vendredi 30 septembre 2022

Dreame L10S Ultra et Dreame H12, les aspirateurs qui font rêver baissent déjà leurs prix

from Les dernières actualités de Futura https://ift.tt/xfKTmR5

Octobre : éclipse partielle de Soleil et pluie d'étoiles filantes (Éphémérides #20)

from Les dernières actualités de Futura https://ift.tt/HWRTe6u

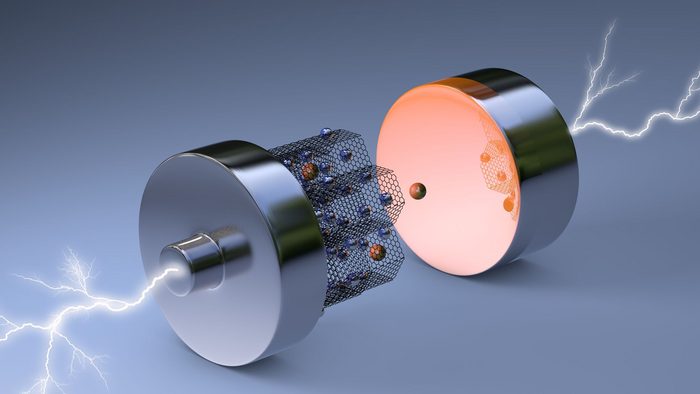

Thick electrodes may allow for EV fast-charging, range increase

Researchers at the University of Texas at Austin fabricated a new type of electrode for lithium-ion batteries that could unleash greater power and faster charging.

In a paper published in the journal Proceedings of the National Academy of Sciences, the scientists explain that they’ve produced thicker electrodes using magnets to create a unique alignment that sidesteps common problems associated with sizing up these critical components.

The result is an electrode that could potentially facilitate twice the range on a single charge for an electric vehicle, compared with a battery using an existing commercial electrode.

“Two-dimensional materials are commonly believed as a promising candidate for high-rate energy storage applications because it only needs to be several nanometers thick for rapid charge transport,” Guihua Yu, co-author of the study said in a media statement. “However, for thick-electrode-design-based next-generation, high-energy batteries, the restacking of nanosheets as building blocks can cause significant bottlenecks in charge transport, leading to difficulty in achieving both high energy and fast charging.”

Yu explained that the key was to use thin two-dimensional materials as the building blocks of the electrode, stacking them to create thickness and then using a magnetic field to manipulate their orientations.

The research team also used commercially available magnets during the fabrication process to arrange the two-dimensional materials in a vertical alignment, creating a fast lane for ions to travel through the electrode.

According to Yu, typically, thicker electrodes force the ions to travel longer distances to move through the battery, which leads to slower charging time. The typical horizontal alignment of the layers of material that make up the electrode force the ions to snake back and forth.

“Our electrode shows superior electrochemical performance partially due to the high mechanical strength, high electrical conductivity, and facilitated lithium-ion transport thanks to the unique architecture we designed,” co-author Zhengyu Ju said.

In addition to comparing their electrode with a commercial electrode, they also fabricated a horizontally arranged electrode using the same materials for experimental control purposes. They were able to recharge the vertical thick electrode to 50% energy level in 30 minutes, compared with 2 hours and 30 minutes with the horizontal electrode.

The researchers emphasized they are early in their work in this area. They looked at just a single type of battery electrode in this research.

Their goal is, thus, to generalize their methodology of vertically organized electrode layers to apply it to different types of electrodes using other materials. This could help the technique become more widely adopted in industry, so it could enable future fast-charging yet high-energy batteries that power electric vehicles.

from MINING.COM https://ift.tt/RaSubZL

Mining People: First Phosphate, Newmont, Nouveau Monde, Trevali Mining

Management appointments announced this week:

Henri Tausch resigned as president and CEO of 5E Advanced Materials.

A.I.S. Resources named Martyn Element president and CEO.

Christopher Drysdale replaced Daniel Whittaker as CEO of Antler Gold.

Buscar Company appointed Jose Kreidler as its new president.

Jim Megann took over the interim CEO role at E-Tech Resources, replacing Daniel Whittaker.

First Phosphate appointed Peter Kent as president.

Guanajuato Silver Company appointed Reynaldo Rivera as VP exploration.

Nancy Buese will step down as EVP and CFO of Newmont.

Nouveau Monde Graphite nominated Anoop Singh as VP mining projects; Josée Gagnon as VP legal affairs and corporate secretary; and Kelly LeBlanc as manager Indigenous relations.

Platinum Group Metals announced the appointment of Greg Blair as CFO.

Rahul Paul stepped down as president and CEO of Radisson Mining Resources.

Nicholas Konkin replaced Tom Griffis as the president of Royal Coal.

Board moves include:

Adventus Mining appointed Stephen Williams and Leif Nilsson to its board following the departures of Paul Sweeney and Mike Haworth.

Daniel Whittaker will assume the position of executive chairman at Antler Gold.

Jose Kreidler became a board member at Buscar Company.

Endeavour Mining appointed Sakhila Mirza as an independent non-executive director.

John Herold, founder of Herold Supply as well as a founding board member of the Sudbury Area Mining Supply and Service Association, passed away.

Tom Griffis and Elia Crespo resigned as directors of Royal Coal. Joining the board is Nicholas Konkin.

Rusoro Mining appointed Anthony Beruschi as a director.

Anthony Taylor resigned as a director of Transforma Resources.

Trevali Mining directors Richard Williams, Jill Gardiner and Jeane Hull resigned.

from MINING.COM https://ift.tt/GfDLpIr

Atlantic Lithium aims to begin production at Ghana mine in 2024

Australia’s Atlantic Lithium (LON: ALL) (ASX: A11) is targeting first production at its Ewoyaa project in Ghana, which would be the country’s first lithium mine, in the second half of 2024.

The exploration and development company, which also has lithium projects in Ivory Coast, estimates the operation has the potential to generate nearly $5 billion in revenue over its 12.5-year lifetime.

Reporting financial results for the year 2022, the Africa-focused exploration and development firm highlighted its agreement with Piedmont Lithium (ASX, NASDAQ: PLL), which would allow Atlantic Lithium to fund Ewoyaa, via a staged earn in of $103 million, to production.

A pre-feasibility study of the project, released last week, projected a production of two million tonnes a year, an initial rate of return of 224% and payback in less than five months. An updated assessment will be published in early 2023.

READ NOW: RANKED — World’s largest clay and hard rock lithium projects

“We have long been confident of the considerable profitability that Ewoyaa offers, but the PFS provided valuable third-party vindication of our belief,” the company’s executive chairman, Neil Herbert, said in the statement. “It is also important to note that ongoing drilling is intended to grow the resource further.” Atlantic Lithium said it would submit its mining licence application for the project in the coming days.

The company started trading shares on the Australian Securities Exchange on Monday, four years after discovering Ghana’s first commercially-viable lithium deposit less than a kilometre off its national highway.

Ghana, known for its gold and cocoa production, has long sought to diversify its exports, and Atlantic Lithium, previously known as IronRidge Resources, believes that mining the battery metal could be a partial solution.

Prices for the ultra-light metal have soared past $70,000 per tonne this year as top automakers scramble to secure more supply to shift production from fossil fuel-burning engines to electric-powered vehicles.

IronRidge changed its name and demerged its gold assets into a separate company at the end of last year to focus on production of the battery metal, key for the batteries that power EVs and high tech devices.

from MINING.COM https://ift.tt/4JiCUOb

Être seul ou malheureux nous fait vieillir plus vite que la cigarette

from Les dernières actualités de Futura https://ift.tt/cFuXEPk

Des traces des toutes premières étoiles de l'Univers viennent d'être retrouvées

from Les dernières actualités de Futura https://ift.tt/hR8ogbD

Le plus grand organisme vivant sur Terre est en train de s'affaiblir

from Les dernières actualités de Futura https://ift.tt/YidQzt9

jeudi 29 septembre 2022

Veriphone, l'outil qui traque les logiciels espions sur smartphone

from Les dernières actualités de Futura https://ift.tt/b72U6iL

First Phosphate appoints Peter Kent as president

First Phosphate Corp. announced Wednesday that former journalist and Canadian Member of Parliament Peter Kent has been appointed to lead the company as president. Kent first joined the board as a director at its annual meeting in August.

Kent brings more than four decades of experience as an international broadcast journalist, reporter, and producer at CTV, CBC, NBC, Monitor, and Global. He was elected as the Member of Parliament for Thornhill, Ontario in the 2008 federal election, a position he held until he chose to leave public office in 2021.

During his time in Parliament, Kent served as Minister of State for the Americas (2008-2011), and as Minister of the Environment (2011-2013). As Environment Minister, he was committed to responsible resource development and oversaw improvements to the environmental assessment process for Canadian mining projects.

“Peter’s decades of experience and unique blend of knowledge, insight, and dedication will be integral to the Company as we continue our growth trajectory to become a leading phosphate producer with a high-purity, ESG-compliant resource,” said CEO John Passalacqua in a statement.”

“Canada has an opportunity to be a global leader in the sustainable automotive ecosystem through a consistent and secure battery grade phosphate supply source right here in Quebec,” said Kent. “I am excited to take on this new challenge and work with John and the rest of the experienced First Phosphate team to develop our Quebec deposits and advance Canada’s climate change goals, while supporting long-term growth in the Saguenay region.”

First Phosphate holds over 1,500 sq. km of total land claims in the Saguenay Region of Quebec, Canada that it is actively developing to produce battery grade phosphate.

from MINING.COM https://ift.tt/6kYdygc

Niobium could be key to supercapacitators

New research from Umeå University proposes the idea of using niobium molecules as building blocks to design electrochemical energy storage materials.

In detail, researcher Mark Rambaran says solid materials can be produced from aqueous solutions containing nano-sized niobium molecules. The molecules are called polyoxoniobates.

“These polyoxoniobates are water-soluble and can be synthesized in large volumes. They act as molecular building blocks, in the same way as when a child stacks Lego bricks,” Rambaran said in a media statement. “They can be used to make a wide range of materials, including supercapacitors that facilitate lithium-ion storage.”

According to the scientist, the synthesis of polyoxoniobates can be done with microwave irradiation because it is a rapid and efficient alternative to conventional hydrothermal methods.

“They can be made in 15 minutes using microwave irradiation, which is much shorter than the 18 hours needed in previous hydrothermal methods,” Rambaran said.

He explained that the nanometer-sized molecules can be dissolved in water and spin-coated to deposit thin films of niobium pentoxide. When these films are heated to temperatures ranging from 200 to 1200°C, surfaces with varying corrosion resistance and electrochemical properties are obtained.

At higher temperatures, the films become crystalline and resistant to very basic conditions—and they are always resistant to acids. This approach facilitates the deposition of alkali-free, metal oxide thin films with varying crystallinity, thickness and roughness.

“This ability to create niobium pentoxide thin films allows for an ease in testing pseudocapacitive properties, for example, which helps in developing electrochemical energy storage devices, such as supercapacitors,” the researcher pointed out.

Due to the arrangement of the atoms in the crystalline niobium pentoxide, it creates channels that can easily accommodate the storage and release of lithium ions for more than a hundred thousand cycles. This is what makes it a supercapacitor, and it offers electrochemical energy storage that can potentially replace a typical lithium-ion battery.

Charging in 10 seconds

Lithium-ion batteries tend to have limited charge storage capabilities and long charge or discharge times of 10 minutes or more, while supercapacitors exhibit charging times as low as 10 seconds. The ability to quickly charge and discharge, allows supercapacitors to provide energy very quickly and efficiently.

Furthermore, the use of water-soluble polyoxoniobates offers an easy and benign method for creating metal oxide thin films, which prevents the use of harmful starting materials like niobium pentachloride or niobium pentafluoride.

“The interest in developing new materials for energy storage is guided by the necessity of mitigating climate change—the biggest and most urgent threat to humanity and the biosphere. To do this, improvement in the manufacturing of solar/fuel cells and batteries is necessary to enhance their electrochemical energy storage capabilities, while remaining environmentally friendly,” Rambaran said.

He believes that research focused on developing electrochemical energy storage devices or materials that exceed the current capabilities of lithium-ion batteries is therefore crucial.

Supercapacitors are considered suitable candidates to rival, if not replace, lithium-ion batteries in terms of electrochemical energy storage. Current applications of supercapacitors include uses in electric vehicles, hybrid electric vehicles, trams, trains, and consumer electronics.

from MINING.COM https://ift.tt/CTgyRAq

Les images incroyables du passage de l'ouragan Ian en Floride

from Les dernières actualités de Futura https://ift.tt/6rfUsWx

Première mondiale : de l’hydrogène vert produit en mer

from Les dernières actualités de Futura https://ift.tt/Be4n0aq

Réchauffement climatique : les montagnes ont perdu 15 jours d'enneigement depuis 40 ans

from Les dernières actualités de Futura https://ift.tt/nkabQ64

mercredi 28 septembre 2022

Researchers push for using metals to treat infections

Researchers at the University of Bern, the University of Queensland and other institutions demonstrated that 21 highly-active metal compounds containing cobalt, nickel, rhodium, palladium, silver, europium, iridium, platinum, molybdenum and gold can be used to treat fungal infections.

In a paper published in the journal JACS Au, the scientists explain that, globally, more than 1 billion people contract a fungal infection and that although they are harmless to most, over 1.5 million patients die each year as a result of such infections.

According to the group led by Angelo Frei, despite more and more fungal strains becoming resistant to one or more of the available drugs, the development of new drugs has come to a virtual standstill in recent years. This lack of interest is what inspired him and his colleagues to look into using metals to breathe new life into the search for treatments.

“The opinion that metals are fundamentally harmful to us is widespread. However, this is only partially true. The decisive factor is which metal is used and in which form,” Frei said in a media statement. “Many of the metal compounds [tested] demonstrated a good activity against all fungal strains and were up to 30,000 times more active against fungi than against human cells.”

The researcher said that out of the 21 compounds, the 11 most active ones were tested in a model organism, the larvae of the wax moth. Only one of the metal compounds showed signs of toxicity, while the others were well tolerated by the larvae. In a subsequent step, some metal compounds were tested in an infection model, and one compound effectively reduced the fungal infection in larvae.

“Our hope is that our work will improve the reputation of metals in medical applications and motivate other research groups to further explore this large but relatively unexplored field,” Frei said. “If we exploit the full potential of the periodic table, we may be able to prevent a future where we don’t have any effective antibiotics and active agents to prevent and treat fungal infections.”

from MINING.COM https://ift.tt/mWbUVJS

James-Webb : grâce aux lentilles gravitationnelles il verrait bien des galaxies 250 millions d'années après le Big Bang

from Les dernières actualités de Futura https://ift.tt/o5rQ3sg

Fuites de Nord Stream : que faire des millions de mètres cubes de gaz qui s’échappent des gazoducs ?

from Les dernières actualités de Futura https://ift.tt/nTEBurz

Révélations d'un diamant rare sur l’eau dans les profondeurs de la Terre

from Les dernières actualités de Futura https://ift.tt/9OcEaD6

Regardez comment l’astéroïde réagit à la collision avec la sonde Dart

from Les dernières actualités de Futura https://ift.tt/vqu1AUC

Le stress modifie la perception que vous avez de votre moitié, et ce n’est pas en bien !

from Les dernières actualités de Futura https://ift.tt/x1CsiIe

mardi 27 septembre 2022

Equinox Partners takes a stand against mining’s nonaligned directors

When Equinox Partners Investment Management adopted a strict voting policy against industry directors who have served for two or more years but have invested less than two years of director’s fees into the underlying equity, it took a stand for shareholder value rarely seen in the junior space.

The New York-based hedge fund, with over $700 million in total assets under management with more than half in gold and silver junior miners, announced its new investment stewardship policy toward directors of public companies last month.

It sets “a clear, lower-bound for director share ownership,” according to chief investment officer Sean Fieler.

He said Equinox Partners intends to push back on the growing indifference of boards to non-executive director stock ownership and the decision of some companies to prohibit non-executive directors from owning stock altogether.

“We have seen a troubling deemphasis of financial alignment among international mining companies,” Fieler said in an interview.

The executive underlined that the company was not acting as an activist investor, but looking out for its interests as a long-term value investor.

Equinox has put in a rigid policy of not voting for directors, even if they’re running in an uncontested election.

“If those directors don’t own at least a very lower bound of stock, which we determined to be two years of their board compensation if they served for two years or more, and we feel like that’s an incredibly generous, probably too low, lower bound, they have really a different view of the role of a director than we do,” he said.

“The policy gets that 10% of the very worst actors.”

By elevating individuals who do not own stock and are unlikely to acquire a significant financial interest in the company they oversee, the board is adding colleagues who will tend to prioritize “collegiality” and “reputation” over its company’s financial interests, particularly in the junior gold space, the executive argues.

‘Clubby’ boardrooms

Fieler said he had witnessed declining levels of insider ownership at the GDX across a swath of companies in the last seven years.

“You see a meaningful drop in insider ownership, and we really see a growing number of boards treating a director position as really a technocratic slot to fill rather than a technically competent person that’s going to be aligned with shareholders, and we think that’s problematic,” he said.

Fieler points to Gold Fields’ (NYSE: GFI; JSE: GFI) proposed acquisition of Yamana Gold (TSX: YRI; NYSE: AUY) as a “particularly interesting wrinkle on this whole problem.”

The context of the Yamana deal is an excellent example of how when one works through the list of reasons to pursue a merger, the valuation is not amongst them, he argues.

And if one has a majority on the board that has no alignment with shareholders, it spells trouble for investors.

Since the Johannesburg-based miner approached its target, shareholders have criticized the proposed all-stock merger, arguing the friendly approach does not guarantee growth and profitability.

Fieler notes Gold Fields’ case as being peculiar in its policy, stating non-executive directors shouldn’t have alignment with shareholders so they can better represent all stakeholders.

“It’s very much not a random thing that is happening in that case – it’s kind of a natural outcome of a potential policy to disentangle the company’s owners from the board. It’s more so than has usually been done in the ‘clubby’ nature of boardrooms,” said Fieler.

“That seems like a particularly extreme example, but something we think is deeply misguided.”

While there is no law against having a ‘clubby’ a boardroom, according to Fieler, boards and chairs of boards don’t want dissidents in the boardrooms. It makes it harder to govern those companies.

“But as a general rule, in the junior mining space, we don’t see an effort on the part of insiders to invite shareholders onto the board or substantial shareholders under the board,” said Fieler.

“That’s not the norm. And because of that, you can really get divergent interests between the shareholders, even substantial shareholders and insiders at these companies. And then that leads to various unattractive behaviours from a shareholder perspective.”

from MINING.COM https://ift.tt/iyaKdI6

Le koala pousse des cris vraiment étranges

from Les dernières actualités de Futura https://ift.tt/RT01YpJ

Comment Windows 11 protège votre mot de passe principal

from Les dernières actualités de Futura https://ift.tt/en6vBYk

ExpressVPN lance Aircove, un routeur Wi-Fi 6 avec protection VPN intégrée

from Les dernières actualités de Futura https://ift.tt/6tYdMyv

VIH : Un patient reçoit le premier traitement basé sur Crispr-Cas9

from Les dernières actualités de Futura https://ift.tt/IAFEgca

lundi 26 septembre 2022

Diversification is the new mining buzzword

It appears the days of being a “one trick pony” mining company are numbered. As global growth slows and talk of a recession becomes louder, falling metal prices, including gold, which recently scraped a two-year low, are forcing companies to play defence, as they seek to maintain profit margins during what could be a prolonged downturn.

The defensive strategy involves diversification, and while that is nothing new — BHP, traditionally an iron ore miner, branched out to copper as far back as 1996, with the $3.2 billion purchase of Magma Copper and its San Manual copper smelter in Arizona, while Barrick Gold’s CEO Mark Bristow in 2020 mulled purchasing the second-largest copper mine in the world, Indonesia’s Grasberg — the current economic conditions are accelerating the trend.

According to Newmont’s CEO Tom Palmer, along with “a very volatile economic environment” including inflation, interest rate hikes and the war in Ukraine, gold miners are facing cost inflation in labor, fuel and energy, as well as materials and consumables, “continuing into the better part of 2023.”

Shaun Usmar, CEO of Triple Flag Precious Metals Corp, was quoted by Bloomberg saying that current hawkish measures being pursued by central banks, i.e., aggressive monetary tightening to bring down inflation, which has lifted bond yields and the dollar, pushing gold prices down, could make it challenging for single-asset producers and development companies that may not have the financing means to absorb costs and increase capital.

For these companies, the equity markets aren’t accessible, and if they are, it’s very expensive and dilutive. Such an environment leaves room for mergers and consolidations, especially for miners with cash and a need to grow, said Usmar, who was Barrick’s CFO from 2014-16.

Last week, the Globe and Mail reported Agnico Eagle Mines is teaming up with Teck Resources to buy a copper-zinc project in Mexico, in what would be a major departure from precious metals for Agnico.

The Toronto-based company, with stock symbol AEM, has gold and silver operations in Canada, Australia, Finland and Mexico, including Canada’s largest gold mine, Canadian Malartic, and the Meadowbank Complex, located in Canada’s far northern Nunavut territory.

Agnico Eagle said last Friday it will pay USD$580 million for a 50% share in Teck’s San Nicolas copper-zinc mine in Zacatecas, Mexico.

The Globe notes that AEM, Canada’s second-biggest gold producer, is currently heavily weighted to precious metals production (about 99%), but once San Nicolas starts up, precious metals would fall to 87% of the company’s output.

Agnico is not alone in increasing its exposure to copper and other green-economy metals, including lithium, graphite and nickel. The latter, seen by investors as ESG-friendly, fit with another decision many mining companies are making, i.e., distancing themselves from “dirty”, old-economy materials like coal and oil.

Even the so-called experts are wrong about critical metals supply

Teck, for example, has said it is open to selling its stake in the Fort Hills heavy oil project in Alberta, and is actively looking at either unloading or spinning off its metallurgical coal unit. Meanwhile, the Vancouver-based firm is moving its business towards copper by building a major new copper mine in Chile, called Quebrada Blanca, or QB2.

About 20% of Barrick Gold’s production now comes from copper, and as mentioned, in 2020 CEO Mark Bristow indicated his interest in Grasberg, then US copper mining giant Freeport McMoRan’s flagship asset (the mine is now co-owned by Freeport and Inalum; the latter, a state-owned miner, becoming a 51% majority owner in 2018 through a $3.9B payment to Freeport and Rio Tinto).

At the time, Bristow said he believes copper will be “the most strategic metal on this planet” in a decade, due to its use in electric vehicles and other clean-energy applications.

The Financial Post reported in its Tuesday edition that Bristow several years ago engaged in unsuccessful merger discussions with Freeport-McMoran. The CEO reiterated his interest in the base metal. “Copper is probably the most strategic metal, and it’s geologically related to gold,” he said. “So if you want to become a world-leading gold company in the fullness of time, you are going to end up producing [copper].”

The Financial Post notes that if gold prices continue to slide, other gold miners may also look to make copper, zinc and other metals part of their portfolio.

While not a gold company, earlier this month Rio Tinto said it is willing to pay $4.2 billion to buy the 49% of Canadian producer Turquoise Hill Resources it doesn’t already own, effectively giving the Anglo-Australian multinational control of the massive Oyu Tolgoi copper-gold mine in Mongolia (Turquoise Hill owns 66% of Oyu Tolgoi, with the Mongolian government holding the remaining 34% interest).

Diversification hasn’t always been as important to mining companies. Miners in the mid-2010s basically ate each other and by shutting down exploration there was no accretive increase in reserves. After years of selling “non-core” assets, mining firms are coming around to realizing that diversification is good.

In a 2021 article, Investors Chronicle writes that, while companies that consolidated into one or two commodities took advantage of higher prices last year, any supply increase or demand deterioration in these markets could sink profits quickly.

To help guard against this, BHP (BHP) and Rio Tinto (RIO) have recently approved massive new projects outside their traditional areas. This marks a turning point in the sector.

BHP greenlit the Jansen potash mine in Saskatchewan, and Rio committed to building the Jadar lithium-borate mine in Serbia.

Smaller companies are also getting on board the diversification train. For example Hochschild Mining, a Peru-based gold and silver miner, in 2019 purchased a rare earths element project for $56 million.

Investors Chronicle said the latest round of diversification among major miners differs from the last mining boom, when the majors tried building non-iron ore projects that would address short and medium-term market conditions, such as oil and gas.

This time it’s different: BHP and Anglo are looking at population growth and more hungry mouths as drivers, while the lithium plan from Rio is largely based on forecast battery manufacturing capacity in Europe.

A report earlier this year from Fitch Solutions confirms that the mining majors are ramping up their diversification policies to capitalize on decarbonization trends.

For example, copper. It’s not an exaggeration to say that copper is essential to decarbonization; nothing happens without it. The continued movement towards electric vehicles is a huge copper driver. EVs use about 4X as much copper as regular internal combustion engine vehicles. It’s in the motor, the wiring, and the charging stations. Copper is also in the “smart grid” to get renewable energy to where it’s needed. The latest use for copper is in renewable energy, particularly in photovoltaic cells used for solar power, and wind turbines.

When it comes to diversification, however, Fitch Solutions says copper is “a particularly troublesome commodity” because of the combined effects of historically high prices (copper reached a record $5.02 a pound on March 6, though it has since fallen back to $3.14), expectations of strong demand growth (due to the electrification & decarbonization trend) and geographic concentration of production in countries that pose a significant risk for mining companies.

The top two copper producers, Chile and Peru, are both seeing a wave of resource nationalism, where governments try to exact a greater share of resource revenues through various means, such as higher royalties and export bans of raw ores, in favor of in-country processing.

In December, leftist candidate Gabriel Boric was elected president of Chile, on a mandate to impose higher taxes, sending a chill through the mining industry which argues the change will impede competitiveness. A vote is scheduled in Congress in the coming weeks.

Peru’s President Pedro Castillo has also proposed to raise taxes on the mining sector by at least 3%, which the country’s mining chamber says could cost USD$50 billion in future investments.

“We, therefore, expect most major miners will face significant impediments to pursuing diversification strategies focused on the acquisition of copper assets in the short- to medium-term unless they become less risk averse financially,” Fitch Solutions said.

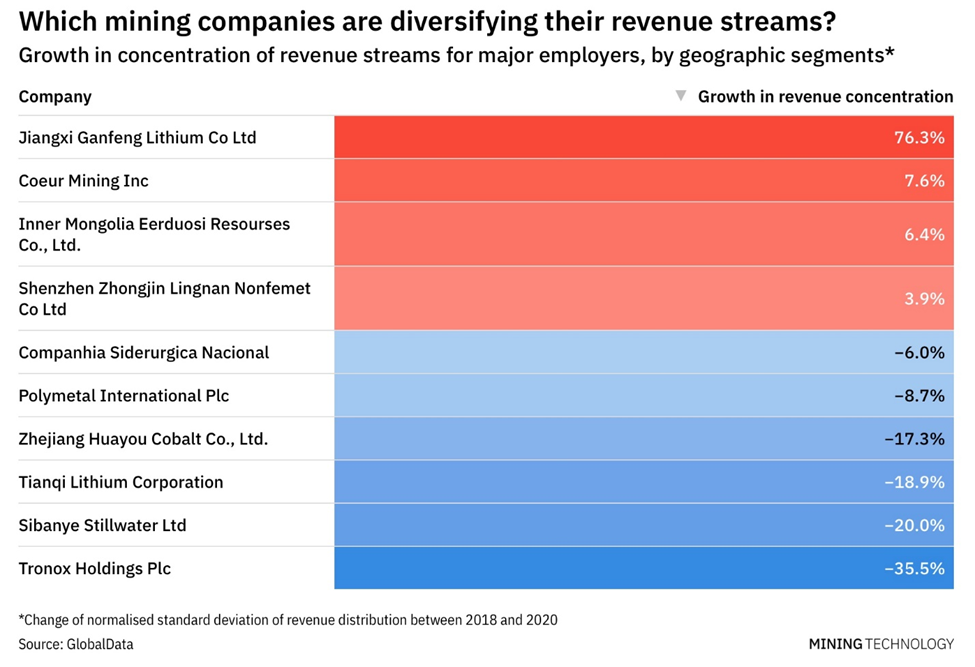

A GlobalData analysis of the extent to which mining companies are diversifying their revenue streams, found that supply chain disruptions caused by the covid-19 pandemic have shown the importance of geographic diversification of revenues. Lockdowns targeting specific sectors similarly demonstrated the value of maintaining a diverse product offering, says the analysis, via Mining Technology.

Out of Mexico, into Colombia

One example of geographic diversification caused not by covid, but resource nationalism, is the flight from Mexico, a major mining country that ranks as the world’s top silver producer, and Latin America’s biggest gold miner.

But government policies are scaring mining companies off. The Mexican government has stopped awarding new mineral concessions, nationalized lithium projects and restricted permitting to extensions of existing mines, Mining Weekly said.

BN Americas reports that mining companies are diversifying away from Mexico in a period of heightened political risk under leftist President Obrador. Two mining and exploration firms have exited the country while a further three mid-tier players have sold off significant assets. Four Mexico-focused companies have made acquisitions overseas, with many targeting Nevada, ranked by The Fraser Institute as the world’s third most attractive mining jurisdiction.

BN Americas points to Orla Mining’s acquisition of Gold Standard Ventures as the latest example of diversification away from Mexico. Orla, whose first mine Camino Rojo in Mexico began production last year, expects to build an open-pit heap leach operation at Gold Standard’s South Railroad gold project in Nevada.

Other Mexico exits include SSR Mining with its sale of the Pitarilla project to Endeavour Silver for USD$70 million in cash and shares; and ASX-listed Azure Minerals, which announced a deal to sell its Mexican assets to Bendito Resources for AUD$20 million.

Some firms took advantage of strong prices to sell their Mexican projects while retaining a strong presence in the country. They include Equinox Gold selling its Mercedes gold mine to Bear Creek Mining for $125M; Alamos Gold divesting its Esperanza gold project to Zacatecas Silver for about $60M; and US-based Coeur Mining’s sale of its La Preciosa primary silver project to Avino Silver & Gold Mines for up to $93.4M.

Also this year, First Majestic Silver announced a $35M deal to sell its La Guitarra primary silver mine to Sierra Madre Gold and Silver; following up on the April 2021 divestiture of Endeavour Silver’s El Cubo primary silver asset to Guanajuato Silver.

Like Orla Mining, First Majestic and Endeavour Silver are also viewing Nevada as a wise pivot from Mexico. The former closed its acquisition of the Jerritt Canyon mine in Nevada in April, 2021; the latter took over the Bruner gold project last September. Gold Resource acquired the Back Forty project in Michigan through its takeover of Aquila Resources, while Santacruz Silver closed the acquisition of a number of Bolivian assets in March.

When it comes to exploration and mining, the loss of confidence in Chile, Peru and Mexico is proving to be Colombia’s gain.

Another BN Americas article said that while coal remains Colombia’s largest mineral export, the country aims to boost gold production and become the world’s third largest copper producer after Chile and Peru.

In an interview, the president of national mining agency ANM, Juan Miguel Duran, told the publication that To increase competitiveness, efforts focus on promoting minerals that can support diversification policies, especially those demanded for the development of new technologies and alternative energy sources.

According to Colombia’s geological service, the best potential for finding new gold deposits is within metallogenic belt districts located in the departments (states) of Antioquia, Santander, Tolima, Huila, Caldas, Nariño, Cauca and Bolívar, along the Andes mountain chain.

To date, 142 copper deposits, occurrences and prospects have been identified, including porphyries, volcanogenic massive sulfides (VMS), skarn, iron-copper-gold oxide deposits, and deposits hosted in sediments or stratabound ones. The most favorable environments for copper deposits are in Córdoba, Chocó, Narino, Antioquia, and the country’s northeast, in the departments of La Guajira and Cesar.

According to Duran, there is tremendous potential for growth in the mining sector. Only 2.8% of Colombia’s territory is dedicated to mining, of which about 2 million hectares have mining titles related to gold, precious metals and copper.

Asked to comment on the status of copper mining, crucial for the energy transition, Duran responded that little copper exploration is currently being done, however, there are important reserves along the mountain ranges.

“Ore is produced in polymetallic concentrates, mainly at El Roble, which reported production of 9,373t in 2020 and 8,194t in 2021, in addition to 1,000t of copper reported by Carbomás,” he said.

“Additionally, flotation processes were implemented at the Buriticá project for the production of polymetallic copper and zinc concentrates in 2021.

The country’s copper potential has encouraged major exploration campaigns, mainly in the departments of Córdoba, Chocó and Antioquia, highlighting the advances in exploration at the Quebradona and San Matías projects.

With the start of new operations in the coming years, Colombia is expected to increase its copper production.”

Conclusion

Portfolio diversification is one of the most important strategies recommended to retail investors, for mitigating risk (eg. a 60-40 split, equities to bonds). It’s no different for mining companies. Too much of a concentration in one metal risks exposure to a decline in the price of that metal. Geographical concentration opens a company up to resource nationalism policies that can cost it more in royalties and other taxes, or even outright expropriation.

Diversification is a way for mining firms to spread the risk, and is seen as a defensive strategy in the current challenging operating environment, where companies are seeking to maintain profit margins during what could be a prolonged downturn, brought on by lower metal prices and persistent mining cost inflation.

One game plan is for mining companies to diversify from gold, to copper and other green-economy metals that are expected to benefit from the energy transition. The copper price has fallen by nearly a third since its March record high, but according to Bloomberg, some of the largest miners and metals traders are warning that in just a couple of years’ time, a massive shortfall will emerge for the world’s most critical metal — one that could itself hold back global growth, stoke inflation by raising manufacturing costs and throw global climate goals off course.

Commodities are the trade for riding out the Fed-caused recession

Companies that diversity into copper now, would be well-positioned to benefit from this shortfall, that should result in a much higher realized copper price. Barrick Gold and Agnico-Eagle are two recent examples. Agnico Eagle will pay USD$580 million for a 50% share in Teck’s San Nicolas copper-zinc mine in Zacatecas, Mexico. About 20% of Barrick Gold’s production now comes from copper.

Another diversification strategy is to spread risk among jurisdictions. This is largely to mitigate the negative impacts of resource nationalism, but it could also be done to take advantage of lower labor costs, better infrastructure, communities friendlier to mining, etc. We are seeing this in a number of mining companies selling assets in Mexico and investing instead in Nevada. The same thing is happening in Colombia, where the government has been trying to diversity its mining sector away from thermal coal, towards copper and gold. In early 2021 the government launched copper and phosphate “strategic mining areas”, with the first areas for gold announced at the PDAC mining conference in March — four blocks of claims in Antioquia for bidding.

The country’s copper potential has encouraged major exploration campaigns. The most favorable environments for copper deposits are in Córdoba, Chocó, Narino, Antioquia, and the country’s northeast, in the departments of La Guajira and Cesar. Some of the world’s leading gold companies are in Colombia, including Newmont, AngloGold Ashanti and Agnico Eagle Mines. Remember, at least one of them, Agnico Eagle, is diversifying from gold into copper. Since they are there already, exploring the Anza project in a joint venture with Newmont, could Agnico Eagle also be interested in developing copper mines in Colombia?

The CEO of Anglo American, another major diversified miner, has indicated that South Africa would be a good jurisdiction to explore for base metals. “We will explore base metals across South Africa… We are already in Zambia and other places, we want to do more in South Africa so we are looking for adjustments in legislation there,” Mark Cutifani said during the 2020 Joburg Mining Indaba conference.

Copper, nickel, lead and zinc are among the base metals Anglo American is focusing its global discovery strategy in greenfield and brownfield projects.

Going forward, it will be very interesting to see companies moving outside of their comfort zones, as they explore for and mine new metals in new jurisdictions.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Follow me on Twitter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

from MINING.COM https://ift.tt/WvKdJ9A

As sentiment turns in favour of nuclear energy, Fission Uranium preps for Q4 feasibility

Fission Uranium (TSX: FCU) discovered the Triple R uranium deposit at its Patterson Lake South (PLS) project in Saskatchewan in 2012 – a year after the Fukushima nuclear plant disaster in Japan decimated the uranium market.

But following a decade in the “wilderness,” uranium stocks are now finally on the upswing, benefitting from growing recognition of nuclear energy’s place in limiting global temperature rises, reducing emissions of greenhouse gases and countries’ looming net zero goals targeted between 2030 and 2050.

“A few years ago, you were always trying to convince people they should be contrarian and look forward, but they really couldn’t see their way out of the weeds,” said Fission CEO Ross McElroy in mid-September.

“When we talk to investors now, there is rarely anybody that I have to convince that nuclear’s the place to be and that it plays a key role in the energy mix and particularly in green energy.”

The Sprott Physical Uranium Trust Fund, launched in mid-2021 has helped support uranium prices, while Russia’s ongoing war in Ukraine has stoked efforts to source the critical energy metal from friendly sources. Japan’s announcement that it will renew its investment in nuclear power, as well as similar moves from other countries, have solidified that positive sentiment.

This, just as the company prepares to complete a feasibility study for the project by the end of the year.

It will build on a positive 2019 prefeasibility study that outlined a capex of C$1.2 billion for an underground mine with a life of 7.3 years. The operation would produce 11.3 million lb. U3O8 per year at low operating costs of $7.18 per lb.

Despite its short mine life and large capex, the study forecast a 25% internal rate of return after taxes, using a long-term uranium price of $50 per lb. The net present value (at an 8% discount rate) was C$702 million.

from MINING.COM https://ift.tt/A2xJWbr

Ce que l'on sait du casse d'un distributeur de billets avec un drone

from Les dernières actualités de Futura https://ift.tt/h0s2VvJ

Ce qu'il faut savoir sur le virus Khosta-2 isolé des chauves-souris en Russie

from Les dernières actualités de Futura https://ift.tt/1uhxpTY

Les bébés réagissent aux saveurs dans le ventre de leur mère

from Les dernières actualités de Futura https://ift.tt/G90QhAE

Jupiter, la plus grande planète du Système solaire, est au plus près de la Terre depuis 1963

from Les dernières actualités de Futura https://ift.tt/xzspw1u

L’humanité va tenter de dévier un astéroïde dans quelques heures

from Les dernières actualités de Futura https://ift.tt/quaMmKl

Ces drones fabriquent une tour en 3D

from Les dernières actualités de Futura https://ift.tt/pbXJtZv

Nos continents actuels reposeraient sur les restes des premiers continents qui ont coulé

from Les dernières actualités de Futura https://ift.tt/gdvhweV

Cette méduse détient le secret de l'immortalité

from Les dernières actualités de Futura https://ift.tt/q8KjYe6

dimanche 25 septembre 2022

Un médicament pour simuler les bienfaits du sport

from Les dernières actualités de Futura https://ift.tt/KZIAzkm

James-Webb : grâce aux lentilles gravitationnelles il verrait bien des galaxies 250 millions d'années après le Big Bang

from Les dernières actualités de Futura https://ift.tt/wtTm0RC

À quoi ressembleraient les Simpson dans la vraie vie ?

from Les dernières actualités de Futura https://ift.tt/HVesPSf

La sonde spatiale Dart va tenter de dévier un astéroïde le 27 septembre

from Les dernières actualités de Futura https://ift.tt/Q3krlBo

Ajouter de l'huile dans l'eau des pâtes les empêche de coller, vrai ou faux ?

from Les dernières actualités de Futura https://ift.tt/qiBY60T

Les collisions d'astéroïdes sur la Lune déplacent ses pôles

from Les dernières actualités de Futura https://ift.tt/pcdyPWa

Un bon petit déjeuner permettrait d'avoir moins faim durant la journée

from Les dernières actualités de Futura https://ift.tt/ON0Qf32

samedi 24 septembre 2022

Mars : une planète humide bien avant la Terre

from Les dernières actualités de Futura https://ift.tt/ztkq1Qs

En déplacement comme à la maison, le pari des stations électriques portables

from Les dernières actualités de Futura https://ift.tt/8RUfvp6

Ramsès II : voici la reconstitution la plus précise jamais réalisée du visage du pharaon

from Les dernières actualités de Futura https://ift.tt/jXvk7Ab

Quatrième jour d’éruption au Piton de la Fournaise !

from Les dernières actualités de Futura https://ift.tt/JOwg8lp

Le puissant séisme au Mexique a créé un tsunami dans une grotte de la Vallée de la Mort !

from Les dernières actualités de Futura https://ift.tt/9JsZIb4

Découverte exceptionnelle d’une grotte funéraire datant du règne de Ramsès II

from Les dernières actualités de Futura https://ift.tt/Qdb7VsG

vendredi 23 septembre 2022

Mining People: Filo Mining, Iamgold, Newmont, Northern Graphite

Management appointments announced this week:

Gary Lobb joined Argo Gold as VP finance and CFO.

Buscar Company appointed Daniel McGill as its new COO.

C2C Gold named Doris Tam as CFO.

Golden Share Resources CEO Nick Zeng passed away.

Grounded Lithium appointed Lawrence Fisher as VP, land and regulatory.

Iamgold announced the departure of Daniella Dimitrov, CFO and EVP of strategy and corporate development. Maarten Theunissen will serve as interim CFO.

David King joined Magna Mining as SVP technical services.

Aaron Puna is joining Newmont as EVP and chief technology officer. In addition, Mark Rodgers, currently SVP North America, will transition to SVP South America, and Bernard Wessels will be promoted to SVP North America.

Guillaume Jacq is the new CFO of Northern Graphite.

Board moves include:

American Manganese founder and Getty Copper director Larry Reaugh passed away.

Anfield Energy appointed Kenneth Mushinski as non-executive chairman.

ColdBlock Technologies appointed Russ Calow to its board.

Gerald Riverin and Morgan Quinn resigned from the board of Copper Road Resources. Their replacements are Michael Waring and Matthew Rees.

Ron Hochstein replaced Phil Brumit on the board of Filo Mining.

Jill Donaldson joined the board of Fireweed Metals.

West Red Lake Gold Mines appointed Susan Neale, Ryan Weymark and Robert van Egmond as independent directors.

from MINING.COM https://ift.tt/MW8QnYf

Sierra Metals halts 2022 production and finance guidance on Peru mine blockade

Sierra Metals Inc. (TSX: SMT) (NYSE AMERICAN: SMTS) (BVL: SMT) said a group of residents from the Peruvian town of Alis are blocking the access to its flagship Yauricocha copper mine, where production has been suspended for over a week.

The Canadian miner did not specify why community members are blocking access to the mine, but some speculate it could be tied to the death of three miners at the operation due to a mudslide on Sept. 12.

Mine production remains halted with activities limited to critical operations to ensure proper safety and maintenance, Sierra Metals said.

The Toronto-based miner noted that due to uncertainty around how long it will take to solve the dispute and the potential delay in the progressive restart of production at Yauricocha, 2022 production and financial guidance have also been suspended.

Company representatives have taken part in conversations with members of the group and are also studying requests organized by the Peruvian government.

Sierra Metals said it remained committed to the social development of its host communities, adding that it was working towards “a peaceful and expeditious resolution” of the situation.

“As a road blockade is a matter of public concern, the company has involved the local authorities for their mediation and assistance in resolving this matter,” it said in the statement.

Yauricocha is an underground mine located in western central Peru in the Yauyos province at an average altitude of 4,600 meters.

Last produced 31.8 million pounds of copper and 79.3 million pounds of zinc.

Conflicts on the rise

Mining conflicts are on the rise in Peru, the world’s No. 2 copper producer and an important producer of zinc, as empowered local communities are upping demands under the administration of leftist President Pedro Castillo, in power since July 2021.

Earlier this year, a wave of protests hit the country’s major operations, including Glencore’s (LON: GLEN) Antapaccay, the country’s sixth largest copper mine. Other operations affected were Southern Copper Corp’s Cuajone mine and MMG’s giant Las Bambas mine, which is the nation’s fourth-largest copper mine and the world’s ninth-largest.

Copper is a hot commodity due to its role in the world’s decarbonization, with experts predicting that demand for the orange metal relating to energy transition activities — clean power and electrified transport, and the infrastructure supporting them — will grow about 4% per year between now and 2040.

Traditional copper consumers, such as construction and manufacturing of heating and cooling equipment will increase their need for copper only 1.5% per year over the same period.

Goldman Sachs expects global demand for copper will begin to outstrip supplies by 2025, pushing prices to twice their current level.

from MINING.COM https://ift.tt/yZWigrv

Midea S8+ : un aspirateur robot au décrassage haut de gamme et high-tech à prix cassé !

from Les dernières actualités de Futura https://ift.tt/3xYMpik

Regardez le projet fou d’Ocean Cleanup pour éliminer le « septième continent » et ses déchets plastiques

from Les dernières actualités de Futura https://ift.tt/Qvzl8a4

À Paris, les directeurs d’agences spatiales décrivent l’état de l’espace aujourd’hui

from Les dernières actualités de Futura https://ift.tt/Uje5Dru

jeudi 22 septembre 2022

Talon Metals drills record intercept of 23.44m grading 6.04% Ni, 2.85% Cu at Tamarack

Talon Metals (TSX: TLO) has received more encouraging results from drilling at its Tamarack nickel-copper-cobalt project in Minnesota, including assays for 17 holes drilled on the western side of the Tamarack resource area between 2021-2022 that demonstrated the continuity and thickness of the high-grade massive sulphide zone.

The new drill holes extended the resource from 320 metres from northwest to southeast. One hole (21TK0380) returned a record intercept of 23.44 metres grading 6.04% nickel and 2.85% copper in the Main zone. Another hole (22TK0412) returned 18.38 metres at 6.98% nickel and 3.12% copper. Both expanded the massive sulphide pool on the southern portion of the western limb.

In addition, an off-hole geophysical anomaly from drill hole 22TK0412 pointed to a possible southwestward continuation of the massive sulphide mineralization beyond the known resource in an area not previously tested by drilling.

“It is exciting to see the massive sulphide on the western limb continue to thicken to a new record 23.44 metres while maintaining an extremely high grade of 6.04% nickel. Exploration around this pooling area has identified hole 22TK0412, which intersected 12.81 metres at 8.08% nickel, and the borehole electromagnetic (geophysical) survey provides evidence that it may trend in a slightly different direction than anticipated,” said Brian Goldner, Talon Metals’ chief exploration officer.

“The southern extent of the western massive sulphide unit remains open and will be a focus for one of the drill rigs currently turning at the Tamarack nickel project,” he added.

Talon Metals is currently focused on expanding and infilling the high-grade resource at Tamarack, which is estimated at 3.9 million tonnes grading 1.91% nickel and 1.02% copper in the indicated category and 7.2 million tonnes grading 1.11% nickel and 0.68% copper in the inferred category. The company has also planned additional drilling to follow up on the mineralization at the Tamarack intrusive complex.

The Tamarack project comprises a large land position in central Minnesota covering 18 km of strike length, with high-grade intercepts outside the current resource area. Talon Metals has the right to earn up to a 60% interest in the project, and currently owns 51%. The 60% earn-in can be achieved by completing a feasibility study, which is now underway, and paying $10 million to joint venture partner Rio Tinto.

Earlier this year, the company entered an agreement with Tesla to supply the electric vehicle giant with 165 million lb. of nickel in concentrate (and certain byproducts, including cobalt and iron) from the Tamarack project over an estimated six-year period once commercial production is achieved, which is anticipated in 2026.

Shares of Talon Metals closed 5.2% higher on the TSX Thursday following the new drill results. The company has a market capitalization of approximately C$387.3 million.

from MINING.COM https://ift.tt/B6cewj5

Ami Vitale, photoreporter : « nous faisons tous partie du problème mais nous pouvons aussi faire partie de la solution »

from Les dernières actualités de Futura https://ift.tt/HPX2Si5

Gare au vomi des mouches, ils sont pleins de pathogènes

from Les dernières actualités de Futura https://ift.tt/DfgalJ3

Pour tester l'appel d'urgence d'un iPhone 14, ils provoquent un accident de voiture !

from Les dernières actualités de Futura https://ift.tt/jWB07Jq

Le réchauffement climatique est en train d’affaiblir le jet stream avec pour conséquence plus de phénomènes météo extrêmes

from Les dernières actualités de Futura https://ift.tt/WY5JZo4

Parkinson : on en sait plus sur la propagation de la maladie dans le cerveau

from Les dernières actualités de Futura https://ift.tt/QlYILTe

Cette méduse détient le secret de l'immortalité

from Les dernières actualités de Futura https://ift.tt/MZLjT75

mercredi 21 septembre 2022

Silvercorp updates resources at Ying property, extends mine life to 2037

Silvercorp Metals (TSX: SVM) has published an updated NI 43-101 technical report that outlines the resources and reserves contained within the Ying property in Henan province, China. The report was prepared by AMC Mining Consultants (Canada) and covers all the mines on the Ying property (also referenced as the Ying mining district), namely the SGX, HZG, HPG, TLP, LME, LMW and DCG underground mines.

Resources in the measured and indicated (M+I) categories are estimated at 18.7 million tonnes (inclusive of mineral reserves) at average grades of 242 g/t silver, 0.27 g/t gold, 3.51% lead and 1.03% zinc, containing146 million oz. of silver, 161,000 oz. of gold, 657,000 tonnes of lead and 193,000 tonnes of zinc. Compared with the 2020 technical report, the M+I tonnage has decreased by 7%, and contained metal has increased by 64% for gold and decreased by 3% for silver, 10% for lead and 16% for zinc.

Inferred resources saw a much larger decline, down 30% to 13.1 million tonnes grading 201 g/t silver, 0.41 g/t gold, 3.15% lead and 0.77% zinc, resulting in decreases in contained metal of 20% for gold, 23% for silver, 27% for lead and 20% for zinc.

These resource estimates were made for a total of 356 mineralized vein structures for the seven active mines at Ying, where Silvercorp has completed 629,000 metres of drilling during 2020-21. The previous resource estimates only included gold values for the HPG mine. Since then, the company has identified and targeted gold-rich veins at SGX, LME, LMW and DCG.

Meanwhile, mineral reserves have risen by 3% to 12.3 million tonnes in the proven and probable categories grading 241 g/t silver, 0.26 g/t gold, 3.36% lead, and 1.03% zinc, containing 96 million oz. of silver, 105,000 oz. of gold, 414,000 tonnes of lead, and 127,000 tonnes of zinc. This was the first time that the DCG mine has been included in the reserve base, and that gold reserves have exceeded 100,000 oz. within the district.

These reserve totals are on top of approximately 11 million oz. of silver produced from the Ying operations over the past two calendar years. Based on the total mineral reserves, annual silver production is now projected to average approximately 7.0 million oz. between fiscal 2023 and 2025, 8.0 million oz. between 2026 and 2029, 7.1 million oz. between 2030 and 2032, and 4.0 million oz. between 2033 and 2037.

There is also the potential to continue mining beyond 2037 if the inferred resource can be upgraded, Silvercorp said.

from MINING.COM https://ift.tt/w7Z0gOj

Découverte exceptionnelle d’une grotte funéraire datant du règne de Ramsès II

from Les dernières actualités de Futura https://ift.tt/6wU123H

Teck says Elkview outage to cost 1.5 million tonnes in coal production

Canada’s largest diversified miner Teck Resources (TSX: TCK.A, TCK.B) (NYSE: TCK) said on Wednesday it expects to lose coal production of about 1.5 million tonnes due to a structural failure at its Elkview coal mine in British Columbia.

The Elkview steelmaking coal mine will remain halted for one to two months, Teck noted, while repairs to the plant feed conveyor belt take place.

When also factoring in the impact of recent labour action at Westshore Terminals, Canada’s biggest export coal terminal, Teck’s third quarter steelmaking coal sales are now expected to be between 5.5 – 5.9 million tonnes, compared to the previously announced 5.8 – 6.2 million tonnes range.

Unionized workers at Westshore Terminals, located in the Metro Vancouver area, walked out of the job over the weekend causing complete halt of operations.

The port, with a capacity to handle 33 million tonnes of coal exports per year, takes production from British Columbia and Alberta, as well as the Powder River basin and Montana to international markets, mainly in the Asia-Pacific area.

The Vancouver-based miner said Elkview would reschedule planned plant maintenance to take advantage of plant downtime and mine operations would focus on pre-stripping during the outage.

Teck, which is also the world’s second-biggest exporter of steelmaking coal, had to halt production at Elkview in 2018 for almost two months. At the time, it lost about 200,000 tonnes in coal output.

Elkview Operations set a new production record in 2021, the first full year of operations since its plant expansion to a capacity of 9 million tonnes per annum.

Teck projects that proven and probable reserves at Elkview are enough to support mining for a further 30 years.

from MINING.COM https://ift.tt/6y2ROtg

Mars : Insight a enregistré la chute d’une météorite jusqu’à son impact sur le sol !

from Les dernières actualités de Futura https://ift.tt/7PmefhY

Midea S8+ : Futura a testé le décrassage haut de gamme et high-tech à prix cassé !

from Les dernières actualités de Futura https://ift.tt/ZWz3ONP

La plus grande usine de captage de CO2 sur Terre va bientôt ouvrir

from Les dernières actualités de Futura https://ift.tt/YfypSe2

Un médicament pour simuler les bienfaits du sport

from Les dernières actualités de Futura https://ift.tt/Uv4HPLA

mardi 20 septembre 2022

GoviEx Uranium feasibility projects 19 year life, $343 million capex for Madaouela in Niger

GoviEx Uranium (TSXV: GXU) says its feasibility study for a mine in the West African country of Niger shows it may earn $1.6 billion over its 19-year mine life.

Production is forecast at 50.8 million lbs. of U3O8 over the life of the mine, averaging nearly 2.7 million lb. a year, the Vancouver-based company said in a press release today.

GoviEx described the project, called Madaouela, as one of the world’s largest uranium resources, with 100 million lb. of U3O8 in measured and indicated mineral resources, plus inferred resources of 20 million pounds.

“The (feasibility study) confirms the strength of the Madaouela project and its ability to deliver good economic results at a time when inflationary pressures are having a significant impact on the development of new projects and operating mines,” GoviEx executive chairman Govind Friedland said. “We maintain our projection to be able to start producing in 2025, subject to project financing.”

The open pit and underground mine has a price tag of $343 million. Using a U3O8 price of $65 per lb. And a molybdenum price of $11 per lb., the after-tax net present value (at an 8% discount rate) is estimated at $140 million and the internal rate of return at 13.3%.

The estimate of $1.57 billion in earnings before interest, taxes, depreciation and amortization is based on an average annual rate of $82.6 million and net free cash flow of $672 million, the company said.

The project has the potential to elevate Niger from near the bottom of the world’s main uranium producers, which are led by Kazakhstan, Canada and Australia, according to the United States Energy Information Administration. Global production is shy of 50 million lb. a year, although some production data is withheld for corporate privacy, the EIA says.

“With two permitted mines in two mining-friendly jurisdictions, the backdrop of a strengthening uranium market, we are well positioned to become a uranium producer,” GoviEx chief executive officer Daniel Major said, adding that the company also has “huge exploration potential upside.”

Madaouela hosts proven and probable reserves of 5.4 million tonnes grading 0.87 kg per tonne U3O8 and 123.1 parts per million molybdenum for 12.3 million lbs. uranium oxide and 664 tonnes molybdenum.

Measured resources at Madaouela stand at 13.7 million tonnes grading 0.85 kg per tonne for 30.1 million lb., with indicated resources at 20.8 million tonnes grading 1.24 kg per tonne for 66.8 million lb. U3O8.

from MINING.COM https://ift.tt/Ir6T5ja

De nouveaux vaccins bivalents contre la Covid-19 débarquent en France : comment ça marche ?

from Les dernières actualités de Futura https://ift.tt/zEDuof5

Scientists take giant step toward developing room-temperature superconductors

An international team of researchers has uncovered the atomic mechanism behind high-temperature superconductors, a finding that could be revolutionary for super-efficient electrical power.

In a paper published in the journal Proceedings of the National Academy of Science, the researchers explain that certain copper oxide materials demonstrate superconductivity at higher temperatures than conventional superconductors, however, the mechanism behind this has remained unknown since their discovery in 1987.

To investigate this, the group developed two new microscopy techniques. The first of these measured the difference in energy between the copper and oxygen atom orbitals, as a function of their location. The second method measured the amplitude of the electron-pair wave function – the strength of the superconductivity – at every oxygen atom and at every copper atom.

“By visualizing the strength of the superconductivity as a function of differences between orbital energies, for the first time ever we were able to measure precisely the relationship required to validate or invalidate one of the leading theories of high-temperature superconductivity, at the atomic scale,” lead researcher Séamus Davis said in a media statement.

As predicted by the theory, the results showed a quantitative, inverse relationship between the charge-transfer energy difference between adjacent oxygen and copper atoms and the strength of the superconductivity.

According to the research team, this discovery could prove a historic step toward developing room-temperature superconductors. Ultimately, these could have far-reaching applications ranging from maglev trains, nuclear fusion reactors, quantum computers, and high-energy particle accelerators, not to mention super-efficient energy transfer and storage.

The scientists also explain that in superconductor materials, electrical resistance is minimized because the electrons that carry the current are bound together in stable ‘Cooper pairs.’

In low-temperature superconductors, Cooper pairs are held together by thermal vibrations, but at higher temperatures, these become too unstable. These new results demonstrate that, in high-temperature superconductors, the Cooper pairs are instead held together by magnetic interactions, with the electron pairs binding together via a quantum mechanical communication through the intervening oxygen atom.

“This has been one of the Holy Grails of problems in physics research for nearly 40 years,” Davis said. “Many people believe that cheap, readily available room-temperature superconductors would be as revolutionary for the human civilization as the introduction of electricity itself.”

from MINING.COM https://ift.tt/gi0eF7J

Premiers regards du télescope spatial James-Webb sur notre voisine Mars

from Les dernières actualités de Futura https://ift.tt/9w3oj1O

Telecoop connecte téléphonie et transition écologique

from Les dernières actualités de Futura https://ift.tt/Vc6G94i

ArianeGroup dévoile Susie, un audacieux étage réutilisable à tout faire, même du vol habité !

from Les dernières actualités de Futura https://ift.tt/Wk0nbze

Les crapauds d’Europe ont une nouvelle stratégie face à la destruction de leurs territoires par l’humain

from Les dernières actualités de Futura https://ift.tt/feZ8T70

lundi 19 septembre 2022

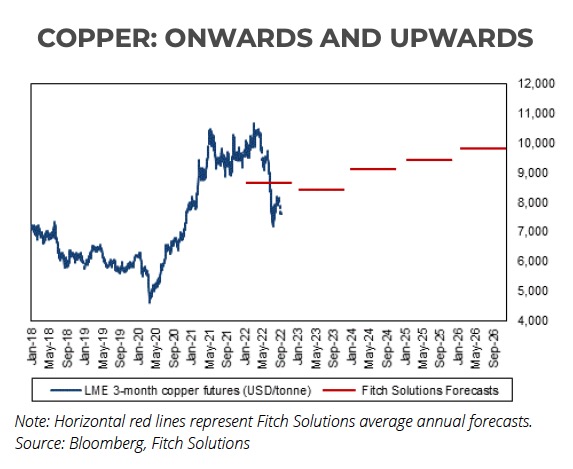

Fitch: Copper price to regain March peaks in 2027

Copper prices have been hovering either side of $3.50 a pound ($7,700 tonne) for the better part of two months, down 21% since the start of the year and nowhere near record highs touched in early March.

Slowing global growth and a strong dollar, which makes copper more expensive in the rest of the world, have undercut the bull case based on historically low inventories and robust longer term demand fundamentals.

A new report by Fitch Solutions cuts the research firm’s 2023 price forecasts for next year by double digits to $8,400 down from a previous projection of an average of $9,580 for the year.

Fitch expects a small surplus on the copper market for this year, but from 2023 expects growing deficits peaking at some 9 million tonnes by the end of the decade as demand accelerates “mainly driven by consumption related to the green transition.”

Fitch says “a significant pipeline of new projects [which] will bring additional copper to the market – particularly in Chile, Peru, Australia and Canada” and also expects “a number of the key supply issues in Latin America to ease in the coming years”:

“From around 2026, however, these improvements in supply will be increasingly outpaced by demand growth from the global transition to a green economy.”

Fitch sees steady improvement to copper prices over the next five years with the metal returning to its March peaks above $10,000 in 2027 and $11,500 in 2031 as “a long term structural deficit emerges.“

Fitch points to a number of risk factors that could darken this rosy long term forecast however including further strengthening of the dollar if US monetary policy tightening accelerates, further regulation by the Chinese government to reduce commodity prices, a more stable resolution to some of the industrial tensions in Latin America and faster-than-expected uptake in copper recycling.

from MINING.COM https://ift.tt/hl7AU1E

Supernova : des astronomes ont remonté le temps jusqu'à son explosion !

from Les dernières actualités de Futura https://ift.tt/TptIVrn

Trevali CEO leaves after two managers convicted of involuntary manslaughter

Trevali Mining Corp.’s president and chief executive Ricus Grimbeek has left the company following a Burkina Faso court’s verdict that found two employees guilty of involuntary manslaughter.

The convictions are related to a tragic incident at the Canadian company’s Perkoa mine in the West African nation caused by a flash flood in April, which trapped and killed eight miners.

South African Hein Frey was fined $3,000 and given a suspended 24-month prison sentence. Australian Daryl Christensen, who worked for contracting company Byrnecut, was handed a 12-month suspended sentence and fined $1,500.

In addition to Grimbeek, former head of Vale’s Sudbury operations, Trevali’s chief operating officer Derek du Preez and director Dan Isserow also resigned, the company said in a press release late on Sept. 16.

The struggling miner has also begun a court-approved sales process for its interest in the 90%-owned Rosh Pinah zinc-lead-silver mine, in Namibia, and its fully-owned Caribou mine, in New Brunswick, Canada.

Flash floods caused by unseasonal, heavy rainfall caused flash floods on April 16 that left eight workers missing underground at the Perkoa mine on April 16.

Trevali spent the next two months pumping out about 137 million litres of water. Equipment had to be imported from other countries, including Ghana and South Africa, raising questions about how prepared for a disaster the company was.

The underground mine, which produced about 316.2 million pounds of zinc in 2021, has remained halted since the tragic incident and Trevali has suspended its production and cost guidance for 2022 for the operation.

Delisting

Earlier this month, the Vancouver-based company announced it was delisting from the Toronto Stock Exchange, effective Monday October 3 after close. The decision came after the company filed an application for creditor protection under Canada’s Companies’ Creditors Arrangement Act (CCAA).

CCAA allows companies to restructure and carry on their business while avoiding the “social and economic consequences of bankruptcy.”

Trading is also expected to stop on the Lima Stock Exchange, OTCQX and the Frankfurt Stock Exchange.

from MINING.COM https://ift.tt/JlgY6PH