lundi 30 novembre 2020

L'Australie est de nouveau frappée par la canicule et des incendies !

from Les dernières actualités de Futura https://ift.tt/3fRsYi4

Botswana Diamonds grabs Sekaka from embattled Petra

Botswana Diamonds (LON:BOD) said on Monday it had completed the acquisition of Sekaka, the exploration vehicle that belonged to embattled rival Petra Diamonds (LON:PDL) and which held three prospecting licenses in the country’s Central Kalahari Game Reserve.

In one of its licences Sekaka had singled out the KX36 kimberlite pipe, which is situated about 70 km from Gem Diamonds’ Ghaghoo mine, and 260 km north-west of Botswana’s capital Gaborone.

Sekaka also had a recently built, fit-for-purpose bulk sampling plant on site. The sampling plant includes crushing, scrubbing, dense media separation circuits and X-ray recovery modules within a secured area.

The acquisition includes an extensive database, built up over 15 years of exploration.

Botswana Diamonds believes the information contained in the database will provide substantial support to its future kimberlite exploration activities in the mining-dependent country, the world’s second-largest diamond producer.

“We are delighted that this acquisition has now closed. This paves the way to explore commercial development options for KX36 and begin to evaluate the extensive database in conjunction with ours to discover more kimberlites in prime diamond real estate,” chairperson John Teeling said in the statement.

Diamond exports from the southern African nation dropped 42% to $1.49 billion in the first nine months of this year as production fell 29% to 12.3 million carats due to covid-related restrictions.

Botswana’s mining sector provides a fifth of the country’s GDP and 80% of its foreign exchange earnings.

Mounting woes

Petra Diamonds, the former owner of Sekaka, has been struggling for over two years. Its weak financial position pushed it to shed non-core assets and put itself up for sale in June.

The company reversed the decision in October, opting instead for a debt-for-equity restructuring. The deal would leave existing shareholders with just 9% of the company.

Petra is also dealing with allegations of human rights abuses at its Williamson mine in Tanzania, resulting from the actions of its security guards.

It recently reported a 36% fall in revenue and a net loss of $223 million (168.7 million pounds) for the year ended June 30, as the coronavirus pandemic deepened the company’s financial woes.

from MINING.COM https://ift.tt/2JqAZi3

MINING.COM MINUTE: Biggest stories of the week

L'énigmatique monolithe de l'Utah a mystérieusement disparu !

from Les dernières actualités de Futura https://ift.tt/2VjL0QI

Surprise : les Alpes continuent de grimper !

from Les dernières actualités de Futura https://ift.tt/36onzfv

Iron hydroxide forms more easily on mineral surfaces than previously thought

New research has found a way to observe the moment iron hydroxide forms on quartz.

In a paper published in the journal Environmental Science & Technology, Young-Shin Jun, a professor at Washington University in St. Louis, explains that for this process to happen, first, sufficient precursor elements need to be in place. Then, the components can come together to form a stable nucleus that will go on to become a tiny solid particle of iron hydroxide, called a nanoscale particulate. The process is called solid nucleation.

Knowing the exact moment when iron hydroxide forms on quartz substrates can support water quality processes at acid mine drainage sites

Nucleation and growth together are known as precipitation — and their sum has been used to predict iron hydroxide’s formation behaviour. But these predictions have largely omitted separate consideration of nucleation.

In Jun’s view, this means that previous results were not accurate enough.

“Our work provides an empirical, quantitative description of nucleation, not a computation, so we can provide scientific evidence about this missing link,” the researcher said.

By using X-rays and a novel experimental cell she developed to study environmentally relevant complex systems with plenty of water, ions and substrate material, Jun was able to observe nucleation in real-time.

The work consisted of employing an X-ray scattering technique called “grazing-incidence small-angle X-ray scattering.” By shining X-rays onto a substrate with a very shallow angle, close to the critical angle that allows total reflection of light, this technique can detect the first appearance of nanometer size particles on a surface.

The empirical measuring of the initial point of nucleation revealed that the general estimates scientists have been using overstate the amount of energy needed for this process.

“Iron hydroxide forms much more easily on mineral surfaces than scientists thought because less energy is needed for nucleation of highly hydrated solids on surfaces,” Jun said.

According to the scientist, her findings can help better understand processes related to water quality at acid mine drainage sites, the reduction of membrane fouling and pipeline scale formation, and the developing of more environmentally friendly superconductor materials.

from MINING.COM https://ift.tt/2JxqvNB

Nouveau Monde Graphite commits to all-electric fleet at Canadian mine site

Nouveau Monde Graphite (TSXV: NOU) has committed to using all-electrical equipment and vehicles at its Matawinie graphite project in Quebec.

In a press release, the Canadian miner said that it is advancing the procurement process for its fleet and charging infrastructure through an international call for pre-qualification.

The Matawinie graphite project should reach commercial production in 2023, with an allocated transition period to fully electrify the fleet by 2028

“Discussions with manufacturers have already enabled us to identify existing machinery in development and/or available, notably for the ancillary fleet where purchasing agreements are being finalized,” the media brief states. “Through the call for pre-qualification, large OEMs and innovative SMEs alike are now invited to submit detailed proposals and performance specs for their production equipment solutions. Whether powered by lithium-ion batteries, plug-in systems or hydrogen fuel cells, Nouveau Monde is seeking the best zero-emission equipment for heavy-duty operations and harsh conditions associated with open-pit mining.”

The over 60 pieces of equipment the company is asking for are to be used at Matawinie, whose target for commercial production is 2023, with an allocated transition period to fully electrify the fleet by 2028.

Nouveau Monde is also working on the construction of a dedicated power line to supply the mine site with a reliable, affordable and clean supply of hydroelectricity and has been selected by the provincial and federal governments as a key partner to develop a new electric propulsion system with a rapid recharging infrastructure adapted to heavy vehicles in the open-pit mining industry.

from MINING.COM https://ift.tt/3mpEJ1H

Le Système solaire se déplace plus vite dans la galaxie et est plus proche du trou noir supermassif

from Les dernières actualités de Futura https://ift.tt/37hVTYY

SpaceX : le premier vol à haute altitude du prototype de Starship est imminent

from Les dernières actualités de Futura https://ift.tt/3mzmPti

US fund threatens Rio with legal action over Oyu Tolgoi

The world’s second largest miner Rio Tinto (ASX, LON, NYSE: RIO) is facing stronger headwinds over how to finance its massive Oyu Tolgoi underground copper project in Mongolia after a US hedge fund threatened the company with legal action.

Pentwater Capital, the second largest shareholder in Rio-controlled Turquoise Hill (TSX, NYSE: TRQ), said on Monday it was ready to file an “oppression” order against the mining giant.

The move is a statutory right available to “burdened” shareholders, empowering them to bring an action against the corporation in which they own shares. They can do so when the conduct of the company has had an effect that is oppressive, unfairly prejudicial, or unfairly disregards the interests of a shareholder.

The Naples, Florida-based fund said it would spare the company the legal action if it allowed Turquoise Hill, Oyu Tolgoi operator, to take on more debt to fund the $6.8 billion underground expansion.

“We do not undertake this lightly, but enough is enough,” Pentwater chief executive Matthew Halbower said in the open letter.

“This mine is a jewel. It will be the third-largest gold and copper mine in the world. It will produce tens of billions of dollars of free cash flow for decades. Its owners should be treated as business partners, not as puppets or pawns,” Halbower said.

This is not the first time Pentwater takes issue with the way Oyu Tolgoi’s expansion is being handled. In April, it demanded a shakeup at operation over what it claimed was “a massive devaluation” of the asset.

Pentwater’s threat comes on the heels of a similar warning issued by Odey Asset Management, a London-based hedge fund. The firm accused Rio last week of holding the “people of Mongolia… accountable for Turquoise Hill’s failings” after it called the country’s government’s $7 billion-equity stake in the copper gold mine “worthless”.

Mongolian muddles

Mounting investor activism is just one of the may headaches Rio Tinto has had while building what would rank as one of the world’s three largest copper mines when operating at full tilt – now expected to be by 2025 at the earliest.

In January 2018, Mongolia’s government served Oyu Tolgoi with a bill for $155 million in back taxes — the mine’s second tax dispute since 2014. The company said at the time the charge related to an audit on taxes imposed and paid by the mine operator between 2013 and 2015.

Shortly after, the mine had to declare force majeure after protests by Chinese coal haulers disrupted deliveries near the border.

The situation prompted Rio’s former chief executive Jean-Sebastien Jacques to visit Prime Minister Ukhnaagiin Khurelsuk to discuss how to build “win-win” partnerships. The trip was followed by the company’s announcement that it was opening a new office in the country, focused on exploration and building local relationships.

The issue resurfaced later, when a group of Mongolian legislators recommended a review of the 2009 deal that launched construction of the mine. It also advised revoking a 2015 agreement allowing for an underground expansion.

In December that year, Mongolia’s parliament unanimously approved a resolution that reconfirms the validity of all the Oyu Tolgoi mine-related agreement, bringing the 18-month review to a close.

Behind schedule and over budget

Mongolia has also complained about overruns in the past. Much of Oyu Tolgoi’s copper lies deep underground. When Rio finally kick off the delayed project, profits from surface extraction were meant to pay for digging up more of the copper below.

With time, it became clear the underground mine alone would cost as much as a third more than the original $5.3 billion budget.

Rio Tinto cut estimated reserves at the project in July and confirmed it would face delays and higher costs after ground instability forced it to redesign the mine plan.

Once completed, the expansion is expected to lift Oyu Tolgoi’s production from 125,000–150,000 tonnes in 2019 to 560,000 tonnes at peak output, targeted for 2025.

The giant deposit, discovered in 2001, is one-third owned by Mongolia’s government and two-thirds by Turquoise Hill. Rio has a 51% stake in the Canadian miner.

More to come…

from MINING.COM https://ift.tt/2Vf5oT7

Des jets nouveau-nés dans des galaxies lointaines

from Les dernières actualités de Futura https://ift.tt/3o18zdo

Dernières heures de la promo 60 Go pour moins de 6 euros / mois chez Auchan Télécom

from Les dernières actualités de Futura https://ift.tt/36lS5q7

Samsung prépare le smartphone pliable de demain

from Les dernières actualités de Futura https://ift.tt/36nb9nO

Incendies et canicules en Australie : c'est reparti pour un tour…!

from Les dernières actualités de Futura https://ift.tt/2HQt64Q

La Dacia Spring et la Renault Zoe bientôt en location chez E.Leclerc

from Les dernières actualités de Futura https://ift.tt/3luPJK9

Bon plan Cdiscount : 1500 € de remise sur la trottinette électrique Xiaomi Pro 2

from Les dernières actualités de Futura https://ift.tt/36j8Pyo

Une course de voitures télécommandées sur la Lune en 2021

from Les dernières actualités de Futura https://ift.tt/2Jva30h

Forfait mobile : Dernier jour de la vente flash 200Go à seulement 15 €/mois chez RED By SFR

from Les dernières actualités de Futura https://ift.tt/33t3P8A

Suède : un ciel se colore en violet... à cause d'un champ de tomates

from Les dernières actualités de Futura https://ift.tt/36j95x9

Feu vert pour la première mission de désorbitation d'un débris

from Les dernières actualités de Futura https://ift.tt/37kZzcf

Live, exposition d'innovations, ateliers participatifs... J-1 avant les Electric Days, l'événement dédié aux énergies de demain !

from Les dernières actualités de Futura https://ift.tt/3fLI9te

Futura Emploi : 500 euros pour aider les jeunes diplômés pendant la crise du coronavirus

from Les dernières actualités de Futura https://ift.tt/33pLnNR

La géoingénierie climatique : bonne ou mauvaise idée ? Décryptage d’experts

from Les dernières actualités de Futura https://ift.tt/3o59WHW

dimanche 29 novembre 2020

Dominican Minister of Mines dismisses rumours that link Barrick’s advanced payments to tailings dam approval

The Dominican Republic’s Minister of Energy and Mines, Antonio Almonte, rejected rumours that linked Barrick Gold’s recent $108-million advanced tax and royalty payment to the possible approval of a tailings dam at the Pueblo Viejo operation.

In a TV interview broadcasted over the weekend, Almonte said that the advanced payment was the result of negotiations led by the ministry of finance and the national government’s economic team, with the goal of addressing the current fiscal deficit that is a direct consequence of the slowdown caused by the covid-19 pandemic.

Barrick’s disbursement included advance payment of income tax, net profit interest and royalties, adding an advance payment of the royalty for the year 2021 estimated at $47 million.

This is the fourth tax payment Pueblo Viejo has made so far this year and brings its contribution to the Dominican government for 2020 to $385 million.

The tailings dam approval is subject to an environmental impact assessment that will determine whether the facility will endanger the surrounding ecosystems and communities or not

The miner has also agreed to advance the royalty payment for the years 2022 and 2023, estimated at $95 million, to support the government’s mission to fight the health and economic crisis caused by the novel coronavirus.

“This does not mean that the State has made any additional commitments to Barrick,” Almonte said. “The decision process related to the construction [of the tailings dam] is tied to the results of the environmental studies.”

The politician emphasized that, even though his office understands that Barrick needs to build the dam, its approval is subject to an environmental impact assessment that will determine whether the facility will endanger the surrounding ecosystems and communities or not.

According to the government official, a complex and detailed EIA needs to be carried out and then submitted to both the Ministry of Energy and Mines and the Ministry of Environment, whose technical teams will conduct an evaluation with the support of international experts.

The Pueblo Viejo operation is located approximately 100 kilometres northwest of Santo Domingo, and it already hosts the El Llagal tailings storage facility, whose hazard classification is considered ‘extreme.’

The facility started operating in 2012, together with the mine. The overall operation is run by Pueblo Viejo Dominicana Corporation — a joint venture between Barrick (60%) and Newmont (40%).

Last year, Pueblo Viejo produced 590,000 ounces of gold, while its 2020 guidance ranges between 530,000 and 580,000 ounces of the yellow metal.

from MINING.COM https://ift.tt/2VggvLs

Science décalée : révéler la fin d'un film dope ses entrées

from Les dernières actualités de Futura https://ift.tt/36jxRgL

Cobalt demand from battery industry expected to grow in the next five years – report

A recent report by Benchmark Mineral Intelligence forecasts that the battery industry will require a further 100,000 tonnes of cobalt by 2025.

The firm’s numbers show that 57% of the world’s cobalt demand will come from the battery sector by the end of the year, a proportion that is expected to increase to 72% in the next five years.

According to the London-based market intelligence publisher, positive sentiment around battery demand for cobalt chemicals is outweighing the bearish sentiment around metal demand from traditional markets in the near term.

Benchmark points out that the EV market’s H2 2020 recovery has been strong, with China having its best quarter in over 12 months and Europe posting surging EV sales numbers, up over 101% Jan-Feb 2020 over the same period a year earlier. This situation, coupled with better than expected demand for portable electronics applications – linked to home working – and mobility products such as eBikes, has seen the sentiment for the outlook for cobalt demand from the battery supply chain improve considerably from where it stood at the start of the pandemic in early 2020.

Positive sentiment around battery demand for cobalt chemicals is outweighing the bearish sentiment around metal demand from traditional markets

“As demand from the battery sector grows, it is natural that it becomes the driving force behind prices and sentiment, as the industry is increasingly focussed on the ‘new world’ of cobalt hydroxide, the battery feedstock to chemical supply chain and the forecasted market balance rather than the ‘old world’ – cobalt metal and the industrial supply chain,” the report reads.”

In the analyst’s view, whilst activity in the metal supply chain will always remain important to the cobalt market, and especially cobalt pricing, shifting sands are starting to see a greater emphasis on cobalt hydroxide, and the availability of this feedstock to the battery market.

“The transition to a hydroxide dominated prevailing price becomes more evident when you look at the global supply outlook,” the document states. “With only 25% of refined products annually produced in metal form, the balance has been in favour of chemicals for some years, largely focussed on the battery market. This is even more evident when looking at the supply of intermediate products, with cobalt hydroxide accounting for 70% of unrefined supply in 2020.”

For BMI, the different elements that make up this context, namely, the battery industry crave for cobalt hydroxide, any perceived tightness as the world moves into 2021 and positive demand sentiment, are responsible for supporting cobalt prices in 2020. Indeed, cobalt metal prices (cobalt battery metal, min 99.8%, EXW Europe, USD/lb) have risen 15% from July 2020 to the most recent data published at the end of October 2020.

Benchmark’s cobalt hydroxide prices (100% Co contained basis, CIF Asia), on the other hand, have risen from a low of $21,600/tonne in April 2020, at the peak of concern of falling demand linked to the pandemic, to $27,150/tonne as assessed at the end of October 2020, an increase of 25.7%.

The other side

Not everything is positive when it comes to the outlook for cobalt.

Benchmark makes a point to mention that as automakers move toward reducing the cost of EVs, alongside improvements in the technology, cheaper lithium-iron-phosphate batteries have seen a resurgence in 2020.

“Whilst this LFP growth is primarily linked to EVs in the Chinese domestic market, this is now starting to bleed into the international market with Tesla recently starting to export Chinese made Model 3 vehicles to Europe which contain LFP cells supplied by CATL,” the report reads.

Besides LFP, cobalt is facing challenges from reducing concentrations in cathode technology as the industry continues its march towards high nickel cathodes, primarily NCM 811.

“Whilst the timeline for this is far from certain, as automakers still face difficulties with deploying the technology, it is looking to be an inevitability at this stage, and will see cobalt use on a per kWh basis continue to fall,” BMI predicts.

from MINING.COM https://ift.tt/3fMJnV2

Cet avion électrique à décollage vertical pourrait atteindre 300 km/h

from Les dernières actualités de Futura https://ift.tt/39s1Hlo

Deux nouveaux corps découverts dans les ruines de Pompéi

from Les dernières actualités de Futura https://ift.tt/3nMolsm

Bon plan Cdiscount : 99 € de réduction sur la trottinette électrique GO RIDE 80PRO

from Les dernières actualités de Futura https://ift.tt/37mEAWJ

La Renault Zoe 3 sera « 100% inédite »

from Les dernières actualités de Futura https://ift.tt/2IWTnPL

Les régimes sans viande exposeraient à un risque accru de fracture osseuse

from Les dernières actualités de Futura https://ift.tt/3fpGtFz

Scientists find ideal conditions to produce high nickel-based batteries

New research conducted at the University of Warwick in the UK found that the drier the conditions in which high nickel-based battery cathodes are stored and processed, the better the battery performs.

High-Ni cathode materials are prone to reactivity and instability if exposed to humidity, therefore how they are stored in order to offer the best performance is crucial.

In a paper published in the journal Electrochimica Acta, the Warwick scientists explain that to find those ideal storage conditions, they exposed NMC-811 (high-Ni cathode material) to different temperatures and humidities, then measured the material’s performance and degradation in a battery over a 28-day period, analyzing them using a combination of physical, chemical and electrochemical testing. This included high-resolution microscopy to identify the morphological and chemical changes that occurred at the micron and sub-micron scale during the batteries charging and discharging.

The driest conditions, at dew points of around -45 degrees Celsius, are the best for storing and processing the materials

The storage conditions included vacuum oven-dried, as exposed (to humidity) and a control measure. The researchers looked for surface impurities, which include carbonates and H2O, and found there were three processes that can be responsible for impurities, namely, residual impurities emanating from unreacted precursors during synthesis; higher equilibrium coverage of surface carbonates/hydroxides (present to stabilize the surface of Ni-rich materials after the synthesis process); and impurities formed during ambient storage time.

They found that in all conditions, (oven-dried and as-exposed) showed inferior first discharged specific capacity and cycling performance, compared to the control. However, the as-exposed measure showed that after 28 days of ambient moisture exposure the H2O and CO2 react with the Li+ ions in the battery cell, resulting in the formation of lithium carbonate and hydroxide species.

The formation of carbonates and oxides on the surface of NMC-811 contributes to the loss of the electrochemical performance during the ageing of the materials, due to the inferior ionic and electronic conductivity, as well as the electrical isolation of the active particles. This means that they can no longer reversibly store lithium ions to convey “charge.” An SEM analysis confirmed the inter-granular porosity and micro-cracks on these aggregate particles, following the 28 days of ambient exposure.

This allowed the scientists to conclude that the driest conditions, at dew points of around -45 degrees Celsius, are the best for storing and processing the materials, in order to then produce the best battery performance.

Conversely, humidity conditions and exposure at junctions along the manufacturing process will cause the materials and components to experience degradation, which results in a shorter battery lifespan.

from MINING.COM https://ift.tt/3lh2Zl9

Ces gouttelettes d'huile se comportent comme des prédatrices !

from Les dernières actualités de Futura https://ift.tt/3mi7bT6

Les perturbateurs endocriniens jouent-ils un rôle dans les formes graves de Covid-19 ?

from Les dernières actualités de Futura https://ift.tt/2UZuyoq

Mars a été le théâtre d'inondations géantes il y a 4 milliards d'années

from Les dernières actualités de Futura https://ift.tt/2UVLdJD

samedi 28 novembre 2020

Concentration record de CO2 dans l'atmosphère : + 45 % en 30 ans !

from Les dernières actualités de Futura https://ift.tt/3nWtw95

Coronavirus : plusieurs milliards de particules virales dans le corps d'une personne infectée

from Les dernières actualités de Futura https://ift.tt/3mhwUv2

Arecibo, la fin d'un géant de l'astronomie

from Les dernières actualités de Futura https://ift.tt/3kYaxcH

Les scientifiques détectent des « superéclairs » 1.000 fois plus brillants que les autres

from Les dernières actualités de Futura https://ift.tt/3o14IwQ

Les corps des visons abattus et enterrés à cause du coronavirus remontent à la surface

from Les dernières actualités de Futura https://ift.tt/33mnlmU

Forfait mobile : 40 Go à 11,99 €/mois même après un an chez Sosh

from Les dernières actualités de Futura https://ift.tt/3qa3Qry

Bon Plan Série Free : 60 Go proposé à seulement 10,99 €/mois

from Les dernières actualités de Futura https://ift.tt/39jAaT3

Cette plante prend l'aspect d'une roche pour éviter d'être cueillie

from Les dernières actualités de Futura https://ift.tt/3fr2Pqh

vendredi 27 novembre 2020

Hawaï : découverte d'un immense réservoir naturel d'eau douce

from Les dernières actualités de Futura https://ift.tt/39osQ8y

Demand for scrap metal expected to grow in next two decades – report

A report published by Wood Mackenzie this week states that since consumer and investor pressures asking for recycled content are starting to change the scrap metal market, demand for this material is expected to grow in the next two decades, with an additional 200 Mt per annum of steel scrap and 75 Mt per annum of aluminum used by 2040 compared to now.

Beyond what happens in the private sector, policies that mandate greater recycling rates are also driving cleaner and more reusable scrap collection.

“Governments across the globe generally share a focus on keeping reusable materials out of landfills,” WoodMac’s principal analyst, Renate Featherstone, writes in the report. “These should, in theory, lead to greater scrap availability and use. However, there are no universal laws that encourage the consumption of recycled materials.”

Policies that mandate greater recycling rates are also driving cleaner and more reusable scrap collection

According to Featherstone, the fact that there isn’t a global vision on the use of scrap metal means that, despite the increased demand, the material is still expected to remain underutilized compared to its overall availability.

“Europe, for instance, collects scrap but does not have enough scrap-smelting capacity to use all the scrap generated,” the document reads. “Consequently, vast quantities of scrap are exported. Unverifiable quality for end-of-life scrap has deterred higher scrap use. But solid waste management laws are tightening, leading to increased scrap separation and quality monitoring.”

For the market analyst, in addition to policy changes, the wide-scale use of scrap metals must go hand-in-hand with compelling incentives and quality assurance.

“Wood Mackenzie believes a strong economic rationale exists for greater scrap processing and use. Capital investment costs for aluminum scrap processing facilities are typically 10% of primary metals, and 50% or less for steel,” the report states. “From an environmental perspective, secondary aluminum production has a carbon footprint five to 25 times lower than primary metal production. For steel, the largest industrial emitter, emissions can be around 30% lower compared to today, despite growing demand.”

The UK-based firm estimates that using all available scrap could bring down aluminum and steelmaking emissions by up to 600 Mt a year each and that if a universal carbon tax rises to $110/tonne, each relevant industry could save $66 billion a year.

Despite these positive outcomes, WoodMac points out that even with increased availability, scrap cannot eliminate the need for primary metal.

“Mining, refining and smelting will remain part of our lives for many decades to come,” the report states.

from MINING.COM https://ift.tt/2JnZkEQ

Eurasian Resources copper, cobalt facility in the DRC to undergo Responsible Minerals Assurance Process

Eurasian Resources Group announced that Metalkol RTR, its hydro-metallurgical copper and cobalt facility in the Democratic Republic of Congo, has committed to undergoing the Responsible Minerals Assurance Process, a flagship programme of the Responsible Minerals Initiative.

Known as RMAP, the Process was developed to meet the requirements of the OECD Due Diligence Guidance, the Regulation (EU) 2017/821 of the European Parliament and the U.S. Dodd-Frank Wall Street Reform and Consumer Protection Act.

The RMAP uses an independent third-party, risk-based assessment of smelter/refiner management systems and sourcing practices

It uses an independent third-party, risk-based assessment of smelter/refiner management systems and sourcing practices to validate conformance with standards related to responsibly sourced minerals in companies’ supply chains.

“Cobalt’s role in the world economy is only set to increase as it is a key ingredient in lithium-ion batteries for electric vehicles and energy storage which will power the green recovery,” Benedikt Sobotka, CEO of Eurasian Resources Group, said in a media statement. “It is vital that the cobalt in these products is sourced responsibly and sustainably, and we have committed to this through our Clean Cobalt Framework, the Cobalt Industry Responsible Assessment Framework and the RMAP.”

Prior to this commitment, the Luxembourg-based miner joined forces with international development organization Pact to implement the initiative “Children out of Mining-Northern Kolwezi.”

Congo’s Kolwezi region hosts the Metalkol RTR operation. This is why the company has made it a point of honour to promote responsible and sustainable cobalt production in this area.

from MINING.COM https://ift.tt/3nWBUFC

European coalition to secure access to 30 critical raw materials

The European Union has launched an initiative that seeks to secure access to a total of 30 critical raw materials by increasing domestic production and promoting recycling of vital elements, particularly rare earths.

The European Raw Materials Alliance (ERMA), a partnership of over 300 companies, business associations and governments, will initially focus on breaking Europe’s dependence on inputs from China and other resource-rich countries.

The EU imports around 98% of rare earths from China. Turkey supplies 98% of its borate, while Chile meets 78% of Europe’s lithium needs. South Africa provides 71% of its platinum and Brazil supplies 85% of the old continent’s niobium, a crucial part of steel alloys used in jet engines, girders and oil pipelines.

“ERMA’s most important task is to secure raw materials supply in Europe by identifying investment opportunities for sustainable and socially responsible access to raw materials in Europe from primary and secondary sources,” EIT RawMaterials chief executive, Bernd Schäfer, said in a statement.

The EU’s inventory of key materials, drew up in 2011 in response to soaring commodity prices, has more than doubled over the past decade. In September, the Brussels, Belgium-based body added lithium, bauxite, titanium — used in aerospace and for orthopaedic implants —and strontium — an ingredients for EV magnets — to the list.

The group of 27 nations will need about 60 times more lithium and 15 times more cobalt for electric vehicles (EV) batteries and energy storage by 2050, analysts estimate. EU demand for rare earths, used in high-tech devices and military applications, is predicted to increase 10-fold over the same period.

Uphill battle

Europe could quickly become independent on some of the materials identified as critical. “For lithium needed for batteries and storage, we’re confident that we can be 80% self-sufficient by 2025,” EU commissioner Maroš Šefčovič said at a virtual conference this week.

He noted that about 15 new battery cell plants, or gigafactories, were being built across Europe, including in Italy, France, Germany, Hungary, Poland, Slovakia and Sweden, which were expected to provide enough cells to power at least 6 million EVs in less than five years.

EU members will face some obvious and longstanding difficulties along the way, including the tough environmental and social regulations deterring mining, FT.com analyst Alan Beattle wrote.

He cited as an example the Norra Karr rare earths project in Sweden, Europe’s largest known deposit of the elements, which was declared off-limits to further exploration by the country’s supreme administrative court. The decision, Beattle noted, was triggered by potential environmental risks from the proposed operations and reversing that decision would be difficult.

“Other problems reflect the peculiarities of the materials involved. Supply chains for rare earths and the like are particularly hard to diversify (…) So when the EU goes looking for supplier countries to produce materials to feed into its manufacturing, it wants stable, environmentally sensitive and economically advanced allies capable of replicating the whole value chain.”

As part of its strategy to reduce reliance on imported supply, the EU is also planning stricter green standards for batteries, expected to be announced on Dec. 9. The new rules aim to reduce the overall carbon and material footprint of batteries manufactured or imported into Europe.

from MINING.COM https://ift.tt/3fGjeqK

Des coronavirus proches du SARS-CoV-2 isolés au Cambodge et au Japon

from Les dernières actualités de Futura https://ift.tt/376pYdC

Offre Cdiscount : -499 € sur le PC portable gamer Lenovo Legion Y540-15IRH

from Les dernières actualités de Futura https://ift.tt/36csMH1

La fonte des glaces fait ressurgir de très anciennes flèches en Norvège

from Les dernières actualités de Futura https://ift.tt/39iSvPV

Covid-19 : toutes les questions sur la future campagne de vaccination

from Les dernières actualités de Futura https://ift.tt/3nTJsJs

MINING PEOPLE: Aris Gold, FPX Nickel, Giyani Metals, Norden Crown Metals, Osisko Development

Management appointments announced this week include:

Guy Belleau has been named COO of ArcelorMittal Mining Canada.

Following Caldas Gold’s announcement of a $85-million financing and name change to Aris Gold, the company will have a new board and management team. The board nominees include Ian Telfer as chair, David Garofalo, Peter Marrone, Attie Roux, Daniela Cambone and Neil Woodyer. Gran Colombia’s nominees will be Serafino Iacono and Hernan Martinez. Frank Giustra will be a strategic advisor. The management team will be led by Neil Woodyer as CEO, with the corporate head office based in Vancouver.

Priya Husada has joined Baru Gold as community development and government relations manager for the Sangihe project in Indonesia.

Valérie Pomerleau is now director of public affairs and communications with Canada Carbon.

Derk Hartman has been appointed president and COO of Giyani Metals, effective March 1, 2021. Wajd Boubou has resigned as president.

Jervois Mining has appointed Wayde Yeoman as group manager, commercial, as it drives development and construction of its Idaho cobalt operations in the United States and restarts the Sao Miguel Paulista refinery in Brazil.

Yuying Liang is now the CFO of Kincora Copper.

Paloma Pantoja has been named CFO and a director of Mojave Gold.

Jeannine Webb has been appointed CFO of Norden Crown Metals, she replaces Alexandra Woodyer Sherron. David Thornley-Hall has been named VP of corporate development and corporate secretary.

Marc Tran is now the CFO of Orogen Royalties. Tran takes over from Mahesh Liyanage.

With the launch of Osisko Development, Sean Roosen was appointed the chair of Osisko Royalties and transitioned from his role as CEO of Osisko Royalties to CEO of Osisko Development (Sandeep Singh became president and CEO of Osisko Royalties). The board of Osisko Development now consists of Roosen, Charles Page, John Burzynski, Joanne Ferstman, Michèle McCarthy, Duncan Middlemiss and Éric Tremblay. The management of Osisko Development consists of Roosen, Chris Lodder as president, Luc Lessard as COO, Benoit Brunet as CFO and VP of finance and corporate secretary, François Vézina as VP of technical services, Chris Pharness as VP of sustainable development and Maggie Layman as VP of exploration.

Lincoln Greenidge has been named CFO of Pasofino Gold. He succeeds Stephen Dunn.

Board moves include:

Steve Burleton is now a director of Angus Gold.

Steve Duchesne has joined the board of Fokus Mining.

Stuart Harshaw has stepped down from the board of FPX Nickel.

Alan Hair and Ken Robertson have joined the board of Gold Royalty, a subsidiary of GoldMining.

Michael Fischer has resigned as a director of Lithium Americas.

Reagan Glazier has been appointed to the board of Starr Peak Exploration.

from MINING.COM https://ift.tt/3q5C3se

Bon Plan forfait mobile : 200 Go à partir de 9,99€ chez Orange ou SFR

from Les dernières actualités de Futura https://ift.tt/3m8gR2u

Hawaï : découverte d'un immmense réservoir naturel d'eau douce

from Les dernières actualités de Futura https://ift.tt/3ler1NE

Ce processeur est si rapide et puissant qu’il prédit les actions à venir

from Les dernières actualités de Futura https://ift.tt/36d911S

Un avion de ligne hybride made in France pour 2026 ?

from Les dernières actualités de Futura https://ift.tt/37fcFrs

Radiateur intelligent à batterie intégré : retrouvez plus de 50 solutions énergétiques durant les Electric Days !

from Les dernières actualités de Futura https://ift.tt/2V7ozxZ

Des gouttelettes vivantes produisent de l’hydrogène

from Les dernières actualités de Futura https://ift.tt/37al67q

Forfait mobile : RED by SFR lance une super vente flash 200Go à seulement 15 €/mois

from Les dernières actualités de Futura https://ift.tt/37bBwMR

Obtenez 3 mois gratuits pour le Black Friday avec Express VPN

from Les dernières actualités de Futura https://ift.tt/3mc2zxV

Ce VPN est offert à 0.94 euros lors du Black Friday !

from Les dernières actualités de Futura https://ift.tt/3q7aeQf

Bon plan Cdiscount : 988 € de remise sur le tapis de course pliable LONTEK P5

from Les dernières actualités de Futura https://ift.tt/2HG8GeO

Certains gels hydroalcooliques vendus en France sont inefficaces

from Les dernières actualités de Futura https://ift.tt/2V6Pvhn

Bon Plan Black Friday : obtenez Windows 10 gratuitement !

from Les dernières actualités de Futura https://ift.tt/36UheHw

Revivez l'immersion au sein du 3DEXPERIENCE Lab en replay, véritable laboratoire d'innovations de rupture !

from Les dernières actualités de Futura https://ift.tt/37gH74J

jeudi 26 novembre 2020

Comment la fonte des glaces en Arctique influe-t-elle celle en Antarctique ?

from Les dernières actualités de Futura https://ift.tt/3q5ur9i

Bon plan Amazon : 220 € de réduction sur l'ASUS ZenBook UX481FA-HJ064T

from Les dernières actualités de Futura https://ift.tt/3pB9yCA

La deuxième lune capturée par la Terre serait bien un astéroïde

from Les dernières actualités de Futura https://ift.tt/3lhPu53

Cette IA ajoute des châteaux volants et des vaisseaux spatiaux à vos vidéos

from Les dernières actualités de Futura https://ift.tt/3fElM8N

Bon Plan PureVPN : -88 % pour le Black Friday

from Les dernières actualités de Futura https://ift.tt/366FmaI

CATL to keep close eye on cobalt, lithium, graphite suppliers

Lithium-ion battery developer and manufacturer Contemporary Amperex Technology (CATL) announced that it has partnered with RCS Global Group, a company that focuses on data-driven responsible sourcing, to keep track of its cobalt, lithium and graphite suppliers.

In a press release, the Chinese company said that, under the scope of the partnership, RCS Global’s ESG audit practice will identify CATL’s suppliers from battery to mine or recycler, and will also assess their conformance with environmental and human rights requirements.

RCS’ ESG audit practice will identify CATL’s suppliers from battery to mine or recycler and work with them to develop a responsible supply chain

Once the evaluation is done, RCS will work with CATL and its suppliers to enhance the development of a responsible supply chain.

“The partnership will enable CATL to become an industry leader in responsible sourcing by ensuring the continuous improvement of its suppliers’ performance in responsible production and sourcing,” the media brief states. “Suppliers, in turn, are benefitting as the process allows them to demonstrate their performance improvement to the market while being given access to best practice guidance. In doing so, the partnership aligns CATL’s risk management approach with best practice expectations within the fast-growing electric vehicle (EV) market, enabling CATL’s long-term sustainable development.”

CATL has collaborated with RCS Global in the past when conducting due diligence audits on its suppliers for stakeholders including Volvo Cars, Groupe PSA, Renault Nissan Mitsubishi Alliance, Volkswagen Group and others. The goal behind those audits was to increase the transparency of the mineral supply chain and reduce uncertainties by identifying risks and taking timely risk-mitigation measures at an early stage.

“As the world’s largest EV battery supplier, we are excited to be expanding our collaboration with CATL,” RCS CEO, Nicholas Garrett, said in the release. “They have a huge presence in the market and huge leverage further up the supply chain where they can help embed responsible practice across the production and supply of key battery metals.”

from MINING.COM https://ift.tt/3fEuLa1

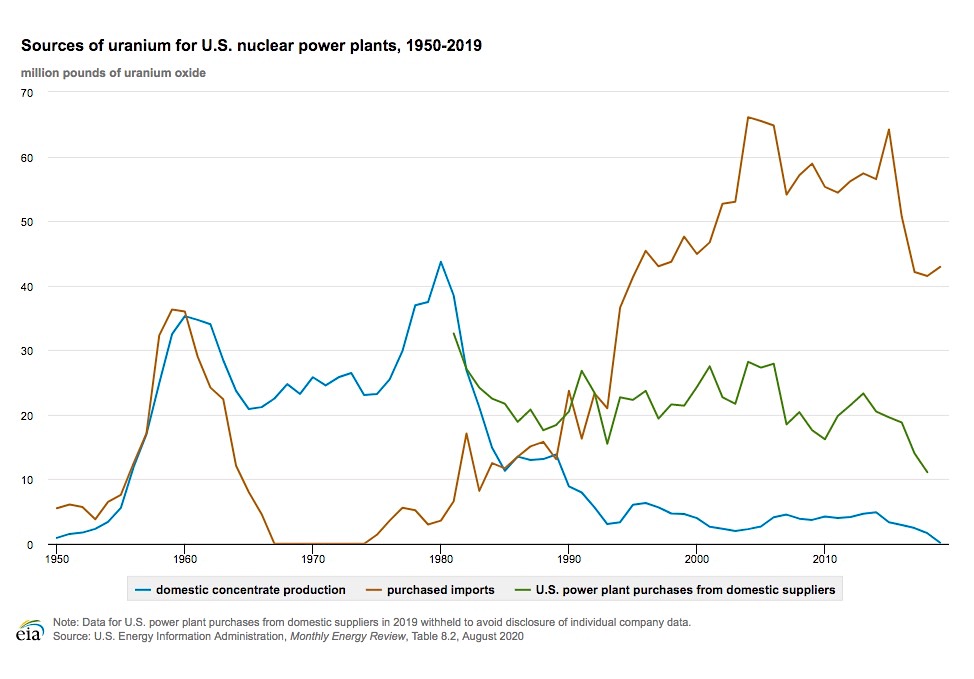

EPA greenlights Azarga’s uranium project in South Dakota

The United States Environmental Protection Agency issued the final permits for Azarga Uranium’s (TSX: AZZ) Class III and Class V underground injection control activities at the Dewey Burdock in-situ recovery uranium project in South Dakota.

In a press release, the miner said that the issuance of the permits marks a “critical milestone” that significantly de-risks the asset, as it follows the agency’s extensive review of the project.

According to Azarga’s president and CEO, Blake Steele, the EPA’s greenlight reaffirms the findings of the United States Nuclear Regulatory Commission that the project is both technically and environmentally sound.

Steele said that now that federal permits are in place, the company can focus on the required state permitting process before the South Dakota Department of Environment and Natural Resources.

Now that federal permits are in place, Azarga can focus on the required state permitting process

“At a time when the uranium market remains in a structural deficit and the United States government has shown historic bi-partisan support for the uranium sector, as evidenced by the Senate Committee on Appropriations draft fiscal year 2021 funding measures and subcommittee allocations’ inclusion of $150 million for a United States uranium reserve, Azarga Uranium continues to unlock the value of one of the preeminent undeveloped in-situ recovery uranium projects in the USA,” the executive said.

Dewey Burdock is an in-situ recovery uranium project located in the Edgemont uranium district, where the radioactive metal occurs in the sandstones as classic roll front deposits favourable to ISR mining methods.

The mine is forecast to produce 14.3 million pounds of U3O8 over its 16 years of production. Initial capital expenditures are estimated at $31.7 million and projected cash flows of the project are expected to be positive in the second year of production, two years after the commencement of construction.

Those estimations were based on $55 per pound sales price, but current uranium spot price is sitting below $30 per pound and analysts at RBC Capital Markets recently lowered their long-term expected price from $65/pound to $50/pound.

Needed local boost

About 90% of the uranium fuel used today in US reactors is imported, official figures show. Last year, the country produced around 174,000 pounds of uranium, the lowest annual total in more than 70 years.

Last week, the Senate released drafts of 2021 funding that allocate $150 million for the US Uranium Reserve. If passed, the measure would enable the Department of Energy to invest in the sector and so stimulate domestic industry growth.

from MINING.COM https://ift.tt/3l4Vde5

Parachutes d'ExoMars : une mise au point toujours aussi difficile

from Les dernières actualités de Futura https://ift.tt/368q9WN

Des lampadaires-bornes de recharge pour voitures électriques arrivent en France

from Les dernières actualités de Futura https://ift.tt/3mb1dTU

Forfaits à moins de 5 € : Dernières heures des promos sur les forfaits 30Go et 80Go chez Cdiscount Mobile

from Les dernières actualités de Futura https://ift.tt/368qh8L

Vaccin AstraZeneca : plus efficace avec une demi-dose ?

from Les dernières actualités de Futura https://ift.tt/3obh1Hd

Étrangeté du vivant : cette fourmi porte une véritable armure pour se protéger des infections !

from Les dernières actualités de Futura https://ift.tt/3mmuDil

Au bureau ou en télé-travail, Microsoft peut surveiller votre productivité

from Les dernières actualités de Futura https://ift.tt/2V2Hl9A

Radiateur intelligent à batterie intégré : retrouvez toutes les innovations énergétiques de demain pour les Electric Days !

from Les dernières actualités de Futura https://ift.tt/3mafSir

Les scientifiques détectent des « superéclairs » 1.000 fois plus brillants que les éclairs normaux

from Les dernières actualités de Futura https://ift.tt/3mdF1bW

Bon plan Cdiscount : 79 € d'économie sur le PC portable Gamer ASUS FX571GT-BQ691T

from Les dernières actualités de Futura https://ift.tt/3nUUX3t

Live, conférences d'experts, réalitée augmentée... Rejoignez les Electric Days, l'événement dédié aux énergies de demain

from Les dernières actualités de Futura https://ift.tt/3o0Ggfg

Dernier jour pour profiter de la super promo NRJ Mobile : 150 Go à moins de 10 euros

from Les dernières actualités de Futura https://ift.tt/2JfQmti

Une nouvelle tempête de poussière se lève sur Mars

from Les dernières actualités de Futura https://ift.tt/33lpxv3

Black Friday VPN : une réduction de 80 euros avec Express VPN

from Les dernières actualités de Futura https://ift.tt/368xIg2

Save the date : l'évènement des énergies qui changent tout

from Les dernières actualités de Futura https://ift.tt/2JbT579

Les hormones sexuelles féminines protégeraient contre les formes graves de Covid-19

from Les dernières actualités de Futura https://ift.tt/3mesaq8

Les T-Rex avaient de brusques poussées de croissance, leurs cousins non

from Les dernières actualités de Futura https://ift.tt/3fznGYx

mercredi 25 novembre 2020

The mental health impacts of having a FIFO work partner

People take up FIFO employment for a variety of reasons. In many cases, it’s predominantly about the money. FIFO jobs pay well compared with the same urban-based jobs and with clever fiscal management, people can make a substantial dent in their household debt, notably mortgage and housing loan repayments.

However, working FIFO also comes with downsides that sometimes all the amount of money in the world can’t adequately compensate for. As we’ve discussed in previous articles, mental health and substance abuse problems abound within the FIFO workforce. Also, unfortunately, some FIFO workers and their families get caught up in a cycle of dependency on FIFO income levels that can be very hard, or almost impossible, to break free of.

Living the lavish lifestyle and developing excessive spending habits have a tendency to rack up financial commitments ie CC debt, forcing people onto a treadmill where they’re obliged to keep doing a job they don’t particularly enjoy just to keep creditors at bay.

Whilst these factors are well known to have a health impact on the workers themselves, what’s often overlooked or underestimated are the effects they may also have on their family and friends, particularly their partners.

FIFO partners can also experience significant mental health issues

Mental health (both within the FIFO workforce and for partners) can be gauged by a series of basic metrics and how much someone experiences or feels each one applies to them.

- Burnout – how mentally exhausted someone is courtesy of work related strains and stresses

- Psychological distress – extent to which someone feels anxious and/or depressed

- Suicidal intent – how much they think about committing suicide*

- Perceived burdensomeness – how much someone feels they are a burden on family, friends and even work colleagues*

- Thwarted belonging – how much someone feels their ‘need to belong’ is being satisfied, or not*

* – these metrics are also used to measure suicide risk.

The WA MHC figures, and what they reveal about FIFO partners ….

Surveys done over the past several decades have built up a general picture of FIFO partners:

- The majority are female.

- When it comes to mental health, they appear to have considerably more issues than their non-FIFO associated peers in society. Indeed, on some of the above mental health metrics they score similarly to FIFO workers. For example:

- Many FIFO partners have equally as high scores for perceived burdensomeness.

- Around one third of the survey respondents (32.7%) experience psychological distress levels (high to very high) far above the norm for their societal female peer groups (13.6%). Conversely, nearly twice as many females in the ‘norm’ group (65%) report LOW levels of psychological distress compared to female FIFO partners (38.1%).

- Similarly, around a third of those FIFO partners who took part in the surveys also have high burnout scores.

- However, their suicidal intent and thwarted belonging scores are typically lower than those of FIFO workers.

- Certain groups of FIFO partners seem to be more prone to experiencing some types of mental health issues than other groups.

- A sizeable proportion of younger FIFO partners – 25 – 34 years (41.3%) and 35 – 44 years (32%) for example reported experiencing significant (high to very high) levels of psychological distress. The female population norms for these levels of psychological distress for these age groups are 11.7% and 13.7% respectively.

- The majority of older partners (45 – 54 years) typically reported feeling low to moderate levels of psychological distress with less than a fifth (18.3%) experiencing high to very high levels. This is consistent with the female population norm of 15.4% for this age group.

What is also interesting about these statistics is that the percentages of FIFO partners experiencing low levels of psychological distress in each of these 3 age groups (27.5% / 36% / 56.3% respectively) are lower (considerably so for the 2 younger age groups) than the female population norms (63.1% / 64.7% / 64% respectively). Could this be a reflection of the greater financial security that comes with having a FIFO worker partner earning good money?

The other interesting trend is that where the tendency towards high to very high levels of psychological distress in FIFO partners appears to reduce (41.3% / 32% / 18.3% respectively) as they get older, the reverse happens in the wider female population (11.7% / 13.7% / 15.4% respectively).

The person – coping with a FIFO lifestyle, FIFO partners, and personal / family relationships

Research shows that ‘person factors’ – how a FIFO worker copes (their ‘coping style’) with the stresses of the FIFO lifestyle and the degree of ‘connection’ they feel with their job – appears to have some bearing on:

- how personal relationships with their partner, family and friends pan out, and

- the emotional, social, and psychological well being of their partner

“…. affective relationships are defined as those interpersonal relationships that satisfy our needs for emotional interactions with significant others; they include the needs for emotional support, exchanging warm attention, and giving nurture.” The Affective Relationships Model

A disengaged, unemotional coping style, a detached relationship with work, and poor personal relationships with work colleagues is often associated with negative wellbeing and mental health issues in an employee.

Not surprisingly, research indicates that families and relationships in which the FIFO worker is like this are more likely to be dysfunctional, with the partner in particular experiencing high levels of depression, anxiety, and thwarted belonging. Likewise, FIFO worker problems with transitioning between work and time off is also linked to higher family dysfunction. These issues appear to be exacerbated when the FIFO worker is obliged by circumstances ie financial / lifestyle commitments, to remain in the job.

Conversely, FIFO workers with a positive, engaged, and affective coping style, who enjoy the FIFO lifestyle, have a good ’emotional attachment’ to their work along with positive personal relationships with colleagues typically experience better wellbeing and mental health. This has positive flow on effects on their families and partners, and for their relationships generally. Notably, their partners tend to experience less depression, anxiety, and burnout, don’t suffer as much from thwarted belonging, and are considerably healthier when it comes to psychological and emotional wellbeing, and overall mental health.

The job – what a FIFO worker does, who employs them, the quality of their line management, and employer policies around mental health and wellbeing, affects their partner

Some interesting insights into the relationships between the type and amount of work a FIFO worker does and the mental health and wellbeing of their partner came to light in the 2018 WA Mental Health Commission study.

For example, the partners of FIFO workers employed in the construction phases of a project or who work for sub contractors reported feeling less satisfied and happy (emotional wellbeing) than the partners of FIFO workers who work in the production phases of the operation or are employed directly by the mining company. Further, the partners’ social wellbeing is also often worse when their partner works in the construction phases. These issues may be linked to:

- Job security and future work concerns for workers in the construction phases of a project, which affects their partners

- The fact that FIFO workers employed by contractors are more likely to get the raw end of the deal when it comes to rosters, accommodation, access to camp facilities and recovery options, and general employment conditions. This affects their mental health and wellbeing with likely flow on effects on their partner. We discussed this in a previous article.

FIFO worker multi-tasking is out for healthy FIFO partners

When it comes to a FIFO job, diversity and multi-tasking may not be such a good thing, or at least not for FIFO partners. It seems that the more task diversity / responsibilities a FIFO worker takes on at work, the greater the likelihood that his or her partner has, or will have, issues with personal growth and self-acceptance (psychological wellbeing). It may be that these partners notice and/or feel their FIFO working partner is overloaded with responsibilities or trying to do too many different things, with corresponding negative impacts on their own wellbeing.

Surprisingly though, there seems to be a correlation between FIFO workers who do a lot of work ie have a big workload, and how much their partners consider themselves a ‘burden’ on society (perceived burdensomeness). As it turns out, the more work the FIFO worker does, the less likely their partner is to feel ‘burdensome’. This could be because the partner believes the FIFO worker is ‘contributing enough to society’ for both of them.

Quality and independent time off is key for FIFO worker and partner mental health

FIFO partners typically report being less depressed and anxious, and experience a greater sense of overall emotional and social wellbeing when their FIFO worker has autonomous time off at home. Translated, this means partners are much happier when the FIFO worker is not contacted by their work whilst they’re at home on R and R! Incidentally, partners are also happier when the worker gets similarly autonomous time off at work.

Management and company policies around mental health matter to FIFO partners

The way a company, and thus its management, approaches and deals with the health and safety of their employees plays a major role in their employees’ overall mental wellbeing across all metrics. It also seems to affect the mental wellbeing of FIFO partners – emotionally, psychologically, and socially. Notably:

- Proactive line management attitudes to O H and S has positive links with the psychological wellbeing of FIFO partners;

- The more on-site help and recovery options (mess facilities, social activities etc) there are for employees, the better their partners emotional wellbeing is;

- Conversely, having more recovery options available on-site adversely affects social wellbeing scores for partners, perhaps because more time spent ‘socialising’ on site means less time communicating with their partners and families;

- It’s often assumed (rightly or wrongly) that mental health and wellbeing are given higher priority than other aspects of a FIFO worker’s life, such as their physical health and wellbeing. This seemingly can cause some psychological wellbeing issues for partners, possibly because they feel the other aspects are not receiving the attention they should, thus negatively impacting their own wellbeing.

Alcohol, smoking, drugs, and the FIFO partner

Like FIFO workers themselves, alcohol, smoking, and drug use amongst FIFO partners differs in many respects from their non-FIFO peers (the ‘norm’ group). Whilst they don’t consume alcohol on a daily basis as much as the norm group does (2.4% compared to 4.5% respectively), they do drink more frequently on a weekly basis (53.6% compared to 32.7%).

Further, only 4.6% of FIFO partners had either not drunk alcohol in the 12 months preceding the 2018 NMHC survey or didn’t drink at all compared to 22.2% of the norm group.

When it comes to quantity of alcohol consumed, 3 times as many FIFO partners (37.8%) indulge in lifetime risky drinking (2+ standard drinks a day) than the norm (10.3%). Likewise, more FIFO partners indulge in single occasion risky drinking (32.9%) than do the norm group (17.5%). When it comes to low risk drinking (2 or less drinks a day) 67% of the norm group are in this category compared to 50.9% of FIFO partners.

FIFO partners appear to smoke marginally less than the norm group but their pharmaceutical drug use is significantly higher:

- 32.6% had used analgesics and pain killers compared to 3.6% of the norm group, and

- 13.8% had used sleeping pills and tranquillisers compared to 1.6% of the norm group.

In summary – a number of associations in the data have been observed between individual and work-related aspects of FIFO work, and the mental health and wellbeing of FIFO partners. However, these associations are often just that – associations suggested by the data.

Significantly, not all FIFO partner mental health and wellbeing issues (scores) can be fully or directly explained by the connected FIFO worker scores. Whilst some of the connections are obvious, many are tenuous or inconclusive at best. One can draw assumptions from the data but ultimately, the researchers involved in the 2018 WA Mental Health Commission Study concluded that the mental health and wellbeing of FIFO partners should be considered a separate issue to that of FIFO workers. And that FIFO work factors that do ‘spill over’ into the lives of partners should be identified and investigated separately.

So what can we conclude from this study, and others like it?

Notably, that FIFO partners statistically appear to enjoy better mental health and wellbeing when their FIFO worker:

- is not contacted by work whilst at home on R and R (ie enjoys more autonomy during their off time at home)

- has a range of recovery options available to them on site

- is positively and emotionally attached to their job and the FIFO lifestyle generally

- enjoys positive personal relationships with co-workers

- has a leadership team that is seen to be committed to mental health and safety

Standout negative associations with FIFO partner mental health and wellbeing include:

- conflicts between work and family,

- the FIFO worker being employed by a contractor or working in the construction phase of a project.

(This article first appeared in Mining International Inc.)

from MINING.COM https://ift.tt/33ift64

Bon plan enceinte Marshall : 73 € de réduction sur Cdiscount

from Les dernières actualités de Futura https://ift.tt/2KJyOH3

Un million de Chinois auraient reçu les vaccins expérimentaux de Sinopharm

from Les dernières actualités de Futura https://ift.tt/3fvRmFW

Gravité quantique : l'écume de l'espace-temps, une clé du Big Bang au vivant ?

from Les dernières actualités de Futura https://ift.tt/2V1DFoK

Bon plan Cdiscount : les meilleures réductions TV avant le Black Friday

from Les dernières actualités de Futura https://ift.tt/370N31i

Bon plan VPN : 3 mois offerts avec ExpressVPN !

from Les dernières actualités de Futura https://ift.tt/3pZgTMs

Hudbay Minerals’ 777 mine back at full tilt

Canadian miner Hudbay Minerals (TSX, NYSE: HBM) has resumed full production at its 777 zinc-copper mine in Flin Flon, Manitoba, following a skip hoist incident in October that forced the company to halt operations.

The Toronto-based company resumed limited operations in late October, while completing repairs to the damaged shaft, which cost less than the C$5 million ($3.8m) originally estimated.

Hudbay temporarily reassigned equipment and staff from the 777 mine to the Lalor mine in Snow Lake during that time, in an effort to offset lost production.

“The shaft incident was an unfortunate event, but the team responded quickly and was successful in bringing this important asset back into full production ahead of schedule,” president and chief executive officer Peter Kukielski said in the statement.

The miner said that while fourth quarter production and sales volumes will be impacted, it continues to expect the Manitoba business unit to achieve its full year production and unit cost targets for 2020.

The 777 mine is near the end of its productive life, with closure slated for 2022. Hudbay’s focus has been shifting toward its Snow Lake operations since the gold-rich Lalor deposit was put into production there in 2014.

from MINING.COM https://ift.tt/3nUArj7

Le cacao rendrait plus intelligent et on sait pourquoi

from Les dernières actualités de Futura https://ift.tt/3pUdVZA

Qu'est-ce que la géodésie ?

from Les dernières actualités de Futura https://ift.tt/3l1qwGV

Starship : Elon Musk a dévoilé la date du premier vol à haute altitude du prototype SN8

from Les dernières actualités de Futura https://ift.tt/369hTWF

Women in Mining report receives record nominations in 2020

Non-profit organization Women in Mining UK announced that its yearly global report broke a record in 2020, after receiving 626 nominations from 60 countries.

The document, titled “100 Global Inspirational Women in Mining” (WIM100), was recently published in book format and it highlights the wealth of female talent within the global mining industry

“The 100 women featured in this edition were selected due to their inspiring contribution towards a stronger, safer and more sustainable mining industry,” the NGO said in a media statement. “This includes making positive and impactful changes, advocacy and a desire to empower others, perseverance in the face of adversity, and an ability to find solutions to challenges.”

In this year’s nominations, there was an increase in women working in the fields of ESG and sustainability

According to WIM-UK, in this year’s nominations, there was an increase in women working in the fields of ESG and sustainability. Many of these women said that one of their main goals is to push for modernizing the mining industry.

“Stereotypes about women in mining can be stubborn but this book shows the breadth of roles and careers women are occupying and the diverse ways in which they enter the industry,” Alex Buck, managing director of WIM, said in the brief. “Through these amazing stories, we hope to inspire more women to seek a career in mining, celebrate the contributions women are already making and demonstrate to companies, large and small, the value of diversity to the long-term success of their business for every stakeholder.”

Among the women highlighted in the document are Loreto Acevedo, co-founder or InDiMin in Chile, a mining tech start-up whose Smart Mining Coach gives real-time feedback about processes; Florence Adu, who chairs Newmont Ghana’s Women and Allies (W&A) Network, part of the mining giant’s global inclusion and diversity strategy; Sumathi Angusamy, the global head of environment, health and sustainability at Vedanta, focusing on energy management and environmental compliance; and Laura Tyler, chief technical officer at BHP, who focuses on securing options in future-facing commodities through exploration and drives improvements on productivity, safety, and sustainability.

Besides women in mining companies, the WIM100 includes people that work at hydroelectric plants, commodity departments in banks, government departments, consultancy firms, star-ups, academia and NGOs.

from MINING.COM https://ift.tt/33gsLjs

Mexico approves Minera Alamos’ environmental statement for La Fortuna gold project

Mexico’s Secretariat of Environment and Natural Resources – Semarnat approved Minera Alamos’ (TSXV: MAI) environmental impact statement for its La Fortuna gold project in the northwestern Durango state.

According to Minera Alamos, this approval means that the company now has all the key federal approvals necessary for the construction of a commercial-scale mine and associated processing facilities on the property.

In a press release, the Canadian miner explained that the permit covers 217 hectares approved for mining use, which includes the required areas for development of the Fortuna Main Zone gold deposit and the related gold extraction and recovery facilities, as well as critical site supporting infrastructure.

The EIS is expected to remain in good standing for a period of 52 years

“The scope of the operating permit includes the initial open-pit mine, waste dump areas, crushing, grinding and flotation facilities and all related infrastructure,” the brief states. “Allowances were made to include additional stages not required for the current start-up plan (i.e. concentrate cyanidation and detoxification) to provide the company with added flexibility in the future.”

Minera Alamos said that the EIS is expected to remain in good standing for a period of 52 years which covers the potential construction, operations, and closure stages for the project.

The validity period, however, depends on the miner complying with a series of standard conditions from the Semarnat that are included to protect and monitor the environment and must be implemented by the company in order to satisfy the permit requirements.

The 6,200-hectares La Fortuna project consists of four mining concessions and was acquired by Minera Alamos in May 2016 from Argonaut Gold.

from MINING.COM https://ift.tt/3m7dIzU