vendredi 30 avril 2021

Urgence climatique : les glaciers fondent plus vite que jamais dans le monde entier

from Les dernières actualités de Futura https://ift.tt/3gLQTCa

Les anticorps de lama pourraient bien être efficaces contre les variants du SARS-CoV-2

from Les dernières actualités de Futura https://ift.tt/3vxx4CA

Bon plan Cdiscount : 116 € d'économie sur le sèche-linge à évacuation INDESIT

from Les dernières actualités de Futura https://ift.tt/3u74TdF

AirTag : à quoi sert le nouveau gadget d'Apple ?

from Les dernières actualités de Futura https://ift.tt/3xcv8B4

L'énorme faille comptable qui fausse le calcul des émissions de CO2

from Les dernières actualités de Futura https://ift.tt/331XWhR

Le gel hydroalcoolique favorise-t-il les gastroentérites ?

from Les dernières actualités de Futura https://ift.tt/2QCqDQ6

Variant indien : que sait-on des trois personnes infectées en France ?

from Les dernières actualités de Futura https://ift.tt/3nA3Gc2

Vente privée RED By SFR : un iPhone 8 offert en souscrivant au forfait 100 Go à seulement 15€ / mois

from Les dernières actualités de Futura https://ift.tt/334gZIC

La police de New York remet Digidog, son chien-robot, à la niche

from Les dernières actualités de Futura https://ift.tt/334Crgl

Deep-sea mining tests resume as lost robot rescued

Belgium’s Global Sea Mineral Resources (GSR) resumed on Friday tests that could lead to the mining of battery minerals from the Pacific Ocean floor after it managed to recover a robot stranded at a depth of thousands of metres.

The company reported Wednesday that its Patania II, a 25-tonne mining robot prototype, had uncoupled from a 5km-long (3.1 miles) cable connecting it to the surface.

The unit of Belgium’s DEME Group is with a group of European scientists to determine the environmental impacts of deep-sea mining. They are working on GSR’s concession in the Clarion Clipperton Zone.

“It’s ironic that an industry that wants to extract metals from the seabed ends up dropping it down there instead,” Sandra Schoettner, deep-sea biologist from Greenpeace Germany, said in a statement. “This glaring operational failure must act as a stark warning that deep sea mining is too big a risk.”

“We are taking a cautious, step-by-step approach to project development. We conduct these trials to better understand the challenges involved so we can continuously refine our technology,” Kris Van Nijen, managing director of GSR, said in the statement.

“The prototype has functioned well, and learnings will be taken into the next phase of development. This is pioneering engineering work and we were prepared for multiple eventualities,” he noted.

Before this week’s incident, Patania II had had collected potato-sized rocks called “polymetallic nodules”, which are rich in manganese, cobalt and nickel from the seabed.

Mining the ocean floor has been promoted as an alternative to land-based mining, as demand for minerals needed for a green energy transition, such as cobalt and nickel, are set to exceed current production rates by 2030.

Read more about how the battery metal rush has pitted miners against marine biologists

DEME Group is among a group of companies, including DeepGreen Metals, Lockheed Martin and China Minmetals Corp., spearheading moves to extract metals needed for electric vehicles and green technologies.

Regulations to support the emerging activity have yet to be agreed upon by the International Seabed Authority (ISA). The UN-backed body of 167 countries has already issued exploration contracts to 21 companies, but they cannot begin mining until regulation is passed.

An international team of researchers published in 2018 a set of criteria to help the ISA protect biodiversity from deep-sea mining activities while it prepares global rules.

According to the US Geological Survey, the deep-sea accounts for more than half the world’s surface and contains minerals in concentrations several times higher than those found in all land reserves combined.

Targeting nodules

The main target of companies planning to mine underwater are polymetallic nodules. These small rocks, which lie in a shallow layer of mud on the seafloor, are rich in cobalt, nickel, copper, manganese and rare earths.

Scientists and explorers have also identified cobalt-rich crusts, located shallower than nodules and sulphates.

Recent reports, including one commissioned by the High Level Panel for a Sustainable Ocean Economy (Ocean Panel), have called for further research to fill gaps in knowledge before any seabed mining is allowed. They have also argued for the need to set protected zones across all ocean regions under the ISA’s jurisdiction.

The European Parliament has also called for a ban on seabed mining until the environmental impacts and risks of disturbing unique deep-sea ecosystems are understood.

In the resolution, passed three years ago, the legislators also urged the European Commission to persuade member states to stop sponsoring and subsidizing licenses to explore and exploit the seabed in international waters as well as within their own territories.

Conservationists recommend countries encourage the recycling of battery metals to reduce the need of finding new supplies.

RELATED: DeepGreen hits backs at firms opposing seafloor mining

Supporters of the activity, however, argue that the extraction of battery metals from the ocean floor could potentially eliminate, or dramatically reduce, most of the environmental and social impacts associated with the extraction of riches from the Earth’s surface.

DeepGreen, one of the companies that are actively seeking to mine the ocean floor, said environmental benefits can be achieved only through collecting polymetallic nodules, 4,000 meters deep on the abyssal plain. At that depth, life is up to 1,500 times less abundant than in the vibrant ecosystems on land from where battery metals are currently sourced, the Canadian firm noted.

Nodules lie unattached on the seafloor and DeepGreen says its approach to collecting them differs from other extractive processes that could affect the integrity of the seafloor crust, as explained by the World Wildlife Fund (WWF).

BMW, Volvo, Google and Korean battery maker Samsung SDI, announced in March they will not buy metals extracted through deep-sea mining until the environmental risks of the activity are “comprehensively understood.”

from MINING.COM https://ift.tt/32ZWVHh

Bon plan Cdiscount : 213 € d'économie sur le salon de jardin Tectake

from Les dernières actualités de Futura https://ift.tt/3t7A47h

Mighty : seriez-vous prêts à payer pour un navigateur web plus performant ?

from Les dernières actualités de Futura https://ift.tt/3t74t5m

Stratolaunch, le plus grand avion du monde, a repris son envol !

from Les dernières actualités de Futura https://ift.tt/3gY0plw

Bon plan forfait mobile : Sosh lance deux forfaits 110 Go et 60 Go à moins de 17 €/mois

from Les dernières actualités de Futura https://ift.tt/3e5cPGz

Depuis 400.000 ans, le permafrost est stable et ce n’est pas une bonne nouvelle

from Les dernières actualités de Futura https://ift.tt/3t5lUUe

Ingenuity : l'hélicoptère de la Nasa a raté le décollage pour son 4e vol

from Les dernières actualités de Futura https://ift.tt/3uctGNu

Les activités humaines façonnent le comportement des animaux sauvages

from Les dernières actualités de Futura https://ift.tt/3xB6aM5

Bons plans forfaits mobiles : 60 Go pour 7,99 €/mois et 20 Go pour 1,99 € / mois chez Auchan Télécom

from Les dernières actualités de Futura https://ift.tt/2QHpqqB

Test Nubia RedMagic 6 : le gaming à 165 hertz sans se ruiner

from Les dernières actualités de Futura https://ift.tt/2R9CO6S

jeudi 29 avril 2021

Les futures missions lunaires et martiennes se préparent dans des tubes de lave à Hawaï

from Les dernières actualités de Futura https://ift.tt/3e6CLBu

Ero Copper reports new copper zone below Vermelhos mine in Brazil

Ero Copper (TSX: ERO) says it has identified a new zone of mineralization at its Vermelhos project, an underground mine under development in Brazil and part of the company’s MCSA mining complex, which includes the Pilar underground mine and the Surubim open pit mine, in the country’s northeastern state of Bahia.

The new discovery, named the Novo zone, was found about 200 metres below the existing infrastructure of the Vermelhos mine. Drillhole FVS-922 intersected 13.8 metres grading 2.62% copper from 554 metres, including 4 metres of 5.52%, and drillhole FVS-872 returned 4.2 metres grading 5.72% copper starting from 205 metres downhole, including 2 metres of 9.60% copper.

The company noted that the new zone was drilled “based upon a revised structural interpretation supported by geologic mapping of the main Vermelhos orebodies” and stated that the discovery “has been interpreted as a sub-horizontal, north-plunging lens of high-grade massive sulphide mineralization, extending over an identified strike length to date of approximately 200 metres.” The lens, it says, remains open down plunge.

Ero Copper’s other assets in Brazil include its Boa Esperanca copper project, in the southeastern state of Para

The company also released other assay results it has received from drilling between December 2020 and early April, including from its regional exploration program within the Curaca Valley, in addition to in-mine and near-mine exploration.

Twenty-three drill rigs are working throughout the Curaca Valley, six of which are allocated to regional exploration. The company is focused in this location on three mineral districts: the Pilar district in the south of the Curaca Valley; the Surubim district, and the Vermelhos district.

In addition to finding the Novo Zone, Ero Copper has identified two new mineralized systems (C4, about 13 km from its Subrahim mine, and Terra do Sal, 8 km from the Subrahim mine), both of which it believes “have excellent potential to host high-grade massive sulphide mineralization as well as disseminated near-surface mineralization.”

At Terra do Sal, the company has identified a surface footprint from surface and extending over 800 metres in strike, and which measures about 250 metres in thickness at surface. Drill highlights included FTS-62, which intersected 25 metres of 1.02% copper starting from 317 metres downhole, including 6 metres of 1.38% copper.

At C4, drilling intercepted disseminated sulphide mineralization from an outcrop to about 700 metres below surface. Drillhole FC4-01 cut 18.8 metres of 0.31% copper from 90 metres, 18 metres of 0.30% copper and 44 metres of 0.33% copper.

Meanwhile, the company continues to undertake exploration with five drill rigs in the Deepening Extension Zone of its Pilar mine, and is targeting mineralization on the East Limb of the mine to the 1500 level, or about 1,200 to 2,000 metres below surface and about 100 metres laterally from the current level of the primary ramp. Drillhole FC48142 returned 20.9 metre grading 5.16% copper starting from 727 metres, including 3 metres of 10.02% copper, while hole FC5175 cut 11.3 metres grading 4.25% copper from 638 metres, including 2.3 metres of 17.70% copper and 9.7 metres of 3.15% copper.

Assays also included results from the deepest drillhole at Pilar to date, about 200 metres deeper than the limit of the 2020 inferred resource, demonstrating, the company says, that the Pilar mine remains open to depth. The drillhole, FC48173B, intersected 7.2 metres of 2.14% copper starting from 360 metres downhole, including 4 metres of 3.08% copper.

Late last year the company also started re-evaluating each of its fully permitted, past-producing open pit mines with the Curaca Valley, with the objective of evaluating “the potential for targeted high-grade open pit and underground development.” So far the company has pinpointed target zonesin two of its past-producing mines from just beneath the historic open pits up to 70 metres beneath the pit limits. Drilling is underway at Lagoa da Mina, the northern portion of the Angicos mine in the Surubim district and at Sucurarana Norte, in the Pilar district. Drilling below the Surubim mine is expected to start in the second quarter.

Ero Copper’s other assets in Brazil include its Boa Esperanca copper project, in the southeastern state of Para, where a 2017 feasibility study estimated an initial mine life of nine years producing about 163,000 tonnes of copper over the life of the mine, and its NX Gold Mining Complex which produces dore bars containing gold and silver in the southeastern state of Mato Grosso.

Shares of Ero Copper have traded in a range of C$14.31 and C$25.14 per share over the last year, and at presstime were approaching their 52-week high, at $25 a piece. The company has about 88 million common shares outstanding for a market cap of about C$2.2 billion.

Farooq Hamed of Raymond James raised his target price on the news to C$28 per share from C$27 per share and has an outperform rating on the stock.

(This article first appeared in The Northern Miner)

from MINING.COM https://ift.tt/3vrfdxh

Champion Iron reports record Bloom Lake production

Production at Champion Iron‘s (TSX: CIA; ASX: CIA) Bloom Lake iron ore mine near Fermont, Quebec, inched upward 1% in the year ended Mar. 31, 2021 to a record 8 million wet metric tonnes (wmt) of 66.4% iron ore concentrate – despite Covid-19 restrictions that included a month of reduced operations early in the pandemic.

For its most recent quarter, production was 2 million wmt of 66.5% iron ore concentrate, up 6% from 1.9 million wmt in the year earlier quarter. The company reported free on board total cash costs of $43 per dry metric tonne, up from $40.1 per dry metric tonne in the previous period.

During the quarter, Champion was able to increase throughput by 7% to 5.2 million tonnes of ore – and take advantage of elevated iron ore prices – thanks to continuous improvement and operational innovations that boosted mill productivity.

A 2019 feasibility study put the capital cost of the Bloom Lake expansion at C$589.8 million

“The commitment and agility of our workforce, partners and communities enabled us to mitigate the impacts of the pandemic, allowing our company to capitalize on rising global demand for high-grade iron ore,” said Champion CEO David Cataford, commenting on the strong quarter. “With our high-grade iron ore concentrate already contributing in reducing emissions in the steel industry, we produced and sold additional DR (direct reduction) quality iron ore concentrate during the period, further improving our ability to positively impact emissions for our customers.”

During the quarter, the company produced an additional 374,400 wmt of DR quality iron ore concentrate, grading 67.6% iron with a combined silica and alumina content of 2.8%.

DR ore represents a growing subset of global steelmaking capacity. Champion made its first shipments of DR quality concentrate last year. In its third-quarter financials, Champion said the shipment confirmed that “Bloom Lake is one of the few producing deposits globally that can transition its product offering in response to potential shifts in steelmaking methods in the coming years.”

Bloom Lake expansion

An expansion of Bloom Lake, which will double production to 15 million t/y from 7.4 million t/y, is under way and on track to be completed by mid-2022. There are currently 200 employees and contractors working on the Bloom Lake Phase II expansion. (The company has a recently expanded, onsite rapid testing Covid-19 lab to screen all site personnel.)

During the quarter, Champion also inked an agreement for the shipping of higher production volumes to support the expansion with Quebec North Shore and Labrador Railway; ordered long lead time items, and received and installed most spirals in its Phase II plant.

As of Mar. 31, Champion had cash on hand and restricted cash of C$680.5 million. It has a total undrawn credit facility of $220 million available.

A 2019 feasibility study put the capital cost of the Bloom Lake expansion at C$589.8 million.

In addition, the company closed its acquisition of the neighbouring Kami iron ore project, located only a few kilometres away from Bloom Lake in southwest Newfoundland, on Apr. 1.

As part of the acquisition, Champion secured an additional 8 million t/y of port capacity, including a pre-payment of port-related fees, at the multi-user berth at the port of Sept-Îles which is currently being uses to export Bloom Lake’s iron ore concentrate.

(This article first appeared in the Canadian Mining Journal)

from MINING.COM https://ift.tt/3313eKC

World’s electric vehicle fleet to reach 145 million by 2030 — report

The global auto industry had a punishing year in 2020 due to pandemic lockdowns, but the electric car market bucked the wider trend with growth of over 40% and is on track for a decade of strong expansion, according to a new report published Thursday by the International Energy Agency (IEA).

The IEA’s Global Electric Vehicle Outlook 2021 finds that despite the pandemic setting off a cascade of economic recessions, a record 3 million new electric cars were registered in 2020, a 41% increase from the previous year.

By comparison, IEA reports, the global automobile market contracted 16% in 2020. Electric cars’ strong momentum has continued into this year, with sales in the first quarter of 2021 reaching nearly two and half times their level in the same period a year earlier.

Near term outlook shines

The near-term outlook for EV sales is bright, says IEA. In the first quarter of 2021, global electric car sales rose by around 140% compared to the same period in 2020, driven by sales in China of around 500,000 vehicles and in Europe of around 450 000. US sales more than doubled relative to the first quarter of 2020, albeit from a much lower base.

Last year’s increase brought the number of electric cars on the world’s roads to more than 10 million, with another roughly 1 million electric vans, heavy trucks and buses.

Vehicle manufacturers announced increasingly ambitious electrification plans, IEA reports. Out of the world’s top 20 vehicle manufacturers, which represented around 90% of new car registrations in 2020, 18 have stated plans to widen their portfolio of models and to rapidly scale up the production of light-duty electric vehicles. The model availability of electric heavy-duty vehicles is also broadening, with four major truck manufacturers indicating an all-electric future.

For the first time last year, IEA found, Europe overtook China as the centre of the global electric car market. Electric car registrations in Europe more than doubled to 1.4 million, while in China they increased 9% to 1.2 million.

Electric vehicles are set for significant growth over the coming decade, IEA reports. Based on current trends and policies, it projects the number of electric cars, vans, heavy trucks and buses on the road worldwide to reach 145 million by 2030. But the global fleet could reach 230 million if governments accelerate efforts to reach international climate and energy goals.

Governments across the world spent $14 billion on direct purchase incentives and tax deductions for electric cars in 2020, a 25% rise year-on-year

If governments around the world pull together to pursue the even more ambitious goal of reaching net-zero emissions globally by 2050, IEA says, the global electric vehicle fleet would grow even bigger.

Governments across the world spent $14 billion on direct purchase incentives and tax deductions for electric cars in 2020, a 25% rise year-on-year. Despite this, the share of government incentives in total spending on EVs has been on a downward slide from roughly 20% in 2015 to 10% in 2020.

All the increase in government spending was in Europe, where many countries responded to the pandemic-induced economic downturn with incentive schemes that boosted electric car sales. In China, government spending decreased as the eligibility requirements for incentive programs tightened.

Worldwide about 370 electric car models were available in 2020, a 40% increase from 2019. China has the widest offering, reflecting its less consolidated automotive sector and that it is the world’s largest EV market. But in 2020 the biggest increase in number of models was in Europe — where it more than doubled.

Automakers offered 370 electric car models in 2020, a 40% year-on-year increase. Eighteen of the 20 largest automakers have announced intentions to further increase the number of available models and boost production of electric light-duty vehicles. These automakers account for 90% of all global auto sales.

The Global Electric Vehicle Outlook 2021 notes that governments helped buffer electric cars from 2020’s downturn by extending existing policy and fiscal support, and augment them with stimulus measures in response to the covid-19 crisis. Leading countries also promoted the competitive position of electric vehicles by strengthening fuel economy and emissions standards, and redoubled their support for developing battery technology and deploying charging station infrastructure.

More details on the implications of this pathway for electric vehicles and the broader transport sector will appear in the IEA’s special report, Net Zero in 2050: A roadmap for the global energy system, which will be released in May.

from MINING.COM https://ift.tt/3gX3WAy

LOTO® Samedi 1 mai : 4 millions d'euros à remporter + 10 gagnants à 20 000 € !

from Les dernières actualités de Futura https://ift.tt/3eHF0KF

Glencore’s board approves pay package for Nagle

Glencore’s (LON: GLEN) board approved on Thursday a pay package for incoming chief executive Gary Nagle despite backlash from proxy groups and some investors in recent weeks, which consider the proposed remuneration “excessive” .

Nagle, who is set to take over Ivan Glasenberg at the end of June, will receive up to $6.4 million in any one year, as 40% of his bonuses will be held back until two years after he leaves post. This ignores any share price changes, distributions or share awards.

Chairman Tony Hayward had defended the payment plan, saying he was disappointed that the two advisory firms were against it.

The company thanked shareholders for their support, adding that having 26% of them opposed to the package would go unnoticed.

“The company liaised extensively with its largest shareholders in developing the remuneration package and is grateful for their support,” it said announcing the AGM’s results. “We will continue to consult with shareholders regarding their concerns and will consider their feedback as we implement our new remuneration policy.”

Glencore has only had three chief executives since founded in 1974. Glasenberg had received a flat annual salary of $1.5 million since Glencore listed in 2011, so Nagle will be the first subject to a conventional pay arrangement. The bulk of his remuneration, however, would from short and long-term incentive schemes.

The Swiss miner and commodities trader group had said in its latest annual report it considered Nagle’s proposed remuneration to be sensible and aligned with shareholder interests.

“The maximum total annual remuneration that the CEO will actually receive during his employment is c. $6.4 million compared to the peer maximum of $11-18 million,” it said.

Strong year of earnings ahead

Earlier in the day, Glencore announced first-quarter results, the last update under Glasenberg.

The company said copper production rose by 3% to 301,200 tonnes on higher output at its South American operations, while zinc, lead and nickel output fell.

Glencore, which is one of the world’s top cobalt miners, also saw production of the battery material cobalt climb 11% in the period.

The firm’s trading arm benefited from rising prices for its crucial commodities.

Glencore said copper prices had averaged $8,501 in the three months to March, up 51% on the same period of 2020, while zinc was up 29%, nickel 38% and thermal coal 27%. The firm was on track to deliver core profit in the top half of its guidance range of $2.2 billion to $3.2 billion this year.

from MINING.COM https://ift.tt/3xxN4GA

Votre eau est-elle potable ? Vérifiez-le grâce aux vibrations de votre smartphone

from Les dernières actualités de Futura https://ift.tt/3xub7GB

Les glaciers fondent plus vite que jamais

from Les dernières actualités de Futura https://ift.tt/3u5tiQL

Sony veut faire jouer une intelligence artificielle à votre place

from Les dernières actualités de Futura https://ift.tt/331mqYx

Vous vous rappelez des anticorps de lama ? Ils pourraient bien être efficaces contre les variants

from Les dernières actualités de Futura https://ift.tt/3eEMEpf

Bacteria may be used to source high-grade copper – study

US and Brazil-based researchers published a new study where they outline what they deem a ‘more efficient and safer’ alternative to sourcing copper via bacteria.

The paper was published in the journal Science Advances and in their discussion, the scientists provide conclusive evidence of how a copper-resistant bacterium found in a copper mine in Brazil transforms copper sulfate (CuSO4) ions into zero-valent Cu or metallic copper.

“By putting the bacteria inside an electronic microscope, we were able to figure out the physics and analyze it. We found out the bacteria were isolating single atom copper,” Francisco C. Robles Hernandez, co-author of the study, said in a media statement. “In terms of chemistry, this is extremely difficult to derive. Typically, harsh chemicals are used in order to produce single atoms of any element. This bacterium is creating it naturally. That is very impressive.”

These results suggest that the conversion process could be an alternative way to produce single atoms of metallic copper in a safer and more efficient way

According to Robles and his colleague Debora Rodrigues, the novelty of this discovery is that microbes in the environment can easily transform copper sulfate into zero-valent single-atom copper. This is a breakthrough because the current synthetic process to achieve the same result is usually not clean, labor-intensive and expensive.

“The microbes utilize a unique biological pathway with an array of proteins that can extract copper (II) (Cu2+) and convert it into single-atom zero-valent copper (Cu0). The aim of the microbes is to create a less toxic environment for themselves by converting the ionic copper into single-atom copper, but at the same time they make something that is beneficial for us too,” Rodrigues said.

In the scientists’ view, these results suggest that the conversion process could be an alternative to produce single atoms of metallic copper in a safer and more efficient way, compared to current methods such as chemical vapor deposition, sputtering and femtosecond laser ablation.

“We have only worked with one bacterium, but that may not be the only one out there that performs a similar function,” Rodrigues said. “The next step for this particular research is harvesting the copper from these cells and using it for practical applications.”

The research team believes these findings may be key to addressing supply challenges derived from the limited availability of high-grade copper in Earth’s crust and the need for intensive smelting and production processes that require sulfur dioxide and nitrogen dioxide to obtain concentrate in useful quantities.

from MINING.COM https://ift.tt/3u2D2v6

Tr’ondëk Hwëch’in First Nation supports Golden Predator’s Brewery Creek project

The Tr’ondëk Hwëch’in First Nation announced that it has submitted letters of support for the timely renewal of the Brewery Creek water license and quartz mining license to the Yukon Water Board and the Yukon Environmental and Socio-economic Assessment Board.

The Brewery Creek gold mine project is owned by Vancouver-based Golden Predator Mining (TSX.V: GPY) and operates under a socio-economic accord with the Tr’ondëk Hwëch’in.

The project currently holds valid licenses but they expire on December 31, 2021. Thus, with the First Nation support, Golden Predator submitted renewal applications on existing terms and conditions for 10-year extensions.

Located 55 kilometers from Dawson City, Brewery Creek is a brownfield, heap-leach gold mine that was operated by Viceroy Minerals from 1996 to 2002

“Tr’ondëk Hwëch’in has a long history of both direct involvement and consultation about the property with its various owners, including an amended and restated socio-economic accord signed in 2012,” the mining company said in a press release. “Golden Predator is applying for renewals of the licenses with the same terms and conditions [and] will consider further licence amendments in the future which would be assessed separately, based on what the company proposes following the completion of the feasibility study.”

Located 55 kilometers from Dawson City, Brewery Creek is a brownfield, heap-leach gold mine that was operated by Viceroy Minerals from 1996 to 2002.

According to Golden Predator, a feasibility study on the project is being conducted by Kappes Cassiday & Associates and it will include a multi-year mine plan, an inventory of the mineralized material remaining on the heap and mine planning for the resumption of the mining of material from leachable resources contained within the licensed area.

from MINING.COM https://ift.tt/33cE7Vr

Condor Gold completes drilling at La India pits

Condor Gold (LON:CNR) (TSX:COG) said on Thursday it had finished infill drilling at the two starter pits that are part of its flagship La India gold project in Nicaragua, adding that the latest results reinforce the company’s geological model, mineral resource, reserve calculation and mining plan.

The miner, which acquired 85% of the land within the permitted site in August 2020, said assay results have been returned for 29 of the planned drill holes, which gives it a complete dataset for the Northern Starter Pit and for the first six drill holes in the Southern Starter Pit.

Condor will continue advancing the development of the two pits, located within 35 metres of the surface. The intention, it said, is to mine them early to quicken the payback period and enhance the project’s economics.

Condor Gold’s plan is to mine two small starter pits early to quicken the payback period and enhance La India’s economics.

La India’s initial pits contain 455,000 tonnes at 4.17g/t gold for 59,674 oz gold using a 2.00g/t cut-off grade. The main open pit, in turn, has a mineral reserve estimate of 6.9 million tonnes at 3.1 g/t gold for 675,000 ounces of gold.

Condor Gold staked concessions in Nicaragua, Central America’s largest country, in 2006. Since then, mining has significantly taken off in the country due to the arrival of foreign companies with the cash and expertise to tap into existing reserves.

The government of Nicaragua granted Condor Gold in 2019 the 132.1 km2 Los Cerritos exploration and exploitation concession, which expanded the La India project concession area by 29% to a total of 587.7 km2.

Condor also attracted a partner — Nicaragua Milling. The privately held company, which took a 10.4% stake in the miner in September 2019, has operated in the country for two decades.

from MINING.COM https://ift.tt/2SdxVdr

Bon plan forfait mobile : 50 et 80 Go de 4G à moins de 4 euros chez Cdiscount Mobile

from Les dernières actualités de Futura https://ift.tt/2S4IIq6

Qu’est-ce que le métier de chef de projet ?

from Les dernières actualités de Futura https://ift.tt/3nwuava

Les calamars des abysses comme vous ne les avez jamais vus

from Les dernières actualités de Futura https://ift.tt/3vuM7x2

Pour la salle de bains et la cuisine, un nouvel enduit de lissage pour les pièces humides

from Les dernières actualités de Futura https://ift.tt/3gNjEOF

Club R Days chez Rakuten : jusqu’à 60% de remise et 30% remboursés sur une sélection de produits high-tech

from Les dernières actualités de Futura https://ift.tt/3h0Ur3J

Aidez Microsoft à choisir sa nouvelle police système

from Les dernières actualités de Futura https://ift.tt/32WjBrV

Voici la Tesla la plus chère et la plus bing-bling

from Les dernières actualités de Futura https://ift.tt/3nAQzr9

Michael Collins : retour en images sur la vie de « l’astronaute idéal. Celui à qui on rêve de ressembler »

from Les dernières actualités de Futura https://ift.tt/3u7f16a

Bon plan Cdiscount : 157 € d'économie sur la TV LG OLED55CX6

from Les dernières actualités de Futura https://ift.tt/3xxRnSj

Les astronomes ont-ils détecté des étoiles d'antimatière ?

from Les dernières actualités de Futura https://ift.tt/3gO25hB

Cyberespionnage : Kaspersky a identifié les nouveaux outils de piratage de la CIA

from Les dernières actualités de Futura https://ift.tt/3aLTwzY

Pfizer teste une pilule pour soigner la Covid-19

from Les dernières actualités de Futura https://ift.tt/3eGFpwV

Comment un hexacoptère pourrait relancer l’exploration de Mars avec de nouveaux objectifs scientifiques

from Les dernières actualités de Futura https://ift.tt/3aOgC9c

Arctique : des « bombes de chaleur » font fondre la glace

from Les dernières actualités de Futura https://ift.tt/330dvGM

mercredi 28 avril 2021

La croûte continentale se serait formée 500 millions d'années plus tôt qu'on ne le pensait

from Les dernières actualités de Futura https://ift.tt/3aLvxkA

U of Calgary-spin off company develops nanotechnology-based lithium extraction solution

Litus announced the launching of LiNC, a patent-pending lithium extraction solution initially developed at the University of Calgary in Alberta, Canada.

In a press release, the company said that the nanotechnology composite material within LiNC has very strong ionic affinity and lithium selectivity in the presence of high concentrations of competing ions such as sodium, magnesium and calcium.

Litus expects mining companies to be able to open up new sources of lithium that have been uneconomic with previous extraction technologies

“While materials capable of such high affinity have generally been shown to be quite fragile, Litus has developed materials that are able to uniquely combine high efficiency with the durability required for effective industrial application and scalability,” the media brief states. “The high performance and selectivity of LiNC result in a solution that it is able to accomplish more in a single step than competing technologies can achieve with several energy and chemically intensive steps.”

According to Litus, its technology is able to efficiently and sustainably extract more lithium from brine sources than similar methods.

“Demand for lithium is growing at a rate that current production methods and technologies simply can’t meet. Through the application of LiNC, mining companies have an opportunity to not only increase the reserves and production of their existing assets but should be able to open up new sources of lithium that have been either uneconomic or too environmentally sensitive to be practical with previous extraction technology,” the firm’s statement reads.

from MINING.COM https://ift.tt/2Pwcfs3

Preliminary results warrant drill campaign at Portofino’s Yergo lithium project in Argentina

Portofino Resources (TSXV: POR) announced that after receiving encouraging results from a geophysical survey and surface geochemical sampling program, it has filed an application with the Provincial Mining Ministry of Catamarca for a drill permit for the Yergo lithium project in Argentina.

According to the Vancouver-based company, the decision to launch a drill campaign was made after the survey identified two large, anomalous sub-basins within the Aparejos Salar, where Yergo is hosted.

In a press release, Portofino said the survey and sampling results confirmed the presence of lithium-rich brines and the potential volume of the brines within the project.

Sampling by Portofino at Yergo returned values of up to 373 mg/L lithium, and up to 8,001 mg/L potassium

“Phase 1 drill testing of the project will enable initial evaluation of the volume and the lithium content of the brines and sediments within the identified zones,” the media brief states. “Definitive drill target locations are being finalized.”

The 2,932-hectare Yergo property encompasses the entire Aparejos Salar and is located in the southern part of the Lithium Triangle, some 15 kilometers southeast of Neo Lithium’s advanced 3Q project.

“Given the proximity of the 3Q project, it is likely that the Aparejos Salar has a similar geological history, including lithium enrichment, due to their common evaporitic climate and local geology,” the Canadian firm’s statement reads. “Sampling by Portofino returned values of up to 373 mg/L lithium, and up to 8,001 mg/L potassium and included low magnesium to lithium ratios.”

from MINING.COM https://ift.tt/2QuncuJ

Des joueurs de Tetris établissent de nouveaux records grâce à une technique inédite

from Les dernières actualités de Futura https://ift.tt/3eCgk6u

Bon plan forfait mobile : jusqu’à 200 Go à partir de 4,99 € sur le réseau SFR ou Orange

from Les dernières actualités de Futura https://ift.tt/3sXJYbp

Copper prices set Teck profit on fire — up 247% in Q1

Teck Resources (TSX:TECK.A | TECK.B)(NYSE:TCK), Canada’s largest diversified miner, became one of the latest mining companies to see its profit swell thanks copper prices being pushed to all-time highs by vaccine rollouts and climate pledges.

The Vancouver-based miner reported a 246.8% jump in first-quarter adjusted profit on Wednesday of C$326 million ($262.88 million) or 61 Canadian cents per share. That compares to a net income of C$94 million, or 17 Canadian cents per share, a year earlier.

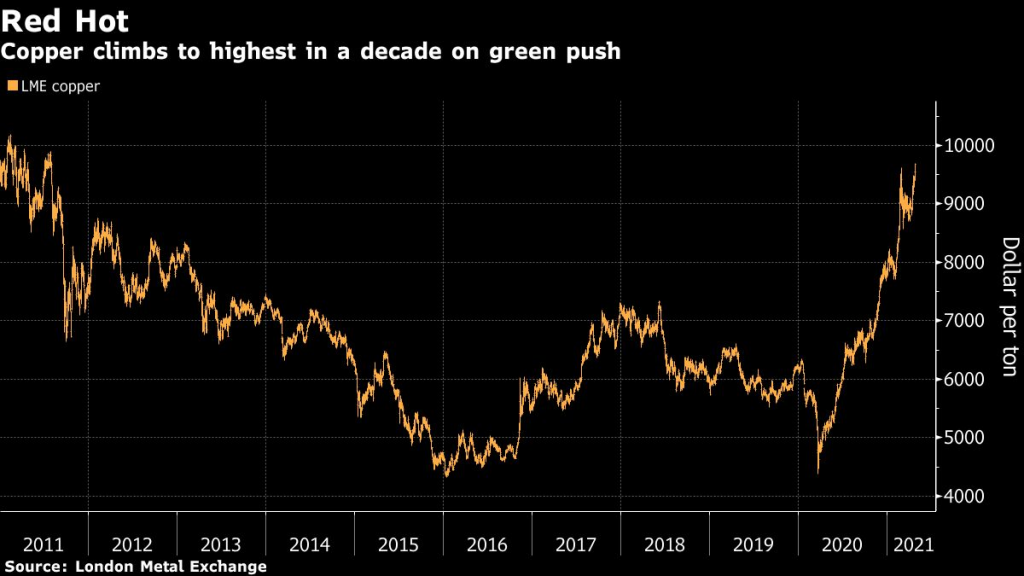

Copper prices have more than doubled from its covid-lows, and are about to pass the 10,000 a tonne mark, fuelled by a widely-held belief that demand for the metal will skyrocket in the short and medium term. Post-pandemic economic stimulus and a worldwide push for decarbonization, in which copper plays a key role, have contributed to the gains.

Prices for the bellwether metal pushed to all-time highs by vaccine rollouts and climate pledges.

Teck attributed the eye-pooping jump in profit not only to the copper bonanza, but also to higher prices of zinc and blended bitumen, which were higher than a year ago.

“Strong first-quarter operational performance, in line with plan, and higher commodity prices contributed to a very solid start to 2021,” Teck chief executive Don Lindsay said in the statement.

The company highlighted milestones achieved at its priority projects, including surpassing the halfway point at its flagship Quebrada Blanca Phase 2 (QB2) copper project in Chile and moving into the commissioning phase of the Neptune coal terminal upgrade, on Canada’s West Coast.

Teck keeps its 2021 guidance unchanged at 275,000 to 290,000 tonnes of copper; 25.5 – 26.5 million tonnes of steelmaking coal; 585,000 – 610,000 tonnes of zinc and 8.6 – 12.1 million barrels of bitumen.

from MINING.COM https://ift.tt/3vu5sy7

L'étonnant projet de piste cyclable sous un lac à Amsterdam

from Les dernières actualités de Futura https://ift.tt/3ucKAeV

-89% sur votre formation dropshipping : bénéficiez d'un bon plan exclusif

from Les dernières actualités de Futura https://ift.tt/3unD3Kn

Shimano annonce deux moteurs pour les vélos électriques cargo et s'ouvre aux batteries tierces

from Les dernières actualités de Futura https://ift.tt/3xz47Z4

Bon plan : la trottinette électrique AOVO en réduction à -110 € sur Cdiscount

from Les dernières actualités de Futura https://ift.tt/2QC0fpn

Covid-19 : « aucun signe » de contagion après le concert-test de Barcelone

from Les dernières actualités de Futura https://ift.tt/2R3z2f5

Les Happy Days AliExpress : le Xiaomi Redmi Note 10 5G NFC à moins de 145 euros

from Les dernières actualités de Futura https://ift.tt/3nv2OFz

Enfin un drone qui peut livrer plusieurs colis en même temps

from Les dernières actualités de Futura https://ift.tt/3evwvCk

La Chine et la Russie s'installeront sur la Lune durant la prochaine décennie

from Les dernières actualités de Futura https://ift.tt/3dZDkNO

Un malware voleur de mots de passe se répand sur Android

from Les dernières actualités de Futura https://ift.tt/3eBwXiL

Bon plan : 141 € d'économie sur le micro-ondes encastrable Hotpoint

from Les dernières actualités de Futura https://ift.tt/32ULRep

AstraZeneca : un adjuvant du vaccin serait-il à l'origine des thromboses ?

from Les dernières actualités de Futura https://ift.tt/3gLrE2E

Une seule dose de vaccin anti-Covid réduirait de moitié la transmission au sein d'un ménage

from Les dernières actualités de Futura https://ift.tt/3aLdUkQ

Bon plan Cdiscount : réduction de 213 € sur le salon de jardin Tectake

from Les dernières actualités de Futura https://ift.tt/3evkIny

Image incroyable de Perseverance photographié par Ingenuity en plein vol !

from Les dernières actualités de Futura https://ift.tt/3dXy9ha

La transition « énergéthique » grâce à Ogaia

from Les dernières actualités de Futura https://ift.tt/3sZhr5t

Vers une extraction massive de l'or présent dans les entrailles de la Terre

from Les dernières actualités de Futura https://ift.tt/3vouQoZ

mardi 27 avril 2021

Enfin un vaccin efficace contre le paludisme

from Les dernières actualités de Futura https://ift.tt/3e0dIQR

Barrick readies to open Loulo-Gounkoto underground mine

Canada’s Barrick Gold (TSX:ABX)(NYSE:GOLD), the world’s second largest bullion miner, said a third underground mine at the company’s giant Loulo-Gounkoto gold complex in Mali has reached its first mining level and is scheduled to start delivering ore tonnes to the plant during the current quarter.

The Toronto-based company has also started a prefeasibility study on two more mines on the Loulo permit — an underground operation at Loulo 3 and a large open pit at Yalea South.

President and chief executive Mark Bristow said the study aims to add mining sources and improve feed flexibility, providing further support for the complex’s robust 10-year plan.

Barrick has also started a prefeasibility study for an underground operation at Loulo 3 and a large open pit at Yalea South.

Exploration programs designed to replace depleted reserves are continuing to deliver good results, Bristow said.

The complex produced 193,014 ounces of gold in Q1 and is on track to achieve its full-year guidance of 640,000 to 700,000 ounces1. Given its strong performance and the relatively high gold price, the joint venture board paid a combined dividend for the Loulo-Gounkoto complex of $80 million in the quarter.

Barrick said the asset remains a pillar of the Malian economy as well as a driver of local economic development. Over the past 24 years, Barrick and its legacy company Randgold Resources have contributed $7.7 billion to the economy, of which $3 billion went to the state in the form of dividends, taxes and royalties, Bristow noted.

from MINING.COM https://ift.tt/3npxRTi

Two-wheelers to play big role in EV market share growth – report

A new report by IDTechEx forecasts that the electric vehicle market will continue to grow in the next two decades, particularly taking into consideration that, despite the covid-19 pandemic, sales of high-voltage hybrids, plug-in hybrids, and battery-electric vehicles all saw an increase in most regions across the globe.

Putting Europe as an example, IDTechEx points out that in 2020, sales of petrol, diesel and other alternatively powered vehicles jointly dropped by 24%, but high-voltage hybrids were up 54%, battery-electric vehicles were up 107%, and plug-in hybrids were up 211%.

Despite positive numbers in the US and Europe, the market analyst says it is important to pay attention to what’s going on in Asia, where the dominant form of transportation is the motorcycle.

“In the past decade, India has overtaken China to become the world’s largest motorcycle market, selling roughly 17 million in fiscal year 2020 (SIAM) in a global market of 57 million (Marklines),” the report states. “It is no coincidence that India has seven out of the world’s top ten most polluting cities. When we hear ambitious electrification targets from countries like India, it is the electrification of two-wheelers and micro-mobility, not cars, which is the focus.”

By 2041, however, the market analyst sees the electric car dominating both unit sales and battery demand, as they have become the focus of automotive startups, particularly in China, with plug-ins increasingly losing share.

When it comes to electric vans or light commercial vehicles, IDTechEx believes that the next few years will see companies conducting large pilot projects to establish that eLCVs meet their operational range, load capacity, payload and reliability requirements.

In the analyst’s view, as experience and trust in electric technology grows, widespread replacement of ageing diesel LCVs with eLCVs will begin. This electrification may be also driven by increasing demand for freight delivery as the retail industry grows its online sales platforms, and consumers gradually abandon private car ownership for mobility-as-a-service platforms.

Similarly, sales of electric buses are expected to grow but not necessarily in its biggest market, China, but rather in Europe and Southeast Asia.

“The days of the fossil fuel powered combustion engine are numbered,” the document states in the segment dedicated to electric trucks.

According to the Cambridge-based firm, government pressure to lower emissions is likely to drive heavy vehicle manufacturers to zero on-road exhaust emission powertrain solutions.

Sea and air

The transition to electric power in the marine sector may not be so smooth – according to IDTechEx – due to the sheer scale of the power, energy and distance requirements for many vessels.

For the analyst, what is likely to happen in the next two decades is that solutions such as batteries and fuel cells to premium fuels, scrubbers and slow-steaming are to become the way of exiting polluting fossil fuels.

“Today, batteries have mainly emerged in leisure boating, ferries and short-sea vessels, where they have enjoyed steady uptake due to small vessel sizes or well-defined cyclical routes (that allow for opportunity charging),” the review states. “In larger deep-sea vessels, uptake is slow, but unprecedented global emissions regulations are driving change, and shortages of traditional solutions on the horizon are creating new opportunities for energy storage start-ups in the arena.”

Finally, in the electric aerospace realm, the prediction is that, given that small fixed-wing pure-electric is trading now, larger hybrid and pure-electric aircraft up to regional aircraft will be available within ten years.

“The wild card is vertical-takeoff pure-electric aircraft as air taxis (eVTOL) and personal aircraft,” the report states.

from MINING.COM https://ift.tt/3eAjEPp

Bon plan : 89% de réduction sur votre formation au Deep Learning

from Les dernières actualités de Futura https://ift.tt/3elml91

Plus que quelques heures pour profiter de la série limitée 200 Go à seulement 15 €/mois chez RED By SFR

from Les dernières actualités de Futura https://ift.tt/3gHaB1L

Retrogaming : visitez l’un des magasins mythiques de jeux anciens sans aller au Japon

from Les dernières actualités de Futura https://ift.tt/3gEkmxO

Gold’s untold story

Gold has uses that affect many aspects of our lives. While gold is known as a safe haven investment asset and is popular worn as jewelry, it is also present, while hidden from view, ensuring the safe operation of the medical and electronic devices we rely on every day.

Responsible gold miners in all parts of the world make significant contributions to society, such as bringing jobs and opportunities to host communities.

The World Gold Council (WGC) has brought the journey from mine to market – gold’s untold story —to life.

Explore WGC’s virtual community setting, where you can see some of gold’s less known uses — such as its role in treating cancer. The WGC virtual mine site also highlights some of the innovations companies are implementing to safely and efficiently produce gold.

Gold mining projects only proceed once the government of the host country has granted permits and all aspects of these applications are scrutinized closely, with Environmental, Social and Governance (ESG) considerations of critical importance.

Securing a “social license to operate”, which is now becoming akin to a mining license, depends on building and nurturing healthy, collaborative partnerships with host governments and communities.

Foundational to these long-term partnerships is trust, built through ESG impact management and stakeholder engagement, contributing to good governance and fairly sharing the benefits of mining.

Take the WGC virtual journey from mine to market here.

from MINING.COM https://ift.tt/3vpUaLE

Soaring iron ore prices boost Vale Q1 profit

Brazil’s Vale (NYSE: VALE), the world’s top iron ore producer, has beat first quarter profit estimates, as prices for the steel-making ingredient continue to hit record highs.

The miner, which is also the no.1 nickel producer, posted net income of $5.6 billion, above market estimates of $5.06-billion. The figure is also significantly higher than the $239 million posted in the first quarter of 2020, which was affected by factors such as fines and compensation to victims of the deadly 2019 Brumadinho tailings dam disaster.

Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) reached $8.4 billion in the three months to March 31, up from $2.9 billion a year earlier.

Seasonally lower production volumes were partially offset by higher commodity prices, with 62% iron ore fines fetching an average 25% more than the previous quarter.

Vale said seasonally lower production volumes, announced last week, were partially offset by higher commodity prices, with 62% iron ore fines fetching an average 25% more than the previous quarter.

Fastmarkets MB’ index for iron ore 62% Fe fines rose by $1.73 per tonne or 0.9% on Tuesday, the second straight day the commodity hits a fresh high.

“I am confident that our positive financial results reflect our consistency in delivering our promises in de-risking Vale,” chief executive officer Eduardo Bartolomeo said in the performance review.

Among the accomplishments of the period, Bartolomeo named the $7 billion Brumadinho global settlement, completing the sale of Vale New Caledonia and the recently announced share buyback program.

RBC Capital Markets analyst Tyler Broda said the buyback would be “well covered” by the $5.8 billion in free cash flow generated in the first quarter.

“The key question in our view is how management will allocate next quarter’s cash flow, and the next,” he wrote.

Rosy outlook

Vale reiterated its bullish short-term stance on iron ore, copper and coal, but warned of a “small surplus” in the nickel market amid “resilient production” in China and Indonesia.

It forecast a “small surplus” in the nickel market this year, but said its long-term outlook for metal remained very positive as demand from the EV sector rising steadily and cost of ownership nearing parity with internal combustion engine vehicles.

“Global sales of electric vehicles are on track to increase by over 80% from 1Q20 led by robust growth in China and moderate increases in Europe and North America,” Vale said.

The Rio de Janeiro-based mining giant had a positive near-term view on copper, thanks to robust demand and supply concerns, as containing the latest wave of covid-19 is proving to be difficult, particularly in Latin America.

from MINING.COM https://ift.tt/3aIExqs

Formation WordPress : jusqu'à -89% de remise en bon plan avec Udemy

from Les dernières actualités de Futura https://ift.tt/32Riyt9

Dernier jour pour profiter du forfait sans engagement 200 Go à seulement 14,99 €/mois chez Bouygues Télécom

from Les dernières actualités de Futura https://ift.tt/3npotz6

Variant indien : comment ses mutations changent sa biologie ?

from Les dernières actualités de Futura https://ift.tt/3vgMbQK

Mochi, le robot de recharge qui carbure à l’électricité verte

from Les dernières actualités de Futura https://ift.tt/2QDygWa

Le mode « nuit » des smartphones ne servirait pas à grand-chose

from Les dernières actualités de Futura https://ift.tt/2S9oWtJ

Bon plan Moulinex : -259 € sur le Robot cuiseur connecté i-Companion

from Les dernières actualités de Futura https://ift.tt/3dUUtrF

Covid-19 : les distances de sécurité en intérieur ne serviraient à rien

from Les dernières actualités de Futura https://ift.tt/3gDR4PT

Bon plan : 89 % de réduction sur la formation au bitcoin et aux cryptomonnaies

from Les dernières actualités de Futura https://ift.tt/3sXXvA2

Promo box internet : la RED Box sans engagement dès 19€ / mois avec 2 mois offerts

from Les dernières actualités de Futura https://ift.tt/3aK62zZ

Bon plan : réduction de 89 € sur l'aspirateur Robot DEEBOT 605

from Les dernières actualités de Futura https://ift.tt/3xnmKix

macOS Big Sur 11.3 : pourquoi il est urgent de mettre à jour votre Mac ?

from Les dernières actualités de Futura https://ift.tt/3xtM2vm

Surprise ! Les vieilles étoiles tournent plus vite que prévu !

from Les dernières actualités de Futura https://ift.tt/3u8xKOo

Offre Cdiscount : économisez 119 € sur la plateforme vibrante Bluefin Fitness

from Les dernières actualités de Futura https://ift.tt/3wDBWri

Le coronavirus représente un risque important pour les femmes enceintes

from Les dernières actualités de Futura https://ift.tt/3gGJqnP

Door Keeper, une serrure intelligente et innovante

from Les dernières actualités de Futura https://ift.tt/3dxyffa

lundi 26 avril 2021

Combien vaut votre profil Facebook ou Twitter sur le Dark Web ?

from Les dernières actualités de Futura https://ift.tt/3aDDeJq

La Covid-19 peut encore tuer six mois après l'infection

from Les dernières actualités de Futura https://ift.tt/3vjUAD1

Des astronomes ont observé une étoile « spaghettifiée » pour la première fois

from Les dernières actualités de Futura https://ift.tt/3gK9UVt

Copper price blasts to 10-year high as global recovery extends metals rally

Copper climbed to the highest since 2011 as the global recovery from the pandemic extended a rally in metals markets.

Copper for delivery in May was up 2% on Monday, with futures at $4.4245 per pound ($9,736 a tonne) on the Comex market in New York.

Top producer Antofagasta’s shares were up 4% on Monday morning in the LSE, while Lundin Mining was up 3% in Toronto.

Click here for an interactive chart of copper prices

Aluminum is surging and iron ore jumped to a fresh high as commodities advance toward the highs of the last supercycle.

The US recovery is accelerating and President Joe Biden’s $2.25 trillion infrastructure plan will highlight sectors like electric cars, driving further gains in commodities critical to the green energy transition. That’s coming alongside a continued economic boom in China, where a push to reduce emissions is filtering through to supply cuts for some metals just as demand is picking up.

Goldman Sachs said recently copper price can surge to $15,000 by 2025. The bank believes annual demand for copper will surge 900% from current levels to 8.7 million tonnes by 2030.

“Ripple effects into non-green channels mean the 2020s are expected to be the strongest phase of volume growth in global copper demand in history,” Goldman said in a note.

“The copper market is unprepared for this critical role.”

“The super part of the copper supercycle is happening right now,” Max Layton, managing director for commodities research at Citigroup Global Markets told Bloomberg.

“The bullish outlook is decarbonization-led, and I’m totally onboard with that for the next three to four years, but the super part of this cycle is actually more related to the scale of global stimulus.”

Still, risks to the industrial rally are building in the short term. A rise in coronavirus cases and new variants threaten to derail reopening plans in some regions such as India, while investors are concerned about a possible pullback in Chinese stimulus.

“Prices could become overly extended for industrial uses,” Xiao Fu, head of commodities strategy at BOCI Global Commodities told Bloomberg.

“I’m not in the $15,000 copper camp. There will be some automatic stabilizers before we approach those kinds of levels, and there will be some demand adjustment,” Xiao.

“And let’s not forget: the pandemic is not over, and cases are still surging in many parts of the world.”

Port workers in Chile, which accounts for about a quarter of the world’s copper supply, called a strike for Monday in response to President Sebastian Pinera’s move to block a bill allowing people to make a third round of early withdrawals from their pension funds.

The threat of covid-19 in nations in South America could hamper the export of key industrial commodities like iron ore and copper, said Gavin Wendt, senior resource analyst at MineLife Pty.

(With files from Bloomberg)

from MINING.COM https://ift.tt/3aFIvjz

Ivanhoe inks deal to boost hydropower at Kamoa-Kakula

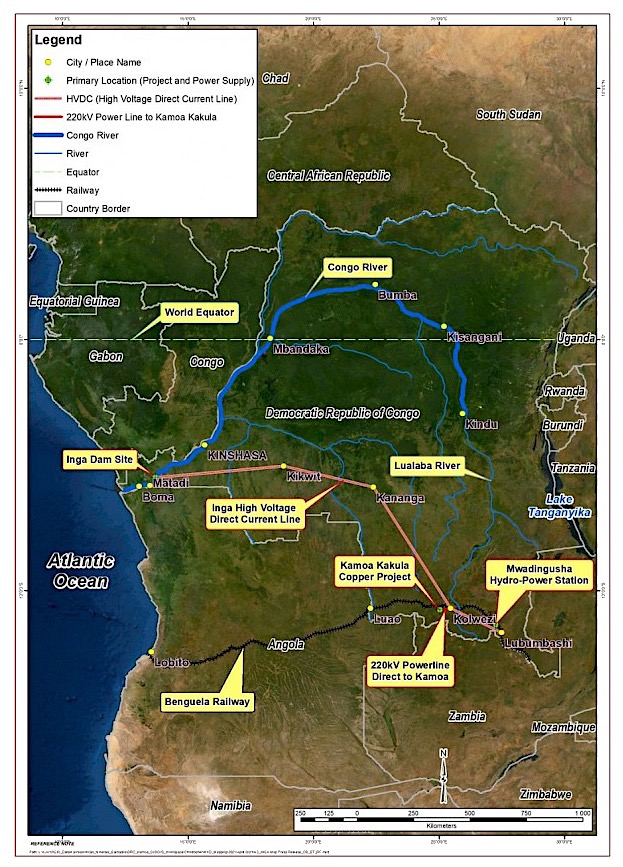

Canada’s Ivanhoe Mines (TSX: IVN) said its Kamoa-Kakula joint-venture in the Democratic Republic of Congo (DRC) had inked a deal with the country’s power company La Société Nationale d’Electricité (SNEL) to upgrade a major turbine, part of the Inga II hydropower complex.

The deal with state-owned SNEL will help Ivanhoe generate clean, renewable electricity to support the copper project’s expansion plans, also providing reliable electricity to local communities.

“The DRC is blessed with extraordinary hydroelectric potential. It is imperative to develop this potential because hydropower is clean, reliable and renewable,” President Félix Tshisekedi said.

“It is undoubtedly the most suitable type of electricity to support our country’s long-term development priorities,” he noted.

Ben Munanga, chairman of Kamoa Copper, said the new power-supply agreement will provide Kamoa-Kakula with priority access to a combined 240 megawatts of clean, renewable electricity from the upgraded turbines at Mwadingusha and Inga II hydropower plants.

The 40-year-old Inga II hydropower plant is located in the country’s southwest, on the Congo River. The waterway is the world’s deepest river and the second longest after the Nile, in Egypt. It is also the only major river to cross the Equator twice. Its rapids and waterfalls give it huge hydropower potential.

World’s second-largest copper mine

Ivanhoe’s co-chairperson Robert Friedland, who made his fortune from the Voisey’s Bay nickel project in Canada in the 1990s, has been working on Kamoa-Kakula for ten years.

The mining veteran believes the project, being developed in partnership with China’s Zijin Mining Group, will become the world’s second-largest copper mine.

“Until now, a key limiting factor in expanding Kamoa-Kakula to its full potential has been the availability of sufficient power,” Friedland said in the statement. “Given the project’s massive Indicated Resources of approximately 1.4 billion tonnes grading 2.7% copper, at a 1% cut-off, and the outstanding potential to find more high-grade copper, the new partnership with SNEL on Inga II gives us a clear line of sight to realizing our vision of building Kamoa-Kakula into the world’s largest, high-grade, green copper mine.”

First production at Kakula, the first mine planned at the Kamoa-Kakula concession, is expected before July this year.

The pit is initially forecast to generate 3.8 million tonnes of ore a year at an average feed grade “well in excess of 6% copper” over the first five years of operation.

Kamoa-Kakula is a strategic partnership between Ivanhoe Mines (39.6%), Zijin Mining Group (39.6%), Crystal River Global Limited (0.8%) and the DRC government (20%).

from MINING.COM https://ift.tt/3no6vNB

Formation au développement web : profitez d’une réduction exceptionnelle de 84%

from Les dernières actualités de Futura https://ift.tt/32Q7dJO

Des détails d'une étoile « spaghettifiée » observés pour la première fois

from Les dernières actualités de Futura https://ift.tt/3tUEOyi

Retour du super deal chez Cdiscount Mobile : 30 Go pour seulement 2,99 € / mois

from Les dernières actualités de Futura https://ift.tt/3sVLhHM

Une nouvelle station spatiale s'installe autour de la Terre jeudi

from Les dernières actualités de Futura https://ift.tt/3eMhdJV

More transparency, data usage expected from the mining industry of the future – report

Perth-based consulting firm Sandpit Innovation and global crowdsourcing platform Wikistrat published a report where they explore the mining industry’s future in the age of social awareness.

The report was prepared after engaging an interdisciplinary crowd of 90 experts from the fields of mining, innovation, disruptive technologies, and futurism who generated more than 70 scenario proposals over the course of eight days.

The simulation combined the insights of the experts on how they envision the mining industry in 2030, followed by a voting round to determine the most likely scenarios.

Employees in mining firms are expected to demand new norms in which information sharing is not avoided but promoted to gain public support

One of the main findings in the report is that increasing demands for transparency from the public and investors, matched with advances in information technologies and rising competition over talent will lead employees in mining firms to demand that management accept and apply new norms in which information sharing is not avoided but promoted to gain public support.

“The shifting social norms within the mining industry, accelerated by digital technologies that will better connect communities to miners, will lead to a new normal in which mining firms will adopt a corporate culture that focuses on restoring and gaining the trust of local communities by providing them with access to information in real-time,” the review states.

According to the document, such transparency is also a must-have when it comes to decision-making. This open-access scenario also sees more automation and data usage, whose value and demand are expected to grow. “As a result, mining firms will create value based on their ability and potential to fulfill such requirements beyond the traditional economic performance indicators,” the analysis reads.

The change in norms and the way things operate is expected to reflect demands not only from employees, communities and regulators but also from the public, as end-consumers are likely to be raising the bar and demanding commitment to Environmental, Social, and Corporate Governance standards.

“The crowd’s primary recommendation to industry executives was to understand that now is the time to experiment, take an active approach, and increase the number and investments in projects that are aimed at achieving better ESG objectives via the use of new technologies, adoption of new norms, whilst seeking to achieve higher transparency,” the report states.

Technological shifts and Tier II miners

Even though new technologies are considered key to keeping the industry current, the experts do not see major risks related to the disruption of the mining sector by Silicon Valley-type of companies.

“While the crowd suspects that the ‘Tesla-ization’ trend will spill over to the mining industry sooner rather than later, the majority of participants don’t perceive it as an existential industry threat (a Kodak-type disruption). Instead, they viewed it as the emergence of a new type of actor alongside the traditional Tier I firms,” the document reads.

In detail, the experts consulted believe that Tier II mining companies will be likely adopting digital technologies at a faster rate and, thus, will use them to improve production while, at the same time, decreasing costs and reducing their environmental footprint.

“A new set of technologies will help smaller companies to tap and explore areas that were considered not profitable, opening the market to new deposits and increasing productivity and efficiency, creating a market that is highly proliferated with new suppliers in comparison to today’s situation,” the report states. “This trend is likely to accelerate as the prices of raw materials such as copper, zinc, gold, and uranium continue to increase.”

Remote operations

Aided by the covid-19 pandemic, mining companies, especially junior firms, are likely to develop remote operations of mobile mining equipment, which may eventually become autonomous.

“This trend, combined with the developments in data aggregation and analysis of fuel consumption, is likely to provide Tier II mining firms with the ability to reduce cost and extract minerals at a higher efficiency,” the document states. “The crystallization of this new normal will happen when the movement from remote work to complete automatization of work starts to take place. As less labor will be required to operate mining equipment, Tier II mining firms will increase the use of technology companies that offer SaaS products, with a focus on remote and autonomous operations.”

In the view of the people consulted by Sandpit Innovation and Wikistrat, the use of digital technologies will also allow Tier II mining firms to use their size as an advantage when streamlining operations, equipment maintenance, and supplying spares to the mine sites.

“In addition, participants developed scenarios in which Tier II companies will operate new circular business models that will use the data collected to reduce the environmental footprint of their products, allowing them to brand themselves as innovative and green in comparison to tier one firms that will be slow to adopt the new technologies,” the report reads.

from MINING.COM https://ift.tt/32OTnaG

Forfait 5G : 50 Go pour seulement 16 €/mois chez SFR

from Les dernières actualités de Futura https://ift.tt/3epFTY8

« Je s’appelle Groot » : Disney donne vie au célèbre Gardiens de la Galaxie

from Les dernières actualités de Futura https://ift.tt/3vnS6Dx

Fortuna Silver to buy Roxgold in $884 million deal

Canada’s Fortuna Silver Mines (NYSE: FSM) (TSX: FVI) is buying fellow miner Roxgold (TSX: ROXG) in a cash-and-stock deal valued at about C$1 billion ($884.32 million), as strong gold prices spurs a wave of mergers and acquisitions in the sector.

Vancouver-based Fortuna, which has operations in Peru, Mexico and Argentina, said the combined company would produce about 450,000 ounces of gold equivalent a year.

West-Africa focused Roxgold’s shareholders will receive 0.283 common shares of Fortuna and C$0.001 for each Roxgold common share held.

The exchange ratio implies a consideration of about C$2.73 per Roxgold share, a 42.1% premium to its last closing price.

After the merger, existing Fortuna and Roxgold shareholders will own about 64.3% and 35.7%, respectively, of the combined miner.

Fortuna’s chief executive officer, Jorge A. Ganoza said the acquisition of Roxgold will provide his company access to a complete business platform which brings low-cost gold production and a permitted feasibility-stage project in West Africa.

“[It also brings] a robust exploration pipeline and key members of a seasoned executive team of proven mine builders, developers and explorers,” Ganoza said in the statement.

Roxgold’s boss John Dorward said the transaction recognizes would provide the company’s shareholders with an immediate premium and a “unique opportunity” to participate in the creation of a new global mid-tier precious metals producer, with significant organic growth and cash flow generating potential.

M&A “second wave”

The gold sector has seen an influx of mergers and acquisitions in the past six months, fuelled by strong metal prices and pressure to replace reserves that have been mined.

Bank of America analyst Michael Jalonen predicted in a note early this year another round of consolidation for the industry in 2021 among small to medium-size gold miners.

Jalonen and his team noted that gold reserves have been falling since 2012, while gold output has remained stable. They added that an effective method to replenish depleted reserves were mergers and acquisitions.

Yamana Gold (TSX: YRI) (NYSE, LON: AUY) is expanded its footprint in the precious metals-rich Abitibi region of Quebec, Canada, by acquiring all shares in smaller rival Monarch Gold late last year.

In January, Agnico Eagle Mines (NYSE:AEM) merged with TMAC Resources, adding 3.5 million ounces of reserves in the process. That more than replaces Agnico Eagle’s reserves mined last year.

Most recently, Scottie Resources (TSX-V: SCOT) and AUX Resources (TSX-V: AUX) announced a potential merger that would consolidate the two companies’ gold-silver holdings in the Stewart mining camp in B.C.’s Golden Triangle.

Junior Stratabound Minerals (TSX-V: SB), which is advancing its Golden Culvert project in southeastern Yukon, said last week it was California Gold Mining (CNSX: CGM) and its Fremont gold project in the US.

More to come…

from MINING.COM https://ift.tt/3esaqVo