du cannabis

from Les dernières actualités de Futura https://ift.tt/33iBFhp

European Metals signs deal with European Battery Alliance to advance Cinovec lithium project

European Metals (AIM: EMH) announced that it has entered a support and financial agreement with EIT InnoEnergy, the innovation engine of the European Battery Alliance initiated by the European Commission.

The goal of the Alliance is to create a competitive and sustainable battery cell manufacturing value chain in Europe.

In a press release, European Metals said this partnership will facilitate the accelerated construction financing and commercialization of the Cinovec project – the largest hard rock lithium deposit in Europe.

The European Battery Alliance wants to create a competitive and sustainable battery cell manufacturing value chain in Europe

“The Cinovec project is strategically located in the heart of Europe, in close proximity to Europe’s EV manufacturers,” the media statement reads. “EIT will help with sourcing construction finance, securing grant funding and assisting in offtake introductions and negotiations for Cinovec.”

The project sits some 100 kilometres northwest of Prague on the border with Germany. It lies on the Krusne hory/Erzgebirge metallogenic province at the northern border of the Bohemian Massif, one of the major metamorphic crystalline complexes of the European Variscan Belt.

According to European Metals, Cinovec hosts a globally significant hard rock lithium deposit with a total indicated mineral resource of 372.4Mt @ 0.4% Li2O and 0.04% Sn and an inferred mineral resource of 323.5Mt @ 0.39% Li2O and 0.04% Sn containing a combined 7.18 million tonnes Lithium Carbonate Equivalent and 262,600t of tin.

from MINING.COM https://ift.tt/2DjzZZH

Canada’s Smooth Rock Ventures becomes sole owner of Palmetto gold project in Nevada

Smooth Rock Ventures (TSXV: SOCK) completed its option-to-purchase agreement on the Palmetto project in the US.

With this completion, Smooth Rock now owns a 100% undivided interest in the project. The total purchase price was $500,000.

Located in Esmeralda County, Nevada, Palmetto consists of 79 unpatented mining claims totalling 1600 acres. The property lies within the southern portion of the Walker Lane gold trend.

Palmetto lies within the southern portion of the Walker Lane gold trend

According to Smooth Rock Ventures, the project has had significant exploration work carried out by Newmont Gold, Phelps Dodge Corp, Cambior Inc., Romarco Minerals, Curran Corp., Amselco Minerals and Escape Gold Group Inc.

“To date, 173 drill holes totalling 43,940 meters have been completed on several targets within the project. The initial ‘Discovery Hole’ in 1988, was drilled by Phelps Dodge and bonanza gold-silver veins were subsequently drilled by Romarco Minerals in 1997-2002,” the miner said in a media statement. “[The project] was most recently explored by ML Gold Corp.”

The Canadian company reported that Palmetto has a historic resource estimation completed by WSP Canada Inc. for ML Gold Corp. in 2017. In the inferred category, these estimates were set at 321,665 ounces of gold and 2,408,030 ounces of silver.

from MINING.COM https://ift.tt/3f9uZEy

Alamos Gold to build new mine in Mexico

Canadian miner Alamos Gold (TSX: AGI) has decided to go ahead with plans to build La Yaqui Grande gold mine in Mexico, following results from a positive internal economic study.

Initial production at La Yaqui Grande is slated for the second half of 2022.

The announcement comes on the heels of the company’s recent decision to begin phase three expansion at the Island Gold mine in Ontario, Canada, which is expected to boost Alamos’ output by 72%.

Initial production at La Yaqui Grande, located only 7km from the miner’s existing Mulatos operation, is slated for the second half of 2022.

The study estimates an initial investment of $137 million. At a $1,750 per ounce gold price, Alamos said Mulatos was expected to self-finance La Yaqui Grande’s development.

Average annual gold production at the five-year mine is expected to be 123,000 ounces, with all-in sustaining costs of $578 per ounce.

Low-cost, high-return

Alamos Gold president and chief executive, John McCluskey, said La Yaqui Grande represents the company’s next low-cost, high-return project in Sonora’s Mulatos district.

The project is adjacent to the past-producing La Yaqui Phase I operation. Just at the mine, the new one will be developed over the next 24 months with an independent heap leach pad and crushing circuit.

La Yaqui Grande received all necessary permits, including the final environmental impact assessment and a change of land use authorization last year.

Gold’s record run to almost $2,000 an ounce has injected fresh cash flows and driven a surge in shares of bullion producers. Analyst believe the ongoing rally will become a new test of discipline for industry actors, which embarked on a spending a spree about decade ago and then paid for it when gold prices nosedived.

from MINING.COM https://ift.tt/2P6Y74M

Airbus a testé un vol complet sans pilote sur un A350

from Les dernières actualités de Futura https://ift.tt/39EoLeM

Notre guide pour tout savoir sur la mission sur Mars de Perseverance

from Les dernières actualités de Futura https://ift.tt/30YxkNl

Perseverance décolle vers Mars demain ! Tout ce qu'il faut savoir sur le rover de la Nasa

from Les dernières actualités de Futura https://ift.tt/306QCRx

La chaleur n'aura pas raison de ces coraux

from Les dernières actualités de Futura https://ift.tt/30YlAdJ

Événement : suivez demain le lancement de Perseverance en direct sur Futura

from Les dernières actualités de Futura https://ift.tt/2X94LM5

OnePlus Nord, cap gagnant sur le milieu de gamme

from Les dernières actualités de Futura https://ift.tt/2P92Fas

Covid-19 : des séquelles cardiaques à long terme ?

from Les dernières actualités de Futura https://ift.tt/3hMRErI

Le lancement de Perseverance en direct sur Futura

from Les dernières actualités de Futura https://ift.tt/39IUriX

Formation Photoshop à 11,99 € : profitez d'un bon plan inédit

from Les dernières actualités de Futura https://ift.tt/2X3a8w7

On vous dit tout sur SuperCam, l'instrument-phare de Perseverance qui va chercher des traces de vie passée sur Mars

from Les dernières actualités de Futura https://ift.tt/3hKIfB1

En vidéo : les « supercontamineurs », clé de la propagation de la Covid-19 ?

from Les dernières actualités de Futura https://ift.tt/3gapMNR

En vidéo : 15 choses à savoir sur Mars

from Les dernières actualités de Futura https://ift.tt/2BJpQW4

mardi 28 juillet 2020

Feu vert pour le lancement vers Mars de Perseverance le 30 juillet

from Les dernières actualités de Futura https://ift.tt/2CNl8XX

Thomas Pesquet retournera dans la Station spatiale à bord de Crew Dragon en 2021

from Les dernières actualités de Futura https://ift.tt/3g9B0Cb

Rio Tinto’s Winu copper project just got bigger

Rio Tinto (ASX, LON, NYSE: RIO) said on Tuesday it had made a “promising” discovery 2 km east of its Winu copper-gold project in Western Australia, which is on track to begin production in 2023.

The world’s no. 2 miner also revealed a maiden resource for the deposit, considered by some analysts Rio’s “next major” copper mine in Australia.

The company reported an inferred mineral resource for the Paterson Province deposit of 503 million tonnes of ore grading at 0.45% copper equivalent. It includes a higher-grade component of 188 million tonnes of ore with a 0.68% copper grade.

Rio also said that study work to date supports the development of a relatively shallow open-pit copper mine.

The discovery of a new zone of gold dominant mineralization by Winu, called Ngapakarra, as well as a number of other drilling results in close proximity to the deposit, has boosted Rio’s vision to develop multiple ore bodies within one system.

Rio Tinto believes that there is further potential for even more discoveries within the deposit, as it has only explored 2% of its tenements in the region so far.

“We’re taking a more agile and innovative approach at Winu,” Rio Tinto group executive of growth and innovation and health, safety and environment (HSE) Stephen McIntosh said in a statement.

“We are working on the studies for a small-scale start-up operation focussed on Winu’s higher-grade core as we take another step towards commercialiszing this deposit.

“We are also assessing options for future expansion in the Paterson region given the extent of mineralizsation identified to date and our large land package.”

The Winu copper-gold-silver discovery is about 130 km (80 miles) from Newcrest’s Telfer copper-gold mine in the East Pilbara. It’s also close to numerous copper prospects discovered recently by juniors, and 350 km (220 miles) southeast of Port Hedland, the world’s largest bulk export port.

Rio Tinto has been investing heavily in copper in the past two years driven by a forecast deficit. Copper supply fears were first triggered by expectations of significantly higher demand to build bigger power grids and electric vehicles (EVs) in the face of no new discoveries and insufficient planned output.

Supply disruptions due to coronavirus-related measures has increased copper worries. A spike in cases in top producer Chile, solid demand in top consumer China and dwindling stockpiles kept prices for the metal near five-month highs in June. The recent bonanza, however, is about to end according to some experts.

Analysts at Saxo Bank say that widespread beliefs on the global economy returning to normal within the next few quarters are likely “to turn out to be wrong.”

“Copper’s recent recovery to pre-pandemic levels will challenge the metal’s ability to reach higher ground in the third quarter,” Ole Hansen, head of commodity strategy at the trading firm, said in an early-July note.

“The risk of a [coronavirus] second wave — particularly in the US and China, the world’s two biggest consumers — may force a rethink and we see no further upside during the coming quarter,” Hansen noted.

Citi analysts, instead, believe copper will likely hold on to recent gains going into the third quarter.

“The copper rally over the past month from $5,700 a tonne to over $6,000 a tonne has occurred against a backdrop of flat to falling equity prices and bond yields, leaving copper looking overvalued by $220 to $420 per ton based on these historical relationships,” analysts from the bank said in a late-June note.

Now read: Forget the gold price, copper was most profitable covid-19 trade

from MINING.COM https://ift.tt/3jHpws1

Des météorites dévoilent des astéroïdes magnétiques qui racontent une autre histoire du Système solaire

from Les dernières actualités de Futura https://ift.tt/3hICkfJ

Le compte à rebours est lancé : feu vert pour le lancement vers Mars de Perseverance le 30 juillet

from Les dernières actualités de Futura https://ift.tt/3fbkuQW

Regardez Gundam, le plus grand robot du monde, faire ses premiers pas

from Les dernières actualités de Futura https://ift.tt/318T6yf

Canadian miners’ CSR programs not prompting real change – study

Mining companies’ corporate social responsibility programs could yield better outcomes if they tackled “real change on the ground,” new research has found.

According to Simon Fraser University’s political economist Anil Hira, miners and companies in other sectors such as forestry and the textile industry should tie themselves to real changes that have broader and lasting impacts in the communities they reach out to.

In a paper published in the journal Global Affairs, Hira explains that this approach is a departure from the current, widespread idea of capital-intensive one-off projects.

EITI data revealed that the mining the industry shows no real improvement for local communities or diminution of conflicts

By analyzing data on how Canadian companies fare in the Extractive Industries Transparency Initiative (EITI), the researcher found that the industry shows no real improvement for local communities or diminution of conflicts, despite a plethora of global CSR efforts.

“If anyone buys a gold ring to get married, they can’t guarantee that gold hasn’t been produced by conflict or child labour in Sub-Saharan Africa,” Hira said in a media statement. “They can’t guarantee that people involved in that gold mining are getting a fair wage, or that their communities are benefiting from the mining project or that the environmental effects won’t last for generations once the mining project ends.”

In his view, these flaws make it difficult for consumers to make ethical product choices.

For the economist, one way to address these issues is by eliminating competing standards, something that companies can do by working with international organizations, NGOs and governments on a harmonized label for consumers. This would improve consumer confidence that the products they are buying were produced ethically and sustainably.

Hira also said that organizations can work with local unions and activists to put pressure on local governments to improve conditions for workers.

from MINING.COM https://ift.tt/3g9KOw5

Celesta copper mine in Brazil reaches production

Lara Exploration (TSXV: LRA) reported that mining and processing have started at its Celesta copper project, located near the town of Curionópolis in northern Brazil.

In a press release, the Canadian miner said that first concentrates are due to be shipped in early August.

Lara owns a 2% net smelter returns royalty on the project and a 5% carried (to production) equity interest in the operating company Celesta Mineração S.A., which is jointly operated by partners Tessarema Resources and North Extração de Minério. In parallel, Ocean Partners UK has provided project finance in exchange for life of mine offtake rights.

According to the media brief, Celesta’s mining program will initially focus on the Osmar target that has an indicated resource estimate of 2.14 million tonnes, with average grades of 4.2% copper and 0.66 parts per million gold.

from MINING.COM https://ift.tt/2DbeVVl

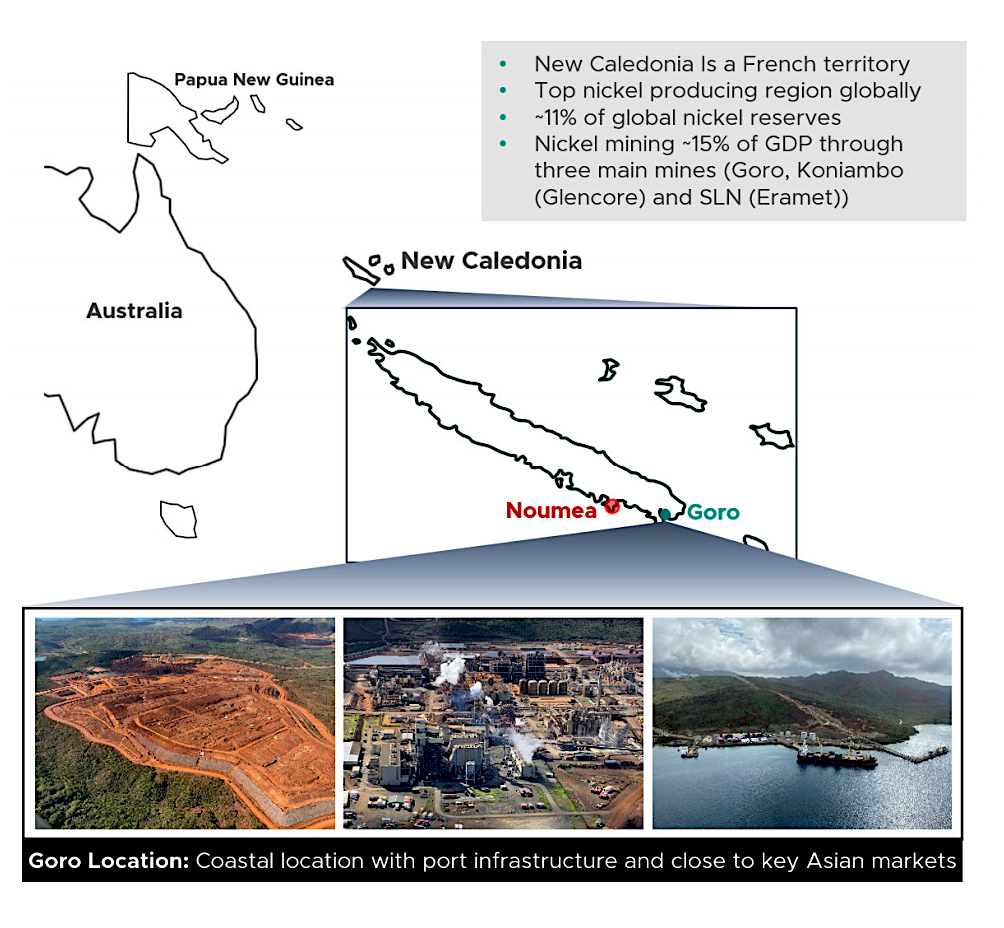

New Century, Vale delay nickel mine deal

New Century Resources (ASX: NCZ) and Vale (NYSE: VALE) have delayed the deadline for closing the sale of the Brazilian miner’s nickel and cobalt operations on the Pacific island of New Caledonia by 45 days.

The Australian zinc producer entered into a 60-day exclusivity agreement to acquire a 95% stake in Vale Nouvelle Calédonie (VNC), the operator of the troubled Goro nickel-cobalt mine on the French territory, on May 26.

New Century said on Thursday it had made “significant progress” in evaluating the technical and commercial aspects of the transaction, but has not yet finished a definitive binding agreement.

The Goro nickel-cobalt mine complex, in New Caledonia, has proven a financial burden for Vale since it began operations in 2010.

VCN has proven a financial burden for Vale since it began operations two years behind schedule in 2010.

The Rio de Janeiro-based miner first announced its intention to exit operations in New Caledonia in December. The decision came after it had to write down $1.6 billion in the fourth quarter related to the ailing mines, the world’s biggest nickel operation.

Vale cut in April its 2020 nickel production guidance to 200,000 – 210-000 tonnes per year from 240,000 tpy to account for the anticipated loss of VNC’s 60,000-tpy output.

Shortly after, the miner revealed it had received non-binding offers for VNC, which includes the Goro mine, a processing plant and the port of Prony.

The timing of this deal couldn’t be better. Tesla boss Elon Musk recently announced the company was searching for sustainable nickel supply for the batteries that power its electric vehicles (EVs)

Analysts estimate the silvery-white metal could face a shortage as soon as 2023.

Goro’s potential

The Goro operation includes a mine, processing facility and port, located on the island of New Caledonia, a French territory which is a top nickel producing region globally.

While the mine has the capacity to produce 60,000 tpy of nickel in the form of nickel oxide, it has never performed to full capacity due to design flaws and operational commissioning issues.

Las year, Goro churned out just 23,400 tonnes of nickel, slightly over a third of its annual capacity.

“The due diligence process has outlined a logical and technically robust solution for Goro’s operation, which is expected to deliver improved production rates and reduced costs,” New Century said.

The Melbourne-based miner noted if the transaction goes through, it would become a major supplier of nickel and cobalt sourced from outside the Democratic Republic of Congo. The African country is currently the world’s biggest supplier of cobalt for the EV sector.

from MINING.COM https://ift.tt/310SURA

Les méga incendies en Australie ont tué près de 3 milliards d'animaux !

from Les dernières actualités de Futura https://ift.tt/3hKf2Gp

Deux pluies d'étoiles filantes à voir cette nuit

from Les dernières actualités de Futura https://ift.tt/2XkltbF

Perseverance embarque deux micros qui nous feront entendre les sons de Mars pour la première fois

from Les dernières actualités de Futura https://ift.tt/32Yohid

Pour Thomas Pesquet, ce sera le Crew Dragon en 2021

from Les dernières actualités de Futura https://ift.tt/3gki3Nz

Les narcissiques et les psychopathes sont plus méfiants face à la prévention de la Covid-19

from Les dernières actualités de Futura https://ift.tt/333IwLw

Peugeot lance ses VTC électriques multi-usage eT01 Crossover, assemblés en France

from Les dernières actualités de Futura https://ift.tt/3g9aFUP

Notre système immunitaire peut-il se défendre contre les micro-organismes extraterrestres ?

from Les dernières actualités de Futura https://ift.tt/30SVRmZ

Microsoft mise sur les piles à hydrogène pour alimenter ses datacenters

from Les dernières actualités de Futura https://ift.tt/3faVEka

Étrangeté du vivant : un délicieux papillon aux ailes vanille-fraise

from Les dernières actualités de Futura https://ift.tt/39wrbvQ

Séismes : une vague de silence dans le monde

from Les dernières actualités de Futura https://ift.tt/308geh0

Mars : Perseverance nous fera entendre les sons martiens pour la première fois

from Les dernières actualités de Futura https://ift.tt/3f7ZYR4

Coronavirus : la combinaison remdesivir et diltiazem ouvre la voie vers de nouvelles perspectives thérapeutiques

from Les dernières actualités de Futura https://ift.tt/3f7NLfs

Un concert pour étudier la propagation du coronavirus

from Les dernières actualités de Futura https://ift.tt/39ACG5p

Antarctique : pourquoi cette fuite de méthane est inquiétante ?

from Les dernières actualités de Futura https://ift.tt/39B9KKk

lundi 27 juillet 2020

Nasa : revivez 20 ans d'exploration de Mars

from Les dernières actualités de Futura https://ift.tt/3jK3ODO

Teranga Gold’s Senegal mine a ‘top tier’ asset, study confirms

Canada’s Teranga Gold (TSX:TGZ) has released results from a prefeasibility study (PFS) for its Sabodala-Massawa complex in Senegal, which it would confirm the asset is “top tier mine” material, the company says.

The Toronto-based miner bought Massawa from Barrick Gold (TSX:ABX) (NYSE:GOLD) in December last year. After completing the $380 million-acquisition earlier this year, Teranga began integrating the asset with its flagship Sabodala gold mine, located only 20 km away.

Consolidating Massawa, one of the highest-grade undeveloped open-pit gold reserves in West Africa, with the Sabodala mine into one complex, has left the company with a solid asset.

Teranga has kicked off a $10-million exploration and drill program at its recently acquired Massawa gold project.

Tier 1 deposits are “company making” mines. They are large, long-life and low-cost. Gold ones, in particular, have an expected mine-life of at least 10 years, with annual production of a minimum 500,000 ounces.

Gold and total cash costs per ounce over a Tier 1 mine life should be in the lower half of the industry cost curve.

Based on the PFS, Sabodala-Massawa meets all those requirements. Its reserve base increased 120% to 4.8 million ounces of gold, at a $1,250 per ounce price. All-in-sustaining costs (AISC) are pegged at $749 per ounce, with net cash flows of over $2.2 billion at $1,600/oz gold over a 16.5- year mine life.

Teranga estimates Sabodala-Massawa’s average annual production for the 2021-2025 period at 384,000 ounces, at all-in sustaining costs of $671 per ounce.

“The integration of Sabodala and Massawa is perhaps the best example in mining of the ‘greater than the sum of its parts’ concept,” president and chief executive, Richard Young, said in the statement.

Mining under way

Teranga has begun digging up at Sofia, the first of the Massawa deposits to be mined. Processing of free-milling, high-grade ore through the Sabodala plant is “scheduled to begin shortly,” it said.

The miner has also kicked off a $10-million exploration and drill program at Massawa.

“We believe in the great potential of this project and are conducting an aggressive drilling campaign for both refractory and free-milling ore, with a goal to sustain Sabodala-Massawa’s gold production between 350,000-400,000 ounces per year beyond 2026,” chief operating officer, Paul Chawrun, noted.

The company also said it planned to issue a revised life of mine production schedule this quarter for its new Wahgnion gold mine in Burkina Faso, where “the plant is exceeding initial performance expectations” following a strong first full quarter in March.

from MINING.COM https://ift.tt/2WZGsQJ

Les secrets des explosions des naines blanches bientôt percés avec les ultraviolets ?

from Les dernières actualités de Futura https://ift.tt/301qiYU

L'impact humain sur l'Antarctique... revu à la hausse

from Les dernières actualités de Futura https://ift.tt/2WXNrd2

Vidéo : 10 choses à savoir sur Perseverance et Ingenuity

from Les dernières actualités de Futura https://ift.tt/2OYXcDf

Caledonia Mining to build solar plant at gold mine in Zimbabwe

Jersey-based Caledonia Mining (AIM: CMCL) announced that it is planning to install a solar power plant at its Blanket gold mine in Zimbabwe.

In a press release, Caledonia said that to go ahead with the project it has entered into a sales agreement whose proceeds are to be used for the construction of the clean-energy facility. The decision was made after receiving a generating licence and the necessary approvals from the Zimbabwe Investment Authority.

The company said that it expects the solar power plant to create a more stable and reliable power source for the operation.

The proposed solar plant will supply approximately 30% of Blanket’s total electricity

“This is an important step towards preventing the loss of downtime and further de-risking the project,” the media brief states. “The proposed solar plant will supply approximately 30% of Blanket’s total electricity requirements across a 24-hour period, including evenings.”

The property is situated in the Gwanda Greenstone Belt, a typical Archaean greenstone-hosted gold deposit. The deposit is situated on the northwest limb of the Gwanda Greenstone Belt along strike from several other prominent gold deposits.

According to Caledonia Mining, Blanket is the largest producing mine in a belt which at one time had 268 operating mines.

Artisanal production at the site started in 1904. Significant early production, however, took place starting in 1965, when Falconbridge acquired the property and increased gold production to an average of approximately 45 kilograms per month.

Later on, in 1993, Kinross took over the property and built an enlarged carbon-in-leach plant with a capacity of approximately 3,800 tonnes per day to treat old tailings dump together with the run-of-mine ore. Gold production reached a level of 110 kilograms per month during the tailings treatment years from 1995 to 2007. To date, in excess of 1 million ounces of gold have been produced from the property.

from MINING.COM https://ift.tt/3fZVsWa

Geoscience BC, British Columbia Geological Survey join forces to support mineral exploration in the province

Non-profit organization Geoscience BC and the British Columbia Geological Survey signed a three-year agreement to coordinate and collaborate on geoscience research related to mineral resources in the province of British Columbia, western Canada.

In a press release, the organizations said that the memorandum of understanding provides the framework to jointly identify public mineral geoscience needs in the province, standardize data collection and public access to data, as well as leverage resources to co-deliver mineral research projects, programs and initiatives.

“The British Columbia Geological Survey and Geoscience BC are the heart of a made-in-BC approach to public geoscience that attracts investment, stimulates innovation and informs responsible mineral exploration and development decisions in the province,” Gavin C. Dirom, Geoscience BC president and CEO, said in the media brief. “Leveraging resources and coordinating on mineral research projects is important to industry, communities and investors that rely on public geoscience, and so formalizing the collaboration between the organizations with this MOU is a logical and welcome step.”

According to Dirom, as part of implementing the MOU, a Coordination Steering Committee has been formed to guide the current and future collaborative work between the organizations and a Charter outlining the purpose and functions of the Committee has also been signed.

from MINING.COM https://ift.tt/30PUeqj

La substance étrange trouvée sur la face cachée de la Lune enfin identifiée

from Les dernières actualités de Futura https://ift.tt/2ZalsZ4

Pourquoi certains moustiques préfèrent piquer l'être humain ?

from Les dernières actualités de Futura https://ift.tt/39ygYz6

Formation Photoshop : profitez d'un bon plan inédit

from Les dernières actualités de Futura https://ift.tt/3hz64vw

Selon Bill Gates, il faudra au moins deux doses par personne de vaccin contre le coronavirus

from Les dernières actualités de Futura https://ift.tt/3f8eCrv

Rien ne va vraiment plus en Arctique où le mercure s’affole au Svalbard

from Les dernières actualités de Futura https://ift.tt/2CUJi2q

Garmin : le point sur une cyberattaque qui paralyse les sportifs

from Les dernières actualités de Futura https://ift.tt/39xUbmS

Vidéo : 10 choses à savoir sur Perserverance et Ingenuity

from Les dernières actualités de Futura https://ift.tt/2CUc3fR

Cette pomme spéciale « réchauffement climatique » résistera aux canicules

from Les dernières actualités de Futura https://ift.tt/39yogmf

Images sidérantes des incendies en Sibérie survolée en drone

from Les dernières actualités de Futura https://ift.tt/30PRBVl

Après Ryugu, Hayabusa 2 pourrait explorer un autre astéroïde

from Les dernières actualités de Futura https://ift.tt/2P1c97Y

Comment le rover Perseverance va-t-il chercher la vie sur Mars ?

from Les dernières actualités de Futura https://ift.tt/30L87pA

Futura emploi : le coronavirus porte-t-il le dernier coup à la recherche française ?

from Les dernières actualités de Futura https://ift.tt/3hDMgqR

Formation Python : profitez d'un bon plan exceptionnel

from Les dernières actualités de Futura https://ift.tt/32XF6tF

Bon plan : découvrez des formations aux métiers du web à prix réduit

from Les dernières actualités de Futura https://ift.tt/3eYBwS9

Mars : magnifique survol du cratère Korolev, empli de glace

from Les dernières actualités de Futura https://ift.tt/2NX7wLn

Les survivants d'Ebola présentent de graves séquelles

from Les dernières actualités de Futura https://ift.tt/2WZdv7m

dimanche 26 juillet 2020

Science décalée : Top 8 des mesures de distanciation sociale les plus loufoques

from Les dernières actualités de Futura https://ift.tt/3c5P4Ks

Venezuela’s interim government faces a number of challenges in the Crystallex dispute

A decision regarding Canadian miner Crystallex’s request to sell the shares of PDV Holdings, the parent company of refiner Citgo Petroleum Corp., which is owned by Venezuela, was expected by the end of July. Now it is likely to be made sometime in August.

This, after US Justice Department lawyers asked District Judge Leonard Stark in Delaware, where Citgo’s parent is incorporated, not to bless Crystallex’s request to sell the shares until US regulators finish examining the deal.

Crystallex is aiming at collecting a $1.4-billion-award in compensation following a decade-long dispute over Venezuela’s 2008 nationalization of its gold mine in the southern Bolívar state. The amount is comprised of $1.2 billion, plus $200 million of interest awarded by a World Bank arbitration tribunal in 2016.

But according to the Justice Department lawyers’ filing, approving the share sale would harm US foreign policy and national-security interests in Venezuela.

In a similar tone, Elliott Abrams, President Donald Trump’s special representative to Venezuela, sent a letter to the Attorney General and the Justice Department stating that Crystallex cannot sell the shares without a license from the US Office of Foreign Asset Control.

These moves back arguments by lawyers for Venezuelan interim president Juan Guaidó, whose team wants to honour the debts with Crystallex but opposes the sale of Citgo’s assets to protect one of the country’s main sources of hard currency.

However, according to economist Francisco Rodríguez, founder of the think-tank Oil for Venezuela, the Guaidó government has a steep hill to climb.

1. Para entender el peligro de pérdida de CITGO ante los acreedores en procesos judiciales y la discusión sobre la responsabilidad de diversos actores públicos en ella, es importante entender los detalles de los procesos judiciales en curso. Abro hilo explicativo.

— Francisco Rodríguez (@frrodriguezc) July 11, 2020

Once it was recognized by the US and other 50 states as the Venezuelan legitimate government, the new administration had to prove that there is a separation between the state and Citgo’s management.

In a series of explanatory tweets, Rodríguez said that the Guaidó government’s ability to prove this separation was severely affected when Venezuela’s National Assembly named Citgo’s board of directors on February 13, 2019. This was supposed to be done by Citgo Holding’s board of directors.

“President Guaidó published a tweet that same day announcing the appointment of Citgo’s new board of directors. He used a format that was very similar to the announcements made by [Nicolás] Maduro which were used months ago by Crystallex as evidence against Venezuela,” Rodríguez said. “Not surprisingly, just a few weeks after, Crystallex filed a legal brief arguing that violations to [the principle of] corporate veil were ongoing under Guaidó and that, therefore, the court should reject any argument related to the way the company is being managed.”

The economist argued that the importance of these mistakes should not be overlooked. On top of having named the board of directors, later on, in July 2019 and June 2020, Citgo Holding and Citgo Petroleum issued, without the approval of Venezuela’s National Assembly, debt bonds whose warranties were the country’s assets.

These issuances, which were made by officials named by the interim government of Juan Guaidó, are now being used by the creditors of the PDVSA 2020 bond to contradict Venezuela’s attempt to invalidate the warranty of these bonds for not having the parliament’s approval. The PDVSA 2020 is a collateralized bond issued by state oil company Petróleos de Venezuela S.A., owner of PDV Holdings.

Economist Francisco Rodríguez said Venezuelans should demand answers to certain questions related to this case

“In the face of the systematic repetition of these types of mistakes that endanger the strategy of safeguarding the country’s assets, Venezuelans should demand answers to certain questions,” Francisco Rodríguez said. “These questions should be part of the regular process of leading a modern democracy. There shouldn’t be any resistance from the interim government to provide a clear explanation of these issues.”

In the economist’s view, analyzing these errors would not only make the new government more transparent, which would separate it from the “obscure practices of [Maduro’s] dictatorship,” but it may also help find solutions to the complex legal position in which Venezuela finds itself.

Thus, he proposed that Guaidó and his team dig deep and respond who were the legal advisors that recommended the “unusual appointment” of Citgo’s board of directors. He said that it is also important to disclose whether these advisors are or were at any point financially tied to Crystallex or any other company that has ongoing litigation with the country.

Finally, he suggested that it would be advisable to restrict, for a certain period, the ability of people that have recently left government offices to become advisors or consultants to companies with financial interests in the Crystallex litigations.

“Only by showing a different way of leading the country we will be able to gain the trust of Venezuelans, which is needed to recover democracy,” the economist said.

from MINING.COM https://ift.tt/3hChVsL

Comment le rover Perseverance va-t'il chercher la vie sur Mars ?

from Les dernières actualités de Futura https://ift.tt/3hPjQdR

Sommes-nous protégés après une infection à SARS-CoV-2 ?

from Les dernières actualités de Futura https://ift.tt/2OTS2bA

Jupiter, Saturne, Neowise, étoiles filantes… : comment les trouver et les observer ? (vidéo)

from Les dernières actualités de Futura https://ift.tt/2OZDNlv

Podcast : découvrez la vie étonnante de Robert Liston, le chirurgien le plus rapide de l'Ouest !

from Les dernières actualités de Futura https://ift.tt/3jATXjz

Tous nos podcasts à écouter cet été !

from Les dernières actualités de Futura https://ift.tt/3f5fqNU

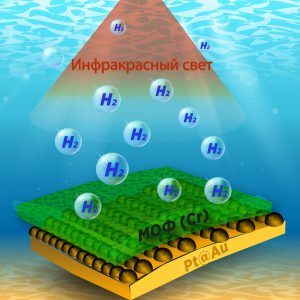

Gold, platinum used in new material to generate hydrogen from salt, polluted water

Researchers from the Czech Republic and Russia have developed a new material that uses gold, platinum and chromium to generate hydrogen molecules from fresh, salt, and polluted water by exposure to infrared sunlight.

The objective behind this development is that the solution becomes another green tool to help tackle the global energy challenge.

In a paper published in the journal ACS Applied Materials & Interfaces, the scientists explain that the material is a three-layer structure with a 1-micrometre thickness. The lower layer is a thin film of gold, the second one is made of 10-nanometre platinum, and the third is a film of metal-organic frameworks of chromium compounds and organic molecules.

“During the experiments, we watered material and sealed the container to take periodic gas samples to determine the amount of hydrogen. Infrared light caused the excitation of plasmon resonance on the sample surface. Hot electrons generated on the gold film were transferred to the platinum layer. These electrons initiated the reduction of protons at the interface with the organic layer. If electrons reach the catalytic centers of metal-organic frameworks, the latter were also used to reduce protons and obtain hydrogen,” Olga Guselnikova, the lead author of the study, said in a media statement.

Subsequent experiments showed that 100 square centimetres of the material can generate 0.5 litres of hydrogen in an hour. This is one of the highest rates recorded for 2D materials.

“In this case, the metal-organic frame also acted as a filter. It filtered impurities and passed already purified water without impurities to the metal layer,” Guselnikova said. “It is very important because, although there is a lot of water on Earth, its main volume is either salt or polluted water. Thereby, we should be ready to work with this kind of water.”

According to the researcher, future work should focus on improving the material to make it efficient for both infrared and visible spectra. This would allow it to perform with 93% of the spectral volume of sunlight.

from MINING.COM https://ift.tt/3jGmLXI

Ce pétrolier à la dérive menace la mer rouge d'un désastre écologique

from Les dernières actualités de Futura https://ift.tt/2ZYZybG

Vidéo : le déploiement sur Mars d'Ingenuity, l'hélicoptère qui accompagne Perseverance

from Les dernières actualités de Futura https://ift.tt/3jDSTvb

En vidéo : les sources de méthane dans le monde

from Les dernières actualités de Futura https://ift.tt/2WUyVTo

samedi 25 juillet 2020

Pourquoi le rover Mars 2020 s'appelle Perseverance ?

from Les dernières actualités de Futura https://ift.tt/38xMSJz

Science décalée : nous surestimons l'intelligence de notre partenaire

from Les dernières actualités de Futura https://ift.tt/3bSdLdp

Les bélugas migrent vers le Canada, à voir en direct !

from Les dernières actualités de Futura https://ift.tt/3jHVUKO

Podcat : découvrez la vie étonnante de Robert Liston, le chirurgien le plus rapide de l'Ouest !

from Les dernières actualités de Futura https://ift.tt/2D3Ig40