dimanche 31 octobre 2021

Science décalée : les énormes risques de maladies infectieuses qui menacent James Bond

from Les dernières actualités de Futura https://ift.tt/3GFXjgL

While China will continue to use rare earths in EVs, Europe may be trying different options – report

A new report by IDTechEx anticipates China continuing to use permanent magnet motors in its EVs but Europe making efforts to decrease the utilization of magnetic materials and especially heavy rare-earths.

The EU’s tactic is based on a wider strategy aimed at shielding its industry from possible price fluctuations promoted by China given its current dominance of rare-earth supply. Back in 2011, the Asian giant restricted exports of rare earths seeing an approximate price rise of 750% and 2000% for neodymium and dysprosium respectively.

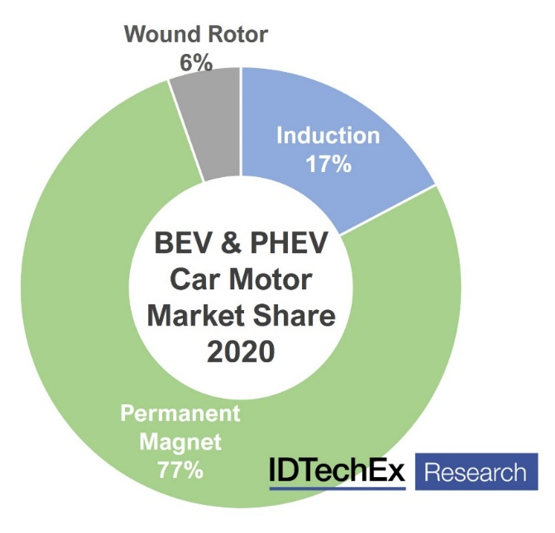

But according to IDTechEx, despite Europe’s efforts, the production of permanent magnet designs will not be completely halted given their superior efficiency and power density. In fact, in 2020, 77% of the electric car market used permanent magnet motors, a ratio that – according to the market analyst – has remained fairly consistent over the past five years.

Within this context, IDTechEx’s report states that the expectation is for neodymium volume demand from battery-electric vehicles in 2032 to be 11 times the demand experienced in 2021.

“The huge neodymium price spike in 2011 may have factored into the decision by Renault to continue with their wound rotor design and for the development of Audi’s induction motors used for the e-tron, but in general, with the settled price, we are seeing more announcements of a switch to permanent magnets,” the dossier reads.

Other carmakers like BMW are also switching to a wound rotor design, in this case for the fifth-gen drive system which will power their next-generation EVs including the iX3, i4, and others.

A wound rotor configuration uses copper windings on the rotor, while induction motors – like the ones used historically by Tesla for its Model S and X – use a copper or aluminum cage on the rotor.

Tesla, however, has been among the companies staying the course, having adopted a permanent magnet motor for their Model 3 onwards whilst keeping an induction motor on the front axle. Audi’s new Q4 e-tron for 2021 also took a similar approach.

“Whilst we have seen some differentiation in the European market, as China largely controls the rare-earth supply, the price volatility is not as much of a concern and they are unlikely to shift away from permanent magnet machines. With China being one of the largest EV markets, this means that permanent magnet motors are here to stay,” IDTechEx’s document states.

Yet, the review is quick to point out that since automotive development timeframes are long, normally on the scale of several years, a few more announcements about the reduction of rare earths in the next few years can be expected, particularly as companies factor in the neodymium price volatility seen in 2021.

After a 2.2 fold increase at the start of the year for neodymium and dysprosium, prices of praseodymium-neodymium oxide, or NdPr — two of the 17 rare earth elements that are used in NdFeB magnets — spiked to $115,000 a metric tonne last Thursday, the highest since November 2011, data from Shanghai Steelhome E-Commerce show.

“[And] in addition to the price concerns, there are environmental concerns,” IDTechEx’s report reads. “Rare earths are extracted from ores which can contain radioactive materials such as thorium and extracting the required rare earths typically uses a huge amount of carcinogenic compounds like ammonia, hydrochloric acids, and sulphates. It has been estimated that processing one tonne of rare earths can produce up to 2,000 tonnes of toxic waste. For EVs to truly be a transition to green technology something about the situation has to change.”

from MINING.COM https://ift.tt/2ZM4vXN

Forfait mobile : 90 Go en 4G+ à seulement 9,99€/mois chez Free Mobile jusqu'à mardi 02 novembre

from Les dernières actualités de Futura https://ift.tt/2ZDZQaE

« Notre avenir dépend des glaciers », l'édito spécial d'Heïdi Sevestre

from Les dernières actualités de Futura https://ift.tt/3q1LNpM

Forfait mobile : jusqu'à 200 Go d’internet à partir de 4,99 €/mois, le super deal du moment

from Les dernières actualités de Futura https://ift.tt/3EN4B0v

C’est l’une des exoplanètes les plus jeunes jamais découvertes

from Les dernières actualités de Futura https://ift.tt/3GBTQ2G

Des villes construites selon le calendrier Maya il y a 3.400 ans

from Les dernières actualités de Futura https://ift.tt/3CvUAE8

Changer la roue arrière de son vélo n'a jamais été aussi facile !

from Les dernières actualités de Futura https://ift.tt/3mszO2C

Research finds four areas of concern when it comes to mining deaths in Western Australia

After conducting a two-year-long study, researchers at Edith Cowan University identified that four main pathways are regularly associated with mining fatalities in Western Australia.

Such pathways were initially outlined in Michael Quinlan’s 2014 book Ten pathways to death and disaster, and the four predominant in mining operations in WA are:

- Pathway 1: Design, engineering, technical and maintenance flaws

- Pathway 4: Failures in safety management systems

- Pathway 5: Failures in Auditing

- Pathway 9: Poor management – worker communication and trust

To be able to pin down these four areas of concern, the researchers surveyed more than 2000 mining company employees from 2017-2019 to gain their perceptions of workplace safety and injury risk. Once this phase was completed, they compared the worker questionnaire results to actual workplace fatalities to see if the way people perceived the injury risk at their workplace aligned with the results of the incidents.

In most cases, they found that survey respondents with leadership roles, such as superintendents and managers, scored their organization’s performance higher than employees in frontline positions.

In a paper published in the journal Safety Science, the scientists point out that their results suggest communication and cultural issues, which could have serious ramifications.

“It highlights potentially dangerous gaps between employee expectations of management – such as prioritizing worker safety – and reality,” Tanya Jenke, lead author of the study, said in a media statement. “Additionally, those in leadership roles perceived a better worker relationship compared to employees in the front line. Mining organizations need to ensure systems and processes are in place to foster a collaborative and transparent work environment.”

The study “highlights potentially dangerous gaps between employee expectations of management – such as prioritizing worker safety – and reality”

Tanya Jenke, lead author

The study also noted significant differences in responses from those based in Perth and workers in other regions of Western Australia, with regional respondents attributing lower scores than their city-based counterparts.

“This possibly indicates a disconnect between operating sites and head office,” Jenke said. “It may illustrate a difference between work as planned by the corporate office, versus work as done by the operations.”

Although not all 10 pathways were identified in the WA case study, the researcher believes this may have been due to how incidents were reported.

“We suggest that this may be a result of data on these pathways were not captured as part of the Fatality Register assessment and that they are contributing to fatalities,” Jenke said. “Given that four pathways were most prominent in the DMIRS Fatalities Register and the remaining six were not, it is argued the type of information required for reporting does not require an organization to publicly address all ten pathways.”

Given this state of affairs, Jenke and her colleagues recommend that benchmarking safety performance, incident investigations, and reviews of the effectiveness of safety management systems include an examination and verification of each organization’s response to the Ten Pathways, a relatively straightforward task that may highlight latent issues or weaknesses that may otherwise remain undetected.

“We aimed to assist the West Australian mining industry in learning from past fatalities and to provide direction for controlling fatality risks in the future,” Jenke said. “The simplicity of the Ten Pathways makes them a valuable risk communication tool, and could readily be used to commence discussions, for example at safety meetings, or implemented in a reporting tool to allow companies to learn about safety matters more effectively.”

from MINING.COM https://ift.tt/3brRxkh

‘Ultimate’ anode for next-generation batteries closer to becoming more efficient

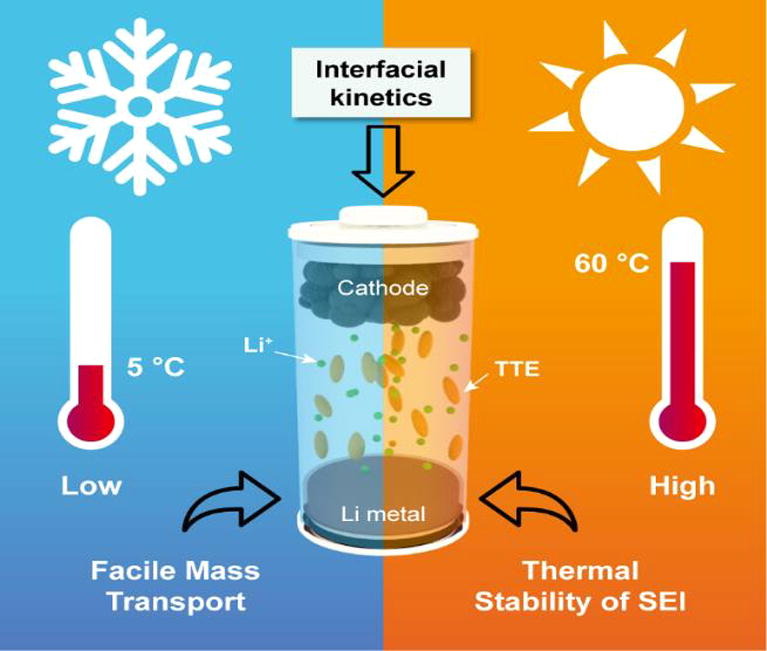

A recent study by researchers at Korea’s Daegu Gyeongbuk Institute of Science and Technology found that high concentration electrolyte (HCE) significantly improves Li+ ion transport at lower temperatures and thermal stability of solid-electrolyte interface at higher temperatures, thereby increasing the cycling performance of lithium metal batteries (LMBs).

In the article published in the Chemical Engineering Journal, the scientists explain that, compared to lithium-ion batteries, LMBs have a very high energy density and charge very quickly. Yet, they suffer from low current efficiency, poor cyclability and are prone to Li-dendrite formation—excess lithium deposition on the electrodes.

So far, research has found that using high salt concentration electrolytes (HCE) diluted with ether-based solvents can solve these problems and improve performance. However, a proper understanding of how HCE dilution affects the working of LMBs over a wide range of working temperatures is still a lingering question.

This is where the DGIST experts come in. After exploring the effect of HCE dilution on lithium metal batteries’ cycle over a wide range of temperatures, the paper’s senior authors, Hongkyung Lee and Hochun Lee concluded that HCEs are often vicious and diluting them can increase the ion migration within the cell and improve wetting of electrodes.

The team, thus, adopted a new HCE dilution technique that allowed them to demonstrate good LMB cycling performance at temperatures between 2–60°C. They, then, conducted a comparative electrochemical analysis of a model HCE well as an HCE diluted with 1,1,2,2-tetrafluoroethyl 2,2,3,3-tetrafluoropropyl ether (TTE).

The experimental results indicated that TTE dilution significantly improved Li+ ion transport and reduced dendritic Li plating at low temperatures, which is essential for maintaining cycling stability. TTE was also found to be responsible for the formation of the thermally stable solid-electrolyte interface that determines the high-temperature cycling ability of LMBs. The analysis also revealed that TTE dilution could also prove beneficial for the high voltage cycling of Li cells.

“The electrolyte-deterministic interfacial stability is a crucial concern for securing battery performances,” Hongkyung Lee said in a media statement. “This work provides a rational strategy for diluting high-concentration electrolytes to stabilize a highly reactive Li surface. The findings in this study can offer the clues to design electrolyte microstructure, identify its fundamental impact on the interfacial stability over a wide temperature range, and contribute toward stable cycling of Li-metal batteries in practice.”

In Lee’s view, the lithium-metal is considered as an ultimate anode for next-generation batteries, which means that the insights from this study can be applied to design small and light but efficient devices with long-term cycling stability that can act as power sources for drones, walking robots, physical augmentation mechanisms, among other things.

“With our research, we tried to reinforce the development of longer-cycling, higher-energy density batteries without sacrificing the charging rate, which is a prerequisite of electric vehicles that have longer mileage,” Lee said.

from MINING.COM https://ift.tt/3nIVgzM

Les animaux n’explorent plus le monde comme avant

from Les dernières actualités de Futura https://ift.tt/3jENPsa

Une puissante tempête solaire pourrait couper Internet plusieurs semaines

from Les dernières actualités de Futura https://ift.tt/2X6RtTr

SpaceX et la Nasa ont repoussé le lancement de Crew Dragon au 3 novembre

from Les dernières actualités de Futura https://ift.tt/3CwvncL

Les plus belles photos de la Terre prises par Thomas Pesquet lors de son séjour dans la Station spatiale

from Les dernières actualités de Futura https://ift.tt/3nN6Jy2

Bon Plan Samsung : avec la Galaxy Watch4, personnalisez vote montre connectée et rendez-la unique !

from Les dernières actualités de Futura https://ift.tt/3Goq1m2

Cet avion à décollage vertical peut voler 1.000 km !

from Les dernières actualités de Futura https://ift.tt/3Bwcipx

samedi 30 octobre 2021

Bertrand Piccard : « La protection de l'environnement crée plus d'emplois et rapporte plus d'argent que sa destruction »

from Les dernières actualités de Futura https://ift.tt/3msHLEM

Découverte de la plus ancienne représentation de fantôme au monde

from Les dernières actualités de Futura https://ift.tt/31i0Gdu

Les vaccins contre la Covid-19 ne protègent pas seulement contre le SARS-CoV-2 !

from Les dernières actualités de Futura https://ift.tt/2ZvcAQh

L’énergie propre à portée de main, par Bertrand Piccard

from Les dernières actualités de Futura https://ift.tt/3m6Fijr

Les ondes gravitationnelles des trous noirs supermassifs peut-être découvertes grâce aux pulsars ?

from Les dernières actualités de Futura https://ift.tt/3GBkIzD

Blue Origin et Sierra Space vont lancer des stations spatiales privées

from Les dernières actualités de Futura https://ift.tt/3BtKAtH

Comment la Terre s’est-elle remise du dernier réchauffement climatique important ?

from Les dernières actualités de Futura https://ift.tt/3jhhQxM

Habitat durable et fenêtres de toit : vers un avenir bas carbone

from Les dernières actualités de Futura https://ift.tt/2ZqzgSe

Forfait mobile : 100 Go de 4G+ à seulement 8,99€/mois sur Orange ou SFR

from Les dernières actualités de Futura https://ift.tt/3vXgHAS

La théorie de la relativité intriquée expliquée par Olivier Minazzoli (2/2)

from Les dernières actualités de Futura https://ift.tt/3nkNn3k

La théorie de la relativité intriquée succédera-t-elle à la théorie de la relativité d'Einstein ? (1/2)

from Les dernières actualités de Futura https://ift.tt/3lUFGkS

Forfait mobile : Bouygues Telecom met en promo son forfait 70 Go à seulement 12,99 €/mois

from Les dernières actualités de Futura https://ift.tt/3Et7PFX

Le Nasdaq désigne 8 cryptomonnaies avec le potentiel de s'imposer dans les mois à venir

from Les dernières actualités de Futura https://ift.tt/3GAwhXZ

Thomas Pesquet fait ses adieux à la Station spatiale internationale… mais pas à l'espace

from Les dernières actualités de Futura https://ift.tt/3EyVT5R

Le Cumbre Vieja produit des fontaines de lave de 600 mètres de hauteur !

from Les dernières actualités de Futura https://ift.tt/3GtF0Ls

Bon Plan Samsung : 50€ de remise immédiate sur la Tab S6 Lite jusqu’au 31 octobre !

from Les dernières actualités de Futura https://ift.tt/3nBdGlZ

Un forfait mobile avec 60 Go de 4G+ à 9,95 €/mois valable à vie sur le réseau SFR, ça vous tente ?

from Les dernières actualités de Futura https://ift.tt/3GDMQSI

Les plus belles photos de la Terre de Thomas Pesquet

from Les dernières actualités de Futura https://ift.tt/2ZIlaf0

On peut toujours accéder au premier site Internet de l'histoire

from Les dernières actualités de Futura https://ift.tt/3bbqBVN

Le multicuiseur Moulinex Cookeo à prix cassé sur Amazon (-63 €)

from Les dernières actualités de Futura https://ift.tt/2ZKxrQ7

Connaissez-vous ces abonnements Futura ?

from Les dernières actualités de Futura https://ift.tt/3bo5aAS

L’eau du robinet formerait une sorte de bouclier capable de nous protéger des microplastiques

from Les dernières actualités de Futura https://ift.tt/3pUq9ns

vendredi 29 octobre 2021

Bon plan Cdiscount : -339 € sur le four multifonction SAUTER SFP930X

from Les dernières actualités de Futura https://ift.tt/3aL3cKw

La puissante éruption solaire qui vient de se produire va créer des aurores ce week-end

from Les dernières actualités de Futura https://ift.tt/3BszmWm

Chile copper output sinks to seven-month low

Copper production in Chile, the world’s top copper producer, registered in September its worst month for copper since February on the back of labour disruptions and falling ore grades at the country’s aging mines.

The country’s output dropped 6.9% year-on-year in September to 451,128 tonnes and 3.4% from August, government statistics agency INE said on Friday.

Soaring copper prices this year have handed unions in Chile more leverage than in the recent past, ratcheting up tensions in some labour negotiations, including an almost one-month strike at Codelco’s Andina mine near capital Santiago.

The newly released figures take Chile’s lost copper production to the end of September to 4.2 million tonnes, a 1.9% drop when compared to the nation’s total output in 2020.

Used in everything from construction materials to batteries and engines, copper is both an economic bellwether and a key ingredient in the push toward renewable energies and electric vehicles. If producers fail to address the deficit, prices will keep rising and present a challenge to the world leaders, who are counting on a worldwide energy transition to fight climate change.

According to estimates from CRU Group, the copper industry needs to spend more than $100 billion to close what could be an annual supply deficit of 4.7 million tonnes by 2030.

What happened to the London Metal Exchange’s copper inventories earlier this month, illustrates how tight the market can become.

The LME was recently caught off guard by a sudden emptying of available copper in its warehouses, which drove inventory levels to their lowest since 1974. Over the past two months, freely available inventories have shrunk by more than 90% in LME-monitored warehouses as orders surged.

from MINING.COM https://ift.tt/3jO7Exi

Comment l'organisme contrôle le VIH après l'arrêt du traitement antirétroviral

from Les dernières actualités de Futura https://ift.tt/2ZvzkzB

Profitez de 429 € de réduction sur le vélo électrique pliable DOHIKER KSB14

from Les dernières actualités de Futura https://ift.tt/3C6jl9s

De mystérieuses infections aux États-Unis causées par un spray d'aromathérapie

from Les dernières actualités de Futura https://ift.tt/3EwZz89

Pourquoi Facebook devient Meta ?

from Les dernières actualités de Futura https://ift.tt/3EttcXP

Comment expliquer l’engouement pour les monnaies « canines » telles que Shiba et Doge ?

from Les dernières actualités de Futura https://ift.tt/2XVkL80

Nouvelle alerte : il est urgent de mettre à jour Chrome

from Les dernières actualités de Futura https://ift.tt/3BldTP2

Une nouvelle espèce humaine vient d'être définie

from Les dernières actualités de Futura https://ift.tt/31igUn3

Le lave-linge hublot Hotpoint AQ114D497SDEUN est à moins de 400 €

from Les dernières actualités de Futura https://ift.tt/3Bm9lI1

Juno révèle les dessous de Jupiter en 3D

from Les dernières actualités de Futura https://ift.tt/3nIYumI

Nickel, cobalt allow for cheaper, more efficient green hydrogen production

Researchers at Curtin University have identified an electrocatalyst that, with added nickel and cobalt, makes green hydrogen from water in a cheaper and more efficient way compared to traditional methods.

Green hydrogen is a zero-carbon fuel made by electrolysis using renewable power to split water into hydrogen and oxygen.

Typically, scientists have been using precious metal catalysts, such as platinum, to accelerate the reaction to break water into hydrogen and oxygen but the Curtin team found that by adding the battery metals to cheaper catalysts, they were able to enhance their performance, which lowers the energy required to split the water and increases the yield of hydrogen.

By adding cobalt and nickel to cheaper catalysts, the researchers were able to enhance their performance, which lowers the energy required to split water and increases the yield of hydrogen

“Our research essentially saw us take two-dimensional iron-sulfur nanocrystals, which don’t usually work as catalysts for the electricity-driven reaction that gets hydrogen from water, and add small amounts of nickel and cobalt ions,” lead researcher Guohua Jia said in a media statement. “When we did this it completely transformed the poor-performing iron-sulfur into a viable and efficient catalyst.”

According to Jia, using these more abundant materials is cheaper and more efficient than the current benchmark material, ruthenium oxide, which is derived from ruthenium element and is expensive.

“Our findings not only broaden the existing ‘palette’ of possible particle combinations but also introduce a new, efficient catalyst that may be useful in other applications,” Jia said. “They also open new avenues for future research in the energy sector, putting Australia at the forefront of renewable and clean energy research and applications.”

At present, 21% of Australia’s energy is produced from renewables, a reality that is seen as an opportunity by many, including mining tycoon Andrew Forrest.

Forrest aims to make his Fortescue Metals Group carbon-neutral by 2030, with green hydrogen at the forefront of the company’s efforts.

The billionaire believes that green hydrogen could supply a quarter of the world’s energy by 2050 and he has been travelling the world to promote this idea.

from MINING.COM https://ift.tt/3vWQqCG

Anglo American to halve indirect emissions by 2040

Anglo American (LON: AAL) aims to halve its indirect greenhouse gases, known as Scope 3 emissions, by 2040 while it continues to boost the use of renewable energy across its operations, particularly in South America.

The company vowed two years ago to meet power requirements of its copper operations in Chile with renewables by 2021. It also said it expected to have its iron ore and nickel operations in Brazil, as well as its copper mine in Peru, relying solely on green power by 2022.

In its Climate Change Report 2021, published ahead of the United Nations climate summit COP26, Anglo broadened its green ambitions. It now expects to draw 56% of grid electricity supply from renewables by 2023. That compares to 2020 levels, when just over a third of the electricity the company used globally was from renewable sources.

Anglo American warned that progress towards cutting Scope 3 emissions depends mainly on the steel sector cutting its own carbon gasses and supportive global policies.

The highly polluting process of making steel involves adding coking coal to iron ore to make the alloy, and is estimated to be responsible for up to 9% of global greenhouse emissions.

“Through innovative technologies and practices, we can be more targeted in accessing those metals and minerals, use less water and energy and, crucially, generate fewer GHG emissions,” chief executive Mark Cutifani said in a statement.

Anglo American has also begun replacing its diesel-powered mine trucks with hydrogen fuel-cell and battery trucks. Haul trucks contribute up to 80% of diesel emissions at the company’s mines, it said.

Exiting coal

Mounting pressure from investors, regulators and environmental organizations has pushed miners to either sell coal assets or to limit their exposure to the fossil fuel in recent years and Anglo has not escaped that pressure.

In April, it spined off its South African coal operations into a new company — Thungela Resources (JSE, LON: TGA). It also made the decision to sell Cerrejón, its thermal coal subsidiary in Colombia, selling a 33.3% interest on the asset to Glencore (LON: GLEN) in June.

The move, part of a gradual offloading of its coal mines that began in 2014, aims at giving investors the choice to whether or not support the coal industry, Cutifani has said.

While Anglo American is moving away from the most polluting kind of coal, metallurgical or coking coal appears to be one of its key commodities moving forward.

The miner recently increased its medium-term guidance for the steelmaking ingredient to an estimated 26-28 million tonnes by 2022.

Its main customers are all in Asia, including India, all of whom rely on coal-fired power, Cutifani has said. “You can’t just walk away from billions of people across the globe,” he has noted.

Gloom and doom

Greenhouse gas emissions are on a path to increase 16% by the end of the decade compared with 2010, setting the world on a threatening course of continued warming, the UN said in a report this week.

A separate study released on Monday from Canadian Environment Minister Jonathan Wilkinson and Jochen Flasbarth, his German counterpart, said rich countries would “probably” meet their goal of providing $100 billion annually to developing nations, but in 2023 — three years behind schedule.

The pair was tasked by COP26 President Alok Sharma with coming up with a plan to deliver the funds, as many developing nations have said their climate pledges are conditional on receiving outside support.

The reports echo an Intergovernmental Panel on Climate Change (IPCC) updated published in August, showing that temperatures on Earth are on track to rise by about 1.5 degrees Celsius in two decades.

The updated report, the first major review of its kind since 2013, added that a near-2m rise in sea levels by the end of this century could not be ruled out and described the finding as “a code red” for humanity.

The UN weather agency also published an eye-opening report this week, warning that concentrations of greenhouse gases in the atmosphere reached records in 2020, despite the economic slowdown caused by the coronavirus pandemic.

from MINING.COM https://ift.tt/3CvzdCW

Mining People: Alto Verde, Excellon, Golden Star, Lomiko, Los Andes Copper, MAG Silver, Pure Gold

Chris Buncic is president, CEO and a founder of the new Chile-focused Alto Verde Copper.

Excellon Resources named Jorge Ortega its VP exploration and Ben Pullinger its senior VP geology and corporate development.

Golden Star Resources said Ben Pullinger will join the company as executive VP, head of discovery on Nov. 1.

The leadership team at Lomiko Metals has been refreshed with the following appointments: Belinda Labatte as CEO, Gordana Siepcev as COO, and Vince Osbourne as CFO.

Los Andes Copper named R. Michael Jones as its new CEO.

The new chief sustainability officer at MAG Silver is W.J. (Jim) Mallory.

Maryse Belanger, a director of the company, has stepped into the role of mine general manager at Pure Gold Mining’s Madsen gold project.

The board of Tacora Resources welcomed Joe Broking as president and CEO, replacing Thierry Martel.

Board moves include:

CEO James Sykes has been given a seat on the board of Baselode Energy.

Braveheart Resources appointed Peter Lacey as an independent director.

Defense Metals has named Luisa Moreno a director.

Excellon Resources seated Jeff Swinoga as an independent director.

John H. Hill has joined the board of Honey Badger Silver.

Ian Burney, Michael Carrick and Tanneke Heersche joined the board of Japan Gold.

Eric Levy has been named an independent director of Lomiko Metals.

Norsemont appointed Kyle Haddow to the board.

Raindrop Ventures named Max Baker and Tim Barry to its board of directors. Scott Davis has stepped down from the board but will remain CFO of the company.

Mark Noppe is now chair of SRK Global.

Awards announced:

The Engineers and Geoscientists of British Columbia (EMGC) have given their 2021 Environmental Award to BQE Water for its installation of a Selen-IX plant at the Kemess copper mine.

Nouveau Monde Graphite has won the Entrepreneur of the Year award presented by the Quebec Mineral Exploration Association.

Palladium One Mining has been recognized with the Barnie Schnieders Discovery of the Year Award for the high-grade Tyko copper-nickel project. The award was presented by the Northwestern Ontario Prospectors Association.

(This article first appeared in the Canadian Mining Journal)

from MINING.COM https://ift.tt/3nyOGf6

Explor'Espace, le premier festival d'astronomie interactif français

from Les dernières actualités de Futura https://ift.tt/3CqIrQx

Le radiateur électrique Carrera est à -160 € sur Cdiscount

from Les dernières actualités de Futura https://ift.tt/3pRVGX8

France 2030 : réinventer le nucléaire et devenir leader de l’hydrogène vert

from Les dernières actualités de Futura https://ift.tt/3jJPht5

Deux exoplanètes sur des orbites perpendiculaires autour de la même étoile

from Les dernières actualités de Futura https://ift.tt/3Bq07L0

24.000 milliards de morceaux de microplastiques dans les océans et ce n’est pas fini

from Les dernières actualités de Futura https://ift.tt/31hjtFX

Environnement et maladies cardiovasculaires : un groupe d’experts fait le point

from Les dernières actualités de Futura https://ift.tt/3vWPDll

jeudi 28 octobre 2021

COP26 will be a colossal mining cop-out

“The International Energy Agency’s annual World Energy Outlook [..] is probably the closest thing to a bible in the energy world,” says a Bloomberg article following the publication of the 2021 edition.

Released earlier than usual in time for the Conference of Parties (COP26) starting in Glasgow next week, this edition – the 44th – “has been designed, exceptionally, as a guidebook to COP26”.

At 386 pages IEA WEO 2021 is quite the tome (download here). Under Section 6.3.1, you’ll find the energy bible’s take on “critical minerals”. It is six pages in total.

Those six pages may be headlined critical minerals, but it’s hard to detect a sense of urgency in Section 6.3.1:

“The rapid deployment of low-carbon technologies as part of clean energy transitions implies a significant increase in demand for critical minerals.”

We have questions

The word “significant” used here contains multitudes (lithium “100 times current levels” according to the IEA’s own calculations) and the Paris-based firm has some questionne:

“The prospect of a rapid increase in demand for critical minerals – well above anything seen previously in most cases – raises questions about the availability and reliability of supply.”

With only six pages to work with, the IEA has to be succinct in its appraisal of the mining industry:

“The [supply] challenges are compounded by long lead times for the development of new projects, declining resource quality, growing scrutiny of environmental and social performance and a lack of geographical diversity in extraction and processing operations.”

Questions raised. Challenges compounded. Take that global warming!

Mining ghost protocol

Edinburgh-based Wood Mackenzie has also been doing some research ahead of COP26.

Woodmac, which beat the IEA by four years, releasing its first oil report in 1973, is expanding its mining and metals practice, most recently with the acquisition of London-based Roskill.

A new report by Julian Kettle, SVP of Woodmac’s metals and mining division, and senior analyst Kamil Wlazly, answers the questions about the availability of supply in the very title:

Mission impossible: supplying the base metals for accelerated decarbonisation

Woodmac is refreshingly blunt in its assessment of mining’s role in fighting climate change:

“The energy transition starts and ends with metals.”

“Achieving global net zero is inexorably linked to base metals supply.”

“Base metals capex needs to quadruple to about $2 trillion to achieve an accelerated energy transition.”

Whoomp, there it is.

The hidden ones

There are many eye-popping graphs in Mission impossible (download here) but this one perfectly illustrates why the decarbonisation goals of the Conference of Parties, without plans for new mines, only add hot air to the warming planet.

Woodmac says “delivering the base metals to meet [net zero 2050] pathways strains project delivery beyond breaking point from people and plant to financing and permitting.”

Copper, which Woodmac emphasizes “sits at the nexus of the energy transition” stands out particularly.

The 19 million tonnes of additional copper that need to be delivered for net-zero 2050 implies a new La Escondida must be discovered and enter production every year for the next 20 years.

Even if you focus on just one of the obstacles bringing new copper supply online – the time it takes to build a new mine – and leave aside all other factors, net-zero 2050 has zero chance.

Great great grandfathered in

Consider that among the world’s largest copper mines, La Escondida is a relative newcomer – it was discovered in 1981, and only hit 1 million tonnes 20 years later. (MINING.COM’s official measure of copper production is the escondida which equals one million tonnes.)

The weighted average discovery year of the planet’s top 20 biggest copper mines is 1928. US number one mine Morenci (less than half an escondida in 2020) was discovered in 1870. Chile and the world’s number two copper mine Collahuasi (O.63 escondida) dates back to 1880.

When Congo’s Kamoa-Kakula went into production in May this year it was the biggest new mine to do so since Escondida. By 2028 it will produce 840,000 tonnes a year. Kamoa-Kakula is a poster child for rapid mine development, yet Robert Friedland’s exploration team discovered the deposit back in 2003.

Let it be resolved

With ample reserves, the US has a number of uncommitted projects that would support the Conference of Parties and their wannabe cheerleader, the Biden administration, advancing its climate goals.

A top contender is the Resolution project in Arizona, near the town of Superior in the area known as the Copper Triangle.

Contained copper tops 10 million tonnes making it the sixth-largest measured deposit in the world. It’s an underground high-grade mine that shrinks its environmental footprint.

The world’s number one and two mining companies, BHP and Rio Tinto, have already spent $2 billion on it, including reclamation of a historical mine. The deposit was discovered in 1995 and 26 years later remains stuck in permitting hell.

Looks like a perfect candidate for fast track approval to help with those lofty climate goals and create those millions of promised green jobs.

Right? Trump – five days before leaving office – publishes a pivotal environmental report on the project.

Wrong. Biden rescinds the study and Democrats add specific wording to the $X.X trillion infrastructure bill that would block Resolution from going ahead.

Perhaps not surprising then, the news that BHP and others are looking at the previously shunned African copperbelt.

When central Africa is a friendlier jurisdiction for miners than the US, there may be something wrong with your strat… For more see above and below.

We process, you dig

The White House’s policy is one of relying on other countries to supply metals to the US because “it’s not that hard to dig a hole. What’s hard is getting that stuff out and getting it to processing facilities.”

A strategy that worked so well for the US with rare earths.

Perhaps the White House got the idea from Indonesia, which insists miners build processing plants and refineries to own the entire battery metal supply chain and by extension huge chunks of electric vehicle manufacture.

Tiny difference though: the grand design of Jakarta, like Beijing, Santiago, et al, includes the first link in the supply chain.

And when things go wrong in metals supply for automaking, they go really wrong, as the EU found out this month.

Overburdening overburden

Biden desperately wants a deal before COP26 to brag about all the ways it fights emissions by subsidizing American electric cars, windmills and solar panels overseas lithium, nickel, cobalt, copper, silver, and rare earth mining companies.

As if the permitting process isn’t torture enough, there’s more in Biden’s bill that’ll make miners and explorers gnash their teeth and pull their hair out.

Also included in the reconciliation spending measure is an 8% gross – yes, gross isn’t it – royalty on existing mines and 4% on new ones. New ones? Ha!

There would also be a 7 cent fee for every tonne of rock moved.

This is a particularly stupefying proposal. Not easy to find anything in the tax code that shows this kind of ignorance of how an industry operates, but it would not be dissimilar to taxing farmers for every acre ploughed (multiplied by the length of the blades just to make sure you precisely measure the displaced dirt), regardless of any harvest.

What’s another year

It was two years ago almost to the day on the occasion of a Greta Thunberg protest in MINING.COM’s hometown of Vancouver, that this paper declared Thunberg and Alexandria Ocasio-Cortez as the mining industry’s unlikely heroines.

We urged miners to embrace the goals of the environmental movement and initiatives like the Green New Deal.

With all the glaring holes drilled into COP26’s decarbonisation plans, it sure feels like it was Greta and AOC that copped out of this embrace, not mining.

from MINING.COM https://ift.tt/3nFxggY

BMO Financial Group vice-chair warns of a potential critical minerals crisis

One of the unexpected repercussions caused by the covid-19 pandemic was the impact it had on global supply chains, pushing up the price of commodities and resources across the board, including within the mining industry. The cracks in the supply chains also highlighted broader geopolitical issues affecting world economies, including the reliance on limited sources of extracting certain minerals and refining them. And at the top of the list of commodities deemed of strategic importance are critical minerals.

With most of the critical minerals being produced and refined in a handful of countries, including China, Indonesia and the Democratic Republic of the Congo, governments and industries in Canada and the United States have become more active in seeking to secure a more stable North American supply chain.

One of those who has been a vocal proponent of creating a stronger critical minerals supply chain between the two countries is David Jacobson, vice chair of BMO Financial Group and the former U.S. Ambassador to Canada in President Barack Obama’s first term (2009-2013). Ambassador Jacobson spoke to The Northern Miner about challenges, opportunities and the potential for a critical minerals crisis.

The Northern Miner: Why do you think it’s important for Canada and the U.S. to address the critical minerals issue?

David Jacobson: Well, I think that the time is right. You just had an election in Canada, the government in the United States is relatively new, so both sides are still feeling each other out as to how they’re going to relate to one another. This issue is as important as any other we’ve seen since covid highlighted the impact of disruptions on supply chains. And perhaps the most critical of those supply chains, to coin a phrase, is critical minerals. The computers that we’re talking over, our cell phones, our cars, our batteries, our smart grids that we want to develop, everything makes use of these critical minerals.

from MINING.COM https://ift.tt/3mmG23S

LaRonde, Meliadine lead Agnico Eagle to record quarterly gold output

Agnico Eagle Mines (TSX: AEM; NYSE: AEM) has reported third quarter net income of $114.5 million and a dividend of $0.47 per share. This represented a drop of about half from the third quarter of 2020 when net income was $222.7 million.

The company said the quarterly decrease was due primarily to lower operating margins, unrealized losses for non-cash items, and higher amortization of property.

For the first nine months of 2021, Agnico reported net income of $440.2 million, or $1.81 per share, compared to $306.4 million in 2020.

Gold production during the third quarter 2021 reached record levels at 541,663 oz. at all-in sustaining costs per ounce of $1,011. This includes 17,947 oz. from the recently acquired Hope Bay mine in Nunavut.

Quarterly production from the mines in the Abitibi region – LaRonde, Goldex and 50% of Canadian Malartic – totaled 222,373 oz. of gold. In Nunavut, the Mediadine mine has a record quarter producing 97,024 oz, including pre-commercial production of 6,881 oz. from the new Tiriganiaq open pit.

The 1.53 million oz. of gold produced in the first nine months of this year was also a record.

Agnico confirmed that guidance for 2021 remains unchanged at approximately 2.05 million oz. with all-in sustaining costs of $950 to $1,000 per ounce. Capital expenditures for the year are also unchanged at $803 million.

For Agnico’s global mines, the measured and indicated resources (as of Dec. 31, 2020) were 341.4 million tonnes grading 1.4 g/t gold for 15.3 million contained oz., and the inferred resource was 283 million tonnes grading 2.57 g/t gold for 23.4 million contained oz. Proven and probable reserves total 15.2 million tonnes grading 0.76 g/t gold for 115.5 million contained oz.

(This article first appeared in the Canadian Mining Journal)

from MINING.COM https://ift.tt/3bngZay

Rio Tinto sells last Argyle diamonds at record highs

Rio Tinto’s (ASX, LON, NYSE: RIO) last pink, red, blue and violet diamonds from its iconic Argyle mine, in the remote east Kimberley region of Western Australia, smashed records on Thursday.

Mining ended at Argyle in November 2020, after 37 years of uninterrupted production, during which the mine became the source of about 90% of the world’s prized rose-to-magenta hued stones.

While pink diamonds became Argyle’s signature, the mine sporadically produced small blue and violet diamonds that, with the operation now closed, will be extremely unlikely to see in a collection again, according to experts.

Rio Tinto’s entire 2021 “Once in a Blue Moon” tender collection of 24.88 carats of blue and violet diamonds held in 41 lots was won by a single bidder, the Hong Kong fancy coloured diamond specialist, Kunming Diamonds.

“We cherish becoming the custodians of the final Australian treasures from this iconic and industry-defining mine and look forward to unearthing the incredible possibilities in the years to come,” Kunming Diamonds executive director, Harsh Maheshwari, said in a statement.

The other collection, made up of 70 rare pink and red diamonds, attracted a record 600-plus bids from ten countries, said Rio Tinto.

The company, which keeps bids and values under wraps, revealed that the 2021 collection continued its trajectory of “double-digit price growth” with 19 successful bidders from nine countries. The miner noted that overall prices for Argyle’s signature pink diamonds have more than tripled since 2000.

Argyle, located within the ancient Matsu Ranges more than 3,000 km north of Perth, was Australia’s first large-scale diamond operation. It pioneered the fly–in fly–out model, drawing workers from across the nation.

It also triggered the creation and adoption of new technology and exploration methods to make the search for diamonds more efficient across the rugged and remote Kimberley landscape.

At its peak, Argyle churned out 40% of the world’s diamond output, which made it the biggest producer by volume.

Its closure removed about 75% of Rio’s diamond output, yet the impact on the miner’s earnings has been negligible. Diamonds bring in only about 2% of the miner’s earnings, while iron ore — its main commodity — accounts for almost 60%.

Rio’s minerals boss Sinead Kaufman said despite Argyle mine is no longer producing diamonds, the company will retain the Argyle Pink Diamonds brand.

“We are extremely proud of the Argyle Pink Diamonds business and its legacy will continue as we retain and manage the brand through a proprietary Argyle pink diamonds trading platform, certification processes and creative collaborations with our trusted partners,” Kaufman said.

from MINING.COM https://ift.tt/3nCz0HF

Forfait mobile : profitez de 20 à 200 Go d’internet à partir de 4,99 €/mois

from Les dernières actualités de Futura https://ift.tt/3nGfvhD

Que pourra voir le télescope spatial James Webb que ne peut pas Hubble ?

from Les dernières actualités de Futura https://ift.tt/3bivCvI

Bon plan : une remise de 86% sur la formation à AutoCAD !

from Les dernières actualités de Futura https://ift.tt/3Cnmwdi

Espace : bientôt des lanceurs utilisant des biocarburants ?

from Les dernières actualités de Futura https://ift.tt/3Cqx1MH

Bon plan : le four encastrable Electrolux ECF6P62X est à -350 € (stock limité)

from Les dernières actualités de Futura https://ift.tt/31bCcTa

Formation WordPress : 86% de remise en bon plan avec Udemy

from Les dernières actualités de Futura https://ift.tt/3hHdrUF

Le gaspillage alimentaire représente une perte d'énergie de 4.000 milliards de mégajoules par an

from Les dernières actualités de Futura https://ift.tt/2Zub7ts

Bon plan Cdiscount : 100 € de remise sur la machine à café à grain Delonghi ECAM22.140.B

from Les dernières actualités de Futura https://ift.tt/3lsWuPJ

Données personnelles : Google propose aux mineurs de supprimer leurs photos

from Les dernières actualités de Futura https://ift.tt/3pIDgIr

« Les priorités ne sont pas les bonnes et c’est inquiétant », confie Thomas Pesquet, témoin des catastrophes sur Terre

from Les dernières actualités de Futura https://ift.tt/3EsX5aT

Offre Cdiscount : la TV HISENSE 58AE7000F est à moins de 500 € !

from Les dernières actualités de Futura https://ift.tt/3jK6cvX

Des cosmonautes russes bientôt à bord du Crew Dragon de SpaceX

from Les dernières actualités de Futura https://ift.tt/3nFGIB3

Bon plan : votre formation au Deep Learning en promo à -86%

from Les dernières actualités de Futura https://ift.tt/2YqK5Dl

Bon plan Cdiscount : 157 € de remise sur le four électrique multifonction Candy

from Les dernières actualités de Futura https://ift.tt/3CpBoaT

La principale cause des épidémies n'est pas celle que vous pensez

from Les dernières actualités de Futura https://ift.tt/30ZOUUQ

Bon plan Amazon : la montre connectée Samsung Galaxy Watch en réduction à -90 €

from Les dernières actualités de Futura https://ift.tt/3GqPGe1

Le Cumbre Vieja produit d’impressionnantes fontaines de lave

from Les dernières actualités de Futura https://ift.tt/3nvOcX4

C’est l’une des exoplanètes les plus jeunes jamais observées

from Les dernières actualités de Futura https://ift.tt/3miqoqi

Samsung Galaxy Z Flip 3 : 200€ de bonus reprise avec la Bespoke Edition !

from Les dernières actualités de Futura https://ift.tt/2XTnE9x

Samsung Galaxy Z Flip 3 : découvrez l’offre de lancement du Bespoke Edition

from Les dernières actualités de Futura https://ift.tt/3CrSXan

Les scientifiques ont besoin de vous pour une expérience sur le blob

from Les dernières actualités de Futura https://ift.tt/3EpBgc0

mercredi 27 octobre 2021

Cobalt-60 — a life-saving medical isotope harvested at Onatrio Nuclear Generating Station

Ontario Power Generation (OPG) said it has completed another harvest of Cobalt-60 (Co-60) at the Pickering Nuclear Generating Station, continuing a decades-long program of producing this life-saving medical isotope.

Co-60 is used in medical radiotherapy, in treating cancer and about 40% of the world’s single-use medical devices, such as syringes, gloves, implants, and surgical instruments, are sterilized with Co-60.

OPG is expanding its production of Co-60 to Darlington Nuclear Generating Station. Implementing Co-60 production at Darlington Nuclear after Pickering Nuclear ceases operations will replace Pickering Nuclear’s capacity and provide increased production to meet global demand.

“We are proud of our long history of supplying medical isotopes to the entire world from the Pickering plant – and this latest harvest of Cobalt-60 is especially needed amid the current global pandemic, for crucial uses including sterilization of gloves and testing swabs,” Dominique Minière, OPG’s Executive Vice President, New Nuclear Domestic and International Strategy said in a media statement.

“OPG has a vital role to play in global health care, given that Ontario’s CANDU reactors produce 50% of the world’s supply of Cobalt-60.”

from MINING.COM https://ift.tt/2Zuvwyp

Bon plan Cdiscount : -199 € de réduction sur le VTT électrique MOOVWAY

from Les dernières actualités de Futura https://ift.tt/3Ei3WDO

RED By SFR : dernier jour pour profiter de la promo sur le forfait mobile 80 Go à seulement 10€/mois

from Les dernières actualités de Futura https://ift.tt/317Dz5i

Réparer le climat de l’Arctique, c’est possible. Mais est-ce une bonne idée ?

from Les dernières actualités de Futura https://ift.tt/3CyGTo1

Bon plan Fnac : économisez 100 € sur la TV LG 55NANO816NA

from Les dernières actualités de Futura https://ift.tt/3xv2Twu

Ce plastique s’auto-répare en moins de 10 secondes sous l’eau !

from Les dernières actualités de Futura https://ift.tt/3CkeTnZ

Samsung Galaxy Watch4 : un max de bons plans pour la nouvelle montre connectée !

from Les dernières actualités de Futura https://ift.tt/3BnT4Cu

Baisse de prix pour l'écran PC Gamer incurvé Samsung Odyssey G7 (-116 €)

from Les dernières actualités de Futura https://ift.tt/3vShWRU

Les émissions de gaz à effet de serre battent encore un record en 2020 !

from Les dernières actualités de Futura https://ift.tt/3BkvmXU

Offre à saisir : l'imprimante 3D Creality3D Ender-3 pro à moins de 200 €

from Les dernières actualités de Futura https://ift.tt/3n9pMma

Windows 11 : l'outil de vérification installé d'office dans une mise à jour

from Les dernières actualités de Futura https://ift.tt/3Bhu2oI

Forfait mobile : Cdiscount Mobile propose 200 Go d’internet à 9,99€/mois sur le réseau Bouygues Telecom

from Les dernières actualités de Futura https://ift.tt/3nzBTc9

La première exoplanète extragalactique aurait été découverte !

from Les dernières actualités de Futura https://ift.tt/3pHdjJd

Dyson : grosse réduction sur l'aspirateur balai V11 Outsize ! (-244 €)

from Les dernières actualités de Futura https://ift.tt/2ZqwUCa

Océans polaires : là où les océans s’acidifient le plus sur Terre

from Les dernières actualités de Futura https://ift.tt/3nPuxlh

Perseverance et Ingenuity ont repris leurs activités : 14e vol réussi au-dessus de Mars

from Les dernières actualités de Futura https://ift.tt/2Zr8Kbq

Forfait mobile : 90 Go en 4G+ à seulement 9,99 €/mois chez Free Mobile

from Les dernières actualités de Futura https://ift.tt/2ZqmEKR

« Notre avenir dépend des glaciers », l'édito d'Heïdi Sevestre

from Les dernières actualités de Futura https://ift.tt/3jFKxoA

Bon Plan Samsung : 50€ de remise immédiate sur la Tab S6 Lite jusqu’au 31 octobre !

from Les dernières actualités de Futura https://ift.tt/3nBdGlZ

Heïdi Sevestre, « sentinelle du climat » et rédactrice en chef spéciale de Futura

from Les dernières actualités de Futura https://ift.tt/3CvGp1y

mardi 26 octobre 2021

Forfait mobile : dernières heures pour profiter de 130 Go à 7,99€/mois sur le réseau Bouygues Telecom

from Les dernières actualités de Futura https://ift.tt/3CuN3Fi

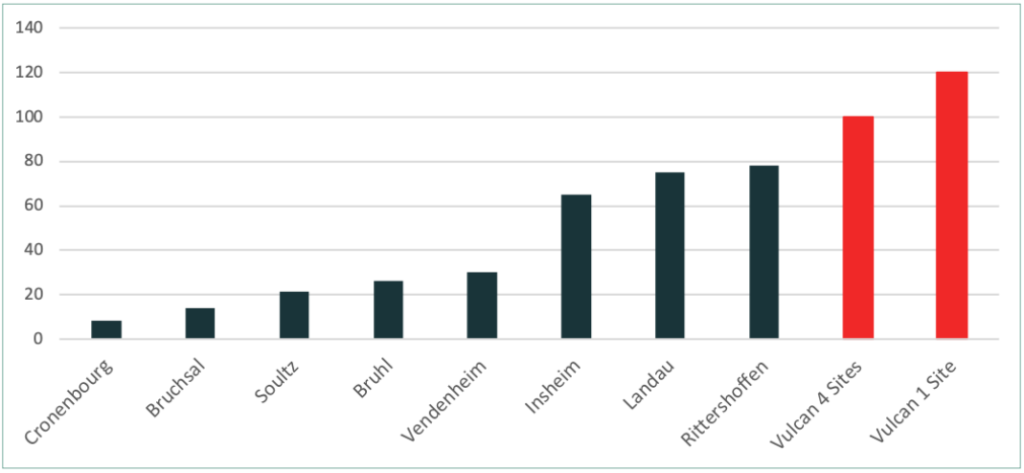

Vulcan Energy accused of misleading investors with positive PFS — report

Vulcan Energy Resources (ASX: VUL) is alleged to have misled investors by issuing a positive pre-feasibility study (PFS) with key assumptions provided by consulting companies owned by management, according to a new report US-based short-seller J Capital Research.

Vulcan, backed in part by Australian investor Gina Rinehart’s Hancock Prospecting, is aiming to produce the world’s first “zero-carbon lithium” from what it considers to be Europe’s largest lithium resource in the Upper Rhine Valley of Germany.

In a report titled “Vulcan: God of Empty Promises”, the firm specializing in due diligence on public companies calls into question the validity of Vulcan’s claims of building a “profitable geothermal power and green lithium project” to serve the growing European electric vehicle market.

J Capital alleges the project may never actually get underway as the costs are higher than the company claims, output will be lower, the environmental impact is brutal enough that public outcry will block permits, as has happened before in the area, and the quality of the lithium resource is low.

J Capital alleges Vulcan’s management team low-balled the costs, thus making the project look profitable, and overstated the quality of the resource shown in the project’s pre-feasability study (PFS).

The study, which was issued in January, is rife with contradictions, J Capital says, pointing to Vulcan’s usage of so-called “independent experts” who presented contradictory information such as operating costs and discount rates to the German government.

“The PFS contained an unrealistic assumption for the flow rate that beautified the project and can be easily disproved scientifically,” J-Capital says.

Vulcan also claims to have a recovery rate of 90% for the lithium, while other projects with the same lab performance are estimating with a 70% recovery rate, it adds.

“Realistic assumptions would halve the output of lithium and kill the commercial viability of the project,” J Capital says.

Vulcan has also reportedly declined to reveal key information about the direct lithium extraction (DLE) technology critical to removing lithium from the brine at a reasonable cost, but claimed to have costs that will be half those of similar proposed projects that are clear about their DLE method, according to J Capital.

More realistic flow and recovery rates will lower lithium output by 50% compared with the PFS, their research estimates.

from MINING.COM https://ift.tt/3CktLT5

TSLA la land: Tesla vs Volkswagen 2021 battery power comparison

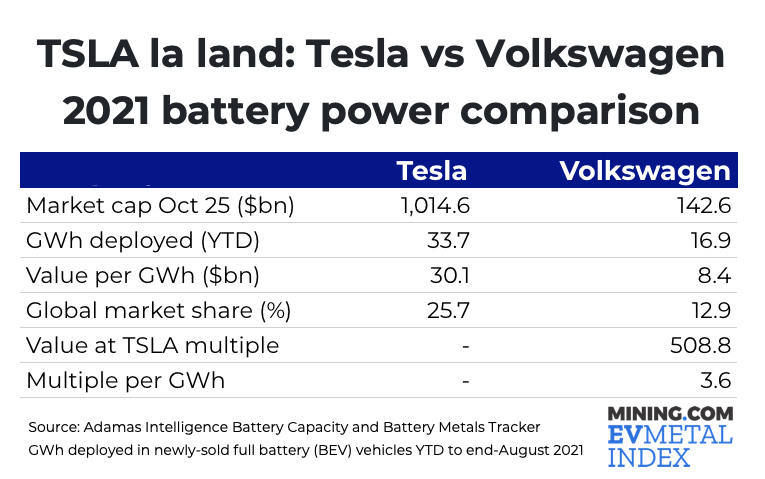

Shorting Tesla (NASDAQ: TSLA) has been a widowmaker trade and fans of the company and its CEO have amped up the stock by more than 160% over the past year to become the first trillion-dollar automaker ever, joining the most rarefied of rarefied clubs.

The first production model Tesla rolled off the line in 2008, and shortly thereafter Elon Musk became CEO. Traditional carmakers remained asleep at the wheel of their oil burners for almost a decade after the first Tesla hit the road. Astonishingly, it wasn’t until 2017 that executives at the world’s largest auto companies identified battery electric vehicles as the top trend in the industry.

Announcements by incumbents of going electric and spending billions doing so have come thick and fast since then. Volkswagen (XETRA: VOW), which owns marques like Audi, Skoda, Bentley, Lamborghini and others, has been the most aggressive – pledging to spend $86 billion through 2030 with a target of 50% of sales to be electric by then.

But Tesla remains way out in front – so far this year the company is responsible for 26% of all the battery power found in newly-sold passenger cars hitting the road, double the kWh of its nearest competitor VW. On a kWh-basis Volkswagen is the number two seller of electric cars, with a 12.9% global market share, about the same as the Model 3 by itself.

Tesla’s relative valuation shows investors regard the age of the internal combustion engine as well and truly over. To test this theory, MINING.COM assigned a value of zero to VW’s traditional vehicle business.

This way investors can compare traditional automakers like VW with Tesla, based on their ability to compete in the battery powered light duty vehicle market. For the sake of apples vs apples, the comparison also excludes all the battery power in the plug-in hybrids VW sells.

For the sake of accuracy, only end-user registered vehicles are counted – not reported production numbers, dealer deliveries or sales projections. At Tesla’s current market valuation, every GWh in the company’s cars sold this year to end-August is worth $30 billion in market cap.

The company’s closest competitor, Volkswagen attracts just over $8.4 billion for the same achievement. Volkswagen would be worth $510 billion if investors were as charged up about its electric cars as they are about Tesla’s.

Again, it’s full electric cars only – anything else Wolfsburg produces is worthless under this scenario. Golf GTI, Audi and Lamborghini Aventador? Relics of a bygone era. Those Bugattis and Bentleys? Not even worth anything as scrap metal.

Put another way, Tesla’s sheet metal, interior finishes, suspension, paint jobs, audio-systems, tires, wiper blades, headlights, and those oh-so-big touch screens are worth $500 billion more than the same stuff in your average VW.

(Google “Tesla build quality” if you think $500 billion may be a tad rich.)

But it’s the over-the-air software updates, the “full” self-driving system and our glorious robo-taxi future that’s worth so much (and probably double that) —is the argument.

Perhaps, as long as you can get it out of the parking lot.

from MINING.COM https://ift.tt/3bfTBvy

Colombian Mining Association establishes sustainable mining standard

At the closing of Colombia’s National Mining Congress this week, the Asociación Colombiana de Minería (ACM) announced the adoption of Towards Sustainable Mining (TSM), a performance system developed by the Mining Association of Canada (MAC) that improves environmental and social practices in the mining sector.

As a result, ACM and its affiliated companies, producers of coal, gold, nickel, emeralds, copper, drag materials, cement, limestone, brick-making and industrial minerals in the country, will adopt a set of indicators that will allow them to measure and publicly report on the quality of its management systems.

“To meet the global demand for minerals and metals that we need to build the greener world we dream of, today the Colombian mining industry takes another big step in terms of sustainability, We have been pioneers in good practices worldwide,” Juan Camilo Nariño, President of the ACM said in a media release. “This standard will allow companies to measure and demonstrate their positive impact models in social and environmental matters.”

The ACM joins eight other mining associations around the world, the third in South America together with Brazil and Argentina, in adopting the standard. With MAC’s support, the ACM will tailor TSM’s performance areas to reflect the unique aspects of its mining industry and commits to implementation in the next five years.

TSM is a globally recognized sustainability program that supports mining companies in managing key environmental and social risks. TSM was the first mining sustainability standard in the world to require site-level assessments and is mandatory for all companies that are members of implementing associations.

Through TSM, eight critical aspects of social and environmental performance are evaluated, independently validated, and publicly reported against 30 distinct performance indicators.

“We feel privileged that Colombia has chosen TSM to drive environmental and social performance in its mining sector and are very proud of TSM’s increasingly global reach,” said Pierre Gratton, MAC’s CEO in a statement. “The past five years have witnessed TSM’s adoption by other mining associations around the world and the program is now in the process of being implemented in Norway, Finland, Spain, Botswana, Brazil, Argentina, the Philippines and Australia, allowing us to say that TSM is a truly global standard.”

Performance in TSM is evaluated across a set of detailed environmental and social performance standards, including climate change, tailings management, water stewardship, Indigenous and community relationships, safety and health, biodiversity conservation, crisis management and preventing child and forced labour. TSM helps drive performance improvement where it counts — at the site level — and contributes to securing support for mining activities from the communities where it operates.

from MINING.COM https://ift.tt/3EmPzOr

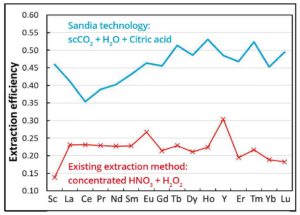

Food-grade solvent can be used to extract rare earth metals from coal ash

New research led by Sandia National Laboratories found that citric acid, a harmless food-grade solvent, can be used to extract highly sought rare-earth metals from coal ash.

In a media brief, the team behind the discovery described a new process that involves using a supercritical carbon dioxide solvent and citric acid as the carrier for rare-earth metals so they separate from coal ash, the host material.

In a controlled setting, the group found that in less than a day, at 70 degrees Celsius and 1,100 pounds per square inch pressure (about 70 times ordinary atmospheric pressure), the method extracted 42% of rare-earth metals present in coal waste samples.

“This technique not only recovers rare-earth metals in an environmentally harmless manner but would actually improve environments by reducing the toxicity of coal waste dotting America,” Guangping Xu, lead Sandia researcher on the project, said.

Guangping pointed out that the most common acids used as chemical separators in mining — nitric, sulfuric or phosphoric acids — also are able to extract rare-earth metals from coal ash but produce large amounts of acid waste, thus causing severe environmental damage.

“Harmless extraction of rare-earth metals from coal ash not only provides a national source of materials essential for computer chips, smartphones and other high-tech products — including fighter jets and submarines — but also make the coal ash cleaner and less toxic, enabling its direct reuse as concrete filler or agricultural topsoil.”

In Guangping’s view, the method, if widely adopted, could turn coal ash from an environmental pariah into a commercially viable product.

Citing a 2016 paper published in the journal Environmental Science and Technology, the geologist and Ph.D. in geochemistry said that, in the United States, approximately 115 million metric tons of coal combustion products are generated annually, and this sum includes 45 million tons of fly ash. This means that if companies decide to go ahead with Sandia’s patent-pending process, they would not lack the necessary raw input.

“Theoretically, an American company could use this technique to mine coal and coal byproducts for rare-earth metals and compete with Chinese mining,” Guangping said.

Data released by Foreign Policy show that China produces or controls over 70% of the world’s mined rare earths, it refines more than 80% of all rare earths into mixed oxides and separates more than 90% of all rare earths into individual elements.

For Guangping, given this state of affairs, “it is probably reasonable to have alternate sources of rare-earth metals to avoid being at the mercy of a foreign supply.”

from MINING.COM https://ift.tt/3Cg9huU