dimanche 31 mars 2019

Une étrange anomalie magnétique détectée sur la Lune

from Les dernières actualités de Futura-Sciences https://ift.tt/2UlbN06

Science décalée : ils prévoient une expédition en Antarctique pour tenter de prouver que la Terre est plate

from Les dernières actualités de Futura-Sciences https://ift.tt/2FMD6bC

Jupiter était quatre fois plus loin dans le passé

from Les dernières actualités de Futura-Sciences https://ift.tt/2WwTSRx

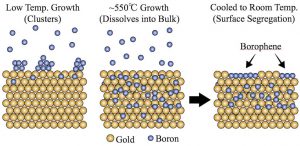

Researchers learn to produce borophene on a gold surface

Scientists from Rice University, Argonne National Laboratory and Northwestern University discovered that when heated in a furnace and place on a gold surface, boron atoms dissolve into a bath of gold and when the materials cool down, they resurface in the form borophene.

Borophene is the atom-flat form of boron.

Illustration by Luqing Wang | Rice University.

In a press release, the researchers explained that their findings constitute a step toward practical applications like wearable or transparent electronics, plasmonic sensors or energy storage for the two-dimensional material with excellent conductivity.

The team led by Boris Yakobson at Rice, Nathan Guisinger at Argonne and Mark Hersam at Northwestern first theorized and then proved that with sufficient heat in a high vacuum, boron atoms streamed into the furnace sink into the gold itself. Upon cooling, the boron atoms reappear and form islands of borophene on the surface.

According to the experts, this is different from most other 2D materials made by feeding gases into a furnace. In their media brief, they said that in standard chemical vapor deposition, the atoms settle onto a substrate and connect with each other. They typically don’t disappear into the substrate.

The metallic borophene islands formed in the reaction are about 1 nanometer square and show evidence of electron confinement which, in the scientists' view, could make them practical for quantum applications.

“Gold, with a lesser charge transfer and weaker bonding, may yield a layer that’s easier to lift off and put to use, although this has not yet been achieved,” Yakobson said.

It took an order of magnitude more boron to grow borophene on gold than it did for silver.

This is not the first time the researcher and his colleagues investigate the possibilities offered by borophene. In a previous experiment, they showed that borophene grown in a particular way on silver becomes wavy, which also gives it interesting possibilities for wearable electronics.

“So far, the substrates with demonstrated success for borophene synthesis closely follow theoretical predictions,” Yakobson said. “The challenge remains to grow it on an insulating substrate. That will permit many intriguing experimental tests, from basic transport to plasmons to superconductivity.”

Boron, in the form of its primary sources colemanite, rasorite, ulexite and tincal, is mostly found in large deposits in Central and Western Turkey.

The post Researchers learn to produce borophene on a gold surface appeared first on MINING.com.

from MINING.com https://ift.tt/2CKliMk

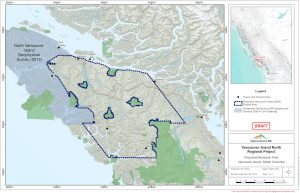

Northern Vancouver Island’s mineral potential to be surveyed

Non-profit organization Geoscience BC is planning a new airborne survey to help identify mineral potential on northern Vancouver Island, in the western Canadian province of British Columbia.

According to the NGO, every time its team runs projects like this one, new investment comes into the region at hand as the data is used to inform mineral exploration and development decisions by the mining sector, government, communities, and Indigenous groups.

In a press release, Geoscience BC explained that the new airborne survey will use helicopters equipped with sensitive instruments that measure the properties of bedrock to help identify potential mineral deposits across Port McNeill and Sayward in the north and Zeballos, Tahsis and Gold River to the south of the island.

Map of the area to be surveyed.

A little bit of activity is already taking place in some of these areas with, for example, Troubadour Resources’ (TSXV: TR) interest in developing the Surespan gold property, where the historic Zeballos high-grade gold mining camp lies.

But in the view of Geoscience’s incoming Vice President for the Minerals division, Christa Pellett, more can be done. “We have heard from experts that even with its strong mining history, this part of northern Vancouver Island is likely to have understated mineral potential,” Pellett said in the media brief.

Pellet also said that, before the survey starts, they would like to gather some information from locals to address any concerns and to make sure the data produced is the best, as it will be made public.

This is not the first time Geoscience BC goes up north on Vancouver Island. Back in 2013, the organization published the results from a survey carried out the year before and, according to its reports, just a couple of months after the data was released, over 16,000 hectares of new mineral exploration claims had been staked in the area.

The post Northern Vancouver Island’s mineral potential to be surveyed appeared first on MINING.com.

from MINING.com https://ift.tt/2V6Ek6M

Neptune : Hubble a vu naître une tempête géante et sombre

from Les dernières actualités de Futura-Sciences https://ift.tt/2HOmWkf

Sony Xperia 10 : est-ce qu'un smartphone doté d'un écran au format cinéma peut séduire ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2V6Bajv

samedi 30 mars 2019

Science décalée : l'amour rend vraiment ivre

from Les dernières actualités de Futura-Sciences https://ift.tt/2F91XUk

Le plus grand tyrannosaure enfin identifié

from Les dernières actualités de Futura-Sciences https://ift.tt/2HQ5Tht

MMG’s subsidiary in Peru rejects blockade at Las Bambas, asks for dialogue

Following this week’s efforts by Peruvian authorities to mediate in a 2-month long conflict, Minera Las Bambas issued a statement saying that management is willing to look for a consensual solution with the community blocking their activities in the southern-central region of Apurímac.

Las Bambas is a joint venture project between MMG, a wholly-owned subsidiary of China’s Guoxin International Investment, and CITIC Metal Co. Ltd. MMG owns 62.5% of the project and is in charge of operations at the massive Las Bambas copper mine, which spans the provinces of Cotabambas and Grau and is located 75 kilometres southwest of the city of Cusco.

Since early February, the Indigenous community of Nueva Fuerabamba has been blocking a national highway called Corredor Minero del Sur (Mining Runway of the South), which passes through its farmland. According to Reuters, local people say the government illegally turned the road into a national highway to be able to ink a deal with the Asian company.

“Changes to the Environmental Impact Assessment were executed before Las Bambas was sold by Glencore to the MMG-led consortium”

But in its recent statement, Las Bambas said that the Ministry of Transportation and Communications confirmed that the blocked way was declared of public use in 2008 at the request of district, provincial and regional authorities. This means that the road was already of public use when, in 2011, the Nueva Fuerabamba community was adjudicated the nearby farmland.

“Like any other public use road, the law states that it can be freely accessed by anyone. Its reclassification as a regional and national runway came later on,” Las Bambas’ release reads. “New representatives of the Nueva Fuerabamba community and their advisers have asked Las Bambas to pay for the use of this public runway and such requests are against the law.”

In the brief, the miner goes on to say that community representatives have rejected the company’s offers to contribute with new development projects. However, it reiterates that its leadership team is open to a dialogue with members of the Nueva Fuerabamba community.

“We recognize government authorities’ efforts to try to find a solution through a mediated dialogue and we ratify our disposition to contribute to such efforts and support the development of the Apurímac region and of Peru as a whole,” the communiqué reads.

According to Las Bambas, it is urgent to find a solution to the blockade because it is preventing 8,000 people from working at the mining complex and it might trigger a total stoppage of activities with severe consequences for the local and national economy.

Since 2016, when the first shipment of copper concentrate to customers departed the Port of Matarani, Las Bambas has paid approximately $226 million in royalties to the Peruvian treasury.

The mine has an annual nameplate throughput capacity of 51.1 million tonnes and in 2017 produced 450,000 tonnes of copper concentrate.

The post MMG’s subsidiary in Peru rejects blockade at Las Bambas, asks for dialogue appeared first on MINING.com.

from MINING.com https://ift.tt/2FJN0uo

Ÿnsect va construire la plus grande usine d'insectes au monde

from Les dernières actualités de Futura-Sciences https://ift.tt/2I2bkcs

vendredi 29 mars 2019

Monarch Gold sells Pandora NSR to Agnico Eagle

The sale of a 0.5% net smelter return royalty on its Pandora property to Agnico Eagle Mines (TSX: AEM; NYSE: AEM) monetizes a non-core asset and reduces the junior’s cost of acquiring its McKenzie Break and Swanson properties by $800,000,Monarch Gold Corp. (TSX: MQR; US-OTC: MRQRF) reports.

The Pandora royalty was part of the assets that Monarch acquired from Richmont Mines in October 2017, along with the McKenzie Break and Swanson properties.

Since drilling at McKenzie Break began in in 2018, Monarch has expanded the deposit and confirmed its high-grade potential.

Assays from the third and last set of drill results from its 13,945 metre drill program (61 holes) last year were released on Mar. 20. Since drilling at McKenzie Break began in in 2018, Monarch has expanded the deposit and confirmed its high-grade potential

Highlights included drill hole MK-18-236, which returned 12.60 grams gold per tonne over 1.35 metres, including 55.90 grams gold over 0.3 metre at 80 metres below surface. The interval is 65 metres southeast of drill hole MK-18-210, which cut 12.50 grams gold over half a metre from the same horizon, extending the lens to the east and demonstrating that it remains open, the company says.

Hole MK-18-236 also intersected another lens at a depth of 145 metres from surface, with values of 13.40 grams gold over 2 metres, including 26.40 grams gold over 1 metre, and 75 metres north, on the same horizon, hole MK-18-232 returned 6.84 grams gold over 2 metres, including 13.65 grams gold over 1 metre.

Hole MK-18-231, to the north of Monarch’s planned Green Zone open pit, returned 15.74 grams gold over 1.5 metres. Hole MK-18-222 cut 13.95 grams gold over 1 metre from 68 metres below surface, about 70 metres northwest of the Green zone.

McKenzie Break, a narrow-vein gold deposit, is 25 km north of Val-d’Or in Quebec, and close to the company’s Camflo and Beacon mills.

The company completed a pit-constrained resource estimate for McKenzie Break in June 2018, outlining 939,860 tonnes grading 1.59 grams gold per tonne for 48,133 ounces of contained gold in the indicated category and another 304,677 tonnes averaging 1.52 grams gold for 14,897 ounces of gold in the inferred.

McKenzie Break also has an underground resource of 281,739 indicated tonnes grading 5.90 grams gold for 53,448 ounces of contained gold and 270,103 inferred tonnes grading 5.66 grams gold for 49,103 ounces of gold.

(This article first appeared in The Northern Miner)

The post Monarch Gold sells Pandora NSR to Agnico Eagle appeared first on MINING.com.

from MINING.com https://ift.tt/2YAtmZl

Alexco tables PFS for Keno Hills in Yukon

Alexco Resource has tabled a prefeasibility study (PFS) for its wholly owned Keno Hills silver project, in Yukon, that assigns the project a $101.3-million after-tax net present value at a 5% discount-rate, and a 74% after-tax internal rate of return (IRR).

It assumes a life-of-mine $17.90 per oz. silver price.

Alexco expects the underground operation would process 154,000 tonnes per year over an eight-year life at 804 grams silver, 2.98% lead, 4.13% zinc and 0.34-gram gold. The project would produce 27.2 million oz. silver, 67.2 million lb. zinc and 65.4 million lb. lead.

Keno Hills would cost an initial $23.2 million: $17.9 million for surface and underground development, including mill commissioning, and $5.3 million for net working capital during the two-month mill ramp up.

Alexco expects the underground operation would process 154,000 tonnes per year over an eight-year life at 804 grams silver, 2.98% lead, 4.13% zinc and 0.34-gram gold

The project would require $76.5 million in sustaining capital, with $321 per tonne direct operating costs. It would operate at $11.98 per oz. silver all-in sustaining costs.

According to the study, the project’s Flame and Moth and Berminham deposits would contribute primarily to the mine’s production, on a 60% and 30% basis. Supplementary production would come from the Bellekeno deposit early in the mine’s life and from the Lucky Queen deposit later in the mine’s life.

Flame and Moth contains 704,211 probable tonnes grading 672 grams silver, 2.71% lead, 5.73% zinc and 0.49-gram gold for 15.2 million oz. silver.

Bermingham contains 362,343 probable tonnes at 972 grams silver, 2.59% lead, 1.32% zinc and 0.13 gram gold for 11.3 million oz. silver.

Bellekeno contains 40,109 probable tonnes at 843 grams silver, 11.9% lead and 6.31% zinc for 1.08 million oz. silver, while Lucky Queen contains 70,717 probable tonnes at 1,244 grams silver, 2.63% lead and 1.38% zinc and 0.12 gram gold for 2.8 million oz. silver.

In total, the project contains more than 30 million probable oz. silver.

Alexco shares are trading at $1.63 in a 52-week range of 92¢ to $2.14. The company has a $177-million market capitalization.

“With the results of the PFS now in hand, we are now on a clear path to production at Keno Hill,” company CEO Clynton Nauman said in a prepared statement.

(This article originally appeared in The Northern Miner)

The post Alexco tables PFS for Keno Hills in Yukon appeared first on MINING.com.

from MINING.com https://ift.tt/2uAfEb3

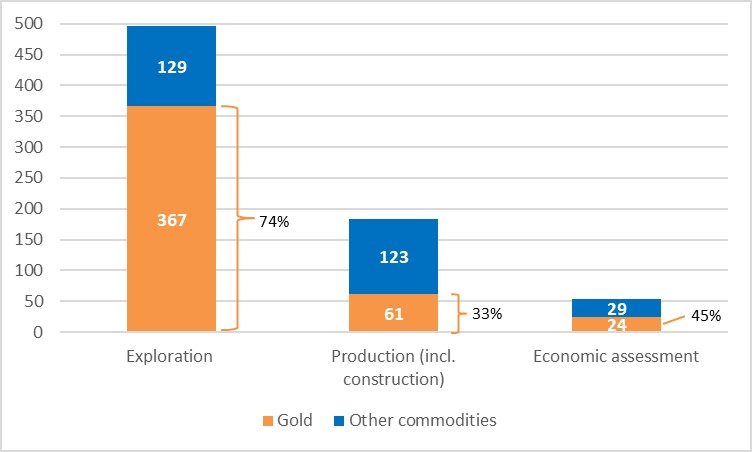

West Africa — an emerging gold exploration investment hotspot

West Africa is well endowed with mineral resources, and many world-class deposits have been discovered there in recent years. The region is a key source of gold, iron ore, bauxite, diamonds, phosphate, uranium, and its mainly untapped mineral wealth provides exceptional greenfield development potential.

But despite increased interest in the whole spectrum of commodities in West Africa, the region is a hotspot for investment in gold exploration.

Foreign companies invested billions of dollars in gold exploration activities over the past few years, resulting in West Africa having the biggest growth rate in the yellow metal’s resources in the world.

Data compiled from Mining Intelligence’s proprietary database demonstrates the number of gold asset changes within West Africa’s mining development pipeline.

West Africa’s mining development pipeline: Number of mining/explorations projects at different stages of development. Source: Mining Intelligence.

Moving down the pipeline from operating mines to exploration projects, the number of gold assets increases, with 61 assets (33% of all assets, regardless of commodity) in the production or construction stages, 24 assets, or 45% of all projects undergoing economic assessment studies, and a whopping 367 assets in the exploration phase.

74% of all exploration projects are focused on gold.

This focus on gold in the exploration stage indicates that the importance of gold in West Africa’s mining sector will only increase in the future, as new projects will enter the production phase.

Experts are confident that significant local gold resources were underexplored, and this can spark even more interest from the international mining community.

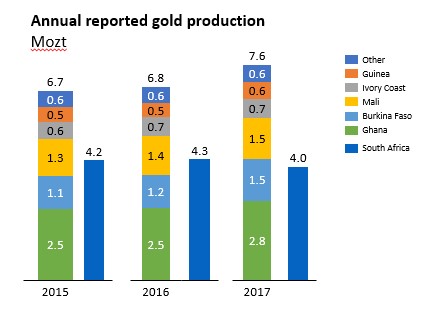

Recent gold production numbers show that South Africa was still the biggest gold producer in the region in 2017, but West Africa’s gold mining industry, led by Ghana, Mali and Burkina Faso, already produces nearly twice as much gold as South Africa, and Ghana alone has chances to overtake its struggling southern peers in gold output in the foreseeable future.

Gold production, South Africa vs. West Africa, Mozt. Source: Mining Intelligence, based on companies’ reports; artisanal miners and non-reporting companies are excluded.

Another important indicator of West Africa’s gold mining sector enticement for investors is production costs measured by the World Gold Council’s all-in sustaining costs (AISC) metrics. AISC shows that in Q2 2018, two West Africa mines were in the global list of top 6 lowest cost gold operations.

B2Gold’s new open-pit high-grade Fekola mine in Mali was the second lowest cost mine by AISC ($445/ozt), and Perseus Mining’s new SGP mine in Ivory Coast was sixth ($520/ozt).

With South Africa’s gold mining sector struggling with increased production costs at underground mines, socio-political turmoil and regulatory headwinds, West Africa is quickly becoming the continent’s main gold mining hub.

Get access to the wealth of data about mineral resources in West Africa and globally, and click here for Mining Intelligence's 2018 Western Africa Mining Map that shows the locations of more than 180 producing mines and development “shovel in the ground” projects, 20 metallurgical facilities, major roads, railroads, ports and shipping distances and regional geology. For other Mining Intelligence maps, click here.

The post West Africa — an emerging gold exploration investment hotspot appeared first on MINING.com.

from MINING.com https://ift.tt/2OC9ErK

Le robot magasinier Handle prêt à remplacer les humains

from Les dernières actualités de Futura-Sciences https://ift.tt/2Oy6NQf

Hubble observe un astéroïde en train de se désintégrer

from Les dernières actualités de Futura-Sciences https://ift.tt/2Uhk9pv

Deux dentifrices sur trois contiennent du dioxyde de titane

from Les dernières actualités de Futura-Sciences https://ift.tt/2WAD1gP

Patient hors norme : elle ne ressent ni douleur ni anxiété

from Les dernières actualités de Futura-Sciences https://ift.tt/2TJ4zyq

Maverix to buy most of the silver from Ascendant’s Honduran mine

Canada’s Maverix Metals (TSX-V: MMX) entered this week into a life of mine purchase and sale agreement for silver produced from the El Mochito mine, owned and operated by Ascendant Resources (TSX: ASND) in Honduras.

El Mochito’s production guidance for 2019 is between 850,000 and 1,200,000 ounces of contained silver in concentrate

In a press release, Maverix said it will make an advance payment of $7.5 million for the right to purchase 22.5% of the silver produced from El Mochito and, subject to certain conditions, a further $7.5 million for an additional 17.5% of the silver produced. The company also committed to pay 25% of the silver price at the time of delivery, for each silver ounce delivered.

“This transaction is consistent with our stated strategy of acquiring long life precious metal streams that are immediately accretive to both our cash flow and net asset value," Dan O'Flaherty, CEO of Maverix, said in the media statement.

The El Mochito mine is located on a 10,000-hectare land package near the town of Las Vegas in north-western Honduras.

It is a 2,300-tonne per day, underground zinc-lead-silver operation expected to grow to a 2,800-tonne per day operation following a 2018 expansion and optimization PEA. Such assessment outlined a 10-year operation with an increased production capacity of 1 million tonnes per annum and an expected output of nearly 600,000 ounces of silver per year.

The post Maverix to buy most of the silver from Ascendant’s Honduran mine appeared first on MINING.com.

from MINING.com https://ift.tt/2Ww4b8s

American Manganese to help US government recover lithium-ion battery materials

American Manganese (TSX.V: AMY) announced this week that it will participate in a U.S. Department of Energy project to advance the economic recovery of lithium-ion battery materials from electric vehicles and other consumer goods.

In a press release, the British Columbia-based firm explained that the project is titled "Lithium-Ion Battery Disassembly, Remanufacturing, and Lithium & Cobalt Recovery Project" and it focuses on developing an economic recovery strategy for critical materials in end-of-use lithium-ion batteries from electric and hybrid electric vehicles and bicycles, as well as from power tools.

Other AMY partners include Oak Ridge National Laboratory, the Idaho National Lab, Purdue University and Case Western Reserve University.

"AMY is very pleased to become the first private-sector company to participate in this project," said Larry Reaugh, CEO of American Manganese, in the media brief. "We're honored to be working with world-renowned national labs and leading U.S. universities on an issue that will dramatically impact our ability to meet rising material demand for lithium, cobalt, manganese and nickel."

Reaugh noted that the work starts immediately under the supervision of the Critical Materials Institute, which is an energy innovation hub led by Ames Laboratory and supported by the U.S. Department of Energy, Office of Energy Efficiency and Renewable Energy, and Advanced Manufacturing Office.

The post American Manganese to help US government recover lithium-ion battery materials appeared first on MINING.com.

from MINING.com https://ift.tt/2UZuRhC

Polish looking for ‘Nazi Gold Train” finds another kind of treasure

More than three years after two treasure hunters claimed to have found a Nazi train laden with gold and gems in the Polish city of Walbrzych, one of the men looking for it has unearthed another kind of treasure: two dozen priceless Renaissance portraits.

Piotr Koper, who spent years hunting for the elusive train rumoured to be laden with gold and gems, has found two dozen priceless Renaissance portraits.

Piotr Koper made the completely accidental discovery while helping renovate a baroque dome in a palace located in the village of Struga, near the city of Wroclaw, local outlet The First News reported.

Since one of the portraits depicts Ferdinand I Habsburg, ruler of the Holy Roman Empire from 1558 till 1564, the renovators deduced that the paintings are at least 500 years old.

The owner of the palace where the portraits were found believes that there may be many other valuable objects to discover there.

Koper’s earlier obsession with the Nazi Gold Train made international headlines between 2015 and 2016.

According to tales that have circulated since the end of World War II, the Nazis hid a train containing up to 300 tons of gold, as well as diamonds and firearms.

A number of trains are believed to have been used by the Nazis in the 1940s to transport goods stolen from people in Eastern Europe back to Berlin. While some might have made it to the German capital, others are said to have been left behind by Soviet troops, as they advanced in 1945.

The post Polish looking for ‘Nazi Gold Train” finds another kind of treasure appeared first on MINING.com.

from MINING.com https://ift.tt/2U454IA

Petra Diamonds shares jump on 425.1-carats discovery at Cullinan

Shares in Petra Diamonds (LON:PDL) jumped more than 8% on Friday after the miner announced it had dug up a 425.1 carat, D-colour, Type II gem quality diamond at its iconic Cullinan mine in South Africa.

The discovery comes less than a month after Petra found a 100.83 carat gem-quality diamond at the same mine, source of the world’s biggest-ever diamond, which was unearthed in 1905.

The company, which appointed last month former gold miner Richard Duffy as chief executive, said both recoveries demonstrated the frequency of such large stones at Cullinan.

The stock climbed on the news, trading 8.3% higher in London at19.60p by 12:32 p.m. local time.

Petra, which has been seeking to turn around its fortunes after piling up debt to expand the operation, plans to sell the 425.10ct diamond during the June quarter.

Diamond miners are struggling across the board, especially those producing cheaper and smaller stones where there is too much supply. In December, some of Rio Tinto’s (LON, ASX: RIO) customers refused to buy cheaper diamonds, while De Beers has been forced to cut prices and offer concessions to buyers.

This week, Africa-focused Firestone Diamonds (LON:FDI) put plans to extend the life of its 75%-owned Liqhobong mine in Lesotho on the back burner, saying that current market conditions don’t support the project.

The post Petra Diamonds shares jump on 425.1-carats discovery at Cullinan appeared first on MINING.com.

from MINING.com https://ift.tt/2UpxRqB

Huawei P30 Pro, le meilleur appareil photo du marché

from Les dernières actualités de Futura-Sciences https://ift.tt/2JOxwJQ

La plus grande grotte de sel du monde découverte en Israël

from Les dernières actualités de Futura-Sciences https://ift.tt/2CGLozI

Exobiologie : des organismes terrestres peuvent survivre sur Mars

from Les dernières actualités de Futura-Sciences https://ift.tt/2uvLrtT

Google Chrome corrige la faille du « curseur maléfique »

from Les dernières actualités de Futura-Sciences https://ift.tt/2JP7i9V

Des bactéries comme future source d’électricité ?

from Les dernières actualités de Futura-Sciences https://ift.tt/2CGpmNK

Cet amas stellaire de 12,8 milliards d'années a vu naître la Voie lactée

from Les dernières actualités de Futura-Sciences https://ift.tt/2uxK4uq

jeudi 28 mars 2019

Des voleurs siphonnent 120.000 litres d'essence à cause d'un code PIN trop simple

from Les dernières actualités de Futura-Sciences https://ift.tt/2TDWATj

Europe aims to take its place on the global EV battery production stage

The European Commission is eyeing opportunities within the EU’s minerals and mining sector, and has put forward, in its Strategic Action Plan (SAP) on batteries, a comprehensive set of targeted measures to make Europe a global leader in sustainable battery production and use.

The SAP focuses on including raw materials research and innovation, financing and investment, standardization, regulation, and trade and skills development to secure a sustainable supply of battery raw materials.

In his opinion piece in the EU Observer, Raw Materials: ‘holy grail’ of 21st century industrial policy, Maros Sefcovic, vice president of the European Commission in charge of the Energy Union, said that Europe has world-leading technologies as well as high environmental and social standards, and that the EU aims to ensure that mining is no longer the polluting industry of the past.

"Our strategy is not to displace environmental costs to other parts of the world. Our strategy is to see sustainable mining with high-quality jobs created in Europe as well as transparent information about the environmental footprint and recyclability,” Sefcovic wrote.

According to 2016 statistics, actual primary production by the EU member states represents only a fraction of global production: 0.1% for lithium; 1.1 % for natural graphite; 7.7 % for cobalt and 13.8% for nickel. “We don’t see all member states have really woken up to the need to put the raw materials in their industrial strategies, and their strategies to achieve climate goals, because too many are just relying on importing these raw materials from abroad" — European Commission

But lithium-ion manufacturing facilities are starting to pop up in Europe, with at least seven new gigawatt sized factories scheduled to be in operation by 2020. Tesla Motors is reportedly in discussions with authorities in Germany and the Netherlands to build its first ever European factory. In October, Germany's BASF and Russian miner Norilsk Nickel struck a nickel and cobalt supply deal to meet the growing demand for electric vehicle (EV) batteries.

There are a relatively high number of exploration projects already in the pipeline, with large lithium deposits identified in the Czech Republic, Austria, Finland, Germany, Portugal and Spain; a large cobalt deposit in New Caledonia, France and a medium sized deposit in Finland; large nickel deposits in New Caledonia, France and medium sized deposits in Finland and Spain; and natural graphite deposits in Sweden and Slovakia, according to European Commission reports on Resource Efficiency and Raw Materials.

But only few are actually moving to commercial projects, as even after having demonstrated the feasibility and economic viability of a project, it can be challenging to attract investors, and growth is forecasted to be slow.

“We have a lot of raw materials in Europe [and] a long tradition of extraction activities. We know that we need to do more to make use of our domestic potential, because global competition of raw materials is going to increase,” Peter Handley, Head of Unit, Resource Efficiency and Raw Materials at the European Commission, told MINING.com.

“While we’re looking at how we can be more effective in accessing the long-term supplies we need outside Europe, we try to do more to make use of our raw materials in Europe itself,” he added. “We have a batter action plan, and we’re looking at what we can do to identify and extract lithium, nickel, and graphite… we have identified what’s critical for us to develop batteries in Europe.”

Handley is optimistic about the projects in the pipeline within the EU, such as lithium projects coming on line in Finland and Portugal.

“We have a dedicated €600 million stream of projects on raw materials. A lot of that is about innovation in the technologies used in mines. We’ve got projects on the way on the use of remote operations, we’ve got work on replacing diesel in mining vehicles with electric-powered vehicles, we’ve got various projects on identifying and accessing resources underwater, we got various projects on processing innovative materials, and we are also doing work on the policy framework through our research program,” noted Handley.

Europe is still far from the EV switch, and it is still in the research and innovation stage.

“We’re not at the stage of deployment these technologies,” Handley said. "What we do see is that there’s still a public impression that mining is still an old-fashioned dirty industry, but we see that it’s very high-tech, there’s a lot of new digital-driven technologies being applied in the mining sector and a lot more complex skills required for people who work in the sector.”

“We don’t see all member states have really woken up to the need to put the raw materials in their industrial strategies, and their strategies to achieve climate goals, because too many are just relying on importing these raw materials from abroad. We might find ourselves constrained on raw materials unless we make a really coherent effort to do more for ourselves,” Handley added.

“As Europe, we’ve just come out with our ideas on 2050 decarbonization strategies. That highlights the importance of seeking raw materials. The demand for raw materials is going to be a hot issue.”

The post Europe aims to take its place on the global EV battery production stage appeared first on MINING.com.

from MINING.com https://ift.tt/2HURYWM

NexGen finds high radioactivity in first holes of 2019

Vancouver-based NexGen Energy has been busy with feasibility stage drilling at its 100% owned Rook I property in the Athabasca Basin.

In the A2 sub-zone, the emphasis is on converting indicated to measured resources. Nineteen closely spaced drill holes (9.0 to 16.7 metres) successfully intersected the sub-zone. In the shear only, composite and off-scale radioactivity results were routinely measured in massive to semi-massive pitchblende.

NexGen is also engaged in a two-stage, 125,000-metre high density drilling program at the Arrow deposit. The results will allow mine optimization exercises. The company says it is fully funded – with C$100 million in the treasury – to complete its drilling, feasibility and development programs this year.

(This article first appeared in the Canadian Mining Journal)

The post NexGen finds high radioactivity in first holes of 2019 appeared first on MINING.com.

from MINING.com https://ift.tt/2K1txtF

Greenstone’s Hardrock project approved by environmental ministry

Greenstone Gold Mines – a 50:50 joint venture of Centerra Gold and Premier Gold Mines – has received approval from the provincial environment ministry for development of the Hardrock gold mine 2 km south of Geraldton, Ontario. Federal approval was received late last year.

An open pit and 27,000 t/d mineral processing plant are planned. The pre-production capex will be near C$1.25 billion to create a project that produces an average of 300,000 oz. of gold over a 14.5-year mine life. The project has a an expected after tax net present value (5% discount) of $818 million, an internal rate of return of 17.5%, and a payback period of 4.5 years.

The project has probable open pit reserves of 141.7 million tonnes grading 1.02 g/t gold for 4.6 million contained oz. Both the indicated and inferred estimates contain underground as well as open pit resources. The cut-off for pit material is 0.30 g/t and for underground is 2.0 g/t. Using those numbers, the indicated resource is 25.1 million tonnes at 2.29 g/t gold for 1.9 million contained oz., and the inferred portion is 21.7 million tonnes at 3.55 g/t gold for 2.5 million contained oz.

The 2019 work plan for Hardrock is to advance the permitting process, proceed with detailed engineering, drill a further 18,000 metres to update reserve and resource estimates, incorporate the optimization work that was done over the past two years, and update the project economics.

(This article first appeared in the Canadian Mining Journal)

The post Greenstone’s Hardrock project approved by environmental ministry appeared first on MINING.com.

from MINING.com https://ift.tt/2OxMm5W

Appointment notices: Kirkland Lake Gold, Nemaska Lithium, and Skeena Resources

Toronto-based Kirkland Lake Gold has announced the retirement of board chairman Eric Sprott, effective after the annual meeting on May 7, 2019. He has been chairman since 2015. The vacancy will be filled by Jeff Parr as interim chairman until the AGM.

Ronald Bougie is joining Nemaska Lithium in Quebec City as VP engineering and construction. His appointment and certain other changes at the company will strengthen controls over construction work at the Whabouchi mine and Shawinigan plant.

Skeena Resources of Vancouver is strengthening its operating team with the nomination of Stacy Freudigmann as project manager for its Eskay Creek and Snip projects. He specializes in mining management, metallurgy and process engineering, project management, and development. He founded Canenco Consulting in 2010.

(This article first appeared in the Canadian Mining Journal)

The post Appointment notices: Kirkland Lake Gold, Nemaska Lithium, and Skeena Resources appeared first on MINING.com.

from MINING.com https://ift.tt/2FI1Z8k

Stornoway finishes year with revenue down, losses up

Stornoway Diamond (TSE: SWY) finished the 2018 calendar year with less production and revenue and more losses. Total net loss for the year was $329.4 million or $0.39 per share, compared to a net loss in 2017 of $114.2 million or $0.14 per share.

The company pointed out that those numbers include a non-cash impairment of $83.2 million, a deferred income tax expense of $77.4 million, and $227.1 million for the cost of goods sold.

Stornoway also recorded lower tonnage through the plant, recovered carats, and sold carats. Last year it sent 2.3 million tonnes through the plant (compared to 2.0 million in 2017), recovered 1.3 million carats (1.6 million), and sold 1.2 million carats (1.7 million).

At the same time cash costs per tonne took a jump. The costs per tonne of kimberlite processed rose to $57.10 or $100.40 per carat. In 2017 the cost per tonne was $42.10 and $54.90 per carat recovered.

The Renard mine finished the year with an indicated resource of 3.7 million carats in 8.7 million tonnes at 42.3 cpht and an inferred resource of 13.0 carats in 23.4 million tonnes at 55.8 cpht. These resources are exclusive of mineral reserves. There is also an exploration upside of 32.8 million to 71.3 million carats, but this potential cannot be included in resources.

(This article first appeared in the Canadian Mining Journal)

The post Stornoway finishes year with revenue down, losses up appeared first on MINING.com.

from MINING.com https://ift.tt/2JP49XV

Golden Star boosts Ghana gold resources despite depletion

Golden Star Resources (TSX: GSC; NYSE: GSS) has increased its overall reserves by 6%, net of mining depletion. It offset a loss in reserves at its Prestea gold mine by adding reserves at its Wassa gold mine, both located in Ghana.

In total the company has 19.4 million proven and probable tonnes grading 2.86 grams gold for 1.79 million oz. gold across its Wassa and Prestea gold mines.

Its biggest loss came at the Prestea mine, where reserves decreased by 36% net of depletion. Prestea now contains 853,000 proven and probable tonnes grading 11.57 grams gold for 317,000 oz. gold.

It also increased reserves at its Wassa mine 23% net of depletion. Wassa now contains 18.6 million proven and probable tonnes at 2.48 grams gold for 1.47 million oz. gold.

It boosted reserves at Wassa underground in particular by 47% net of depletion. Wassa underground now contains 7 million proven and probable tonnes at 3.95 grams gold for 949,000 oz. gold.

In February 2019, the company also increased inferred resources by 93% at its Father Brown gold project in Ghana. The project now contains 2.3 million inferred tonnes at 6.4 grams gold for 474,743 oz. gold.

(This article first appeared in The Northern Miner)

The post Golden Star boosts Ghana gold resources despite depletion appeared first on MINING.com.

from MINING.com https://ift.tt/2U2LKvi

K92 Mining reports early result from Blue Lake prospect in Papua New Guinea

K92 Mining (TSXV: KNT) has intersected 175 metres of 0.28 gram gold per tonne and 0.22% copper from 259 metres downhole at its Blue Lake porphyry prospect, 4 km southwest of its Kora deposit at the Kainantu gold mine in Papua New Guinea.

The hole ended in mineralization.

The company discovered the prospect in 2017 after a surface mapping and sampling program. It completed a soil grid at 50-metre spacing over a 2-sq-km area and collected more than 1,000 samples, revealing a large coincident gold and copper anomaly.

The company expects the mine will produce 68,000 to 75,000 ounces of gold-equivalent this year

Silicified breccias in outcrop were initially encountered in September 2017, with samples assaying up to 20 grams gold per tonne and 15% copper.

K92 plans to complete a 2,400-metre diamond drill program at the porphyry prospect this year. The program will consist of six 400-metre deep holes.

Earlier this month, the company announced its decision to double capacity at its Kainantu gold mine to 400,000 tonnes a year by the end of the fourth quarter, increasing production to an average of 120,000 ounces of gold-equivalent annually over the next 13 years.

The company expects the mine will produce 68,000 to 75,000 ounces of gold-equivalent this year and 115,000-125,000 ounces of gold-equivalent in 2020.

Capital costs for the expansion are estimated to be $15 million over a 12-month period.

A preliminary economic assessment of the expansion plan completed in January demonstrated the expanded operation would produce almost 650,000 ounces of gold and 10,000 tonnes of copper over the next five years and over 1.3 million ounces and 60,000 tonnes of copper over a mine life of 13 years. The study estimated cash costs of US$429 per gold-equivalent ounce and all-in sustaining costs of US$615 per gold-equivalent ounce.

The Kainantu mine is in the Eastern Highlands province of Papua New Guinea. The property was previously mined by Highlands Pacific and Barrick Gold (TSX: ABX; NYSE: GOLD) in the early 2000s. After being commissioned in 2006, the processing facilities operated for just under a year before Barrick put them on care and maintenance in December 2008.

The 410-sq-km property is about 180 km west-northwest of Lae.

(This article first appeared in The Northern Miner)

The post K92 Mining reports early result from Blue Lake prospect in Papua New Guinea appeared first on MINING.com.

from MINING.com https://ift.tt/2HLoewe

Chile's Codelco to boost production at El Teniente copper mine

Chile’s state miner Codelco, the world’s No.1 copper producer, plans to boost production at its El Teniente mine to more than 500,000 tonnes per year by 2025, a first in the operation’s history.

The production increase would position the mine, which produced 465,000 tonnes of the red metal in 2018, among the world's five largest copper operations, local paper El Mercurio reports.

El Teniente is the world’s biggest underground copper mine and the sixth largest by reserve size.

As part of the plan, Codelco — which hands over all of its profits to the state — aims at raising the annual surplus generated by the El Teniente division by 20%. Currently it contributes about $1 billion.

The miner also expects to reduce the division’s cash costs, with the goal of setting them at $1 per pound of copper.

El Teniente is the world’s biggest underground copper mine and the sixth largest by reserve size. Located 80km south of Santiago in the Andes mountain range in Chile, the facility is undergoing an extensive $3.4 billion-expansion project called El Teniente New Mine Level project to extend its productive life by 50 years.

The expansion, expected to be completed in 2013, is part of an ambitious, 10-year, $39 billion investment drive at Codelco to open new projects and overhaul older mines.

The state-miner holds vast copper deposits, accounting for 10% of the world's known proven and probable reserves and about 11% of the global annual copper output with 1.8 million tonnes of production.

The post Chile's Codelco to boost production at El Teniente copper mine appeared first on MINING.com.

from MINING.com https://ift.tt/2U8obkY

Une tempête géante observée sur une exoplanète à 129 années-lumière de la Terre !

from Les dernières actualités de Futura-Sciences https://ift.tt/2ODHf4B

Le réchauffement de l’Arctique fait craindre des sécheresses aux latitudes moyennes

from Les dernières actualités de Futura-Sciences https://ift.tt/2JMYxgR

Une partie des Congolais pense que l'épidémie d'Ebola est une invention

from Les dernières actualités de Futura-Sciences https://ift.tt/2CI7t13

Firestone Diamonds halts Liqhobong mine expansion plans, limits losses

Africa-focused Firestone Diamonds (LON:FDI) has put plans to extend the life of its 75%-owned Liqhobong mine in Lesotho in the back burner, saying that current market conditions don’t support the project.

The company, which reported 2019 interim results on Thursday, managed to limit its losses in the six months to December 31, despite a global price slump for smaller, lower-value diamonds.

Firestone lost $6.6 million in the period, or 1.3c per share, compared to a loss of $7.8 million, or 2.2c per share, in the first half of the 2018 financial year.

Higher production and average grade per carats from Liqhobong — 465,680 compared to 379,716 carats in 2018 — help shored up finances, though prices for its low-end diamonds and a $2.2 million charge ultimately weighed on the bottom line.

Diamond miners are struggling across the board, especially those producing cheaper and smaller stones where there is too much supply. In December, some of Rio Tinto’s (LON, ASX: RIO) customers refused to buy cheaper diamonds, while De Beers has been forced to cut prices and offer concessions to buyers.

Firestone spent $185 million building Liqhobong, which started production in late 2016, and boasts over 11 million carats in reserve. The total open pit resource contains over 17 million carats to a depth of 393 metres.

The post Firestone Diamonds halts Liqhobong mine expansion plans, limits losses appeared first on MINING.com.

from MINING.com https://ift.tt/2V5LgBe

Xiaomi Mi Flex : une nouvelle vidéo du smartphone avec écran pliable

from Les dernières actualités de Futura-Sciences https://ift.tt/2UjQDPV

L'antimatière vous révélera ses mystères la nuit du 1er avril

from Les dernières actualités de Futura-Sciences https://ift.tt/2FBMKMM

Le langage des abeilles enfin décrypté

from Les dernières actualités de Futura-Sciences https://ift.tt/2HHZFAg

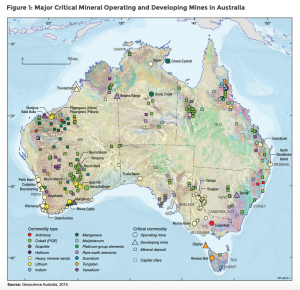

Australia launches Critical Minerals Strategy 2019 focused on innovation and tech

The Federal Government of Australia launched today the Critical Minerals Strategy 2019 aimed at putting emphasis on what politicians call “the industries of the future.” In their view, these sectors include agritech, aerospace, defense, renewable energy and telecommunications.

“We have some of the world’s richest stocks of critical minerals and while the market for some of our minerals such as lithium is relatively mature, other minerals markets such as cobalt remain largely underdeveloped in Australia,” said the Minister for Trade, Tourism and Investment Simon Birmingham from Kemerton, the area where Albemarle’s lithium processing plant is being built.

In Birmingham’s view, Australia needs to work a little bit harder on attracting and locking-in domestic and overseas investment to get projects off the ground. “That’s why a key part of this strategy is about how industry and government agencies such as Austrade can work together to promote our potential to the world to attract more international investment, particularly in downstream projects and greenfield opportunities,” he said.

The Strategy reinforces the work of the A$100.5 million Exploring for the Future initiative, which is aimed at helping explorers target new mineralization by using high tech to observe the deepest roots of mineral systems all the way through to the surface.

The plan also supports the work of the MinEx Cooperative Research Centre, a 10-year research program whose goal is to develop and deploy the next generation of drilling technology and which will receive A$20 million in the coming years.

The 2019 action plan contemplates that the Cooperative Research Centre for Optimising Resource Extraction consumes all of its A$34.45 million in funding by 2021 as it works on developing energy-saving and resource-expanding technology that will allow lower-grade ores to be economically and eco-efficiently mined.

The Critical Minerals Strategy also backs the Major Projects Facilitation Agency, which provides a single entry point for major project proponents seeking tailored information and facilitation of their regulatory approval requirements.

For Tania Constable, CEO of the Minerals Council of Australia, government funding for innovation, skills and investment promotion is valuable, but she believes more needs be done. “Investment in the next wave of base metal and critical commodity mines and processing plants is not guaranteed, as Australia faces growing competition to attract international capital. The resources industry needs to convert this potential into lasting economic benefits,” she said in a media statement.

The post Australia launches Critical Minerals Strategy 2019 focused on innovation and tech appeared first on MINING.com.

from MINING.com https://ift.tt/2FG5kVd

Walker River and Smooth Rock to join forces in Nevada gold project

Canada's Walker River Resources (TSXV: WRR) announced this week that it signed a letter of intent with Smooth Rock Ventures (TSXV: SOCK) to enter into an exploration agreement with option to form a joint venture on the Garfield Flats project, located in Mineral County, Nevada.

The deal contemplates that Smooth Rock can earn an undivided 50% interest in the property by funding $600,000 in exploration expenditures. Walker, on the other hand, would be the operator of the exploration during the earn-in period.

Mineral County, where the Garfield Flats property is located, is one of the most pro-mining counties in Nevada.

The Garfield Flats project consists of 106 unpatented mining claims that occupy approximately 858 hectares near the town of Hawthorne and cover several past-producing small-scale high-grade gold and copper mines such as Bodie, Aurora, Borealis, and Pamlico.

In a media statement, the companies involved in the project explained that the claims also cover altered and mineralized zones discovered by previous geological compilations. "Historical sampling on the project has revealed the presence of copper, bismuth, and antimony as well as pervasive lower grade gold mineralization, cut by vein structures (some previously mined) of higher-grade gold," the press brief reads.

According to Walker and Smooth rock, Garfield Flats has been held mostly by private interests so it remains very underexplored with potential for new discoveries on several targets.

The post Walker River and Smooth Rock to join forces in Nevada gold project appeared first on MINING.com.

from MINING.com https://ift.tt/2UWLz0W

Mission H24 : un prototype à hydrogène roule au Mans avec Bertrand Piccard

from Les dernières actualités de Futura-Sciences https://ift.tt/2HLj6Im

AngloGold to go ahead with underground expansion of Tropicana

Joint venture partners AngloGold Ashanti (JSE:ANG) (NYSE:AU) and Independence Group (IGO) have approved $79.3 million underground expansion at their Tropicana gold mine in Western Australia.

The project, dubbed the Boston Shaker, is expected to contribute higher-grade mill feed, resulting in an improved gold production profile and enhanced cash flow.

Once the underground portion is operative, Tropicana — located 200km east of Sunrise Dam and 330km east-northeast of Kalgoorlie — will be able to maintain gold production at between 450,000-500,000 ounces annually over the five years to and including the 2023 financial year.

The Boston Shaker extension is expected to contribute an annual average of 100,000 ounces to Tropicana’s production profile from the 2021 financial year.

Boston Shaker is expected to contribute around 100,000 ounces a year, with first gold expected during the September 2020 quarter. The feasibility study estimated a capital cost for the project of A$105 million, higher than the $95 million estimated in December.

“Underground mining at Boston Shaker will leverage further value from this high performing operation, achieving pay-back in just over three years,” Ludwig Eybers, AngloGold Ashanti’s Chief Operating Officer International, said in the statement.

The Boston Shaker ore body remains open at depth and the JV partners will continue to test high grade extensions to the mineral resource beneath the Tropicana and Havana pits to assess the opportunity for further underground mining operations, they said.

Macmahon Holdings has been awarded a five-year, $170 million mining services contract for the underground mine. The work adds to the supplier’s existing agreement at Tropicana, which is already the site of the company’s largest mining contract in Australia.

AngloGold, now under the leadership of Kelvin Dushnisky, a Barrick Gold veteran, looks very different from four years ago. The company has become increasingly global, with only about 13% of its output from South Africa after selling mines to stem losses in the country. That’s down from 43% in 2007.

AngloGold's other mines stretch from Australia to Argentina and Ghana, and the company owns 70% of Tropicana while Independence Group NL holds the rest.

The post AngloGold to go ahead with underground expansion of Tropicana appeared first on MINING.com.

from MINING.com https://ift.tt/2CSI9pd

Mars : la sonde TGO scrute les changements à la surface de la Planète rouge

from Les dernières actualités de Futura-Sciences https://ift.tt/2Ov7nhL

Avion hybride : Faradair annonce le premier vol commercial pour 2025

from Les dernières actualités de Futura-Sciences https://ift.tt/2FGfNAa

Courir ou manger du chocolat : ce sont les récepteurs cannabinoïdes qui décident

from Les dernières actualités de Futura-Sciences https://ift.tt/2YwmJHu

Le glacier le plus rapide du Groenland a ralenti !

from Les dernières actualités de Futura-Sciences https://ift.tt/2TF4Y57

Surprise : l’astéroïde Ryugu est un tas de débris très secs

from Les dernières actualités de Futura-Sciences https://ift.tt/2FESNBs

Les bactéries voyagent dans les airs pour partager leurs gènes

from Les dernières actualités de Futura-Sciences https://ift.tt/2YwRY5l

mercredi 27 mars 2019

Nourrir les oiseaux a des conséquences sur la nature et sur nous

from Les dernières actualités de Futura-Sciences https://ift.tt/2FxKV3u

Rubicon boosts measured and indicated resources at Phoenix by 110%

After a 20,000-metre drill program last year at its Phoenix project in Red Lake, Rubicon Minerals (TSX: RMX) has increased measured and indicated resources by 110% to 589,000 oz. gold compared with the earlier estimate of 281,000 oz. gold, while gold grades fell 2% to 6.26 grams gold per tonne from 6.37 grams gold.

Inferred resources fell 28% to 540,000 oz. gold compared to the previous estimate of 749,000 oz. gold, while grades increased 9% to 6.53 grams gold from 6 grams gold, previously.

The company has started a preliminary economic assessment which it expects to complete by year-end.

Rubicon plans further infill drilling to expand the measured and indicated resources to a threshold of more than 650,000 oz. gold, a level that the company says is required to advance the project to the feasibility stage. The company plans to drill another 20,000 metres this year.

The company says its 35,000-tonne test trial mining and bulk sampling work at the end of 2018 validates its current geological model.

Exploration target areas with greater than 80-metre centres have the potential of between 0.9 million and 1.2 million tonnes of mineralizered material grading between 5 grams and 7 grams gold, mostly at depth, the company says.

The updated mineral resource model covers a strike length of about 1,200 metres and depths down to 1,403 metres, and remains open along strike and at depth. It excludes the crown pillar and depleted resources from test trial mining.

Rubicon is the second-largest property holder in the Red Lake gold camp of northwestern Ontario, with more than 28,000 hectares

At a base case cut-off grade of 3 grams gold per tonne, Phoenix contains 2.93 million measured and indicated tonnes grading 6.26 grams gold for 589,000 oz. gold and a further 2.57 million inferred tonnes grading 6.53 grams gold for 540,000 oz. gold.

Rubicon says that it has boosted measured and indicated resources by a total of 456% over the last two years.

In addition, surface infrastructure is ready for operations, the company says, including a fully operational hoist, civil and earthworks, an electric substation, upgrades to a 200-person camp, a tailings management facility and a water treatment plant.

Underground, more than 14,000 metres of development are also in place, including an operational shaft down to 730 metres below surface.

Rubicon is the second-largest property holder in the Red Lake gold camp of northwestern Ontario, with more than 28,000 hectares.

Trial mining of the project was called off in late 2015, when the company, under a previous management team, realized the geology was more complex than it had thought, and a new resource estimate revealed that contained gold ounces in the indicated resource category had plunged 91% from a 2013 resource estimate, while contained gold ounces in the inferred category had fallen 86%. The company halted all work and spent the rest of the year and much of 2016 staving off bankruptcy.

The company hired mining engineer George Ogilvie in July 2016 to restructure Rubicon and turn the Phoenix project around.

Ogilvie began his career in 1989 with AngloGold in South Africa working in the ultra-deep, high-grade gold mines in the Witwatersand basin. Before joining Rubicon, Ogilvie was the CEO of Kirkland Lake Gold (TSX: KLG) from 2013 to 2016, where his management team improved operations at the company’s Macassa mine and guided its acquisition of St Andrew Goldfields. Before joining Kirkland, Ogilvie was the CEO of Rambler Metals and Mining (TSXV: RAB), where for over seven years he guided the company from grassroots exploration to a profitable junior producer.

(This article first appeared in The Northern Miner)

The post Rubicon boosts measured and indicated resources at Phoenix by 110% appeared first on MINING.com.

from MINING.com https://ift.tt/2V0v9Vl

First Mining improves indicated resource at Goldlund

First Mining Gold (TSX: FF) has updated the resource estimate at its Goldlund gold project in northwestern Ontario. The company added 248,700 oz. gold to its indicated resource but lost 628,400 oz. gold from its inferred resource.

The project now contains 12.8 million indicated tonnes grading 1.96 grams gold for 809,200 oz. gold. It previously contained 9.3 million indicated tonnes at 1.87 grams gold for 560,497 oz. gold.

It also contains 18.3 million inferred tonnes grading 1.49 grams gold for 876,954 oz. gold. It previously contained 40 million inferred tonnes at 1.33 grams gold for 1.75 million oz. gold.

First Mining updated two of the project’s seven zones with results from its 40,000 metre, 2018 infill drill program.

In the indicated category, the company reduced tonnage in Zone 1 but improved grade and added ounces. The zone now contains 4.8 million indicated tonnes at 2.16 grams gold for 330,150 oz. gold. It previously contained 5.5 million indicated tonnes at 1.65 grams gold for 292,197 oz. gold.

It also tabled Zone 7’s first indicated resource. The zone now contains 4.1 million indicated tonnes at 1.58 grams gold for 210,753 oz. gold.

(This article first appeared in The Northern Miner)

The post First Mining improves indicated resource at Goldlund appeared first on MINING.com.

from MINING.com https://ift.tt/2OvzUnj

Galaxy Resources, Cree Nation sign pre-development deal

Australian miner Galaxy Resources and the Cree Nation of Eastmain have entered into a pre-development agreement for the James Bay lithium mine, 100 km east of the community of Eastmain, Quebec.

The PDA commits the company to notify the Cree of employment and training opportunities. It also specifies that the company practice preferential hiring of qualified Cree individuals and seek business proposals from Cree companies. Galaxy will also hire a local community liaison co-ordinator who will be based in Eastmain.

The Cree will support pre-production activities and development of the project. They will also co-operate with the company regarding environmental and social impact assessment studies and use best efforts to ensure that the project proceeds in an efficient and timely manner through the review process.

Galaxy filed the environmental and social impact review for the James Bay project with the Canadian Environmental Assessment Agency in October 2018.

(This article first appeared in the Canadian Mining Journal)

The post Galaxy Resources, Cree Nation sign pre-development deal appeared first on MINING.com.

from MINING.com https://ift.tt/2FGBmRg

Golden Predator consolidates holdings in 3 Aces district

Vancouver-based Golden Predator has agreed to purchase 100% of the Reef gold property from Precipitate Gold. The Reef property is 200 km north of Watson Lake, adjacent to Golden Predator’s 3 Aces gold project. The purchase of the Reef property consolidates Golden Predator’s holdings in the district.

The original option agreement signed in February 2017 has been amended, saving Golden Predator $450,000 in cash plus about $400,000 in shares.

Golden Predator has spent several years exploring the 3 Aces project, concentrating on the Central Core area. The company has tested the Reef property and determined that the geology and style of mineralization at the Reef targets are very similar to that of the Central Core area.

The company plans to restart the pilot plant and continue with bulk sampling this year.

(This article first appeared in the Canadian Mining Journal)

The post Golden Predator consolidates holdings in 3 Aces district appeared first on MINING.com.

from MINING.com https://ift.tt/2Wyv4Zz

Iamgold reports new discovery at Côté project

Toronto-based Iamgold Corp. (70% owner) and Sumitomo Metal Mining Co. (30% owner) of Japan have announced the discovery of a new gold zone at their Côté project 125 km southwest of Timmins, Ontario. The new zone of intrusive-hosted mineralization has been named the Gosselin zone.

Drill cores from the new zone yielded the following assays:

- Hole CL15-39EXT: 0.81 g/t gold over 350.0 metres, including 2.43 g/t over 15.0 metres,1.13 g/t over 91.0 metres, and 1.12 g/t over 104.0 metres;

- Hole GOS17-05: 0.68 g/t gold over 345.0 metres including 1.13 g/t over 132.3 metres;

- Hole GOS18-07: 0.63 g/t gold over 130.0 metres and 1.36 g/t gold over 139.7 metres, including 2.11 g/t over 79.0 metres; and

- Hole GOS18-09: 0.65 g/t gold over 261.2 metres, including 0.95 g/t over 163.0 metres, and a separate intersection of 1.42 g/t gold over 92.0 metres.

The Gosselin zone is located about 1.5 km northwest of the Côté gold deposit. The mineralized zone is a wide corridor of mineralization approximately 750 metres along strike, 200 metres wide and 400 metres in depth.

Iamgold completed a feasibility study for Côté last year. It was estimated to contain measured and indicated resources of 10 million oz. of contained gold and inferred resources of 2.4 million oz.

(This article first appeared in the Canadian Mining Journal)

The post Iamgold reports new discovery at Côté project appeared first on MINING.com.

from MINING.com https://ift.tt/2uwL6qF

Last kimberlite trucked to plant at De Beers Victor mine

The last truckload of kimberlite from Ontario’s first and only diamond mine has left the pit. De Beers Canada said mining ceased at Victor mine on March 5 – 11 years to the day after the official opening in 2008.

The honour of driving the last truck went to Nancy Wesley, of Kashechewan First Nation. She worked at Victor for 11 years, as a haul truck driver, dozer operator and production drill operator.

Stockpiled kimberlite will keep the recovery plant running until early May.

The Victor mine was forecast to produce 6 million carats of diamonds over its life, but it beat that by recovering a total of 8 million carats – with a record 936,000 carats produced in 2018. The project provided about 1,360 jobs and $3.7 billion of revenue to the province.

De Beers received several safety awards for Victor and was named International Mine of the Year in 2009.

(This article first appeared in the Canadian Mining Journal)

The post Last kimberlite trucked to plant at De Beers Victor mine appeared first on MINING.com.

from MINING.com https://ift.tt/2U7LJph

Avec AMP, Google va transformer les e-mails

from Les dernières actualités de Futura-Sciences https://ift.tt/2WuAJ2O

Newmont readies leadership team post-merger with Goldcorp

US gold giant Newmont Mining (NYSE:NEM) has put together an executive leadership team that will come into effect once its acquisition of Canada’s Goldcorp (TSX:G) (NYSE:GG) is completed, which is expected to happen in the second quarter.

The group, says the company, will feature some of the industry’s best talent and most experienced mining executives known for superior operational execution, consistent project delivery and leadership in safety and sustainability.

Chief executive Gary Goldberg will remain as such until the fourth quarter, when he will retire, to be succeeded by Tom Palmer.

“Going forward, Newmont Goldcorp will maintain its focus on the success and continuity of our business through strategic leadership development, building high performing teams, and robust succession planning,” Tom Palmer, President and COO, said in a statement.

Chief executive Gary Goldberg will remain as such until the fourth quarter, when he will retire, to be succeeded by Tom Palmer who keeps his role of President.

Rob Atkinson will take over the COO position on June 1.

Other promotions include Jennifer Cmil as executive VP for human resources, Dean Gehring as VP and chief technology officer, Steve Gottesfeld as executive VP and chief sustainability and external affairs officer and Nancy Lipson executive VP and general counsel.

Randy Engel will remain as VP for strategic development and Marcelo Godoy as senior VP for exploration.

Newmont and Goldcorp announced their $10 billion combination in January, but the deal was faced recent challenges, with Newmont shareholders revolting over an “unfair” benefit that Goldcorp shareholders would have following the Nevada joint venture agreement between Newmont and Barrick.

The Greenwood Village, Colorado-based mining giant weathered the storm by promising investor to sweeten the pot with the largest dividend in 32 years.

The post Newmont readies leadership team post-merger with Goldcorp appeared first on MINING.com.

from MINING.com https://ift.tt/2JJmNAk

Cern : LHCb confirme l'existence du pentaquark

from Les dernières actualités de Futura-Sciences https://ift.tt/2WtFpWi

Huawei annonce ses smartphones P30 et plein d'autres nouveautés

from Les dernières actualités de Futura-Sciences https://ift.tt/2CHOhjJ

Le « prix Nobel d’informatique » décerné au Français Yann LeCun

from Les dernières actualités de Futura-Sciences https://ift.tt/2HJdzlW

La pilule contraceptive masculine se montre efficace dans un essai clinique

from Les dernières actualités de Futura-Sciences https://ift.tt/2V1QkX6

Le cerveau fabrique des nouveaux neurones jusqu'à 90 ans et plus

from Les dernières actualités de Futura-Sciences https://ift.tt/2CAMHjN

U.N., ethical investors join miners quest for global tailings rules

The International Council on Mining and Metals (ICMM), a London-based industry group representing 27 major companies, said Wednesday it was working with the United Nations Environment Programme (UNEP) and ethical investors to come up with global standards for tailings dams.

The initiative is in response to the recent tragedy at Vale’s Corrego do Feijão mine in Brazil, where a tailings collapsed in January, killing about 300 people.

Other than UNEP, ICMM is also working with the Principles for Responsible Investment (PRI), a group that brings together ethical investors overseeing around $80 trillion worth of investments.

Currently there are no established global standards defining what a tailings dam is, how to build one and how to care for it after it is decommissioned.

There are about 3,500 tailings dams around the world. Unlike the ones used to build reservoirs or hydroelectric projects, tailings dams are not usually made from reinforced concrete or stone. They are mostly constructed from the waste material left over from mining operations, which — depending on the type of mine — can be toxic.

Only three countries in the world ban upstream dams — Chile, Peru, and now Brazil. Chile, the world’s No.1 copper producer, also regulates the minimum distance between dams and urban centres. But the nation still has 740 tailings deposits, only 101 of which are active, with the rest abandoned or inactive, according to data from mining agency Sernageomin.

ICMM, which announced its intention to work on global standards last month, counts as members major companies including BHP, Rio Tinto, Glencore and Vale itself.

Click here for complete coverage of the dam burst at Vale's Córrego do Feijão mine.

The post U.N., ethical investors join miners quest for global tailings rules appeared first on MINING.com.

from MINING.com https://ift.tt/2TCmEhU

Seabridge gets extension of environmental certificate for the KSM project

The western Canadian Province of British Columbia approved a 5-year extension of Seabridge Gold's (TSX: SEA) (NYSE: SA) Environmental Assessment certificate for the KSM project.

According to Seabridge, the original permit was issued for an initial 5-year term on July 29, 2014, following a comprehensive independent environmental assessment review.

The new certificate, whose terms mirror those of the previous one and establish that the Toronto-based miner has to commence construction of the project before July 29, 2024, was given to the company after it carried out an engagement process with the Nisga'a Nation, and the Tahltan and Gitxsan Nations.

From 2013 to 2016, Seabridge targeted higher grade zones beneath KSM's near surface porphyry deposits, resulting in the discovery of Deep Kerr (2013) and the Iron Cap Lower Zone (2014).

"We are pleased that our EA Certificate has been renewed until 2024 under the same terms and conditions, reaffirming the Government of British Columbia's support for KSM and the robustness of the original 2014 EA," Seabridge Chairman and CEO, Rudi Fronk, said in a media statement. "The extension highlights that KSM is a well-designed, environmentally responsible project offering significant economic benefits for British Columbia and Canada. The receipt of the extension allows us to continue our engagement with prospective joint venture partners for KSM."

The KSM project, located near the town of Stewart, has been described as one of the largest undeveloped gold projects in the world, measured by reserves.

An updated Preliminary Feasibility Study estimates that the property's proven and probable reserves total 38.8 million ounces of gold and 10.2 billion pounds of copper.

At present, Seabridge reports advancing exploration programs to produce major improvements in the economic and environmental parameters of the project.

The post Seabridge gets extension of environmental certificate for the KSM project appeared first on MINING.com.

from MINING.com https://ift.tt/2FzEHjv

Margaux executes definitive agreement to acquire Cassiar gold project in BC

Margaux Resources (TSXV: MRL) executed this week the definitive agreement with Wildsky Resources (TSXV: WSK) that was first announced two months ago and the refers to an option to acquire a 100% interest in the Cassiar gold project in northern British Columbia.

The property, including all existing infrastructure such as a 270 tonne per day flotation and gravity mill and a tailings storage facility, is held by Cassiar Gold, a wholly-owned subsidiary of Wildsky. Under the terms of the definitive agreement, Margaux has to acquire all of the common shares in the capital of Cassiar Gold and issue 58,200,000 common shares in the capital of Margaux at a deemed price of $0.08 per share, for aggregate consideration of $4,656,000.

Margaux has to invest at least $400,000 on the planning, development and execution of the Cassiar 2019 work program.

Margaux must also undertake exploration on Cassiar's property.

“The Sheep Creek and Cassiar projects are two of the three regions identified in a recently published GeoScience BC report as having good upside potential for orogenic gold mineralization in BC,” Tyler Rice, President and CEO of the buying company, said in a media statement. “Margaux looks forward to applying our learning and geological insights from our recent work at Sheep Creek to the Cassiar project.”

Rice explained that the Cassiar gold project is an advanced-stage orogenic gold system with a historical Inferred Resource of 1.04 million ounces gold (32.4 million tonnes at an average grade of 1.0 g/t gold using a cut-off grade of 0.5 g/t gold).

The CEO also said that these data were presented in 2009 and thus his firm is not treating the historical estimate as current mineral resources or mineral reserves. “As Margaux works to complete its evaluation of the property it anticipates identifying and completing a drill program in 2019, completing further QA/QC work and engaging an independent reserves evaluator to complete an updated 43-101 report.”

The post Margaux executes definitive agreement to acquire Cassiar gold project in BC appeared first on MINING.com.

from MINING.com https://ift.tt/2CGx0aO

More than a third of gold mines in Congo exposed to Ebola — report

More than 35% of the gold mines in the Democratic Republic of Congo (DRC) are at risk of being directly or indirectly affected by the ongoing Ebola outbreak in the country, the world’s top cobalt miner and a significant copper and gold producer, a study shows.

The number of people infected with the often fatal virus has now exceeded 1,000 cases, the World Health Organization confirmed, making it the second-worst outbreak in history, with daily rates on the rise as response workers continue to face violence.

Together with the obvious risks for those working in the country’s gold mines, companies are now facing delays in their exports, as part of Ebola prevention methods being implemented at border checkpoints, Indigo Ellis, Verisk Maplecroft’s lead DRC Analyst warns.

Barrick’s Kibali and Vector Resources’ Adidi-Kanga gold mines are now threatened as the Ebola-infected areas grow, potentially jeopardizing output, says Verisk Maplecroft.

The effect on gold producers depends on whether mines are industrial or artisanal, and on how close they are to known cases, the expert says. In Ellis’ view, there are two major issues the gold mining industry has to urgently deal with.

One, is the risk to mine staff. “Larger industrial mining companies will need to enact strict protocols to reduce the risk of transmission to their sites, which will likely slow down ore extraction and construction efforts,” the analyst says.

The other is related to shipments disruptions. “Ebola prevention methods at border checkpoints will almost certainly slow gold exports as the Ugandan government and World Health Organization (WHO) introduce measures to limit the spread,” Ellis says. “A combination of lengthier processes, such as heat signature mapping, and less time-consuming methods, such as hand washing, will result in tailbacks at border crossings.”

Verisk Maplecroft has detected a growing threat to industrial mines such as Barrick’s Kibali and Vector Resources’ Adidi-Kanga, which increases the likelihood of gold production being affected, especially after the recent confirmation of cases in Bunia, a city of close to 1 million people, closer to the Ugandan border than previous outbreaks.

High tech companies, including Apple and US consumer products manufacturer Richline Group, may soon be affected as well, the global risk consultancy says, as they source artisanal gold from the affected areas.

The risk assessment specialist notes that, in its current form, the Ebola epidemic won’t impact the nation’s cobalt production, as the distance from the Katanga region largely prevents its spread. Ellis bases his predictions on the DRC’s low-risk score achieved in Verisk Maplecroft’s Pandemic Transmission Index, which measures the likelihood of pandemic spread relative to connectivity, including travel infrastructure.

The DRC generates more than 60% of the world’s cobalt, a key material for making the batteries that power electric cars.

Worse before it gets better

The consultancy’s outlook is not encouraging as it expects health workers to continue to struggle to track contacts with Ebola patients, which makes it hard to stop the virus from spreading across the eastern provinces.

Violence in the DRC has forced Ebola treatment facilities to shut. Five Ebola centres have been attacked since last month, sometimes by armed assailants. The violence led French medical charity Doctors Without Borders to suspend its activities at the epicentre of the outbreak on Feb. 28.

This past week saw 58 new cases, the highest number in a week this, according to the International Rescue Committee (IRC).

“We are already almost seven months into this outbreak and at this stage we should be seeing the case rate declining, not on the rise,” Tariq Riebl, IRC’s Emergency Response Director in the DRC, told Times Magazine.

“With an optimistic outlook this outbreak is predicted to last another six months — but realistically we could be looking towards another year of fighting this disease,” Riebl said.

The post More than a third of gold mines in Congo exposed to Ebola — report appeared first on MINING.com.

from MINING.com https://ift.tt/2FzpT4s