samedi 31 octobre 2020

Ce phénomène naturel invisible peut vous faire voir des fantômes !

from Les dernières actualités de Futura https://ift.tt/34Fhudw

Science décalée : les 10 meilleures séries pour un plan « Netflix & chill »

from Les dernières actualités de Futura https://ift.tt/3jJhqOf

Étrangeté du vivant : cet animal marin capture ses proies comme une plante carnivore

from Les dernières actualités de Futura https://ift.tt/356JPs7

Le gros astéroïde Apophis, qui frôlera la Terre en 2029, a sa trajectoire modifiée

from Les dernières actualités de Futura https://ift.tt/3kMmGCa

Podcast : la seule opération de l'Histoire avec un taux de mortalité de 300%

from Les dernières actualités de Futura https://ift.tt/32ZJO8D

Flippant : une vidéo de mygale géante en train de dévorer un oiseau

from Les dernières actualités de Futura https://ift.tt/3hsUGko

Covid-19 et grippe : quels scénarios pour cet hiver ?

from Les dernières actualités de Futura https://ift.tt/37ZNefx

La Lune en 5 mythes et croyances qui ont la vie dure

from Les dernières actualités de Futura https://ift.tt/2noiJrs

Un terrifiant poisson des profondeurs pour la première fois en vidéo

from Les dernières actualités de Futura https://ift.tt/3kMgWrQ

Podcast : la baie de la Terreur, sort tragique en Arctique

from Les dernières actualités de Futura https://ift.tt/3h4n2mi

Coronavirus : une variante espagnole du virus à l'origine de la deuxième vague meurtrière en Europe

from Les dernières actualités de Futura https://ift.tt/34Jxqvl

Test Mario Kart Live Home Circuit : la réalité augmentée déboule dans votre salon

from Les dernières actualités de Futura https://ift.tt/3kOZGlW

Un bras bionique low-cost pour démocratiser les prothèses

from Les dernières actualités de Futura https://ift.tt/3mBJYuY

Réinfection par le coronavirus : l'Inserm fait le point

from Les dernières actualités de Futura https://ift.tt/34GQ47e

Les chauves-souris vampires pratiquent la distanciation sociale

from Les dernières actualités de Futura https://ift.tt/3oIfNEi

vendredi 30 octobre 2020

MINING.COM MINUTE: Biggest stories of the week

This week’s top stories:

- US court upholds miners’ rights to explore on federal lands – Read more

- Nordgold submits off-market bid for Cardinal in takeover war – Read more

- Over $1 trillion needed for energy transition metals – Read more

- Teck profit drops by almost 67% on weak coal prices – Read more

from MINING.COM https://ift.tt/3echZiD

McEwen gets back on track in Q3

McEwen Mining (NYSE: MUX) (TSX: MUX) saw its production rebound during the third quarter after successful restart of all four of its operations, which were temporarily halted during Q2 2020 due to covid-19.

Total output for Q3 2020 was 23,100 gold ounces and 575,000 silver ounces, or 30,400 gold-equivalent ounces. At quarter-end, the company had cash and working capital of $18.8 million and positive $21.6 million, respectively.

“I am feeling much better this year than I did last year at this time because the bad news is behind us,” chairman founder Rob McEwen said in a quarterly report to shareholders.

“Our operations are starting to turn around and improve; the financial pressure on our balance sheet has been alleviated; and our future growth is becoming much brighter. Investment capital is still in the early stages of moving into precious metals,” McEwen said.

“Our operations are starting to turn around and improve; the financial pressure on our balance sheet has been alleviated”

Rob McEwen, chairman and Founder

Production from Black Fox, where development of the access to the Froome underground deposit has advanced 47% by the end of the quarter, reached 5,800 GEOs in Q3 at cash costs and all-in sustaining costs (AISC) of $1,581 and $1,644 per GEO, respectively.

The Northern Ontario operation benefited from additional development work completed during Q2, which increased mining flexibility, and the company expects production to continue to trend higher next quarter while the company transitions to mining the Froome deposit. McEwen said it expects to reach the main deposit in Q2 2021, with commercial production from Froome beginning in Q4 2021.

At the San José mine in Argentina, attributable production to the company in Q3 was 8,600 gold ounces and 571,000 silver ounces, for a total of 15,900 GEOs. Total cash costs and AISC were $1,269 and $1,538 per GEO, respectively.

Meanwhile, the company is preparing a preliminary economic assessment (PEA) on the Fox Complex, which hosts nearly three million gold ounces in measured and indicated resources. Results of this study are expected to be available in Q4 2020.

The plan is to grow the Fox Complex to an annual production of 100,000-150,000 ounces of gold at a cash cost of $800/oz and AISC of $1,100/oz over a 10-year life, with production envisioned to start ramping up from 2022.

Shares of McEwen Mining were down 3.8% by 1 p.m. EDT Friday following its Q3 2020 results. The company’s market capitalization is approximately $380.2 million.

“I believe McEwen Mining is one of those companies whose share price has a lot of catching up to do,” chairman McEwen stressed.

“Yes, last year was a nightmare and as shareholders we all suffered great frustration and confusion over the large loss of share value at a time when the price of gold was climbing ever higher. Our problems were many, some were due to non-recurring events and others were operational.”

from MINING.COM https://ift.tt/37WazyQ

Des centaines d'hôpitaux victimes d'une cyberattaque sans précédent aux États-Unis

from Les dernières actualités de Futura https://ift.tt/3kIyXaH

La sonde Juno a vu des « farfadets » et des « elfes » dans l'atmosphère de Jupiter

from Les dernières actualités de Futura https://ift.tt/34F3pga

PR2, le robot qui lave votre linge sale !

from Les dernières actualités de Futura https://ift.tt/2HNXdcY

Ariane 6 ne s’envolera pas avant 2022

from Les dernières actualités de Futura https://ift.tt/3jC0dWY

Des pages web transformées en vidéo avec url2Video

from Les dernières actualités de Futura https://ift.tt/31Z8sqd

Les virus copient les protéines des cellules pour mieux les infecter

from Les dernières actualités de Futura https://ift.tt/2GcQ6u1

Rio Tinto invests $51m in Canadian alumina refinery

The world’s second largest miner Rio Tinto (ASX, LON: RIO) is investing $51 million on upgrading facilities at its Vaudreuil alumina refinery, in Québec, Canada.

The company said three new energy efficient buildings are under construction and existing facilities will be rearranged to provide close to 400 employees with a centralized control room, offices and common areas.

The project, expected to be completed in early 2021, aims to improve employee safety and optimize operations at the Saguenay region’s plant, built in 1936.

Rio has already awarded more than half the planned investment to companies in the Saguenay – Lac-St-Jean region such as Proco, with more contracts to be granted in the coming months.

Two years ago, the company vowed to invest C$250 million to extend the life of the operation past 2022. The plan included the construction of a filtration plant on site to manage bauxite waste.

The residue, known as red mud, is what’s left over after extracting the alumina from the bauxite and can include small amounts of toxic metals like arsenic and lead.

Circular economy

The plant will also be used to make cement out of the smelting process leftover in an effort to promote circular economy initiatives, Rio said earlier this month.

In partnership with Geocycle Canada and leading construction materials Lafarge Canada, Rio has created a new product called Alextra. The new development, made from used potlining, is a result of the aluminum electrolysis process that would otherwise go to landfill, the company said.

Rio Tinto is the only primary aluminum producer in North America to process its industrial residue into an inert by-product.

from MINING.COM https://ift.tt/31Xa8k5

La Nasa montre comment elle a mis en sécurité en urgence les échantillons prélevés par la sonde Osiris-Rex

from Les dernières actualités de Futura https://ift.tt/2HP9Jss

Spearmint launches work program at Perron-East gold project in Quebec

Spearmint Resources (CSE: SPMT) announced that it has kickstarted an initial work program at its Perron-East gold project in Quebec, which is in the direct vicinity of AMEX Exploration’s Perron property.

In a press release, the miner said that the phase 1 work program will include a complete compilation and evaluation of historical data, a high-resolution magnetic survey, an extensive sampling program, and the identification of the highest priority drill-hole targets for phase 2.

Perron-East covers prospective ground for orogenic gold and polymetallic VMS-style mineralization

“We are pleased to be underway with operations on our Perron-East gold project in Quebec which has multiple fault lines running through our property,” James Nelson, president of Spearmint, said in the media brief. “The team at Laurentia Exploration has developed significant experience in the area having done work for AMEX Exploration as well as Starr Peak Exploration and we look forward to what this phase 1 work program will uncover.”

The Perron-East gold prospects consist of five mineral claim blocks covering 11,608 acres located in the Abitibi greenstone belt of northwestern Quebec. Besides being situated in the direct vicinity of Amex Exploration’s Perron property, the claims are also adjacent to the past-producing Normetal mine, from which approximately 10.1 million tonnes grading 2.24% copper, 5.41% zinc, 0.526 g/t gold and 44.45 g/t silver were extracted periodically between 1937 and 1975.

According to Spearmint, the property covers prospective ground for orogenic gold and polymetallic VMS-style mineralization in a region well known for its gold occurrences and historical production.

from MINING.COM https://ift.tt/3jJu1Ro

Silver Sands kicks off drilling campaign at Virginia project in Argentina

Silver Sands Resources (CSE: SAND) announced that it has started Phase I of its 2020 drilling campaign at the Virginia silver project in Santa Cruz, Argentina.

In a press release, the miner said that an initial program of 2,500 metres will focus on seven untested or minimally tested epithermal silver veins, namely, Ely Central, Magi, Margarita, Naty West, Roxanne, Martina and Patricia / Daniela.

The program is designed to test gaps and extensions of the principal veins previously defined at the Virginia project

The program is designed to test gaps and extensions of the principal veins previously defined at the Virginia project, which are the Naty West, Ely Central, Martina and Magi veins. It will also test new vein structures that have returned high silver assay results from rock chip sampling, namely the Margarita, Patricia and Daniela veins.

According to Silver Sands, the new drill targets are located to the north, south and east of the Virginia resource area and represent high potential drill-ready zones within the vein field.

“At the easternmost side of the vein field, where the Magi and Johanna veins are located, the outcropping expressions appear to be much higher in the epithermal system, based on cooler silica species and textures and weaker surface silver grades,” the media brief states. “Previous limited drilling by Mirasol Resources Ltd. to shallow depths under these eastern veins showed a marked increase in silver grade with depth, indicating that completely preserved and higher-grade ore shoots might exist at depth.”

Virginia is a low to intermediate sulphidation epithermal silver deposit located in the Deasado Massif, lying within the Santa Cruz province in the Patagonia region of Argentina.

Through initial discovery in 2009 to four drill programs between 2010 and 2012, Mirasol Resources defined an initial indicated mineral resource of 11.9 million ounces of silver at 310 g/t Ag and a further inferred 3.1 million ounces of silver at 207 g/t Ag within seven outcropping bodies.

Silver Sands is working towards earning a 100% interest in Virginia by issuing sufficient shares for Mirasol to end up with 19.9% of the issued and outstanding of Silver Sands and completing US$6 million in exploration over 3 years.

from MINING.COM https://ift.tt/37WevQc

Yamana Gold confirms underground potential of Malartic

Yamana Gold (TSX: YRI) (NYSE: AUY) announced this week drill results that provide further support for the development of a future underground operation at the East Gouldie, Odyssey and East Malartic zones at its Canadian Malartic open pit gold mine in Québec, Canada.

The precious metals miner said that an ongoing C$24 million drill program had confirmed expected grades and widths of East Gouldie mineral inventories, supporting plans to ramp up exploration.

Mineralization is currently defined over 1,400m of strike length and a 1,200m vertical interval and occurs in two closely spaced panels that locally converge into a single wide mineralized body, Yamana said.

The Toronto-based company also said that assays indicate grades averaging more than 3 grams per tonne with consistent homogeneous grade distribution.

The results are expected to increase inferred mineral resources at the higher-grade East Gouldie zone by the end of the year. This, Yamana noted, would improve the economics of the Canadian Malartic underground project and help define a project with a multi-million-ounce deposit that supports a decades-long life underground mine.

Canadian Malartic, located in the Abitibi region of Québec, is a 50:50 joint venture between Yamana and Agnico Eagle Mines (TSX, NYSE: AEM). Last year, the mine churned out more than 660,000 ounces of gold.

Osisko Gold Royalties has a 5% net smelter royalty on the operation. The company, known until 2014 as Osisko Mining, built the mine and put it into production. Yamana and Agnico acquired the asset through the friendly acquisition of Osisko Mining Corporation.

Highest cash-flow in five years

Yamana also had positive news when releasing its third quarter results. Highlights include the highest operating cash flows since 2015 of $215 million, year-over-year free cash flow up more than 300%, and net debt declining a further $148.9 million.

The strong figures allowed the miner to up its annual dividend by a further 50% to $0.105 per share. At the new rate, the divvy will be 425% higher than the rate just 18 months ago.

The company also increased its 2020 production guidance to 915,000 gold equivalent ounces (GEO) from the previous 890,000 GEO, representing a 3% jump.

Yamana also hiked gold and silver production targets by approximately 1% and 6%, respectively, from previous guidance.

“Exceptional” operational performances in the quarter from the company’s Jacobina mine in Brazil, El Peñón and Minera Florida, in Chile, as well as Canadian Malartic, prompted the company to re-think plans.

More to come…

from MINING.COM https://ift.tt/34DvbtA

Pourquoi est-on moins motivé pour apprendre en vieillissant ?

from Les dernières actualités de Futura https://ift.tt/2GbMwQS

Méga-feux : l'Australie doit se préparer à vivre des catastrophes « plus graves et plus fréquentes »

from Les dernières actualités de Futura https://ift.tt/35KHweM

L'Univers jeune a formé des galaxies étonnamment matures

from Les dernières actualités de Futura https://ift.tt/31VLjVw

Les immatriculations de voitures électriques et hybrides dépassent les diesel pour la première fois en Europe

from Les dernières actualités de Futura https://ift.tt/3elRjMt

17 % des patients qui ont eu la Covid-19 seraient encore porteurs du virus

from Les dernières actualités de Futura https://ift.tt/3kIe5QV

Téléchargez les trois nouvelles attestations de déplacement

from Les dernières actualités de Futura https://ift.tt/387fsVZ

Nasa : la mission de Tom Cruise à bord de l'ISS se précise

from Les dernières actualités de Futura https://ift.tt/2JgSJMx

Ces araignées peuvent vous entendre

from Les dernières actualités de Futura https://ift.tt/2HQbztF

jeudi 29 octobre 2020

How Olympic Dam went from mother of all digs to debottlenecking

A decade ago BHP Billiton, was gearing up to dig the world’s biggest hole in the Australian outback.

In 2011, BHP delivered the largest annual profit in Australian corporate history and like its peers, was flush with cash as China sucked up metals and minerals at never seen before rates.

Iron ore prices appeared headed to $200 a tonne, copper was setting records above $4.50 per pound/$10,000 a tonne and uranium averaged double today’s levels.

While other industries were still struggling to emerge from the global financial crisis, the late noughts and early 2010s were the acme of global mining.

And with megabucks came megadeals and megaprojects.

BHP acquired Olympic Dam, located 560km north of Adelaide in South Australia, in 2005 and quickly looked for ways to expand, delivering a draft economic impact study for public scrutiny four years later.

ODX was going to take olympian effort just to get to the orebody – the first six years would have been spent on removing overburden.

The copper resource at Olympic Dam (a livestock watering hole named after the 1956 Melbourne Olympic Games) is considered the world’s fourth largest, and its uranium resources number one.

There is also more than a decent amount of gold and silver at Olympic Dam, and the expansion sailed through state and federal government permitting. An Olympic Dam Task Force was even set up to streamline the process further.

Olympic Dam Expansion – ODX – would place the operation in the top three globally, adding 515,000 tonnes of copper to underground output of over 200,000 tonnes.

But even during those heady days, the project came with an eye-popping price tag. $30 billion – US.

Everything about ODX, which had its own glossy 22-page brochure, was grand in scale.

A new desalination plant running 100% on renewable energy with a 320km pipeline, a 270km transmission line, a 105km rail line, a new airport to cater for large jets, a worker village, and a 8,000-strong workforce.

The project would also double the size of the nearby Roxby Downs township. There would be robots too.

ODX was going to take olympian effort just to get to the orebody – the first six years would have been spent on removing overburden.

By 2050 the pit would grow to be 4.1 kilometres (2.55 miles) long, 3.5 kilometres wide and 1 kilometre deep.

Kloppers’ successor Andrew Mackenzie was less than enthusiastic about the project saying Olympic Dam needed a technological breakthrough before the economics would make sense.

Waste rock piled 150 metres high would cover approximately 6,720 hectares (26 square miles).

The final feasibility was completed in May 2012, but by the time the Australian winter arrived BHP was freezing capex budgets and institutional investors told companies spending like drunken soldiers to chill.

Deadlines for board approval were quietly missed as the industry tightened belts and by August then CEO, Marius Kloppers, declared the company would look for less capital intensive options.

One of those options, a previously discarded plan to add a giant heap leach operation, was put back on the drawing board where it remains today. The heap leach development trial only ended in June last year with results deemed “promising” but not much besides.

Kloppers’ successor Andrew Mackenzie was less than enthusiastic about the project saying Olympic Dam needed a technological breakthrough before the economics would make sense.

In 2017 another inspiring acronym was introduced at Olympic Dam – BFX or Brownfield Expansion.

Modest in its ambitions – expanding surface infrastructure and extracting higher grade ore from the southern zone – the projected cost was less than a tenth of the open pit.

A level of uncertainty about the outcome of BFX was noticeable from the outset with potential annual output put anywhere from 240,000 to 350,000 tonne. $2.5 billion for perhaps only 40,000 tonnes more makes ODX a comparative bargain.

BHP was trying to rationalize what a cruel mistress exploration can be.

Then last week after three years of study and more than 400 kilometres of drilling BFX was axed, a decision tucked away in BHP’s quarterly production review.

“The studies have shown that the copper resources in the southern mine area are more structurally complex, and the higher grade zones less continuous than previously thought,” was BHP trying to rationalize what a cruel mistress exploration can be.

“We have decided the optimal way forward for now is through targeted debottlenecking investments, plant upgrades and modernisation of our infrastructure,” was BHP softening the body blow to South Australia and Roxby Downs with management catchphrases.

Not that Olympic Dam is not firing right now, with the mine’s best production results in years, and a life still measured in decades.

There are also other options for BHP in the region. Perhaps sensing defeat for BFX, the company has, uncharacteristically, made much of its exploration success at Oak Dam, 60km from the underground mine.

BHP also said last week “the long-term opportunity for Olympic Dam is unchanged.”

But if long term optimism about copper demand and prices, a narrow global pipeline of major projects, grades the envy of most large-scale mines, juicy gold credits and a uranium price that won’t go lower from here, are not enough to clear a brownfield investment hurdle, what would?

With BFX cactus, the era of mining megaprojects seems well and truly over.

from MINING.COM https://ift.tt/3oMSvgH

No punishment 5 years after the Fundão dam tragedy

On November 5th, 2015, the Fundão dam, owned by Samarco – controlled by Vale and BHP – burst, releasing 39.2 million cubic meters of tailings waste in the Rio Doce Basin, on the biggest environmental disaster ever in Brazil.

Along the way, the mud caused the death of 19 people and a series of impacts in 39 municipalities from Minas Gerais to Espirito Santo state, along 670 kilometers.

Five years later, Brazilian prosecutors say that the Renova Foundation, created by the miners for the reparation of the damages did not delivered any of its promises.

A civil action ask for $27.4 billion to repair all the damages

“It is sad, the disaster destroyed an area equivalent to Portugal territory and non of the victims, agricultures, fisherman, workers or indigenous people received full compensation,” said Brazilian federal prosecutor Silmara Goulart.

“The emergency support for families was suspended in the midst of the pandemic, in communities that already face insecurity to the consumption of water and fish, with houses that still present cracks”.

The prosecutors also said the companies did not hire independent technical advisors to support the victims, as part of an agreement.

Lawsuit

Of the 21 people who had been charged in 2016 by the Federal Public Ministry for the crime of qualified homicide with possible intent, five continue to respond to a lawsuit in the Federal Court. Today, however, they are responding to flood and landslide crimes followed by death, as well as environmental crimes. The crime of homicide was removed from the process in 2019. Vale, BHP Biliton and Samarco are defendants in this process.

Samarco’s former CEO, Ricardo Vescovi; the director of operations, Kleber Terra; and the three managers Germano Lopes, Wagner Milagres and Daviely Rodrogues Silva, are still responsible for the crimes of flood and collapse followed by death, in addition to environmental crimes. They deny the charges.

Last week, prosecutors accused BHP and Vale of colluding with a lawyer to reduce compensation for victims and interfere with a landmark lawsuit against BHP in the UK.

Indigenous people recently blocked Vale’s rail road in Aracruz, to protes

In a 91-page document attached to court filings on Thursday, prosecutors in Minas Gerais state criticized a judge who accepted compensation limits for nine plaintiffs and then extended the limits to all victims in Baixo Guandu, Espirito Santo state, affected by the sludge flowing down river from the disaster. Details of the decision are under seal.

“Moral damages” claims were limited to 10,000 reais ($1,780), a little more than a minimum wage in Brazil.

The prosecutors said the judge ruled under seal in the case, without the proper participation of the prosecution office, despite requests for access.

The decision would end liabilities for BHP, Vale and Samarco for victims who accept the compensation, the prosecutors said. Victims who received payouts under the decision would have no chance to claim further compensation outside the country.

BHP is also the subject of a $6.3 billion lawsuit in the United Kingdom brought by 200,000 Brazilian people and groups. BHP has called the lawsuit “pointless and wasteful.”

“Those affected are anxious to receive this low compensation because they have been waiting for five years. Curiously, despite the defeat, the companies have not appealed the indemnities” said federal prosecutor Edilson Vitorelli.

On Thursday, prosecutors filed new a lawsuit contesting the compensation package.

The Federal Public Ministry asks that the payment may be extended to all the victims and that all other liabilities continue. A civil action ask for $27.4 billion to repair all the damages.

Indigenous people recently blocked Vale’s rail road in Aracruz, to protest. In total, 3,400 indigenous people were affected by the disaster.

The Renova Foundation told MINING.COM that as of August 31, approximately R $ 2.6 billion ($450 million) had been paid in indemnities and emergency financial aid for approximately 321 thousand people.

“The new compensation system covers several professional categories, which, due to their degree of informality and difficulty in proving it, could not be compensated,” said Renova, mentioning artisans, fishermen, small farmers and mineral extractors.

Vale said that, as a shareholder in Samarco, reinforces its commitment to repair the damage caused by the Fundão dam rupture, providing all support to the Renova Foundation.

“These programs have so far received more than R $ 10 billion ($1.7 billion). Vale also informs that it observes the legal procedures and respects all agreements signed between the parties, in the course of the judicial process.”

from MINING.COM https://ift.tt/2TIj7kh

Syndrome de Cotard : le délire du « mort-vivant »

from Les dernières actualités de Futura https://ift.tt/3kINB1M

Le fantastique pouvoir des cellules souches

from Les dernières actualités de Futura https://ift.tt/37Zvelk

BMO ranked top mining M&A advisor – report

BMO Capital Markets emerged as the top financial adviser for mergers and acquisitions (M&A) in the global mining sector by value as well as volume through the first three quarters of 2020, says GlobalData, an analytics and consulting firm.

According to GlobalData’s figures, total of 1,233 M&A deals were announced in the metals and mining sector during the period.

This represents a 24.2% increase over the 993 deals announced during the same nine-month period in 2019. However, deal value decreased by 40.1% from $46 billion in Q1–Q3 2019 to $27 billion in Q1–Q3 2020.

In GlobalData’s ranking, BMO Capital Markets gained top spot in terms of deal value and volume by advising on 12 deals worth $4 billion. (Click to see full rankings)

“Of the top 10 advisors by value, BMO Capital Markets was the only adviser to have double-digit deal volume. The firm’s involvement in big-ticket deals also helped it to outpace its peers by a great margin in value terms. The firm was involved in seven $100m+ deals,” Aurojyoti Bose, lead analyst at GlobalData, commented.

The Bank of Nova Scotia occupied the second position by value with six deals worth $2.7 billion, followed by National Bank of Canada with three deals worth $2.5 billion and JP Morgan with six deals worth $2.3 billion.

Canaccord Genuity Group occupied the second position by volume with 11 deals worth $700 million, followed by RBC Capital Markets with seven deals worth $1.2 billion.

“Mining has remained a key sector for Canada’s economy and it is no surprise that the top three advisers by value and volume are also Canadian firms,” Bose noted.

Top metals & mining M&A deals

| Announced date | Deal type | Acquirer | Target | Value ($bn) | Target country |

| May 12, 2020 | Acquisition | Vedanta Resources | Vedanta | 2.1 | India |

| February 3, 2020 | Asset transaction | Stone Canyon Industries | Business -Kissner Group | 2.0 | Canada |

| May 11, 2020 | Merger | SSR Mining | Alacer Gold | 1.8 | Canada; United States |

| March 16, 2020 | Private equity | Waterton Global Resource Management | HudBay Minerals | 1.5 | Canada |

| September 28, 2020 | Merger | Cleveland-Cliffs | ArcelorMittal USA | 1.4 | United States |

from MINING.COM https://ift.tt/37RNkWp

Wheaton expands into Europe with LSE listing

Wheaton Precious Metals (TSX: WPM; NYSE; WPM; LSE: WPM), one of the world’s largest gold and silver streaming companies, began trading on the main market of the London Stock Exchange (LSE) today.

The Vancouver-based company will maintain its primary listing on the Toronto Stock and a listing on the New York Stock Exchange, Randy Smallwood, Wheaton’s president and CEO, said in an interview.

The move makes Wheaton the largest metals and mining company to join the exchange since Glencore in 2011

“We’re a Canadian company, so we’re not moving anywhere, we’re just expanding,” he said. “For us, a listing on the LSE is the next step in becoming a truly global company.”

The company, he added, is not seeking to raise money from the listing but is looking to expand its investor base in Europe and, in particular, the United Kingdom.

About 30% of the company’s stock is currently traded on the TSX and 70% on the NYSE.

The move makes Wheaton the largest metals and mining company to join the exchange since Glencore (LSE: GLEN) in 2011.

“One of the appeals of listing on the LSE is there that there aren’t many precious metal mining companies on the exchange, especially on the streaming side,” said Smallwood. “We offer a much lower risk alternative to miners that will attract generalist investors, and our business model offers a unique opportunity to gain exposure to precious metals through a diversified portfolio of high-quality, low-cost assets.”

The company generates its revenue primarily from the sale of precious metals by entering into agreements to purchase all, or a portion, of the precious metals produced from mines for an upfront payment and an additional payment upon the metals’ delivery.

Currently, Wheaton has purchase agreements with 17 mining companies, including Barrick Gold (TSX: ABX; NYSE: GOLD), Vale (NYSE: VALE), and Glencore, relating to 20 producing mines, and nine which are at various stages of development, located across 11 countries.

Smallwood said the company has been considering a listing on the LSE for the past couple of years and spent the past year weighing up the benefits of registering on the exchange.

“A large portion of funds based in the UK have restrictions on them in terms of how much they are allowed to invest out of the country,” he said. “We already had a pretty good investor base with about 15% to 20% of our stock typically held by mainly UK-based funds, but after speaking with a number of them, it was clear there was an appetite for making it easier to own stock in Wheaton.”

While the LSE is home to over 450 listed investment funds, some of these funds can only invest in LSE-listed companies.

The company is currently reviewing about a dozen different projects as potential acquisitions, Smallwood said, particularly in the base metal sector.

In light of the high prices for precious metals, he noted, precious metal companies currently have strong balance sheets. However, base metal companies that are now looking to generate value from non-core precious metals present the biggest opportunities for Wheaton.

“Our business is to supply capital to the mining industry, and we’re blessed with the fact that the industry always needs capital,” he said. “Right now, we are looking at companies with copper, lead-zinc, and nickel assets to purchase gold and silver offtakes from them.”

At press time in Toronto, Wheaton was trading at C$59.02 per share within a 52-week trading range of C$26.99 and C$76.69.

The company has around 449 million common shares outstanding for a C$26.5-billion market capitalization.

(This article first appeared in The Northern Miner on October 28)

from MINING.COM https://ift.tt/2HL5df4

Bon plan : PureVPN casse les prix pour Halloween avec une offre à -84 % !

from Les dernières actualités de Futura https://ift.tt/34Fr5Bb

Des scientifiques sont sur les traces d’une grande île disparue dans les Antilles

from Les dernières actualités de Futura https://ift.tt/3kEikwV

Lundin Mining lowers guidance on mine troubles

Canada’s Lundin Mining (TSX: LUN) saw profit increase in the third quarter and declared a dividend, but labour and technical disruptions forced the company to lower its guidance for three of its four operating mines.

The Toronto-based miner reported attributable net earnings of $122.4 million, or 17c per share, for the July-September period, up from $26.4 million in the same three months of 2019.

Gross profit was $199.3 million, up from $128.6 million. Lundin said the jump was driven mostly by higher realized metal prices and price adjustments, which partially offset by lower sales volumes.

Lundin declared a dividend of C$0.04 per share, payable on Dec. 16.

The miner cut 2020 guidance for Chapada in Brazil from 51,000-56,000 tonnes of copper to 45,000-50,000 tonnes, and from 85,000-90,000 ounces of gold to 80,000-85,000 ounces.

The new figures reflect the impact of 60 days of production at around 30% capacity after the mill suffered electrical damage in September. It expects to resume full production late this year.

Less copper, zinc

Neves-Corvo’s copper guidance went from 35,000-40,000 tonnes down to 32,000-34,000 tonnes. Expected zinc output at the Portuguese mine went from 70,000-75,000 tonnes to 70,000-72,000 tonnes, reflecting lower grades and ore availability.

The expansion project, halted since March, at Neves-Corvo is scheduled for early 2021 and planned fourth quarter 2020 activities include commissioning of the SAG mill with waste.

The company also reduced expected zinc output at its Zinkgruvan mine in Sweden to between 72,000 and 74,000 tonnes.

Lundin had withdrawn its guidance for Candelaria copper-gold mine in Chile earlier this month. The operation remains suspended due to strike action over a wage dispute.

The company expected Candelaria to produce 160,000-175,000 tonnes of copper and 90,000-100,000 ounces of gold this year on a 100% basis, according to revised guidance in April.

from MINING.COM https://ift.tt/3oF3hFl

Un drone inspiré d'un rapace pour voler plus longtemps

from Les dernières actualités de Futura https://ift.tt/3jyIAr2

VanadiumCorp’s Lac Doré project among world’s biggest

Canada’s VanadiumCorp Resource (TSX-V: VRB) published on Thursday the results of a mineral resource estimate on its Lac Doré vanadium property in Quebec, Canada, which shows the asset is one of the world’s most significant sources of the metal.

Total Measured and Indicated Mineral Resources for the Lac Doré project are estimated at 214.93 million tonnes (Mt) of mineralized material contained in the the main zone.

It means the project has the the potential to produce 52.97 million tonnes of magnetite concentrate grading 1.3% vanadium pentoxide (V2O5), 62% iron (Fe) and 8.7% titanium dioxide (TiO2).

The project also hosts 86.91 Mt grading 0.4% V2O5, 28.0% Fe, 7.6% TiO2 and 25.9% magnetite concentrate in the Inferred category which are estimated to contain 22.55 Mt of magnetite concentrate grading 1.2% V2O5, 62% Fe and 9.2% TiO2.

Lac Doré was a crown asset for over 50 years. It is located 27 km east-southeast from the city of Chibougamau, in Eeyou Istchee James Bay Territory, northern Québec.

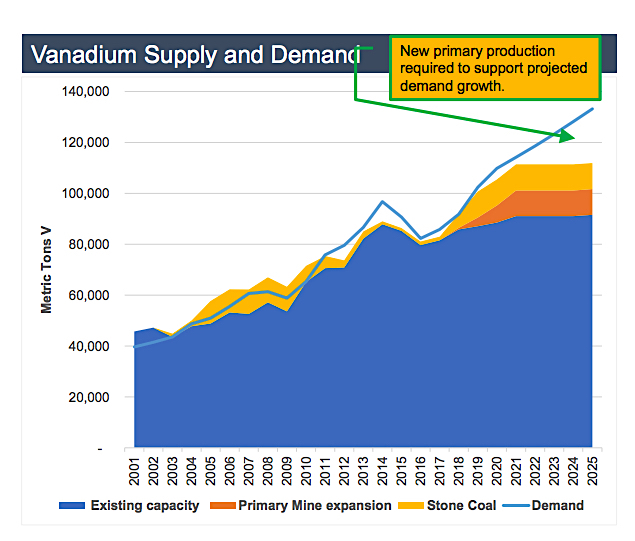

Vanadium, traditionally used to harden steel, is also employ in the renewable energies sector.

First discovered in 1801 by a professor of mineralogy in Mexico City, the metal — whose symbol V is based on the Norse goddess Vanadis — has some rare qualities that give it the ability to make materials stronger, lighter, more efficient and more powerful.

Adding small percentages of it to steel and aluminum creates ultra-high-strength, super-light and resilient alloys.

Henry Ford was the first to use vanadium on an industrial scale, in the 1908 Model T car chassis. But it is only recently that automakers have begun adding it to car bodies to make them lighter and stronger.

Positive outlook

Demand for the metal is slated to jump as new Chinese rebar standards are requiring more vanadium. Vanadium Flow Batteries (VRFBs) are also becoming increasingly popular in commercial energy storage.

Analysts at Roskill believe the short-term outlook for vanadium will be largely determined by ongoing impacts of the covid-19 pandemic.

The experts’ view is that the Chinese steel industry will be relatively insulated from the impacts of the pandemic as infrastructure spending offsets lower steel exports, both directly and indirectly.

“As a result, vanadium demand should be sustained by Chinese consumption,” they say, adding that a drop in steel production will negatively impact demand for vanadium.

Over the longer term, vanadium demand is positive with all major end-uses (steel, non-ferrous alloys, chemicals, and batteries) expected to drive growth.

Roskill expects vanadium demand for Vanadium Redox Flow Battery (VRFB) markets to hit 31,000 tonnes by 2025, amounting to 3,100% increase in a decade.

Shares in VanadiumCorp Resource jumped 44% in early trading in Toronto on the news and were still trading 22% higher at 0.055 Canadian by 10:09 am ET.

The Vancouver-based mining and technology company has a market capitalization of C$16.5 million.

from MINING.COM https://ift.tt/34BIzOK

La fibre à moins de 15 €/mois chez Bouygues Telecom

from Les dernières actualités de Futura https://ift.tt/3e9UxCg

Un nouveau récif corallien découvert en Australie et il est énorme

from Les dernières actualités de Futura https://ift.tt/31Sd41f

Reconfinement : le Premier ministre livre plus de détails sur les mesures

from Les dernières actualités de Futura https://ift.tt/3oCcLRL

Étrangeté du vivant : ce cerf a des canines de vampire

from Les dernières actualités de Futura https://ift.tt/3kFOQyH

Coronavirus : les études cliniques reprennent pour le vaccin d'Oxford

from Les dernières actualités de Futura https://ift.tt/34B6eiu

How mining can affect food security in Africa

In 1996 the World Food Summit came up with a definition for ‘food security’, namely that it is achieved “at the individual, household, national, regional and global levels, when all people, at all times, have physical and economic access to sufficient, safe and nutritious food to meet their dietary needs and food preferences for an active and healthy life“.

Although the definition doesn’t take into account some important criteria like ‘food sovereignty’ (the right of people to choose their own agricultural and food systems) and ‘food self-sufficiency’, it is nevertheless the most commonly accepted standard for determining whether or not a country / community / population is ‘food secure’.

Mining and other extractive industries can have a significant impact upon a local population’s food security, especially in areas where much of the food production cycle is subsistence in nature, and where regulatory authorities / local governments are weak, corrupt, inadequate, and unresponsive. High levels of unemployment, discrimination, lack of security, and poor living conditions further exacerbate food insecurity.

Mining and other extractive industries can have a significant impact upon a local population’s food security, especially in areas where much of the food production cycle is subsistence in nature

These types of scenarios are unfortunately relatively common across swathes of Sub-Saharan Africa. Many communities throughout this region are economically poor and heavily reliant on small-scale crop production that can be very adversely affected by near-by mining operations, particularly in the absence of strong protective local governance.

There is a silver lining

There’s no doubt that extractive industries in general can significantly improve the lot of local communities, including their food security. We’ve seen this happening with improved water and transport infrastructure courtesy of mining operations across a number of developing regions, including Africa.

Usually however, how much of a positive (or negative) impact mining makes generally comes down to how the country / state concerned views and legislates control over, and access to, its mineral resources and the land they sit in/on. Corrupt political systems and governments are renowned for being more interested in selling out to the highest bidders than they are in ensuring their citizens, their livelihoods, and their well-being are protected – before and after miners move in.

Potential benefits to local communities that can have flow on improvements in food security include:

- Improved transport infrastructure and new transport corridors such as roads and railways allow farmers and primary producers in more rural and remote areas to get their produce to wider markets, thus generating more income for them and increasing food supplies for local communities close to that infrastructure.

- These transport corridors and infrastructure also allow those living in rural and remote areas access to off-farm employment and increased earning potential, which helps improve their ability to purchase better or more food.

- By entering into wealth sharing agreements with local and/or state administrations, mining operations can contribute financially to local / state coffers. Under good governance, these funds can be used to improve the health, education, and overall well-being of local communities as well as provide for new infrastructure, and expand food sourcing and supply.

- Employment of locals within mining and extractive operations provides them with additional income that can be spent on more or better food, thus improving local food security.

- Mining companies can invest time and money in training and upskilling locals so they can take on better paid and more responsible jobs within their operations, and improve their future employment / earning prospects (and food security).

- Mining operations can generate indirect jobs for locals in support and associated industries that again help improve living standards, encourage economic growth, and allow the purchase of / access to better / more food.

- Mining operations that utilise local organisations and services can improve food security for local communities by expanding existing food outlets and developing new ones to cater for the increased demand produced by their operations.

- Purchase of public land for mining operations and associated infrastructure can provide money to local communities, which may then be used to improve and increase food production and living standards.

- Mining companies may establish and share resources like power and water treatment facilities with local communities and agricultural operations, thereby improving production and increasing food security.

Disadvantages To Local Communities And Their Food Security Caused By Mining:

- One of the most significant ways in which mining operations generally negatively affect food security for local communities in regions like sub-Saharan Africa is through the dispossession / displacement of local landholders and their operations, much of which is agricultural in nature. This displacement occurs when

- governments execute their rights to take over state owned resources on locals’ land,

- the land is directly acquired for mining and associated infrastructure,

- new transport corridors cut across farming land, restricting access to crops and grazing for livestock.

Whilst monetary compensation (if it happens) for families affected by this may offset the loss of their land in the short term, evidence strongly suggests it negatively affects both their long-term future income and their ability to continue producing food. This has inevitable flow on effects around food security for the affected farming families themselves and for the communities they provide food for.

- Pollution of, and increased pressure on water resources caused by mining operations also adversely affects agricultural productivity and significantly threatens food security for nearby communities.

- Mining activities store and use hazardous chemicals that can (and do) leak into the surrounding soil and water systems, harming local agricultural production and food supplies to local communities. In parts of Africa, the situation is not helped by inadequate regulations governing mining dumps and waste management.

- Operational mines have the potential to raise the cost of living due to influxes of non-local workers that create higher demand for existing products, services and infrastructure, and put greater pressure on local facilities. These factors feed into ‘supply and demand’ price increases, making it harder for locals on low incomes to purchase good quality food in sufficient quantities to feed themselves adequately.

- Mining operations can also cause shifts in the traditional distribution of labour markets as farmers leave the land (and thus food production) to pursue work within mining and its associated industries. When the mine ‘closes down’, many of these people are not able to return to their previous agricultural work for various reasons, thereby perpetuating permanent reductions in the local food production cycle.

- The ore extracted by mining companies is often exported for processing, again depriving local communities and economies of job / income opportunities that would improve their ability to access food [United Nations Economic Commission for Africa, 2011, pp. 102–105]. Granted, this is generally influenced by a lack of local or domestic processing facilities but even so, some foreign mining companies still choose to send or sell raw materials offshore even if there are local processing facilities available! This isn’t just restricted to Africa either; the bulk of Australia’s raw iron ore for example is exported overseas for processing (and then sold back to them as steel and steel based products).

Foreign miners and food security issues in Africa

Several research papers have proposed that multinational and foreign owned mining companies, particularly those without a percentage of domestic ownership, tend to have a greater negative impact upon local food security in some parts of Africa than domestic companies do, for various reasons. Notably, such companies can act as triggers for disruptive social conflict within local communities that eventually impacts food production, and can lead to escalating violence. Some research for instance indicates that where foreign owned extractive companies set up shop (particularly oil companies), forcible state suppression of local dissention has a tendency to follow, or escalate, especially if a repressive regime is already in place.

Land ownership issues

Researchers have found that foreign owned companies tend to catalyse land ownership issues, particularly in jurisdictions where access to natural resources is poorly governed and/or subject to corruption (ie where resource ownership, and thus resource rent, is ‘allowed’ to fall into foreign hands). The subsequent ‘siphoning’ of this rent out of the local community understandably creates significant resentment. Very often, the land in question was used for agricultural purposes and was part of the local food supply chain. Foreign ownership of the resources on their land effectively cuts locals out of any benefits they would otherwise gain from the compensatory loop, making it harder for them to afford to buy food to replace what they once grew on the land they can’t use any more.

Influx of foreign workers

Unless there is legislation in place that requires foreign companies to train and employ locals in a variety of skilled roles, they may bring in foreign workers for all bar some of the most low paid, unskilled work. This reduces the job opportunities available for locals, hinders knowledge and skills transfer, and removes valuable training opportunities. Under such conditions locals essentially remain ‘low skilled’ workers with little prospect of improving their lot in life.

Imported products and services

Companies owned by foreign interests may also import many of the products and services they require, including food (the international oil sector in Nigeria has traditionally done this). This significantly reduces the amount of money flowing back into local economies, and provides very little firsthand fiscal value to them.

Post mining problems

Modern public perception expects, or even demands, that extractive industries accept they have an environmental obligation to restore the land they’ve used to something at least approaching its pre-mining state. Unfortunately, the reality is that whilst jurisdictions do have ‘rehabilitation’ clauses written into their mining licences, the clarification around what constitutes ‘natural’ or ‘adequate’ rehabilitation can be open to interpretation.

Very often, the land in question was used for agricultural purposes and was part of the local food supply chain

Companies may be (and often are) left to their own devices and will take the cheapest way out. Often that means simply replacing the top soil, throwing seeds on top, providing the bare minimum of TLC required under the terms of their licence, and hoping for the best. If the land was agricultural, and much of it was, it can take years to re-establish farming operations back to what they were pre mining under those circumstances. Yet, the potential is there to create vastly improved post-mining agricultural environments through soil, topography, and pasture improvements.

The value of domestic companies for improving food security

Domestic mining companies on the other hand, particularly those that are state-owned or controlled, typically have a legislated and/or vested interest in (over) employing locals, and in training and equipping them to take out skilled roles within their operations. They also tend to utilise local businesses and suppliers wherever possible, and are more prepared to invest in upgrading these to meet the increased demand.

Furthermore, when resource ownership remains in domestic hands there may be less resentment about the resource rent because it isn’t being ‘siphoned’ away into foreign hands. Indeed, under socially responsible regimes some of it is undoubtedly invested back into the local communities from whence it came.

Many of the benefits mining can bring to African communities depend upon state and local authorities ‘doing the right thing’ and legislating / levering advantageous terms and conditions for their citizens (and not themselves!) into the mining licences they hand out. Companies that are committed to dealing ethically, morally and responsibly with the communities affected by their operations, regardless of their legal and basic social obligations, can also go above and beyond to become major players in the future well-being of those communities. Some of the various initiatives currently carried out by mining, oil and gas companies include

- sponsoring education around more sustainable food production techniques,

- contributing to the provision of equipment that can improve production outcomes,

- committing to foreign direct investment (FDI) in African agriculture,

- returning ‘mined’ agricultural land to something approaching its pre-mining status.

(This article first appeared in Mining International Inc.)

from MINING.COM https://ift.tt/31OCyN1

Robex Resources’ Nampala mine in Mali goes solar

Canada’s Robex Resources (TSXV: RBX) has decided that, for the next 15 years, most of the energy used at its Nampala mine in Mali will come from solar power.

To fulfill this goal, the miner has engaged Vivo Energy, a firm that sells Shell and Engen-branded fuels in Africa.

In a press release, the companies said that the idea is to produce and store solar energy at Nampala. The hybrid production and supply project includes a 3.9 MWp solar photovoltaic power plant and a 2.6 MWh battery which, through the energy management system, will be fully integrated with the mine’s existing thermal power plant to ensure a continuous supply of power to the mine at all times and at a lower cost.

The hybrid production and supply project includes a 3.9 MWp solar photovoltaic power plant and a 2.6 MWh battery

“We are proud to introduce solar power into our mining business. This energy will allow us to reduce our carbon impact by around 60,000 tonnes over 10 years, to have an additional source of energy to stabilize our electricity production and to reduce our production costs, which are already among the lowest in the world,” Benjamin Cohen, Robex Resources CEO, said in the media brief. “It is expected that this installation will reduce the current cost of mine activities by $0.04 per kilowatt.”

Located in southern Mali, the Nampala mine began commercial production on January 1, 2017.

According to Robex, during its second year of production, the plant processed very low-grade saprolite (0.8 g/t) and achieved a record 1,796,000 tonnes, which allowed recovering 44,946 ounces of gold for a cost per ounce of $643/once.

from MINING.COM https://ift.tt/37NODpv

Cerrado’s resource inventory in Argentina reaches one million ounces of gold

Cerrado Gold, a privately-owned Toronto-based mining and exploration company, announced that it has entered into a binding letter of intent with New Dimension Resources (TSXV: NDR) to acquire 100% of its Argentine subsidiary Minera Mariana Argentina S.A.

To go ahead with the deal, Cerrado Gold will have to pay a purchase price of C$2.25 million payable in shares of Cerrado.

The main assets owned by Minera Mariana are the Las Calandrias and Los Cisnes projects, located in the southern Santa Cruz province. In total, the projects consist of approximately 60,400 hectares with the bulk of the landholdings on the property adjacent to Cerrado’s Minera Don Nicolás gold mine.

The main assets owned by Minera Mariana are the Las Calandrias and Los Cisnes projects, adjacent to Cerrado’s Minera Don Nicolás gold mine

According to the Canadian miner, the acquisition of these projects implies the addition of 379,000 ounces of gold and six million ounces of silver in the indicated category and 42,000 ounces of gold and 401,000 ounces of silver in the inferred category, directly adjacent to Don Nicolás’ Escondido deposit.

“The additional gold resource base increases our total resource inventory in the region to just under one million ounces in Argentina,” Mark Brennan, Cerrado’s co-chairman and CEO, said in a media statement. “This transaction will support, not only additional resources for the Don Nicolás mill but also support our ongoing review of the potential to use ore leaching of lower grade materials at the north of our property. We expect to complete these studies and complete an economic assessment early in the new year with the potential to increase our annual production rate by 20-30K ounces per year.”

from MINING.COM https://ift.tt/37T1KWq

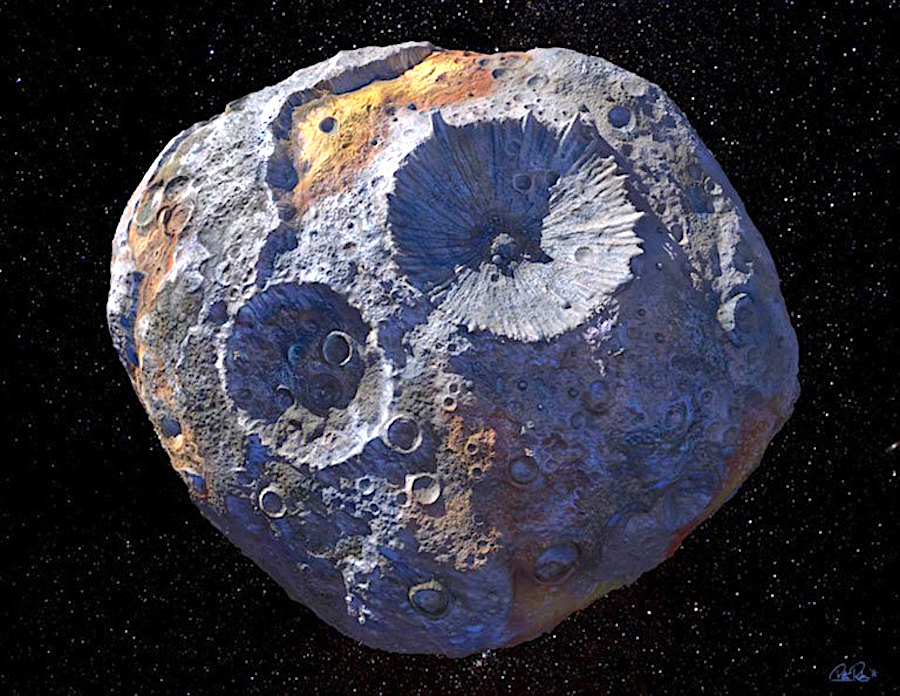

NASA finds rare metal asteroid worth more than global economy

NASA’s Hubble Telescope has obtained images of an asteroid so rich in rare metals that its worth puts our global economy to shame. Think $10,000 quadrillion ($10,000,000,000,000,000,000), compared to the world’s economy, which was worth about $142 trillion in 2019.

The rare heavy-metal object, called “16 Psyche,” is one of the largest celestial bodies in the Solar System’s main asteroid belt orbiting between Mars and Jupiter. It’s located at roughly 370 million km (230 million miles) from Earth and measures 226 km (140 miles) across.

16 Psyche was actually discovered in 1852, but this is the first time scientist get a closer look. What makes it special is that, unlike most asteroids that are either rocky or icy, 16 Psyche is made almost entirely of iron and nickel, a study published this week in The Planetary Science Journal shows.

Tracy Becker, a planetary scientist and author of the paper, says the asteroid is likely the leftover core of a planet that never properly formed because it was hit by objects in our solar system and effectively lost its mantle and crust.

Closer look

While Hubble has been able to get clear images of 16 Psyche, only a visit to its surface will reveal what it’s really like. Fortunately, NASA already has plans to do just that as part of its Discovery Program, with an orbiter set to launch from Florida’s Kennedy Space Center in August 2022.

The mission would arrive at 16 Psyche in January 2026 and spend at least 21 months mapping and studying the asteroid’s unique properties.

“To understand what really makes up a planet and to potentially see the inside of a planet is fascinating,” says Becker, who is also a planetary scientist at the Southwest Research Institute in San Antonio, Texas. “Once we get to Psyche, we’re really going to understand if that’s the case, even if it doesn’t turn out as we expect.”

If the mission could kindly bring the asteroid back to Earth, every person on the planet — all 7.8 billion of us — would get roughly $1.2 billion, based on current metal prices.

NOW READ: Moon richer in metals than previously thought

from MINING.COM https://ift.tt/34AkDvg

Exobiologie : Titan contient une molécule jamais encore détectée dans une atmosphère

from Les dernières actualités de Futura https://ift.tt/2TChEfz

Covid-19 : pourquoi la deuxième vague est-elle plus forte ?

from Les dernières actualités de Futura https://ift.tt/2TzFngm

États-Unis : des centaines d'hôpitaux et cliniques sont la cible d'une cyberattaque sans précédent

from Les dernières actualités de Futura https://ift.tt/2HNwltI

Mars a perdu son atmosphère plus vite pendant la tempête globale de 2018

from Les dernières actualités de Futura https://ift.tt/3myY7ch

Alimentation et cancer : que savons-nous ?

from Les dernières actualités de Futura https://ift.tt/37QVwXa

mercredi 28 octobre 2020

Atalaya begins feasibility study on cathode production plant

Atalaya Mining (AIM: ATYM, TSX: AYM), which currently produces copper concentrates from its Proyecto Riotinto site in Spain, has launched a feasibility study to evaluate the economic viability of producing cathodes from complex sulphide ores prevalent in the Iberian pyrite belt.

The production of cathodes has the potential to generate cost savings by reducing charges associated with concentrate transportation, treatment and refining, and penalty elements, while also reducing carbon emissions, the company says.

This will be done through the application of a newly developed extraction process called the E-LIX System with a new industrial scale plant. The technology was developed and owned by Lain Technologies, which is led by an electrochemistry expert from the University of Cambridge.

E-LIX System is considered to be a more environmentally friendly process than existing technologies

Through the application of singular catalysts and physicochemical conditions, E-LIX System is able to achieve high metal recoveries under low residence times by accomplishing rapid reaction rates while overcoming classic surface passivation issues that have typically impaired metal recovery from complex sulphide ores.

E-LIX System is also considered to be a more environmentally friendly process than existing technologies; it is a zero-emissions process that does not consume water nor acid, and runs under mild operating conditions (atmospheric pressure and room temperature).

E-LIX System was patented in 2014 by Lain Tech and has been developed in collaboration with Atalaya from an initial concept in the laboratory to a fully operational pilot plant located at Proyecto Riotinto.

The pilot plant, which has a 5 t/d capacity, has been running for the past nine months, with only mandatory stoppage owing to covid-19 restrictions. Leach rates of up to 250 kg/h have been achieved processing copper concentrates, zinc concentrates and blends of different types of sulphides.

The plant also contains a solvent extraction and electrowinning (SX-EW) section and has successfully produced high-purity copper cathodes as a proof of concept.

Atalaya affirms that the pilot plant has demonstrated that the E-LIX System treats effectively the impurity levels typically associated with the complex sulphides present in the world-class pyrite belt.

Licensing agreement

During the past five years, Atalaya has provided financial assistance to Lain Tech to develop the E-LIX System and now has an agreement to use its patents on an exclusive licence basis within the Iberian pyrite belt in Spain and Portugal.

This allows Atalaya to conduct a feasibility study to evaluate the construction of an industrial scale plant for the production of a minimum of 10,000 tonnes of copper cathode metal a year.

The study — at a cost of approximately €1 million — will be funded by Atalaya and is expected to be finalized in 2021. The license agreement provides for a profit-sharing arrangement between Atalaya and Lain Tech.

Atalaya believes that the use of the E-LIX System could potentially be applicable to the large amount of complex sulphide ore inventory present throughout the Iberian pyrite belt, including Atalaya’s mining properties such as Proyecto Riotinto and Proyecto Masa Valverde.

from MINING.COM https://ift.tt/2HHqEh2

Comète Tchouri : révélations sur le deuxième site heurté par le robot Philae

from Les dernières actualités de Futura https://ift.tt/2HHB28x

Ce système de filtration de l'eau des Mayas est le plus ancien connu

from Les dernières actualités de Futura https://ift.tt/31SFJmG

7 défis mathématiques à 1 million de dollars et autres problèmes non résolus

from Les dernières actualités de Futura https://ift.tt/3mxPI9c

Chemin Des Mûres, l'application qui soutient l'alimentation locale

from Les dernières actualités de Futura https://ift.tt/3jC4Znx

Un robodog de Boston Dynamics se balade à Tchernobyl

from Les dernières actualités de Futura https://ift.tt/37OgZQr

Nordgold submits off-market bid for Cardinal in takeover war

A battle between Nordgold (LON: NORD) and China’s Shandong Gold over Cardinal Resources (ASX: CDV) continues to rumble on as the Russian miner announced on Wednesday it would supplement its A$1-per-share bid with an off-market offer of equal value.

Nordgold, which first approached Cardinal in March with an unsolicited takeover bid, had said on Monday it wouldn’t sweeten its “final and best offer”, which matched Shandong’ s final proposal.

On Tuesday, however, Shandong said it was prepared to increase its offer by five Australian cents to A$1.05 if a higher offer emerged, leaving Nordgold on the ropes.

The Moscow-based gold miner, which spun out of Russian steelmaker Severstal in 2012, has responded with an off-market takeover offer for all of Cardinal’s outstanding shares. It has also vowed to provide accelerated payment terms, as long as there are no higher competing offers.

If a higher bid comes along, Nordgold said that it would increase its offer to a price that could defeat the higher competing submission, and any other rival offer from Shandong.

The Russian miner is also proposing to make an offer to certain of Cardinal option holders for their options, at the same terms as those offered by Shandong.

A source familiar with the matter told MINING.COM there is “enough evidence” of Shandong’s “misleading” and “coercive activities” to try swaying Cardinal shareholders.

“After nearly a year of protracted takeover processes, it’s very clear there will not be a third party bidder, unless it is a fabricated Chinese party, in which case the regulator would step in,” the insider, who wishes to remain anonymous, said.

Eyes on Ghana

The main reason behind the two bidders back-and-forth contest for Cardinal is the Australian miner’s 5.1 million-ounce Namdini gold asset in Ghana.

A feasibility study into the project estimates that it will produce about 4.2-million ounces of gold over a mine life of 15 years. Nearly 1.1 million ounces would be generated in the first three years of operation.

Initial capital costs for Namindi were forecast to range from $275 million and $426 million, depending on the project’s scale.

Nordgold, which acquired many of its major assets during the 2008-2009 financial crisis, claims it is not only offering better terms for Cardinal’s shareholders, but that it also has a track record of best practice operations in West Africa.

The company owns several gold mines in Africa, including Bissa in Burkina Faso and Lefa in Guinea. It also operates in Russia and Kazakhstan.

from MINING.COM https://ift.tt/37OkCG3

Perseverance est officiellement à mi-chemin de son voyage vers Mars

from Les dernières actualités de Futura https://ift.tt/3mw0Kf6

Covid-19 et grippe : à quoi faut-il s'attendre cet hiver ?

from Les dernières actualités de Futura https://ift.tt/35EQ6M1

Millennial Lithium commissions lithium carbonate pilot plant at Pastos Grandes project

Millennial Lithium (TSXV: ML) announced that the commissioning of a lithium carbonate pilot plant at its flagship Pastos Grandes project in Argentina is underway.

In a press release, the Canadian miner said that the pilot plant, located adjacent to the Pastos Grandes salt flat, is a full flowsheet design for producing up to three tonnes per month of battery-grade lithium carbonate.

The pilot plant is expected to produce up to three tonnes per month of battery-grade lithium carbonate

According to Millenial, pilot ponds filled with brine pumped from the central part of the project and in operation since late 2018, are at the required concentration to provide lithium-rich brine concentrate to the pilot plant

“Despite covid-19 restrictions and minor delays, the Millennial team has advanced the lithium concentration ponds and the pilot plant to the production stage. Evaporation ponds have been concentrating lithium and plant feed,” Farhad Abasov, the company’s president and CEO, said in the media brief. “The first stage of the plant, the Solvent Extraction (SX) unit to remove boron, has been installed and tested. The first output of battery-grade lithium carbonate is planned for Q4-2020 marking another significant milestone for the company.”

Abasov said that, at present, the pilot plant is being fed with concentrated lithium-rich brine from the smaller feeder ponds which had reached a grade of 2.7% Li, and expected to reach the target 3% Li with naturally reduced impurities by the time the full flow sheet is commissioned.

Located in the northwestern part of Argentina, Pastos Grandes covers over 12,619 hectares. To date, Millennial has invested more than C$40 million in exploration and development work on the property, which includes 22 completed exploration/monitoring wells, four pumping test production wells, pilot ponds, the pilot plant as well as a year-round camp supported by a hybrid solar power system.

from MINING.COM https://ift.tt/35L6Tgs

Demand for seaborne thermal coal expected to rise in the next decade – report

The Minerals Council of Australia released a report related to the outlook for seaborne thermal coal in terms of demand to 2030 in the Asia Pacific region.

The report was commissioned to Commodity Insights and it states that Asian thermal coal imports are expected to grow by more than 270 million tonnes (Mt) to 1.1 billion tonnes per annum in the next decade.

The market analyst says that this growth stands on the same drivers that allowed seaborne thermal coal volumes to double between 2006 and 2019, from 500Mt to 1,000Mt, rising in volume every year of that period except in 2015.

Asian thermal coal imports are expected to grow to 1.1 billion tonnes per annum in the next decade

These driving factors are high electricity demand across developing nations, pushed by strong economic growth, increasing industrialization and higher electrification rates; high population growth, particularly India and Southeast Asia; significant coal-fired generation capacity commissioned in many countries; and, in some regions, an inability of domestic coal production to keep pace with demand growth, amplified by increasing demand for high-quality thermal coal, which is typical of seaborne traded coals.

According to the report, even though growth will be negative in 2020 due to the impact of covid-19, it will be followed by a solid recovery and most countries are expected to increase imports, with only Taiwan and Korea reducing volumes.

Moreover, five countries – among them The Philippines, India, and Vietnam – are forecast to increase demand by more than 30Mt.

In Commodity Insights’ view, such a rise illustrates the breadth of market demand growth for imported thermal coal – which is not reliant on growth from China.

from MINING.COM https://ift.tt/3oBxGV6

Gem Diamonds back in the black on higher prices

Africa-focused Gem Diamonds (LON:GEMD) became on Wednesday the latest miner to show signs of a slow but steady recovery in the market after showing it had swung to positive cash flow and slash debt on the back of rising diamond prices.

The company reduced its net debt position by $6.6 million in the July-September quarter, ending the period with $1.1 million in cash. This compares to a net debt of $5.5 million in the first half of the year.

The sale of seven diamonds for more than $1 million each, helped the miner’s bottom line, generating revenue of $25.6 million during the period.

The company achieved an average diamond price in the third quarter of $2,215 per carat, up from $1,714 per carat in the first half of the year.

“These prices achieved, on a like-for-like basis, are higher than those realized in the pre-covid-19 market conditions of the second half of the 2019 [financial year]”, chief executive Clifford Elphick said in the statement.

The apparent ongoing recovery in the diamond market is still thought to be fragile. De Beers, the world’s largest diamond producer by value, said in early October it was too early to be sure of a sustained upturn in trading conditions.

“Whilst the market has been defibrillated, we think it will remain in intensive care for some time, although any improvement is good news for the smaller pure play producers with weak balance sheets,” BMO Analyst Edward Sterck said in a note last month.

Letšeng back at full tilt

Gem Diamond’s Letšeng mine in Lesotho returned to full ore mining and treatment capacity in a phased manner during the second quarter and, the company said.

Enhanced focus on stability and overall uptime of the Letšeng plants resulted in a conscious decision to reduce the instantaneous feed rate to each plant to reduce feed variability and enhance recovery, Gem noted.

Since acquiring Letšeng in 2006, Gem Diamonds has found more than 60 white gem quality diamonds over 100 carats each, which makes the mine the world’s highest dollar per carat kimberlite diamond operation.

The company recently secured a 10-year extension for its mining lease, with the government of Lesotho granting the company exclusive rights for further renewals.

At an average elevation of 3,100 metres (10,000 feet) above sea level, Letšeng is also one of the world’s highest diamond mines.

from MINING.COM https://ift.tt/3kD1yya