samedi 31 juillet 2021

Forfait mobile : 70 Go de 4G à seulement 13 €/mois sans prix qui augmente chez RED by SFR

from Les dernières actualités de Futura https://ift.tt/3j1qgbG

Sediment plumes from deep-sea mining become turbulent cloud

Midwater sediment plumes that are discharged through pipes used by mining machinery that descend 1,000 meters or more into the ocean’s aphotic zone become a highly turbulent cloud of suspended particles that mix rapidly with the surrounding ocean water, when initially pumped out.

New research by oceanographers at MIT, the Scripps Institution of Oceanography, and other institutions made this discovery after carrying out the first-ever experiment to study the sediment plume that mining vessels would potentially release back into the ocean.

Based on their observations, they developed a model that makes realistic predictions of how a sediment plume generated by mining operations would be transported through the ocean.

The researchers developed a formula that can be used to calculate what volume of ocean water would be impacted over the course of a 20-year nodule mining operation

In a paper published in the journal Nature Communications: Earth and Environment, the scientists explain that the model predicts the size, concentration, and evolution of sediment plumes under various marine and mining conditions. These predictions, they say, can now be used by biologists and environmental regulators to gauge whether and to what extent such plumes would impact surrounding sea life.

“The science of the plume dynamics for this scenario is well-founded, and our goal was to clearly establish the dynamic regime for such plumes to properly inform discussions,” said Thomas Peacock, professor of mechanical engineering at MIT and co-author of the study.

How the model was tested

To pin down plume dynamics, the team set sail 50 kilometres off the coast of Southern California aboard the Sally Ride. They brought with them equipment designed to discharge sediment 60 meters below the ocean’s surface.

“Using foundational scientific principles from fluid dynamics, we designed the system so that it fully reproduced a commercial-scale plume, without having to go down to 1,000 meters or sail out several days to the middle of the CCFZ,” Peacock said.

Over one week the team ran six plume experiments, using novel sensors systems such as a Phased Array Doppler Sonar (PADS) and epsilometer developed by Scripps scientists to monitor where the plumes travelled and how they evolved in shape and concentration. The collected data soon revealed the turbulent cloud.

“There was speculation this sediment would form large aggregates in the plume that would settle relatively quickly to the deep ocean,” Peacock said. “But we found the discharge is so turbulent that it breaks the sediment up into its finest constituent pieces, and thereafter it becomes dilute so quickly that the sediment then doesn’t have a chance to stick together.”

Reality matched lab tests

Previous to their field trip, the scientists developed a model to predict the dynamics of a plume that would be discharged into the ocean. When they fed the experiment’s initial conditions into the model, it produced the same behaviour that the team observed at sea, proving the model could accurately predict plume dynamics within the vicinity of the discharge.

The group then used these results to provide the correct input for simulations of ocean dynamics to see how far currents would carry the initially released plume.

“In a commercial operation, the ship is always discharging new sediment. But at the same time, the background turbulence of the ocean is always mixing things. So you reach a balance. There’s a natural dilution process that occurs in the ocean that sets the scale of these plumes,” Peacock said. “What is key to determining the extent of the plumes is the strength of the ocean turbulence, the amount of sediment that gets discharged, and the environmental threshold level at which there is impact.”

Based on their findings, the researchers have developed formulae to calculate the scale of a plume depending on a given environmental threshold. For instance, if regulators determine that a certain concentration of sediments could be detrimental to surrounding sea life, the formula can be used to calculate how far a plume above that concentration would extend, and what volume of ocean water would be impacted over the course of a 20-year nodule mining operation.

from MINING.COM https://ift.tt/379fWJi

Faudra-t-il une troisième dose pour contrer le variant Delta ?

from Les dernières actualités de Futura https://ift.tt/3A1DvjP

Vénus : le climat nocturne de notre voisine se dévoile

from Les dernières actualités de Futura https://ift.tt/3zS7drl

5 astuces simples pour garder sa maison au frais en été

from Les dernières actualités de Futura https://ift.tt/3j5LeGt

Comment une bombe nucléaire a ébranlé le champ magnétique terrestre dans les années 1960

from Les dernières actualités de Futura https://ift.tt/3lhsGWo

À la rescousse de la Grande Barrière de Corail grâce aux nouvelles technologies

from Les dernières actualités de Futura https://ift.tt/3ifQ5FK

Dans les yeux de Thomas Pesquet : un dernier mont pour la faim, l'Everest

from Les dernières actualités de Futura https://ift.tt/3iVvRQN

Nasa : des astronomes lancent une pétition pour renommer le télescope spatial James Webb

from Les dernières actualités de Futura https://ift.tt/3zVMBOR

Abonnement Futura : posez toutes vos questions à la rédaction !

from Les dernières actualités de Futura https://ift.tt/3j6K0ej

Variant Delta : des scénarios pessimistes de l'Institut Pasteur pour les mois à venir

from Les dernières actualités de Futura https://ift.tt/3wIaVla

Ce contraceptif masculin chauffe les testicules avec des nanoparticules

from Les dernières actualités de Futura https://ift.tt/3fcjW00

Débloquez des contenus Netflix exclusifs grâce à IvacyVPN et obtenez une réduction de -20% sur ce VPN !

from Les dernières actualités de Futura https://ift.tt/3Ajxu2P

Mini-piscine en kit : la solution pour profiter d’une piscine dans un petit jardin

from Les dernières actualités de Futura https://ift.tt/3ltS9ML

Télétravail : offrez-vous Windows 10 à partir de 6 € !

from Les dernières actualités de Futura https://ift.tt/3BVH0Kd

20 ans de Futura : participez à notre livre d'or

from Les dernières actualités de Futura https://ift.tt/3rBE3K3

Bon plan forfait mobile : 70 Go à seulement 12,99 €/mois valable à vie chez Bouygues Télécom

from Les dernières actualités de Futura https://ift.tt/3ffWa3r

Une ancienne voie romaine découverte au fond de la lagune de Venise

from Les dernières actualités de Futura https://ift.tt/3yaSNSF

Marianne North, une baroudeuse exotique au XIXème siècle

from Les dernières actualités de Futura https://ift.tt/3j4OBgR

vendredi 30 juillet 2021

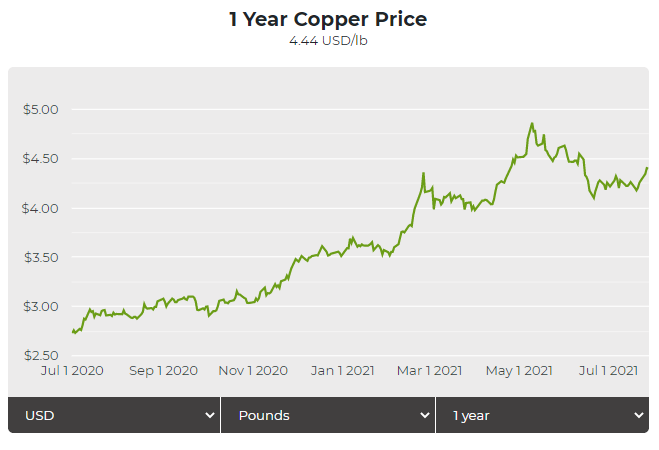

Copper price falls after China’s auction

Copper price fell on Friday after China released more base metals from its state reserves.

Copper for delivery in September fell 1.2% from Thursday’s settlement price, touching $4.466 per pound ($9,825 per tonne) on the Comex market in New York.

The release of state metal reserves is one of a number of attempts by Beijing to cool a stellar rally in commodity prices that has squeezed manufacturers’ margins.

Click here for an interactive chart of copper prices

China announced it would release a total of 170,000 tonnes of metals, including copper, aluminum and zinc, from state reserves on Thursday to nonferrous fabricators.

A total of 30,000 tonnes of copper and 50,000 tonnes of zinc was open for public bidding on the platform operated by China Minmetals Corp.

Related Article: Copper price: After China ban, Australia had no problem finding new concentrate buyers

The platform crashed several minutes after auctions started but later resumed.

Goldman Sachs said in a recent note that copper prices are poised to grow as demand outpaces supply since the concentrate market is very tight, particularly in China.

The bank’s three-month, six-month and 12-month price targets for copper are $10,500 per tonne, $11,000 per tonne, and $11,500 per tonne, respectively.

(With files from Reuters)

from MINING.COM https://ift.tt/2VePWcN

Native Americans ask court to block Lithium Americas Corp Nevada mine

Two Native American tribes have formally asked a US federal court to prevent Lithium Americas Corp from excavating its Thacker Pass lithium mine site in Nevada, which they say contains their ancestors’ bones and should not be disturbed.

The Reno-Sparks Indian Colony and Atsa koodakuh wyh Nuwu/People of Red Mountain filed their preliminary injunction request late Thursday, a filing that had been expected. The tribes say federal regulators did not adequately consult with them before approving the project in January.

The project would become one of the largest US producers of the electric vehicle battery metal. First, though, Lithium Americas needs to conduct archaeological digging at the site in order to catalog historical artifacts. It has not yet obtained necessary permits from federal officials to do so.

The tribes’ injunction request essentially asks the court to prevent that archaeological digging even if the company obtains those permits.

“The excavators and shovels could harm the very human remains the archaeologists would be looking for,” the tribes said in the filing.

Chief Judge Miranda Du of the US District Court for Nevada asked for responses from Lithium Americas and the U.S. Bureau of Land Management – which manages the federal land atop the lithium deposit – by August 12.

Vancouver-based Lithium Americas and the BLM declined to comment on the filing.

Du denied a similar injunction request last week from environmentalists who argued the project could harm wildlife. Earlier this week, though, the judge allowed the tribes to join the lawsuit to argue their concerns the project could harm historical sites.

Beyond the injunction requests, Du is considering whether former President Donald Trump’s administration erred when it approved the entire project in January. That ruling is expected by early 2022.

(Reporting by Ernest Scheyder; Editing by David Gregorio)

from MINING.COM https://ift.tt/3j5jTEr

BHP to build solar farms at Nickel West

BHP (ASX, LON, NYSE: BHP) plans to build two solar farms and a battery storage system in partnership with Canada’s TransAlta Renewables to power the Mt Keith and Leinster nickel mines, part of its Nickel West complex in Western Australia.

The world’s no. 1 miner said the project will help cut its carbon emissions by 12% compared with 2020 levels at the two operations, which currently obtain their power with diesel and gas turbines.

The solar farms will also help produce sustainable low-carbon nickel used in electric-vehicle (EV) batteries, BHP said, for which the company signed a supply agreement with EV giant Tesla.

The solar farms will contribute to BHP’s medium-term target to reduce scope 1 and 2 emissions by at least 30% from 2020 levels by 2030.

BHP commissioned the solar farms and battery to be built, owned, and operated by TransAlta as part of the power purchase agreement (PPA) extension signed in October 2020.

The propose installations will contribute to the miner’s medium-term target to reduce scope 1 and 2 emissions from its assets by at least 30% from 2020 levels by 2030, it said.

Construction is set to begin in the second quarter of 2022 and would take 12 to 14 months for completion.

“This is the first large-scale onsite solar farm and battery that BHP has commissioned at any of its global operations,” BHP Nickel West president, Eddy Haegel, said.

Embracing renewables

BHP has been steadily shifting its power sources from fossil fuels to green energy. It already has four power agreements in Chile aimed at running its operations the country, including the Spence plant, and Escondida, the world’s largest copper mine, entirely on renewable power.

The Melbourne, Australia-based giant is also aiming to eliminate the use of water from aquifers in Chile by 2030.

At home, BHP inked a deal last September to support the development of new solar and wind farms in Queensland.

The miner, which runs nine metallurgical coal operations in the Bowen Basin through its BHP Mitsubishi Alliance (BMA) and BHP Mitsui Coal (BMC), said that move would help it cut its indirect emissions in Australia by 20% over five years.

from MINING.COM https://ift.tt/3j1Gems

Ce composé de l'herbe et des fruits pourrait traiter la maladie de Parkinson

from Les dernières actualités de Futura https://ift.tt/3yfbrc9

Ce nouveau type de virus vole les mots de passe sur Android

from Les dernières actualités de Futura https://ift.tt/3f9EdDh

Apollo 15 : il y a 50 ans, la Nasa relançait son programme lunaire

from Les dernières actualités de Futura https://ift.tt/37aTj7q

L'amarrage du module Nauka à la Station spatiale ne s'est pas si bien passé que cela

from Les dernières actualités de Futura https://ift.tt/3ldLzK4

BeachBot : enfin un robot pour ramasser les mégots sur la plage !

from Les dernières actualités de Futura https://ift.tt/3lj5sQ1

Les chats pourraient bien nous en apprendre plus sur notre génome

from Les dernières actualités de Futura https://ift.tt/3rMdm5E

Records de froid en Amérique du Sud, de la neige au Brésil

from Les dernières actualités de Futura https://ift.tt/3A5Pwor

Ariane 5 fait son retour en vol ce soir : comment suivre le lancement ?

from Les dernières actualités de Futura https://ift.tt/3795ZeV

Civil unrest in South Africa, covid-19 may push cobalt prices up – report

Civil unrest in South Africa, a third wave of covid-19 and supply curbs in the Democratic Republic of Congo may push cobalt prices up to $25 per pound through 2021 from the current average of $23.94 per pound, according to a new report published by Fastmarkets.

Author William Adams, head of commodity markets research, believes that continued protests in South Africa – a major transportation route for cobalt mined in the DRC – may hinder miners’ ability to deliver their product to international customers, thus affecting supply.

More than 70 people were killed during a series of riots that started on July 8, 2021, after former leader Jacob Zuma turned himself to the authorities to serve a 15-month jail term for contempt of court.

The violent demonstrations put resource companies operating in the country under alert, with Glencore describing the situation as a “force majeure event” in a letter to customers about cobalt and a number of other ores, alloys and metals exported from the country, although it was not a declaration of force majeure.

Another factor that could be bullish for the price is if the DRC authorities step in, as is their intention, to buy the cobalt ores produced by artisanal and small-scale miners

“In a notice to customers on Wednesday, July 14, seen by Fastmarkets, the trader-miner warned that ongoing violence in South Africa could potentially prevent them from fulfilling contracts with customers,” Adams wrote in the report. “Glencore’s warning highlights the potential for supply disruptions due to civil unrest.”

In the analyst’s view, another factor that could be bullish for the price is if the DRC authorities step in, as is their intention, to buy the cobalt ores produced by artisanal and small-scale miners.

“The Entreprise Generale Du Cobalt (EGC) was set up to ensure a responsible sourcing standard, to regulate ASM mining and to buy ASM produced cobalt. Key will be whether the EGC tries to influence prices by holding back material from the market,” the review states. “At these price levels, we would imagine the state would be more interested in getting the revenue. For now, we do not expect this to get in the way of supply, although bureaucracy may well cause some delays.”

A third wave of covid-19 fueled by the Delta variant in the Democratic Republic of Congo is also seen by the Fastmarkers expert as a possible element of concern because even though earlier waves had little impact on mining, this mutation is on the rise throughout Africa and is causing serious illness in young people.

“If we see anything like the impact of Covid-19 on South America’s base metals mines in summer 2020, the cobalt industry could be in for a bumpy ride,” Adams said.

In terms of demand, the market analyst predicts it will go up, particularly after China released strong NEV data that showed 1.2 million plug-in electric vehicles were sold in the first half of the year, while the EU’s EV registrations have also held up well despite a semiconductor shortage. In fact, Fastmarkets data-gathering shows that battery-only EV registrations totalled 210,298 cars and plug-in hybrid totalled 235,730 cars, which are well above 2020 levels.

“For the first half of the year, plug-in EV registrations totalled just short of 900,000 vehicles,” the document reads. “Given Europe’s preference for NCM batteries, the robust numbers bode well for cobalt demand growth.”

from MINING.COM https://ift.tt/3j8Ikkx

Lucara digs up 393-carat diamond at Karowe

Canada’s Lucara Diamond (TSX: LUC) has recovered a 393.5 carat diamond from its company’s prolific Karowe mine in Botswana, the seventh stone greater than 300 carats dug up at the operation so far this year.

The top white Type IIa gem rock, found from direct milling of ore sourced from the M/PK(S) section of the South Lobe, is also third gem quality +300 carat produced from the unit. The other two are a 341 carat and a 378 carat top white gems both recovered in January.

Type II diamonds are found less frequently and are more valuable than Type I diamonds, as they have no measurable nitrogen impurities. This gives them exceptional transparency and brilliance.

Finds come at a crucial time for Lucara, which has begun spending in the $514-millon underground expansion of the prolific mine.

“July’s recoveries continue a trend of strong diamond recoveries in May and June and, combined with several other high value stones still to be sold, bodes well for future revenue and cash flow potential,” BMO Metals and Mining analysts, Raj Ray, wrote on Friday.

The finds come at a crucial time for Lucara, which has begun spending in the $514 million-underground expansion of Karowe, which began commercial operations in 2012.

The project, expected to take five years, will extend the mine’s productive life for at least another 13 years after the open pit ceases operations in 2026.

The development will also allow Lucara to exploit the highest value part of the orebody first and generate over $5.25 billion in gross revenue.

Expansion funds

The Vancouver-based miner recently completed a couple of major milestones ahead of kicking off underground expansion. On July 12, it secured $220 million finance facility and, three days later, it closed a C$41.4 million (about $33.1m) equity financing.

“Given that the remaining capex will be funded from cash flow from current open-pit operations and stockpiles (expected to continue until 2026), ongoing strong performances from the open-pit (as so far seen in 2021) are crucial to further de-risking Karowe underground,” Ray wrote.

Lucara’s high value stones 2021 inventory includes two diamonds over 150ct and four pink stones found this month, four >150ct ones recovered in June, six >100ct dug up in May 2021.

The two diamonds larger than 300ct recovered in January this year, the 1,758ct Sewelô found in 2019 and the 549ct Sethunya recovered in 2020, add to the impressive list.

from MINING.COM https://ift.tt/3BQ0pfw

Voici les meilleurs endroits où survivre en cas d'effondrement, selon une étude

from Les dernières actualités de Futura https://ift.tt/3ibrvG8

Le géant chinois CATL lance une batterie sodium-ion pour les transports électriques

from Les dernières actualités de Futura https://ift.tt/2Vmluxz

4e vague : la surprenante baisse des infections au Royaume-Uni et en Europe

from Les dernières actualités de Futura https://ift.tt/3j5g1TL

Avec ses trois ailes, le SE200 veut révolutionner l'aviation

from Les dernières actualités de Futura https://ift.tt/3iaAIi3

L'apparition des premiers animaux remonterait à 890 millions d'années !

from Les dernières actualités de Futura https://ift.tt/3iba6NJ

Le retour en vol d'Ariane 5, c'est aujourd'hui !

from Les dernières actualités de Futura https://ift.tt/3yd7STS

Le module Nauka est arrivé à bon port à la Station spatiale

from Les dernières actualités de Futura https://ift.tt/2TIPdA9

Bon plan forfait mobile : profitez de 40 à 200 Go dès 4,99 €/mois

from Les dernières actualités de Futura https://ift.tt/2V3jgmS

L'aimant le plus fin du monde mesure à peine un atome d'épaisseur

from Les dernières actualités de Futura https://ift.tt/3zR9nHD

jeudi 29 juillet 2021

Mining People: Arizona Sonoran, Cordoba, Mako, Mantaro, Royal Fox, SilverCrest

Management appoints announced this week:

Morgan Tiernan is the new CFO replacing David Robinson at Allied Copper.

Rita Adiani has joined Arizona Sonoran Copper as senior VP strategy and corporate development.

David Garratt is the new CFO at Cordoba Minerals, replacing Chris Cairns who is resigning Sept. 1.

Mako Mining has named Ezequiel Sirotinsky its director of finance in Nicaragua.

Mantaro Silver has appointed Jorge Masson Pazos as its Peruvian general manager and legal counsel.

Royal Fox Gold has named Adree DeLazzer as VP exploration. She was previously with Kirkland Lake Gold.

Clifford Lafleur is the new VP technical services at SilverCrest Metals. Previously, he spent five years with Torex Gold in Mexico.

Tombill Mines has appointed Tom Rowcliffe as its new CFO.

Kevin Francis has joined U.S. Gold as VP exploration and technical services.

Vizsla Silver has named Michael Pettingell to the role of VP business development and strategy.

Board moves include:

Karen Lloyd and Geoff Gay have been appointed to the board at CanAlaska Uranium.

CEO and director of EnviroGold Global, Mark Thorpe, has been appointed chair of the Canadian Mining Innovation Council.

Pancontinental Resources (Pancon) has invited Philip Corriher to join the board.

Surge Copper has nominated Richard Colterjohn and John Dorward to its board of directors.

(This article first appeared in the Canadian Mining Journal)

from MINING.COM https://ift.tt/377oO23

Expériences sans gravité : des flammes froides ont été recréées dans l'espace !

from Les dernières actualités de Futura https://ift.tt/3zMT9PN

Comment rafraîchir sa maison tout en respectant la Planète ?

from Les dernières actualités de Futura https://ift.tt/3xa2Shd

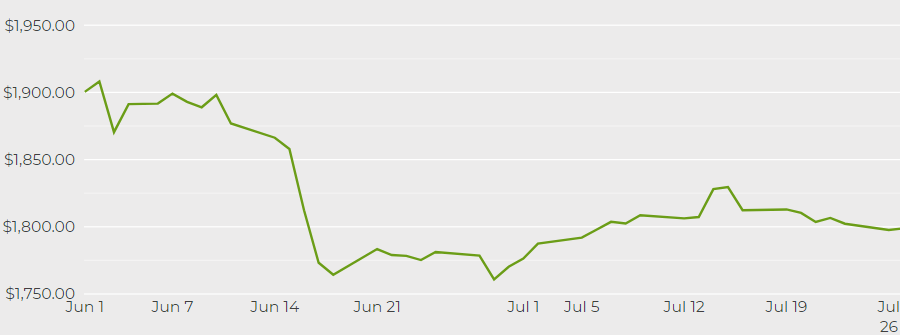

Gold price jumps to 2-week high as Fed maintains dovish tone

Gold prices jumped by more than 1% on Thursday after moving sideways over the past week, as investors reacted on the US Federal Reserve’s dovish messaging after keeping the benchmark interest rate near zero (as expected).

Spot gold was up 1.3% to $1,830.06 per ounce by noon ET, close to its highest since mid-July. US gold futures saw a larger gain of 1.7%, trading at $1,831.40 per ounce in New York.

[Click here for an interactive chart of gold prices]

On Wednesday, Fed chairman Jerome Powell stated that the central bank is “nowhere near considering a rate hike” despite the optimism about the economy.

He added that the US job market still has “some ground to cover” before it would be time to pull back support.

“You’re going to see inflation heat up moving forward because the Fed is more focused on employment and is not going to fight them in the near-term and that is a positive environment for precious metals,” David Meger, director of metals trading at High Ridge Futures, told Reuters, adding that:

“This is not a flash-in-the-pan type rally but a more sustainable one because nothing is standing in gold’s way.”

Reinforcing Powell’s views, data showed the US economy grew at a 6.5% annualized rate last quarter, below a forecast for an 8.5% rise by economists in a Reuters poll.

A dovish tone from the Fed is good news for gold, as lower interest rates reduce the opportunity cost of holding non-yielding bullion.

Adding to gold’s support, the dollar index slipped to a one-month low, making gold less expensive for holders of other currencies.

“Rising monetary policy uncertainty, inflation and increasing risk of equity market volatility should favour demand for safe-haven assets,” ANZ Research said in a note.

Meanwhile, global demand for gold rose in the second quarter to its highest quarterly level in a year as central banks and investors stepped up purchases, according to the World Gold Council’s quarterly report.

(With files from Reuters)

from MINING.COM https://ift.tt/3fbZNr4

Les anticorps de lama s'attaquent au variant Delta

from Les dernières actualités de Futura https://ift.tt/3BTZ8UY

Ce fossile exceptionnel fait reculer l'origine des animaux de plus de 200 millions d'années !

from Les dernières actualités de Futura https://ift.tt/2WyGnWR

BeachBot, le robot doté d'une IA qui ramasse les mégots de cigarettes à la plage

from Les dernières actualités de Futura https://ift.tt/3zPyn1Q

Des milliers de bébés flamants roses morts dans un lac en Turquie

from Les dernières actualités de Futura https://ift.tt/2WynjrL

Anglo American half-year profit best in its 104-year history

Anglo American (LON: AAL) will return $4.1 billion to shareholders as soaring commodity prices and the reopening of economies around the world helped the company hit the best half-year profits in its 104-year history.

The diversified miner reported pre-tax profits of $10.1 billion for the six months to June, up from $1.7 billion in the same period last year.

Revenue rose 114% to $21.7 billion and profit attributable to shareholders climbed to $5.2 billion, compared with $471 million in H1 last year. It means that Anglo American more than double what it made in 2020 as a whole.

In line with its objective of maximizing shareholder returns, the company declared dividends of $3.1 billion, or $3.31 cents a share, including a $1 billion special dividend and $1 billion in share buybacks.

“The first six months of 2021 have seen strong demand and prices for many of our products as economies begin to recoup lost ground, spurred by stimulus measures across the major economies,” chief executive Mark Cutifani said. “The share buyback should tell you that we don’t think this is as good as it gets.”

“The platinum group metals and copper – essential to the global decarbonization imperative as we electrify transport and harness clean, renewable energy – and premium quality iron ore for greener steelmaking, supported by an improving market for diamonds, all contributed to a record half-year financial performance,” Cutifani noted.

News of Anglo’s dividend follows rival Rio Tinto’s (ASX, NYSE, LON: RIO) posting a record $9.1 billion dividend, thanks to improved demand from China and strong prices for iron ore, one of its key commodities.

ESG issues

It also comes against the backdrop of an ongoing class action suit brought on behalf of over 100,000 members of the community of Kabwe, Zambia, against Anglo American South Africa.

International human rights lawyers published a statement asking Anglo American to back its public commitment to Environmental, Social and Governance performance (ESG) with actions.

“Anglo has repeatedly said it takes ESG seriously, vowing to support human rights and be accountable to communities, yet its denial of responsibility for the health crisis in Kabwe is at odds with this stance. We call upon shareholders to continue asking serious questions about the true cost to communities like Kabwe of Anglo’s financial gains,” said Richard Meeran, partner and head of the International Department at Leigh Day.

“Anglo would far sooner distribute its profits amongst management and the Board than look after communities blighted by its operations.”

Lawyer Zanele Mbuyisa, Partner at Mbuyisa Moleele

“Anglo would far sooner distribute its profits amongst management and the Board than look after communities blighted by its operations,” noted Zanele Mbuyisa, Partner at Mbuyisa Moleele.

The company reiterated its commitment to carbon neutrality across its operations by 2040. Anglo has consistently been offloading coal operations since 2014. Together with announcing its intention to spin off its South African unit last year, it made the decision to sell Cerrejón, its thermal coal subsidiary in Colombia.

It also said discussions over potential increases in taxes and royalties in Peru and Chile, where Anglo has many of its copper operations, were more “sensible” than initial proposals.

Lawmakers in Chile are discussing an opposition-sponsored bill that could see taxes on miners jump by up to 75% depending on the price of copper, the country’s key export. Peru’s new president Pedro Castillo, in turn, has vowed to squeeze more money from miners.

When Cutifani joined Anglo in 2013, Peru’s then president Ollanta Humala “was supposed to be extremely lef-twing, and we ended up having a very constructive relationship. And I am hopeful that’s where we will end up with Castillo as well,” Anglos’ boss said, adding that he is already engaged in conversation with Peru’s new leader.

from MINING.COM https://ift.tt/2VcG6YV

D’où venait la météorite qui a tué les dinosaures ?

from Les dernières actualités de Futura https://ift.tt/3f977ne

Domino Challenge : un record du monde battu par un robot !

from Les dernières actualités de Futura https://ift.tt/3jh2Kb9

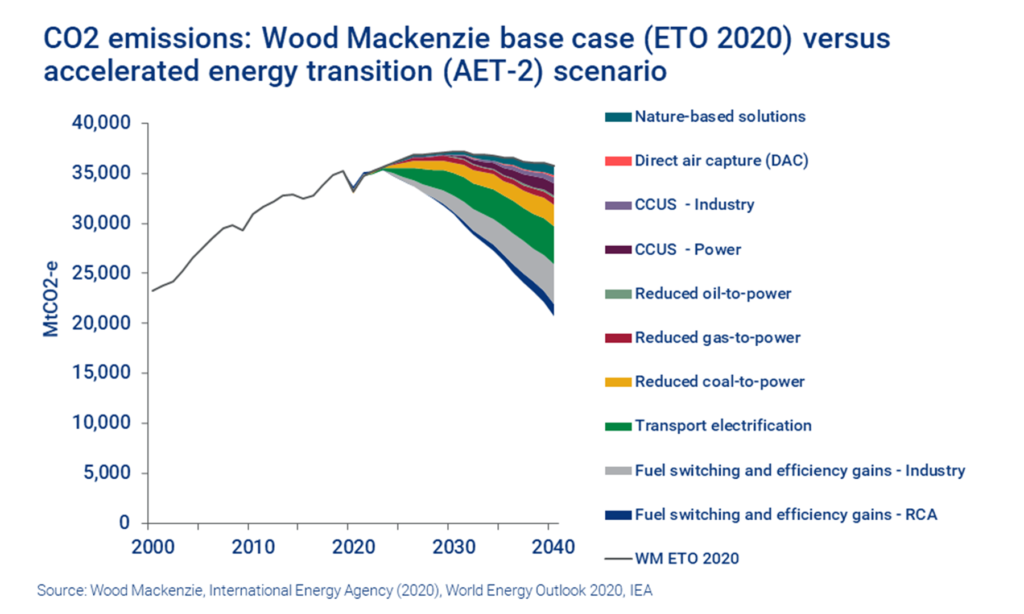

Low-carbon power for steel, aluminum industries key for reaching global decarbonization goals – report

A reduction in coal-based power production, the electrification of transport and industrial fuel switching and efficiency gains should be the focus of global decarbonization efforts if ambitious climate goals are to be achieved.

This, according to a recent analysis by Wood Mackenzie, whose vice-chair of metals and mining, Julian Kettle, explained the firm’s accelerated energy transition 2-degree or AET-2 scenario.

Based on WoodMac’s estimations, limiting the average global warming to two degrees above pre-industrial levels would require the elimination from the global economy of around 17,000 million tonnes of CO2 equivalent emissions by 2040, compared with 2020 levels. Meanwhile, by 2030 the reduction required is ‘only’ 7,500 Mt CO2-e – still a huge target, especially given that on current projections emissions are set to continue to rise until at least 2025.

The problem is that certain sectors, such as the steel and aluminum industries, loom large when it comes to fuel switching and, together, they represent more than 10% of global emissions.

“Steel will require a truly monumental shift into hydrogen-based production. This is likely to start with direct reduced iron and the adoption of innovations such as Hydrogen Breakthrough Mining Technology (HYBRIT),” Kettle wrote in his analysis. “Greater use of low-carbon energy to fuel scrap processing will also help. The widespread availability of green hydrogen will therefore determine the rate of decarbonization of steel production. However, the challenge is that the cost of the technological solution to decarbonization, or carbon abatement cost, is more than $200 per tonne of CO2-e.”

When it comes to aluminum, Kettle said that while the use of inert anode technology and low-carbon processing of bauxite will play a part, the most significant carbon reduction will come from the use of low-carbon power.

In his view, greater recovery and processing of scrap will also play a large role, but only if low-carbon power is available. The costs of carbon abatement for aluminum therefore chiefly relate to long-duration renewables, which are in the range of $50-150 per tonne of CO2-e.

“In short, the rate-determining step in the decarbonization of steel and aluminum will be the widespread availability of green hydrogen for the former and low carbon power for the latter,” his review reads. “Without an alignment between carbon taxes, emissions caps and the cost of abatement, the economics of green steel and aluminum won’t stack up. It will not be possible to state the decarbonization aspirations of industry and consumers at the same time.”

Electric vehicles

Taking into consideration the recent EV boom, Kettle explained that in order to follow the AET-2 pathway, by 2025 EV sales would have to reach around 50 million units, and by 2030 around 85 million units.

However, he believes the biggest question is whether the mining industry will be able to deliver the tonnage necessary to ramp up battery production facilities fast enough.

“My considered opinion is unequivocal: the numbers simply don’t add up in terms of the scale and speed of the buildout of mine supply required and processing capacity needed to deliver on a two-degree pathway,” Kettle wrote.

The analyst pointed out that under Wood Mackenzie’s base case, battery EV, plug-in hybrid and hybrid build and sales reach around 20 million units by 2025 and around 50 million units by 2030.

For the market researcher, such numbers can be managed by the raw materials supply chain, albeit with some thrifting and innovation.

The role of policy

Kettle also pointed out that another issue hindering a proper global move towards a cleaner future is the low price attached to carbon emissions and the low coverage of emissions trading schemes.

“This reality becomes stark when we consider that our AET-2 scenario assumes a global carbon tax of $110 per tonne by 2030. At present, very few countries have any carbon taxes at all, and even when they do the coverage is small in comparison to total emissions and the level of taxation is pitifully low,” the analysis states.

Wood Mackenzie expects a massive lag between the delivery targets of a low carbon world and the reality until carbon taxes and emissions trading prices become aligned and grow in significance.

from MINING.COM https://ift.tt/3rKXMab

Norco dévoile trois VTTAE Shimano EP8 avec batterie 900 Wh

from Les dernières actualités de Futura https://ift.tt/3f5WUbi

FLSmidth grabs Thyssenkrupp’s mining unit for $386 million

Denmark’s FLSmidth said on Thursday it is buying German engineering firm Thyssenkrupp’s mining business for €325 million (around $386 million), closing six months of negotiations between the two companies,

Thyssenkrupp’s mining business, TK Mining, is present in 24 countries with engineering and global service centres, competing with Finland’s Metso Outotec and Sweden’s Sandvik and Atlas Copco.

The business combination will create a leading global mining technology provider with operations from pit to plant, extending the strategic customer relationships with a complementary product offering and customer base as well as improved geographic coverage, the firms said in the statement.

Business combination will create a top global mining technology provider with operations from pit to plant

“TK Mining’s extensive active installed base, together with FLSmidth’s strong existing service setup, will provide additional aftermarket opportunities, while the joint R&D capabilities and combined portfolio will enable accelerated innovation in digitalization and MissionZero solutions,” FLSmidth said.

In recent months, Thyssenkrupp chief executive Martina Merz has focused on improving the company’s bottom line and structure by divesting underperforming businesses.

The service provider is also in advanced talks with potential buyers for its Italian stainless steel division AST, as well as its Infrastructure unit, which among other goods makes scaffolding and flood protection equipment, Merz said in May.

The deal, announced in January, is expected to close in the second half of 2022.

from MINING.COM https://ift.tt/3xbh4XA

RétroFutura : 20 ans de chasse aux ondes gravitationnelles

from Les dernières actualités de Futura https://ift.tt/3iUQCw6

Jour du dépassement : les principaux facteurs qui ont avancé la date au 29 juillet

from Les dernières actualités de Futura https://ift.tt/3xeE6N7

Télétravail : les meilleurs offres de l'été sur les logiciels Windows 10 à partir de 6 € !

from Les dernières actualités de Futura https://ift.tt/3zJQlD5

En Corée, des toilettes transforment vos excréments en argent numérique

from Les dernières actualités de Futura https://ift.tt/3C3qx6W

Ariane 5 est de retour en vol le 30 juillet

from Les dernières actualités de Futura https://ift.tt/3yfH7Oo

Ariane 5 est de retour en vol le 30 juillet après plusieurs mois d'absence

from Les dernières actualités de Futura https://ift.tt/3BRicmA

Alaska : alerte tsunami après un violent séisme de magnitude 8,2 !

from Les dernières actualités de Futura https://ift.tt/3BOuV9P

Vaccin anti-Covid-19 et réaction allergique : que faire pour la seconde injection ?

from Les dernières actualités de Futura https://ift.tt/3j121ud

Quels sont les effets d'une alimentation végétale chez les enfants ?

from Les dernières actualités de Futura https://ift.tt/2UgyZhu

mercredi 28 juillet 2021

VIDEO: Chinese workers condemned for ordering soldiers to beat up artisanal miners in the DRC

(WARNING This article contains graphic images that may be disturbing to viewers. Viewer discretion is advised)

Three Chinese citizens were condemned to 4 months of penal servitude and to pay 1 million Congolese Francs of fine ($504) for ordering Congolese soldiers to inflict “degrading and humiliating treatment” on illegal Congolese miners in the mining town of Kolwezi, in the Democratic Republic of Congo, as reported by the INITIATIVE LUALABA YA BIS.

According to the Armed Forces of the Democratic Republic of the Congo (FARDC), the mine workers ordered two soldiers of the FARDC to beat up and mistreat the artisanal miners.

“The army proceeded to the arrest and then the transfer of these two soldiers and their Chinese accomplices”, army spokesman Leon-Richard Kasonga said in a statement.

On Twitter, the INITIATIVE LUALABA YA BIS profile shared a video of the crime. The video began circulating this week although it’s not confirmed as to when it was shot.

“We severely condemn the action taken by our FARDC to whip our compatriots on the orders of the Chinese in a cobalt mine! Regardless of the fault committed,” the organization posted.

Nous condamnons sévèrement le geste posé par nos FARDC de fouetter nos compatriotes sur ordre des Chinois dans un mine d cobalt! Peut importe la faute commise. C'est ainsi nous appelons les autorités Prov @fifimasuk à s'impliquer pour identifier et punir les auteurs de ces actes. pic.twitter.com/h5P586hrfv

— INITIATIVE LUALABA YA BIS(@ILualabaYabiso) July 21, 2021

Southern Congo sits atop an estimated 3.4 million tonnes of cobalt, almost half the world’s known supply. In recent decades, hundreds of thousands of Congolese have moved to the formerly remote area. Artisanal miners extract cobalt by hand in precarious conditions, often working on illegal or only semi-regulated sites.

Illegal miners often make forays into mines legally assigned to Congolese or foreign industrial operators, causing similar incidents.

According to the South China Morning Post, a Chinese company is officially authorized to operate the mine where the crime took place.

Related Article: What China’s increasing control over cobalt resources in the DRC means for the West – report

from MINING.COM https://ift.tt/3BSTthJ

Google Maps indique les zones à faibles émissions dans plusieurs villes européennes

from Les dernières actualités de Futura https://ift.tt/3BKhsQh

« Pour combattre le réchauffement climatique il faut s'attaquer à la source : la surexploitation de la planète », alertent des scientifiques

from Les dernières actualités de Futura https://ift.tt/3ycspHV

Taxis volants : record de distance pour Joby, premier vol public piloté pour Volocopter aux US

from Les dernières actualités de Futura https://ift.tt/3iTOPaM

La neutralité carbone en 2030 : les gouvernements doivent « donner un coup de collier », selon Jean Jouzel

from Les dernières actualités de Futura https://ift.tt/3zLWw9K

N'oubliez surtout pas votre seconde dose de vaccin anti-Covid-19 : voici pourquoi

from Les dernières actualités de Futura https://ift.tt/3f7vEcp

First Quantum shelves plan to sell stake in Zambian copper mines

First Quantum Minerals has shelved plans to sell a stake in its Zambian copper mines, Chief Operating Officer Tristan Pascall said on Wednesday.

China’s Jiangxi Copper had been speculated as a potential suitor for minority interests in First Quantum’s Kansanshi and Sentinel mines.

First Quantum on Tuesday flagged rising costs on the back of higher Zambian royalty rates driven by increased copper prices.

“There has been limited progress” on talks with the Zambian government for terms which would pave the way for an expansion of ore processing at Kansanshi ahead of national elections, Pascall said.

Zambian President Edgar Lungu faces his most serious challenge yet from businessman and serial presidential hopeful Hakainde Hichilema in elections set for August 12.

Zambia’s ZCCM-IH sealed its acquisition of Mopani Copper Mines in March giving the state a deeper understanding of mine operations, Pascall said.

“We don’t see any significant risk there given where tax rates are at the moment,” he said.

First Quantum reported total copper production of 199,689 tonnes in Q2 2021, an increase of 18% from Q2 2020, due to near-record production at Cobre Panama of 81,686 tonnes, 276% higher than the same period in 2020.

Total gold production for the quarter was 81,375 ounces, a 49% increase from the same period in 2020, attributable to record production at Cobre Panama of 36,290 ounces and consistent delivery from Kansanshi of 32,942 ounces.

Nickel production at Ravensthorpe in Q2 was 4,543 tonnes. The company announced in May that it has entered into a binding agreement to sell a 30% equity interest in Ravensthorpe for $240 million to POSCO, one of the world’s leading integrated producers of materials for the electric vehicle sector.

(With files from Reuters)

from MINING.COM https://ift.tt/2V1n9bM

Bluejay Mining to sell projects in Finland for $5.6m

Bluejay Mining (LON: JAY) has agreed to sell its Paltamo and Rautavaara nickel, zinc, copper and cobalt projects in Finland to Metals One for £4 million ($5.6m) in cash and shares.

The explorer and developer is not fully walking away from the assets, as the deal makes it a significant shareholder Metals One, a battery metals miner.

Bluejay is also keeping its Outokumpu copper gold cobalt project and it will continue exploring around the historical Hammaslahti copper mine in Finland.

“The Paltamo and Rautavaara projects have the potential to replicate the giant adjacent Talvivaara nickel-zinc-copper-cobalt mine”, Bluejay chief executive Bo Møller Stensgaard said in the statement.

The explorer and developer is not fully walking away from the assets, as the deal makes it a significant shareholder Metals One, a battery metals miner.

As the demand for nickel from electric vehicle batteries is expected to increase ten-fold by 2030 from 2019 levels, concerns around the environmentally-conscious supply of the metal are also on the rise.

Tesla (NASDAQ: TSLA) boss Elon Musk is trying to mitigate that impact a jump in nickel mining by offering a “giant contract for a long period of time” to any firm able to extract it in an efficient, environmentally sustainable manner.

Top miners have aggressively been acquiring nickel projects in the last year, with Canada’s Noront Resources (TSX-V: NOT) currently at the centre of a bidding war between BHP (ASX, LON, NYSE: BHP) and Australian mining billionaire Andrew Forrest’s Wyloo Metals.

Just last week, BHP sealed a nickel supply deal with Tesla (NASDAQ: TSLA), as part of its push to secure a slice of the battery metals pie.

Greenland-focused

Bluejay’s flagship asset is the Dundas ilmenite project on the northwest coast of Greenland, 80 km north of the town of Qaanaaq.

After obtaining the exploitation permit in December, the junior has focused on securing financing ahead of commencing commercial production

The permit, valid for an initial 30-year period, allows Bluejay to produce 440,000 tonnes of ilmenite annually over an initial mine life of 11 years. The mineral is considered the most important ore of titanium, used commercially in the production of paint, adhesives and personal care products such as toothpaste.

from MINING.COM https://ift.tt/3BOlJC8

L’Edge Computing : comment apporter l'intelligence et la réactivité au plus proche de la source

from Les dernières actualités de Futura https://ift.tt/3l5b8Nh

8 millions d'emplois en plus dans le domaine de l'énergie d'ici 2050

from Les dernières actualités de Futura https://ift.tt/3BNIXZd

Attention aux arnaques au faux support technique

from Les dernières actualités de Futura https://ift.tt/2UVV2uJ

De la vapeur d'eau découverte dans l'atmosphère de Ganymède, la plus grande lune du Système solaire

from Les dernières actualités de Futura https://ift.tt/3f4tl9X

New technology closer to reaching superhot geothermal energy sources

Geothermal could become a terawatt source of energy with the power densities of fossil fuels if the ability to drill to 20 kilometers and 500 degrees Celsius is developed.

This, according to experts gathered in late July at the PIVOT2021 conference organized by the Geothermal Entrepreneurship Organization (GEO) at the University of Texas and which was focused on the challenges and opportunities of geothermal energy, and in particular of reaching the superhot rock deep beneath our feet.

Conventional geothermal plants reach temperatures of about 230 degrees Celsius through holes about two kilometers deep. Superhot rock can be found close to the surface in a few areas like Iceland and near volcanoes, but for most of the world, it is between seven and 20 kilometers down.

According to the panellists at the conference, things get especially interesting over about 374 degrees Celsius, where water pumped to rock becomes supercritical, in a steam-like phase. This supercritical water can carry some 5-10 times more energy than regular hot water, making it an extremely efficient energy source if it could be pumped above ground to turbines that could convert it into electricity.

Superhot rock can be found close to the surface in a few areas like Iceland and near volcanoes, but for most of the world, it is between seven and 20 kilometers down

But drilling techniques are not quite there yet.

In a session titled “In Pursuit of the Holy Grail: Deep and Superhot Geothermal,” presenters said that conventional drill bits used in the oil and gas industry fail under the extreme temperatures and pressures involved in reaching geothermal sources.

Modern drills also include electronic components that do not withstand extreme conditions, while other elements, such as materials for lining and supporting the boreholes, also need to survive repeated thermal cycling or large changes in temperature.

Yet, steps towards solving these issues are being taken. The experts mentioned things such as self-healing cement that recrystallizes to fix any fractures and the use of more accurate data to characterize subsurface rock conditions and better calibrate devices going into very deep systems.

“Open access to the data and models that are underpinning these pilot projects are key,” Mark Ireland, a lecturer in energy geoscience at Newcastle University, said during the session. “Then we can open the lid on the box and explore all the different parameters in it, and compare and contrast how we’re characterizing the potential resource. The more we’re able to share, the better our decision making.”

To that end, Ireland and others emphasized the need for collaboration between the groups worldwide that are exploring superhot geothermal.

Steps forward

An example of such a group is Quaise Energy, whose representatives presented their gyrotron at the conference’s “The Future of Drilling for Deep Geothermal” session.

Quaise’s machine works by creating millimeter wave energy, a cousin to the microwaves for cooking, that is directed to deep, hot rock via waveguides. A gas that accompanies the millimeter waves brings the vaporized rock back up to the surface.

According to the firm’s CEO, Carlos Araque, conventional drilling techniques are used in the shallower rock they were optimized for and then, they are switched over to the millimeter-wave technology for harder, hotter, deeper rock.

Geothermal Anywhere Drilling, on the other hand, uses plasma, an energized gas, to break deep, hard rock into tiny pieces. Their technology is embedded into conventional drilling systems and it is being tested at a state-of-the-art facility near Bratislava, Slovakia that can reproduce the high pressures and temperatures far underground.

Another approach showcased was that of HyperSciences, whose hypersonic projectiles fired in front of a rotating bit are said to allow it to drill about 10 times faster in hard, deep, high-temperature rock. This technology – as the other ones – is being tested in field trials, and it is also being applied to tunnelling, mining, and aerospace.

A final project, titled ORCHYD and supported by the European Union, was presented by researchers from ARMINES/ MINES-ParisTech in France. Still under development, their technique involves combining high-pressure water jetting with percussive drilling.

“I see coming down the pike a number of really high potential drilling methods,” Susan Petty, chief technology officer at Cyrq Energy and the president and founder of AltaRock Energy, said at the conference.

from MINING.COM https://ift.tt/3BRsgfi

Petra Diamonds finds 342.92 carat rough at Cullinan mine

South Africa’s Petra Diamonds (LON:PDL) has recovered a 342.92 carat Type IIa white rough at its iconic Cullinan mine.

The company said the diamond is “exceptional” quality, in terms of both its colour and clarity, and that it will likely be sold at the September tender.

Petra fetched in March $12.2 million for a 299.3 carat Type IIA white diamond. That meant it obtained $40,701 per carat, which exceeds the $34,386/ct received for the 424.89 carat “Legacy of the Cullinan Diamond Mine” in May 2019.

Type II diamonds are found less frequently and more valuable than Type I diamonds

Type II diamonds are found less frequently and more valuable than Type I diamonds, as they have no measurable nitrogen impurities. This gives them exceptional transparency and brilliance

Cullinan is known as the birthplace of the 3,106-carat Cullinan diamond, which was cut to form the 530-carat Great Star of Africa.

The operation also yielded the 317-carat Second Star of Africa.

They are the two largest diamonds in the British Crown Jewels.

Cullinan is known as the world’s most important source of blue diamonds, such as the 39.34 carats one Petra found in April and which sold for $40.2 million earlier this month. It was the company’s highest price ever for a single stone.

from MINING.COM https://ift.tt/3i6FT2w

Nous devons ces vagues de chaleur extrêmes à la rapidité du réchauffement climatique

from Les dernières actualités de Futura https://ift.tt/3BSh4Pu

Cigarette électronique : inquiétudes de l'OMS qui demande une réglementation plus sévère

from Les dernières actualités de Futura https://ift.tt/3ya99Lt

Runet : la Russie déconnecte son réseau d'internet

from Les dernières actualités de Futura https://ift.tt/3BZvptM

Le module Pirs a quitté la Station spatiale et s'est désintégré dans l'atmosphère sous le regard de Thomas Pesquet

from Les dernières actualités de Futura https://ift.tt/2Wyr8gJ

Samsung Summer Festival : derniers jours pour profiter de bons plans sur de nombreux produits Samsung !

from Les dernières actualités de Futura https://ift.tt/3BHc28u

La Terre engloutit plus de carbone qu’on ne le pensait

from Les dernières actualités de Futura https://ift.tt/3zJ9HrX

Des astronomes de la Nasa lancent une pétition pour renommer le télescope spatial James Webb

from Les dernières actualités de Futura https://ift.tt/3BLC9ex

Jeff Bezos offre à la Nasa une remise de 2 milliards de dollars pour un atterrisseur lunaire

from Les dernières actualités de Futura https://ift.tt/3f0qdf1

Ces souris « contrôlent » leurs impulsions de dopamine

from Les dernières actualités de Futura https://ift.tt/3BRv9wy

mardi 27 juillet 2021

Chile environmental regulator files charges against Lundin’s Candelaria mine

Chile’s environmental regulator SMA filed on Tuesday six charges against Lundin Mining’s (TSX: LUN) Candelaria copper mine for a series of irregularities related to the company’s operational plan up to 2030.

The watchdog said three of the infractions were “minor” and the other three “grave”. They range from exceeding the limit of emissions related to liquid industrial waste to infringing provisions outlined in the mine’s environmental qualification, or RCA for its initials in Spanish.

Among the gravest violations, SMA found the mine used more explosives than allowed between August 2019 and April 2020. This, the regulator said, caused an increase in the total emissions generated by the company, which could have risked the health of locals.

Among the gravest violations, SMA found the mine’s used more explosives than allowed between August 2019 and April 2020. This, the regulator said, caused an increase in the total emissions generated by the company

Another serious charge is linked to the miner’s failure to comply with its commitment to reducing the consumption of freshwater, leading to a loss of underground water at Copiapó river’s aquifer — an area known for its water scarcity.

The SMA said the company could be subject to a fine of up to about $23 million, the revocation of its environmental credentials (RCA), or the project’s closure.

Lundin now has 10 business days to present evidence of the compliance Program and 15 business days to dispute the charges.

Last month, Lundin announced a 14% drop in copper output at the mine.

Full-year guidance has been reduced from 155,000 to 150,000 tonnes copper and from 90,000 to 85,000 ounces of gold, compared with between 172,000 to 182,000 tonnes copper and 95,000 to 100,000 ounces of gold expected previously.

Candelaria produced 34,203 tonnes of copper and about 21,000 ounces of gold in concentrate on a 100% basis in the March quarter. While mill throughput was higher than the prior-year quarter, copper output was lower due to planned lower grades in the most recent quarter.

The complex is indirectly owned by Lundin Mining (80%) and Sumitomo (20%), with the Toronto-based miner acquiring its ownership from Freeport-McMoRan in 2014.

from MINING.COM https://ift.tt/3xj6ePn

Top Australian capital raises seek to create mining value

Australia-headquartered miners have been tapping the capital markets in the year to July 14 to raise a total of US$2.33 billion in capital, according to an analysis by the Northern Miner’s sister company Mining Intelligence. The financings offer the companies financial firepower to execute their respective value creation strategies.

The Mining Intelligence data shows the money was raised via 36 rights offerings that attracted US$1.15 billion in capital and 81 private placements raising US$965.52 million, among other methods of capital raising.

Leading the lineup is Regis Resources (ASX: RRL), which raised about US$155 million in April and another US$348.5 million in May.

The company had in April bought a 30% stake in AngloGold Ashanti‘s (NYSE: AU) Tropicana mine for A$903 million (US$688.3 million), increasing its production base by a third.

from MINING.COM https://ift.tt/2UWQV1x

Comment une lagune en Argentine a viré au rose vif

from Les dernières actualités de Futura https://ift.tt/3rAQ0Q4

Jeff Bezos offre à la Nasa une remise de 2 millions de dollars pour un atterrisseur lunaire

from Les dernières actualités de Futura https://ift.tt/3iQBaBb

Copper price down under pressure from rebounding dollar

Copper prices snapped a five-session winning streak on Tuesday under pressure from a rebounding dollar as investor focus shifted to a US Federal Reserve meeting expected to give more direction on monetary policy.

Copper for delivery in September fell 0.3% from Monday’s settlement price, touching $4.572 per pound ($10,058 per tonne) midday Tuesday on the Comex market in New York.

Benchmark copper on the London Metal Exchange lost 0.8% to $9,727.50 per tonne in official trading, after touching its highest since June 15 at $9,924.

Click here for an interactive chart of copper prices

“Given the scale of moves we have seen since the (close of business) 19th July … some sort of pause was to be expected especially given the Fed’s two-day meet,” said Alastair Munro at broker Marex.

The dollar eased early on Tuesday just below recent peaks, but the safe-haven currency rebounded later in the session as investors turned their focus to this week’s Federal Reserve meeting.

Forecast

Goldman Sachs said in a recent note that copper prices are poised to grow as demand outpaces supply since the concentrate market is very tight, particularly in China.

The bank’s three-month, six-month and 12-month price targets for copper are $10,500 per tonne, $11,000 per tonne, and $11,500 per tonne, respectively.

Floods in central China, especially in the industrial and transport hub city of Zhengzhou in Henan province, have raised supply concerns and demand for rebuilding damaged infrastructure.

A four-day-long blockade in Peru by protesters seeking greater benefits from natural resources is also disrupting operations of MMG Ltd’s Las Bambas copper mine, one of the country’s largest.

(With files from Reuters)

from MINING.COM https://ift.tt/3iQJxwF

Le régime alimentaire de Paranthropus questionne l'évolution humaine

from Les dernières actualités de Futura https://ift.tt/3rAOptN

Une ville chinoise engloutie par un colossal « mur de sable »

from Les dernières actualités de Futura https://ift.tt/373fYSV

Aura-t-on besoin d'une troisième dose pour contrer le variant Delta ?

from Les dernières actualités de Futura https://ift.tt/3f3Wja1

Battle for Noront heats up with BHP’s $258 million bid

BHP (ASX, LON, NYSE: BHP) has offered C$325 million ($258.45 million) for Canadian nickel miner Noront Resources (TSX-V: NOT), trumping a bid by Australian mining billionaire Andrew Forrest’s Wyloo Metals, as top miners race to secure supplies of battery metals.

The world’s largest miner is offering C$0.55 per share of Noront, representing a premium of 129% to the firm’s closing price on May 21, a day before Wyloo’s proposal.

Noront is recommending shareholders to accept the bid, which comes through BHP Lonsdale, a subsidiary that already owns 3.7% of the Canadian nickel producer.

“BHP has the financial strength, world-class mining expertise, and commitment to work in partnership with stakeholders to advance Eagle’s Nest and the Ring of Fire, which has the potential to deliver benefits to local communities, First Nations and, and Ontario for years to come,” Noront’s chief executive Alan Coutts said.

BHP is speeding up its push into so-called future-facing commodities, including nickel, lithium and copper, which are poised to benefit from the green-energy transition.

BHP is speeding up its push into so-called future-facing commodities, including nickel, lithium and copper, which are poised to benefit from the green-energy transition.

Last week it sealed a nickel supply deal with Tesla (NASDAQ: TSLA) and is expected to decide on the giant Jansen potash project in Canada next month.

“Noront represents a growth opportunity in a prospective nickel basin capable of delivering a scalable, new nickel-sulphide district,” the Melbourne, Australia-based mining giant said in the statement.

The company also in the process of exiting thermal coal and is considering exiting the oil and gas sector as part of its commitment to reduce emissions.

Wyloo Metals, which is Noront’s top shareholder with a 23% stake as of December, had in May offered C$0.315 per share for the stock it did not already hold in the company. Noront had adopted a poison pill to stop the takeover.

BHP’s offer comes on the heels of its decision to move the exploration team headquarters to Toronto, Canada’s most populous city.

The company plans to would almost double exploration spending for base metals within five years.

Clean metals hub

Noront owns the early-stage Eagle’s Nest nickl and copper deposit in the Ring of Fire of northern Ontario. It has been billed by Wyloo as the largest high-grade nickel discovery in Canada since the Voisey’s Bay nickel find in the eastern province of Newfoundland and Labrador.

Eagle’s Nest is expected to begin commercial production in 2026 with the mine running initially for 11 years.

The mine’s start date has repeatedly been pushed back by Noront due to successive federal and provincial governments’ inability to consult and reach unanimous agreement with First Nations in the area.

Nickel production would need to increase nearly fourfold to meet expected demand for electric and hybrid vehicles, the company estimates. Likewise, copper output would also need to grow exponentially to meet demand from renewable power generation, battery storage, electric vehicles, charging stations and related grid infrastructure.

Tesla’s boss Elon Musk has expressed worries about a looming nickel shortage. He pleaded with miners last year to produce more nickel, promising a “giant contract” for supply produced efficiently and in an “environmentally sensitive way.”

The EV maker became involved in March in the development of the conflict-ridden New Caledonia nickel mine, as part of the company’s attempt to secure enough supply of the key battery metal.

BHP’s offers coincides with Canada’s push to position the country as a hub for clean-tech metals.

The bid is conditional on acceptance by more than 50% of the Noront common shares, excluding a small stake that BHP already owns

from MINING.COM https://ift.tt/2Ws3BxR

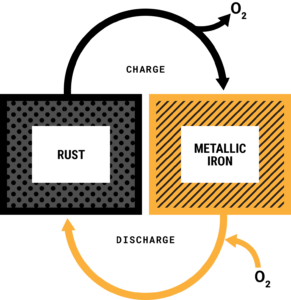

New iron-air battery aims to make multi-day, clean energy storage systems a reality

Form Energy Inc. announced the launching of its first commercial product, a rechargeable iron-air battery capable of delivering electricity for 100 hours at system costs competitive with conventional power plants and at less than 1/10th the cost of lithium-ion.

According to the Massachusetts-based company, its front-of-the-meter battery can be used continuously over a multi-day period and will enable a reliable, secure, and fully renewable electric grid year-round.

“We conducted a broad review of available technologies and have reinvented the iron-air battery to optimize it for multi-day energy storage for the electric grid,” Mateo Jaramillo, Form Energy’s CEO and co-founder, said in a media statement. “With this technology, we are tackling the biggest barrier to deep decarbonization: making renewable energy available when and where it’s needed, even during multiple days of extreme weather or grid outages.”

The battery’s basic principle of operation is reversible rusting, which means that while discharging, the battery breathes in oxygen from the air and converts iron metal to rust. While charging, the application of an electrical current converts the rust back to iron and the battery breathes out oxygen.

Each individual battery is about the size of a washing machine, which is filled with a water-based, non-flammable electrolyte, similar to the electrolyte used in AA batteries. Inside of the liquid electrolyte there are stacks of between 10 and 20 meter-scale cells, which include iron electrodes and air electrodes.

To create a storage system, Form Energy proposes grouping together thousands of batteries in modular megawatt-scale power blocks, which are to be installed in environmentally protected enclosures.

Depending on the system size, tens to hundreds of these power blocks will be connected to the electricity grid. For scale, in its least dense configuration, a one-megawatt system requires about an acre of land. Higher density configurations can achieve >3MW/acre.

“Our battery systems can be sited anywhere, even in urban areas, to meet utility-scale energy needs,” the company’s website states. “Our batteries complement the function of lithium-ion batteries, allowing for an optimal balance of our technology and lithium-ion batteries to deliver the lowest-cost renewable and reliable electric system year-round.”

According to Jaramillo, Form Energy’s goal is to source the iron domestically and manufacture the battery systems near where they will be sited. In fact, the firm has already signed a deal with Great River Energy to develop its first project near the heart of America’s Iron Range in Minnesota.

In addition to this, it received a $200-million Series D financing round led by ArcelorMittal’s XCarb innovation fund, which should be devoted to the development of iron materials for the battery systems.

Besides the steel giant, the Wall Street Journal reported earlier this month that Form Energy also counts Breakthrough Energy Ventures – a climate investment fund whose investors include Microsoft’s co-founder Bill Gates and Amazon’s founder Jeff Bezos – among its backers.

from MINING.COM https://ift.tt/3iPBErm