dimanche 31 juillet 2022

Les meilleurs endroits pour bâtir une ville sur la Lune et chercher la vie sur Mars

from Les dernières actualités de Futura https://ift.tt/yJkXurN

Bolivian authorities investigate tailings pond collapse near Potosí

Bolivian authorities are investigating the causes behind the collapse of a tailings facility near the southern town of Potosí, an accident that took place a week ago and that caused a mix of mud and mine residue to reach at least four rivers that drain into the Pilcomayo River.

Pilcomayo is an international, 1,100-kilometre-long river that passes through Bolivia, Argentina and Paraguay and that defines most of the border between the latter two before it joins the Paraguay River near Asunción.

The tailings pond that failed belonged to the Departmental Federation of Mining Cooperatives whose members extract silver and zinc through artisanal means in the nearby areas.

Following a visit to the site where the accident took place, Potosí city councillor Reyna Menacho published a series of videos on social media pointing out that the residues are starting to sediment, which means that it may take about 10 years for the ecosystem to fully recover.

Together with Menacho were representatives from the Mining Administrative Jurisdictional Authority (AJAM), the governor’s office of the Potosí Department, the Bolivian Mining Corporation, and the Mining and Forestry Environment Commission, among others. They carried out a full inspection that allowed them to find clandestine mining work in the vicinity of the Mazuni Lagoon, something the AJAM had been reporting since 2017.

According to the councillor, the illegal mineshafts, some of them over 80 metres in depth, were destroyed and authorities made a commitment to monitor the area and dismantle similar operations that “that threaten the environment and public health.”

This is not the first time this type of accident occurs in Bolivia, a situation that has been criticized by its neighbours to the south.

from MINING.COM https://ift.tt/wDe7C4B

Les liens entre la sérotonine et la dépression à l'épreuve de la science

from Les dernières actualités de Futura https://ift.tt/XZ3pJLj

Des images inédites du plus grand canyon du Système solaire

from Les dernières actualités de Futura https://ift.tt/USZfQA4

Pourquoi une si longue sécheresse installée sur toute la France et l’Europe ?

from Les dernières actualités de Futura https://ift.tt/TeRx2Wb

La caféine et la théine, c'est la même chose, vrai ou faux ?

from Les dernières actualités de Futura https://ift.tt/fn97wEB

samedi 30 juillet 2022

Patient Bizarre : une maladie étrange qui fait disparaitre les ongles des mains et des pieds

from Les dernières actualités de Futura https://ift.tt/l7uCN2y

La Nasa veut utiliser le Soleil pour voir la surface des exoplanètes !

from Les dernières actualités de Futura https://ift.tt/mdVqEMF

Retour des fortes chaleurs début août avec une troisième vague

from Les dernières actualités de Futura https://ift.tt/WGTfd4h

Attention aux apps santé pour smartphone qui ne sont pas homologuées

from Les dernières actualités de Futura https://ift.tt/za6vwxh

Le James-Webb révèle la composition du gaz autour d'un trou noir supermassif

from Les dernières actualités de Futura https://ift.tt/m6PERZW

Alzheimer : la fraude soupçonnée remet-elle en cause nos connaissances sur la maladie ?

from Les dernières actualités de Futura https://ift.tt/zYxlQer

Soutenez une rédaction engagée pour la vulgarisation scientifique à partir de 1.50 € par semaine !

from Les dernières actualités de Futura https://ift.tt/y9U24g0

vendredi 29 juillet 2022

Qista, une solution durable pour la démoustication

from Les dernières actualités de Futura https://ift.tt/KoFLXrA

La recherche sous les feux des projecteurs avec Orange

from Les dernières actualités de Futura https://ift.tt/Oyps0aY

Tout indique que le marché de Wuhan a été le point de départ de la Covid-19

from Les dernières actualités de Futura https://ift.tt/yQKw2o8

Découverte d’une étoile à neutrons qui bat tous les records !

from Les dernières actualités de Futura https://www.futura-sciences.com/sciences/actualites/etoile-neutrons-decouverte-etoile-neutrons-bat-tous-records-99924/#xtor%3DRSS-8

Quelle est cette étrange créature sur laquelle sont tombés des scientifiques dans l’océan Pacifique ?

from Les dernières actualités de Futura https://ift.tt/rv0wRjJ

jeudi 28 juillet 2022

Canada races ahead of US on current lithium project pipeline

Canada’s lithium supply response is expected to post strong growth through 2031 and outperform the US, a new analysis by Fitch Solutions Country Risk & Industry Research suggests.

Canada’s current solid project pipeline, prospective investments into petroleum brine production techniques in Alberta, and a fast-growing battery and electric vehicle (EV) manufacturing base in Quebec and Ontario provide more significant upside in the medium-term due to Canada’s more attractive regulatory environment, the authors say.

Mine permitting times are shorter compared with the U.S., and the current government, led by Prime Minister Justin Trudeau, has proposed C$3.8 billion in spending in April to support the mining sector. This includes the creation of infrastructure for remote projects, of which C$1.6 billion were dedicated to critical minerals projects.

Critical Elements Lithium’s (TSXV: CRE) Rose project, Sayona Mining’s (ASX: SYA) Authier project, and Sayona and Piedmont Lithium’s (Nasdaq: PLL; ASX: PLL) jointly owned La Corne mine — all in Quebec — are expected to begin production in 2023. The three projects are expected to add over 50,000 tonnes of lithium carbonate equivalent (LCE) production. La Corne targets a total production capacity of 265,000 tonnes per year in the longer term, assuming its planned expansions are authorized and financed.

Nemaska Lithium’s rebooted Whabouchi mine, also in Quebec, is expected to enter production in 2025 and add another 52,500 tonnes annual output.

According to Fitch’s ‘Americas Lithium Outlook: Robust Project Pipeline To Secure Future Production,’ these planned projects are buoyed by an additional 20 projects without stated production dates receiving growing interest from manufacturers who increasingly provide financing for upstream projects. These arrangements allow them to secure long-term offtake and reduce exposure to spot market prices through contractual price caps.

from MINING.COM https://ift.tt/bSBZPDN

Des sursauts gamma pourraient aider à comprendre la nature de l'énergie noire

from Les dernières actualités de Futura https://ift.tt/4yAlUNp

Le jour du dépassement de la Terre est encore plus tôt cette année

from Les dernières actualités de Futura https://ift.tt/rTix7Sq

La Nasa et l'ESA ont un nouveau scénario très audacieux pour les retours d'échantillons de Mars !

from Les dernières actualités de Futura https://ift.tt/8nq6Vri

Mars : découvrez le nouveau scénario très audacieux pour les retours d'échantillons de roches

from Les dernières actualités de Futura https://ift.tt/cZXTKDM

Découvrez les abonnements Futura à partir de 0,80 € par semaine

from Les dernières actualités de Futura https://ift.tt/JzpkZmr

C’est le pire endroit du monde pour chercher plus de pétrole

from Les dernières actualités de Futura https://ift.tt/cl0VoD7

mercredi 27 juillet 2022

Station spatiale internationale : la Russie s'en va avant les autres partenaires

from Les dernières actualités de Futura https://ift.tt/68i4JyC

Japon : alerte volcanique maximale depuis la forte explosion du Sakurajima

from Les dernières actualités de Futura https://ift.tt/JC1Zr84

Mobiliser l’intelligence artificielle contre l’errance diagnostique des maladies rares

from Les dernières actualités de Futura https://ift.tt/Bga3LPG

La plus grande lune de Mars a été photographiée par une sonde spatiale chinoise

from Les dernières actualités de Futura https://ift.tt/DInQv6l

Variole du singe : ce que l'on sait sur les lésions cutanées terriblement douloureuses

from Les dernières actualités de Futura https://ift.tt/3w4O9Zg

Air Liquide Normand’Hy accélère la production d’hydrogène renouvelable à grande échelle

from Les dernières actualités de Futura https://ift.tt/G48Kog6

mardi 26 juillet 2022

Myocardites fulminantes et Sars-CoV-2 : des chercheurs mettent en évidence deux profils distincts

from Les dernières actualités de Futura https://ift.tt/LYDdswv

Microsoft a trouvé une parade pour limiter les ransomwares

from Les dernières actualités de Futura https://ift.tt/KX4o9nS

Quand un logiciel d'astronomie aide à surveiller les grains de beauté

from Les dernières actualités de Futura https://ift.tt/ztFxlCZ

Variole du singe : mieux comprendre les lésions cutanées causées par la maladie

from Les dernières actualités de Futura https://ift.tt/gCGWMPa

On sait pourquoi Jupiter n'a (quasiment) pas d'anneaux !

from Les dernières actualités de Futura https://ift.tt/A5vLq47

Une sonde chinoise envoie une image inédite de la plus grande lune de Mars

from Les dernières actualités de Futura https://ift.tt/GzHNLPQ

La Nasa finance une mission scientifique sur la face cachée de la Lune

from Les dernières actualités de Futura https://ift.tt/gxhisCS

Plus de la moitié de l’Europe est en sécheresse sévère à extrême : comment l’expliquer ?

from Les dernières actualités de Futura https://ift.tt/unPUYva

lundi 25 juillet 2022

High-performance aluminum alloys can now be produced with little energy

Researchers at the Pacific Northwest National Laboratory (PNNL) have developed a new process that cuts in half the energy needed to manufacture high-performance aluminum alloys.

According to the scientists, Shear Assisted Processing and Extrusion (ShAPE) technology can eliminate heat treatment steps in the production process, resulting in significant energy savings and reduced emissions.

ShAPE has been defined as a green, affordable manufacturing approach that enables the broad use of high-performance aluminum alloys in automotive applications.

In a paper published in the journal Materials and Design, the researchers explain that conventional metal production uses heat to melt individual metals and alloying elements together—like aluminum, copper, or magnesium—to create alloys that are lighter, stronger, or easier to form. If these elements aren’t well-mixed, cracks and fractures can form during processing, which compromise the properties of the final product. In metal production, heat is used to ensure that individual metal elements in an alloy are well-mixed during a step called homogenization.

During homogenization, large metal castings called billets are heated to nearly 500 degrees Celsius for up to 24 hours. This heat treatment step dissolves alloy aggregates in the billet to ensure that all metal elements are evenly distributed or homogenized. This improves the performance of the final product. After homogenization, the metal rods undergo further heating and forming in a step called extrusion.

However, homogenization is the biggest energy-consuming step in the entire metal extrusion process.

This is where the ShAPE process comes in.

Scott Whalen, PNNL chief materials scientist and co-developer of the technology, said that the ShAPE machine eliminates the need for separate homogenization and extrusion steps by combining heating and deformation—the change in the shape of the metal itself.

In the ShAPE machine, the metal billet is simultaneously pushed through a small opening in a die which rotates. Together, the rotational movement and deformation thoroughly mix the metal elements as they are being extruded.

In other words, the new process homogenizes the metal billet in a few seconds, immediately before it is extruded. This eliminates the need for a day-long, pre-heating homogenization step and means that no additional energy is used to heat the billet during extrusion. Together, this results in energy savings of up to 50%.

Whalen and his colleague Tianhao Wang ran some performance testing that showed that their technology also improves how well the individual alloying elements are mixed, leading to a better final product. In detail, components made of aluminum alloys processed with ShAPE exceeded current American Society for Testing and Materials standards for strength and elongation.

“We took a closer look using an electron microscope and saw that ShAPE breaks apart the alloy aggregates and dissolves them into the aluminum matrix prior to extrusion, making it more extrudable,” Wang said. “This translates to better performance—our aluminum 7075 alloys are stronger and stretch farther before breaking.”

from MINING.COM https://ift.tt/oQlUFvJ

Ref Bikes lance des vélos fabriqués en France, évolutifs et personnalisables

from Les dernières actualités de Futura https://ift.tt/aBCqxDK

Jean Schneider : « J’attends la découverte d'un système planétaire avec davantage de planètes que dans le Système solaire »

from Les dernières actualités de Futura https://ift.tt/g8xOI4D

Fukushima : le Japon va rejeter les eaux contaminées dans l'océan

from Les dernières actualités de Futura https://ift.tt/aJZvnPi

Variole du singe : ce que l'on sait, avec Xavier Lescure, de l'hôpital Bichat

from Les dernières actualités de Futura https://ift.tt/CqBbunQ

dimanche 24 juillet 2022

Cet été, offrez-vous des connaissances avec le Mag Futura

from Les dernières actualités de Futura https://ift.tt/gEA8lmP

For All Mankind : à quand la colonisation de Mars ?

from Les dernières actualités de Futura https://ift.tt/MbyPUz1

Les arbres sont en train de disparaître en Californie

from Les dernières actualités de Futura https://ift.tt/tYbrvjx

Il existe un continent de plastique dans l'océan, vrai ou faux ?

from Les dernières actualités de Futura https://ift.tt/c27bI38

Une guêpe et une fleur de 30 millions d'années découvertes en très bon état

from Les dernières actualités de Futura https://ift.tt/MTGunxE

Des compotes en sachet contiennent plus de sucres que le Coca-Cola, s'inquiètent des scientifiques

from Les dernières actualités de Futura https://ift.tt/9WfkIgl

samedi 23 juillet 2022

15 raisons de s'inquiéter pour la biodiversité marine, menacée d'effondrement dans la prochaine décennie

from Les dernières actualités de Futura https://ift.tt/fM3pvtK

Ce que l'on sait sur la variole du singe avec Xavier Lescure, de l'hôpital Bichat

from Les dernières actualités de Futura https://ift.tt/GJ6mayF

Nos voitures « gaspillent » les deux tiers de leur carburant

from Les dernières actualités de Futura https://ift.tt/lBXCnGy

Une startup française plante des « îlots de fraicheur » dans les villes et les entreprises

from Les dernières actualités de Futura https://ift.tt/T5Jj1ho

Lectures d'été : faites le plein d'idées autour de 4 enjeux déterminants pour l'avenir

from Les dernières actualités de Futura https://ift.tt/Iiqu2a0

L'incendie entre la dune du Pilat et La Teste-de-Buch vu de l'espace

from Les dernières actualités de Futura https://ift.tt/jtQvwfH

vendredi 22 juillet 2022

La captation du CO2 a des rendements plus faibles qu'annoncés

from Les dernières actualités de Futura https://ift.tt/AQWs7mj

Ce qui a causé la chute de la capitale maya Mayapán

from Les dernières actualités de Futura https://ift.tt/eF06alz

Comment l'humanité a appris à lutter contre le feu

from Les dernières actualités de Futura https://ift.tt/x10hCWU

Ce groupe prépare un concert aux portes de l'espace !

from Les dernières actualités de Futura https://ift.tt/WewRvqp

Test Bang & Olufsen Beoplay EX : des écouteurs Bluetooth élégants qui régalent les oreilles

from Les dernières actualités de Futura https://ift.tt/pECc6v0

jeudi 21 juillet 2022

Teck, Royal Ontario Museum partner to showcase copper’s antimicrobial properties

Teck Resources (TSX: TECK.A and TECK.B, NYSE: TECK) and Canada’s Royal Ontario Museum (ROM) announced Thursday a partnership to outfit ROM with antimicrobial copper surfaces and build awareness around the health benefits of copper.

ROM is the first museum in Canada to incorporate antimicrobial copper, which continuously kills bacteria and reduces the spread of infection, to help create a safer environment for visitors and staff.

Through its Copper & Health program, Teck has donated C$500,000 to ROM which is being used, in part, to outfit high-traffic areas with antimicrobial copper surfaces known as CuVerro Shield by Aereus Technologies.

This installation will cover door handles, washroom stall latches and other high-touch surfaces to provide an added layer of protection to ensure the health and safety of all those who visit the museum.

Funding will also go towards an interactive digital educational program to explain the health benefits of copper and illustrate the important role this natural resource plays today and for the low-carbon future.

Copper has unique antimicrobial properties and is proven effective in eliminating up to 99.9% of harmful bacteria within two hours of contact. When installed in high-touch, high-traffic locations, copper can help reduce the spread of infectious disease.

This ROM and Teck initiative is the latest in a series of contributions through Teck’s Copper & Health program to expand the use of antimicrobial copper which also includes partnerships with numerous B.C. hospitals, post-secondary educational institutions, Vancouver International Airport and on public transit in Vancouver and Toronto.

from MINING.COM https://ift.tt/2jkdDH6

IAMGOLD named one of Canada’s best corporate citizens of 2022

IAMGOLD (NYSE: IAG) (TSX: IMG) has published its 2021 Sustainability Report, highlighting its progress across a range of ESG practices, and has been named as one of the Corporate Knights’ Canada’s Best 50 Corporate Citizens of 2022, ranking as one of the top 50 companies in Canada for corporate citizenship.

“Being recognized as among the Best 50 Corporate Citizens in Canada is a great honour and reflects the dedication, passion and commitment of our people,” Maryse Bélanger, interim CEO of IAMGOLD said in a media statememt.

“We take pride in being responsible operators and are committed to using this strong foundation to help transform IAMGOLD into a stronger, more agile, and sustainable business,” she said.

“As we move forward, IAMGOLD will remain open, engaged, and committed to maximizing the benefits of mining to create a brighter future for our stakeholders and host communities.”

IAMGOLD’s sustainability report is here.

from MINING.COM https://ift.tt/3Cx7kUT

Réparer n’est heureusement pas jeter grâce à Spareka

from Les dernières actualités de Futura https://ift.tt/iRSqm2j

Aidez les scientifiques à percer les mystères de l'atmosphère de Jupiter

from Les dernières actualités de Futura https://ift.tt/Ag6t8iD

Le Mag Futura : « D'où vient la Lune ? »

from Les dernières actualités de Futura https://ift.tt/D20YIc1

mercredi 20 juillet 2022

Glencore’s proposed British Columbia coal mine advances to public comment period

It has been nearly a decade since the Sukunka metallurgical coal mine proposal near Chetwynd and Tumbler Ridge was first pitched to the British Columbia Environmental Assessment Office.

The project, estimated to cost C$450 million (about $350m) to build, is still in play, and the project will soon enter a final review by the BC Environmental Assessment Office (EAO).

The clock has been stopped on the review several times to allow the company to respond to numerous questions and concerns raised about environmental impacts – from impacts on fish to greenhouse gas emissions and impacts on caribou habitat.

The company behind the project is Glencore Coal Assets Canada, a Canadian subsidiary of the multi-national mining major, Glencore Plc.

An EAO application review resumed last week, following the lifting of a suspension that was granted to Glencore to continue discussions about the Southern Mountain Caribou.

On August 2, the BC EAO will begin a public comment period on a draft assessment report and proposed environmental assessment conditions for the proposed mine.

The Sukunka project – a proposed open-cut metallurgical coal mine — was first pitched to the BC EAO in 2013 by a former owner, Xtrata Coal Co.

It was originally rejected by the BC EAO for a review due to a “lack of detail related to mine planning, geotechnical information, geochemistry and water quality predictions.”

Glencore resubmitted an application, providing the details required, and the project formally entered the EAO process in 2015.

The mine would produce about 3 million tonnes of steelmaking coal annually, with capacity for expanded production, and would have a mine life of 20 years. Unlike thermal coal, which is burned to generate electricity, metallurgical coal is used to make steel.

From the beginning, concerns about the mine’s impact on the Quintette population of Southern Mountain Caribou was a concern, and the project received a number of suspensions, with the EAO hitting the pause button several times to allow the company to address various environmental concerns and consult with First Nations.

The West Moberly, Saulteau, and McLeod Lake First Nations commissioned their own impact study to assess the mine’s environmental impacts. A major concern for First Nations in the area is the mine’s impact on Southern Mountain Caribou, which have been in a long-term decline and are listed as a “threatened” species.

The three First Nations, as well as the Doig River First Nation, opposed the EAO’s lifting of the suspension on the review, saying impacts on caribou have still not been fully addressed.

In February, they also raised the concern about “cumulative impacts.”

All four First Nations are signatories to Treaty 8. Last year, the BC Supreme Court ruled in favour of the Blueberry River First Nation – also a Treaty 8 signatory – which claimed decades of industrial development in their territory constitutes a breach of treaty rights. That has put a temporary halt to some industrial activities in the Peace region.

In a letter in February, the four First Nations urged the EAO to keep the Sukunka review paused until their concerns were further addressed.

“Given that the project will only exacerbate these already extensive cumulative impacts and infringements, it is not appropriate for the EAO to lift the suspension,” they write in their letter to the EAO.

Since the project was first accepted for an environmental review, a new caribou recovery plan for the area has been created.

Another new wrinkle not anticipated by the company to be part of the environmental review was greenhouse gases, which the B.C. Climate Action Secretariat began asking about, after the project passed its initial review.

All mines produce some greenhouse gas emissions, but coal mines in particular can be the source of fairly significant amounts of methane, which has a high global warming potential, compared to CO2.

The GHG intensity of major projects weren’t a formal consideration when the Sukunka mine started the EAO review process.

Glencore noted that questions raised about GHG emissions occurred after the initial 180-day review period, so it had not been part of original information requests.

These information requests arise from the initial review and public comment period, in which the proponent is required to respond to questions about various environmental impacts, and suggest mitigation measures.

Glencore took issue with the GHG issue being raised after the formal review period, which is when those questions are supposed to be raised.

“Glencore is respectfully seeking additional justification as to why the EAO is allowing ‘new’ comments on the content of the application to be received 11 months after it was accepted for review,” the company wrote in 2016.

“Being required to respond to these comments at this stage of the review process seems to be inconsistent with the EAO’s Fairness and Service Code, especially when no prior acknowledgment of these potential outstanding information requests was provided.”

Nevertheless, despite its objections, Glencore responded by commissioning Stantec to do a GHG life cycle analysis.

The Stantec report estimated the Sukunka mine would account for 16% of all emissions produced from coalmines in B.C. — a total of 259,648 tonnes annually of CO2 equivalent, of which methane would constitute 63,289 tonnes annually.

The project is estimated to add 2% to B.C.’s total emissions by 2050.

“Project GHG emissions will change the BC GHG targets for years 2020 and 2050 by 0.6% and 2% respectively,” the Stantec report notes. “It should be noted however, that the project is expected to be completed within 20 years of commencement, and as such is unlikely to contribute to the BC GHG targets for 2050.”

Asked by the EAO if coal bed methane could be captured, Glencore, through Stantec, responded that it was possible, “but that it is not financially feasible.”

(This article first appeared in Business in Vancouver)

from MINING.COM https://ift.tt/O3JwIRe

Belo Sun Mining rises after Brazil court overturns halt of Volta Grande gold project

Shares of Belo Sun Mining (TSX: BSX; US-OTC: BSXGF) jumped by 55% on Wednesday morning after the company reported that the Supreme Court of Pará State in Brazil had overturned a suspension order related to the construction and environmental licences of its Volta Grande gold project.

In May, the Agrarian Court of Altamira had suspended the company’s licences until a socio-environmental study of the local riverside peoples, at a minimum distance of 10 km from the project, was carried out on both banks of the Xingu River. The order also required the company to undertake prior, free, and informed consultations and receive the consent of the riverside communities.

The State Supreme Court overturned the suspension order as there was “no evidence of damage or harm to the riverside people” and “they were properly consulted as part of the environmental studies conducted by Belo Sun,” the miner said in a press release.

“This decision confirms our belief that Belo Sun properly consulted with all local communities, including the communities living along the Xingu River,” the company’s CEO Peter Tagliamonte said in a press release.

Located in the state of Pará, near the city of Altamira, the Volta Grande open pit mining project has proven and probable reserves of 115.9 million tonnes grading 1.02 grams gold per tonne for 3.7 million oz. gold.

Based on a 2015 feasibility study, the project is expected to produce about 268,000 oz. gold annually over the first 10 years of the mine life. At a 5% discount rate, the project would generate a post-tax net present value of $665 million and a post-tax internal rate of return of 26%. The initial capital cost has been pegged at $298 million.

Scotiabank analyst Ovais Habib described the latest update as positive for the company as it moved the project “closer to resuming development activities at Volta Grande.”

from MINING.COM https://ift.tt/0kfuMZv

Gold price sinks below $1,700 ahead of key central bank meetings

Gold prices sank below $1,700 on Wednesday afternoon as investors continued to shed holdings of gold-backed exchange-traded funds ahead of key central bank meetings over the next week, which may result in more aggressive interest rate hikes.

Spot gold fell 0.9% to $1,696.71 per ounce by 5:10 p.m. ET, a new 11-month low, after holding steady earlier in the session. US gold futures shrank 1.0% to $1,694.30 per ounce in New York.

[Click here for an interactive chart of gold prices]

Bullion has been hovering in a narrow trading range since late last week, with the US dollar index also retreating for three straight sessions through Tuesday, a sign of waning haven demand. However, the gauge for greenback has since then recovered, pulling investor demand away from the precious metal.

Holdings in gold-backed ETFs have now dropped for 15 days, the longest stretch since March 2021, according to initial data compiled by Bloomberg.

“We don’t expect a sustained improvement in market sentiment until investors get greater clarity on the outlook for the economy, central bank policy and political risks,” UBS chief investment officer Mark Haefele said in an earlier Bloomberg note. “Uncertainty in all of these areas remains elevated, in our view.”

Traders are currently awaiting on key central bank decisions to see how policy makers will address soaring inflation across the globe.

Bloomberg sources speculate that the European Central Bank may consider raising interest rates on Thursday by double the quarter-point it previously outlined. The US Federal Reserve, meanwhile, is likely to hike rates by another three-quarters of a percentage point at its meeting next week, according to CNBC reports.

“There’s actually scope for a relief rally coming up to the July FOMC meeting where we can see a little bit of a bounce and perhaps prices heading back toward $1,750 in the near term,” Suki Cooper, a precious metals analyst at Standard Chartered Plc, said in a Bloomberg Television interview, referring to the policy-setting Federal Open Market Committee.

For gold to actually rally, ETF outflows would have to stabilize, and a lot of the downside risk has to be priced in by markets, Cooper added.

In a separate Reuters report, TD Securities commodity strategist Daniel Ghali said: “Gold is trading in a tight range, but it is trading heavy. Fed speakers have pushed back the notion of 100 bps hike, but gold still hasn’t managed to rally because there are still traders who are using the chance to sell before prices fall further.”

“The conflict in Ukraine catalyzed a massive amount of inflows into gold ETFs earlier in the year, but the relevance of that has faded. The hawkish central bank regime is reducing appetite for gold purchases,” Ghali added.

(With files from Bloomberg and Reuters)

from MINING.COM https://ift.tt/9SYiblc

Former Australian PM and Alcoa COO appointed to solar energy company advisory board

GlassPoint, a California-based firm that specializes in decarbonizing the production of materials essential to the energy transition, announced Wednesday that the former Prime Minister of Australia, Malcolm Turnbull, and the former COO of Alcoa, Tomas Sigurdsson, have joined its advisory board.

Turnbull and Sigurdsson will play a role in helping GlassPoint bring its solar steam solution to help industries essential to the energy transition achieve net-zero commitments, with a focus on mining, metals and manufacturing, the company said.

Of the world’s top miners, 28 have committed to a goal of net zero direct and indirect carbon emissions by 2050 or sooner, according to the International Council on Mining and Metals. The new advisors join the board at a time when mining companies are increasingly seeking ways to cost-effectively reduce carbon emissions and meet net-zero commitments with rapidly approaching deadlines.

Before his term as the 29th Prime Minister of Australia, Turnbull held a number of parliamentary positions, including Minister for Environment and Water Resources. Before entering parliament in 2004 he was a trial lawyer and investment banker, where he led his own investment firm and served as a partner of Goldman Sachs.

“The world can’t meet its net-zero pledges unless industrial players make enormous leaps in decarbonizing operations,” Turnbull said in a media statement. “Consider that it’s common for large industrial plants to require more energy than many cities, much of which goes to thermal processes. Solutions like GlassPoint, which help hard-to-abate industries reduce emissions up to 80% and are available today, will play a major role in combating climate change.”

Tomas Sigurdsson is CEO of HS Orka, a private renewable energy company in Iceland. He was formerly COO and executive vice president of Alcoa, producer of aluminum, alumina and bauxite. Sigurdsson was responsible for the daily operations of global assets of the company’s bauxite, alumina, energy and aluminum segments across geographies. He previously served as president of Alcoa EU and ME.

“Throughout my career, I have been deeply involved in energy solutions for the industry, both from the demand as well as the supply side,” Sigurdsson said in an email to MINING.com.

“The ultimate goal has always been to drive the adoption of proven sustainable solutions. The energy transition in the industry will happen with multiple different solutions and with industrial steam being such a big part of global energy consumption, I firmly believe that GlassPoint’s offering will be transformational to a number of industries,” Sigurdsson said.

Sigurdsson said GlassPoint is different from the typical solar energy company in that it doesn’t capture the sun’s rays to transform it into an electric current.

“Instead, [it] uses giant mirrors to focus sunlight to generate heat. Mirrors track the sun and direct its energies on pipes filled with water,” he said. “This concentrated sunlight boils the water, yielding steam in a process that generates no hydrocarbons. This steam is then used for a wide range of industrial processes that require heat. This is a huge market as nearly 74% of all energy used in industry is in the form of heat.”

The news comes after GlassPoint signed a Memorandum of Understanding with Saudi Arabian Mining company MA’ADEN to develop the world’s largest solar process heat plant at MA’ADEN’s Alumina refinery, a 1.5GWth facility in Ras al Khair.

When complete, Sigurdsson said, the 1,500-megawatt facility will help the Saudi mining enterprise achieve its sustainability goals by reducing carbon emissions by more than 600,000 tons annually, or 4% of its overall carbon footprint.

from MINING.COM https://ift.tt/i32SENe

L'incendie entre la dune du Pilat et La Teste-de-Buch vu de l'espace

from Les dernières actualités de Futura https://ift.tt/sQzl9SF

Cet été, faites le plein d'idées avec le Mag Futura

from Les dernières actualités de Futura https://ift.tt/9vuIpHc

Une guêpe et une fleur de 30 millions d'années découvertes en très bon état

from Les dernières actualités de Futura https://ift.tt/parxOyS

mardi 19 juillet 2022

Derniers jours pour découvrir l’ordinateur portable Pavilion 14 de HP et sa remise de 400 € pour les soldes !

from Les dernières actualités de Futura https://ift.tt/9QMdpyG

Un trou noir « dormant » découvert pour la première fois en dehors de notre Galaxie

from Les dernières actualités de Futura https://ift.tt/jvcH67u

Canicule : la Bretagne n'a jamais eu aussi chaud et nuit tropicale sur la France !

from Les dernières actualités de Futura https://ift.tt/AvkaBmo

Cette nouvelle image de James-Webb donne des frissons !

from Les dernières actualités de Futura https://ift.tt/pOPtx0J

Plus de 3 millions de smartphones touchés par ce virus !

from Les dernières actualités de Futura https://ift.tt/QqBIjRN

Abonnements Futura : découvrez une navigation sans publicité à partir de 0,80 € par semaine

from Les dernières actualités de Futura https://ift.tt/oYtROJH

lundi 18 juillet 2022

Et maintenant, Jupiter dans les yeux du télescope spatial James-Webb

from Les dernières actualités de Futura https://ift.tt/ZG7TtXh

Cet été, faites le plein d'idées avec le Mag Futura

from Les dernières actualités de Futura https://ift.tt/MwBajxz

Le jeûne intermittent favoriserait la régénération des nerfs !

from Les dernières actualités de Futura https://ift.tt/mOLgK2G

Le Mag Futura : « Comment nourrir le monde sans le détruire ? »

from Les dernières actualités de Futura https://ift.tt/zFiBxtq

Un étrange lac découvert au fond de la mer Rouge

from Les dernières actualités de Futura https://ift.tt/Ucvu5R1

L'histoire de la mystérieuse roche martienne « Black beauty » vient d'être révélée

from Les dernières actualités de Futura https://ift.tt/bxXqH1o

dimanche 17 juillet 2022

8 indicateurs santé pour avoir un cœur en pleine forme !

from Les dernières actualités de Futura https://ift.tt/WRAq9xZ

Les solstices et équinoxes tombent le 21 du mois, vrai ou faux ?

from Les dernières actualités de Futura https://ift.tt/sthO2U6

Focus sur une infection grave chez l'adulte et l'enfant : la méningite à méningocoque

from Les dernières actualités de Futura https://ift.tt/1vsrJuT

Offre spéciale : profitez de -20% pour découvrir le Mag Futura !

from Les dernières actualités de Futura https://ift.tt/hC1AU0n

Le cerveau des moustiques est câblé pour nous repérer

from Les dernières actualités de Futura https://ift.tt/rj2Hcg8

samedi 16 juillet 2022

Des ingrédients de base à la vie détectés au centre de la Voie lactée

from Les dernières actualités de Futura https://ift.tt/gNPf5B0

Le lien entre cancer colorectal et nitrites est confirmé

from Les dernières actualités de Futura https://ift.tt/BgSrTN9

Le Royaume-Uni se lance dans la viticulture

from Les dernières actualités de Futura https://ift.tt/OGZpK6m

Revivez la présentation historique des premières images de James-Webb

from Les dernières actualités de Futura https://ift.tt/otYfBnS

Derniers jours pour découvrir l’ordinateur portable Pavilion 14 de HP et sa remise de 400 € pour les soldes !

from Les dernières actualités de Futura https://ift.tt/W8usMdc

La comète géante K2 vient de faire son passage au plus près de la Terre

from Les dernières actualités de Futura https://ift.tt/4aIQpqz

La carte d'identité bientôt sur smartphone

from Les dernières actualités de Futura https://ift.tt/PnIABhY

Le Mag Futura : l'IA peut-elle devenir vraiment intelligente ?

from Les dernières actualités de Futura https://ift.tt/2wpGstx

vendredi 15 juillet 2022

Phishing : une attaque contourne l’authentification à deux facteurs

from Les dernières actualités de Futura https://ift.tt/0RlYWgz

Déménager en été : est-ce le bon moment pour le faire ?

from Les dernières actualités de Futura https://ift.tt/sLBeMT6

Des microalgues pour lutter contre le réchauffement climatique

from Les dernières actualités de Futura https://ift.tt/08ZA5K4

Faites le plein d’idées cet été avec le Mag Futura à un prix exceptionnel !

from Les dernières actualités de Futura https://ift.tt/7XoO5Fp

jeudi 14 juillet 2022

US environmentalists take aim at British Columbia mines

American environmental groups are taking aim at British Columbia’s “industrial gold rush” and calling on President Joe Biden to call on the Canadian government to ban tailings dams.

Four American environmental groups are pointing to a report commissioned by the BC Mining Law Reform and SkeenaWild Conservation Trust that analyzes the risks of tailings pond failures in B.C.

They are zeroing in on two mines in particular – one already in operation, Copper Mountain in southern B.C., and one proposed, the KSM mine in northwestern B.C.

“One major threat to U.S. waters is the Copper Mountain copper mine, located just 25 miles from the Washington border on the Similkameen River, which feeds into the Columbia River watershed,” the groups say in a press release.

“Mine operators have proposed a plan to increase the height of one of its tailings dams to 853 feet — 250 feet higher than Seattle’s Space Needle. This would make the Copper Mountain Mine tailings dam the second tallest in the world.”

As for the KSM mine proposal, the large gold-copper mine would be located close to the Alaskan border, so there are concerns about the impact of a tailings pond failure on American rivers and fish.

“British Columbia’s industrial gold rush at the headwaters of rivers that flow into Alaska is a ticking time bomb and we are sitting ducks” said Breanna Walker, director of Juno-based Salmon Beyond Borders.

“That’s why communities around Southeast Alaska are asking President Biden to urge a ban on these mine waste dams along the headwaters of our wild salmon strongholds.”

B.C. has become an easy target for environmentalists concerned about mining. For one thing, B.C. has been experiencing a boom in both exploration and mine development, notably in northwestern B.C. – known as the Golden Triangle.

B.C. was also the location of one of the most significant mine tailings pond failures in recent history. In 2014, a tailings pond for the Mount Polley mine collapsed, flooding local waters with water and mine slurry.

That disaster prompted a special expert panel review and a number of regulatory changes aimed at improving tailings pond design, management and safety. That included regulations requiring mines to establish Independent tailings review boards, have an engineer of record responsible for tailings facilities design, conduct and report on annual dam safety inspections, and conduct regular dam safety reviews.

The Mount Polley disaster also prompted the BC Mining Law Reform and Skeena Wild Conservation Trust to create a new database of tailings ponds in B.C.

The recent report, by Steven Emerman of Malach Consulting, uses the database to examine sites that might pose the greatest risks, should they experience a tailings pond failure.

“The 86 sites containing at least one tailings storage facility in British Columbia include 57 sites that are closed or under care and maintenance, 18 operating sites, and 11 proposed sites,” the report notes.

“Out of 86 sites containing tailings storage facilities, 54 are located directly within salmon habitat.”

Emerman’s report examines three main risks that might contribute to dam failure: dam height, high seismicity and designs that use upstream dam construction.

Upstream dam construction does not refer to its location to rivers. Rather it is an approach in which a starter dam is first built, and then gradually raised, upstream of the starter dam, using tailings.

These upstream designs can be be less stable than other designs, according to the engineering firm Klohn Crippen Berger. Mine operators have therefore been moving away from upstream dam construction to centerline design or, in some case, modified centerline.

The KSM tailings facility would use centerline design, with four dams and three cells, with the middle cell isolating any mine waste with acid generation potential, and multiple drainage ditches and tunnels around the facility to divert water from the dam. It’s the sheer height of the KSM tailings pond dams that makes it a concern, according to Emerman’s report.

The environmental groups in their news release say the KSM dams would ultimately be built as high as 784 feet.

“The tailings facility could hold up to 2.6 billion metric tons of wet tailings, the equivalent of 460,000 Olympic-size swimming pools,” the press release says.

Emerman’s report uses three rankings for risk — high, very high, and extreme — corresponding to potential loss of life.

“It should be noted that, although the tailings dam failure at the Mount Polley mine was one of the greatest environmental disasters in Canadian history, its failure consequence category was only in the Significant category because there was negligible potential for loss of human life,” the report notes.

The report identifies five mines or proposed mines that it considers to have extreme risk ratings: Copper Mountain, Gibraltar, Highland Valley Copper, New Afton and KSM. It also identifies one closed mine operation, Brenda, in the extreme risk category.

“The sites in this failure consequence category include two operating sites with upstream dams (Copper Mountain and Gibraltar –TSF),” the report notes.

“In both cases, the tailings storage facility with the upstream dam is the same as the tailings storage facility with the Extreme consequence rating, which is a disturbing combination of unacceptable probability of failure and unacceptable consequences of failure.”

Following the Mount Polley tailings pond failure, the B.C. government required all proposed mines to review their tailing facilities designs.

Seabridge Gold (TSX:SEA) formed an Independent Geotechnical Review Board comprised of experts in tailings management, and submitted the KSM tailings pond proposal to a Best Available Tailings Technology (BATT).

“This study confirmed that the existing tailing management facility design is the best available technology for tailings deposition and the most environmentally responsible plan to minimize long term risks associated with the proposed tailing storage facility for the KSM Project,” Seabridge says in an email to BIV News.

If built, the dam would be subject to ongoing reviews, Seabridge says.

“KSM’s TMF will be regulated and monitored in compliance with the Canadian Dam Safety Association (CDA), International Commission on Large Dams (ICOLD), International Council on Mining and Metals (ICMM), Mining Association of Canada (MAC), and Engineers and Geoscientists BC (EGBC), along with regular reviews by an eight-member Independent Geotechnical Review Board.”

As for Copper Mountain, the company’s chief operating officer, said the company is “confident in the robustness of our tailings design and operation.”

“The Copper Mountain Tailings Management Facility (TMF) is designed and managed to the high standards established for B.C. tailings management facilities, and to the high professional and ethical standards required of BC Qualified Professionals,” he writes in an email.

“We are transparent with our TMF designs and performance reports, which are available on our web site, and which we also review with our Community of Influence. We encourage the use of facts and science.”

The Mining Association of BC (MABC) takes issue with Emerman’s report.

“Unfortunately, this report appears to either ignore the facts or mislead British Columbians about key aspects of our province’s mining laws and regulation,” said MABC president Michael Goehring. “The report fails to consider how BC tailings facilities use design and engineering requirements and best available technology to mitigate risk.

“Importantly, tailings storage facilities are already designed to withstand extreme weather and seismic events, and any suggestion otherwise is wrong or deliberate fear-mongering. In 2021, the independent BC Chief Auditor of Mines released an audit that determined BC’s regulations for mine tailings are among the best in the world.”

(This article first appeared in Business in Vancouver)

from MINING.COM https://ift.tt/u8tEfey

Canicule : quelle température limite peut supporter le corps humain ?

from Les dernières actualités de Futura https://ift.tt/12hspgt

L'histoire de la mystérieuse roche martienne « Black beauty » vient d'être révélée

from Les dernières actualités de Futura https://ift.tt/8BV6kYq

Images impressionnantes de l'effondrement soudain d'un glacier au Kirghizistan

from Les dernières actualités de Futura https://ift.tt/qlZ6cdu

Voici les 5 raisons de vous abonner à Futura cet été

from Les dernières actualités de Futura https://ift.tt/Tqk5QBu

Nous ne sommes pas les seuls mammifères à cultiver notre nourriture : eux aussi !

from Les dernières actualités de Futura https://ift.tt/ElpmNxh

mercredi 13 juillet 2022

Découvrez l’ordinateur portable Pavilion 14 de HP et sa remise de 400 € pour les soldes !

from Les dernières actualités de Futura https://ift.tt/PWlU2Ed

En images, 7 trombes marines qui se forment en même temps !

from Les dernières actualités de Futura https://ift.tt/NK6Lf2x

Premières images de James-Webb : le replay du live événement de Futura

from Les dernières actualités de Futura https://ift.tt/HEI3d81

James-Webb : les premières images ouvrent une nouvelle ère de l'astronomie

from Les dernières actualités de Futura https://ift.tt/qANSyeb

Du nouveau sur la formation de la Terre et de toutes les planètes du Système solaire

from Les dernières actualités de Futura https://ift.tt/VMaeEIx

Le Mag Futura : « Quels mystères nous cache encore la Lune ? »

from Les dernières actualités de Futura https://ift.tt/rEL5nMS

mardi 12 juillet 2022

CSIRO contracted to plan environmental monitoring for deep-sea nodule collection

The Metals Company (Nasdaq: TMC) announced Tuesday that its Australian subsidiary, The Metals Company Australia Pty Ltd., has entered into a research funding agreement with a consortium of institutions led by Australia’s Commonwealth Scientific Industrial Research Organisation (CSIRO) to create a framework for the development of an ecosystem-based management and monitoring plan (EMMP) for its proposed deep-sea polymetallic nodule collection operations in the Clarion Clipperton Zone (CCZ) of the Pacific Ocean.

Mining international waters is in the spotlight as companies and countries are looking at minerals concentrated on the ocean floor that can be used in batteries for smart phones and electric vehicles. Last year, TMC said the nodule resource is now estimated at four megatons (Mt) measured, 341Mt indicated and 11Mt inferred mineral resources.

The CSIRO-led consortium, which includes leaders in the development and application of effective EMMPs in a diversity of marine areas, will leverage TMC’s environmental baseline data — acquired in the NORI project area in the CCZ — to help develop appropriate indicators and tolerance limits to create safe parameters for collecting seafloor nodules, the company said in a news release.

The work will form the scientific foundation of TMC’s future Adaptive Management System (AMS), a predictive system that will use environmental and operational data to enable the company to mitigate operational impacts in the deep-sea environment as much as possible.

A core component of this system, the company said, will be the Digital Twin, which is expected to provide scenario testing of seafloor mine plans, monitoring of nodule collection operations and a dashboard for review by stakeholders.

“Last year our subsidiary, NORI, completed environmental baseline studies in partnership with leading marine research institutions,” Gerard Barron, CEO of The Metals Company, said in the statement.

“We’ve now got one of the world’s most extensive deep-sea datasets to hand over to the CSIRO-led consortium, experts with the practical experience we need to develop a scientifically robust framework for a marine ecosystem-based management program for NORI-D.”

Environmentalists have called for a ban on deep-seabed mining that would extract resources including copper, cobalt, nickel, zinc, lithium, and rare earth elements from nodules on the ocean floor.

Development of technologies to collect polymetallic nodules first began in the 1970s when oil, gas and mining majors including Shell, Rio Tinto (Kennecott) and Sumitomo successfully conducted pilot test work in the Clarion Clipperton Zone (CCZ) of the Pacific Ocean, recovering over ten thousand tonnes of nodules, TMC said.

The polymetallic nodule fields in the CCZ of the Pacific represent the largest known, undeveloped nickel resource on the planet.

The Metals Company said it has invested significant resources in its deep-sea environmental baseline program, and in November 2021 the company entered into an agreement with Kongsberg Digital to develop a Digital Twin.

As TMC prepares for pilot nodule collector system trials in the CCZ later this year, the CSIRO-led research project will propel the development of a management plan focussed on the cumulative impacts of collecting nodules at a regional scale within the CCZ to enable TMC to operate within safe ecological limits, it said.

The company expects to employ the science-based framework developed by the CSIRO-led consortium in the Adaptive Management System — which will also draw on expert opinion and machine learning to improve operational efficiencies and reduce the uncertainty of environmental impacts over time — ahead of planned commercial operations expected to commence in 2024.

from MINING.COM https://ift.tt/bFEg8DM

Les champignons au service de l’agroécologie avec Mycophyto

from Les dernières actualités de Futura https://ift.tt/zaPKXGO

Une étrange mer bioluminescente observée en Indonésie

from Les dernières actualités de Futura https://ift.tt/XlgtbxK

Port du masque : pourquoi miser sur la responsabilité des Français est une mauvaise stratégie

from Les dernières actualités de Futura https://ift.tt/T7boLPI

[REDIFFUSION] L'orang-outan, un grand singe extrêmement futé !

from Les dernières actualités de Futura https://ift.tt/t2eHblQ

L'expansion de l'anticyclone des Açores provoque la pire sécheresse depuis plus de 1.000 ans dans la péninsule ibérique

from Les dernières actualités de Futura https://ift.tt/y6vzr87

lundi 11 juillet 2022

James-Webb : la première image montre l'Univers âgé de seulement 100 millions d'années !

from Les dernières actualités de Futura https://ift.tt/R0mbdBF

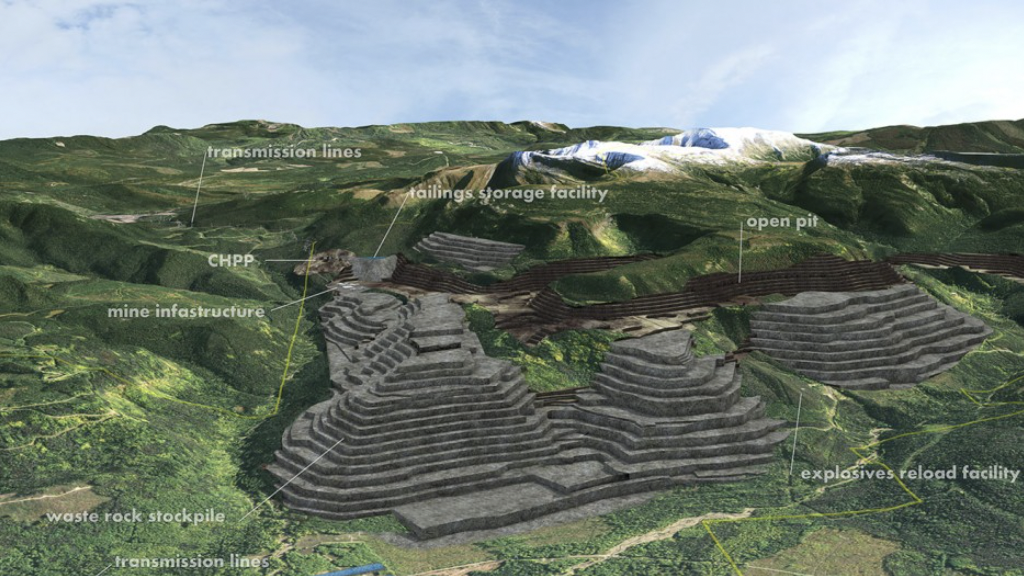

Seabridge Gold to spend $115 million this year prepping KSM mine in British Columbia

The company behind what is said to be the largest undeveloped gold-copper deposit in the world – the massive KSM project 65 kilometres northwest of Stewart, British Columbia – plans to spend C$150 million ($115m) this year preparing the massive project for development.

But Seabridge Gold (TSX:SEA) will need a joint venture partner with deep pockets to help build the mine, which has an estimated initial capital cost of C$8.3 billion ($6.4 bn). When sustaining capital is added, the total capital cost of the project is C$12.5 billion ($9.6 bn).

“KSM is the largest undeveloped gold-copper project in the world by resources,” Brent Murphy, Seabridge’s senior vice president of environmental affairs, told BIV News.

Seabridge has already spent C$480 million to move the KSM project through exploration, engineering and environmental permitting.

Earlier this year, Seabridge raised C$285 million through Sprott Resource Streaming and Royalty Corp. and the Ontario Teachers’ Pension Plan, and signed a power agreement with BC Hydro to supply the new mine with power.

Work is now underway to build a power substation that will provide the mine site with up to 250 megawatts of power from the Northwest Transmission Line. Construction of a new power transmission line to tie into the Northwest Transmission line is expected to begin next year.

Seabridge plans to spend C$150 million this year on infrastructure needed to prepare the new mine for development, and as much again next year. That includes things like building road access, work camps and a new bridge. Across the Bell Irving River. About 150 workers are currently employed.

“By the end of this year, we will probably have spent close to C$600 million on KSM,” Murphy said.

Some of the work going on now also includes fish habitat compensation work.

“These projects are designed to compensate for the impacts of building and bridge crossings on fish habitat,” Murphy said.

The work taking place this year and next is required by a provincial environmental certificate, approved in 2014, as it requires a substantial start on the project within a specified time period. Some of that work was delayed by the covid-19 pandemic, something acknowledged by the BC Environmental Assessment Office, which issued the company a two-year extension.

“The work is also designed to further de-risk the project further and make it more attractive to securing a joint venture partner,” Murphy said.

“Seabridge would not take this project through to full construction and start the mining operations. That’s not our strength. We are looking for a major mining company that has both the technical, financial and social sustainability wherewithal to operate this project from both an environmental and socially responsible mind-set.

“Seabridge is really good at de-risking projects, but our strength is not in operating projects.”

The KSM project (short for Kerr-Sulphurets-Mitchell) has been more than 20 years in the making. Seabridge bought the original claims from Placer Dome in 2000. Since then, additional deposits were discovered and added – the Mitchell deposit in 2007, Iron Cap in 2010, and East Mitchell in 2020.

It took nearly seven years for the KSM project to go through a federal-provincial environmental review process. Much has changed since the project received its environmental certificate in 2014. Initially, the proposal was to develop four distinct deposits of gold, copper, silver and molybdenum in a complex of open-pit and underground mines.

“We’re now focused primarily on an open pit mining approach on the deposits,” Murphy said. “We’re deferring any underground mining to a later date. The reason we’re focusing on open-pit mining is we’re simply trying to drive the best economics for the project.”

The mine site would be connected to a tailings facility some 23 kilometres away by a twin tunnel.

In 2014, KSM’s resources were estimated at 38.2 million ounces of gold and 9.9 billion pounds of copper. An updated estimate on proven and probable gold reserves has increased gold reserves by 22%, to 47.3 million ounces, due to higher gold grades from the East Mitchell deposit.

But the mine’s copper reserves have decreased to 7.3 billion pounds, and silver reduced to from 180 million ounces to 160 million ounces. That’s partly due to a change in the mining plans, which includes eliminating underground mining for deposits that are more copper-rich.

“We’re eliminating the underground operations in Iron Cap and Kerr, and hence why our drop in copper,” Murphy explained.

The project’s original estimated total capital cost — both initial and sustaining – has dropped from $10.5 billion to $9.6 billion.

“However, our initial capital has increased from $5 billion to $6.4 billion, primarily due to inflation,” Murphy said.

Seabridge has also increased its estimated annual production, which would shorten the mine’s life. Since the project was approved in 2014, Seabridge has increased its expected annual production of gold by 90%, copper by 22%, and silver by 36%. It plans to increase the mine’s mill throughput from 130,000 tonnes per day to 195,000 tonnes per day.

The increased throughput would reduce the mine life from 53 years to 33 years. As a result of the increased production volumes, Seabridge now estimates the payback period will decrease from 6.8 years to 3.7 years.

The company estimates building the mine would take a workforce of 1,550 annually over a five-year construction phase, and 1,400 jobs ongoing once in production. Seabridge has signed benefits agreements with the Nisga’a and Tahltan First Nations.

Seabridge’s stock value has dropped by more than 40% since mid-April, falling from C$27.05 per share April 14 to Monday’s price of C$14.81.

It appears to be part of a sector-wide decrease, as other gold companies, like Barrick Gold (TSX:ABX) and Newmont Gold (TSX:NGT), have likewise seen a steady declines in stock prices since mid-April. Market-watchers blame increasing U.S. treasury yields for the general decline in gold company stocks.

(This article first appeared in Business in Vancouver)

from MINING.COM https://ift.tt/sPAx4pO

Il y a 50 millions d’années, le fond de l’océan Atlantique était à 20 °C !

from Les dernières actualités de Futura https://ift.tt/xpJU0iF

Les briques de base de l'ARN au cœur de la Voie lactée

from Les dernières actualités de Futura https://ift.tt/H610nLS

L'expansion de l'anticyclone des Açores provoque la pire sécheresse depuis plus de 1.000 ans dans la péninsule ibérique

from Les dernières actualités de Futura https://ift.tt/y6vzr87

Population mondiale : combien d'humains la Terre peut-elle supporter ?

from Les dernières actualités de Futura https://ift.tt/jpF7cQO

Assez de la publicité sur Futura ? Découvrez nos abonnements en ligne !

from Les dernières actualités de Futura https://ift.tt/TOs35i0

dimanche 10 juillet 2022

Aurores, comètes, galaxies… : des photos à couper le souffle sélectionnées pour le grand prix

from Les dernières actualités de Futura https://ift.tt/XhfoCaQ

Se couper les cheveux à la pleine lune les aide à pousser plus vite, vrai ou faux ?

from Les dernières actualités de Futura https://ift.tt/QFc4yAx

L’Espagne et le Portugal subissent leur pire sécheresse depuis plus de 1.000 ans et ça va continuer !

from Les dernières actualités de Futura https://ift.tt/10pdkec

Est-ce le bon moment pour déménager ?

from Les dernières actualités de Futura https://ift.tt/Opm8Yok

Covid long : des foyers de virus cachés dans les intestins responsables de la persistance de symptômes ?

from Les dernières actualités de Futura https://ift.tt/dQipCxJ

samedi 9 juillet 2022

Portrait de Bérengère, agricultrice depuis 7 ans dans la culture de la betterave

from Les dernières actualités de Futura https://ift.tt/ulQaYh8

Effondrement du glacier en Italie : que s'est-il passé ?

from Les dernières actualités de Futura https://ift.tt/kdFmpx7

Voici à quoi ressemble un proton

from Les dernières actualités de Futura https://ift.tt/SALuB8D

Enquête : quels sont les critères de développement durable des français ?

from Les dernières actualités de Futura https://ift.tt/mHbNWZl

vendredi 8 juillet 2022

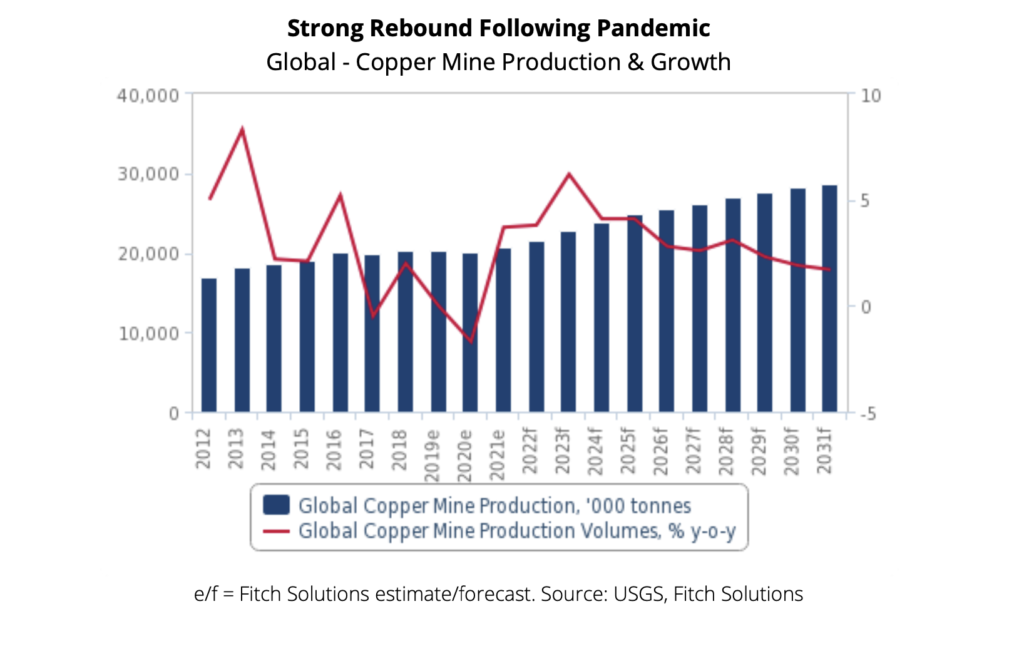

Copper production, price rebound on the horizon — report

Global copper mine production over the next few years is slated to be strong as a number of new projects and expansions come online, supported by rising copper prices and demand, market analyst Fitch Solutions asserts in its latest industry report

Fitch forecasts global copper mine production to increase by an average annual rate of 2.8% over 2022-2031, with annual output rising from 24.6mnt in 2022 to 31.0mnt by 2031.

Leading project development are mainly large-scale miners, including BHP and Teck Resources, which have been attracted to Chile, the world’s top copper producer, due to the country’s well-developed infrastructure and history of stability.

Fitch’s 2022 growth forecast is primarily underpinned by the ramp up of BHP’s Spence Growth Option project. First production occurred in December 2020 but the ramp up has been delayed due to covid-19.

As of May 2022, the ramp up to full production capacity is ongoing, following which Spence is forecast to average 300 ktpa of production (including cathodes) over the first four years of operation.

Growth following 2021 will also benefit from the delayed project ramp ups and some operational recovery at Escondida. Fitch expects lower than usual output through the 2022 fiscal year (ending June 2022) as a result of current workforce levels.

Meanwhile, Teck Resources’ Quebrada Blanca Phase 2 project is expected to begin production over the second half of 2022. Project development was delayed by five-to-six months due to the pandemic and has since restarted. The company estimates copper production over the first five years will average 286kt per annum. Teck is also looking into a third phase for the project, which could significantly boost capacity in the longer term.

In May 2021, Chilean copper miner Codelco announced that it was readying to commence the construction of the Rajo Inca project which is valued at $1.38 billion. Codelco intends for the project to overhaul its Salvadore mine and add 47 years to the lifespan of the mine.

Codelco reports that it planned to reach production of 90.0kt in the first half of 2023. The Rajo Inca project will create 2,476 new jobs with an average workforce of 973 people per day. The project is part of Codelco’s 10-year $40 billion initiative to upgrade ageing mines; and Fitch notes this initiative will play into the expected increase in copper production which comes as a result of new projects.

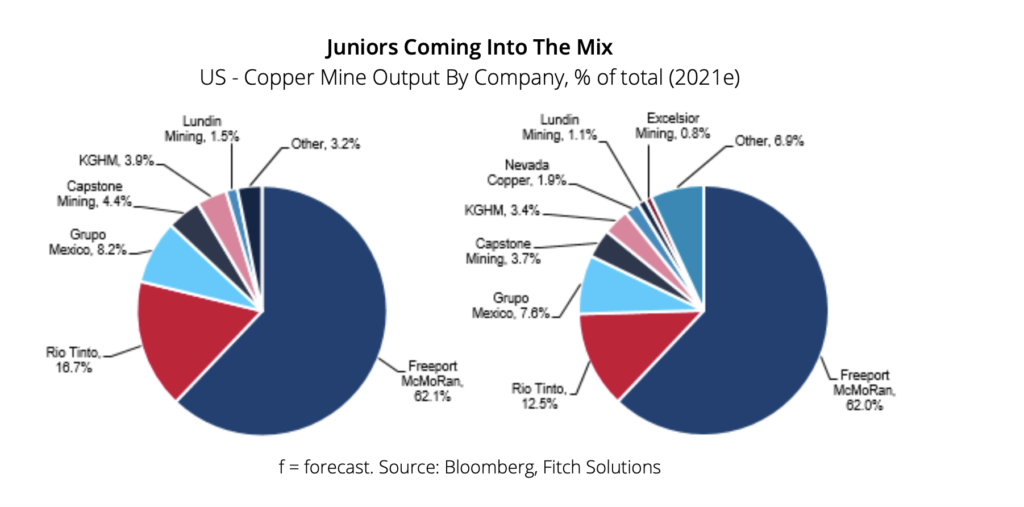

United States

The US has a high ratio of new (39) to operational (15) projects which meet the scale criteria for inclusion in Fitch’s Global Mines Database, and the analyst suggests that a number of key projects are likely to move to production in its forecast period out to 2031.

Production growth is likely to accelerate in the second half of the decade as these projects ramp up and others begin operations, Fitch says, though it notes that the current administration’s renewed focus on environmental scrutiny for projects may delay some investment.

A bullish view on copper prices will incentivise firms within US’s well-supplied project pipeline to push forward with project development, Fitch predicts.

Over the coming years, Fitch forecasts high copper prices on the back of a bullish demand outlook. As prices rise, the economics of copper mining projects will become increasingly attractive to investors, which in some cases have faced relatively high production costs.

The country’s largest copper miner Freeport McMoRan announced in July 2021, as part of its H121 report, that it successfully completed the initial development of the Lone Star copper leach project in the second half of 2020 and achieved design capacity approximating 90kt annually.

Other projects include new junior entrants Nevada Copper and Excelsior Mining. While both of their respective projects faced setbacks in their timeline due to covid-19 headwinds, Fitch expects them both to ramp up output over 2022 as restrictions loosen.

(Read the full report here)

from MINING.COM https://ift.tt/pv4GMoO

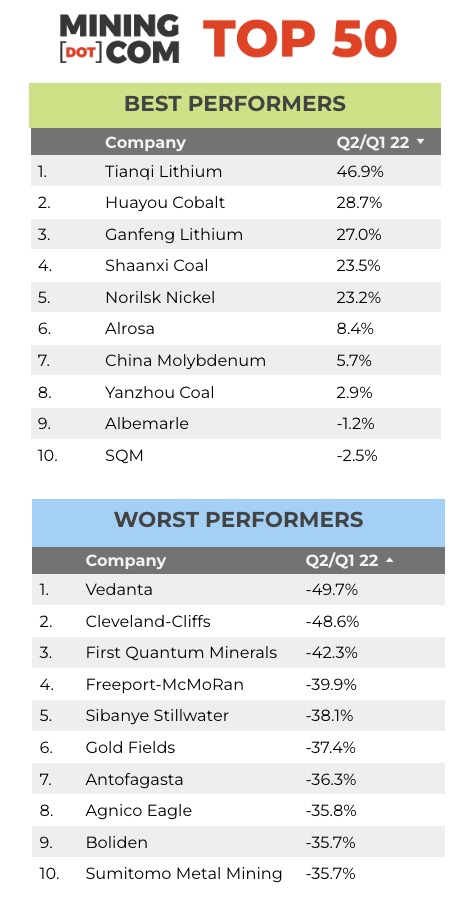

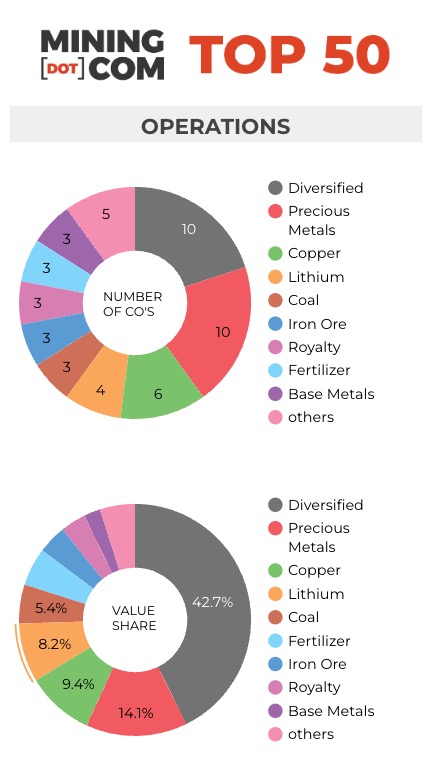

Top 50 mining stocks lose $1.2 trillion in market value from peak

After a brutal second quarter, investors in the world’s 50 biggest mining companies are in full retreat as metal prices slump and uncertainty grips the sector.

Extreme volatility on metal and mining markets intensified in the second quarter and after hitting record highs in March, copper, nickel, aluminium, zinc and tin went into meltdown mode over the three months to end June.

Copper is trading at its lowest since November. After soaring above $200 this time last year iron ore prices are again coming dangerously close to double digits.

Despite historically low stockpiles – 700kt vs 2.4m tonnes a year ago – industrial metals continue to be hammered down. Nickel’s wild ride ended up going nowhere with the price of the stainless steel ingredient back to where it started the year.

After initially offering safe harbour for investors, gold has now also succumbed to weakness dropping to nine month lows this week.

While prices for lithium have held not far off recent all-time highs, stock prices have not. The Ukraine war lit a fire under PGMs, only to give up those gains and more.

Tough at the top

As fear overtook greed in Q2, MINING.COM’s TOP 50* ranking of the world’s most valuable miners fell by $383 billion – based on primary exchange share price movements converted into US dollars – over the course of the second quarter and are now worth $1.37 trillion, down from a peak of $1.75 trillion at the end of March this year.

As an indication of just how volatile the market has become and how much sentiment has changed over the last three months measured from the stocks’ 52-week highs, mining’s top tier stocks lost a stunning $1.26 trillion.

The top 10 mining companies lost a combined $600 billion – with BHP one of the worst performers. At the end of June, nervous investors had shaved more than $110 billion, or 44% from the market value of the world’s largest miner since the stock hit a record high little less than a year ago (and came within an inch of that level again in April).

Among the heavyweights, pureplay copper producers were hardest hit and most of those losses came in the past couple of weeks.

Freeport, the world’s number two copper producer behind Chile’s state-owned Codelco, has lost 30% year-to-date while Southern Copper, Antofagasta, First Quantum and Jiangxi are all down 20% or more.

Cool coal

After spending time outside the top 10 last year, Glencore just pipped Vale’s market cap at the end of June to become the world’s third most valuable mining company. Unlike its peers, Glencore has not abandoned coal mining amid a spike in prices, and its trading arm is benefiting from sky high prices for energy, helping the Swiss firm stay in the black year to date.

Coal companies are the best performers on the index – with Shaanxi Coal and Yanzhou Coal both up more than 65% this year and the world’s top producer, Coal India, also enjoying a bull market, up nearly 20% in 2022.

While coal producers did well across the board, the top performer year to date and Chile’s sole entry into the ranking is lithium extractor SQM.

Russian resilience

While trading on Western markets in Russian stocks have been halted, the country’s miners, much like the rouble and the Moscow Stock Exchange, have proved resilient.

While there is a measure of artificiality to the valuation of the likes of Norilsk Nickel because of captive investors on the MCX, it is remarkable that the palladium, nickel and copper producer has managed to show gains so far in 2022 and strong gains in Q2 after the resumption of trading.

Diamond giant Alrosa also returns to the ranking thanks to a robust quarter, and Polyus is just in positive territory YTD.

Chinese cheer

With the addition of Huayou Cobalt at position no 23, the combined value of miners from China has now surpassed that of the US at $236 billion versus $185 billion. The market worth of the country’s miners was boosted by coal and lithium mining, with Tianqi and Ganfeng both jumping in value in the second quarter.

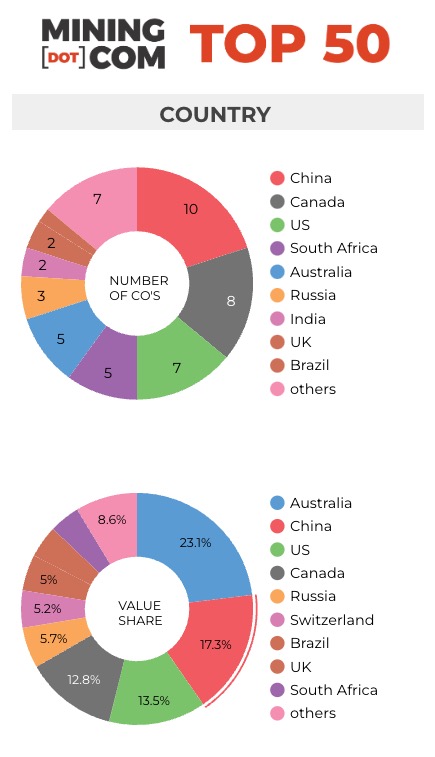

In terms of numbers, China now also has the most firms represented at ten, followed by Canada, the US and South Africa. Australia is down to 5 representatives after lithium company Mineral Resources had to make way for uranium giant Kazatomprom, which returns to the ranking based on units in the company trading in London.

*NOTES:

Source: MINING.COM, Miningintelligence, Morningstar, GoogleFinance, company reports. Trading data from primary-listed exchange at June 30, 2022 where applicable, currency cross-rates July 4, 2022.

Percentage change based on US$ market cap difference, not share price change in local currency.

Market capitalization calculated at primary exchange from total shares outstanding, not only free-floating shares.

As with any ranking, criteria for inclusion are contentious issues. We decided to exclude unlisted and state-owned enterprises at the outset due to a lack of information. That, of course, excludes giants like Chile’s Codelco, Uzbekistan’s Navoi Mining, which owns the world’s largest gold mine, Eurochem, a major potash firm, Singapore-based trader Trafigura, and a number of entities in China and developing countries around the world.

Another central criterion was the depth of involvement in the industry before an enterprise can rightfully be called a mining company.

For instance, should smelter companies or commodity traders that own minority stakes in mining assets be included, especially if these investments have no operational component or warrant a seat on the board?

This is a common structure in Asia and excluding these types of companies removed well-known names like Japan’s Marubeni and Mitsui, Korea Zinc and Chile’s Copec.

Levels of operational or strategic involvement and size of shareholding was another central consideration. Do streaming and royalty companies that receive metals from mining operations without shareholding qualify or are they just specialised financing vehicles? We included Franco Nevada, Royal Gold and Wheaton Precious Metals.

Lithium and battery metals also pose a problem due to the booming market for electric vehicles and a trend towards vertical integration by battery manufacturers and mid-stream chemical companies. Battery producer and refiner Ganfeng Lithium, for example, is included because it has moved aggressively downstream through acquisitions and joint ventures.

Vertically integrated concerns like Alcoa and energy companies such as Shenhua Energy where power, ports and railways make up a large portion of revenues pose a problem as do diversified companies such as Anglo American with separately listed majority-owned subsidiaries. We’ve included Angloplat in the ranking as well as Kumba Iron Ore.

Many steelmakers own and often operate iron ore and other metal mines, but in the interest of balance and diversity we excluded the steel industry, and with that many companies that have substantial mining assets including giants like ArcelorMittal, Magnitogorsk, Ternium, Baosteel and many others.

Head office refers to operational headquarters wherever applicable, for example BHP and Rio Tinto are shown as Melbourne, Australia but Antofagasta is the exception that proves the rule. We consider the company’s HQ to be in London, where it has been listed since the late 1800s.

Please let us know of any errors, omissions, deletions or additions to the ranking or suggest a different methodology.

from MINING.COM https://ift.tt/1keN0KC