lundi 31 août 2020

Un arbre pétrifié depuis 10 millions d'années raconte une autre histoire du climat passé

from Les dernières actualités de Futura https://ift.tt/34X1mVz

Nearly a tonne of CO2 emitted per ounce of gold produced in 2019 – report

Gold mines emitted on average 0.8 tonnes of CO2 equivalent for every ounce of gold that was produced in 2019, according to a report from S&P Global.

Strong price performance has led to a large number of new gold mines opening and, with this, also concerns of mining’s impact on climate change.

Another recent report from Wood Mackenzie found that emissions from metals production will need to halve over the next 20 years in order to achieve the Paris Agreement decarbonization goals.

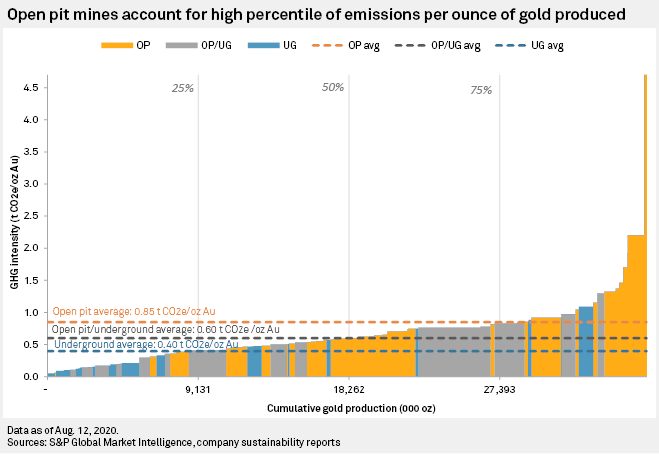

According to S&P, underground gold mines – which operate at higher grades and process less material – generally have lower greenhouse gas footprints than their larger open pit counterparts.

“Open pit mines emit on average around twice as much CO2e per ounce of gold produced as underground mines, at 0.85 tCO2e and 0.40 tCO2e, respectively. Open pit mines also process roughly five times the amount of ore at an average grade of around 1.05 g/t Au for the population evaluated, versus 3.25 g/t Au for underground mines,” says S&P.

While the larger gold mines do have the capacity to generate a greater amount of free cash, that large production base comes with higher emissions.

“Underground mines have an even clearer advantage on a free cash flow basis than was evident on a per-ounce of gold produced basis, generating as much as $2,112/tCO2e emitted, compared to just $951/tCO2e from open pit mines. While underground mines do generate more free cash flow than open pits — around $422/oz versus $375/oz — the scale is far greater on a greenhouse gas emissions level given the comparative lower emissions of underground mines.”

Regional variation

Though most mines typically emit less than 70 tCO2e per thousand tonnes of ore processed each year, regional variations do exist.

Australian gold mines have a comparatively high greenhouse gas intensity — emitting more greenhouse gas per kilotonne of ore processed — roughly on par with Russian gold mines.

Canadian mines have among the lowest greenhouse gas intensities, in part due to the large proportion of higher-grade underground mines. Another significant factor is the source of power across the country, with as much as two-thirds of the country’s electricity is derived from renewable sources and 82% from non-greenhouse gas emitting sources.

According to S&P, on a cash flow basis, Russian mines generate substantially more free cash flow per ounce of gold produced as a result of low ruble valuation and low fuel cost, averaging $991/oz, just ahead of the US at $989/oz.

“As we evaluate how free cash generation compares to a mine’s emissions, Canada and Eastern & Central Africa are considerably ahead, with the former home to a greater number of mines. Largely thanks to a smaller emissions footprint, Canadian mines generate on average $2,609/tCO2e emitted. The high emissions of Russian mines lower that jurisdiction’s ratio to $1,210/tCO2e.”

from MINING.COM https://ift.tt/31HSCk0

Ce vélo électrique est le plus léger du monde. Devinez combien il pèse

from Les dernières actualités de Futura https://ift.tt/34VmYlb

Lion One hits high-grades at Tuvatu gold project in Fiji

Lion One Metals (TSX-V: LIO) announced on Monday that it has encountered high-grade gold mineralization in a diamond wedge hole, drilled to a depth of 709.0 metres at its Tuvatu gold project in the island of Viti Levu, Fiji.

High-grade intervals include 70 g/t Au over 3.3m including two narrower intervals of 305.00 g/t Au over 0.3m and 255.00 g/t Au over 0.6m. High-grade intervals encountered in the mother hole include 2.0m grading 46.70g/t Au and 12.7m grading 55.43g/t Au including sub-intervals of 4.7m grading 120.16g/t Au with an exceptionally high-grade core of 0.9m grading 582.33g/t Au.

The company is now drilling a second daughter wedge hole from the mother hole to further retest the newly discovered high-grade zone under the Tuvatu lode system.

The Tuvatu gold deposit — located on the island of Viti Levu — contains an estimated 1.12 million tonnes of indicated resources at 8.17 g/t Au (294,000 oz. Au) and 1.3 million tonnes of inferred resources at 10.60 g/t Au (445,000 oz. Au).

Shares of Lion One Metals surged 13% on the TSX by 1:45 p.m. EDT Monday. The Vancouver-based miner has a market capitalization of approximately C$288 million.

from MINING.COM https://ift.tt/3beRuYo

Copper price leaps 26-month high on strong Chinese rebound

Copper easily cleared the pivotal $3 a pound level on Monday as the recovery in the Chinese economy, the world’s top consumer of the metal, gains momentum.

Copper for delivery in December trading on the Comex market in New York changed hands for $3.065 a pound ($6,757 a tonne) in early afternoon trade, the highest since June 2018. Monday’s move brings gains for 2020 to 10% and a mouthwatering 58% since the covid-19 lows struck in March.

“Prices still have the potential to increase, but in the short-term they will be floating around,” analyst He Tianyu of CRU Group told Reuters, expecting a price rally from mid-September at the earliest, when the traditionally strong copper season kicks in.

Parallels to GFC

Jonathan Barnes, of Roskill, said in a recent report the copper price will likely rise further towards the end of 2020, and that the current environment has strong parallels to the rebound in the copper price after the global financial crisis thanks to massive stimulus efforts by Beijing.

In Shanghai, copper recorded its fifth straight month of gains – the longest winning streak since 2009.

Indeed, on the Shanghai Futures Exchange, the bellwether metal racked up its fifth straight month of gains in August which is the longest winning streak since 2009.

Copper hit a low of $1.32 a pound in January 2009, then surged to $3.55 by April the next year on its way to an all-time peak just shy of $4.58 (more than $10,000 per tonne) in February 2011.

Roskill believes while the effects of covid-19 could decrease world consumption of the metal by 3%–4% this year, the drop in mine output and scrap flows has been greater.

Economic rebound

A key gauge of Chinese economic activity released on Monday showed continuing expansion of the country’s manufacturing and services sector in August.

While the official manufacturing PMI index declined slightly to 51.0 (a reading above 50 means expansionary conditions) on the back of flooding in the manufacturing centres in southwest China, the services sector leaped to 55.2 – a 31-month high.

An investment-led rebound would eventually also shore up consumer sentiment and household spending, keeping the overall economic recovery on track

The construction index stayed above 60 on the back of Beijing’s stimulus programs despite which lifted the composite to 54.5 – a two-year high.

Capital Economics says in a note “it’s not too surprising that the manufacturing PMI has started to level off since growth in industry has already returned to its pre-virus level.”:

But with fiscal support on course to be stepped up in the coming months, we still think there is some further upside to industrial activity. Meanwhile, it’s encouraging that the recovery is broadening out, with service sector activity now playing catch-up with industry.

This is consistent with our view that an investment-led rebound would eventually also shore up consumer sentiment and household spending, keeping the overall economic recovery on track.

from MINING.COM https://ift.tt/3bd2GV5

La « voiture volante » SkyDrive de Toyota réussit son premier vol d’essai public

from Les dernières actualités de Futura https://ift.tt/2QHnlHq

Gold price set for first monthly decline since March

Gold prices edged higher on Monday as the US dollar weakened, although record-high equities capped bullion’s gains and set it for its first monthly decline since March.

Spot gold advanced 0.4% to $1,971.90 per ounce by 12:10 p.m. EDT after touching a two-week high of $1,976.05 earlier in the session. US gold futures inched up 0.2% to $1,980.20 per ounce on the Comex in New York.

For the month of August, the precious metal was down 0.2% despite rallying to an all-time high of $2,072.90 during the earlier part of the period.

Gold has gained about 29% so far this year, supported by rising economic uncertainty stemming from the covid-19 pandemic

“The weaker dollar and the anticipation that we are going to get a further dollar weakness has led to some small increases (in gold),” Jeffrey Sica, founder of Circle Squared Alternative Investments, told Reuters. The US dollar fell to its lowest since May 2018 against other major currencies.

Meanwhile, world stocks hovered near record highs as investors bet on continued central bank monetary support to reinvigorate the global economy.

However, “there is a significant concern that the (equities) market might have gotten extended and there might be some profit taking coming, which may lead to a rotation back to gold,” Sica said.

Gold has gained about 29% so far this year, supported by rising economic uncertainty stemming from the covid-19 pandemic as well as the upcoming US elections.

Last week, the US Federal Reserve said it would adopt an average inflation target, meaning rates are likely to stay low even if inflation rises a bit in the future, which could serve as further impetus for bullion.

(With files from Reuters)

from MINING.COM https://ift.tt/3jv5aBb

Friedland’s Nimba iron ore project to get World Bank backing

The World Bank is said to be mulling an $135 million investment in the proposed Nimba iron ore mine in southeastern Guinea, which is owned by Canada’s High Power Exploration (HPX), a privately-held company founded my mining mogul Robert Friedland.

The move by MIGA, the bank’s agency for foreign investment, would help HPX deal with potential political risks associated with the mine’s exploration phase, including the completion of key studies preceding Nimba’s construction and operations.

MGA’s involvement could prove crucial for both the Guinean economy and the local biodiversity, Africa Intelligence reports.

The proposed open pit is located in the Guinean Nimba Mountains, classified as a strict nature reserve in 1944 and then as a World Heritage Site in 1981-82 for being home to globally threatened and endemic species.

The boundary of the strict nature reserve and World Heritage Site was modified in 1993 to exclude a keyhole-shaped area to allow mining in the proposed project area.

Vancouver-based HPX acquired the iron ore deposit in September 2019. Based on a 2015 report by the United States Geological Survey (USGS), Nimba holds roughly one billion tonnes of high-grade iron ore.

HPX is currently conducting studies that it hopes will enable production of up to 20 million tonnes annually.

Rail issue

Guinea is also host to the famed Simandou project, which Rio Tinto, Vale and billionaire Beny Steinmetz’s BSG Resources fought over for years. However, West African nation has never exported a tonne as it lacks infrastructure to transport the ore to local ports.

In October, Guinea and Liberia inked a deal to allow several Guinean mines, including the Nimba project, to export through Liberian ports.

Friedland’s company still needs to reach agreements with Germany’s steel giant ArcelorMittal, the sole rail concession holder in Liberia, to allow the company make use of its infrastructure.

Conservation International, a US-based environmental organization, is currently working with ArcelorMittal to make sure that local communities share the economic benefits of mining activities and are also empowered to protect the natural resources they rely on.

Friedland made his fortune from the Voisey’s Bay nickel project in Canada in the 1990s. Since then, he has been involved in some of the biggest mineral discoveries in the world, including the giant Oyu Tolgoi copper mine in Mongolia and the Kamoa-Kakula project in Democratic Republic of Congo.

from MINING.COM https://ift.tt/3lAyl7S

La coquille de glace d'Europe, lune de Jupiter, s'est décalée de 70°

from Les dernières actualités de Futura https://ift.tt/32DZzSt

Interview : que savons-nous réellement de l'avant-Big Bang ?

from Les dernières actualités de Futura https://ift.tt/2EPLTLM

Rentrée scolaire et coronavirus : la France n'est pas prête selon plusieurs médecins

from Les dernières actualités de Futura https://ift.tt/3lzH3U0

La « voiture volante » SkyDrive de Toyota réussit son premier vol d’essai publique

from Les dernières actualités de Futura https://ift.tt/3lHbvvx

This is why lithium-ion batteries fail

Researchers from the Universities of Cambridge and Liverpool have identified a potential new degradation mechanism for electric vehicle batteries – a key step to designing effective methods to improve battery lifespan.

In a paper published in the journal Nature Materials, the scientists explain that they monitored changes of nickel-rich battery materials in real-time over several months of battery testing. Then, they used laser technology to design a new coin cell, also known as button cell.

“This design offers a new possibility of studying degradation mechanisms over a long period of cycling for many battery chemistries,” Chao Xu, the first author of the study, said in a media statement.

The identification of this degradation mechanism is a key step to designing effective methods to improve battery lifespan

According to Xu, after conducting systematic observations, his team noticed that a proportion of the cathode material becomes fatigued following repetitive charging and discharging of the cell, and the amount of the fatigued material increases as the cycling continues.

After witnessing this, he and his colleagues dove deep into the structure of the material at the atomic scale to seek answers as to why such a fatigue process occurs.

“In order to fully function, battery materials need to expand and shrink as the lithium ions move in and out,” Xu said. “However, after prolonged use, we found that the atoms at the surface of the material had rearranged to form new structures that are no longer able to store energy.”

The scientists said that what’s worse is that these areas of reconstructed surface apparently act as stakes that pin the rest of the material in place and prevent it from the contraction which is required to reach the fully charged state. As a result, the lithium remains stuck in the lattice and this fatigued material can hold less charge.

Given these results, the researchers are now seeking effective countermeasures, such as protective coatings and functional electrolyte additives, to mitigate this degradation process and extend the lifetime of such batteries.

from MINING.COM https://ift.tt/3lAQD96

Genomic sequencing techniques could be used to identify mineral deposits – report

Geoscience BC published a report explaining how genomic sequencing techniques could be used as a tool to identify mineral deposits.

The document titled Microbial-Community Fingerprints as Indicators for Buried Mineralization in British Columbia shows how analyzing bacterial species’ DNA could be used to locate mineral deposits buried beneath glacial overburden.

“Soil microbes are very sensitive and responsive to chemical and physical changes in their environment,” the study’s co-lead Sean Crowe said in a media statement. “Comparing the quantity and species of bacteria found in soil samples collected over ore deposits with soils from other areas can help to zero in on buried mineral deposits.”

The researchers collected samples from Consolidated Woodjam Copper’s Deerhorn copper-gold deposit and Teck Resources’ Highmont South copper-molybdenite deposit

To prove this assertion in the field, Crowe and his team from the University of British Columbia departments of Earth, Ocean, and Atmospheric Sciences and Microbiology and Immunology, and the Mineral Deposit Research Unit collected samples surrounding two copper porphyry deposits in BC’s South Central Region: Consolidated Woodjam Copper’s Deerhorn copper-gold (Cu-Au) deposit near Williams Lake; and Teck Resources’ Highmont South copper-molybdenite (Cu-Mo) deposit at Highland Valley Copper near the city of Kamloops.

By combining the results of high-throughput DNA sequencing with geomicrobiological knowledge, the researchers identified groups of indicator bacterial species that help distinguish soils above mineralization from background soils.

“We found that sequence-based anomaly detection is both sensitive and robust, and could go a long way towards helping discover new mineral resources,” microbiologist and lead report author Rachel Simister said in the press brief.

from MINING.COM https://ift.tt/2YPWUnH

AngloGold, Barrick to sell 80% of Morila mine in conflict-ridden Mali

AngloGold Ashanti (NYSE: AU) (JSE: ANG) and partner Barrick Gold (TSX: ABX) (NYSE: GOLD) are selling their 80% stake in Mali’s Morila gold mine amid political uncertainty in the country still reeling from a recent coup, the second in less than 10 years.

Australian miner Mali Lithium (ASX: MLL) will pay between $22 million and $27 million for the joint company that holds the two miners’ stakes in the mine. The remaining 20% will stay in the government of Mali’s hands.

AngloGold expects its share of the net consideration for the purchase to be roughly $10 million or less, the company said.

Barrick said the move would allow it to focus on its strategy of “discovering, developing, owning and operating Tier One assets.”

The acquisition of Morila will turn Mali Lithium into a cash-generating gold producer.

The Morila gold mine poured its first gold in October 2000 and became the foundation stone of African gold giant Randgold Resources, now part of Barrick.

The mine halted operations last year, but ore stockpiles continue being processed. Mali Lithium said it planned to reopen the mine as soon as possible.

“Morila is one of West Africa’s great gold mines and we are excited and privileged to acquire a mine of Morila’s calibre with its past production plus Mineral Resources (gold endowment) of 8.7 million ounces of gold,” executive chairman Alistair Cowden said in a separate statement.

“This is truly a transformative transaction for the company as we become a gold producer,” Alistair added.

The acquisition of Morila, which lies adjacent to Mali Lithium’s Massigui gold project, is set to turn the Australian company into a cash-generating gold producer.

Morila, known in its heyday as “Morila the Gorilla”, is expected to produce approximately 26,350 ounces of gold from November this year to the second quarter of 2021.

The parties expect to complete the transaction by October this year.

Most miners safe

Mali President Ibrahim Boubacar Keita resigned on Aug. 18 after seven years as a head of state and dissolved parliament hours after soldiers detained him at gunpoint and seized power in a coup.

The following day, Colonel Assimi Goita declared himself the leader of the military figures behind the coup — a group who identify themselves as the National Committee for the Salvation of People (CNSP).

The events have sparked international condemnation and are likely to further destabilize the West African nation, following months of anti-government mass protests and a rising insurgency from Islamist militants.

Experts believe that miners operating in the country’s west and south are unlikely to face any significant threats to their assets. They will, however, have to deal with disruptions, including the imposition of a nightly curfew and the closure of all Malian borders, Alexandre Raymakers, senior Africa analyst at risk analysis company Verisk Maplecroft, said in a note.

Mining companies should also expect substantial administrative delays when dealing with authorities as government structures will be paralyzed by the ongoing political crisis, Raymakers wrote.

from MINING.COM https://ift.tt/2QBnZq6

Comment un simple spray nasal pourrait bloquer le coronavirus

from Les dernières actualités de Futura https://ift.tt/32ATZjG

Informatique quantique : un nouvel obstacle confirmé par les chercheurs

from Les dernières actualités de Futura https://ift.tt/3hOIETu

Informatique quantique : un nouvel obstacle confirmé par les chercheurs

from Les dernières actualités de Futura https://ift.tt/3gJEwCX

Les robots aussi peuvent faire des réserves de graisse

from Les dernières actualités de Futura https://ift.tt/3jtDH2P

Al-Amal, la sonde la plus lointaine observée optiquement !

from Les dernières actualités de Futura https://ift.tt/2G3VmzF

Posséder un iPhone peut être un atout de séduction

from Les dernières actualités de Futura https://ift.tt/2QBFu9P

Démonstration de Neuralink : « c’est comme une Fitbit dans votre crâne », d’après Elon Musk

from Les dernières actualités de Futura https://ift.tt/3gJIITc

Covid-19 : pourquoi la mortalité n'augmente pas avec le nombre de cas

from Les dernières actualités de Futura https://ift.tt/3hHXs6g

Un système anti-collision inspiré des criquets

from Les dernières actualités de Futura https://ift.tt/3juPwpo

dimanche 30 août 2020

Science décalée : comment détecter une personne qui ment par SMS ?

from Les dernières actualités de Futura https://ift.tt/2T3FWOp

Méditation à l'école : a-t-elle des vertus sur l'empathie et les liens sociaux ?

from Les dernières actualités de Futura https://ift.tt/2Db3HAw

Global gold production to grow 2.5% by 2029 – report

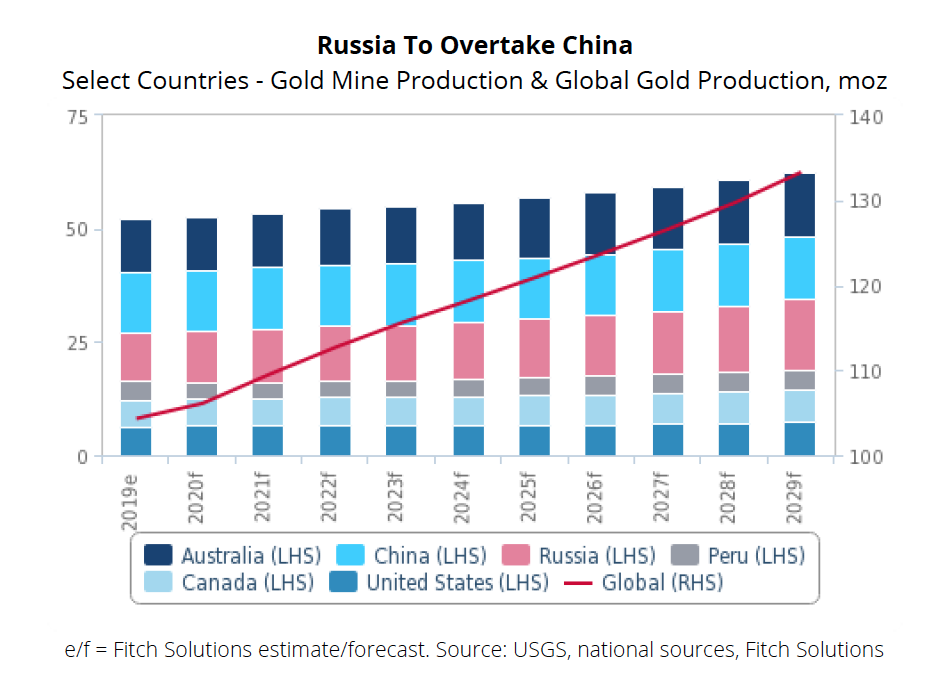

A report by Fitch Solutions forecasts that the global gold production will increase from 106moz in 2020 to 133moz by 2029, averaging 2.5% annual growth.

According to the report, this result would be an acceleration from the average growth of just 1.2% over 2016-2019.

In the market analyst’s view, Russian gold production will lead the rise with gold output jumping from 11.3moz in 2020 to 15.5moz in 2029. This figure represents an average annual growth of 3.7% during 2020-2029 and would see Russia overtake China as the largest gold miner, accounting for 11.6% of global output by 2029, compared with 10.6% in 2020.

Russia’s growth is being driven by ongoing and expanding US sanctions because the rising risk of state banks being frozen out of dealing in US dollar-denominated assets as bilateral relations remain strained is pushing the Russian central bank to increase its holdings of gold.

However, Fitch says that in the longer term, Russian gold production will be underpinned by at least 21 new mining projects due to come online. At the forefront of this trend is Polyus Gold, whose Natalka project achieved full production in 2019 and has a production capacity of 420-470koz per annum. At the same time, the company is developing the Sukhoi Log, one of the largest untapped goldfields with a potential annual output of 1.7moz.

China’s gold production, on the other hand, is expected to remain roughly stagnant in the next 10 years, with an average annual growth rate of 0.2%, a notable slowdown compared with the average annual growth of 3.1% over the previous decade.

Fitch’s review states that these results are the product of stricter environmental regulations, particularly those around solid waste from gold prospecting, which led to a wave of gold mine closures and output declines in major producing provinces, including Shandong, Jiangxi and Hunan.

Years of intensive gold mining also plays a role in the deceleration, as the activity has resulted in falling reserves and production halts in several areas, including Qinghai and Gansu.

On the other hand, major Chinese firms are expected to ramp up investment in foreign gold mines, as the country’s gold demand growth far outpaces that of production. As an example of this, Fitch highlights Shandong Gold’s purchase of a 50% stake in the Veladero mine in Argentina from Barrick Gold for $960 million.

Australia and the US

Australia is expected to see modest production growth over the coming years, supported by a strong project pipeline, rising gold prices and competitive operating costs.

Production Down Under is posed to increase from 11.7moz in 2020 to 14.2moz by 2029, averaging 2.2% annual growth.

OZ Minerals is the company on top of the curve, as it continues to develop its A$916 million Carrapateena copper-gold project, one of the largest mines being built in Australia.

Carrapateena was commissioned in Q4 2019, after which the project will ramp up to steady state production. The mine will be a 4.25mnt per annum copper-gold underground operation, with an estimated life of 20 years. Life of mine average annual production is expected to be 65kt of copper and 67koz of gold.

Finally, Fitch’s report states that the US gold mining sector will continue to attract significant investment activity supported by the country’s history of exploration and known precious metal deposits. Nevada in particular will remain a key location for exploration and development, with both Barrick and Newmont Goldcorp committed to several large-scale projects in the state.

Among these projects are Barrick’s flagship Goldrush project near Cortez, which offers proven and probable reserves of 8.7moz.

At the same time, the world’s second-largest gold producer together with Newmont Corporation – the No. 1 – is building a third shaft at the Turquoise Ridge mine near Winnemucca, which is forecast to increase annual production to more than 500koz a year by 2023.

Barrick is also working with Premier Gold Mines at South Arturo and it expects production to increase in Q419 following the completion of construction activities of Phase 1 open pit and El Niño underground mine.

from MINING.COM https://ift.tt/3gEUcHp

New minister wants to update Dominican Republic’s mining law

The new Minister of Energy and Mines of the Dominican Republic, Antonio Almonte, announced that his office will push for Congress to reform the mining law.

A bill related to this matter was presented by the country’s previous mining minister and Almonte, who was assigned to his post in July by president-elect Luis Abinader, said he wants to update it and add the input of mining companies and other sectors.

Antonio Almonte wants to update the mining law and add the input of mining companies and other sectors

According to the minister, mining is key for the Dominican Republic’s GDP and foreign exchange earnings so, in his view, it must be done in a responsible manner within an updated legal framework that allows for the safeguarding of the interests of the state and those of the community.

Among others, companies operating on the island include Barrick Gold and Newmont Goldcorp, whose Pueblo Viejo gold-silver mine produced 590,000 ounces of gold in 2019; Canada’s Unigold, which owns the Nieta gold project some 200 kilometres north of Santo Domingo; and Precipitate Gold, whose Pueblo Grande project has granted it a $10-million investment from Barrick.

Local media report that Almonte – an engineer who specializes in nuclear energy – also wants to propose an update to Law 57-07, which tackles the provision of incentives to alternative and renewable energy sources, particularly to the private sector.

Before going ahead with such incentives and promoting environmentally friendlier projects, however, it is necessary to update transmission lines and substations as – the government official said – there is only one robust transmission network in the entire country.

from MINING.COM https://ift.tt/32Heewb

Les chats sont de grands flemmards, la science le confirme

from Les dernières actualités de Futura https://ift.tt/2DHu1Cr

Nano-diamond battery that lasts for 28,000 years closer to becoming commercial product

US startup NDB, a company that says it has created the first and only universal, self-charging nano-diamond battery that provides thousands of years of charge, announced that two of its proofs of concept achieved a breakthrough 40% charge. This is a significant improvement over commercial diamonds, which have only a 15% charge collection efficiency.

The two proofs of concept were led by University of Cambridge physicist Sir Michael Pepper and in both cases the 40% charge achieved was attributed to the batteries’ nanodiamond surface treatment that actively extracts the electric charge from the diamond, allowing the battery to make use of significantly more power than any other battery before it.

“Our team is bringing together leaders in the nanotechnology, nuclear science and diamond fields with military, academic and research backgrounds, and combining our unique mix of expertise has made it possible for us to crack the code in developing this groundbreaking, life-changing solution,” Nima Golsharifi, CEO and co-founder of NDB, said in a media statement. “We are extremely concerned about the welfare of the planet and are focused on lowering climate change to protect our planet for future generations. With the NDB battery, we have achieved a massive, groundbreaking, proprietary technological breakthrough of a battery that is emission-free, lasts thousands of years and only requires access to natural air in order to power devices.”

When he says thousands of years, Golsharifi means approximately 28,000 years of battery life for cell phones, aircraft, rockets, electric vehicles, sensors and other devices and machinery.

According to the executive, the company has already secured two beta customers for its solution, including a leader in nuclear fuel cycle products and services and a leading global aerospace, defence and security manufacturing company.

Golsharifi said that the development of the first NDB commercial prototype battery is currently underway and will be available later this year.

How it works

The battery is known as Diamond Nuclear Voltaic (DNV), where a combination of a semiconductor, metal and ceramic has two contact surfaces to facilitate charge collection. Several single units are attached together to create a stack arrangement, which is fabricated to create a positive and negative contact surface similar to a common battery system. Every layer of the DNV stack consists of a high-energy output source.

Within the DNV, radioisotopes are placed in a way that facilitates inelastic scattering originated due to the presence of a single crystalline diamond in the unit. At the same time, stacks along with the source are coated with a layer of polycrystalline diamond, which is known for being the most thermally conductive and hardest material and also has the ability to contain the radiation within the device.

from MINING.COM https://ift.tt/2EI2rW1

Le Soleil était en couple avec une étoile née en même temps que lui

from Les dernières actualités de Futura https://ift.tt/31zcvtn

samedi 29 août 2020

Science décalée : un canon à saumon devient viral sur Internet

from Les dernières actualités de Futura https://ift.tt/2Zfjibk

FRB 121102 : le mystérieux sursaut radio rapide est de retour… comme prévu

from Les dernières actualités de Futura https://ift.tt/2YHDCjY

Le secret des femmes moins touchées par la Covid-19 réside-t-il dans l'immunité ?

from Les dernières actualités de Futura https://ift.tt/2EFIuPT

Quelle serait l’origine des espèces selon Charles Darwin ?

from Les dernières actualités de Futura https://ift.tt/2DaOpf7

En vidéo : voyage de l'autre côté des orages à la découverte des sprites

from Les dernières actualités de Futura https://ift.tt/2QxukCQ

Microsoft Word sait désormais retranscrire les enregistrements audio

from Les dernières actualités de Futura https://ift.tt/34I9cSv

Empoisonnement de Navalny : quel est le poison qui a failli le tuer ?

from Les dernières actualités de Futura https://ift.tt/3hFycO3

À quoi ressemblerait votre quotidien avec des serrures intelligentes ?

from Les dernières actualités de Futura https://ift.tt/2EhEDIz

Un astéroïde va-t-il s’écraser sur Terre le 2 novembre 2020 ?

from Les dernières actualités de Futura https://ift.tt/3hPXARv

En vidéo : votre avatar numérique servira de cobaye médical

from Les dernières actualités de Futura https://ift.tt/3gEgI3j

vendredi 28 août 2020

Des créatures auraient survécu à l'extinction du Permien-Trias grâce à l'hibernation

from Les dernières actualités de Futura https://ift.tt/32whQkE

Canada to have rare earth processing plant in 2022

Canada will have rare earth processing plant in operations by the end of 2022 as the province of Saskatchewan has committed C$31 million (about $24m) to build the facility, which aims at boosting domestic supply of the key ingredients for military weapons, electric vehicles and phones.

The process of turning rare earths (REE) ore into individual products is done in two main stages. The first is the concentration of ore to mixed REE Carbonate. The second is the more complex separation stage that converts the mixed REE Carbonate to commercial pure-grade REEs. The facility, owned and operated by the Saskatchewan Research Council (SRC), will address both stages of REE processing.

The province said it would be the first of its kind in Canada, adding that it is expected an industry model for future commercial rare earth expansion.

“Saskatchewan’s new Rare Earth Processing Facility will be a catalyst to stimulate the resource sector in the province and across Canada, providing the early-stage supply chain needed to generate cash-flow, investment and industrial growth of the sector,” Premier Scott Moe said in the statement.

Setting an independent domestic rare earth and critical minerals supply chain has become a priority for Canada and, particularly, the United States. Both currently rely on China, which accounts for 70% of global production.

The Asian giant also controls more than 60% of a $14 billion global market for materials used in magnets and motors that power phones, wind turbines, electric vehicles and military devices.

The 69,000 square foot plant will be located in north Saskatoon and will employ about two-dozen people.

from MINING.COM https://ift.tt/3hE22lY

De quelle couleur est le Soleil ?

from Les dernières actualités de Futura https://ift.tt/3llgeTc

Le halo de la galaxie d'Andromède frôle celui de la Voie lactée

from Les dernières actualités de Futura https://ift.tt/3b53Y4t

Australia’s IronRidge Resources becomes member of European Battery Alliance

Australia’s IronRidge Resources (AIM: IRR) announced that it has been accepted as a member of the European Battery Alliance, an organization committed to driving a competitive and sustainable battery industry in Europe by 2025.

In a press release, IronRidge explained that the EBA250 network brings together over 400 interested stakeholders, industry specialists and participants from both the public and private sectors of the EU’s battery value chain.

Among other benefits, members have access to the InnoEnergy Venture Capital Community and potential alternate funding sources.

“EBA250 membership will be highly valuable to the company as we continue to progress our Cape Coast Lithium Portfolio,” Vincent Mascolo, IronRidge’s CEO, said in the media brief. “We are confident in our project fundamentals and the project’s proximity to Europe is highly advantageous and may deliver multiple pathways through the value-adding vertical integration ambitions of the EU.”

The miner’s Cape Coast Lithium Portfolio covers some 684 square kilometres in Ghana, West Africa and includes the spodumene-rich Ewoyaa lithium project, which has with a maiden mineral resource estimate of 14.5Mt at 1.31% Li2O in the inferred and indicated category including 4.5Mt @ 1.39% Li2O in the indicated category.

IronRidge also entered into earn-in arrangements with Obotan Minerals, Merlink Resources, Barari Developments and Joy Transporters Limited of Ghana, and secured first access rights to acquire the historical Egyasimanku Hill spodumene-rich lithium deposit, estimated to be in the order of 1.48Mt at 1.67% Li2O and surrounding tenements.

from MINING.COM https://ift.tt/2EqcTSr

Australian Strategic Materials, ZironTech produce titanium using 70% less energy than common methods

Australian Strategic Materials and its Korean partner ZironTech produced this week 20.8 kilograms of high-purity titanium metal (99.83%) using 30% of the energy employed in standard titanium industry processes.

“This innovative metal technology energy usage is 35 kW per kilogram compared to the industry standard Kroll process that uses 117 kW per kilogram of metal, and shows significant environmental benefits,” ASM managing director, David Woodall, said in a media statement. “We are focussed on ensuring these high-purity permanent-magnet metals and titanium metals do not cause the environmental impacts of traditional methods.”

ASM is focussed on ensuring high-purity permanent-magnet metals and titanium metals do not cause the environmental impacts

Just a couple of months ago, Australian Strategic Materials and ZironTech were able to produce 30 kilos of titanium metal alloy with the patented reduction process the JV has developed using 45% less power than current industry methods, so August’s results are interpreted as a positive step.

Woodall said that the company is now working on commencing a metal plant feasibility which will confirm the optimal size of a plant in Korea, with the opportunity to build additional plants in key manufacturing areas in Australia, North America, and Europe.

The idea is to feed these plants with the output from its polymetallic Dubbo project in New South Wales, which has a large in-ground resource of zirconium, rare earth elements (including yttrium), niobium, and hafnium.

from MINING.COM https://ift.tt/2QybMCu

Barrick to fight PNG’s attempt to grant Porgera lease to state-backed miner

Canada’s Barrick Gold (TSX: ABX) (NYSE: GOLD) said it would challenge the Papua New Guinea (PNG) government alleged move to grant a 20-year lease for the Porgera gold mine to a state-backed firm.

The world’s second-largest gold producer and its Chinese partner, Zijin Mining, are embroiled in a dispute with Prime Minister James Marape, who rejected in April their application for a lease extension.

The companies temporarily halted operations in response. They also served Marape with a dispute notice arguing the refusal of Porgera licence extension violated a bilateral investment treaty between PNG and Australia. The move, they said, also infringed international law governing foreign investment.

Barrick said at the time that if the parties were unable to settle the row through negotiations, it would take PNG to international arbitration.

Barrick Niugini Limited (BNL), Porgera’s operator, said in a release it was aware of alleged actions taken by the Marape government to grant the mining for Porgera lease by Marape to state-owned Kumul Minerals Holdings.

The company noted it considered such move “unlawful and “invalid”, adding that it was unaware of any consultation with local owners about the change.

“In purportedly granting a special mining licence in this non-transparent and rushed manner, the Marape government sets a precedent of the State disenfranchising landowners and making decisions with fundamental consequences for their futures and those of their children without doing them the justice of listening to their views,” BNL said in the statement.

Settlement attempts

Barrick offered in May an extra 15% stake in the Porgera mine to local landowners, in a fresh attempt to break the impasse with the government over the mine’s future.

PNG later threatened Barrick with criminal proceedings, claiming the company’s joint venture in the country was planning to illegally export $13 million in gold and silver to Australia. BNL refuted the allegations.

The ongoing dispute has done to Barrick what the pandemic did not — dent its expected output for the year. It now expects to produce between 4.6 million and 5 million ounces of gold this year — 200,000 ounces lower than its previous estimate.

Barrick revealed at the time that PNG was also asking the company and Zijin to pay $191-million in back taxes, arising from tax audits conducted between 2006 and 2015.

Earlier this week Marape said his government wanted to reopen the mine, but that the lease had reverted to the state. He has previously said the mine should be operated by the government of PNG.

Tier one potential

The company’s president and chief executive officer, Mark Bristow, said in March that Porgera had “tier one potential” but faced many challenges in the form of “legacy issues and an unruly neighbourhood.”

The gold mine, located in PNG’s northern highlands region, is a joint venture between Barrick and Zijin Mining. Each owns 47.5% of the mine, with the remaining 5% held by landowner group Mineral Resources Enga.

Porgera contributes to about 10% of the nation’s exports and employs over 3,300 Papua New Guinea nationals.

The open pit and underground gold mine sits at an altitude of 2,200-2,600 metres in Enga province, and is about 600 km (370 miles) northwest of Port Moresby.

Other mining companies operating in PNG, including Australia’s Newcrest (ASX: NCM), have not been impacted by the decision regarding Porgera. The miner has “welcomed” the Prime Minister’s support for its Wafi Golpu gold and copper asset, adding that its special mining lease at the Lihir operations remains in good standing with a renewal not needed until 2035.

More to come…

from MINING.COM https://ift.tt/3lpf3Ch

Enquête sur le retour des néonicotinoïdes dans les champs de betteraves

from Les dernières actualités de Futura https://ift.tt/2YHOGO5

Flight Simulator permet de suivre les ouragans en temps réel

from Les dernières actualités de Futura https://ift.tt/3gxOrLD

Les virus du microbiote sont uniques à chaque individu

from Les dernières actualités de Futura https://ift.tt/2ECnp8Z

LG lance un masque connecté avec purificateur d'air et UV

from Les dernières actualités de Futura https://ift.tt/3gDR3I7

En vidéo : où en est le traitement de la Covid-19 avec le plasma ?

from Les dernières actualités de Futura https://ift.tt/3hxDNG6

Voici les animaux que nos ancêtres rencontraient il y a 2 millions d’années en Europe

from Les dernières actualités de Futura https://ift.tt/34Iae10

Les ovules de deux dernières rhinocéros blancs du Nord ont été collectés

from Les dernières actualités de Futura https://ift.tt/3lnJ05I

Naissance de dizaines de bébés tortues sur une plage de Fréjus

from Les dernières actualités de Futura https://ift.tt/34HlKtq

Velocifero Beach Mad : cette moto électrique ne ressemble à aucune autre

from Les dernières actualités de Futura https://ift.tt/32xLxBJ

Amazon lance un étonnant bracelet pour la santé

from Les dernières actualités de Futura https://ift.tt/34Tk4xl

Ces météorites pourraient être à l'origine de l'eau sur Terre

from Les dernières actualités de Futura https://ift.tt/2QwxC9l

Étrangeté du vivant : des scientifiques pêchent un requin sans peau et sans dents !

from Les dernières actualités de Futura https://ift.tt/3hDey5p

Quelle température faisait-il sur Terre durant la dernière période glaciaire ?

from Les dernières actualités de Futura https://ift.tt/2YJ218V

Coronation : un documentaire choc révèle la situation à Wuhan à travers les yeux de ses habitants

from Les dernières actualités de Futura https://ift.tt/3bbES4c

jeudi 27 août 2020

Antarctique : la moitié des barrières de glace sont fragilisées par le réchauffement climatique

from Les dernières actualités de Futura https://ift.tt/2QwduUX

MINING.COM MINUTE: Biggest stories of the week

MINING.COM MINUTE is a roundup of the biggest stories from the global mining and metals industry.

This week’s top stories:

- Rhodium price on track for new record as mine output plummets – Read more

- Copper price to extend rally on “signs of Chinese panic buying” – Read more

- New nickel price launched as attention shifts to green supply – Read more

- Northern Dynasty stock plummets further with Pebble project in limbo – Read more

- Vale opens iron ore grinding hub in China – Read more

- Glencore strategy to underpin cobalt prices post covid-19 – Read more

from MINING.COM https://ift.tt/3hztFNe

SilverCrest buys asset by its Las Chispas gold-silver project

Canada’s SilverCrest Metals (TSX: SIL) announced on Thursday the acquisition of El Picacho gold-silver property in Sonora, Mexico, from local American Metal Mining and an affiliate for $1.6 million.

The asset comprises 11 concessions covering 7,060ha and it’s located about 40km northeast of SilverCrest’s Las Chispas project gold-silver project, the company said.

Depending on drilling results, the Vancouver-based junior said El Picacho may be considered either a standalone mine or a satellite feeder mine to Las Chispas, which is currently under development.

SilverCrest plans to begin drilling on the property in by the end of the year, pending receipt of permits.

Analysts backed the move, saying that the addition of El Picacho, a past gold and silver producer, could boost Las Chispas mine life.

“In our view, the Picacho property could be a driver of mine life extensions for Chispas and a source of ore to blend with the ultra-high grades being delineated from some of the veins such as Babi Vista,” Scotiabank analyst Trevor Turnbull said in a note to investors.

A preliminary economic assessment on Las Chispas supports and underground operation with estimated production 5.4 million ounces of silver a year and 55,700 ounces of gold annually, over 8.5 years.

The mine would need an initial invest of $100 million.

Despite being the world’s top silver producer and price for the metals hitting historic highs, Mexico’s economic outlook is gloomy.

Latin America’s second-largest economy is expected to contract by almost 13% this year, Mexico’s central bank warned on Wednesday.

The bank noted the pandemic lockdown has thrown the country into the deepest slump since the Great Depression.

from MINING.COM https://ift.tt/3gxJIJZ

Sibanye-Stillwater profit jumps on bullion prices

Sibanye-Stillwater on Thursday reported a half-year profit boosted by higher precious metals prices and a weaker rand currency. Production from all the company’s operating segments increased year-on-year despite the disruptions posed by the pandemic.

The precious metals producer said headline earnings per share for the six months to June were 350 cents ($0.21) per share compared with a loss per share of 54 cents a year earlier when output was hit by strikes.

The company, which last paid a dividend in the second half of 2016 due to the acquisition of the Stillwater operations, declared an interim dividend of 50 cents per ordinary share.

Sibanye is reviewing the ramp-up schedule of its Blitz project in Montana due to disruptions

“Along with significantly higher precious metal prices received for the period, the operational results added higher production to achieve record six-month adjusted earnings before interest, taxes, depreciation and amortisation (Ebitda) of $990 million, 718% higher than for the comparable period in 2019.” company said in a press release.

Sibanye reported production from the South African gold operations of 12,554kg (403,621oz), 17% up compared to the same period of 2019.

“The SA operations are likely to achieve optimal production levels by Q4 2020, with the outlook for precious metals prices constructive, the operating and financial outlook for H2 2020 is extremely positive.” said Neal Froneman, CEO of Sibanye Stillwater.

Output at the company’s U.S platinum group metals (PGM) operations rose 5% to 297,740 ounces, while recycled production fell 6% on a global slowdown of auto catalyst collections and deliveries and logistical constraints, the company said.

PGM production from its South African operations rose 5% year-on-year to 657,828 ounces, with the inclusion of the Marikana operations during the period offsetting disruptions due to covid-19.

Sibanye is reviewing the ramp-up schedule of its Blitz project in Montana due to disruptions caused by the pandemic, with early indications showing a delay of 18 months.

It’s estimated that the project will boost the firm’s platinum group metals (PGM) production in the US by more than 50% to around 850,000 ounces.

Midday Thursday, Sibanye’s stock was up 0.4% on the NYSE. The company has a $7.9 billion market capitalization.

($1 = 16.9571 rand)

(With files from Reuters)

from MINING.COM https://ift.tt/2G3e0YC

Voie lactée : le « paradoxe de la barre galactique » enfin résolu ?

from Les dernières actualités de Futura https://ift.tt/3hArQj4

Fairphone 3+, le mobile vertueux passe sous le tournevis de Futura

from Les dernières actualités de Futura https://ift.tt/3hCMz5J

Danakali eyes finish line for Eritrea potash project

Australia’s Danakali (ASX, LON:DNK) said on Thursday it plans to spend the rest of the year focused on closing the required financing to bring its Colluli potash project closer to construction, as Eritrea eases covid-19 restrictions.

Reporting results for the six months to June 30, the Perth-based miner said it’s considering a range of options to fund pending work at Colluli, a 50:50 joint venture between the company and the Eritrean National Mining Corporation (ENAMCO).

“We started 2020 with the kick-off of the project development for Colluli and despite the unprecedented and challenging covid-19 pandemic, we have been able to make good progress with our engineering, procurement and construction management activities,” chief executive officer Niels Wage said in the statement.

The project, Wage noted, is on track for production in 2022.

In the initial phase of operation, Colluli would produce more than 472,000 tonnes a year of sulphate of potash (SOP), a premium grade fertilizer.

Annual output could rise to almost 944,000 tonnes if Danakali decides to go ahead with a second phase of development, as the project has a possible 200-year plus mine-life.

Losses widen on higher costs

The miner, which posted a widened loss of $1.7 million from $1.5 million in the same period last year, said that plans for the remainder of 2020 include finalizing conditions to receive $28.5 million from the African Finance Corporation (AFC).

Danakali also said that administration expenses in the first half of the year were 36% higher at $1.7 million from $1.3 million in 2019.

The company will also begin phase three of construction at the project, which has been called “a game-changer” for the East African nation’s economy.

Colluli’s development coincides with the move towards diplomatic relations between the once feuding countries of Eritrea and Ethiopia, which officially declared peace in July 2018.

Until that year, Eritrea was on the United Nations’ sanctions list.

from MINING.COM https://ift.tt/2EvvIDC

Une « comète rasante » qui pourrait devenir très brillante

from Les dernières actualités de Futura https://ift.tt/32xKWQq

Covid-19 : une méta-analyse indique que l’hydroxychloroquine augmente la mortalité avec l’azithromycine

from Les dernières actualités de Futura https://ift.tt/3b0gS3M

Comment se forment les embouteillages routiers ?

from Les dernières actualités de Futura https://ift.tt/32Kmwn9

BHP to set fresh targets for emissions reduction by 2030

BHP (ASX, LON, NYSE: BHP) is fine-tuning details of a revamped strategy to reduce the company’s operational emissions and its use of diesel, which will set concrete targets to be reached by 2030, chief executive Mike Henry said on Thursday.

The “very tangible actions”, to be announced on Sept. 10, are part of the world’s largest miner’s broader commitment to become carbon-neutral by 2050.

Henry told shareholders he would also announce concrete steps towards reducing the company’s Scope 3 emissions (those generated by end-users), an important consideration given BHP is the top exporter of coking coal used in steelmaking and number three in iron ore, the raw material for steel.

The highly polluting process of making steel involves adding coking coal to iron ore to make the alloy, and is responsible for up to 9% of global greenhouse emissions.

Some of the projects that will help the company cut emissions will be funded through a $400 million climate investment program announced in 2019.

BHP boss noted that some of the projects that will help the company cut emissions will be funded through a $400 million climate investment program announced in 2019.

Henry also highlighted some of the steps the company has already taken to be a “greener” company. Those include carbon capture and storage and other innovations such as direct air capture.

BHP announced four power agreements last year aimed at running its Chilean operations Spence and Escondida, the world’s biggest copper mine, entirely on renewable power.

The Melbourne, Australia-based giant is also aiming to eliminate the use of water from aquifers in Chile by 2030.

Spence, a desalination water plant with a capacity of 1,000 litres per second, was expected to support a $2.5 billion expansion. The project, originally slated to be completed by the end of this year, was recently deferred until early 2021 due to effects of the coronavirus pandemic, BHP said in April.

At Escondida, a second desalination plant was commissioned in 2017 with a maximum capacity of 2,500 litres per second. Additional upgrades, plus the connection of the original desalination plant to this conveyance system will further increase total capacity.

Chile’s environmental watchdog said in July it would charge Escondida with drawing more water than its permits allowed for nearly 15 years.

Moving away from coal

BHP will also update in September its portfolio assessment, taking into account Paris agreement goals, Henry said. The miner said in June that it would sell or demerge some of its coal mines, including the Mount Arthur thermal coal mine in Australia.

Executive remuneration will also include an element tied to climate change actions, the executive said.

BHP’s Australian annual general meeting takes place on Oct 14, and its London AGM on Oct. 15.

from MINING.COM https://ift.tt/31v4WE6

Physique quantique : cette expérience remet-elle en question notre réalité ?

from Les dernières actualités de Futura https://ift.tt/2G48zIX

Des exercices militaires de l'Otan à l'origine d’échouages de baleines en mer du Nord ?

from Les dernières actualités de Futura https://ift.tt/3loi9q7

Pacific Empire Minerals options Pinnacle copper-gold project in British Columbia

Pacific Empire Minerals (TSXV: PEMC) signed a non-binding letter of intent to grant 1111 Acquisition Corp. an exclusive option to earn up to a 70% interest in the Pinnacle copper-gold project in British Columbia, Canada.

Pinnacle is located in central British Columbia, 50 kilometres west of Centerra Gold’s Mt. Milligan mine and 20 kilometres north of the Pacific Empire’s own Jean Marie copper-gold-silver-molybdenum project.

According to the Pacific Empire, since 2014, Pinnacle has seen over $2 million in partner-funded exploration, as an IP survey over three target areas identified three areas of anomalous chargeability, two of which (Elbow and Sooner) were prioritized for follow-up diamond drill testing in 2015. Back then, anomalous gold intercepts were associated with sericite-biotite alteration at the Elbow Zone.

Since 2014, Pinnacle has seen over $2 million in partner-funded exploration

Under the terms of the LOI, 1111 Acquisition can earn a 70% interest by completing $5.7 million in exploration expenditures on the project, paying PEMC an aggregate of C$375,000 in cash payments and issuing 3.5 million common shares to PEMC by the fourth anniversary of the signing of the definitive agreement.

“PEMC continues to pursue additional opportunities for partner-funded drilling on several projects while we advance our Jean Marie, Weedon and Worldstock projects,” Brad Peters, president and CEO of Pacific Empire, said in a media statement. “Drilling at Pinnacle in 1991 intersected intriguing copper and gold values at the Aplite Creek Zone while partner-funded and PEMC-funded drilling over the last six years revealed anomalous gold values over a wide area at the Elbow Zone, in addition to anomalous copper values. We are excited to have a very strong technical group advance the project and look forward to upcoming diamond drilling at Pinnacle in 2021.”

from MINING.COM https://ift.tt/3lrlfJV

Ces produits cosmétiques contiennent des composants « toxiques » avertit 60 millions de consommateurs

from Les dernières actualités de Futura https://ift.tt/3hCjdUY

Ford dévoile sa voiture de course virtuelle inspirée de la Ford GT

from Les dernières actualités de Futura https://ift.tt/2EmupHb

Mars est de plus en plus proche de la Terre : il est temps de l'observer !

from Les dernières actualités de Futura https://ift.tt/2Qwfk8q

L’ouragan Laura vient de toucher terre. La Louisiane et le Texas sont en alerte maximale

from Les dernières actualités de Futura https://ift.tt/3gz25hI

LG va sortir un masque avec purificateur d'air et UV

from Les dernières actualités de Futura https://ift.tt/3hDBpO8

Coronavirus : les États-Unis autorisent le traitement avec le plasma des patients guéris. Que faut-il en penser ?

from Les dernières actualités de Futura https://ift.tt/2Em1set

Les gigantesques incendies en Californie vus de l'espace

from Les dernières actualités de Futura https://ift.tt/3jiUci5

Des girafes à cou court, des rhinocéros, des tigres à dents de sabre : une grande diversité d'animaux se promenaient en Europe il y a 2 millions d’années

from Les dernières actualités de Futura https://ift.tt/31wDDsS

Découverte d'un énorme diamant de 422 carats au Lesotho

from Les dernières actualités de Futura https://ift.tt/3hKmf9G

Le coronavirus peut-il se transmettre par les eaux usées ?

from Les dernières actualités de Futura https://ift.tt/3jcLemu

Origine de la vie et panspermie : la vie sur Terre pourrait venir de Mars

from Les dernières actualités de Futura https://ift.tt/3grIgc8

mercredi 26 août 2020

Minas Gerais asks court to block Vale assets worth $4.7bn

Brazil’s Minas Gerais state authorities and federal prosecutors have asked a judge to order Vale (NYSE: VALE) to pay for economic losses and other damages stemming from last year’s deadly Brumadinho tailings dam disaster, which killed 270 people.

The authorities have sent a joint petition seeking a judge’s order for the miner to freeze 26.7 billion reais ($4.78 billion) in assets for eventual restitution to the state.

They are also seeking 28 billion reais ($5.01 billion) in collective “moral and social” damages.

“This amount corresponds to the net profit distributed to shareholders in 2018, an amount that could have been applied to guarantee the safety of the dams”, defended the prosecutors.

Vale have not responded to requests for comment on the decision.

In July, a court decision suspended $1.5 billion in legal deposits that had been previously required in a case related to the deadly dam collapse.

In May, the city of Brumadinho suspended Vale’s operating license after health agents said that the company’s onsite activities have “not respected the rules of social isolation.”

A Minas Gerais state court in Brazil later revoked the decree after the company argued that the suspension was issued to avoid the spread of the new coronavirus, but had the main purpose of serving as retaliation for non-payment of emergency aid to the entire population of the city.

The Fire Brigade of Minas Gerais will resume tomorrow the search for still missing bodies of 11 victims of the disaster. Work was halted on March 21 due to pandemic protocols.

Earlier this year, state prosecutors charged Fabio Schvartsman, the chief executive at the time of the burst, and 15 other people with homicide. Schvartsman left his position at the company in March 2019.

from MINING.COM https://ift.tt/3gu35U7

Jaguar enters option on Iamgold land package in Brazil

Jaguar Mining (TSX: JAG) announced Wednesday it has signed an option agreement with Iamgold (TSX: IMG) on a package of 28 exploration tenements covering an area of more than 27,000 hectares in the Iron Quadrangle of Minas Gerais, Brazil.

Under the agreement, Jaguar has the option to earn an initial 60% interest in the land package by spending $6 million on exploration over four years beginning in the third quarter. The company is required to spend a minimum of $500,000 per year during the earn-in period, and the exploration program must include the completion of at least 5,000 metres of diamond drilling.

Upon Jaguar vesting an initial 60% interest, Iamgold may elect to fund its pro-rata share of ongoing expenditures under a conventional 60/40 JV that will be formed for this purpose.

The Iron Quadrangle has been an area of mineral exploration dating back to the 17th century and contains world-class gold deposits such as Morro Velho, Cuiabá and São Bento. Jaguar currently holds the second-largest gold land position of the producers in the region with just over 35,000 hectares.

“The Iron Quadrangle agreement with Iamgold will serve to enhance and expand Jaguar’s strategic focus, where we already have an impressive footprint with the Turmalina and Pilar operating gold mines and the Paciência mill which has been in care and maintenance since 2012 ,” Jaguar Mining CEO Vern Baker stated.

According to Jon Hill, VP geology and exploration, there is a “multitude of historical mines and mineralized occurrences” within the area, and existing data and ongoing work have shown indications of “tier 1 potential targets.”

Shares of Jaguar Mining jumped 7.7% by 1:20 p.m. EDT on the option agreement announcement. The Toronto-based miner has a market capitalization of C$607.7 million.

from MINING.COM https://ift.tt/2EwN2rI

Paulson bolsters position in Midas Gold

New York investment management firm Paulson & Co. is significantly bolstering its shareholding in Midas Gold (TSX: MAX), which is currently focused on redeveloping the former Stibnite gold, silver, antimony and tungsten mine in Valley County, Idaho.

In a Wednesday press release, the Vancouver-based miner announced that Paulson, on behalf of the several investment funds and accounts managed by the firm, will exercise the conversion feature on the C$82.1 million in convertible notes held by Paulson for a total of 199.69 million common shares of Midas Gold.

This would result in Paulson holding approximately 44.12% of the company’s outstanding shares. Prior to the conversion, Paulson held approximately 9.66 million shares, representing a shareholding of 3.52%.

Stibnite contains one of the largest gold reserves in the nation, capable of producing 337,000 ounces of gold annually

Paulson first invested in Midas back in 2016 through a C$55.2 million financing. In March of this year, the firm made a further investment with a C$47.6 million convertible note financing to help Midas advance the Stibnite project, which contains one of the largest gold reserves in the US, capable of producing 337,000 ounces of gold annually.

Earlier this month, the proposed Stibnite mine was made available for public comment when the US Forest Service released the project’s draft environmental impact statement.

“Given the release of the DEIS and the commencement of the public comment period, we believe that it is an appropriate time for the conversion of the notes, and Paulson intends to remain a long-term shareholder of the company,” Marcelo Kim, partner of Paulson and Midas chairman said in a press release.

Barrick Gold, the world’s second-largest gold miner, also holds a near 20% stake in Midas Gold.

Shares of Midas Gold were down 3.4% by noon EDT, giving the company a market capitalization of C$460.1 million.

from MINING.COM https://ift.tt/2YBD6nD

La polio est officiellement éradiquée en Afrique

from Les dernières actualités de Futura https://ift.tt/3hy7RBl

Ce VTTAE Kellys Theos F inaugure un cadre composite deux fois plus résistant que la fibre de carbone

from Les dernières actualités de Futura https://ift.tt/3jijahK

Une pintade dévoile le secret de la marche des dinosaures

from Les dernières actualités de Futura https://ift.tt/2YE2DN7

Les illusions d'optique expliquées grâce au cerveau des mouches

from Les dernières actualités de Futura https://ift.tt/34MZJtx

Codelco gets $22 million-refund from insurance fraud

Chile’s Codelco, the world’s top copper producer, has secured a $22 million-refund corresponding to damages caused to the company and its workers as a result of life insurance overpricing between 2005 and 2018.

The state-owned miner filed a lawsuit in January after an internal investigation concluded that insurance firm Chilena Consolidada had overcharged Codelco for 14 years on premiums to coverage acquired by unions at its Chuquicamata and Radomiro Tomic divisions.

The copper giant said that half of the fraud-related costs had been borne by the company and half by its workers.

The unions said at the time that all insurance agreements had been signed off by Codelco’s human resources managers.

The company noted it would not withdraw the lawsuit against the union leaders until those responsible are identified.

Chilena Consolidada, a unit of Zurich Insurance Group, has already transferred $11 million to Codelco and signed a contract to transfer the other half owed directly to the workers and former workers affected by the fraud.

Ahead with expansion projects

Copper output levels have held up so far in Chile, despite the coronavirus pandemic.

In the first six months of the year, Codelco boosted output by 4.7% to 744,000 tonnes of copper even as it had to rely on skeleton crews at its deposits because of covid-19.

The company has also plowed ahead with an ambitious 10-year, $40 billion mines overhaul to keep up production rates.

It has already finished one of its biggest projects — the $5.6 billion conversion of the Chuquicamata open pit mine into an underground operation.

Ongoing major mine upgrades include a $5.5 billion new level at the El Teniente underground mine, the company’s largest and the world’s no. 6 by reserve size, slated to begin operations in 2023.

It also involves converting the El Salvador mine to an open-pit mine from underground operations. The $1 billion project, known as Rajo Inca, is expected to extend the productive life the mine by 40 years and increase output by 30% from current levels.

Salvador is Codelco’s smallest division by production. Last year, it churned out 50,600 million tonnes of copper, down 16.8% from 2018.

In the copper giant’s pipeline of structural projects there is also the $1.3 billion expansion of the Andina mine. The operation accounted for roughly 11% of Codelco’s output in 2018.

Codelco operates seven mines and four smelters, all in Chile. Its assets account for 10% of the world’s known proven and probable reserves and about 11% of the global annual copper output, with 1.8 million tonnes of production.

from MINING.COM https://ift.tt/2EDQuk0

L'Homme et les grands singes sont les espèces plus menacées par le coronavirus

from Les dernières actualités de Futura https://ift.tt/32lee4A

Commerce Resources gets $160K in grants to back development of Ashram rare earth project

Canadian miner Commerce Resources (TSXV: CCE) has received C$160,000 in grant money from both government and private organizations in support of research and development of the Ashram rare earth and fluorspar deposit’s flowsheet.

Located in northern Quebec, Ashram is one of the largest rare earth deposits in the world with a fluorspar component which also ranks as one of the largest defined globally.

The research and development program focused on the project will be carried out as a collaboration between Commerce Resources, Université du Québec en Abitibi-Témiscamingue and the Industrial Waste Technology Centre.

Ashram is one of the largest rare earth deposits in the world with a fluorspar component which also ranks as one of the largest defined globally

Within this collaboration, Commerce has committed to providing approximately 1.5 tonnes of Ashram material to be used as feed for the various test programs with the goal of optimizing the flotation process to produce high-grade (>30% REO) mineral concentrate using only this method, and further demonstrate the scale-up of the process from bench to mini-pilot scale; enhancing mineral liberation by using a high-voltage electrical pulse (HVEP) fragmentation method; and evaluating wet screening as a classification approach in the grinding circuit.

“The programs that have been outlined by UQAT and CTRI have the potential to provide significant process optimizations and cost efficiencies to the Ashram project (e.g. energy reductions, improved mineral liberation and flotation performance, etc.), as well as make a strong contribution to academia and the research and development of strategic minerals in Quebec,” Chris Grove, president of the Vancouver-based mining company, said in a media statement.

Besides these grants, Commerce has received C$1 million in direct equity investment from the Quebec government, C$365,000 in funding for a parallel pilot plant program and software modelling (Universite’ Laval), and C$300,000 for tailings optimization program (INRS).

from MINING.COM https://ift.tt/34BN10y