vendredi 31 décembre 2021

Orange ou SFR, profitez de ce forfait mobile 100 Go en 4G à seulement 8,99€ jusqu'au 05 janvier

from Les dernières actualités de Futura https://ift.tt/3sObcVC

Copper coating could enhance effectiveness of masks against covid-19

Researchers at the University of Waterloo and Wilfrid Laurier University have discovered that using a thin-film coating of copper or copper compounds on surfaces could enhance copper’s ability to inactivate or destroy the SARS-CoV-2 virus, which is responsible for covid-19.

In a paper published in the journal ATL Materials, the scientists explain that they investigated how six different thin metal and oxide coatings interacted with HCov-229E, a coronavirus that is genetically like SARS-CoV-2 but safer to work with.

“While there was already some data out there on the lifetime of the virus on common-touch surfaces like stainless steel, plastics and copper, the lifetime of the virus on engineered coatings was less understood,” Kevin Mussleman, senior author of the study, said in a media statement.

Given what previous research had found, the team tested the effectiveness of the antiviral coatings on glass and N95 mask fabric.

Testing involved depositing coatings that were about 1,000 times thinner than a human hair, then immersing the coated glass and fabric in a viral solution or exposing them to smaller droplets of the viral solution. After removing the virus from the coatings, each extract was placed in contact with healthy cells and measured for its ability to replicate.

Results showed the other coatings did not have the same antiviral effects as copper or a copper-containing compound.

Additionally, they found that in some cases nanoscale thin films of copper can come off from the surface and rapidly dissolve in virus-containing droplets, enhancing the virucidal effect. This means that there are opportunities to tailor the coating in a way that enhances its interaction with the viral droplet and the antiviral effect.

In the view of lead author Louis Delumeau, adding an antiviral coating containing copper to the outside of masks or an inside filter could add an additional layer of safety.

“Not only would a mask that covers the nose and mouth greatly limit the transmission of the virus but adding a coating such as the one we developed could actually kill the virus rapidly and reduce the amount of virus spread,” Delumeau said.

“The antiviral coating could also be applied to high-touch public surfaces.”

Following these findings, the Waterloo research group is developing coating techniques for masks and is continuing to explore the dissolution process for smaller droplet sizes, as well as investigating how to control the adhesion of copper films to various surfaces.

from MINING.COM https://ift.tt/3eCXM6i

Formation à GNU/Linux : profitez de 88% de remise sur ce bon plan

from Les dernières actualités de Futura https://ift.tt/37Osg1P

Agnico Eagle shares drop as covid-19 cases rise in Nunavut

Agnico Eagle announced an update linked to the hike in covid-19 cases at its Nunavut operations.

There have been a total of 13 tentative cases at its Meliadine, Meadowbank and Hope Bay operations since Dec 18, 2021.

The company decided to send home the Nunavut-based workforce (Nunavummiut) from the Meliadine, Meadowbank and Hope Bay operations as well as its Nunavut exploration projects.

Due to the reduction, the company expects production to be minimal over this period. It is also reassessing current protocols in preparation for a resumption of activities expected in early 2022.

All Nunavummiut workers, presently on-site, will be sent home and those that are currently off-site will not return to work at this time for a period of at least three weeks.

Shares of Agnico Eagle have declined 25.4% in 2021 compared with a 13.3% fall of the industry.

Last year, miners working in remote locations in Canada, including Agnico, sent home Indigenous workers and limited contact between fly-in workers and communities to minimize the risk of spreading covid-19. The highly transmissible Omicron variant of the virus now threatens a wave of new disruptions, even after the roll-out of vaccines and vaccine mandates this year.

Nunavut is extending its “circuit-breaker” lockdown as a rise in covid-19 cases pushes the territory’s healthcare system to a breaking point.

The territory’s chief public health officer, Dr. Michael Patterson, said Wednesday the province has 74 cases in eight communities after counting zero cases on Dec. 21.

from MINING.COM https://ift.tt/3EI3Zsr

LCLS-II : le rayon X le plus puissant du monde est presque achevé

from Les dernières actualités de Futura https://ift.tt/3pGNgBu

Formation au langage Python : bénéficiez d'une offre de -88% sur ce bon plan

from Les dernières actualités de Futura https://ift.tt/3JrIW0Z

Bon plan Amazon : réalisez 100 € d'économie sur les AirPods Max

from Les dernières actualités de Futura https://ift.tt/340w0yC

Contre Omicron, le vaccin Johnson & Johnson efficace à 85 % contre les formes graves

from Les dernières actualités de Futura https://ift.tt/3pGFMhR

De nombreuses promotions sur les écouteurs Apple Airpods !

from Les dernières actualités de Futura https://ift.tt/3FYwtzL

Bon plan Amazon : 140 € de réduction sur la trottinette électrique SOUTHERN WOLF

from Les dernières actualités de Futura https://ift.tt/32SloBz

Faites des économies avec le radiateur électrique Carrera à -170 € sur Cdiscount

from Les dernières actualités de Futura https://ift.tt/3sNZytM

Starlink : Elon Musk minimise les risques de désordre orbital que poseraient ses satellites

from Les dernières actualités de Futura https://ift.tt/32SfsZj

Le centre de recherche IBM ouvre les portes du futur

from Les dernières actualités de Futura https://ift.tt/3t1Qemn

Bon plan : l'aspirateur robot iRobot Roomba i7156 à -163 € sur Cdiscount

from Les dernières actualités de Futura https://ift.tt/3mKjh9X

Tout savoir sur l’histoire du compteur du Téléthon

from Les dernières actualités de Futura https://ift.tt/3rgMuMC

jeudi 30 décembre 2021

Étrangeté du vivant : une plante mangeuse de champignon ?

from Les dernières actualités de Futura https://ift.tt/3eDHRVq

Bon plan Amazon : la draisienne électrique UrbanGlide à un prix incroyable !

from Les dernières actualités de Futura https://ift.tt/3EJI7Nc

Harvest Gold shares drop on strategic investment by Crescat

Harvest Gold (TSXV:HVG) announced on Thursday that Crescat Portfolio Management LLC, a global macro asset management firm based in Denver, Colorado, has become a new strategic investor in the company.

The parties have entered into a subscription agreement under which Crescat will purchase 3.4 million units of Harvest Gold at a price of C$0.10 per unit for aggregate gross proceeds of C$340,000 ($267,000).

Each unit consists of one common share of Harvest Gold and one common share purchase warrant, exercisable at C$0.20 per share for a period of three years from the closing date of the private placement (December 31, 2021).

In the event the closing price of Harvest Gold’s shares is C$0.50 or greater during any 15 non-consecutive trading day period after June 15, 2022, the warrants will expire on the 30th day after the date on which the company provides notice of such accelerated expiry to Crescat.

Harvest Gold’s stock dropped 13.5% by 12:15 p.m. ET following the Crescat investment, trading at C$0.16 a share on the TSX Venture Exchange. The copper-gold junior has a market capitalization of C$5.3 million.

Harvest Gold is focused on the Interior Plateau of British Columbia, exploring for near-surface gold deposits and copper-gold porphyry deposits. Its flagship project is the Emerson property, consisting of five contiguous mineral claims located 15 km west of Houston, BC.

“We are extremely pleased to welcome Crescat as a significant new shareholder of the company. Crescat is known in the industry as a leading technical-based investor, and we believe its decision to join us further supports our hypothesis for discovery at Emerson,” Harvest Gold’s president and CEO Richard Mark stated in a news release.

from MINING.COM https://ift.tt/3FHpfjr

Bientôt un vaccin contre les allergies aux chiens ?

from Les dernières actualités de Futura https://ift.tt/343hBBL

Bon plan : la machine à café KRUPS Essential à -92 € sur Cdiscount

from Les dernières actualités de Futura https://ift.tt/3FLU727

Grâce à Ariane 5, James-Webb fonctionnera plus longtemps que prévu

from Les dernières actualités de Futura https://ift.tt/3pEDpvZ

Amazon explose le prix du robot cuiseur Moulinex Clickchef !

from Les dernières actualités de Futura https://ift.tt/3ezn99d

Le prix de la Smart TV Hisense 40A5600F est en chute libre sur Cdiscount !

from Les dernières actualités de Futura https://ift.tt/3zaP2hc

Bon plan literie : pour Noël, -10% sur les oreillers ergonomiques Wopilo !

from Les dernières actualités de Futura https://ift.tt/3yVWCw1

Dassault Aviation fait décoller ses datacenters avec les infrastructures Dell Technologies

from Les dernières actualités de Futura https://ift.tt/3nVQZJd

Bon Plan Samsung : en cette fin d'année, 50 euros remboursés pour l'achat d'une Galaxy Watch 4 !

from Les dernières actualités de Futura https://ift.tt/32OyMXm

Les roches de l'intérieur de Mars reproduites en laboratoire sur Terre

from Les dernières actualités de Futura https://ift.tt/3FFA2dZ

Noël 2021 : des cadeaux qui font du mal à la Planète

from Les dernières actualités de Futura https://ift.tt/3eCk4oQ

mercredi 29 décembre 2021

Amazon fait chuter le prix de la montre connectée Garmin Forerunner 45

from Les dernières actualités de Futura https://ift.tt/3eF1XOZ

Téléthon : comment fonctionne le principe du don ?

from Les dernières actualités de Futura https://ift.tt/3xRjEnn

Cdiscount : excellente remise sur le robot cuiseur Moulinex Companion XL (-150 €)

from Les dernières actualités de Futura https://ift.tt/3qAUWo2

Grichka Bogdanoff, jumeau d'Igor, est décédé à l'âge de 72 ans du Covid-19

from Les dernières actualités de Futura https://ift.tt/3ew4CKW

Les 10 crypto qui ont marqué l'année 2021

from Les dernières actualités de Futura https://ift.tt/318B3vT

Covid-19 : record de contamination à l'approche du Nouvel An

from Les dernières actualités de Futura https://ift.tt/3pAbHAs

Top gold stories of 2021 and what to expect in 2022

Coming off a record-setting 2020, gold’s performance has underwhelmed for much of this calendar year.

A big reason is a more hawkish-than-expected stance from the US Federal Reserve, which created a high interest rate environment and reduced the appeal of the non-yielding bullion.

The promise of higher returns on other assets also coincided with the arrival of covid vaccines, a signal for economic recovery, thus tilting the market towards riskier investments.

As a result, gold prices are trading 4.9% lower year-to-date (as of December 27, 2021), paving the way for its first annual loss in three years.

Still, despite a lackluster year for the yellow metal, 2021 is rife with plenty of gold-related news for investors to digest heading into the new year.

#1 Billion-dollar M&As

Back in January, analysts at Bank of America already predicted that the need to replace gold reserves would be a driver for more mergers and acquisitions this year. Indeed, the gold sector delivered a slew of deals, some involving the big players.

Agnico Eagle and Kirkland Lake Gold’s C$13.5 billion merger to create a new gold giant with a $24 billion market capitalization and 48 million ounces in reserves grabbed headlines.

During a recent symposium held by the Canadian Mining Journal, Kirkland Lake CEO Tony Makuch said that this is “one of the Canadian gold sector’s most important mergers in recent memory.”

However, the Agnico-Kirkland Lake merger announced in September is likely to be “the last blockbuster M&A deal by a major in the Canadian mining sector,” according to Haywood Securities mining analyst Kerry Smith.

Another merger of note is Newcrest’s acquisition of Pretium Resources in early November. The prize of this $2.8 billion deal is the Brucejack property, about 140 km from the Australian miner’s majority-owned and operated Red Chris mine located within British Columbia’s Golden Triangle.

A month later, Kinross also looked to expand its footprint within another famed gold mining region in Canada — the Red Lake district of Ontario — with its $1.4 billion acquisition of Great Bear Resources and its flagship Dixie project.

Barring any significant developments in the final week of 2021, this would be the last significant gold M&A deal of the year.

#2 Earlier deals

While no billion-dollar deal was announced during the first eight months, the impact that some of the earlier M&As may have on the industry cannot be overlooked.

Agnico already had a head start in January by snapping up TMAC Resources after the Canadian government rejected a bid from China’s Shandong Gold for the Nunavut miner. In the same month, Eldorado Gold acquired QMX Gold in a friendly merger, thus significantly expanding its landholding in Quebec.

In March, Newmont made its move by acquiring the remaining stake in GT Gold in a C$393 million all-cash deal. This would give the world’s biggest gold miner full control over the Tatogga project, also located near the Red Chris mine in BC. Also in March, Australia’s Evolution Mining grabbed Battle North Gold, whose operations are based in Ontario’s Red Lake, for C$343 million.

In April, Fortuna Silver Mines announced that it would acquire the West Africa-focused Roxgold for $884 million, thus taking its operations beyond Latin America.

Also not missing out on the action is AngloGold Ashanti, which offered in July to buy the rest of Corvus Gold for $370 million to consolidate its landholdings in Nevada.

#3 Future mines

2021 also marks a milestone year for some of the world’s soon-to-be gold mines.

In October, Equinox Gold began construction at its $1.23 billion Greenstone project in Ontario, which is slated to become one of Canada’s largest gold mines, producing more than 400,000 ounces annually for the first five years.

Ascot Resources, which is developing the Premier gold project in BC’s Golden Triangle, was recently given the go-ahead to begin construction, with first production expected in Q1 2023.

Some mines have also achieved commercial production this year, highlighted by the Segilola mine in Nigeria, the first ever gold operation in the country.

Read also: RANKED: World’s top 10 biggest gold mines

#4 Overseas conflicts

Political factors remain a driving force behind a miner’s decision over some gold operations.

In the Dominican Republic, Barrick and Newmont could be forced to end their Pueblo Viejo joint venture without approval of a new tailings storage facility.

B2Gold is also at impasse with the Malian government over an exploration project near the company’s flagship Fekola gold mine.

A new law passed in Kyrgyzstan also saw Canada’s Centerra Gold lose control over its Kumtor mine, which is now a subject of international arbitration proceedings.

#5 Other trends

In the first half of 2021, the world’s top gold miners reported a 1.1% decline in production compared to last year, due to lower ore grades and mill throughput, according to analytics firm GlobalData, though it expects output to recover in the second half to keep production flat for the year.

Gold production was also exacerbated by the covid pandemic, which interrupted many operations. What the lockdowns did not affect was emissions caused by gold mining operations, as shown by a study published by S&P Global Market Intelligence.

On the demand side, the World Gold Council believes there is a noticeable trend among investors to seek out assets that have previously helped their portfolios but are less liquid. The shift towards riskier alternatives would pave the way for gold, according to the Council, given that the metal provides capital and liquidity needed during a market sell-off.

What’s in store for 2022

Still, with inflation pressures mounting and the possibility of multiple rate hikes, 2022 could manifest a year of recovery for the yellow-colored metal.

Analysts, including those at TD Securities remain optimistic about a potential gold rally in H1 2022.

The outlook for gold in the first quarter of 2022 is upbeat, with the main driver being inflation, which is keeping a floor under prices, said Jim Wyckoff, a senior analyst at Kitco Metals, in the latest Reuters report.

(With files from Reuters)

from MINING.COM https://ift.tt/3HiI2BV

Bon plan Fnac : le vélo électrique pliant HIMO Z16 à -140 €

from Les dernières actualités de Futura https://ift.tt/3172Htc

Amazon : promo incroyable sur les écouteurs Sennheiser Momentum True Wireless 2 !

from Les dernières actualités de Futura https://ift.tt/3eDkTxy

Microsoft a déposé un brevet pour un smartphone à triple écran

from Les dernières actualités de Futura https://ift.tt/31dm7wI

Bon plan : une superbe chaise gaming à moins de 100 € sur Cdiscount

from Les dernières actualités de Futura https://ift.tt/3EGvhPQ

Bon plan Cdiscount : la machine à café Delonghi Autentica ETAM29.510B à -160 € !

from Les dernières actualités de Futura https://ift.tt/3pDJucd

Bon plan Amazon : l'aspirateur balai Rowenta Air Force Flex 560 à -150 €

from Les dernières actualités de Futura https://ift.tt/3mFgEGv

La station spatiale chinoise contrainte de manœuvrer pour éviter des satellites Starlink

from Les dernières actualités de Futura https://ift.tt/3qBIOmZ

Le vélo électrique pliant VIDALXL est à moins de 800 € sur Cdiscount !

from Les dernières actualités de Futura https://ift.tt/3CmopGF

L'éruption du trou noir de Centaurus A occupe 16 fois la taille de la Lune dans le ciel

from Les dernières actualités de Futura https://ift.tt/3FCNe3b

mardi 28 décembre 2021

Des anticorps monoclonaux capables de neutraliser le variant Omicron identifiés

from Les dernières actualités de Futura https://ift.tt/3qE9P9o

Mountain Province Diamond says covid outbreak at Gacho Kué won’t affect production

The Office of the Chief Public Health Officer in Canada’s Northwest Territories declared on Tuesday an outbreak of covid-19 at Mountain Province Diamonds’ (TSX: MPVD) Gahcho Kué operations, a joint venture with De Beers Canada in which the company holds 49% interest.

Four cases of covid-19 have been detected at Gahcho Kué, with three individuals exhibiting mild cold-like symptoms. Eight close contacts are in quarantine and have tested negative.

All other mine personnel have also tested negative following site-wide testing conducted on December 26.

On December 22, Gahcho Kué implemented heightened preventative measures on site, above the base-line safety measures due to the rapid spread of the omicron variant in Canada.

Mountain Province says the entire workforce at Gahcho Kué is fully vaccinated against the virus, and at this time, no material impact to production is expected.

Gahcho Kué, located 300 km east-northeast of Yellowknife and 230 km south of the Arctic Circle, consists of five kimberlites that are actively being mined and developed.

from MINING.COM https://ift.tt/3FCEOJ9

La trottinette électrique MICRO X21 profite d'une belle promo (-200 €)

from Les dernières actualités de Futura https://ift.tt/3z4a55h

La montre connectée Withings Steel HR Sport affichée en promotion !

from Les dernières actualités de Futura https://ift.tt/3EANy15

LOTO® mercredi 29 décembre : 4 millions d'euros à remporter + 10 gagnants à 20 000 € !

from Les dernières actualités de Futura https://ift.tt/3FCCuld

En Chine, une IA peut décider de vous mettre en prison

from Les dernières actualités de Futura https://ift.tt/3z6djoP

Bon plan : le robot cuiseur Kenwood kCook CCL401WH à prix sacrifié !

from Les dernières actualités de Futura https://ift.tt/3evnRV1

Top iron ore stories of 2021 and what to expect in 2022

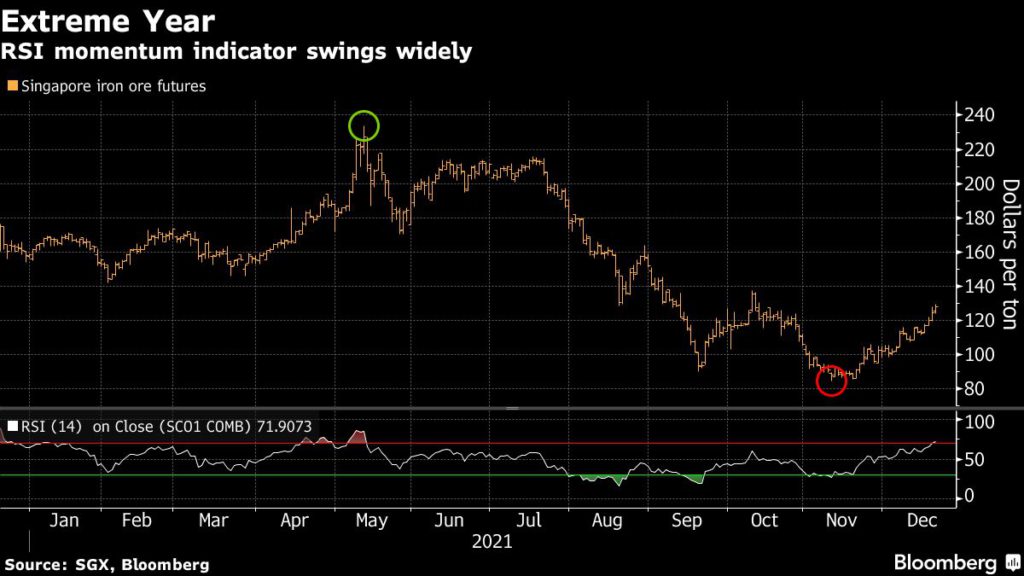

The iron ore price went on a white knuckle ride in 2021.

Prices jumped to a record of $237 a tonne in May, and crashed to about $85 in November on China’s pledge to reduce steel output. In November, Fitch Solutions said the iron ore price rally was over. In the last weeks, however, the metal rallied 50%.

According to analysts, the volatility is set to persist into 2022. Here are the top iron ore stories of 2021.

#1 China

Iron ore is a barometer for the Chinese economy, so Chinese steel curbs to control carbon emissions set the tone for the metal’s performance during the year.

In March, the Tangshan government issued a second-level pollution alert, urging heavy industrial companies such as steelmakers and coking plants to cut production accordingly.

The move dampened the market’s optimism about a post-Lunar New Year demand boost for iron ore in the world’s top steel producer.

Concerns about the debt problems of Chinese property developers, a sector that accounts for about a quarter of the domestic steel demand, also added pressure on prices of iron ore and steel.

After rumours of financial difficulties, heavily indebted property giant Evergrande failed to sell assets to raise money and missed a September 23 deadline on an $83.5 million interest payment due on some of its dollar-denominated bonds.

The iron ore price in China sank to the lowest close in nearly three years as fears over the real estate market deepened.

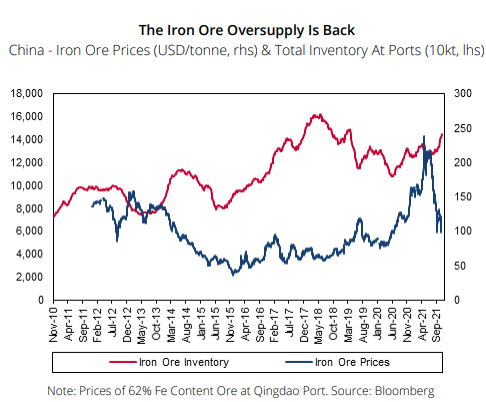

#2 Oversupply is back

On the supply side, improving production growth from Brazil and Australia has started to loosen tight supplies on the seaborne market.

Vale is working at a current iron ore production capacity of 330 million tonnes. The company’s Q1 2021 iron ore production was 68 million tonnes, 14.2% above Q1 2020, while Q2 2021 production came in at 76 million tonnes, 12% higher than Q2 2020.

Meanwhile, in Australia, Fortescue beat its full-year shipment estimate with a total volume of 182 million tonnes in FY2021 and set shipment guidance for FY2022 at 180-185 million tonnes.

Similarly, BHP reported iron ore production of 253.5 million tonnes for FY2021, which sits at the upper end of its forecast range.

“Among the major producers, only Rio Tinto painted a dismal outlook in its half-yearly results, warning that shipments are likely to come in at the bottom end of its 325-340 million tonnes guidance for 2021 at best, and this would require a significant ramp-up in output over the next five months,” said Fitch.

Related read: RANKED: World’s top 20 biggest iron ore operations

#Simandou

While major producers had positive outlooks in 2021, one treasure remained untouched.

At two billion tonnes of iron ore with some of the highest grades in the industry, the giant Simandou deposit in Guinea continued to be the subject of dispute between Vale and Israeli billionaire Beny Steinmetz.

In December, Steinmetz was arrested in Greece after a Swiss court found him guilted of minerals rights-related bribery in January.

TIMELINE: The battle for Simandou

At full production, the concession would export up to 100 million tonnes per year and be by itself the world’s fifth-largest producer behind Fortescue Metals and BHP.

#2022

Strong headwinds are building for iron ore next year.

China is pushing ahead with cutting carbon emissions ahead of the 2022 Winter Olympics in Beijing, steel output is expected to shrink for a second year, while the debt-laden property sector is weighing on steel consumption and broader growth.

“Iron ore demand will broadly, gradually decline,” said CITIC Futures Co. analyst Zeng Ning.

“The property industry is rather weak, steel consumption is likely to contract and more mills will use scrap to reduce emissions.”

UBS Group AG expects iron ore to average $85 a tonne in 2022, while Citigroup sees $96. Capital Economics predicts $70 by the end of next year.

“We are neutral on iron ore prices in the near term, given the collapse they recorded in H2 21. However, we see them trending lower later in 2022, and averaging $90 tonne next year,” Fitch said in a report.

Among bright spots are potential fiscal stimulus in China, possible further easing in monetary policy, and more support for the property industry, while steel output could rebound when limits are removed after the Olympics.

(With files from Reuters and Bloomberg)

from MINING.COM https://ift.tt/3EvPt6V

Les échantillons de l'astéroïde Ryugu commencent à révéler leurs secrets

from Les dernières actualités de Futura https://ift.tt/3evdP6d

Les excellents écouteurs Bluetooth Sony WF-1000XM3 à prix cassé sur Amazon !

from Les dernières actualités de Futura https://ift.tt/3pAm8nS

lundi 27 décembre 2021

Bon plan Xiaomi : 120 € de réduction sur la trottinette électrique Pro 2 Mercedes

from Les dernières actualités de Futura https://ift.tt/3mAv8Hs

La machine à café à grain Delonghi Autentica Plus ETAM29.620.SB à prix réduit (-270 €)

from Les dernières actualités de Futura https://ift.tt/3eq9bXa

Sur la piste d'un vaccin contre les allergies aux chiens

from Les dernières actualités de Futura https://ift.tt/3pEE8gV

Gold price nears 1-week high amid rising omicron fears

Gold prices reversed course to approach a one-week peak on Monday, as renewed risks to global economic growth from rising omicron cases overshadowed pressure from a stronger US dollar.

Spot gold rebounded from an earlier slump and rose 0.5% to $1,811.81 per ounce by 11:40 a.m. ET. US gold futures stayed relatively flat at $1,813.10 per ounce in New York.

[Click here for an interactive chart of gold prices]

Meanwhile, the dollar index rose from its weakest level in nearly a week, which makes the greenback-priced gold less attractive for holders of non-US currencies.

Still, the outlook for gold in the first quarter of 2022 is upbeat, with the main driver being inflation, which is keeping a floor under prices, Jim Wyckoff, a senior analyst at Kitco Metals, told Reuters.

“The underlying support comes from inflation concerns,” Wyckoff said, adding “the leanings of the Fed for a little bit tighter monetary policy seems to have assuaged the gold traders a little bit.”

“While there is a firmer US dollar, there isn’t a lot of movement in gold today,” said Quantitative Commodity Research analyst Peter Fertig, adding that one of the main reasons for the lack of liquidity is closed markets over Christmas.

“Slightly higher yields increase the opportunity cost for holding gold, which is weighing a little on gold prices,” Fertig added.

“Although quiet overall this week, the low liquidity makes headline sensitivity more pronounced, as the thin markets are likely to make for more jittery price action if something were to happen,” DailyFX currency strategist Ilya Spivak commented.

(With files from Reuters)

from MINING.COM https://ift.tt/3sAhZSH

Bon plan Amazon : la machine à café Krups Espresseria Latt Espress Silver à -280 € !

from Les dernières actualités de Futura https://ift.tt/3z0DPjg

Portal Go et Portal TV : zoom sur ces nouvelles entrées qui veulent vous faciliter la vie

from Les dernières actualités de Futura https://ift.tt/3GVlvL5

Top lithium stories of 2021 and what to expect in 2022

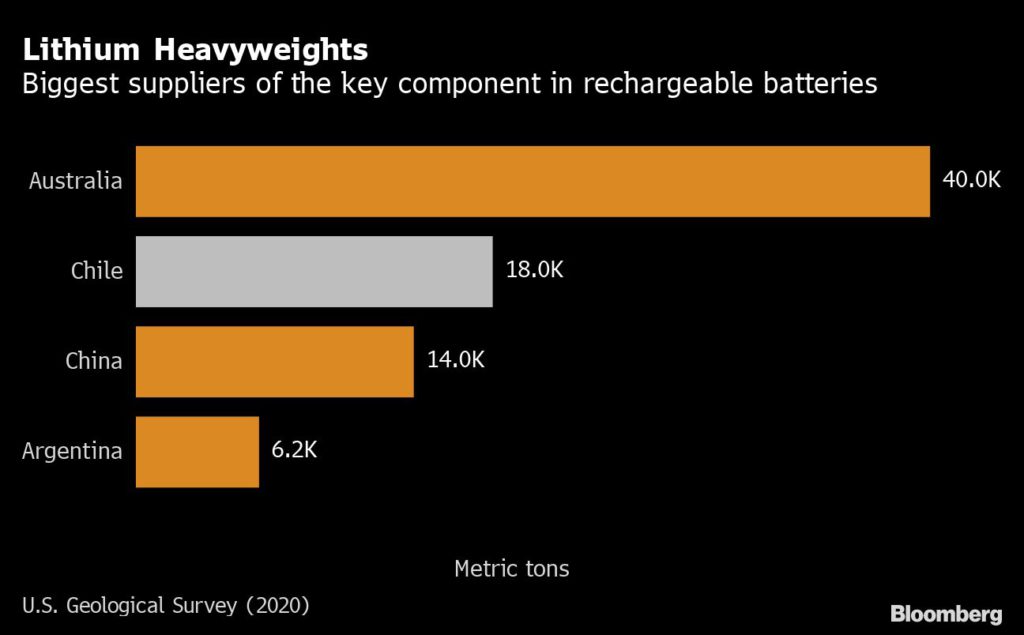

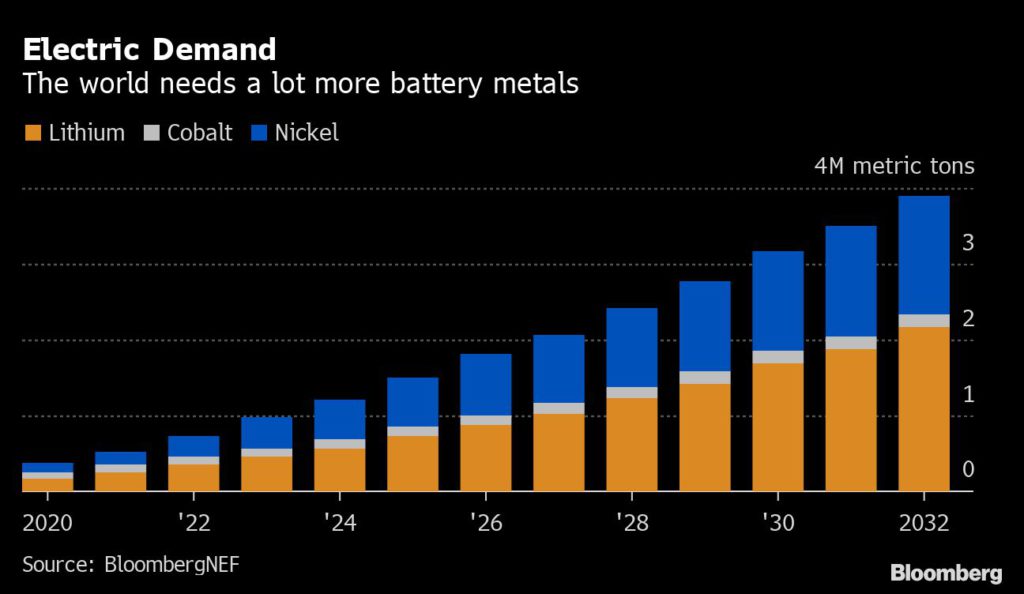

Lithium prices skyrocketed in 2021, with a benchmark index more than doubling and key prices in China hitting records. Driving the frenzy was and is the metal’s role in transitioning the world towards a greener economy, as it is a key component for the rechargeable batteries used to power electric vehicles.

Limited supply not only helped prices, but pushed companies moving to meet demand, which made lithium take centre stage in our news coverage.

#1 Jadar

Rio Tinto (ASX, LON, NYSE: RIO) greenlighted in July its $2.4 billion Jadar lithium project in Serbia. The world’s second-largest miner said at the time that by 2030 EV makers will need about three million tonnes of lithium, compared with the roughly 350,000 tonnes they consume today.

Existing operations and projects combined, however, are slated to contribute one million tonnes of lithium.

Filling that supply gap, Rio Tinto said, would require more than 60 Jadar projects. The proposed mine is slated to produce 58,000 tonnes of lithium carbonate, 160,000 tonnes of boric acid and 255,000 tonnes of sodium sulphate a year at full tilt.

But the company is facing fierce opposition to the project. In early December, local opponents organized a movement that has rocked the government and brought cities to a standstill as thousands of protesters marched in the streets. Authorities subsequently suspended a land-use plan for the proposed mine, though they didn’t reject the project completely.

Rio said on Dec. 23 it plans to pause its Jadar lithium project after a municipality in the country scrapped a plan to allocate land for the mine, during which it will engage in a public dialogue about the project.

#2 Chinese offensive

Even though China’s lithium reserves rank as the world’s fourth-largest, the battery metal is mainly found in the salt lakes around Tibet and Qinghai, a sparsely populated Chinese province spread across the high-altitude Tibetan plateau. That makes it difficult to refine and transport, and partly explains why Beijing looked elsewhere this year.

Ganfeng Lithium, one of the world’s top producers, bid for a stake in Canada’s Millennial Lithium in July, while battery making giant CATL, led by billionaire Zeng Yuqun, joined the race a few months later, trumping Ganfeng. In the end, it was a third company, Lithium Americas, that emerged victorious.

The company also acquired Mexico-focused explorer and developer Bacanora Lithium (LON: BCN) this year, adding the Sonora project to its growing portfolio.

Ganfeng didn’t stop there and bought in September International Lithium, which was its partner in the Mariana project in Argentina, one of the biggest deposits globally.

Representatives of five Chinese companies obtained special visas and travelled to Afghanistan in early November to conduct on-site inspections of potential lithium projects.

Zijin Mining also grabbed headlines, especially with the acquisition of Canada’s Neo Lithium Corp in October.

#3 Aussie M&As

One of the biggest stories of the year in the lithium market came in April, with Australian lithium miners Galaxy Resources (ASX: GXY) and Orocobre (ASX: ORE) announcing their merger. The business combination created a $3.1 billion (A$4bn) company, set to be the world’s fifth-largest producer of lithium chemicals.

A joint venture between Tianqi Lithium and IGO Ltd also grabbed headlines as they produced Australia’s first batch of lithium hydroxide, used to make cathodes for lithium-ion batteries that power electric vehicles. Once in full production, Kwinana will be the largest lithium hydroxide-producing operation and the biggest spodumene converter in the world.

Piedmont Lithium (ASX: PLL) and its 19%-owned Sayona Mining (ASX: SYA) completed the acquisition of Canada’s North American Lithium (NAL), as part of their plan to create a potential lithium production hub in the Abitibi region of Quebec.

Weeks later, they bought another Canadian project: Moblan project in the Eeyou-Istchee James Bay region of northern Quebec.

Liontown Resources (ASX: LTR) confirmed plans in November to bring its Kathleen Valley hard rock project in Western Australia into production, a year earlier than originally targeted as it released a definitive feasibility study.

Pilbara Minerals (ASX: PLS), one of Australia’s top lithium miners, closed the year by slashing its forecast for shipments due to a raft of issues — from delays in commissioning and ramping up more processing capacity, to unplanned shutdowns and skilled worker shortages.

#4 Chile fighting back

Chile, which lost the crown as the world’s largest lithium producer to Australia in 2018, began staging a comeback. It opened in October a tender for the exploration and production of 400,000 tonnes of lithium.

In only a couple of weeks, 57 companies showed interest in new contracts, according to official figures.

Albemarle (NYSE: ALB) and SQM (NYSE: SQM), the world’s no. 1 and 2 lithium miners respectively, already have operations in Chile’s north, which they plan to expand.

SQM targets to reach a total capacity of 180,000 tonnes annually next year, with total production expected to achieve 140,000 tonnes. These represent increases of roughly 60,000 t/year and 40,000 t, respectively, from 2021.

Next: 2018 déjà vu?

The rush to meet lithium demand could see a repeat of 2018 when a glut saw the lithium price crash, analysts predict.

While miners are scurrying to expand capacity, they can’t keep up with demand, so market tightness is likely to persist in the near term, they say.

Fitch Solutions goes even further, predicting increasingly large deficits out to 2030 that could “deeply” alter the market’s dynamics.

“Lithium supply will face a number of vulnerabilities, including geographical concentration at both the mining and refining level, as well as the limited presence of established and large mining players, which pose risks to the project pipeline execution,” the consultancy said in a December note. “Rising resource nationalism in key lithium markets could also hamper the development of new projects.”

Pilbara Minerals (ASX: PLS), one of Australia’s top lithium miners, closed the year slashing its forecast for shipments, which has further exacerbated tight supply for the key battery metal.

Some industry actors fear that climbing lithium prices could end up raising costs for batteries and electric vehicles, hampering the consumption of clean-energy sources at a time the world urgently needs them.

Experts at UBS project that by 2030 the world will need to produce 2,700 GWh of lithium-ion batteries annually to supply the EV industry. That is 13 times the amount of battery power used now, or “225 billion iPhone 11 batteries.”

Most existing suppliers are planning expansions. Albemarle’s MARBL joint venture with Minerals Resources in Western Australia recently unveiled plans to restart one of the Wodgina mine’s three 250,000 mt/year processing lines in Q3 2022.

Livent (NYSE: LTHM) plans to add 5,000 mt of lithium hydroxide capacity in the US by Q3 2022. It is also adding an initial 10,000 mt lithium carbonate in Argentina, although this is only due to reach commercial production in the first quarter of 2023, with another 10,000 mt to be added in the second phase by the end of 2023.

New projects should also start up in 2022, including Lithium Americas’ 40,000 tonnes/year carbonate Caucharí-Olaroz project in Argentina and Sigma Lithium’s 330,000 t/year spodumene project in Brazil.

Lithium Americas is also developing the Thacker Pass lithium mine in Nevada, though that project has faced legal setbacks. The company is expected to publish a definitive feasibility study on Thacker Pass next year.

New techs, zero-carbon and national security

The ongoing development of new lithium extraction techniques could boost primary supply of lithium. The upcoming development of lithium recycling and uncertainties around its timeline could also surprise the upside supply expectations, experts agree.

We can also expect new actors to strengthen their position in the market, particularly European ones.

The European Commission added lithium to its list of critical raw materials for the first time in 2020, signifying its shift to the forefront of attention.

Portugal is currently the continent’s largest lithium producer, accounting for 1.6% of global production in 2019, however the country’s lithium is not marketed to the auto sector, but to ceramics and glassware makers.

Savannah Resources (AIM: SAV) is forging ahead with its Mina do Barroso proposed lithium mine in Portugal and it plans to soon publish a definitive feasibility study for the project.

Erris Resources (LON: ERIS) is working on the Zinnwald project, in Germany, located in the heart of Europe’s chemical and car industries.

Vulcan Energy Resources (ASX: VUL), backed in part by Australian investor Gina Rinehart’s Hancock Prospecting, is aiming to produce the world’s first “zero-carbon lithium” from what it considers to be Europe’s largest lithium resource in the Upper Rhine Valley of Germany.

The company has in recent weeks signed lithium supply agreements with several European automakers, including Volkswagen, Stellantis and Renault. It aims to start commercially producing lithium by 2024.

An International Energy Agency (IEA) report published in May recommended governments to start stockpiling battery metals, noting that lithium demand could increase 40-fold in the next 20 years. IEA executive director Fatih Birol said this would become an “energy security” issue.

(With files from Reuters and Bloomberg)

from MINING.COM https://ift.tt/3Evtwow

dimanche 26 décembre 2021

Misstep could reignite blockade against Las Bambas copper mine in Peru

Any miscalculation from the Peruvian government in the proposal to be discussed with mining communities on December 30, could reignite protest actions against MMG Ltd.’s Las Bambas mine.

In recent declarations to local media, the president of the Fighting Committee for the Mining Corridor, Luis Huamaní, said the communities that surround the world’s ninth-largest copper mine expect an agreement to be reached between the Peruvian president, its prime minister, and the ministers of transportation and mines and energy.

According to Huamaní, such an agreement should be in line with the Constitution and be reasonable, otherwise, a new blockade will be launched against Las Bambas and, this time, 18 farming communities from the southern Chumbivilcas province will take part in it.

Residents of Chumbivilcas have been blocking the road used by Las Bambas since November 19, 2021, as they demand jobs and economic contributions from the company, which they say generally fails to benefit residents despite its great wealth.

On December 22, the activists agreed to lift the blockade until the meeting with the country’s prime minister and company representatives takes place at the end of the month.

“We have called a truce for the holidays and plan to resume our fight on the 30th. We cannot accept the proposal of Mirtha Vásquez [Peru’s Premier], as she has asked us to negotiate a constitutional right, a value chain and a series of projects, but we demand jobs and respect to the Political Constitution and the environment. There cannot be more abuses from Las Bambas MMG,” Huamaní told La República newspaper on Sunday.

Citing sources from the Cabinet, the publication said that prior to meeting community representatives, the prime minister, the ministers of energy and mines and transportation and company executives will get together to refine a proposal that increases their chances of reaching a deal with the people of Chumbivilcas.

La República said the issue has created tensions within the government to a point where the permanence of some ministers in their posts depends on the resolution of the conflict, as President Pedro Castillo is performing a balancing act trying to tend to both communities and mining investors.

MMG is a unit of state-owned China Minmetals. At present, Las Bambas accounts for 2% of the world’s copper supply and produced about 290,000 tonnes of copper concentrates this year to December 18. The company had already said in July that in 2021 that production at the mine was expected in the low end of its 310,00-330,000 tonnes forecast.

Prior to shutting down on December 16, stockpiles on site were already 60,770 tonnes of copper in concentrate.

from MINING.COM https://ift.tt/3mC60jB

Les glaciers de l'Himalaya fondent à une vitesse inquiétante !

from Les dernières actualités de Futura https://ift.tt/3FwWVjp

Researchers link cobalt mining in the DRC to violence, substance abuse, food-water insecurity

After studying the impacts of cobalt mining in the Democratic Republic of the Congo, an interdisciplinary team of researchers led by Northwestern University is calling for more data on how emerging technologies affect human health and livelihoods.

Congo is the world’s top producer of cobalt, which is used in many of the batteries that power electric vehicles. EV sales are expected to soar in the coming years, as countries strive to cut carbon emissions.

In a paper published in the journal One Earth, the group behind the new study explains that exploratory fieldwork in cobalt mining communities in the Lualaba Province was conducted to be able to construct social life cycle assessments (S-LCA).

The team comprised of anthropologists, engineers and public health experts collected qualitative data through in-depth interviews and focus-group discussions with miners and other community members.

“For this type of work, it’s important to work across fields in order to be informed,” Sera Young, one of the study co-authors, said in a media statement. “It might be difficult for engineers who are developing the technologies to understand the social effects. By working together, we can form a whole picture of the consequences of resource extraction.”

After such exploratory work, the researchers found that cobalt mining was associated with increases in violence, substance abuse, food and water insecurity, and physical and mental health challenges. Community members reported losing communal land, farmland and homes, which miners dug up in order to extract cobalt. Without farmland, Congolese people were sometimes forced to cross international borders into Zambia just to purchase food.

“You might think of mining as just digging something up,” Young said. “But they are not digging on vacant land. Homelands are dug up. People are literally digging holes in their living room floors. The repercussions of mining can touch almost every aspect of life.”

Young also pointed out that waste generated from mining cobalt and other metals can pollute water, air and soil, leading to decreased crop yields, contaminated food and water, and respiratory and reproductive health issues.

In fact, the miners that participated in the study reported that working conditions were unsafe, unfair and stressful. Several workers noted that they feared mineshaft collapses.

Young said that as industry leaders move toward decarbonization to slow, stop or even reverse human-caused climate change, technologies are increasingly relying on batteries instead of fossil fuels but data related to the effects of these technologies on social well-being are needed.

“If we’re trying to be do-gooders by caring for the environment, then the environment shouldn’t be limited to only the natural environment — but also the human environment,” the scientist said.

For her and her colleagues, collecting good quality data for social impact assessments, thus, requires leveraging reliable sources that can help understand localized effects of mining.

In their view, those sources are: (1) interviews and focus groups of affected community members; (2) local public records, including land-related court claims, documentation of forced migration and publicly available health records; (3) cross-culturally validated scales, including data collected by national statistics agencies and organizations such as UNICEF and the World Bank; (4) data collected for the Sustainable Development Goals; and (5) remote sensing and imagery, including satellite imagery showing how farmland has changed after cobalt mining is established.

The researchers believe such methods can be applied to other scenarios beyond cobalt mining to gather social data surrounding emerging technologies.

from MINING.COM https://ift.tt/3FwbALW

Russias largest new copper deposit to be developed under UN Global Compact guidelines

Udokan Copper, one of the companies owned by Russian billionaire Alisher Usmanov’s holding firm USM, announced that it has joined the UN Global Compact.

Joining the initiative means the company voluntarily agrees that its business strategy and operations should align with the UN Ten Principles on human rights, labour, environment and anti-corruption, and the UN Sustainable Development Goals (SDGs).

Normally, the UN Global Compact participants are full-fledged operating businesses, but Udokan Copper — which is developing the Udokan copper deposit in the Zabaikalye Territory in Russia’s Far East — decided to join the UN initiative in the construction stage.

According to the miner, the reason to do so is that it is already following the best global practices in ESG, minimizing its carbon footprint, and pursuing a large-scale social investment program, with over $24 million already spent on social initiatives.

“Joining the UN Global Compact means more responsibility; it also provides access to the expertise of the United Nations and other international participants of the initiative, and to advice from top global experts,” the company said in a media statement. “This move will help the company strengthen its repute, gain new business connections all over the world and facilitate its participation in global events and the UN global projects.”

For Udokan Copper’s management, doing business sustainably is a necessary condition to compete on the global product and capital markets, to gain access to financing, to build a trustful and effective relationship with society and the state, and to be an appealing employer.

“Developing the Udokan deposit is a greenfield project that was launched as an example of sustainable and responsible production. The UN SDGs can only be reached by pooling the will and the effort of the governments, people, civil organizations and businesses. We are glad to join the global like-minded community and make yet another step towards the sustainable future,” the press brief reads.

Udokan Copper was established to develop its namesake deposit, which has resources exceeding 26 million tonnes and is considered to be Russia’s largest new copper deposit.

The resources of the deposit, according to JORC are 26.7 million tonnes of copper, with a copper grade of 1.05%. The deposit is located in the Kalar Municipal District of the Zabaikalye Territory, 30 kilometres away from Novaya Chara station of the Baikal-Amur Mainline.

The project includes the commissioning of a mining and metallurgical plant, with the final products being cathode copper and sulphide concentrate. Production volume has been estimated at 135,000 tonnes of copper per year.

from MINING.COM https://ift.tt/3pt9U0b

15 événements sur Terre en 2021 vus de l'espace

from Les dernières actualités de Futura https://ift.tt/3mBeoQx

Les queues des comètes ne sont jamais vertes et l'on sait enfin pourquoi

from Les dernières actualités de Futura https://ift.tt/3JisGPw

samedi 25 décembre 2021

Un forfait mobile avec 90 Go en 4G+ à 10€99, le super deal lancé par Free pour la fin d'année

from Les dernières actualités de Futura https://ift.tt/3qmgip3

Lancement du télescope spatial Webb : Ariane 5 réussit le vol le plus prestigieux jamais réalisé

from Les dernières actualités de Futura https://ift.tt/3FoLf2e

L'ESA reçoit le « premier appel » du télescope spatial Webb

from Les dernières actualités de Futura https://ift.tt/3mxeNDt

5 choses à savoir sur le télescope spatial Webb

from Les dernières actualités de Futura https://ift.tt/3msqJGn

Manta Ray : des drones sous-marins à l’autonomie infinie imaginés par la Darpa

from Les dernières actualités de Futura https://ift.tt/3swKrVr

vendredi 24 décembre 2021

Le plus grand groupe de planètes « errantes » jamais découvert dans la Voie lactée

from Les dernières actualités de Futura https://ift.tt/33XlqZl

En photos : la « comète de Noël » se donne en spectacle

from Les dernières actualités de Futura https://ift.tt/32r2K3n

C'est Noël : prolongations pour réserver le Mag Futura

from Les dernières actualités de Futura https://ift.tt/3z46tjK

Pluton : la dynamique des glaces d'azote dans la plaine Sputnik enfin expliquée ?

from Les dernières actualités de Futura https://ift.tt/3swm7Tz

Un test pour savoir si votre chat est un psychopathe

from Les dernières actualités de Futura https://ift.tt/3seN7GZ

J-1 : l'événement astronomique et spatial de la décennie aura lieu le 25 décembre !

from Les dernières actualités de Futura https://ift.tt/3qlfiS8

jeudi 23 décembre 2021

Découverte exceptionnelle d’un œuf de dinosaure sur le point d’éclore

from Les dernières actualités de Futura https://ift.tt/3yQi8m4

Omicron échappe-t-il aussi aux traitements à base d'anticorps monoclonaux ?

from Les dernières actualités de Futura https://ift.tt/3stZ6R7

Attention, le virus Joker est de retour sur Android

from Les dernières actualités de Futura https://ift.tt/3pmRSwz

Bon plan literie : pour Noël, -10% sur les oreillers ergonomiques Wopilo !

from Les dernières actualités de Futura https://ift.tt/3yVWCw1

Un procédé révolutionnaire pour faire durer plus longtemps les batteries

from Les dernières actualités de Futura https://ift.tt/3muXNO9

Une paire de trous noirs supermassifs aurait creusé des cavités géantes dans un amas de galaxies

from Les dernières actualités de Futura https://ift.tt/3elhrrj

Prise en main du Surpass, un vélo électrique au rapport qualité-prix redoutable

from Les dernières actualités de Futura https://ift.tt/3GtRmT6

J-2 : l'événement astronomique et spatial de la décennie aura lieu le 25 décembre !

from Les dernières actualités de Futura https://ift.tt/32t1PQ6

L'incroyable percée du stablecoin Terra UST

from Les dernières actualités de Futura https://ift.tt/3H1vD58

L'élégant et confortable vélo électrique Surpass à moins de 550 € sur Cdiscount

from Les dernières actualités de Futura https://ift.tt/3pob3pS

Des neurones humains ont appris à jouer à Pong

from Les dernières actualités de Futura https://ift.tt/3z6ulTX

Découverte du plus grand groupe de planètes « errantes » de la Galaxie connu à ce jour

from Les dernières actualités de Futura https://ift.tt/3H6Hpv1

La « comète de Noël » se donne en spectacle après un sursaut d'activité

from Les dernières actualités de Futura https://ift.tt/3En0VBG

Conflit en Ukraine : comment une cyberattaque pourrait paralyser le pays

from Les dernières actualités de Futura https://ift.tt/32r5Q7t

mercredi 22 décembre 2021

90 % de vaccinés et toujours pas d’immunité collective ?

from Les dernières actualités de Futura https://ift.tt/3yOV9HU

Réchauffement climatique en 2021 : les signaux d'alarme sont partout !

from Les dernières actualités de Futura https://ift.tt/3Elqcw0

Covid-19 : les mesures pour contrer la reprise de l’épidémie

from Les dernières actualités de Futura https://ift.tt/32kggGn

Et si votre toit vous faisait économiser de l’énergie ?

from Les dernières actualités de Futura https://ift.tt/3yReHeN

Des centaines de cadres des GAFAMs quittent leur boulot pour rejoindre des start-up de cryptomonnaies

from Les dernières actualités de Futura https://ift.tt/3EjLXwq

Voici la batterie souple la plus longue du monde : 140 mètres !

from Les dernières actualités de Futura https://ift.tt/3Fn40TB

Rhume : « l'utilisation des vasoconstricteurs expose à des risques », avertit l'ANSM

from Les dernières actualités de Futura https://ift.tt/3pj45lT

Après le vol de voitures, l’AirTag est utilisé pour suivre les femmes seules…

from Les dernières actualités de Futura https://ift.tt/3FmfMhg

Téléthon : comment fonctionne le principe du don ?

from Les dernières actualités de Futura https://ift.tt/3xRjEnn

Nouveau report du lancement du télescope spatial Webb

from Les dernières actualités de Futura https://ift.tt/30QCeQD

Un Noël 2021 anormalement chaud dans le monde

from Les dernières actualités de Futura https://ift.tt/3mLNjKD

Repas de Noël : les conseils de spécialistes pour « discuter » avec les complotistes (ou pas)

from Les dernières actualités de Futura https://ift.tt/3Em9YD3

Top 15 des villes cryptomonnaies : devinez quelle est la première européenne ?

from Les dernières actualités de Futura https://ift.tt/3EjH5aF

Le super-typhon Rai est-il un avant-goût de ce qui nous attend ?

from Les dernières actualités de Futura https://ift.tt/3EkGAgg

mardi 21 décembre 2021

Étrangeté du vivant : le seul animal connu pour vivre sans oxygène !

from Les dernières actualités de Futura https://ift.tt/3GYnqi8

Variant Omicron : simple rhume ou Covid-19 ?

from Les dernières actualités de Futura https://ift.tt/3EaAK1a

Comment la fonte de l'Arctique met le feu aux États-Unis

from Les dernières actualités de Futura https://ift.tt/3pgeAGE

Dassault Aviation fait décoller ses datacenters avec les infrastructures Dell Technologies

from Les dernières actualités de Futura https://ift.tt/3nVQZJd

Le solstice d'hiver est aujourd'hui à 16 h 59 !

from Les dernières actualités de Futura https://ift.tt/3ef4D5M

Les queues des comètes ne sont jamais vertes et les astronomes savent enfin pourquoi

from Les dernières actualités de Futura https://ift.tt/30Mst5X

lundi 20 décembre 2021

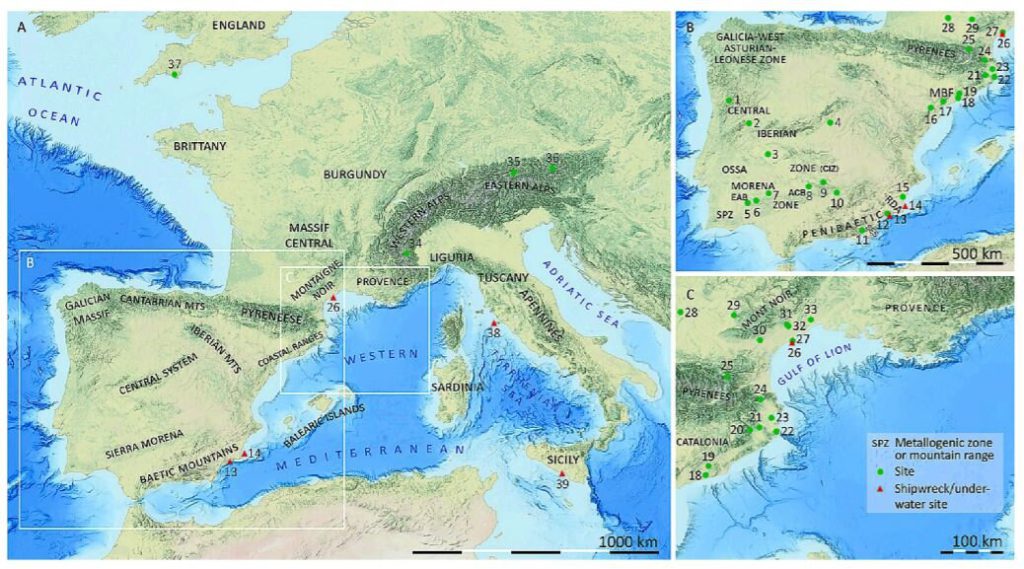

Pure copper ingots unlock secrets of Iron Age trade routes

Archaeologists from Flinders University and the Institute of History (CSIC) in Spain conducted elemental and lead isotope analyses of ancient copper ingots and unlocked secrets of Early Iron Age trade routes and how indigenous Mediterranean communities functioned about 2,600 years ago.

The Iron Age metal items were recovered from the underwater site of Rochelongue in southwestern France, which was discovered in 1964 and dates to about 600 BCE.

The site is believed to host four small boats whose cargo included 800 kilos of copper ingots and about 1,700 bronze artifacts. They contain very pure copper with traces of lead, antimony, nickel and silver.

According to the researchers, the isotope analysis shows the composition of different ingots in the cache is consistent with Iberian and also eastern Alpine metalliferous sources, and possibly some Mediterranean sources—illustrating that water trade and movement was active in this period between Atlantic, Continental and Mediterranean circuits.

The discovery, thus, provides a key to investigating the coastal mobility and cultural interactions between the Languedoc area in France and the broader Western Mediterranean basin in 600 BCE—before permanent Greek settlement occurred in this region.

In a paper published in the Journal of Archaeological Science, the team behind the study also pointed out that while the various sizes, shapes and composition of the ingots found at Rochelongue show they originated from diverse geographical sources, the elemental and lead isotope analyses provide much more comprehensive knowledge, showing that a broad and diverse exchange network existed in this period for metals that includes continental and maritime routes.

“These metallic objects are important diagnostically because they lend themselves to source tracing of geological components, and technological studies of their processing and manufacture,” Wendy van Duivenvoorde, co-author of the study, said in a media statement. “The copper ingots were made of unalloyed copper with low levels of impurities—and more than half can be linked to the Iberian Peninsula. This points to the circulation of metal through the wider Mediterranean region, but also to local and western alpine mining and manufacture, and possibly north-western Sardinia.”

In van Duivenvoorde’s view, the Rochelongue items speak of indigenous agency rather than maritime intervention.

from MINING.COM https://ift.tt/3pdXJ7c

Bon plan literie : -10% sur les oreillers ergonomiques Wopilo !

from Les dernières actualités de Futura https://ift.tt/3EHV5Mn

Une île cryptomonnaies dans le Pacifique Sud

from Les dernières actualités de Futura https://ift.tt/3e9ju1H

Une troisième dose contre le variant Omicron suffit-elle ?

from Les dernières actualités de Futura https://ift.tt/3J7mNVi

Mars : Ingenuity menacé par la faille Log4Shell ?

from Les dernières actualités de Futura https://ift.tt/3mfo6I7

Spaceways : l’Europe met en place un « code de la route » pour le trafic spatial

from Les dernières actualités de Futura https://ift.tt/3qf7d18