lundi 28 février 2022

Les troupes russes ont détruit le plus gros avion au monde

from Les dernières actualités de Futura https://ift.tt/lkKpQo9

De combien d’armes nucléaires dispose la Russie et qu’est-ce que Satan-2 réputé « invulnérable » ?

from Les dernières actualités de Futura https://ift.tt/fNTvnaq

Guerre en Ukraine : les Anonymous attaquent la Russie

from Les dernières actualités de Futura https://ift.tt/W2V4BXu

Une collision d'amas de galaxies cause une « explosion » de 6,5 millions d'années-lumière !

from Les dernières actualités de Futura https://ift.tt/a0bPsme

Conflit en Ukraine : la Russie suspend l’utilisation des Soyouz depuis Kourou et marque un point

from Les dernières actualités de Futura https://ift.tt/yA0PnSr

dimanche 27 février 2022

Committing to carbon neutrality, venturing into forward-facing commodities is miners’ way to stay in business – report

Cutting their own emissions is the most effective way for miners to respond to climate change, White & Case’s annual Mining & Metals Survey found.

According to the poll – which gathered information from 63 decision-makers in the mining and metals sector – 37% of mining companies in the sample believe that comitting to carbon neutrality is the way to go to stay in business. This is particularly the case considering that emissions from both their operations and those caused when the materials they mine are used by their customers remain significant obstacles for many investors.

This new reality led nearly every major miner to commit, back in 2021, to becoming carbon-neutral at their own operations over the next two to three decades and to develop roadmaps to achieve such a goal.

“Most striking was Rio Tinto’s pledge to spend $7.5 billion to halve its own emissions by the end of this decade,” White & Case’s report reads. “The scale of the investment to future-proof its business rather than drive immediate shareholder returns shows just how seriously the industry is taking it, but also the scale of the costs involved.”

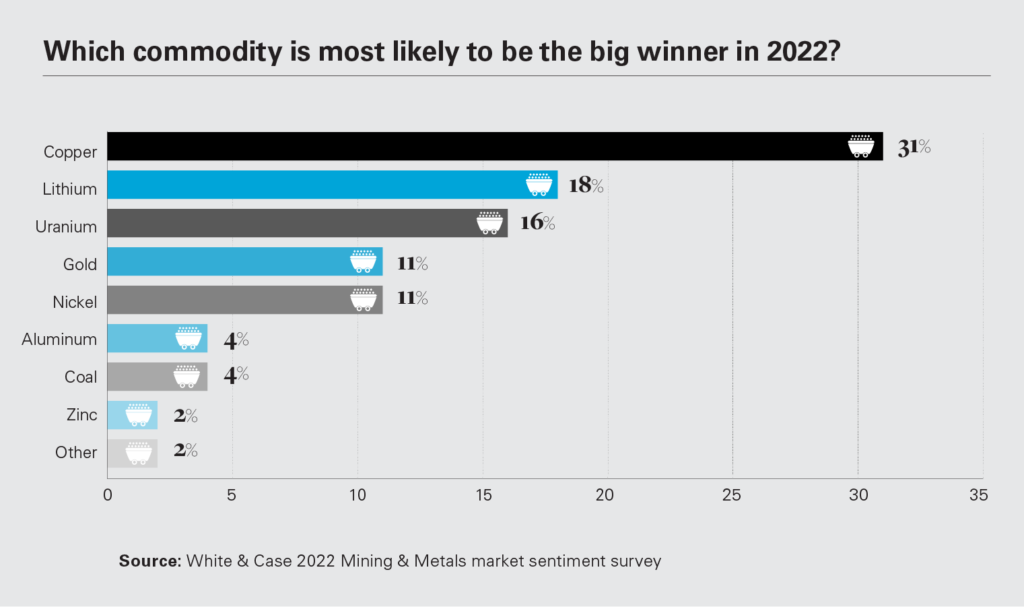

In addition to cutting emissions, miners are placing increased focus and spending on energy transition materials, with 31% of respondents venturing into this realm, up from 6% last year. In fact, major firms are increasingly looking to take stakes in junior miners sitting on forward-facing commodities such as copper, nickel and lithium.

In the view of the experts at White & Case, this is particularly the case considering that big gold M&As have come to a halt and companies are repositioning their portfolios.

“There was a small window at the start of the pandemic when equity values plummeted, but now with many of the miners trading near record highs, transformational M&A looks to be an unlikely prospect,” the dossier reads. “According to our survey, that means opportunistic deals remain the most likely, especially as portfolios continue to shift toward more ESG-friendly commodities. Some 42% of respondents expect consolidation in the battery minerals space this year, up from only 13% a year ago.”

Among the battery metals gathering attention, copper is king as the biggest miners remain bullish on its prospects, with demand expected to surge this decade and new supplies looking increasingly scarce.

“For the third straight year, our survey has picked copper to be the best-performing metal in 2022, with 31% saying it’s set for another year of outperformance,” White & Case’s study reads. “The metal, an economic bellwether and key material for the energy transition, hit record prices last year, breaking above $10 thousand per ton. Minor production losses, from both covid-19 disruptions and water issues in Chile, combined with strong industrial demand. Our respondents’ enthusiasm for the metal is matched by the wider mining industry.”

In addition to copper, the second pick is lithium, the crucial ingredient for electric vehicle batteries.

Based on its survey and market analyses, W&C predicts market tightness is likely to persist in the near term supported by the mining industry’s inability to keep up with demand so far, despite efforts to expand lithium capacity.

Recycling

In addition to miners’ interest in battery metals and the energy transition, their green commitments have also pushed them to look into recycling both already-processed metals and tailings dumps on mine sites.

White & Case’s survey showed that 38% of respondents see increased recycling as a key structural shift that the industry can undertake to burnish its ESG credentials.

“Although early-stage, this has begun to play out with miners and downstream players seeking to build on the opportunity,” the document states. “Glencore has been steadily increasing its recycling capacity, especially for electronic waste, while BHP and Freeport have invested in Jetti Resources, a US startup that says it can process millions of tons of copper from existing waste dumps.”

For the law firm, it is likely that the trend towards recycling will accelerate further in the coming years as technologies improve, especially if commodity prices continue to rise.

from MINING.COM https://ift.tt/1hZFkB5

Quelle est la part de la France dans la déforestation en Amazonie ?

from Les dernières actualités de Futura https://ift.tt/zDqhNSb

Le cerveau modifie ses connexions dans l'espace

from Les dernières actualités de Futura https://ift.tt/W2VMrgP

There is a connection between Mars and heavy metal-polluted Rio Tinto

Researchers at the University of Tübingen have found parallels between the minerals discovered by the Mars rover Curiosity in the sediment of the Gale Martian crater and those present in Spain’s heavy metal-polluted Rio Tinto estuary.

Iron-oxidizing bacteria in the Rio Tinto form colourful minerals such as goethite, red hematite, schwertmannite and jarosite, which are deposited in the river’s sediment. The same minerals exist on the Red Planet and it is believed that they formed 4.1 to 3.7 billion years ago by similar acid-loving microorganisms in a large-scale river system. At that time, Mars would have had wetter conditions and more moderate temperatures than it does today.

In a paper published in the journal Applied and Environmental Microbiology, the Tübingen researchers explain that the discovery took place when they set up to investigate where the microorganisms in the Rio Tinto estuary get energy for their metabolism under the extreme conditions caused by acidic river water – polluted with heavy metals from ore mining and mineral weathering – mixing with the saltwater of the Atlantic Ocean.

They also wanted to learn what influence the microbes have on the depositing or dispersion of heavy metals in the estuary.

The team conducting the research found that the microorganisms that love such extreme conditions form a unique community. They live in water as acidic as vinegar, are resistant to high salinity, some also cope very well with high levels of toxic metals and most derive their energy from dissolved iron.

“In the process, they form iron minerals and precipitate other toxic metals around their cell wall. These aggregates of cells and minerals are then transported downstream to the estuary,” Andreas Kappler, co-author of the study, said. “We were particularly interested in what happens when the acidic river water mixes with seawater there.”

Kappler and his colleagues noticed that the high chloride concentration from the seawater is toxic to the acid-loving iron-oxidizing microbes. This means that most of them disappear in the estuary. However, once there, other iron oxidizers that can cope with the high salinity take over. In addition, the high levels of iron dissolved in the estuary attract species of marine iron oxidizers.

According to the scientists, the iron oxidizers are also the ones that form iron minerals in the estuary and precipitate toxic metals such as arsenic and chromium, which are deposited in the sediment of the Rio Tinto. Some of these minerals are also transported further to the edge of the sea.

“By gaining insights into this microbial community, we are learning more about the influence of microorganisms on the mobility of toxic metals in Rio Tinto,” co-author Sara Kleindienst said.

The researcher noted that pollution in the area began very early, in the Chalcolithic Period, around 5,000 years ago. Back then, people were mining ore on the upper reaches of the river above the pyrite belt of the southern Iberian Peninsula.

The rock belt contains gold, silver, copper, tin, lead and iron, as well as large iron sulphide deposits. When the ore was mined, the iron sulphide came into contact with oxygen in the air, allowing certain microorganisms to oxidize iron and sulphur. “This creates blood-red, extremely acidic water that dissolves tons of other toxic metals such as manganese, cobalt, nickel and cadmium from the rocks every year and washes them into the river,” Kleindienst said.

For the researcher, the new study helps clarify many of the processes that take place in the so-called “red river.”

from MINING.COM https://ift.tt/jXI4kHv

Greffe : des médecins rendent un poumon compatible avec tous les patients

from Les dernières actualités de Futura https://ift.tt/Wm2KYZl

Du mal à vous organiser ? Prenez exemple sur le rat

from Les dernières actualités de Futura https://ift.tt/Zj8Fhwp

Alcyonée, la plus grande radiogalaxie jamais observée

from Les dernières actualités de Futura https://ift.tt/oVxlBgZ

Communautés énergétiques : que peuvent-elles changer face au changement climatique ?

from Les dernières actualités de Futura https://ift.tt/iuTyFaN

samedi 26 février 2022

Ce crocodile géant avait avalé un dinosaure avant d'être fossilisé

from Les dernières actualités de Futura https://ift.tt/3w9NLaC

Hawaï : le lac de lave du volcan Kilauea se vide et se remplit de manière cyclique

from Les dernières actualités de Futura https://ift.tt/gE4u8Dj

Les scientifiques s'inquiètent de l'appauvrissement rapide des sols dans les régions méditerranéennes

from Les dernières actualités de Futura https://ift.tt/0dsChl1

La Russie pourrait-elle vraiment faire tomber la Station spatiale sur les États-Unis ?

from Les dernières actualités de Futura https://ift.tt/FcWxKuM

Ces images de Vénus prises par la sonde Parker Solar sont extraordinaires

from Les dernières actualités de Futura https://ift.tt/eA0j3yJ

vendredi 25 février 2022

South America Snapshot: Eight companies exploring and developing new mines

The need for battery metals is propelling many projects in resource-rich South America, but gold and silver projects retain their appeal, too.

Bear Creek Mining

The Corani silver-zinc-lead project in southern Peru is shovel ready for 100% owner Bear Creek Mining (TSXV: BCM). It sits on the eastern peaks of the Andes between 4,800 and 5,200 metres above sea level.

The project has received all key permits to begin construction, and the environmental impact assessment has been approved. Life-of-mine agreements are also in place with supportive local communities.

Bear Creek began exploring Corani in 2005 and has identified proven and probable reserves of 139.1 million tonnes grading 50.3 grams silver per tonne, 0.9% lead and 0.59% zinc. In terms of contained metals, it contains 225 million oz. silver, 2.75 million lb. lead and 1.91 million lb. zinc.

Corani’s measured and indicated resources stand at 96.7 million tonnes grading 27.9 grams silver per tonne, 0.38% lead and 0.26% zinc, and inferred resources add 39.9 million tonnes grading 37.2 grams silver, 0.58% lead and 0.40% zinc.

The life of the Corani mine would be 15 years during which time 144 million oz. silver, 1.48 million lb. lead and 1.04 million lb. zinc would be produced. Average annual production would be 9.6 million oz. silver and the all-in sustaining cost on a by-product basis would be S$4.55 per oz. silver.

The pre-production capital cost was estimated in 2019 to total $579 million, including $59 million for the mine and $234 million for the processing plant. Payback of the initial capex after taxes would be 2.4 years. The report used prices of $18 per oz. silver, 95¢ per lb. lead and US$1.10 per lb. zinc.

After taxes, Corani has a net present value with an 8% discount of US$369 million and an internal rate of return of 22.9%.

Bear Creek raised C$34.5 million for work at Corani last year. The mining and processing plans are being optimized and procurement is in progress. One of the major undertakings is a substation to supply power to the project and upgrade the supply to nearby communities. The company is also upgrading local roads.

In addition to Corani, Bear Creek is exploring northwest of Lima at the Maria Jose property where work is moving underground, and the company has optioned its Tassa silver-gold prospect to Teck Resources.

In December 2021, Bear Creek announced its intention to acquire the operating Mercedes gold-silver mine in Sonora, Mexico. It will make a cash payment of US$75 million and issue 24.73 million shares to current owner Equinox Gold to acquire a 100% interest. A second cash payment of US$25 million is due within six months of closing.

Bear Creek has a market capitalization of $110.6 million.

Ero Copper

Ero Copper (TSX: ERO; NYSE: ERO) has two producing mines in Brazil and is developing a third. The flagship property is the MCSA mining complex, in which Ero holds a 99.6% interest, in Bahia state.

Production began 40 years ago at the MCSA mining complex, which incudes two underground mines (Pilar and Vermelhos) and one open pit (Surubim). The complex has at least a 12-year life remaining with annual production anticipated to be 101.4 million lb. of copper in 2022-24. Ore is processed by conventional crushing and flotation at the Caraiba mill next to the Pilar mine. It produces a concentrate grading 35% copper.

The mines at MCSA contain underground proven and probable reserves of 30 million tonnes grading 1.44% copper for 953.3 million lb. contained metal and proven and probable open pit reserves of 29.3 million tonnes grading 0.6% copper for 385.1 million lb. contained copper.

Reserves are included in resources which, for underground mining, are 69.4 million measured and indicated tonnes grading 1.46% copper for 2.23 billion lb. contained copper, plus 40.3 million inferred tonnes at 1.14% copper. Open pit resources are 35.3 million measured and indicated tonnes grading 0.59% copper for 457.5 million lb. contained copper, plus 3.0 million inferred tonnes grading 0.5% copper.

In 2019, Ero discovered what it called the ‘superpod’ below the known mineralization in the Pilar mine. Early drill results featured 51.8 metres grading 3.49% copper, including 33.4 metres at 4.96% copper, and 62.5 metres grading 1.65% copper, including 26.1 metres grading 2.37% copper.

Last October, results released for the upper levels of the Pilar mine featured 71.2 metres grading 3.55% copper, including 13 metres at 8.87% copper, and 61 metres grading 2.11% copper, including 1.8 metres of 3.92% copper.

The company enjoys a positive track record of mine life extensions and operational improvements at MCSA so it will deploy up to 20 drills this year. There is about 25% excess mill capacity that could be filled.

Ero also holds 97.6% of the NX gold mine in Mato Grosso state. The underground mine is a high-grade, shear-hosted quartz vein system accessed via a single decline. Ore is processed in a conventional three-stage crushing circuit, and a combination of gravity, flotation and carbon-in-pulp recovery.

The NX mine produces between 50,000 and 60,000 oz. of gold annually at an all-in sustaining cost of US$550 to US$650 per ounce. It currently has a six-year life at average annual production of 53,000 oz. gold.

The Santo Antonio vein is currently in production; it contains a probable reserve of 958,000 tonnes grading 9.01 grams gold per tonne for 277,000 oz. contained gold. Reserves are included in the indicated resource of 950,000 tonnes grading 10.56 grams gold per tonne and the inferred resource of 248,000 tonnes grading 2.99 grams gold.

The mill has about 40% unused capacity, so Ero has mounted an exploration program on the Matinha vein, with the intention to mine it. There the probable reserve is 146,000 tonnes grading 6.26 grams gold per tonne for 29,000 oz. contained gold. The reserve is within the indicated resource that totals 124,000 tonnes grading 8.55 grams gold per tonne and an inferred resource of 310,000 tonnes grading 10.47 grams gold per tonne.

Ero has ten drill rigs operating at the NX gold mine this year.

The company’s third project is the Boa Esperança copper project in Para state, for which the board gave the go-ahead for construction in mid-February. Construction is expected to begin by the middle of this year, and production is anticipated in the third quarter of 2024.

The Boa project has a mine life of 12 years, during which time it will produce a total of 717.9 million lb. copper.

Upfront capital costs will be about $294 million to establish an operation capable of producing 59.5 million lb. annually. During the first five years, output will average 77.2 million lb. copper. After taxes, the project payback will be 1.4 years. Ero used a sliding scale for copper prices in its estimate: $3.80 per lb. in 2024, $3.95 per lb. in 2025, and $3.40 per lb. in 2026 and beyond.

The Boa project has a post-tax net present value with an 8% discount of $380 million and a post-tax internal rate of return of 41.8%

Open pit resources at Boa are 47.7 million measured and indicated tonnes grading 0.86% copper for 907.6 million lb. contained copper and 554.8 million inferred tonnes grading 0.65% copper for 7.9 million lb. contained copper. Contained within the measured and indicated category are proven and probable reserves of 43.1 million tonnes grading 0.83% copper for 786.2 million lb. copper.

There are no measured and indicated resources for the underground material, but it does have an inferred resource of 11 million tonnes grading 0.8% copper for 195.3 million lb. copper.

Ero Copper has a market capitalization of $1.2 billion.

Horizonte Minerals

Horizonte Minerals (TSX: HZM; US-OTC: HZMMF) has two nickel projects in Brazil — the shovel ready Araguaia project and the pre-feasibility stage Vermelho.

Early works are already underway at the Araguaia ferronickel project in Para state, and more than half the financing has been secured. The goal is to develop an open pit laterite operation that delivers ore from a number of pits to a central processing facility for 28 years.

The plant will consist of a single rotary kiln electric furnace (RKEF). Full capacity would be 900,000 tonnes of dry ore per year from conventional open pit mining. Annual production would be 52,000 tonnes of ferronickel containing 32 million lb. nickel. Production is anticipated in late 2023 or early 2024.

Capex for Araguaia is estimated at $443 million, which would be paid back after 4.2 years. Horizonte used a nickel price of $14,000 per tonne.

The after-tax economics are robust with a net present value (NPR) with an 8% discount (8%) of $401 billion and an internal rate of return (IRR) of 20.1%. There would be a net cash flow of $1.6 billion.

Horizonte has outlined proven and probable reserves of 119.3 million tonnes grading 1.69% nickel and 17.15% iron. Reserves are contained within 1.5 billion measured and indicated tonnes grading 1.27% nickel and 18.91% iron (3.4 billion lb. contained nickel), plus 12.9 million inferred tonnes grading 1.19% nickel and 20.21% iron (339.5 million lb. contained nickel).

Resources are sufficient to take the Araguaia project beyond its initial 28-year life with the addition of a second RKEF plant. This would double output for an additional 26 years.

The expansion would be financed through operational cash flow with no additional capital outlay. It carries an after-tax NPV (8%) of $741 million and an IRR of 23.8%.

The Vermelho nickel-cobalt project, also in Para state, was first investigated by Vale. Despite producing a positive feasibility study, Vale put it on hold when it bought Inco in 2005. Horizonte acquired 100% of Vermelho in 2017.

Horizonte produced a positive prefeasibility study in 2019 for a somewhat smaller and lower-cost project than Vale planned. The open pit laterite mine includes two pits, a concentrator, high-pressure acid leaching (HPAL), and a refinery. Over a projected 38-year life, it would produce 2 billion lb. nickel contained in nickel sulphate, 79.4 million lb. cobalt sulphate, and 4.48 million tonnes of a saleable kieserite by-product.

Annual production would be 25,000 tonnes of nickel and 1,250 tonnes of cobalt from the HPAL.

Total pre-production capital costs would be $2.3 billion, including $10.8 million for the pit and US$1 billion (in two stages) for the plant.

Vermelho has an after tax NPV (8%) of $1.7 billion and an IRR of 26.3%. Net cash flow is estimated to be $7.3 billion.

Measured and indicated resources are 145.7 million tonnes grading 1.05% nickel (for 3.4 million lb.) and 0.05% cobalt (for 170,400 lb.). The inferred resource is another 3.1 million tonnes grading 0.96% nickel (for 63,900 lb.) and 0.04% cobalt (for 3,100 lb.). No reserves have yet been calculated.

Horizonte has relied heavily on metallurgical testing done by the former owner. It intends to build the processing plant in two stages. It will have an initial autoclave capacity of 1 million tonnes per year. After three years, a second process train will be added, doubling capacity.

Horizonte has a market capitalization of $320 million.

Josemaria Resources

Josemaria Resources (TSX: JOSE; US-OTC: JOSMF) is advancing what it hopes will be the world’s next major copper producer — the Josemaria copper-gold project in San Juan province of Argentina, 9 km east of the boarder with Chile.

The company says the project is on track to become a low-risk open pit mine with a rapid payback. There are up to 6.7 million lb. copper, 7 million oz. gold and 31 million oz. silver waiting in the reserves. The project has proven and probable reserves of 1 billion tonnes grading 0.3% copper, 0.22 gram gold per tonne and 0.94 gram silver per tonne.

As for sulphide resources using a 0.1% copper-equivalent cut-off, the measured and indicated category contains 1.2 billion tonnes grading 0.19% copper, 0.21 gram gold and 0.9 gram silver per tonne (0.41% copper-equivalent). This category contains an estimated 7.4 billion lb. copper, 2.3 million oz. gold and 18.6 million oz. silver. The inferred resource is 704 million tonnes grading 0.19% copper, 0.1 gram gold and 0.8 gram silver (0.25% copper-equivalent).

There is also a small measured and indicated oxide resource using a 0.2% copper-equivalent cut-off. It totals 41 million tonnes grading 0.31 gram gold per tonne and 1.2 grams silver per tonne. In terms of contained metal, the estimate is 410,000 oz. gold and 1.6 million oz. silver but no copper.

The Josemaria deposit was first staked in 1999, and the discovery made in the 2004-05 exploration program. Production is expected in 2025.

The Josemaria feasibility study examined a 152,000 tonne-per-day mine and mill with a 19-year life. Over the life of the mine, average annual production would be 249.1 million lb. copper, 331,000 oz. gold and 1.2 million oz. silver. During the first three years of operation, copper and silver production would be about 20% higher and gold production would be almost 50% higher. All-in cash costs (excluding closure) are anticipated to be $1.55 per lb. copper-equivalent.

The pre-production capital expenditure is estimated at $3.1 billion, followed by sustaining capex of $940 million. Payback would occur in 3.8 years from the start of production. Prices used in the study were $3.00 per lb. copper, $1,500 per oz. gold, and $18 per oz. silver.

The project has a net present value with an 8% discount of $1.5 billion and an internal rate of return of 15.4% after taxes.

The 2021-22 field season is busy with a 65,000-metre drill campaign to de-risk the project, convert resources, and bore deep holes to test for extensions of the deposit. As part of the de-risking, mineralogical and geotechnical data will be used to optimize the production profile.

The company has acquired a highly prospective exploration property adjacent to the Josemaria deposit where previous work identified a large porphyry target. This year, soil sampling, mapping, geophysics and targeted drilling are planned.

Josemaria recently joined the Lundin Group, a portfolio of companies producing a variety of commodities in over 20 countries.

Josemaria Resources has a market capitalization of $503 million.

Lithium Americas

Lithium Americas (TSX: LAC; NYSE: LAC) is on track to put its Cauchari-Olaroz lithium brine project into production within the year in the Jujuy province of northern Argentina. The project is fully permitted, and all the major equipment and bulk materials have arrived on site.

Lithium Americas began exploring for lithium in 2009, ran a demonstration recovery plant two years later, and completed a feasibility study in 2012. The company attracted a major investor in 2020, and Cauchari-Olaroz is now a joint venture of Lithium Americas (44.8%), Ganfeng Lithium (46.7%), and JEMSE, the state-owned mineral explorer of Argentina, (8.5%).

Cauchari-Olaroz is to be developed in two stages. With the first phase close to commissioning, construction of the second phase is expected to begin this year.

The first phase of the project is based on proven and probable reserves estimated to be 1.1 million cubic-metres of drainable brine with an average concentration of 607 mg lithium per litre for 366,700 tonnes of contained lithium. The measured and indicated resources are 6.3 billion cubic-metres with an average concentration of 592 mg lithium per litre, for 3.7 million tonnes of contained lithium, and the 1.5 billion cubic-metre inferred resource (at the same concentration) contains 887,300 tonnes of lithium metal.

The reserves give the Cauchari-Olaroz a first stage life of 40 years producing 24,000 tonnes of lithium carbonate annually. Operating costs per tonne of lithium carbonate are expected to be $3,379, compared to the current lithium carbonate price, which hovers around $40,000 per tonne.

Initial capital costs are expected to be about $641 million for development of the brine fields, evaporation ponds, recovery plant and all other costs. Operating costs will be $143.2 million per year. Using a conservative lithium carbonate price of $12,000 per tonne, payback is expected in two years and ten months after the start of production.

After taxes, Cauchari-Olaroz has a projected net present value at an 8% discount rate of $1.96 billion and an internal rate of return of 45.2%.

Lithium Americas is also advancing the Pastos Grandes project. It acquired the project in December 2021 when it bought Millennial Lithium. The former owner had invested $40 million in the project. The property is located in Salta province about 100 km from the Cauchari-Olaroz project.

There are 22 exploration and monitoring wells, four pumping test production wells, pilot ponds, a pilot plant and a year-round camp supported by a hybrid solar power system. A feasibility study was produced in 2019 by the previous owner for a phased, conventional brine operation capable of producing about 24,000 tonnes of lithium carbonate annually for 40 years.

The total initial capital expenditure would be $448.2 million with a large portion of the amount ($115 million) being spent to establish the evaporation ponds. Operating costs for the first phase of the project would be $3,377 per tonne lithium carbonate and for the second phase would be $3,388 per tonne. Payback would occur in the fifth year after production begins. Battery-grade lithium carbonate prices were assumed to be $13,050 per tonne.

Pastos Grandes has an NPV (8% discount rate) of $1 billion and an IRR of 24.2%, both figures calculated post-tax.

The measured and indicated resources at Pastos Grandes are 1.8 billion cubic-metres averaging 427 mg lithium per litre for 774,000 tonnes of lithium metal. There is also an inferred resource estimated to be 3.5 million cubic-metres at 427 mg lithium per litre containing 150,000 tonnes of lithium metal. Potassium also occurs in the brine and presents in the resources at concentrations of 4,440 mg per litre and 4,457 mg per litre, respectively.

Although the environmental permit has been received, Lithium Americas has not released a timeline for taking Pastos Grandes to production.

Outside South America, Lithium Americas owns the Thacker Pass lithium project in Nevada in the United States.

Lithium Americas has a market capitalization of $3.7 billion.

Serabi Gold

Serabi Gold (TSX: SBI; US-OTC: SRBIF) is focused on gold projects in Brazil. It has two producing mines (Palito and Sao Chico) and the Coringa development project in the country’s Para state.

The Palito gold mine was in production from 2004 to 2008, when it was placed on care and maintenance. Commercial production resumed in mid-2014. The Sao Chico mine was acquired in 2013 and commercial production began early in 2016.

The mines are underground and use long hole and selective stoping methods. Ore from both mines is processed at Palito in a 500 tonne-per-day plant with an ore sorter, conventional flotation and carbon-in-pulp circuits. Gold is recovered both as doré bars and in concentrate.

Serabi gives 2022 guidance of about 45,000 oz. gold for Palito and Sao Chico. They have proven and probable reserves of 284,053 tonnes grading 6.76 grams gold per tonne for 61,700 oz. contained gold.

At Coringa, as many as 322,600 oz. of gold have been recovered by artisanal miners, but it has not otherwise been developed. Mineralization at Coringa is very similar to Palito. It is associated with a shear-vein system with a strike length of over 7 km. Gold is almost exclusively associated with quartz-sulphide veining similar to veins found in orogenic gold deposits. After numerous metallurgical tests, Serabi believes gold recovery will be 94% to 96% from a 750 tonne-per-day plant. Tailings will be dry-stacked.

Serabi acquired the project from Anfield Gold in 2017, and released a preliminary economic assessment two years later. The PEA was based on 735,000 indicated tonnes grading 8.24 grams gold per tonne for 195,000 contained oz. of gold and 1.6 million inferred tonnes grading 6.54 grams gold per tonne for 346,000 contained oz. gold.

The study outlined an underground mine with a life of nine years and average annual production of 38,000 oz. gold at an all-in sustaining cost of $852 per ounce.

Pre-production capital costs are estimated to be $24.7 million, followed by $9.2 million for sustaining costs. Payback (at a gold price of $1,450 per oz.) would occur 2.3 years after production begins. The company expects production to start in 2023.

Coringa has a post-tax net present value with a 5% discount rate of $79.6 million and a post-tax internal rate of return of 46%. At a gold price of $1,450 per oz., the project would have an after-tax cash flow of $114 million per year.

Serabi has a market capitalization of $60.4 million.

Sigma Lithium Resources

Sigma Lithium Resources (TSXV: SGML; NYSE: SGML) has a single lithium development project in Gerais state, Brazil. The focus of activity is the 100%-owned Grota do Cirilo hard rock project, which the company says is the largest in South America.

The Grota do Cirilo project has been producing 6% spodumene concentrate on a pilot scale since 2018. Beginning this year, the commercial plant will produce 33,000 tonnes of lithium carbonate-equivalent annually in phase one. Xuxa will be the first deposit mined.

To double output to 66,000 tonnes in the second phase, the Barreiro deposit will also be mined. The prefeasibility study for phase two is underway with increased production beginning as early as a year from now.

Phase one of the Grota do Cirilo project has measured and indicated resources in the Xuxa deposit of 17.4 million tonnes at an average grade of 1.55% lithium oxide and an inferred resource of 3.8 million tonnes grading 1.58% lithium oxide using a 0.5% lithium oxide cut-off. The proven and probable reserves are 13.8 million tonnes grading 1.46% lithium oxide.

The second phase of the Grota do Cirilo project is based on the Barreiro deposit, which has measured and indicated resources of 20.5 million tonne grading 1.43% lithium oxide and an inferred resource of 1.9 million tonnes grading 1.44% lithium oxide. Mining this deposit will add 13 years to the life of the project.

The cash cost of producing a tonne of product is estimated to be $342 per tonne, including transportation. With the start of phase two, cash costs are expected to be $360 per tonne, compared to an estimated selling price of $750 per tonne.

The initial capital cost was forecast to come in at $136 million through phase two. The capital cost of the phase two expansion is $44.5 million with a payback period of 0.4 years.

The net present value with a discount of 8% for phase two is $442 million, compared to the NPV for the first phase of $395 million. The internal rate of return is 208%. The larger project will have an after-tax free cash flow of $60 million annually.

Construction for phase one is advancing. Civil construction and engineering are underway. Long lead items, such as the electric transformers, crushers, thickeners, tailings stackers, water treatment, magnetic separators, and control system hardware have been ordered. The company is also in negotiations for engineering, procurement and construction management services as well as contractors to develop and operate the first mine.

Sigma says it is taking care to build green technology into the Grota do Cirilo project. No hazardous chemicals will be used in processing, and 100% of the water will be recirculated. Tailings will be dry-stacked. When phase two begins, 100% of the power will be supplied by hydroelectric facilities.

Sigma Lithium has offtake agreements with Mitsui and LG, both of which will accept concentrate and then manage chemical conversion into battery-grade material. The contracts have take-or-pay provisions linked to lithium hydroxide prices.

Sigma Lithium has a market capitalization of $940 million.

South Star Battery Metals

South Star Battery Metals (TSXV: STS; US-OTC: STSBF) is developing the Santa Cruz graphite project in Bahia state, Brazil, which the company says is the second-largest flake graphite producing district in the world with over 80 years of continuous operation.

Production is to begin this year from a 5,000 tonne-per-year concentrate plant that will be built at a cost of $8 million. There is a second phase of the project that will take output to 25,000 tonnes of concentrate annually in the fourth year at an additional cost of $27 million.

The payback of the initial capital investment will take four years, while the post-tax free cash flow is estimated to be $129 million over the project life.

At full production, the planned open pit at Santa Cruz has a life of 12 years. The average operating cost per tonne of concentrate is expected to be $396 over the life of the project. Compare that to the average weighted price used in the prefeasibility study of $1,287 per tonne.

The post-tax net present value with a discount rate of 5% is $81.2 million with an internal rate of return of 35%.

The Santa Cruz deposit is open along strike and at depth. So far the measured and indicated resources are estimated to be 14.9 million tonnes grading 2.29% carbon for 341,240 tonnes of in situ graphite. The inferred resource is 7.9 million tonnes at 2.32% carbon for 183,550 tonnes of in situ graphite.

Proven and probable reserves total 12.3 million tonnes grading 2.4% total carbon for 295,400 tonnes of contained graphite.

South Star says one of the advantages of its project is the high percentage of large flakes — 63% of the concentrate contained jumbo to large flakes that were screened at +80 mesh. Such natural flakes command a premium price of US$1,400 per tonne, compared to medium flake at $1,200 per tonne and small flake at $800 per tonne.

The company also has a graphite project in the U.S. state of Alabama for which it is preparing an initial resource estimate this year.

South Star Battery Metals has a market capitalization of $20.9 million.

(This article first appeared in The Northern Miner)

from MINING.COM https://ift.tt/J8CYoK4

Iamgold reports fire at Côté batch plant

IAMGOLD Corporation (NYSE: IAG) (TSX: IMG) announced Friday that a fire occurred overnight on February 24 in the concrete batch plant at the company’s Côté gold project in Ontario, Canada.

On-site emergency responders were deployed and immediately initiated response procedures, working in conjunction with the local fire department, the company said in a release.

The fire was extinguished and no injuries were reported. Activities at site resumed in the early morning and the cause of the fire is being investigated, Iamgold said.

The project team is assessing the situation and evaluating potential mitigation measures to determine the impact this event may have to ongoing construction activities.

from MINING.COM https://ift.tt/qX9fygV

L'astéroïde qui a tué les dinosaures est tombé au printemps

from Les dernières actualités de Futura https://ift.tt/gZE74ay

Des flashs cosmiques en provenance d’une source inattendue

from Les dernières actualités de Futura https://ift.tt/oI9ASex

Les animaux de compagnie font du bien à notre cerveau

from Les dernières actualités de Futura https://ift.tt/Ldb9FR1

Les femmes victimes d'agressions sexuelles sont exposées à un risque accru d'hypertension

from Les dernières actualités de Futura https://ift.tt/98cYJmi

Il était une fois le futur des objets connectés

from Les dernières actualités de Futura https://ift.tt/BQSxm5L

jeudi 24 février 2022

Des « fantômes verts » observés pour la première fois au-dessus d’un jet géant dans le ciel

from Les dernières actualités de Futura https://ift.tt/UtEuLoe

E.Leclerc lance de nouveaux écouteurs sans fil !

from Les dernières actualités de Futura https://ift.tt/qtORlSD

Sur quoi portera le prochain rapport du Giec qui sortira lundi ?

from Les dernières actualités de Futura https://ift.tt/ILoPrMJ

Un jaguar filmé en train d'attaquer un anaconda géant en Amérique du Sud

from Les dernières actualités de Futura https://ift.tt/KYhXkp5

Cérès : les taches blanches à sa surface trahissent la présence d'un océan

from Les dernières actualités de Futura https://ift.tt/JuLhFiM

mercredi 23 février 2022

PGO introduces short-term registration for Canadian geoscientists

Professional Geoscientists Ontario (PGO), Ontario’s regulatory body for geoscientists, is implementing a short-term registration scheme for geoscientists registered in other jurisdictions in Canada, which would allow them to legally work short-term in the province, with a registration process designed to be quick, easy and inexpensive.

Known as Incidental Practice Registration, this new application of temporary registration gives professional geoscientists the ability to register with PGO and then renew on a monthly basis instead of having to apply for a 6-month or a 12-month registration.

“Our goal for introducing this new type of short-term registration is to remove barriers to incidental practice in Ontario. This new temporary registration will make it easier and more affordable for professional geoscientists registered elsewhere in Canada to work in Ontario on a short-term basis,” said Tony Andrews, PGO’s CEO.

“By illustrating that this low-cost initiative is viable, we hope that other geoscience regulators across Canada will reciprocate and offer a similar type of registration in the future, thus facilitating incidental practice and mobility of professional geoscientists Canada-wide,” Andrews added.

Scott McLean, PGO’s past president, said, “Mobility of our geoscience practitioners throughout Canada continues to be a key area of focus for PGO and an important issue for me personally when I became president of the organization in 2020, and as a professional geoscientist desiring to work in multiple jurisdictions across Canada.”

The new incidental practice registration is available for a maximum of 36 months within a 48-month period. Once the 36-month period of incidental practice registration has been used, the registrant will not be eligible for incidental practice during the five years following the most recent registration, but will be able to apply for full Practicing registration with PGO.

(This article first appeared in the Canadian Mining Journal)

from MINING.COM https://ift.tt/14HFsNh

Ukraine : les images satellites qui nous montrent la réalité du terrain

from Les dernières actualités de Futura https://ift.tt/9lzeOg3

Des lanternes sur les filets de pêche pour protéger les espèces

from Les dernières actualités de Futura https://ift.tt/aXnRsMV

On ne connaît que 9 % des contes médiévaux européens

from Les dernières actualités de Futura https://ift.tt/SNeygAZ

Des fœtus humains in vitro surveillés par des IA à la Matrix ? (TechPod #29)

from Les dernières actualités de Futura https://ift.tt/gCnXcKm

mardi 22 février 2022

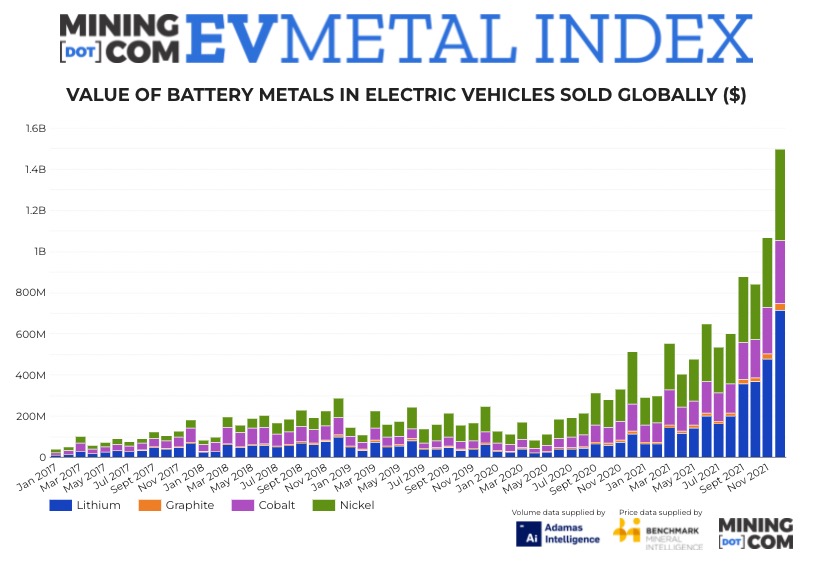

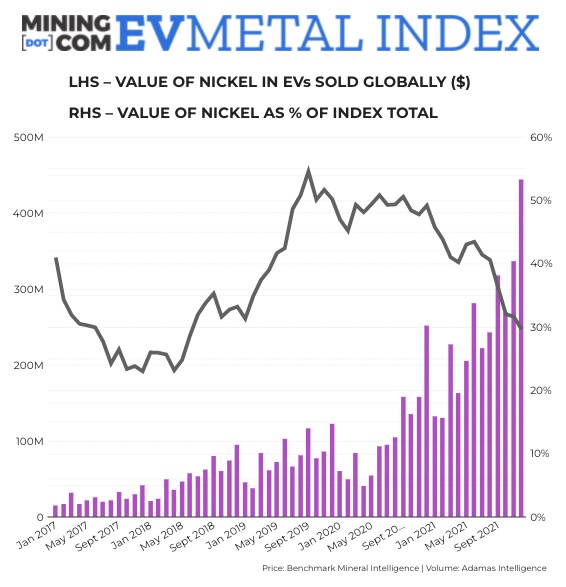

Value of battery metals in newly-sold EVs tops $1.5bn in single month

The EV Metal Index, which tracks the value of battery metals in newly registered passenger EVs (including full battery, plug-in and conventional hybrids) around the world, totaled $1.5 billion in December, an increase of 192% over the same month.

Year to date the index totals to $8.1 billion which means as much EV battery metal business was done in 2021 than the combined total of the preceding four years. In fact, the value of battery metals deployed in December was more than all of 2017.

Total battery capacity of the 1.25m EVs sold during December set a new monthly record, surging 71% year on year to 43 GWh according to Adamas Intelligence, which tracks demand for EV batteries by chemistry, cell supplier and capacity in over 100 countries.

Annual EV sales in 2021 surged to over 10m, with full battery electric vehicles responsible for 46% and plug-in hybrids 19% of the total.

In order to produce the most accurate data, the monthly battery capacity deployed numbers in the MINING.COM EV Metal Index do not include cars leaving assembly lines, those on dealership lots or in the wholesale supply chain, only end-user registered vehicles.

As such, the tonnages reflected in the end-product are fractions of what would have been procured from mines, with losses in yield during chemical conversion, and cell, cathode and battery manufacture.

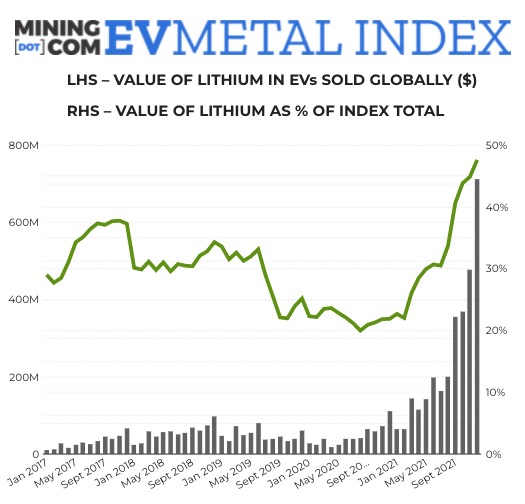

Lithium

In December 2021, a record 25.9 kilotonnes of lithium carbonate equivalent were deployed onto roads globally in batteries of all newly-sold passenger EVs, 68% more than in the previous year and a 31% increase over November according to Adamas.

Average lithium on a per vehicle basis (including hybrids) was up 12% year over year in December, jumping from 18.5kg to 20.7kg, a testament to the relative popularity of full electric cars over hybrids.

Carbonate made up 57% of the total as demand for nickel and cobalt-free LFP batteries continues to strengthen versus hydroxide’s 43%, with the latter favoured in the manufacture of high-nickel content batteries.

Lithium prices have jumped across the board over the past year, but inside China there is a mad scramble, particularly for carbonate, which continues to soar in 2022 after more than quadrupling in value last year according to Benchmark Mineral Intelligence, a battery supply chain researcher and price reporting agency.

A massive gap has opened up between ex-works prices in China for minimum 99.5% battery grade carbonate which is now trading in the $60,000 a tonne range according to Benchmark’s mid-February price update with scarcity exacerbated by maintenance downtime at chemical plants during Chinese New Year.

That compares to European prices for carbonate of $30,000 (CIF minimum 99%, Jan 2022). Benchmark also points out that the premium of lithium carbonate over lithium hydroxide – used in high nickel cathodes – reached nearly $20,600/tonne in February. Historically hydroxide has always been the pricier one.

Benchmark in a recent report said record high Chinese lithium carbonate prices have pushed the costs of LFP cells at least 5% higher than high-nickel cells on a dollar per kilowatt-hour basis, in a reversal of a decade-long trend.

“The turnaround highlights the acute pricing pressures facing producers of LFP battery cells in China, which could translate into higher prices for electric vehicles and energy storage systems.”

The lithium subindex topped $700 million for the first time in December. As a percentage of the overall index value, lithium now has the biggest share, surpassing that of nickel. From a low of 20% in 2020, when prices spent several months under $7,000 a tonne, to just over 47% now.

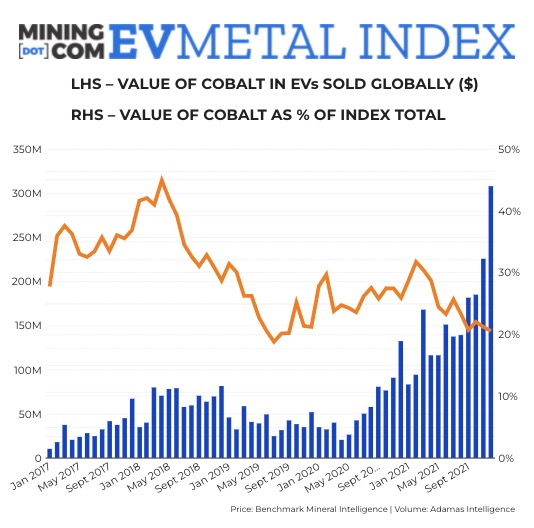

Cobalt

At over 4,000 tonnes for the first time, cobalt deployment rose 36% in December, compared to the same month last year and recorded a 25% month on month jump. On a per vehicle basis cobalt use dropped 10% from last year, another indication of the popularity of LFP-equipped vehicles and the move to lower cobalt cathode chemistries for NCM batteries.

Cobalt hydroxide used in the battery supply chain has surged over the past year topping $65,000 a tonne (100% Co basis) in January, the highest price since June 2018. Chinese factory cobalt sulphate prices are up 57% over the past year while battery metals prices are up 93% to over $34 a pound.

Despite the price appreciation, cobalt’s share of the EV Metal Index continues to shrink, reaching 20.6% in December. That compares to 45% in April 2018 when the metal was on its way to record highs.

Nickel

Nickel use was up 44% compared to the same month last year with a new record during the month of 19.6 kilotonnes while on a per vehicle basis nickel use declined 4% to 15.7kg. Nickel sulphate climbed to $22,600 a tonne (100% Ni basis) level in December according to Benchmark data, but premiums over nickel metal traded on the LME continued to shrink.

Nickel hit a decade high above $25,000 a tonne on Monday on worries that Ukraine tensions could disrupt supplies from Russia at a time of dwindling global inventories of the metal and a spot market in backwardation when prompt delivery contracts are priced higher than futures.

Graphite

In December 2021, just shy of 39 kilotonnes of synthetic and natural graphite were deployed globally in batteries of all newly-sold passenger EVs, also a record tally. The monthly total represents 78% jump over the same month last year.

On a per-vehicle basis graphite use is up 19% year on year to 31kg when taking into account full battery, plug-in hybrid and conventional hybrid vehicles.

Graphite prices have increased more than 20% since December 2020 at roughly $860 a tonne according to Benchmark data, after spending all of 2020 below $700 and hitting a low of $644 in September. Prices for the anode material peaked above $1,500 a tonne in early 2012.

from MINING.COM https://ift.tt/j1fuUEW

CIM names incoming President-Elect

The Canadian Insitute of Mining, Metallurgyand Petroleum (CIM) has appointed Ian Pearce to the role of incoming President-Elect. Pearce work closely with the President and President-Elect to provide direction to CIM that will ensure it continues to be the leading not-for-profit technical society of professionals in the Canadian minerals, metals, materials and energy industries.

“We are thrilled to announce the appointment of Ian Pearce as the CIM Incoming President Elect,” current president Pierre Julien said in a press release. “Ian brings exceptional global mining experience to CIM. Ian is a proven leader, mine builder, innovator and advocate for diversity and inclusion in our industry. His broad experience and insights will further strengthen CIM’s executive team and its ability to execute its vision to be a trusted authority & collective source for advancing the mineral industry towards a sustainable future.”

Pearce will assume the role of CIM president in May 2024 following Michael Cinnamond (2023-2024) and Anne Marie Toutant (2022-2023).

With more than 35 years of experience as a leader and innovator within the mining industry, Pearce has a deep understanding of the challenges faced by the mining sector. He has held senior engineering and project management roles at Fluor Inc. and executive roles at Falconbridge Limited and Xstrata Nickel.

He currently serves as Chair of the Board of MineSense Technologies, Chair of the Board of Directors at New Gold, and Non-Executive Director at Metso Outotec, Northland Power Inc and NextSource Materials Inc. Pearce is also a Senior Advisor at KoBold Metals and Electrasteel.

Pearce’s interests go well beyond the mining industry. He is an active supporter of several non-profit organizations, including the Canadian Cancer Society, Engineers Without Borders Canada, the Trans Canada Trail, the Canadian Museum of Nature and Eva’s Initiative in Toronto.

from MINING.COM https://ift.tt/xpjXZ4K

Un objet non identifié va s’écraser sur la Lune dans quelques jours

from Les dernières actualités de Futura https://ift.tt/kVws6j9

La montée des océans est en train d'accélérer

from Les dernières actualités de Futura https://ift.tt/whMsazS

La gigantesque éruption solaire du 15 février vue par la sonde Solar Orbiter

from Les dernières actualités de Futura https://ift.tt/pV2w16E

Attention à cette nouvelle arnaque par SMS

from Les dernières actualités de Futura https://ift.tt/S5T2OEf

Mais quel est donc cet objet non identifié qui va s’écraser sur la Lune ?

from Les dernières actualités de Futura https://ift.tt/O1VJHkm

E.Leclerc se lance dans l'audio sans-fil avec ses écouteurs bluetooth Linkster

from Les dernières actualités de Futura https://ift.tt/H4LtuPB

lundi 21 février 2022

Canada’s Trans Mountain pipeline expansion soars to over $16 billion

The capital cost of completing the twinning of the Trans Mountain pipeline has soared to a whopping C$21.4 billion ($16.7bn).

The expansion project was last estimated to cost C$12.6 billion. Last week, Trans Mountain Corp. released a new estimate for completing the project: C$21.4 billion. And whereas the last estimate for completion and commissioning was the end of this year, Trans Mountain now says construction will be pushed into late 2023.

But the Trudeau government says it will not commit any more public dollars to the project to cover the overrun.

“TMC will instead secure the funding necessary to complete the project with third-party financing, either in the public debt markets or with financial institutions,” the federal Department of Finance said in a news release today.

Meanwhile, Trans Mountain Corp. is going to need a new CEO. In addition to announcing the project’s new cost, Trans Mountain Corp. today also announced that Trans Mountain CEO Ian Anderson will retire in April.

The new pricetag for completing the project is four times what the project was estimated to cost in 2013, when the project was still owned by Kinder Morgan (NYSE:KMI).

The new pricetag raises the question of whether the Canadian government will be able to sell it, once completed, as it had hoped to do, or end up its permanent owner.

The project has faced numerous delays and setbacks, including floods in November that forced the pipeline to shut down as a precautionary measure.

“This estimate includes the costs of all known project enhancements, changes, delays and financing, including impacts of the covid-19 pandemic and the substantial preliminary impacts of the November 2021 BC floods in the Hope, Coquihalla and Fraser Valley areas,” Trans Mountain said in a project update today.

“The progress we have made over the past two years is remarkable when you consider the unforeseen challenges we have faced including the global pandemic, wildfires, and flooding,” Trans Mountain CEO Ian Anderson said. “At every step of the way, we have found solutions and responded. As a result, the project is advancing with significantly improved safety and environmental management, and with a deep commitment to ensure this project is being built the right way.”

As BIV News reported in January, Trans Mountain’s third quarter financial reports indicated the project was only half built but that 71% of the C$12.6 billion capital budget spent.

In 2013, Kinder Morgan estimated the pipeline twinning project at C$5.4 billion, with an in-service date of December 2019. The estimated capital cost has since increased four times — first to C$6.8 billion, then C$7.4 billion, and then C$12.6 billion, after the Canadian government bought the pipeline from Kinder Morgan and assumed responsibility for completing the twinning project.

Trans Mountain breaks down the increased costs into five categories:

- project enhancement, C$2.3 billion;

- scheduling pressures, C$2.6 billion;

- pandemic and flooding, C$1.4 billion;

- safety and security, C$500 million;

- financing costs, C$1.7 billion

The C$2.6 billion in scheduling pressures include the cost of permitting. As for the last estimated in-service date of December 2022, it appears that target won’t be met. Late 2023 now appears to be the new completion target.

“Schedule pressures total approximately C$2.6 billion of the increase and include permitting processes required for the several thousand permits that are required for the project, and significant construction challenges in both marine and difficult terrain which have extended the schedule into late 2023.”

Even with the new pricetag, the Department of Finance insists the project is still commercially viable.

“The government has engaged both BMO Capital Markets and TD Securities to provide advice on financial aspects of the project,” the department says in a news release.

“Their analyses confirms that public financing for the project is a feasible option that can be implemented promptly. They have also confirmed that, despite the increased cost estimate and completion timeline, the project remains commercially viable.”

Trans Mountain pipeline was built in the 1950s. The twinning project involves adding a second pipeline, running 1,150 kilometres from Alberta to Burnaby. It will increase the pipeline’s capacity from the current 300,000 barrels of oil per day to 890,000 barrels per day.

The second line will increase the capacity of Alberta oil producers to export oil to foreign markets, via Westridge Marine Terminal in Burnaby.

With the benchmark Brent Crude sitting at more than $90 per barrel, Alberta producers would be fetching high prices for their oil right now, if the new pipeline were in operation today.

(This article first appeared in Business in Vancouver)

from MINING.COM https://ift.tt/EKqsVfm

Inédit : Journée mondiale pour sauver les ours avec le grand photographe David Bittner

from Les dernières actualités de Futura https://ift.tt/HMlmptJ

Le béton de bois pour décarboner les constructions de demain

from Les dernières actualités de Futura https://ift.tt/KaQYs2d

Détecter les cancers de la peau en quelques minutes avec un simple appareil portable

from Les dernières actualités de Futura https://ift.tt/dgQDJEu

Écouter les séismes pour comprendre la fonte du permafrost

from Les dernières actualités de Futura https://ift.tt/rt5d1DF

dimanche 20 février 2022

L’ESA prépare des modules d’hibernation pour ses astronautes contrôlés par une IA et inspirés de l’ours

from Les dernières actualités de Futura https://ift.tt/Mp1DsHf

Alrosa to host first-ever auction of nanomarked diamond

Russia’s Alrosa (MCX: ALRS) announced that its first-ever auction of a 1.1-carat nanomarked diamond will take place from March 21 to April 3, 2022.

The lot’s starting price is $6,700 and the auction will take place on Alrosa’s online platform.

According to the company, its nanomarking technology enables a personalized message, voice note, photo or even video to be imprinted inside a diamond’s crystal lattice, along with information about the gem’s origin and characteristics.

“Blood diamonds are a challenge of the past, as the technology allows each stone to be traced with 100% accuracy,” the miner said in a media statement. “Unlike conventional etching, the nanomark cannot be polished off and is read with a special scanner.”

The noninvasive laser marking was developed by Alrosa together with researchers from the Russian Academy of Sciences and the Yakutniproalmaz Institute.

The marking is made by applying a laser pulse of a certain wavelength, intensity and duration to both rough diamonds and the gemstones created from them. This laser radiation acts at an atomic level on the crystal lattice, imitating the natural acceleration of atomic diffusion that occurs over millions of years in the earth’s upper mantle. As a result of the radiation, nanodomains form within the crystal. These domains are different from the diamond’s background and are visible only using a scanner specially created to read the markings.

The world’s top diamond miner by output said that in addition to making it easier for buyers to trace the provenance of the rocks they acquire, the new solution also helps them identify and distinguish Alrosa diamonds from others, including lab-grown gems.

Good prospects

The diamond industry has rebounded since the start of the pandemic. Consumers on lockdown bought stones instead of travelling and kept buying as the economy strengthened. This trend pushed cutters to buy more roughs to restock and fulfill the orders placed by jewellers and retailers.

Alrosa’s sales revenue jumped by 49% to $4.2 billion last year as demand exceeded supply, helping it recover from the hit it took at the start of the covid-19 pandemic.

The miner boosted production by 8% to 32.4 million carats by increasing output at deposits in Russia’s far east.

from MINING.COM https://ift.tt/h6qMdsQ

Le programme Polaris de SpaceX ouvre une nouvelle ère pour les vols habités privés dans l’espace

from Les dernières actualités de Futura https://ift.tt/Cq1Zevi

New project to investigate if California’s Lithium Valley is the world’s largest brine source of lithium

Researchers at the Lawrence Berkeley National Laboratory, UC Riverside, and Geologica Geothermal Group have launched a project to both quantify and characterize the lithium resource in the Salton Sea geothermal field in California.

After receiving a $1.2-million grant from the US Department of Energy, the scientists plan to use an electron microscope and other advanced analytical tools to learn what are the mineral sources of lithium in the area and whether the rocks will “recharge” the brine with lithium after it has been extracted from the produced fluids.

At present, 11 commercial plants operating at the Salton Sea field produce geothermal energy by pumping up hot fluids from deep underground and converting the heat to electricity. Normally, the cooled fluid would simply be reinjected underground, but the researchers want to first extract the lithium from the brine before injecting it back.

The project team will also investigate the potential environmental impacts of this process. In other words, they plan to quantify how much water and chemical usage is needed for lithium extraction, how the air quality changes during the extraction process, and potential induced seismicity from the associated geothermal energy production.

“The Salton Sea geothermal system is the primary potential geothermal resource for lithium in the United States, and it’s a world-class resource,” Pat Dobson, the Berkeley Lab scientist who is leading the project, said in a media statement. “But there is a wide range of estimates in terms of the size of the resource, and also not a great understanding of where the lithium comes from, the rate at which it would decline over time with the extraction of lithium from the geothermal brine, and whether it would be replenished by the remaining lithium in the host rocks.”

Largest brine source of lithium in the world?

According to Dobson and his colleagues, doing a back-of-the-envelope calculation, it is possible to estimate that there’s somewhere between 1 and 6 million metric tons of lithium in the so-called Lithium Valley.

“That would be the largest brine source of lithium in the world, bigger than any individual South American salar deposit,” UC Riverside geochemist Michael McKibben said. “So, it’s a big number, and it means the potential is there for – again, back-of-the-envelope calculations – something like 50 to 100 years’ worth of lithium production.”

McKibben has been studying the Salton Sea since the 1970s and together with Maryjo Brounce, leads the UC Riverside effort in this project. Their goal is to use instrumentation to map out where the lithium is located within the reservoir rocks, and what form it is in. This geochemical characterization will then be incorporated into models to assess the rate of resupply of lithium to geothermal fluids.

“We’ll look at how quickly might you expect the resource to be regenerated – is it centuries? Decades?” Brounce said. “Those chemical reaction rates will depend on where in the rock lithium is stored pretty strongly, so it can help create a predictive tool.”

To better understand the reservoir and its regeneration capabilities, the research team will use data from companies active in the area as well as published documents and field data from the state of California’s Geologic Energy Management (CalGEM) databases.

“We need better data on the chemistry of the brines and their lithium content and how it’s distributed in terms of position and depth in the geothermal field,” McKibben said. “We’ve asked the geothermal companies to share their brine data with us. Pat and his group will put that in a database. Then if we can use the database to correlate lithium concentration with things like temperature, chlorinity, and other physical and chemical parameters, we can actually predict how much lithium might be in brine in parts of the field that haven’t been completely drilled out yet.”

from MINING.COM https://ift.tt/KjlIva1

Au cœur de l’inflammation de type 2, pour comprendre certaines maladies inflammatoires chroniques comme la polypose nasale.

from Les dernières actualités de Futura https://ift.tt/6bH5tRw

Moonfall : que se passerait-il si la Lune s'écrasait sur la Terre ?

from Les dernières actualités de Futura https://ift.tt/FJpVTKQ

Pourquoi des scientifiques déconseillent de boire dans les bouteilles en plastique réutilisables ?

from Les dernières actualités de Futura https://ift.tt/YKLoPst

Betterave : découvrez une transformation aux multiples facettes !

from Les dernières actualités de Futura https://ift.tt/7MAsVEH

samedi 19 février 2022

Mexico’s Supreme Court issues draft decision declaring Almaden Minerals’ claims ineffective

Mexico’s Supreme Court has ordered the Ministry of Economy (ME) to declare ineffective Almaden Minerals’ (TSX: AMM; NYSE-AM: AAU) titles for its Ixtaca gold-silver project, located in the east-central state of Puebla.

The decision comes after seven years of legal procedures, which were initiated by the Tecoltemi Indigenous community whose members alleged that they were not consulted about the project and that the mining operation put their water sources, health and rights to a clean environment at risk.

The Supreme Court’s decision is based on an appeal of an April 2019 lower court ruling that was originally brought to the Collegiate (Appeals) Court of Mexico by the Mexican government, and Almaden as an affected third party. The top court was forced to intervene after the Collegiate resolved that it did not have the authority to hear the case.

The Puebla state court ruling on which the appeal was centred stated that Mexico’s mineral title system is unconstitutional because consultation with Indigenous communities is not required before titles are granted. This means that the system contravenes the International Labour Organization’s Indigenous and Tribal Peoples Convention, which has been endorsed by Mexico.

Three years ago, the state court also ruled that Almaden’s mineral claims should be suspended while consultation was completed.

In its recent decision, however, the Supreme Court said that the Mexican mineral title law is constitutional but that before issuing Almaden’s mineral titles, the Ministry of Economy should have provided for a consultation procedure with relevant Indigenous communities.

Besides declaring the Canadian miner’s titles ineffective, the draft orders the ME to re-issue them following the Ministry’s compliance with its obligation to carry out the necessary procedures to consult with Indigenous communities.

According to Almaden, since the Supreme Court issued a draft decision, the final ruling may be modified.

“The decision will take effect at the time of official notification of the decision to the company which is expected within the next two months,” the Vancouver-based firm said in a media statement. “Almaden intends to review the final decision when it is available and interact with Mexican government officials and local community officials in order to fully understand the impact of this decision on the company’s mineral claims prior to determining its next steps. At present, there is no timeline for consultation by the Ministry of the Economy with Indigenous communities.”

The high-grade Ixtaca project is located 120 kilometres southeast of the Pachuca mine, whose historic production of 1.4 billion ounces of silver and 7 million ounces of gold makes it one of the largest gold and silver deposits in Mexico.

The Ixtaca deposit, on the other hand, hosts a proven and probable reserve containing 1.38 million ounces of gold and 85.1 million ounces of silver (73.1 million tonnes grading 0.59 g/t Au and 36.3 g/t Ag). A feasibility study was completed in 2018, and Almaden has been working on advancing the project towards production.

from MINING.COM https://ift.tt/b1OQqZ6

« Les algues terrestres pourraient participer au piégeage du carbone dans les sols »

from Les dernières actualités de Futura https://ift.tt/Bo2iuaP

Pourquoi les lichens vont bientôt disparaître ?

from Les dernières actualités de Futura https://ift.tt/rHMdGbu

La spectaculaire éruption solaire du 15 février vue par la sonde Solar Orbiter

from Les dernières actualités de Futura https://ift.tt/QSxcLTi

Pourquoi les lichens devraient bientôt disparaître ?

from Les dernières actualités de Futura https://ift.tt/4U8bgar

Homo sapiens était déjà en Europe il y a 54.000 ans et c'est étonnant

from Les dernières actualités de Futura https://ift.tt/cmFOvzq

Futura recrute un journaliste scientifique

from Les dernières actualités de Futura https://ift.tt/f5JMWmk

Dormir une heure de plus aiderait à perdre du poids

from Les dernières actualités de Futura https://ift.tt/PRLdCOv

Étonnant ! Le lac de lave du Kilauea, à Hawaï, se vide et se remplit de manière cyclique !

from Les dernières actualités de Futura https://ift.tt/aB7YVxO

Ce que l’on sait sur le premier cas du variant Deltacron détecté au Royaume-Uni

from Les dernières actualités de Futura https://ift.tt/qYtf6Uu

vendredi 18 février 2022

Des restes de galaxie dévorées par la Voie lactée retrouvés par les astronomes

from Les dernières actualités de Futura https://ift.tt/CKtq021

Le noyau interne de la Terre n’est pas vraiment solide !

from Les dernières actualités de Futura https://ift.tt/vidTzlt

Origine du SARS-CoV-2 : la thèse de l’accident de laboratoire écartée par l’Institut Pasteur

from Les dernières actualités de Futura https://ift.tt/QwIVyeU

Le cerveau des astronautes modifie ses connexions pour s'adapter au long voyage dans l'espace

from Les dernières actualités de Futura https://ift.tt/GZDXF1n

Pourquoi l'arrivée de Chrome 100 et Firefox 100 fait trembler Internet

from Les dernières actualités de Futura https://ift.tt/ABKhWfm

Perseverance : un an de découvertes et de prouesses sur Mars avec Ingenuity

from Les dernières actualités de Futura https://ift.tt/QIXe3YK

L'observatoire spatial de rayons X Chandra est en panne

from Les dernières actualités de Futura https://ift.tt/oeql69t

CBD : des effets bénéfiques prouvés dans l’anxiété et les problèmes de sommeil ?

from Les dernières actualités de Futura https://ift.tt/Nsm6gBT

jeudi 17 février 2022

Une startup veut rendre la voile plus simple et accessible à tous !

from Les dernières actualités de Futura https://ift.tt/eMr7w4o

Télémédecine : découvrez ce que nous réserve 2022

from Les dernières actualités de Futura https://ift.tt/rJD7GE8

Le nucléaire recrute ! devenez acteur de la transition énergétique !

from Les dernières actualités de Futura https://ift.tt/2W6qt1z

Une patiente guérie du VIH après une transplantation de cellule souche

from Les dernières actualités de Futura https://ift.tt/4s9BOHt

Les animaux sauvages infectés à la Covid sont-ils une menace ? (Covipod #26)

from Les dernières actualités de Futura https://ift.tt/7oFnwkl

En attendant de pouvoir voler, Virgin Galactic ouvre sa billetterie

from Les dernières actualités de Futura https://ift.tt/SXotVlu

mercredi 16 février 2022

Appian Capital Advisory sells stake in Peak Rare Earths

Appian Capital Advisory LLP announced Wednesday that it has substantially exited its position in Peak Rare Earths (ASX: PEK) and through a solely owned subsidiary, has sold its 19.9% interest to global rare earth group Shenghe Resources Holding Co.

The sale of Appian’s position was priced at A$0.99 per share, representing a substantial 24.5% premium to Peak’s shares pre-closing. As a leading rare earth major with a global operational footprint, Shenghe will be a technical and financial partner to Peak going forward.

Appian said in a media release it believes Peak’s Ngualla rare earth project in Tanzania is potentially the best undeveloped rare earth asset in the world with technical advantages and long-term commercial potential and that the rare earth project can contribute to global decarbonization initiatives via the manufacture of permanent rare earth magnet critical for the energy transition.

“The sale to a rare earth major is a strong endorsement of Peak’s world-leading project, enabling it to move on to the next stage of development,” Michael W. Scherb, Appian CEO said in a news release.

from MINING.COM https://ift.tt/c2gNBEH