mercredi 31 mars 2021

La sédentarité tuerait directement plus de 4 millions de personnes chaque année dans le monde

from Les dernières actualités de Futura https://ift.tt/2QS72eh

Stars are aligning for uranium price rally

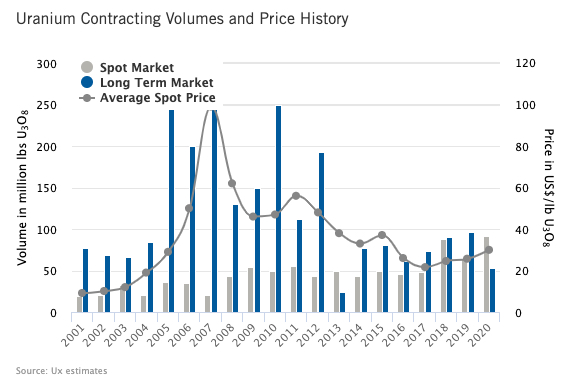

The uranium market is emerging from years in the doldrums as the overhang from the nuclear disaster in Japan is cleared and global demand picks up steam.

The spot price for U3O8 moved above $30 per pound for the first time this year as uranium producers and mine developers hoover up above-ground inventories and reactor construction continues apace.

Two new research notes from BMO Capital Markets and Morgan Stanley say today’s price marks a floor and predict a rally in prices over the next few years to the ~$50 level by 2024.

The stars seem to be aligning for a new phase of nuclear energy investment with the US, China and Europe bolstering the bull case for the fuel this month.

Although nuclear energy was not mentioned explicitly in the $2 trillion Biden infrastructure proposal released today, its federally mandated “energy efficiency and clean electricity standard” is hardly achievable without it.

Over the weekend leaked documents showed a panel of experts advising the EU is set to designate nuclear as a sustainable source of electricity which opens the door for new investment under the continent’s ambitious green energy program.

China’s 14th five-year plan released a fortnight ago also buoyed the uranium market with Beijing planning to up the country’s nuclear energy capacity by 46% – from 48GW in 2020 to 70GW by 2025.

The opacity of the inventory situation remains a key uncertainty to price – see for example palladium, which needed almost 7 years of deficit before the price really took off

There are several factors working in uranium’s favour, not least the fact that annual uranium demand is now above the level that existed before the 2011 Fukushima disaster when Japan shut off all its reactors:

- Uranium miners, developers and investment funds like Yellow Cake (13m lbs inventory build up so far) are buying material on the spot market bringing to more normal levels government and utility inventories built up over the last decade

- Major mines are idled including Cameco’s Cigar Lake (due to covid-19) which accounts for 18m lbs or 13% of annual mine supply. The world’s largest uranium operation McArthur River was suspended back in July 2018 taking 25m lbs off the market.

- Permanent closures so far this year include Rio Tinto’s Ranger operation in Australia (3m lbs) and Niger’s Cominak mine (2.6m lbs) which had been in operation since 1978. Rio is exiting the market entirely following the sale of Rössing Uranium in Namibia.

- Like Cameco, top producer Kazatomprom which mined 15% less material last year due to covid restrictions has committed to below capacity production (–20% for the state-owned Kazakh miner) for the foreseeable future.

- Price reporting agency and research company UxC estimates that utilities’ uncovered requirements would balloon to some 500m lbs by 2026 and 1.4 billion lbs by 2035.

- Roughly 390m lbs is already locked up in the long term market while 815m lbs have been consumed in reactors over the last five years according to UxC

- There are 444 nuclear reactors in operation worldwide and another 50 under construction – 2 new connections to the grid and one construction start so far in 2021

- Much cheaper and safer, small modular nuclear power reactors which can readily slot into brownfield sites like decommissioned coal-fired plants (or even underground or underwater) are expected to become a significant source of additional demand

There are caveats to this rosy scenario however.

Morgan Stanley warns that “the opacity of the inventory situation remains a key uncertainty to price – see for example palladium, which needed almost 7 years of deficit before the price really took off.”

BMO says given the still high levels of inventories “acute shortages and price squeezes are extremely unlikely, both for this year and the foreseeable future,” adding that “there is no obvious need for new mine supply in the near future.”

from MINING.COM https://ift.tt/3rFS0oO

Vale sells New Caledonia nickel assets to Trafigura

Vale (NYSE: VALE) said on Wednesday it had concluded the sale of its nickel and cobalt operations in New Caledonia, a French territory in the Pacific, to a consortium called Prony, which includes commodity trader Trafigura.

While the Brazilian miner did not disclose the exact terms of the deal, it said that $1.1 billion will be invested in the New Caledonia assets, with $555 million coming from its subsidiary Vale Canada Ltd.

“Vale’s intent from the beginning of the divestment process was to withdraw from New Caledonia in an orderly and responsible manner. This deal accomplishes that,” chief executive Eduardo Bartolomeo said in the statement.

Vale will have a supply contract to off-take part of the nickel produced, the world’s top nickel and iron ore producer, it said.

The Rio de Janeiro-based miner had been on the hunt for a buyer for over a year, but the sale was complicated by the fact that New Caledonia has been debating getting its independence from France, and where nickel is one of their main sources of wealth.

Click here for an interactive nickel price chart

The South Pacific archipelago, 1,200 km (750 miles) east of Australia, was gripped by riots over the sale process of Vale’s local business last month, with protesters saying a locally-led offer had been unfairly overlooked.

Vale Nouvelle Calédonie (VNC), the operator of the troubled Goro nickel-cobalt mine, proved to be a financial burden for Vale since it began operations two years behind schedule in 2010.

Mounting issues, including a $1.6 billion-write down related to the ailing mines, pushed the mining giant to announce in 2019 its intention to exit New Caledonia.

Vale later cut its 2020 nickel production guidance to 200,000 – 210-000 tonnes per year from 240,000 tpy to account for the anticipated loss of VNC’s 60,000-tpy output.

A few weeks later, the miner revealed it had received non-binding offers for VNC, which includes the Goro mine, a processing plant and the port of Prony.

Goro’s potential

Analysts estimate the nickel market could face a shortage as soon as 2023. A recent announcement by Tesla boss Elon Musk aimed at locking supply of the metal used in the batteries that power its electric vehicles (EVs), seemed to confirm shortfall fears.

Musk promised a millionaire contract to any company able to provide Tesla with sustainable nickel, which helps cram more energy into cheaper and smaller battery packs, allowing EVs to charge faster and travel farther between plug-ins.

Tesla (NASDAQ: TSLA) became a “technical adviser” at the New Caledonia nickel mine in early March. The move followed the company’s announcement that it was planning to move into the mining business to secure resources for battery production.

While Goro has the capacity to produce 60,000 tpy of nickel in the form of nickel oxide, it has never performed to full capacity due to design flaws and operational commissioning issues.

New Caledonia is the world’s fourth-largest nickel producer, behind Indonesia, the Philippines and Russia.

(More to come…)

from MINING.COM https://ift.tt/3rycMGM

BMW, Volvo, Google and Samsung call for ban on deep-sea mining

BMW, Volvo, Google and Korean battery maker Samsung SDI, have vowed not buy metals produced from deep-sea mining until the environmental risks of the activity are “comprehensively understood”.

The companies are the first global businesses to support a World Wildlife Fund (WWF) call for a moratorium on mining the seabed, which could deal a major blow to firms planning to mine the deep ocean this decade.

The signatories have also said they will not finance any deep sea mining companies.

“Before any potential deep seabed mining occurs, it needs to be clearly demonstrated that such activities can be managed in a way that ensures the effective protection of the marine environment,” they said in the statement.

“All alternatives to deep sea minerals must be explored as a matter of urgency, with a focus on reducing demand for primary metals, transitioning to a resource-efficient, closed-loop materials economy, and developing responsible terrestrial mining practices,” the four companies noted.

“All alternatives to deep sea minerals must be explored as a matter of urgency, with a focus on reducing demand for primary metals”

BMW, Volvo, Google and Samsung SDI

Mining the ocean floor has been promoted as an alternative to land-based mining, as demand for minerals needed for a green energy transition, such as cobalt and nickel, are set to exceed current production rates by 2030.

Yet regulations to support the emerging activity have yet to be agreed upon by the International Seabed Authority (ISA). The UN-backed body of 167 countries has already issued exploration contracts to 21 companies, but they cannot begin mining until regulation is passed.

An international team of researchers published in 2018 a set of criteria to help the ISA protect biodiversity from deep-sea mining activities while it prepares global rules.

According to the US Geological Survey, the deep-sea accounts for more than half the world’s surface and contains minerals in concentrations several times higher than those found in all land reserves combined.

Targeting nodules

The main target of companies planning to mine underwater are polymetallic nodules. These small rocks, which lie in a shallow layer of mud on the seafloor, are rich in cobalt, nickel, copper, manganese and rare earths.

Scientists and explorers have also identified cobalt-rich crusts, located shallower than nodules and sulphates.

Recent reports, including one commissioned by the High Level Panel for a Sustainable Ocean Economy (Ocean Panel), have called for further research to fill gaps in knowledge before any seabed mining is allowed. They have also argued for the need to set protected zones across all ocean regions under the ISA’s jurisdiction.

The European Parliament has also called for a ban on seabed mining until the environmental impacts and risks of disturbing unique deep-sea ecosystems are understood.

In the resolution, passed three years ago, the legislators also urged the European Commission to persuade member states to stop sponsoring and subsidizing licenses to explore and exploit the seabed in international waters as well as within their own territories.

Conservationists recommend countries to encourage the recycling of battery metals to reduce the need of finding new supplies.

Supporters of the activity, however, argue that the extraction of battery metals from the ocean floor could potentially eliminate, or dramatically reduce, most of the environmental and social impacts associated with the extraction of riches from the Earth’s surface.

Companies actively seeking to mine the ocean floor include GSR, UK Seabed Resources and DeepGreen, which recently announced plans to go public in a merger with a special purpose acquisition company (SPAC).

from MINING.COM https://ift.tt/31zIb0Z

Journée coupon Rakuten : Profitez de 30€ offerts dès 299€ d'achat sur tout le site

from Les dernières actualités de Futura https://ift.tt/3m5ZK26

Comment se débarrasser des punaises de lit ?

from Les dernières actualités de Futura https://ift.tt/3uaslpT

New fuel from plastic waste aims to replace fossil fuels in the marine industry

London-based Clean Planet Energy announced the creation of two new ultra-clean fuels manufactured to replace fossil fuels in the marine industry.

According to the company, the fuels are produced using non-recyclable waste plastics as the feedstock, therefore removing waste that would otherwise go to incineration, landfill or into the ocean. In addition to reusing these materials, when employed in ships and other vessels, the fuels are expected to provide CO2e reductions of over 75%, and significantly reduce harmful air-pollutants such as sulphur by up to 1,500x.

The products have been dubbed “ultra-clean marine residual fuel” – also known as bunker fuel or fuel oil -, which is said to meet international ISO 8712 2017 standards, and “premium marine distillate fuel,” which matches the highest EN15940 diesel specification.

“Under the IMO 2020 [International Maritime Organisation] regulations implemented last year, a ship with a scrubber installed onboard is allowed to emit 35,000ppm of sulphur into the sea when burning fossil marine fuel oil, whilst a ship without a scrubber is allowed to emit 5,000ppm of sulphur into the air”, the firm’s CTO, Andrew Odjo, said in a media statement. “In contrast, Clean Planet Energy’s marine residual fuel has a sulphur content of just 35ppm, and Clean Planet Energy’s marine distillate has a sulphur content of just 3ppm. This means that ships using Clean Planet Ocean’s marine distillate fuel can reduce sulphur pollution by over 1500x compared to ships using fossil fuel without a scrubber, and by more than 10,000x compared to ships with a scrubber”.

Ships using Clean Planet Ocean’s marine distillate fuel can reduce sulphur pollution by over 1500x compared to ships using fossil fuel without a scrubber, and by more than 10,000x compared to ships with a scrubber

Odjo said that the plan is to produce these circular fuels inside eco-plants that can accept and convert some of the 203 million tonnes of non-recyclable waste-plastics expected to be discarded worldwide in 2021.

Two of these eco-plants are currently in the construction phase, with another four in development. Each facility is able to process 20,000 tonnes of waste plastics every year but the company’s final goal is to recycle and reuse over 1 million tonnes of waste plastics per annum.

“There is currently no legitimate and scaled alternative compared to using carbon-based fuels in the marine and aviation sectors. Whereas cars are moving to electric, the lifespan of large vessels means we’ll be stuck using fossil fuel engines for many years to come,” Odjo said. “By using non-recyclable waste plastics as a feedstock for fuels in these industries, we can reduce the daily CO2e emissions by 75%, keep fossil-oil in the ground, and win valuable time in the world’s battle to hit net-zero carbon emissions.”

from MINING.COM https://ift.tt/3wfc19b

ABB, Hitachi to develop GHG-reducing solutions for the mining industry

Tech and equipment company ABB and Hitachi Construction Machinery signed a memorandum of understanding to jointly develop solutions aimed at reducing greenhouse gas emissions associated with heavy machinery in mining.

In a press release, the companies said that they plan to explore the possibilities of applying ABB’s electrification, automation and digital solutions to mining trucks and excavators provided by Hitachi as part of wider efforts with mine operators to electrify all processes from pit to port.

Hitachi is also expected to share its expertise in driverless operation and labor-saving technologies.

“We are ready to work more with OEMs to establish a common approach for the market and, through strategic collaborations, provide solutions that can help enable a low-carbon society and make mining operations more responsible,” Joachim Braun, ABB’s division president for process industries, said in the media brief. “New emissions-reducing technologies can transform the energy-intensive mining industry to achieve an even more productive, but also sustainable future.”

According to Braun, this collaboration with Hitachi is one of many that ABB is looking to develop with OEMs to accelerate the transition to all-electric mines.

from MINING.COM https://ift.tt/2PkBRI4

Super deal chez B&You : 5 Go de 4G à seulement 4,99 €/mois

from Les dernières actualités de Futura https://ift.tt/31B1reE

Covid-19 : les variants ne semblent pas échapper aux lymphocytes T cytotoxiques

from Les dernières actualités de Futura https://ift.tt/3fuF1E4

Congo launches state-owned cobalt miner

The Democratic Republic of Congo (DRC) has officially begun operations at Entreprise Générale du Cobalt (EGC), a state-owned company with monopoly rights to the purchase and sale of the country’s hand-mined cobalt.

EGC, created a year ago to help control artisanal supplies and boost government revenue through price controls, will sell cobalt hydroxide under a five-year contract with trading house Trafigura.

The non-exclusive supply deal will also see Trafigura finance the creation of strictly controlled artisanal mining zones, buying centres and logistics to trace supply.

DRC holds around 70% of the world’s reserves of cobalt, crucial for the lithium-ion batteries used in the fast-growing electric vehicle (EV) sector.

Congo’s artisanal miners are the world’s second largest source of cobalt after the country’s industrial mines. Consultancy CRU expects the DRC to produce more than 100,000 tonnes of cobalt this year or 71% of the global total, of which 8,000 will come from artisanal sources.

As part of the offtake deal with EGC, Trafigura will fund the creation of up to six strictly controlled artisanal mining zones.

Child labour and a lack of safety measures in artisanal mining are behind many initiatives to formalize the sector.

According to Amnesty International, children as young as seven have been found scavenging for rocks containing cobalt in the DRC. The group also claims to have evidence that the cobalt those miners dig has been entering the supply chains of some of the world’s biggest brands.

“All of us engaged in this endeavour are aligned in a firm commitment to collaborate transparently with our stakeholders and to ensure that together we create effective solutions for responsibly sourced cobalt,” Jeremy Weir, Trafigura executive chairman and CEO said in the statement.

“Ultimately, we believe that a formalized artisanal mining sector can transform lives and serve as a catalyst for economic growth in the DRC,” he said.

Cleaning the sector’s image

EV makers including Tesla and Volkswagen have recently vowed to help improve working conditions in the DRC. The metal, a by-product of copper or nickel, is an essential metal in the production of the batteries that power EVs and high tech devices.

China’s biggest cobalt producer, Huayou Cobalt, which supplies to LG Chem as well as Volkswagen, said last year it would stop buying from artisanal miners in the DRC.

Trafigura has been involved in efforts to monitor and improve artisanal cobalt mines in the Central African nation since 2018. That year, it opened a pilot project to formalize informal miners at Chemaf Sarl’s Mutoshi mine.

After raising $450 million in 2019 for the facility, Trafigura had to suspend the project in March last year, due to the global pandemic.

Official figures show that more than 200,000 people make their living digging cobalt and copper in Congo’s southeast Katanga region.

EGC is a wholly owned subsidiary of state-miner Gécamines. The new company has not disclosed the terms of its agreement with Trafigura.

from MINING.COM https://ift.tt/3dkgOxm

« Celui qui fait peur » : découverte d'un dinosaure redoutable !

from Les dernières actualités de Futura https://ift.tt/3rI8s7L

Bon plan TV Samsung incurvée : 236 € d'économie sur Cdiscount

from Les dernières actualités de Futura https://ift.tt/2O7dL2Y

Comment les ondes 5G peuvent alimenter des appareils

from Les dernières actualités de Futura https://ift.tt/39r1MVq

Bon plan montre GPS : la Polar Vantage M est en réduction sur Cdiscount

from Les dernières actualités de Futura https://ift.tt/3lt5imX

PayPal s’ouvre au Bitcoin et aux cryptomonnaies Litecoin, Ethereum et Bitcoin Cash

from Les dernières actualités de Futura https://ift.tt/3m894T1

SpaceX : explosion en vol du prototype SN11 après un décollage dans le brouillard

from Les dernières actualités de Futura https://ift.tt/3m8NXAb

La comète interstellaire 2I/Borisov livre un de ses secrets

from Les dernières actualités de Futura https://ift.tt/2O7Doke

Record de la plus basse température jamais mesurée dans un nuage

from Les dernières actualités de Futura https://ift.tt/3sFFIhk

Bon plan logiciel vidéo : -65% de réduction sur VideoProc !

from Les dernières actualités de Futura https://ift.tt/3rAm9Wp

Un enfant prend le contrôle du Twitter du commandement des armes nucléaires

from Les dernières actualités de Futura https://ift.tt/3fGCXJh

OGM : comment l'Europe a manqué une bonne occasion de réduire ses émissions de gaz à effet de serre

from Les dernières actualités de Futura https://ift.tt/2O8THxj

Vos yeux révèlent quasiment tous les secrets sur votre identité

from Les dernières actualités de Futura https://ift.tt/2PpsMOa

mardi 30 mars 2021

Un sursaut gamma a révélé un trou noir intermédiaire, peut-être primordial

from Les dernières actualités de Futura https://ift.tt/3wdr9nw

50-year gold price vs stocks chart shows bullion fair value above $2,500

Gold has been flirting with a bear market this week with the price down nearly 20% from the intra-day high of $2,089 an ounce reached in August last year.

Still, bullion remains up nicely from a year ago and on a longer time horizon has performed in a way that should satisfy most gold bugs.

But in comparison to stock markets, gold doesn’t quite look like the store of value or lucrative investment it is made out to be.

Gold underperformance relative to the S&P 500 Index is striking and even at its record high was a bargain on an historical basis.

Today, you need just over 2.3 ounces to buy the market. The ratio is now back to where it was in August 2018 when an ounce of gold could be picked up for $1,200.

The ratio is now back to where it was in August 2018 when an ounce of gold could be picked up for $1,200

The ratio today is also on par with that of August 1971, when the US left the gold standard and gold was pegged at $35 an ounce. The average since then is 1.56.

You can argue that during gold’s spike in 1980 to $850 an ounce – in inflation-adjusted terms still the all-time high – it lost touch with stock values (and some would say reality) entirely.

But even during the August 2020 peak when gold averaged $1,968 for the month did it return to the historical ratio.

All things being equal at today’s S&P500 index approaching 4,000 points, the fair value for gold is north of $2,500 an ounce, which either means gold should return to an uptrend soon or stocks are in for a real beating.

from MINING.COM https://ift.tt/3sCeg4b

Origine du coronavirus : l'accident de laboratoire jugé extrêmement improbable par l'OMS

from Les dernières actualités de Futura https://ift.tt/3sOl27b

Condor Gold touts drilling results at La India

Condor Gold (LON:CNR) (TSX:COG) said on Tuesday that first drill results from the starter pit at its flagship La India gold project in Nicaragua reinforced the company’s confidence on the geological model, mineral resource, reserve calculation and mining plan.

The miner, which acquired 85% of the land within the permitted site in August 2020, has completed 40 drill holes on the northern starter Pit, for a combined 2,170 m of infill and reverse circulation replacement drilling completed within both of La India’s initial pits.

According to a mineral resource estimate completed in January 2019, the La India project comprises 9.85 million tonnes at 3.6 g/t gold for 1.14 million oz gold in the indicated category, as well as 8.48 million tonnes at 4.3 g/t gold for 1.17 million oz gold in the inferred category.

The La India vein set hosts an open pit mineral resource of about 8.37 million tonnes at 3.1 g/t gold for 837,000 oz gold in the indicated category and 887,000 tonnes at 2.4 g/t gold for 69,000 oz gold in the inferred category.

Beneath the La India open pit is an underground mineral resource estimate of 678,000 tonnes at 4.9 g/t gold for 107,000 oz gold in the indicated category and 1.71 million tonnes at 5.6 g/t gold for 309,000 oz gold in the inferred category.

The la India open pit hosts probable mineral reserves of 6.9 million tonnes at 3.01 g/t gold for 675,000 oz gold with all-in-sustaining-cash costs of $690 per ounce.

Trail blazer

Condor Gold staked concessions in Nicaragua, Central America’s largest country, in 2006. Since then, mining has significantly taken off in the country due to the arrival of foreign companies with the cash and expertise to tap into existing reserves.

The government of Nicaragua granted Condor Gold in 2019 the 132.1 km2 Los Cerritos exploration and exploitation concession, which expanded the La India project concession area by 29% to a total of 587.7 km2.

Condor also attracted a partner — Nicaragua Milling. The privately held company, which took a 10.4% stake in the miner in September 2019, has operated in the country for two decades.

from MINING.COM https://ift.tt/3cwJeoF

La lumière polarisée de la comète interstellaire 2I/Borisov livre un de ses secrets

from Les dernières actualités de Futura https://ift.tt/3rHj86Y

SpaceX : RIP pour le prototype SN11 qui a explosé en plein vol !

from Les dernières actualités de Futura https://ift.tt/31wQ0Vc

Les vaccins à ARNm diminuent drastiquement le risque d'être infecté par le coronavirus

from Les dernières actualités de Futura https://ift.tt/3dySoAz

Eye tracking : vos yeux révèlent quasiment tous les secrets de votre identité

from Les dernières actualités de Futura https://ift.tt/3rDE8LA

B2Gold denied exploration permit renewal in Mali

Canada’s B2Gold (TSX: BTO) said the Mali government had not renewed the Menankoto exploration permit, which formed a part of the Anaconda area and is located 20 km north of its flagship Fekola mine license area.

The Vancouver-based company said that its Malian subsidiary, Menankoto SARL, had applied for a one-year renewal of the permit in early February 2021.

“The company strongly believes that Menankoto is entitled to a renewal of the permit under applicable law and is engaged in ongoing discussions with the Malian government to clarify the situation,” B2Gold said.

The miner noted that since beginning its activities in Mali it has enjoyed a “positive and mutually beneficial relationship” with the country’s government.

Even after last year’s military coup in the West African nation, the company decided to boost output at its Fekola mine and examine other opportunities both in the country and across the region.

Since beginning its activities in Mali, B2Gold has enjoyed a “positive and mutually beneficial relationship” with the country’s government

West Africa, one of the last frontiers for gold-mining investors, is likely to remain in the spotlight as the industry consolidates, chief executive Clive Johnson told MINING[dot]COM in September during a mining symposium.

The executive noted at the time that while B2Gold planned to examine deals, it would not “overpay” for assets as strong gold prices push up valuations.

He also emphasized the importance of gold mining to Mali, which accounts for 10% of the nation’s GDP and 25% of the government’s revenue that comes through taxes and other streams.

B2Gold, which expanded the mill at Fekola last year, noted the mine is projected to produce 530,000 to 560,000 ounces of gold in 2021. The figure does not include the Anaconda area, it said.

from MINING.COM https://ift.tt/3u1rtne

NEO’s silicon anodes achieve long-term cycling

NEO Battery Materials (TSXV: NBM) announced that it has achieved a highly stable long-term cycling ability using 100% silicon (Si) anodes.

In a press release, the Vancouver-based firm explained the pure Si anode that does not contain graphite anode materials has been successful in demonstrating these results at automotive rates of charge and discharge for over 1000 cycles.

According to the company, its proprietary uniform nano-coating technology also allowed it to reduce capacity decay to less than 25% after running 1000 cycles.

“Our patented elastomer nano-coating layer which has both electronic and ionic conductivity is able to compensate for the mechanical stress of the Si anode during a long-term cycling test. Our technology effectively scatters the stress from the Si anode, allowing commercial level areal capacity of >2.0 mAh/cm2,” Jong Hyeok Park, director and chair of NEO’s scientific advisory board, said in the media brief.

The pure Si anode that does not contain graphite anode materials has been successful at charging and discharging for over 1000 cycles

In his statement, Park quoted Tesla’s CEO, Elon Musk, who said that, although it is difficult to incorporate a durable anode from 100% silicon nanoparticles into Li-ion batteries, doing so has the potential to improve energy density by 20-40%, extending the maximum range of vehicles by 20%.

“NEO is continuing to develop Si anode material modification technology to manufacture innovative anode materials for next-generation lithium-ion batteries at a low and scalable cost,” the executive said.

Besides technology development, the company is focusing on exploring and producing silicon at a number of mining claims it has staked in British Columbia, Canada.

The properties occupy 467 hectares and are along a strike with a quartzite bed, targeting silica in the quartzites.

from MINING.COM https://ift.tt/3sNWgni

Ivanhoe working towards accelerating Phase 3 expansion at Kamoa-Kakula copper mine

Ivanhoe Mines (TSX: IVN) announced that part of the proceeds from the recently completed $575 million, 2.50% convertible senior notes offering will be used to accelerate the Phase 3 expansion at the Kamoa-Kakula copper mine in the Democratic Republic of Congo.

According to the company, fast-tracking additional hydropower upgrades in the DRC also is a high-priority opportunity to ensure clean and renewable electricity for all subsequent expansions at Kamoa-Kakula.

“The company will now look to further increase production at our Kamoa-Kakula copper joint-venture, and to accelerate the Phase 3 concentrator expansion from 7.6 million tonnes per annum to 11.4 million tonnes per annum,” co-chairman Robert Friedland said in a media statement. “Together with our partner Zijin Mining, we have already accelerated the Phase 2 expansion to begin production in Q3 2022 and bring copper production to approximately 400,000 tonnes, or approximately 880 million pounds, per year.”

Ivanhoe wants to accelerate the Phase 3 concentrator expansion from 7.6 million tonnes per annum to 11.4 million tonnes per annum

Friedland said that the Phase 3 expansion would bring copper production at Kamoa-Kakula up to approximately 530,000 tonnes, or approximately 1.2 billion pounds per year.

“Our company is about to make the long-fought transition from an explorer and developer to becoming a major diversified mining company,” the executive said. “It has been a remarkable journey for Kamoa-Kakula and Platreef; to grow from grassroots discoveries to imminently joining the ranks of the world’s largest producers of copper, platinum-group metals and nickel.”

At present, Kamoa-Kakula’s Phase 1, 3.8-Mtpa concentrator is nearing completion, with the civil works for the second 3.8-Mtpa concentrator (Phase 2) advancing rapidly. At the same time, the second stage commissioning of the Phase 1 ball mills and the concrete foundations for the second set of ball mills for the Phase 2 concentrator are underway.

Kamoa-Kakula has been independently ranked as the world’s fourth-largest copper deposit by Wood Mackenzie. Its updated resource estimate shows that it holds 1.4 billion indicated tonnes grading 2.74% copper for 83.7 billion pounds of copper and another 339 million inferred tonnes grading 1.68% copper for 12.5 billion pounds of copper at a 1% cut-off grade.

According to Friedland, as infrastructure projects are being completed on the property, the recently obtained funding will also be used to expand and accelerate a copper exploration program on the company’s Western Foreland exploration licences, located in close proximity to the Kamoa-Kakula mining licence.

from MINING.COM https://ift.tt/2QQaMx0

Humble One, un SUV solaire qui promet 800 km d'autonomie

from Les dernières actualités de Futura https://ift.tt/3sNHrBa

Petra Diamonds delays release of probe into human rights abuses

Petra Diamonds (LON: PDL) has delayed the publication of an internal probe into alleged human right abuses at its Williamson mine in Tanzania after obtaining fresh information related to the case.

The company had originally committed to provide feedback on an investigation being carried out by an external adviser, in conjunction with its legal advisers, by the end of March.

Petra now expects to release results of the inquiry and the company’s rection to them by the end of April.

“The company has recently obtained further additional information relating to the allegations, which will help with the preparation of its report, and this information is currently being processed by the external adviser,” it said in the statement.

The announcement comes only days after UK-based corporate watchdog RAID revealed it had further evidence of alleged abuses at the diamond mine.

The non-profit organization published a new report on March. 25 that included dozens of eye witness accounts on how security guards employed at Williamson have allegedly abused their power.

Among the testimonies, a former guard said rubber projectiles were intentionally swapped with metal bullets in their weapons, causing “serious harm” to local residents shot on Petra’s concession.

While rubber bullets can cause serious injury, even kill, they are not supposed to penetrate, whereas “the gun pellets can enter someone’s body and stay there,” the guard told RAID. “Someone would need an operation to remove them, and if they are close to the gun, they can definitely cause death.”

Petra reacted to the report by saying it had taken a number of actions to address the situation at the mine, including the replacement of the third-party security contractor Zenith.

The diamond miner, which also has three operations in South Africa, formed in February an internal committee to oversee the ongoing investigation. The move came after UK-based law firm Leigh Day filed a lawsuit against the company in the High Court of England on behalf of 32 anonymous individuals.

The Williamson mine, active since 1940, is in Shinyanga, one of Tanzania’s poorest regions. It produced a 54.5-carat pink diamond presented to Queen Elizabeth for her wedding in 1947.

Illegal miners incursions

The Africa-focused diamond producer has said the mine had been the target of illegal artisanal miners “for some time” due to challenges in securing the large perimeter of the license area.

“This illegal mining activity is managed by the mine operator Williamson Diamond Limited (WDL) and the local government authorities on an ongoing basis,” it said at the time.

Petra has dealt with the incursion of illegal miners at its operations before. Last year, it opened up some of its Koffiefontein mine’s tailings, in South Africa, to small scale miners. The move aimed at tackling illegal activities and solved some issues caused by artisanal miners at the asset.

It previously carried out a similar exercise at Kimberley, in Northern Cape, where small scale miners operated “the floors” of the property — an area previously worked by Kimberley’s founding miners.

The project, kicked off in 2017, was not a success. Its then joint venture partner, Ekapa Mining, reported a year later it was still spending R3 million (about $180,000) a month in security to keeping individual out of its operating boundaries. Petra sold its stake in the Ekapa partnership in 2018.

from MINING.COM https://ift.tt/3rBrmgw

Vente Flash Amazon : Le robot cuiseur Moulinex Clickchef à seulement 299,99 €

from Les dernières actualités de Futura https://ift.tt/31xTuqA

Covid-19 : la gravité de l'épidémie est-elle surestimée en France ?

from Les dernières actualités de Futura https://ift.tt/3wciRw3

Bon plan Cdiscount : 529 € de réduction sur le vélo électrique pliable Windgoo

from Les dernières actualités de Futura https://ift.tt/3wmcExQ

Bon plan Cdiscount : 149 € d'économie sur le Huawei Matebook 13 Core-i5

from Les dernières actualités de Futura https://ift.tt/3dh8LBA

Un Raspberry Pi Zero au cœur de la sécurité des stations spatiales

from Les dernières actualités de Futura https://ift.tt/39rD0Eu

Pour seulement 9,99 €/mois, profitez d'un forfait tout illimité avec 80 Go chez Coriolis

from Les dernières actualités de Futura https://ift.tt/3dfVzgd

Vaccination : quatre stratégies britanniques que la France aurait dû prendre en exemple

from Les dernières actualités de Futura https://ift.tt/3m5Y4Wd

SpaceX : le vol du prototype du Starship SN11 pourrait finalement avoir lieu cet après-midi

from Les dernières actualités de Futura https://ift.tt/3dmx3tK

Deep Time : une aventure hors du temps dans le ventre de la Terre

from Les dernières actualités de Futura https://ift.tt/3sAsNNz

Yogosha, la cybersécurité crowdsourcée

from Les dernières actualités de Futura https://ift.tt/3m4cFl3

Anniversaire AliExpress : tempête de bons plans sur les produits tech

from Les dernières actualités de Futura https://ift.tt/3rBqlVM

lundi 29 mars 2021

Deep Time : une aventure hors du temps

from Les dernières actualités de Futura https://ift.tt/3cz2YYG

Iron ore prices jump on strong industrial activity in China

Iron ore prices jumped on Monday on rising demand amid strong construction and manufacturing activity in China.

According to Fastmarkets MB, benchmark 62% Fe fines imported into Northern China (CFR Qingdao) were changing hands for $167.88 a tonne, up 6.58% from the previous trade.

China’s industrial profit surged 179% in the first two months from the year-ago period, data from the National Bureau of Statistics showed on Saturday.

“This is the start of the boom, not the end”

Tribeca Global Natural Resources portfolio manager Ben Cleary

Margins in the manufacturing sector jumped 219.5% on an annual basis, while profit earned by ferrous smelting and processing companies soared 271% during the January-February period, according to the statistics bureau.

Apparent demand for five main steel products, including steel rebar and hot-rolled coil, rose 5.6% week-on-week, data from Mysteel consultancy showed.

“According to the usual practice, if daily turnover for construction materials stays above 200,000 tonnes for a week, it can be proved that peak demand season has come,” Tang Chuanlin, analyst with CITIC Securities told Reuters.

Last week, Tangshan, China’s top steelmaking city, said it will punish firms that either have not taken the steps spelled out under its emergency anti-pollution plan or have illegally discharged pollutants.

But despite prices dropping after the announcement, experts believe market conditions will remain supportive for producers.

“This is the start of the boom, not the end,” said Tribeca Global Natural Resources portfolio manager Ben Cleary.

Top producer Australia expects to log a record A$136 billion ($103.85 billion) from iron ore exports this financial year, a government report showed on Monday.

(With files from Reuters)

from MINING.COM https://ift.tt/31tHc2n

Old photos show South Dakota mine that caused sinkhole wasn’t so hidden

Historic photographs from the 1960s show the US state of South Dakota operated a second gypsum mine beneath portions of the Black Hawk area that began to collapse in April 2020, forcing residents to evacuate their homes.

The photos, taken by the US Department of Agriculture and other agencies, contradict state claims it conducted surface mining only, according to Fox Rothschild LLP, who is seeking class action status in a lawsuit on behalf of 300 homeowners against the state.

The images also demonstrate that the whole neighbourhood may be in danger of collapse, not just the portion of Hideaway Hill that has done so already, the law firm noted.

“We have been digging to find these pictures, and what they show is the state was doing plenty of digging too – underground, in the northwest part of the subdivision” says Kathleen Barrow of Fox Rothschild.

“This is further proof that the state of South Dakota is responsible for the danger my clients are facing and the damage to their homes and neighbourhood.”

The photos show a mine entrance in the side of a cliff, not far from where the state was also conducting surface mining.

Hideaway Hill residents are suing the state, real estate agents, county officials and developers after public records revealed the Meade County Planning Board knew about the mine when it approved the Black Hawk housing development.

Meade County is investigating how the Meade County Planning Board approved the subdivision in 2002.

Most of the world’s gypsum, used in fertilizer, filler in paper and textiles and retarder in cement, is produced by surface mines.

In the US, gypsum is mined in about 19 states, including Oklahoma, Iowa, Nevada, Texas and California. Together, these five states account for about two-thirds of the country’s annual production of gypsum.

from MINING.COM https://ift.tt/31u7OjH

« Une informatique 100 % sécurisée ne serait ni très efficace ni très innovante »

from Les dernières actualités de Futura https://ift.tt/3sz6Qi6

SpaceX : le quatrième vol suborbital du prototype du Starship devrait avoir lieu ce soir

from Les dernières actualités de Futura https://ift.tt/3u8JH6D

Une première : des champs magnétiques astrophysiques recréés en laboratoire

from Les dernières actualités de Futura https://ift.tt/2PFE3tK

Copper price falls amid rising exchange inventories

Copper prices fell on Monday amid rising exchange inventories and signs of weakening demand from top consumer China weighed on sentiment.

Copper for delivery in May was down 1.43% by midday, with futures touching $4.01 per pound ($8,822 a tonne) on the Comex market in New York.

Click here for an interactive chart of copper prices

The most-traded May copper contract on the Shanghai Futures Exchange advanced 1.1% to 66,290 yuan ($10,131.28) a tonne.

Copper inventories in LME warehouses have risen 67% so far in March to 123,800 tonnes, their highest since Dec. 16, 2020. Stockpiles of the metal in ShFE warehouses were last at 188,359 tonnes, a high level unseen since September 2020.

Meanwhile, Yangshan copper premium dropped to $60 a tonne, its lowest since Dec. 23, 2020, as inventories in bonded warehouses leaped to 382,000 tonnes, their highest since July 2019, indicating weakening demand for imported metal into China.

A report by Roskill says the industry opinion is strongly – and evenly – divided between bearish and bullish views.

“Bears will point out that this year’s price spike occurred during Lunar New Year when Chinese traders were away, indicating that the surge was largely speculatively driven, without much fundamental support, and during the quiet season for consumption in the rest of the world,” said the market researcher.

The problem is the body of evidence supporting the bulls is equally convincing.

“At the end of February, the combined exchange inventories of LME + Comex + SHFE + INE plus those in Chinese bonded warehouses stood at 710kt, sufficient to meet only 1.5 weeks of global refined consumption,” said Roskill.

(With files from Reuters)

from MINING.COM https://ift.tt/2PFsIKd

Gold price on back foot as US dollar firms

Gold prices fell on Monday as the US dollar and global share markets firmed on the back of improving economic outlook, with elevated bond yields putting further pressure on the precious metal.

Spot gold fell 1.2% to $1,711.86 per ounce by 11:40 a.m. in New York, its largest drop in almost four weeks. US gold futures were down 1.3% to $1,709.00 per ounce.

Meanwhile, US Treasury yields held close to one-year highs, and the dollar began the week firmly as US economic strength and a faster vaccine rollout drew investors into the greenback.

“Yields are the big threat to gold in the near term,” Michael McCarthy, chief market strategist at CMC Markets, told Reuters. “If the sell-off in bonds gathers momentum, gold could fall below $1,700 very quickly,” he added.

Further weighing on gold, Asian equity markets inched higher as the chance of yet more trillions in US fiscal spending underpinned the global growth outlook.

Market participants are now waiting for US President Joe Biden’s infrastructure spending package on Wednesday, which is speculated to be in the $3-$4 trillion range.

“While gold is still good for inflation, the problem is, it’s not good right now because yields are going higher in concert with inflation,” said Stephen Innes, chief global market strategist at financial services firm Axi.

“We need those yields to stop going higher, and then you know, once the inflation takes over then gold goes up.”

(With files from Reuters)

from MINING.COM https://ift.tt/39pqxBc

Le stress favorise les allergies, selon une étude japonaise

from Les dernières actualités de Futura https://ift.tt/3whKFiT

Nasa : « Ce calcul nous apporte une preuve directe que les activités humaines modifient le budget énergétique de la Terre »

from Les dernières actualités de Futura https://ift.tt/3sxs1AZ

Bon plan casque Beats : 129 € d'économie sur Cdiscount

from Les dernières actualités de Futura https://ift.tt/2O5HDgg

McEwen resumes operations at El Gallo mine in Mexico

McEwen Mining (TSX: MUX) (NYSE: MUX) said on Monday it has resumed operations at its El Gallo project in Mexico following negotiations with members of nearby communities, which forced the company to halt operations earlier this month after illegally blocking the mine’s main access.

The Canadian miner said it had inked a new 10-year agreement with locals, which provides “additional support to the communities and greater long-term certainty for the El Gallo operation.”

El Gallo is one of the company’s four gold producing assets in the Americas. The residual heap leaching operation is expected to contribute 3-4% of the company’s gold-equivalent production this year.

McEwen is planning to breathe new life into the complex through the proposed Fenix redevelopment, which involves building a mill at the existing mine site.

The facility will initially reprocess the existing heap leach material and then transition to process ore from open pits at the El Gallo Silver, Palmarito, Carrisalejo and El Encuentro deposits.

from MINING.COM https://ift.tt/3rz5Jh9

Decommissioning, other environmental costs often underestimated – study

Researchers at Sweden’s University of Gothenburg analyzed the information provided by 164 European listed mining, oil and gas and nuclear power companies and found that most of them give sparse information on future environmental liabilities in their annual reports.

In detail, the experts used computerized text analysis to examine information on environment-related restoration costs in the notes to annual reports, over a 12-year period. Among other things, they searched for information about the discount rate and estimated time horizon for payments – key information needed to assess the size of environmental liabilities.

“The future environmental liabilities such as decommissioning costs are often underestimated and few understand the burden these costs might impose on future generations,” Mari Paananen, a professor of business administration who led the study, said in a media statement. “If, for example, an oil and gas company fails, it costs an incredible amount to clean up after old oil wells and the risk is great that the taxpayers will have to pay the bill. Therefore, it is important that environmental obligations are made visible to investors, lenders and the public so that we can discuss the problem.”

Only 60% of the companies provided information about discount rates and 65% disclosed the time horizon for the expected future cash outflow

According to Paananen, even though the disclosure of environmental information in the annual reports has increased over time, at present only 60% of the companies provided information about discount rates and 65% disclosed the time horizon for the expected future cash outflow. On the other hand, just over a third provided information about both.

In the researcher’s view, since there is no clear claimant for this type of future obligations, there is also little demand for information. Thus, she believes that the International Accounting Standards Board needs to provide clearer requirements about what data should be included in the annual reports in order to make it possible to assess environmental liabilities.

“I think that such guidelines would make companies inclined to disclose more information and would also provide, for example, auditors a mandate to demand specific information,” she said.

Paananen and her team also investigated whether the level of disclosure increased when companies faced media exposure focusing on environmental issues or how companies take responsibility for the environment.

“We clearly saw that if companies were exposed in the media, the environmental information increased and the companies provided more specific disclosure on environmental liabilities in the following annual report,” the expert said.

from MINING.COM https://ift.tt/3cy5Kha

Anniversaire Gearbest : jusqu’à 52% de remise sur les smartphones et produits high-tech

from Les dernières actualités de Futura https://ift.tt/3cvjI36

Attention : trop de sport peut nuire à votre santé

from Les dernières actualités de Futura https://ift.tt/3cvg0Xe

Le masque facial futuriste développé par Razer bientôt en vente

from Les dernières actualités de Futura https://ift.tt/3de2YMY

Nornickel stops water inflows at two Arctic mines

Russia’s Nornickel (MCX: GMKN), the world’s largest palladium miner and a significant nickel producer, said on Monday it had stopped water flowing into its two of its Siberian Arctic mines, adding that and both were on track to fully resume production in coming months.

Nornickel partially suspended output at the Oktyabrsky mine and the interconnected Taymirskiy operation on Feb. 24 after subterranean water flowing into one of them, first detected on Feb. 12, intensified.

The water was stopped thanks to the installations of barriers and after the company poured 32,000 tonnes of concrete into the mines. The method is a traditional way of dealing with the sudden inflow of water to underground mines, although Nornickel’s case has been complicated by the intensity of the inflow.

Oktyabrsky is expected to resume full production in the first 10 days of May, while Taymirskiy is scheduled to resume in early June, Nornickel said in the statement. The mines account for 36% of ore mined by the company in Russia.

The inflows, which have forced Nornickel to cut its 2021 output forecast by about 20%, are just one of the issues it has had to deal with this year. The miner was recently ordered to pay about $2 billion in compensation after a massive diesel spill from one of its fuel tanks in the Arctic last year.

A few days later, three people were killed when a roof of the ore reloading facility and adjoining walkway at the Norislk concentrator plant collapsed during repairs. The facility processes ore from several operations, including from the water-affected mines.

The company noted it now estimated that its 2021 output guidance in the baseline scenario will fall short of the initially announced plans by about 35,000 tonnes nickel, 65,000 tonnes of copper and 22 tonnes of platinum group metals.

from MINING.COM https://ift.tt/3syusU2

Vente Flash Amazon : -120 € sur le casque de réalité virtuelle HTC

from Les dernières actualités de Futura https://ift.tt/3dbkAZU

Des variations naturelles derrière le casse-tête climatique

from Les dernières actualités de Futura https://ift.tt/3u6YDlp

Attention, un virus se fait passer pour une mise à jour d'Android !

from Les dernières actualités de Futura https://ift.tt/2QJgvEF

Encelade, lune de Saturne, aurait des courants dans son océan comparables à ceux de la Terre

from Les dernières actualités de Futura https://ift.tt/3cwgJYb

Du jamais-vu : un gène a « sauté » d'une plante à un animal

from Les dernières actualités de Futura https://ift.tt/3w6I8Yw

Futura emploi : le taux de dépression en hausse chez les salariés

from Les dernières actualités de Futura https://ift.tt/3cyig06

-65% de réduction sur VideoProc, le meilleur logiciel de convertisseur vidéo !

from Les dernières actualités de Futura https://ift.tt/2QE0gZs

dimanche 28 mars 2021

Canada needs to work toward gaining leadership in the EV revolution – report

“Canada has great potential to become a leader in the global Li-ion battery market,” a new analysis by Roskill states.

The research firm published the insight following the announcement by Lion Electric, a manufacturer of all-electric trucks and buses, of the construction of a C$185-million battery manufacturing plant and innovation center in Quebec.

The project is expected to receive a joint C$100-million investment from the federal and provincial governments and it is planned to begin operations in early 2023.

According to Lion, the factory will produce battery packs and modules made from lithium-ion cells, which should translate into a considerable reduction in the cost of its vehicle manufacturing, with a particular impact on the development of heavy-duty electric transportation.

Yearly production capacity is forecast to be 5 gigawatt-hours in battery storage, which means that the company will be able to electrify approximately 14,000 medium and heavy-duty vehicles annually.

“Building an EV battery plant in Quebec would be a crucial step in the advancement of the Canadian Li-ion battery ecosystem, stimulating the cell production in the country and further localising the supply chain,” Roskill’s report reads. “Across the Canadian Li-ion battery supply chain, cell and module production has been relatively weak. Based on the announced production plans by March 2021, Roskill’s analysis shows that Canada will account for only 0.03% of global Li-ion battery cell capacity by 2030.”

In the market researcher’s view, if projects like Lion Electric’s reproduce across the country, Canada could start gaining leadership in the EV revolution, particularly given its large mineral endowments and production capacity for key battery raw materials, including lithium, nickel, cobalt, manganese, copper, and graphite.

“As of today, however, Canada mainly exports these commodities in the form of mineral concentrates to Asia, with very little value added to produce Li-ion battery materials (precursor, cathode, and anode) retained in Canada,” the document states.

Were Canada to start working towards processing these raw materials, it would be in a privileged position to build a more sustainably powered EV battery supply chain, given the high proportion of clean power delivered to the country’s grid.

At present, the Great White North is the world’s third-largest producer of hydroelectricity, with 67% electricity coming from renewable sources and 82% from non-greenhouse gas emissions sources.

“With accelerating global demand for Li-ion batteries, Roskill believes that Canada has a unique opportunity to develop into an important Li-ion battery material and even cell hub in the North American EV supply chain, though there remains significant investment required to achieve this status,” the review reads.

from MINING.COM https://ift.tt/2O2eR03

Science décalée : pour retrouver un cadavre, suivez la couleur des feuilles !

from Les dernières actualités de Futura https://ift.tt/3irS0Vr

Eleven miners trapped inside flooded gold mine in Colombia

Colombia’s National Mining Agency informed that 11 people remain trapped since March 26 inside an illegal gold mine located in the central Caldas department.

According to the Agency, a 17-metre deep pit flooded with at least 3 cubic metres of water given that the area is experiencing torrential rains. Four entrances to the pit, located to the south of the main well and two to the north are completely covered by water.

Rescue teams had to be taken to the site via rail as the main roads had been damaged and blocked by ongoing storms.

The Mining Safety and Rescue Group, the fire department, the Civil Protection Agency, local authorities, other miners, personnel from Canada’s Caldas Gold, and other emergency organizations have been at the site day and night, trying to bring the miners back to the surface.

Electric pumps to extract water have been installed and authorities asked the Caldas Hydroelectric Plant to make the necessary adjustments to maintain a 220v three-phase current and guarantee that the pumping equipment can efficiently operate.

“I’m very sorry that this happened and stand by the miners’ families during this emergency in Neira’s El Bosque community,” Luis Carlos Velásquez, Caldas’ governor, said in a statement. “Personnel from the municipal, departmental and national government continue to join forces to maintain the search and rescue efforts.”

from MINING.COM https://ift.tt/3m7x9JW

Le carbone suie, lié à la pollution automobile, augmente les risques de cancer

from Les dernières actualités de Futura https://ift.tt/39nhels

Astronomie : une nova à observer dans Cassiopée

from Les dernières actualités de Futura https://ift.tt/3tZgECq

Le MIT et la Réserve fédérale préparent un dollar numérique

from Les dernières actualités de Futura https://ift.tt/3cwqUvK

Le virus du rhume inhibe la réplication du SARS-CoV-2

from Les dernières actualités de Futura https://ift.tt/2QAK1ML

Changement d'heure : est-il bon pour la santé ?

from Les dernières actualités de Futura https://ift.tt/2To2wCj

Uber or Skip? Bronze Age miners had their own food delivery service

Nowadays, the delivery of food and supplies to remote mine sites like Canadian Royalties’ Nunavik nickel project in northern Quebec is big news. However, researchers say that this practice dates back to the Bronze Age.

In a paper published in the journal PLOS ONE, scientists from the Austrian Academy of Science and the University of Innsbruck present evidence that backs the idea that Bronze Age mining sites relied on outside sources to deliver pre-processed food to sustain the community.

According to the researchers, ancient copper mining sites are thought to have been specialized communities of craftspeople and miners that would not have produced their own food, instead requiring food to be provided by outside sources.

While some previous research has examined the animal-based foods common to these communities, few studies have investigated plants. In this study, however, lead author Andreas Heiss and colleagues contribute to this discussion with an examination of plant remains from the mining site of Prigglitz-Gasteil in the Eastern Alps in Austria, which was active between the 11th and 9th Century BCE.

The team was able to identify a variety of cereal plant remains showing signs of various forms of processing, such as grinding and dehulling, but little evidence of plant remains discarded during processing, such as chaff, or of tools used to process the material. This suggests that much of the site’s cereal food was being processed and possibly cooked off-site before being delivered to the miners.

Although these results match analyses of other Bronze Age mining sites of the Eastern Alps, it remains unclear exactly where these delivered foods were being originally processed.

The authors hope that further study on cereal plant remains and cooking tools at Prigglitz-Gasteil and other sites will help archaeologists piece together the details of how specialized sites were provided essential supplies.

from MINING.COM https://ift.tt/39mPei1

Étrangeté du vivant : découvrez le plus petit reptile du monde

from Les dernières actualités de Futura https://ift.tt/31r99rA

Moto électrique : Premier aperçu de la future Triumph TE-1

from Les dernières actualités de Futura https://ift.tt/39nctZc

Ces 55 produits chimiques jamais signalés chez l’Homme ont été détectés sur des femmes enceintes

from Les dernières actualités de Futura https://ift.tt/3suiZoA

Bon plan Cdiscount Mobile : le forfait 80 Go à seulement 3,99 €/mois

from Les dernières actualités de Futura https://ift.tt/3u7nPsl

Biodiversité : où chercher des espèces encore inconnues ?

from Les dernières actualités de Futura https://ift.tt/3u26Ur2

Les habitants de Pompéi sont morts en 17 minutes pendant l'éruption du Vésuve !

from Les dernières actualités de Futura https://ift.tt/3lZyLoW

Covid-19 : pourquoi il vaut mieux se faire tester l'après-midi

from Les dernières actualités de Futura https://ift.tt/3lVdcpy

Profitez d'un super bon plan forfait mobile : 30Go pour seulement 2,99€/mois chez NRJ Mobile

from Les dernières actualités de Futura https://ift.tt/3lW4F5N

La pêche au chalut émet autant de CO2 que le transport aérien

from Les dernières actualités de Futura https://ift.tt/2PdJksv

Covid-19 : le variant anglais touche aussi les animaux de compagnie

from Les dernières actualités de Futura https://ift.tt/3cqcr4G

MINING.COM MINUTE: Biggest stories of the week

MINING.COM MINUTE is a roundup of the biggest stories from the global mining and metals industry.

This week’s top stories:

- Class action against Rio Tinto over Oyu Tolgoi escalates – Read more

- Taseko wins court battle over Florence copper project: Read more

- Resolute Mining shares drop 25% on Ghana lease termination – Read more

from MINING.COM https://ift.tt/31DUIRf

samedi 27 mars 2021

Science décalée : tous les virus SARS-CoV-2 du monde tiendraient dans une canette de Coca

from Les dernières actualités de Futura https://ift.tt/3bGJMa7

La betterave au fil des saisons : tout se joue maintenant

from Les dernières actualités de Futura https://ift.tt/3u0XAnm

L’internet des objets : fantasme futuriste ou réalité déjà bien ancrée ?

from Les dernières actualités de Futura https://ift.tt/2OZkaxr

Combien de variants circulent ? Lesquels sont les plus dangereux ?

from Les dernières actualités de Futura https://ift.tt/2PAL1QI