mercredi 30 novembre 2022

World Impact Summit 2022 : un sommet international pour innover autrement

from Les dernières actualités de Futura https://ift.tt/AxG3TlH

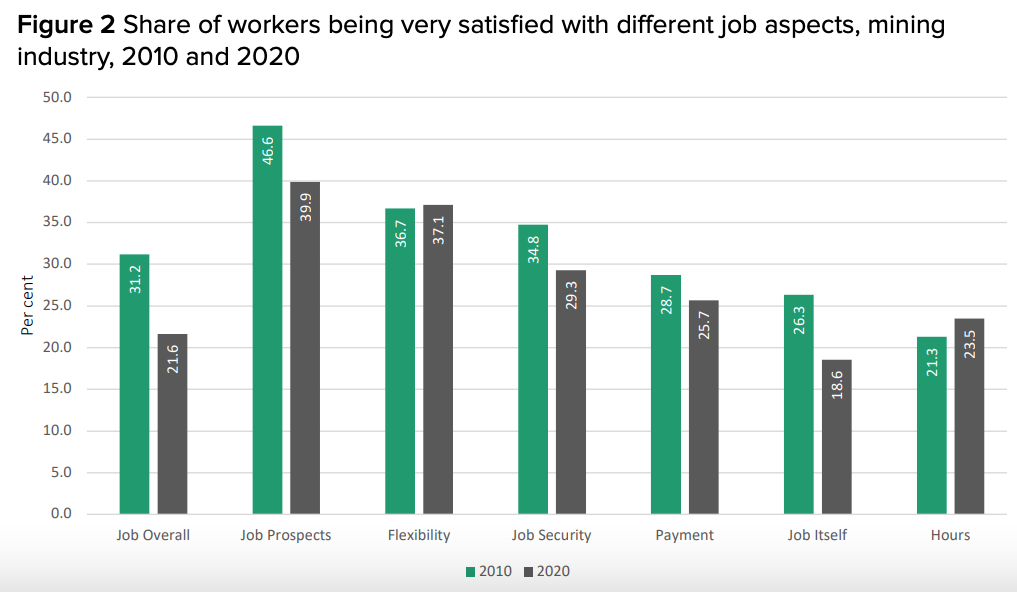

Most Australian mine workers dissatisfied with their jobs – report

A recent report led by researchers at Curtin University has found that Australian mining companies have a stronger focus on employees’ physical health and safety than on their mental health and well-being.

The study examined employee welfare in the mining sector and found that only 22% of workers were very satisfied with their overall job, with employees experiencing poor job satisfaction, job security and job prospects compared to other industries.

By reviewing secondary evidence from the Australian Human Rights Commission, the authors of the report also found the mining sector is one of the worst five industries in the country in relation to sexual harassment issues, with 40% of workers and 74% of female workers reporting sexual harassment in the last five years.

The dossier develops a unique index to capture the prioritization of employee health and well-being based on mining companies’ public reports and found that many of them, particularly those that are larger or have women at the helm, are prioritizing well-being. However, only 33% refer to loneliness, social connection, or isolation in their reports, and only 50% of mining companies refer to sexual harassment, assault, and sexism.

According to Astghik Mavisakalyan, co-author of the study and a professor at the Bankwest Curtin Economics Centre, all of these factors contribute to the mining industry rating the lowest among all Australian industries for job satisfaction.

“We found that while mining sector workers experienced good physical health and were more satisfied with their jobs now compared to 15 years ago, the number of very satisfied workers was the lowest of all industries,” Mavisakalyan said. “The report also showed that the levels of high distress of mining sector workers had risen considerably in the past decade, from 9% in 2009 to 15% in 2019.”

For Mavisakalyan and her colleagues, it is important to identify and support employees that are experiencing poor mental health and proactively create a healthy work environment.

“This means developing work cultures in which women are welcome and accepted, as well as, for all workers, having meaningful jobs with decent rosters, acceptable levels of job demands, and supportive managers,” Sharon Parker, a researcher at Curtin’s Future of Work Institute, said. “Having anti-harassment and mental health policies is necessary but not sufficient. These policies need to be backed up by on-the-ground support, such as effective systems for reporting harassment, and education and training of managers to effectively implement the policies.”

Parker and Mavisakalyan also mentioned this report is the first contribution to a major project that is intended to promote positive and effective change for those working in the mining industry who might be experiencing poor mental health and well-being, as well as those subjected to sexual harassment in the workplace.

from MINING.COM https://ift.tt/EuTFOci

Un intrigant dinosaure nain avec une tête plate découvert en Transylvanie

from Les dernières actualités de Futura https://ift.tt/PcXInWs

Le MIT crée des robots intelligents auto-répliquants !

from Les dernières actualités de Futura https://ift.tt/KbQnD8X

Une « triple épidémie » de virus respiratoires menace les hôpitaux

from Les dernières actualités de Futura https://ift.tt/qIZPK7h

mardi 29 novembre 2022

Cassiar Gold drilling in northern British Columbia returns promising grades

The latest results from drilling at Cassiar Gold’s (TSXV: GLDC; US-OTCQX: CHLCF) Taurus deposit in the Cassiar North area of northern British Columbia confirm the project’s bulk-tonnage potential, the Calgary, Alberta-based company says.

According to Cassiar’s CEO, Marco Roque, the assay results from six holes drilled this summer demonstrate similar grades and apparent thickness as drill holes used in the 2022 Taurus resource estimate.

Highlights include drill hole 22TA-158 at Taurus West, which intersected 72.3 metres of 1.09 grams gold per tonne from 337 metres downhole, extending mineralization 50 metres beyond the inferred resource open-pit shell.

Drill hole 22TA-152 at Taurus Central returned several intervals, including 20.2 metres of 1.33 grams gold from 157.4 metres downhole outside the current resource grade shell, including 0.5 metre of 25.9 grams, and 29.1 metres of 1.17 grams gold from 279.7 metres downhole. The holes expanded on deeper mineralized areas outside the inferred pit shell.

Also, in the Taurus Central area, hole 22TA-149 cut 36.8 metres of 1.3 grams gold per tonne from 8.2 metres downhole, including 5.3 metres of 4.09 grams gold, confirming near-surface mineralization encountered in historical drill holes.

The company’s 2022 program included 70 drill holes and over 23,000 metres of diamond drilling that began in June and finished in October. The exploration focus of the drilling targeted high-priority areas at the Taurus deposit, significant vein prospects at Cassiar South and more brownfield opportunities on the property.

The Taurus deposit hosts a near-surface, inferred resource of 1.4 million oz. grading 1.14 grams gold per tonne in 37.9 million tonnes of material, which remains open in all directions.

With Cassiar’s most extensive drilling program to date now complete, the company expects to release more results through year-end and into the new year. Results from 19,102 metres of drilling (57 drill holes) remain pending.

The company is working towards a potential resource update in 2023, dependent on results from the 2022 drill campaign at Cassiar North and Cassiar South.

Cassiar had C$10.3 million cash in the bank as of September.

The company’s Toronto-quoted equity fell about 5% on the news Tuesday to C52.5¢ per share, giving it a market cap of C$42.8 million. It is down about 31% over the past 12 months, having tested C48¢ to C$1.48 per share.

from MINING.COM https://ift.tt/ez7YxCW

Fortescue keeps women on the top job with Fiona Hick’s appointment

Australia’s Fortescue Metals Group (ASX: FMG) has named former Woodside Energy (ASX: WDS) executive Fiona Hick as its new chief executive officer, effective February 2023.

With the appointment, the iron ore miner ends a year-long search for a leader to replace current CEO Elizabeth Gaines, who will remains on Fortescue’s board as a non-executive director.

Hick, who began her mining career at Hamersley Iron in 1996, joins Fortescue at a time when the company is tapping into new commodities, such as critical minerals and rare-earths.

The miner has also kicked off a transition plan into a green energy firm through its unit Fortescue Future Industries (FFI), and Hick said she is ready to grow the company into one of the world’s most climate-responsible miners.

She will be directly responsible for the iron ore operations in the Pilbara and a new iron ore mine in Gabon, as well as an ambitious energy minerals exploration program.

“I am so thrilled to have found someone so close to home that knows the Pilbara like the back of her hand,” Andrew Forrester, Fortescue’s founder and executive chairman said in the statement.

“I have enjoyed and grown immensely during my 20 years in energy. I am as committed to the new future of the world as Andrew is,” Hick noted. “We must provide the metals and the energy which will help to accelerate the energy transition.”

The upcoming CEO spent more than two decades at Woodside, most recently as the executive vice-president of Australian operations.

She was part of the team that led the company through its $40 billion merger with BHP’s petroleum division.

Hick’s nomination to one of the top roles in corporate Australia comes after some high-profile executive departures within Forrest’s business empire.

Former Reserve Bank of Australia deputy governor Guy Debelle stepped down last week as chief financial officer of Fortescue Future Industries, the company’s green energy arm.

His departure followed former NAB executive Andrew Hagger’s, who in October vacated the CEO position at of Forrest’s philanthropy firm Minderoo and private investment vehicle Tattarang.

Elizabeth Gaines made history when she was appointed in 2017, becoming the first woman to run the iron ore giant and the second chief executive officer to have taken the role since Fortescue inception in 2003.

from MINING.COM https://ift.tt/LDjIHbT

L'énorme densité neuronale des éléphants impressionne les scientifiques

from Les dernières actualités de Futura https://ift.tt/W1BE2jp

Artemis I : Orion capture une éclipse de la Terre comme vous n’en avez jamais vu !

from Les dernières actualités de Futura https://ift.tt/aCscWtf

Twitter : les données personnelles de plus d'un million de Français piratées

from Les dernières actualités de Futura https://ift.tt/JQxYG86

Major US labs launch energy storage consortium

Three ‘major-league’ laboratories in the US have joined forces to launch Stor4Build, a new consortium on energy storage for buildings that is tasked with accelerating the growth, optimization, and deployment of storage technologies.

Co-led by the Department of Energy’s National Renewable Energy Laboratory (NREL), Lawrence Berkeley National Laboratory (Berkeley Lab), and Oak Ridge National Laboratory (ORNL), Stor4Build will focus on cost-effective energy storage for the large-scale deployment of renewable electricity, electrification, and decarbonization.

According to the labs, as much as 50% of electricity consumption in buildings in the United States goes toward meeting thermal loads. Thermal energy storage (TES) solutions, thus, show promise as a cost-effective energy storage alternative.

“A multidisciplinary consortium like Stor4Build can accelerate the discovery-to-deployment timeline so that thermal energy storage can be deployed on a massive scale to tackle climate change,” Ravi Prasher, Berkeley Lab’s former associate lab director who was instrumental in the development of this collaboration, said in a media statement.

TES refers to the energy that can be stored in a material as a heat source or a cold sink, rather than as electrical energy, and reserved for use at a different time. These solutions can increase load flexibility, promote the use of renewable energy sources, and allow heat pumps to function more effectively and in more extreme climates.

The general target of TES systems is to reach installed capital costs of less than $15 per kWh of stored thermal energy, and the consortium plans to develop metrics for identifying optimal performance targets for power and energy density, working temperature, materials and systems costs, round-trip efficiency, lifetime and durability, installation and operation, and maintenance costs.

“By shifting HVAC loads off-peak, TES addresses grid challenges associated with electrification and decarbonization. To become impactful nationwide requires new materials and new methods of integrating storage with HVAC,” said Kyle Gluesenkamp, ORNL senior scientist and Stor4Build co-director. “Stor4Build will bring together the stakeholders necessary to accelerate development and market adoption of scalable TES technologies.”

Gluesenkamp and his colleagues identified four research areas as foundational to all consortium activities: materials optimization and manufacturing; modelling and analysis; system optimization and integration; and market, policy, and equity.

Democratizing thermal energy

Led by industry-recognized experts at the national laboratories, the consortium also plans to include active participants from diverse stakeholder groups representing industry, utilities, nonprofit organizations, communities, building owners, academia, government, and other research institutions. The cross-cutting team will address the need of developing equitable solutions to ensure the benefits of storage technologies are clear for all communities, including those historically disadvantaged.

“A major goal of the consortium is to develop and deploy thermal energy storage technologies for all communities while accelerating their commercialization and utilization for building applications,” Sumanjeet Kaur, Stor4Build’s Berkeley Lab co-director, said. “Thermal energy storage is a natural solution for buildings that can complement other energy storage technologies. In fact, proper system sizing and controls of these hybrid systems that combine on-site electrochemical and thermal energy storage could result in better overall performance than either system alone.”

The consortium plans to complete a community-scale demonstration of technologies to showcase the initial achievements of the consortium, which will serve as a foundation for large-scale deployments of TES, along with electrochemical battery energy storage and systems capable of satisfying both the heating and cooling needs in buildings.

from MINING.COM https://ift.tt/jsUTpiv

Les bébés les plus vieux du monde viennent de naître

from Les dernières actualités de Futura https://ift.tt/WFXTYxf

lundi 28 novembre 2022

Consensus forecast is for two years of stagnant copper prices

The copper price fell on Monday as unprecedented street protests in cities across China threatened to further dampen already subdued economic activity in the country responsible for more than half the world’s consumption of base metals.

Copper for delivery in March fell 1% on the Comex market in New York, touching $3.59 per pound or $7,915 per tonne. The bellwether metal is now down 27% since hitting record highs in March and a new survey of over 30 investment banks and economic research houses sees little prospect for an exit from the bear market.

FocusEconomics, a Barcelona-based independent research company, says demand for copper and industrial metals should stay fairly limp during the first half of next year “as global interest rates peak and China’s economy likely stays weighed down by the property crash and covid-19.”

The consensus forecast for average copper prices in 2023 is below current levels at around $7,660 per tonne, according to FocusEconomics with the lowest prediction at just $5,430 per tonne and the top end at an uninspiring $8,775 per tonne.

In 2024 prices are expected to average $8,000 per tonne – with the most bearish prediction pegged at below $5,000 and the highest $10,750 per tonne.

FocusEconomics quotes Goldman Sachs as saying historically low global inventories of copper could boost prices in the near term:

“Whilst we would attribute limited benefit to the expected copper end demand path next year from [Chinese economic] reopening per se, the potential for a meaningful restock to occur on confidence effects would still have a significant bullish implication given global visible stocks now stand at just under 240kt, the lowest level for this point in the year since 2006.

“We estimate that if China were to increase its stocks in consumption terms from the current 1 week to the 3 weeks seen during the immediate pre-covid era, that would boost China’s physical demand by close to 500kt next year.”

The longer term outlook is also bullish, with the Economist Intelligence Unit commenting that “underinvestment in futures projects to tighten the underlying fundamentals in the second half of the decade”:

“Although recent mine and smelter expansions have seen minimal disruptions, we maintain our view that factors such as resource nationalism and stricter environmental oversight are likely to persist in the long term, raising concerns that new mine projects and planned smelter expansions will be insufficient to meet future demand.”

from MINING.COM https://ift.tt/cqIiKnH

BHP averts strike at world’s biggest copper mine

Unionized workers at Escondida mine in northern Chile have accepted BHP’s (ASX, LON, NYSE: BHP) latest offer and will not move forward with a strike that was planned for Nov. 28 and 30.

Workers at Sindicato 1, which represents more than 2,000 members, backed on Monday the agreement reached last week between union representatives and the Australian miner.

The deal, which was subject to vote, came after days of negotiations with union representatives, who had called for a strike on November 21 and 23 due to multiple “non-compliances, infractions and violations” allegedly committed by BHP.

“This proposal contains a series of concrete and verifiable measures to improve the hygiene and safety of workers,” the union said in a statement. “Especially an intense joint inspection program between the union and the company of all work areas.”

It noted the proposal also “set aside changes in operating practices the company was pursuing.”

With the deal, BHP has averted a strike at the world’s largest copper mine at a time of tight global supplies and high prices for the the orange metal, a key material needed for the world’s transition to a green economy.

The Escondida copper mine is responsible for about 5% of the world’s total copper output and Chile is the world’s top producer of the metal.

In 2017, unionized workers at the mine staged a 44-day strike, the longest in Chilean mining history. The labour action cost the company $740 million in losses and meant a contraction of about 1.3% of Chile’s GDP.

While Escondida is majority-owned and operated by BHP, Rio Tinto and a Japanese consortium that includes Mitsubishi Corp and JX Nippon Mining & Metals also hold stakes in the mine.

Chile’s state owned mining company Codelco, the world’s biggest copper producer, warned last week that global shortages of the metal may reach eight million tonnes by 2032, as soaring demand continues to offset new projects numbers.

from MINING.COM https://ift.tt/CQbJyPa

Et si les extraterrestres se cachaient dans des grottes ?

from Les dernières actualités de Futura https://ift.tt/Q8jUrnC

Elon Musk pourrait lancer un smartphone alternatif

from Les dernières actualités de Futura https://ift.tt/4lB1LtT

Antarctique, une clé de voûte du monde en péril ?

from Les dernières actualités de Futura https://ift.tt/Wy1mNXk

L’atmosphère de Vénus aurait été détruite par d’énormes éruptions volcaniques

from Les dernières actualités de Futura https://ift.tt/qScRzn4

dimanche 27 novembre 2022

La première édition de Ma thèse en 3 minutes par Orange fait la Une !

from Les dernières actualités de Futura https://ift.tt/OwlVEo1

Offrez-vous le ciel profond et devenez astronome citoyen avec les eVscopes d'Unistellar

from Les dernières actualités de Futura https://ift.tt/e5w3WzN

UK, South Africa seek deeper cooperation on critical minerals

London and Pretoria announced a partnership to promote the responsible exploration, development, production, and processing of critical minerals in South Africa.

In a media statement, both governments said that this new collaboration will start with the launching of regular ministerial and technical dialogues between South Africa’s Department for Mineral Resources and Energy and the UK’s Department for Business, Energy and Industrial Strategy.

“South Africa is a leading producer of minerals including platinum, palladium and iridium for hydrogen production and vanadium and manganese for battery storage,” the release points out. “Cooperation will help to support investment into exploration, production and beneficiation activities, securing and expanding access to minerals that are key for clean industrial and economic development and the global clean energy transition.”

South Africa is responsible for 60% of the global manganese supply, 75% of the platinum supply and 40% of the palladium supply. It also produces or has the potential to produce, vanadium, nickel, cobalt and rare earth elements.

Thus, in addition to boosting the mining sector, the UK and South Africa plan to work together to identify and carry out joint projects aimed at developing clean energies and technologies such as battery storage, fuel cell technologies, energy efficiency and renewable energy solutions.

“This joint work aims to create an enabling environment for promoting participation of private sector companies, support investment flows into the minerals mining sector and grow new clean jobs, noting that the UK is a leading centre of mining finance, standards, and metals trading,” the communiqué reads. “Both countries will encourage and support partnerships between UK and South African companies across the value chain for minerals and clean energy to grow and strengthen business links to the benefit of both economies.”

Commenting on the announcement, Jordan Roberts, from market analysis firm Fastmarkets NewGen, said that industry observers may not be so fond of a UK-SA collaboration and would rather view cooperation with the likes of Canada and Australia on battery materials being more attractive, particularly when considering their ESG prospects.

“Despite this massive mineral endowment, many believe that the South African economy faces major long-term challenges, amid concerns around its sovereign debt, political corruption and the loss of high-skilled workers,” Roberts said.

from MINING.COM https://ift.tt/mdUin0P

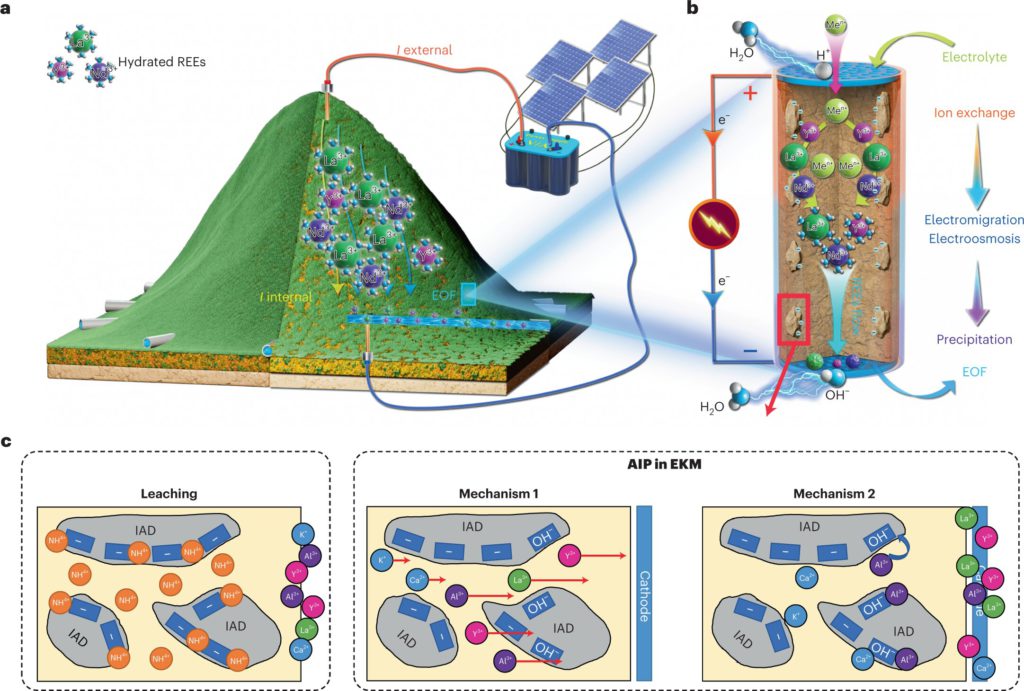

Electrokinetic mining allows for green, efficient recovery of REEs

Researchers at China’s Guangzhou Institute of Geochemistry have developed a new technique, electrokinetic mining (EKM), for the green and efficient recovery of rare earth elements from weathering crusts.

The technique exerts a voltage on the top and bottom of the ion-adsorption rare earth deposits (IADs), which generates an electric field to accelerate REE and water migration toward the cathode.

Compared with conventional techniques, EKM achieves ~90% recovery efficiency, ~80% decrease in leaching agent usage, and ~70% reduction in metallic impurities in the obtained REEs.

To get to those figures, the scientists first carried out bench-scale experiments in a homemade prototype with a simulated IAD. Results suggested that the REE recovery efficiency achieved by the EKM technique was 2.6 times higher than that achieved by the commonly used ammonium leaching technique.

Then, they carried out scaled-up experiments at the kilogram scale (20 kg) in a larger EKM setup. The results were consistent with the bench-scale trials, that is, the EKM technique was able to achieve higher recovery efficiency and required less treatment time.

Based on the successful bench-scale and scaled-up experiments, the researchers applied the EKM technique to an actual IAD (~14 t-scale) during an on-site field experiment. Results suggested that the REE recovery efficiency was higher than 90% in 264 hours.

The group, thus, decided to further explore the mechanisms underlying the high REE recovery efficiency of the EKM. They noticed that the applied electric field that accelerates REEs and water migration unidirectionally towards the designed place via electromigration and electroosmosis is the key to enhancing REE recovery efficiency.

According to head researcher He Hongping, apart from its sustainability and high recovery efficiency, the EKM technique shows selectivity for REEs from other metallic impurities, namely, Al3+, Ca2+ Na+, and K+.

“We identified an autonomous impurity purification mechanism during the electrokinetic process, which is based on velocity and reactivity diversity between REE and other active metal ions,” He said.

from MINING.COM https://ift.tt/z9C0hMI

On sait comment les trous noirs accélèrent naturellement les particules… ou presque !

from Les dernières actualités de Futura https://ift.tt/xoCd4k9

Êtes-vous incollable sur le nucléaire ? Testez-vous avec ce questionnaire !

from Les dernières actualités de Futura https://ift.tt/OkD7FM2

La Chine dévoile le nouveau design de sa mégafusée pour aller sur la Lune

from Les dernières actualités de Futura https://ift.tt/1dbryxG

Vider complètement la batterie de son smartphone prolonge sa durée de vie, vrai ou faux ?

from Les dernières actualités de Futura https://ift.tt/5zWajCO

samedi 26 novembre 2022

Astronautes : la proportion de femmes sélectionnées est plus importante que celle des femmes candidates

from Les dernières actualités de Futura https://ift.tt/b6YdhAV

Transformez vos selfies en personnages historiques avec l’AI Time Machine

from Les dernières actualités de Futura https://ift.tt/kzx82ud

On a simulé en laboratoire la création de particules par le Big Bang

from Les dernières actualités de Futura https://ift.tt/WKgVJGx

Sécurité énergétique et réchauffement climatique : comment réduire nos émissions de méthane ?

from Les dernières actualités de Futura https://ift.tt/FB5mC0X

Vers des « supers El Niño » dès 2030 avec des sécheresses et des inondations extrêmes pour une partie du monde

from Les dernières actualités de Futura https://ift.tt/NgmdTs8

vendredi 25 novembre 2022

Austral Gold sells Pinguino project in Argentina to ASX-listed E2 Metals

Austral Gold (TSXV: AGLD; ASX: AGD) is selling its Pinguino polymetallic project in Argentina to E2 Metals (ASX: E2M) for $10 million in cash and shares, the companies said on Friday.

The deal is for $5 million in cash, with $2.5 million paid on closing plus staggered payments of $750,000 on the first and second anniversaries of closing and $1 million on the third, the companies said in a release.

The rest is to be paid in options and shares amounting to 19.99% of E2. Austral also keeps its option to purchase all or half of the existing 2% net smelter return royalty on the Pinguino project. They expect the deal to close by the end of March.

“This transaction with E2 Metals will enable us to share in the project’s potential upside and use the proceeds from the sale to fund our exploration activities in Argentina and Chile,” Austral chief executive officer Stabro Kasaneva said in the release.

“We will become the largest shareholder in an ASX-listed company with a sound shareholder base and strong position in the mining friendly Argentine province of Santa Cruz.”

Melbourne-based E2 Metals reported drilling this month showing “encouraging” mineralization at its Conserrat gold and silver project, just 30 km from Pinguino. The company also owns other properties in Argentina and Australia.

The Pinguino sale marks another stage in the long-running silver, gold, zinc, lead and indium project in south-central Argentina. Austral, led by Eduardo Elsztain, one of the country’s most prominent business leaders with large real estate and agriculture holdings, joined the project in 2013 when it was run by the now dormant Argentex Mining. But exploration at the site stretches back decades. At one point a financing arm of the World Bank held 12% in Argentex, which acquired the project in 2003.

An indicated resource estimate from 2014 shows Pinguino has 6.3 million tonnes grading 103.4 grams silver and 0.58 gram gold per tonne, 0.77% zinc and 0.54% lead (or 132.3 grams silver equivalent per tonne) for 20.9 million contained oz. silver and 117,000 contained oz. gold.

Pinguino, located about 300 km southwest of the city of Comodoro Rivadavia in Santa Cruz, a province known for mining. Pinguino lies in the same Deseado Massif geologic structure as AngloGold Ashanti’s (JSE: ANG) Cerro Vanguardia mine and Newmont’s (TSX: NGT; NYSE: NEM) Cerro Negro mine, Austral said, while noting six other projects have been developed in recent years in the same province.

The strike length at Pinguino has intermediate sulphidation epithermal veins. The deposit has a near-surface silver-gold oxide zone with supergene enrichment and older intrusive-related sulphide epithermal veins with zinc, silver, indium, lead and gold.

E2 Metals also holds the Cobar copper and gold project about 600 km west of Sydney, 900 sqkm of titles in Argentina’s Santa Cruz province and 273 sqkm of land in Rio Negro province further north.

Deal specifics

In the details of the Pinguino deal, Austral gets 15 million options worth one share of E2, but they can be used only until Austral has 19.99% of E2. They have an exercise price of C$0.26 until the third anniversary of the closing.

Austral also keeps its 51% interest and option to acquire an additional 49% interest in the Sierra Blanca project, which is next to Pinguino, from Capella Minerals (TSXV: CMIL). Austral owns the Guanaco-Amancaya mines in Chile and the Casposo-Manantiales mine complex (currently on care and maintenance) in Argentina.

The company has non-controlling interests in the Rawhide Mine in Nevada, in Ensign Gold, which holds the Mercur project in Utah, and in Chile copper project developer Pampas Metals (TSXV: PM).

Shares in E2 Metals closed A$0.015 higher on Friday in Sydney at A$0.145, within a 52-week range of A$0.10 and A$0.36, valuing the company at A$28.9 million.

Austral Gold stocks fell C$0.01 each to C$0.035 on Friday, its lowest-ever price, valuing the company at C$21.4 million. It’s traded as high as C$0.09 in the past year.

from MINING.COM https://ift.tt/S17j3Ps

Historique : le premier parastronaute rejoint la promotion de l'Esa

from Les dernières actualités de Futura https://ift.tt/tqPAzHx

European consortium gets 12.3m euros to develop mine management system

A multidisciplinary consortium made of partners from Norway, Portugal, Spain, Italy, Slovenia, and the Netherlands has been granted 12.3 million euros by Horizon Europe, the EU’s key funding programme for research and innovation, to develop an innovative and holistic mine management system that aims to digitize and modernize the industry.

The ultimate goal behind the new system is to reduce Europe’s dependence on imported minerals and metals used to produce everything from mobile phones, to renewable energy, and modern defence equipment.

The project’s name is DINAMINE, which stands for “Digital and Innovative Mine of the future.” Its main focus will be on the small and medium-sized mines that account for more than half of the value added in Europe.

Among the technologies to be developed and demonstrated is a smart database system for real-time integration of various types of information such as geological and geophysical data, mineral resources, geomechanics, mineral processing data, tailings and environmental data. The data system will be utilized in combination with the economical and practical factors for holistic mine planning, monitoring, and managing.

The companies involved in the consortium also plan to create a machine vision-based technology for improving rock engineering-related activities such as rock mass mapping, optimizing rock blasting, and suggesting relevant stabilizing measures. This will be achieved by incorporating the technology in a semi-autonomous jumbo drill.

Finally, a real-time geomechanical monitoring technology for underground openings and open pits is also expected to be developed.

All the new systems and solutions will be tested at two demonstration sites in Norway and Portugal, under the auspices of Norwegian Skaland Graphite and Portuguese Felmica Minerais Industriais, respectively. The test sites have been selected to be representative of European regions, raw materials, and value chains.

In addition to these two firms, other consortium members are the Norwegian Geotechnical Institute, which is heading the 3.5-year project; fellow Norwegian companies and organizations AMV AS, SINTEF Nord AS, SINTEF AS and SINTEF Helgeland AS; Spain’s Worldsensing SL, Slovenia’s National Institute of Chemistry, Italy’s Ciaotech Srl and the Netherlands’ SPECTRAL Industries BV.

from MINING.COM https://ift.tt/WwXUghe

Rio Tinto-Turquoise Hill takeover vote set for December 9

Canada’s Turquoise Hill Resources (TSX: TQR) has set December 9 as the date its shareholders will finally vote on the proposed $3.3 billion takeover of the company by Rio Tinto (ASX, LON: RIO).

The meeting has been repeatedly delayed because of the opposition of key minority shareholders in Turquoise Hill, mainly US-based fund managers.

The situation took a turn for the worst earlier this month, after a Canadian top securities regulator decided to review the transaction, following a side deal between Rio Tinto and dissident shareholders.

Turquoise Hill said Quebec’s Autorité des marchés financiers (AMF) has cleared the transaction and that its board has repeated its unanimous recommendation to minority shareholders to vote for the sweetened offer.

Rio Tinto initially offered C$34 a share in March this year, but increased it to C$43 per share in cash in August. That was a more than 19% premium to the stock’s end-of-August closing price and a 67% premium from the day before the initial offer was made.

The Australian mining giant has had a rocky relationship with Turquoise Hill, particularly over how to fund Oyu Tolgoi’s expansion. The mining giant has also drawn criticism from some of Turquoise Hill’s minority shareholders about the control it exerts over the company.

The Melbourne and London-based firm, which has mined copper from Oyu Tolgoi’s open pit for a decade, and the Mongolian government ended earlier this year a long-running dispute over the $7 billion expansion of the mine.

Biggest new copper mine

Once completed, the underground section of Oyu Tolgoi will lift production from 125,000–150,000 tonnes in 2019 to 560,000 tonnes at peak output, which is now expected by 2025 at the earliest. This would make it the biggest new copper mine to come on stream in several years.

“Rio Tinto’s strategy over its stake in Turquoise Hill has been subject to discussion for many years, but we didn’t think it would end up offering to buy out the minorities based on previous form,” BMO Metals and Mining analysts said in a note to investors.

“Given the dearth of copper opportunities elsewhere, combined with its recently lowered risk profile, perhaps increasing its Oyu Tolgoi exposure now makes sense,” BMO Alexander Pearce and David Gagliano wrote in September.

Rio Tinto chief executive Jakob Stausholm has said the proposed takeover would simplify governance, improve efficiency and create greater certainty of funding for the long-term success of the Oyu Tolgoi project.

Experts forecast a vast deficit in the copper market due to a ramp up in the clean energy and electric vehicles (EV) sectors.

It is estimated the copper industry needs to spend more than $100 billion to build mines able to close what could be an annual supply deficit of eight million tonnes by 2032.

from MINING.COM https://ift.tt/HnoKJ0E

Emmanuel Macron va se doter d'un smartphone hyper sécurisé

from Les dernières actualités de Futura https://ift.tt/Yub2its

Une IA a inventé le chocolat au lait ultime

from Les dernières actualités de Futura https://ift.tt/AnRcsOG

jeudi 24 novembre 2022

Des robots pour éliminer les criminels bientôt à San Francisco ?

from Les dernières actualités de Futura https://ift.tt/os16uaP

Il y a une énorme tache sombre sur la face opposée du Soleil

from Les dernières actualités de Futura https://ift.tt/0OVPHYj

Tribune : pour une science au service de l'avenir

from Les dernières actualités de Futura https://ift.tt/CrgYpIl

Le Mag' Futura est de retour avec plein de nouveautés !

from Les dernières actualités de Futura https://ift.tt/hWMwGLP

1 milliard de jeunes adultes risquent la surdité prématurée (La Santé Sur Écoute #19)

from Les dernières actualités de Futura https://ift.tt/Qg7DYOE

L'ESA dévoile sa nouvelle promotion d'astronautes

from Les dernières actualités de Futura https://www.futura-sciences.com/sciences/actualites/astronautes-esa-devoile-nouvelle-promotion-astronautes-19365/#xtor%3DRSS-8

mercredi 23 novembre 2022

La magnifique nébuleuse d’Orion sondée en profondeur par 3 télescopes spatiaux de la Nasa et de l’ESA

from Les dernières actualités de Futura https://ift.tt/jvcgGOC

Les anti-inflammatoires pourraient aggraver l'arthrose

from Les dernières actualités de Futura https://ift.tt/GPturIL

Le tardigrade peut résister aux conditions les plus extrêmes !

from Les dernières actualités de Futura https://ift.tt/p0JhoM7

La fonte rapide des glaciers libère des bactéries dans les écosystèmes qui inquiètent les scientifiques

from Les dernières actualités de Futura https://ift.tt/A09dPph

Et voici le premier disque dur dopé à l'Intelligence artificielle !

from Les dernières actualités de Futura https://ift.tt/Uog6vQu

Le tardigrade peut résister aux conditions les plus extrêmes !

from Les dernières actualités de Futura https://ift.tt/mZ0jhUz

mardi 22 novembre 2022

Les planètes et leur étoile grandissent en même temps

from Les dernières actualités de Futura https://ift.tt/L0McRCy

C’est confirmé : les vaccins anti-Covid-19 perturbent le cycle menstruel

from Les dernières actualités de Futura https://ift.tt/CvjOFTY

Climat : quelles avancées dans la réduction des émissions de méthane ?

from Les dernières actualités de Futura https://ift.tt/jwp1Pez

Ces enceintes « invisibles » veulent révolutionner le son en voiture

from Les dernières actualités de Futura https://ift.tt/pHnrsoq

Artemis I : des images magnifiques du vaisseau Orion qui frôle la Lune

from Les dernières actualités de Futura https://ift.tt/narBZi6

La première édition de Ma thèse en 3 minutes par Orange fait la Une !

from Les dernières actualités de Futura https://ift.tt/tNjk2np

Le dépistage du cancer du foie serait bientôt possible grâce à un test sanguin

from Les dernières actualités de Futura https://ift.tt/2ARD90v

La Chine dévoile le nouveau design de sa mégafusée pour aller sur la Lune

from Les dernières actualités de Futura https://ift.tt/k0usaoC

Réchauffement climatique : vers quel scénario nous dirigeons-nous ?

from Les dernières actualités de Futura https://ift.tt/5LM9JCc

lundi 21 novembre 2022

Des hackers parviennent à glisser un malware dans Windows !

from Les dernières actualités de Futura https://ift.tt/iGdF2T9

Artemis I : découvrez en direct la Lune survolée par le vaisseau Orion

from Les dernières actualités de Futura https://ift.tt/E2cLgBG

2023 : la mode sera au smartphone pliable

from Les dernières actualités de Futura https://ift.tt/mg7abik

Le nucléaire peut-il vraiment être écolo ?

from Les dernières actualités de Futura https://ift.tt/YHgDdRB

dimanche 20 novembre 2022

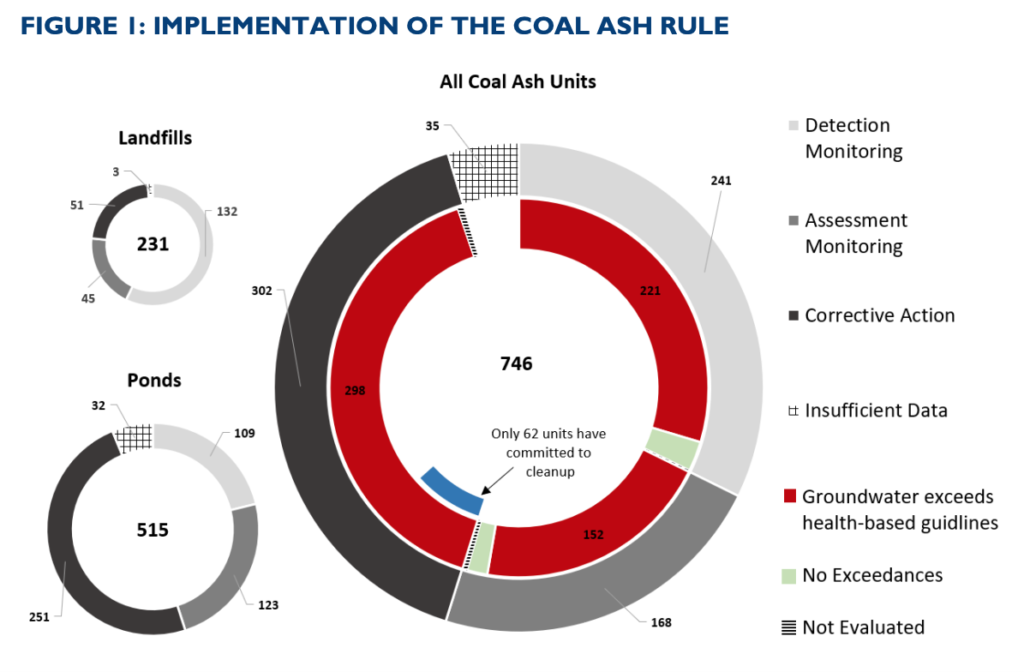

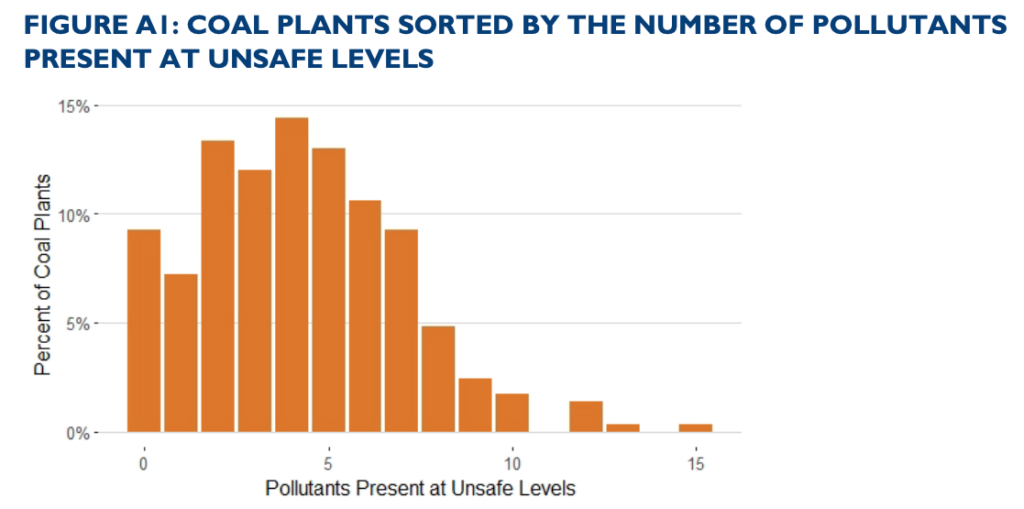

Hundreds of power plants in the US violate Coal Ash Rule – report

A recent report by the Environmental Integrity Project (EIP) and Earthjustice found that seven years after US Environmental Protection Agency imposed the first federal rules requiring the cleanup of coal ash waste dumps, only about half of the 265 power plants that are contaminating groundwater agree that cleanup is necessary, and 96% of these power plants are not proposing any groundwater treatment plan.

The report, which is based on an examination of public records and data from coal plants across the country, also found that out of the 292 power plants assessed in 43 states, only one is planning a comprehensive cleanup, while 10 are proposing incomplete cleanup plans.

“The failure of the vast majority of power companies to follow the 2015 Coal Ash Rule has serious consequences for water quality and public health. Monitoring data shows that 91% of US coal-fired plants have ash landfills or waste ponds that are leaking arsenic, lead, mercury, selenium, and other metals into groundwater at dangerous levels, often threatening streams, rivers, and drinking water aquifers,” the document reads.

The dossier mentions that although coal consumption has declined across the US over the last decade, the power industry continues to generate about 70 million tons of coal ash annually. It also notes that after 100 years of burning coal, power plants have generated about five billion tons of coal ash.

The Coal Ash Rule requires the cleanup of both the source of pollution (coal ash) and the groundwater. However, the report authors found that of the 142 plants with contaminated groundwater that agree that cleanup is necessary, only 38 plants have committed to at least one cleanup action and, of those, 27 are not treating groundwater. They are instead relying on the pollution naturally dispersing.

“Because some power plants have multiple waste disposal sites, there are a total of 515 coal ash waste ponds evaluated in this report. Of these, there are 372 unlined ash ponds within five feet of groundwater, and many of these are sitting in groundwater,” the dossier states. “The majority (200) are being closed without removing the ash, despite being in or dangerously close to groundwater. Companies have closed 81 ponds by removing the ash and have scheduled the closure of another 91 by removal.”

Worst sites

Looking at the top 10 most contaminated coal ash sites in the US, the report ranked the San Miguel Electric Plant in Texas as the worst one as the plant has two coal ash ponds, an ash pile and some of the most contaminated groundwater in the country, including with cobalt at 488 X safe levels.

Next is the retired Reid Gardner station, northeast of Las Vegas, Nevada. According to EIP and Earthjustice, despite having lithium concentrations in the groundwater at 161 X safe levels and arsenic and 121 X safe levels, the owners have failed to admit responsibility or select a remedy and continue to violate the Coal Ash Rule in a number of ways.

The Naughton Power Plant in Wyoming ranks third on the list as the report authors found that the six ash waste ponds at this plant are leaking selenium into groundwater at 150 X safe levels, lead at 16 X safe levels, and arsenic at 10 X safe levels, while owners are pursuing an incomplete cleanup plan and have only selected a remedy for one of the six ponds.

Also in Wyoming, the Jim Bridger Power Plant makes the list because it has two coal ash ponds and an ash landfill, and groundwater monitoring nearby shows lithium at 164 X safe levels and sulphate at 125 X safe levels.

In North Carolina, the Allen Steam Station occupies the fifth spot because it has two ash ponds and a landfill and groundwater monitoring that shows cobalt at 466 X safe levels and lithium at 12 X safe levels. The owner is moving ash to a new landfill on the site but does not plan to treat the groundwater.

Next is the New Castle Generating Plant in Pennsylvania, which has been closed since 2016 but still has a large, leaking ash disposal area. Groundwater monitoring shows arsenic at 372 X safe levels and lithium at 54 X safe levels. In addition to this, the report notes that the owner is not planning to take any cleanup action.

In Maryland, the Brandywine coal ash landfill, southeast of Washington, DC, also joins the group because it holds waste from three power plants in the area and is contaminating local streams and groundwater, with monitoring wells showing lithium at 222 X safe levels and cobalt at 47 X safe levels.

Following Brandywine is the R.D. Morrow power plant in Mississippi, which had two ash ponds and a landfill and stopped burning coal in 2018. The owners closed the ponds and removed their ash in 2021, and capped the landfill without removing the ash. But the company has not treated the contaminated groundwater, even though monitoring wells show molybdenum at 176 X safe levels and lithium at 167 X safe levels.

In the ninth spot is the Hunter Power Plant in Utah, which has an ash landfill and pond, and groundwater beneath them with lithium at 210 X safe levels and cobalt at 28 X safe levels. The owners installed groundwater collection wells to capture the leachate, but monitoring data suggest they are not working.

The last plant on the list is the Allen Fossil Plant in Tennessee, which is now closed but has contaminated groundwater, including with arsenic at 294 X safe levels and is threatening the drinking water aquifer that serves Memphis. According to the dossier, the owners are removing the ash from two onsite ash ponds, but only treating the groundwater and conducting monitoring at one of the two ash ponds.

from MINING.COM https://ift.tt/3AHbwMY

Surprise : les pré-Néandertaliens étaient présents en Europe 200 000 ans plus tôt qu'on ne le pensait !

from Les dernières actualités de Futura https://ift.tt/9aS0JDW

Ötzi, l’homme des glaces, ne serait pas mort à l’endroit que l’on pensait

from Les dernières actualités de Futura https://ift.tt/PCf6xEb

Découverte exceptionnelle de 24 statues de bronze romaine et étrusque qui pourraient « réécrire l’histoire »

from Les dernières actualités de Futura https://ift.tt/wUOc36g

Réchauffement climatique : la moitié des arbres replantés ne survit pas

from Les dernières actualités de Futura https://ift.tt/SxBQZtM

S'étirer avant le sport réduit les risques de courbatures, vrai ou faux ?

from Les dernières actualités de Futura https://ift.tt/WG9uBT3

Des preuves d'une communication intentionnelle chez ces singes !

from Les dernières actualités de Futura https://ift.tt/3yj8fo2

samedi 19 novembre 2022

Bertrand Piccard : « on vit dans une société de gaspillage, d’inefficience et de déchets »

from Les dernières actualités de Futura https://ift.tt/g4p2jfr

Une magnifique carte interactive d’une partie de l’Univers crée par des astronomes

from Les dernières actualités de Futura https://ift.tt/pdH83X2

Quand l’armée américaine découvre qu’elle utilise des logiciels russes !

from Les dernières actualités de Futura https://ift.tt/Z5APoIu

Découverte d’une tortue géante fossilisée qui avait la taille d’une voiture

from Les dernières actualités de Futura https://ift.tt/oga7EVP

Cancer : une pompe administre la chimiothérapie directement dans le cerveau

from Les dernières actualités de Futura https://ift.tt/FlPeg3u

vendredi 18 novembre 2022

Retour vers la Lune : lancement réussi pour Artemis !

from Les dernières actualités de Futura https://ift.tt/zTJNXlL

Massive emerald cluster sets new record at Gemfields auction

Africa-focused Gemfields (LON: GEM) (JSE: GML) racked up $30.8 million in revenue from its latest emerald action, which included a massive cluster of emeralds weighing 187,775 carats (37,555 grams).

The Kafubu Cluster, discovered at its Kagem mine in Zambia in March 2020, set a new record as the most expensive single emerald item ever sold by Gemfields, the miner said without providing specifics.

“Our end-of-year emerald auction has delivered a pleasing and solid result despite a clear softening of both prices and sentiment when compared with the remarkable highs we enjoyed in May 2022,” Adrian Banks, managing director of product and sales, said. “This has been a record-shattering year for Kagem with an amazing $149 million in auction sales.”

The coloured gems producer said proceeds will be reinvested in Zambia, including royalties due to the country’s government, which has 25% stake in Kagem.

Zambian emeralds tend to have a higher iron content than emeralds from other origins, which means they are less fragile. High iron content also means fewer surface-reaching fractures and less need for treatments and enhancements.

from MINING.COM https://ift.tt/xqYMk8e

Manger trop gras et trop sucré expose à des risques de troubles neurologiques

from Les dernières actualités de Futura https://ift.tt/qkrIsQR

On a simulé en laboratoire la création de particules par le Big Bang

from Les dernières actualités de Futura https://ift.tt/g31Lv5Y

Les aspirateurs robots, la croisade de l’innovation

from Les dernières actualités de Futura https://ift.tt/8Tv0PCV

Listenbourg : l'épopée éclair d'un pays inventé par Twitter

from Les dernières actualités de Futura https://ift.tt/OhV1sgA

jeudi 17 novembre 2022

Minister denies Baffinland Iron Mines expansion in Nunavut

Baffinland Iron Mines corporation announced Thursday that the Minister of Northern Affairs Dan Vandal denied the company’s Phase 2 expansion application.

In May, Baffinland Iron Mines’ proposed expansion of its Mary River iron ore operation on the northern tip of Baffin Island, in Canada’s Nunavut territory, suffered a major blow after a review board advised against the project on environmental grounds.

After four years of consultations and deliberations, the Nunavut Impact Review Board (NIRB) rejected the miner’s request to more than double output to 12 million tonnes a year, to eventually reach 30 million tonnes annually.

Mary River, considered one of the world’s richest iron deposits, opened in 2015 and ships about six million tonnes of ore a year.

“We are disappointed by the Minister’s decision,” Baffinland CEO Brian Penney said in Thursday’s news release. “Our Phase 2 proposal was based on on years of in-depth study and detailed scientific analysis, we executed a new Inuit Certainty Agreement with the QIA, and we have had extensive consultations with, and made additional commitments to stakeholders post release of the NIRB recommendation in May.”

“The Minister’s decision has immediate and significant implications for the current MAry River operations and our workforce of 2,500 people,” Penney said. “We look forward to immediately meeting with the QIA and the Minister to discuss a practical path forward.”

If the expansion is approved, Baffinland would send about 12 million tonnes of the 30 million tonnes via the North Railway to Milne Port. It also plans to build a second railway to Steensby Port, from which it intends to ship an additional 18 million tonnes of ore a year.

Current shipping volumes have already had a “devastating” impact on the area’s narwhal population, Inuit hunters have said. Last year, a group of hunters from Arctic Bay and Pond Inlet blocked access to the mine in protest of the company’s ice breaking practices due to their negative impacts on narwhals.

from MINING.COM https://ift.tt/gR52Mew

SQM expects high lithium prices to stay put

Chile’s SQM (NYSE: SQM), the world’s second largest lithium producer, expects prices for the battery metal to stay high into 2023 on the back of soaring demand boosted by strong sales of electric vehicles (EVs) in China.

In its results for the the three months to September 30, the miner announced record lithium sales, which more than quadrupled in the quarter from a year ago.

The company’s highest quarterly sales, combined with above-average lithium prices, helped it achieve a net profit of $1.1 billion in the period.

Revenue surged more than four times year-on-year to $2.95 billion, with lithium revenues growing more than 12 times.

Prices for the battery metal jumped to record levels during Q3 at more than $56,000 per tonne, it said.

Despite market fears over a possible cooling-off of China’s two-year lithium buying spree, SQM remains bullish on the long-term outlook.

The Santiago-based miner forecast global lithium demand to grow this year by at least 40% thanks to rising EVs sales in China, which it estimates will exceed 6.5 million units — double last year’s amount.

“On top of the strong demand growth, similar to what we have seen in the past, new lithium supply outside of SQM has been delayed and slow to come online,” it said. That will keep the market tight and means “this high-priced environment could continue for the remainder of 2022 and into 2023.”

Albemarle (NYSE: ALB), the world’s top lithium producer, also reported a surge in sales earlier this month.

Both companies are the only two producing the battery metal in Chile’s Atacama region, which supplies nearly one-quarter of the globe’s lithium.

The copper-rich country currently generates about 29% of the world’s supply, but it plans to double production by 2025 to about 250,000 tonnes of lithium carbonate equivalent (LCE).

from MINING.COM https://ift.tt/4JmhXNT

Le télescope James-Webb a photographié un sablier formé par une étoile en train de naître !

from Les dernières actualités de Futura https://ift.tt/HmstJRX

Découverte extraordinaire au Canada d’une pièce en or datant d’avant l’arrivée de Christophe Colomb !

from Les dernières actualités de Futura https://ift.tt/6ThjH5g

L’évolution des arbres serait à l’origine de plusieurs extinctions de masse sur terre

from Les dernières actualités de Futura https://ift.tt/IfSaGCP

Le spermatozoïde : une espèce en voie de disparition ?

from Les dernières actualités de Futura https://ift.tt/lH1rpCU

mercredi 16 novembre 2022

Anglo American greens Australia operations

London-based multinational Anglo American (LSE: AAL) has reached an agreement with the Queensland government to supply all of its Australian power needs from wind and solar generation by 2025 and onwards.

The 10-year deal will see Stanwell Corporation, a government-owned power utility, effectively remove all scope two emissions from Anglo American’s steelmaking coal business in the country.

Scope two emissions refer to greenhouse gas released into the atmosphere from the generation of purchased energy such as electricity, steam, heat and cooling.

It aligns with Anglo’s strategy of achieving carbon-neutral operations by 2040.

Critically, Anglo American Australia CEO Dan van der Westhuizen said in a statement that Stanwell’s investment in 650 megawatts (MW) of renewable generating capacity is NPV positive compared with the current energy mix.

Combined with the agreements Anglo already has in place for all of its South America operations, from 2025, the major expects to be drawing 60% of its global electricity needs from renewable sources, transforming the important scope two emissions profile.

The company says metallurgical coal production remains critical to global decarbonization goals.

“Many of the metals and minerals we produce are critical to the infrastructure and technologies required to decarbonize the world’s energy and transport systems – and this includes the ingredients needed for steelmaking,” said Anglo’s group director for corporate relations and sustainable impact in a statement.

No value for the investment was disclosed.

The partnership between Anglo American and Stanwell underwrites investment in the two major Queensland renewable energy projects – Clarke Creek wind farm in Central Queensland, and Blue Grass solar farm near Chinchilla.

Anglo is the world’s third-largest exporter of metallurgical coal for steelmaking, and its operations in Australia serve customers throughout Asia, Europe and South America.

Its tier-one coal assets include the Moranbah and Grosvenor metallurgical coal mines in Queensland (88% ownership). The mines are underground longwall operations and produce premium-quality hard coking coal.

According to Anglo’s 2021 annual report, more stringent environmental and safety regulations have required many steel producers to run cleaner, larger and more efficient blast furnaces. That, combined with several mine closures in recent years, resulted in increased global structural demand for high-quality coking coal, such as that produced in Australia.

Anglo has completed its exit from thermal coal operations, having demerged to shareholders its remaining thermal coal operations in South Africa during 2021, and completed a sale of its 33.3% shareholding in Cerrejón in Colombia in January.

Anglo started getting serious about investing in renewables in South America in 2019. The supply agreements in place will see its Brazilian, Chilean and Peruvian carbon dioxide emissions fall 70% over time.

Elsewhere, Anglo unveiled in May a prototype of the world’s largest hydrogen-powered mine haul truck designed to operate in everyday mining conditions at its Mogalakwena PGMs mine in South Africa. The 2 MW hydrogen-battery hybrid truck generates more power than its diesel predecessor and can carry a 290-tonne payload.

It forms part of Anglo’s nuGen zero emission haulage solution that entails another industry-transforming prong of its 2040 decarbonization ambitions.

from MINING.COM https://ift.tt/grbPRWw

Cette IA prédit ce que vous allez dire !

from Les dernières actualités de Futura https://ift.tt/DH5USsX

Newcrest resumes operations at Brucejack mine

Newcrest Mining (ASX, TSX, PNGX: NCM) said on Wednesday it had resumed operations at its Brucejack gold-silver mine in Canada, which had been shut since late October following the death of a worker.

Australia’s largest gold producer said that during the three-and-a-half weeks Brucejack was suspended, it reviewed the operation to identify major hazards and corresponding critical controls to prevent fatalities and life-changing injuries.

“The devastating incident at Brucejack is a stark reminder that safety must always be our number one priority as a business,” chief executive Sandeep Biswas said in the statement.

The latest accident was the third workplace death at the northern British Columbia operation since it opened in 2018. In the two previous cases, either the mine or its contractors were disciplined for failing to ensure workers received adequate safety training.

Newcrest added Brucejack to its portfolio earlier this year, following the acquisition of Pretium Resources.

The mine began commercial production in July 2017 and is one of the world’s highest-grade operating gold mines.

The asset spans 1,200 square kilometres in the heart of British Columbia’s Golden Triangle, which has a 100-year mining history and also hosts the Red Chris, Eskay Creek and Snip mines.

from MINING.COM https://ift.tt/HMYaDQp

Les rats aussi bougent en rythme sur la musique

from Les dernières actualités de Futura https://ift.tt/D8n5xfk

Tribune : pour une science au service de l'avenir

from Les dernières actualités de Futura https://ift.tt/Uh54NRn

Artemis I : la plus puissante fusée de l’histoire a décollé avec succès, les États-Unis sont de nouveau dans la course à la Lune

from Les dernières actualités de Futura https://ift.tt/3p2WZEw

mardi 15 novembre 2022

Defense Metals drills 221 metres of 2.14% TREO, including 3.52% at Wicheeda

Assay results are only partial, but Defense Metals (TSXV: DEFN) shared what they have received from the additional 353-metre hole at its 100%-owned Wicheeda rare earth elements (REE) deposit. The property is located 80 km northeast of Prince George in central British Columbia.

Infill hole WI22-69 intersected a zone of dolomite carbonatite averaging 2.14% total rare earth oxide (TREO) over 221 metres, including 3.52% TREO over 111 metres.

The company has drilled over 5,500 metres in 18 holes this year as part of the Wicheeda resource delineation and pit geotechnical program. The company has released assays for a total of 2,493 metres in seven holes. Assays for the remaining 11 holes totalling 3,017 m are expected in the coming weeks and months.

“With these additional assay results our 2022 drilling continues to yield significant intervals of the high-grade REE dolomite carbonatite lithology,” Defense Metals president Luisa Moreno said in a release. “Recent flotation variability test work has shown this type of mineralization consistently delivers high-grade mineral concentrates greater than 40% TREO, at recoveries in excess of 80%.”

The 2021 preliminary economic assessment (PEA) for Wicheeda project demonstrated an after-tax net present value (8% discount) of C$517 million and an internal rate of return of 18%. A unique advantage of the project is the production of a saleable high-grade flotation-concentrate, according to Defense Metals.

The PEA contemplates a 1.8 million tonnes per year mill throughput, open pit mining operation with 1.75:1 (waste/mill feed) strip ratio over a 19-year mine life producing and average of 25,423 tonnes REO annually. The mining plan includes rapid access to higher grade surface mineralization in year one and payback of C$440 million initial capital within five years.

The Wicheeda deposit has an indicated resource of 5.0 million tonnes averaging 2.95% TREO and an inferred resource of 29.5 million tonnes at 1.83% TREO.

from MINING.COM https://ift.tt/aqPRiNb

Wealthiest nations offer Indonesia $20 billion to wean it off coal

Rich nations led by the US and Japan have pledged to give Indonesia a $20 billion-package to help the coal-dependent country shift to renewable energy and reach carbon neutrality by 2050.

The deal put forward by the Just Energy Transition Partnership (JETP), which includes the US, Japan, Canada, the UK, and several European countries, including the EU and Norway, has been more than a year in the making.

Launched at the sidelines of the G20 summit in Indonesia, which is being held in parallel to the COP27 UN Climate Summit in Egypt, the package includes $10 billion in public funding and a further $10 billion from the private sector, The White House said on Tuesday.

“Today, G20 leaders highlighted the importance of investing together and investing stronger to fill the enormous need for better infrastructure in low- and middle-income countries around the world, and we welcome all who share this vision to join our efforts,” US President Joe Biden said in the statement.

As part of the agreement, Indonesia committed to cap power sector emissions at 290 megatons of CO₂ annually by 2030, and to generate about a third of its power from renewable sources by 2030.

Another $580bn needed

Indonesia, South-east Asia’s largest economy and home to the world’s third-largest rainforest, is one of the biggest carbon emitters globally.

It is estimated the nation needs $600 billion to phase out coal-based power sources in favour of a grid powered by renewables, which are crucial to Indonesia’s goal of reaching net-zero carbon emissions by 2060..

The government of Joko Widodo, who is in his second and final presidential term, has at times questioned climate deals, including an agreement inked last year to end deforestation by 2030.

Officials welcomed the pact despite the worries.

“[The deal shows] we can create a more sustainable world for our grandchildren, our citizens, and the future generation,” Indonesia’s coordinating minister of maritime and investment affairs Luhut Binsar Pandjaitan said.

US climate envoy, John Kerry, the US climate envoy, said the accord was “groundbreaking”.

“We’ve built a platform for co-operation that can truly transform Indonesia’s power sector from coal to renewables and support significant economic growth,” Kerry said.

The pact with Indonesia is the JETP’s second of its kind. The first was an $8.5 billion deal inked with South Africa at the COP26 last year. Talks are under way with Vietnam, India and Senegal to reach similar agreements.

from MINING.COM https://ift.tt/DkKoF4I

Découverte exceptionnelle d'un long tunnel sous un temple en Égypte

from Les dernières actualités de Futura https://ift.tt/KGFfAcN

Des compléments alimentaires dérivés de la vitamine B3 soupçonnés d'augmenter le risque de cancer

from Les dernières actualités de Futura https://ift.tt/fnrNA6b

lundi 14 novembre 2022

Metso Outotec expands its Metrics to stationary screens

Metso Outotec is now expanding on Metrics, the company’s monitoring system, to cover the tools, sensors and dashboard access for monitoring customers’ stationary screening equipment. The cloud-based system portfolio is one of Metso Outotec’s key digital solutions for customers.

Metrics will now offer improved safety, increased uptime, higher throughput, and reduced unplanned maintenance. Additionally, it will enable operators, controllers and service professionals to see real-time analysis of vibrating screen performance and bearing condition.

“The customer feedback received has helped us to offer a solution focused on customer centricity and sustainability. Metrics for screens helps customers to optimize their process, as they can easily see how the changes implemented have impacted their screening operations,” says Jan Wirth, technology director with Metso Outotec’s screening solutions business.

“In addition, continuous monitoring helps in the avoidance of several potential breakdowns. It also has a positive impact on sustainability, as running the screen in an optimal way enables increased uptime and less consumption of media, spare parts, oil and energy. Our strong development roadmap will enable us to release more data-driven and value-added services soon,” says Wirth.

from MINING.COM https://ift.tt/qvLbTGw

Novel copper-based material key to safely convert heat into electricity

A recent study published in the journal Angewandte Chemie presents a new synthetic copper material that acquires a complex structure and microstructure through simple changes in its composition, thereby laying the foundation for converting heat into electricity.

In detail, the novel material is composed of copper, manganese, germanium, and sulphur, and is produced in a relatively simple process.

“The powders are simply mechanically alloyed by ball-milling to form a pre-crystallized phase, which is then densified by 600 degrees Celsius. This process can be easily scaled up,” Emmanuel Guilmeau, corresponding author of the study, said in a media statement.

Thermoelectric materials convert heat to electricity. This is especially useful in industrial processes where waste heat is reused as valuable electric power. The converse approach is the cooling of electronic parts, for example, in smartphones or cars. Materials used in this kind of application have to be not only efficient, but also inexpensive and, above all, safe for health.

However, thermoelectric devices used to date make use of expensive and toxic elements such as lead and tellurium, which offer the best conversion efficiency.

But Guilmeau and his team were convinced that it is possible to create safer alternatives. This is why they decided to explore derivatives of natural copper-based sulphide minerals. These mineral derivatives are mainly composed of nontoxic and abundant elements, and some of them have thermoelectric properties.

The team succeeded in producing a series of thermoelectric materials showing two crystal structures within the same material.

“We were very surprised at the result. Usually, slightly changing the composition has little effect on the structure in this class of materials,” Guilmeau said.

He and his colleagues found that replacing a small fraction of the manganese with copper produced complex microstructures with interconnected nanodomains, defects, and coherent interfaces, which affected the material’s transport properties for electrons and heat.

Guilmeau pointed out that the novel material is stable up to 400 degrees Celsius, a range well within the waste heat temperature range of most industries. He is convinced that, based on this discovery, novel cheaper and nontoxic thermoelectric materials could be designed to replace more problematic components.

from MINING.COM https://ift.tt/buIkVQs

Salazar, Adventus reach deal for $270m Ecuador copper-gold project

Canada’s Salazar Resources (TSX-V: SRL) and Adventus Mining are set to ink a final a foreign direct investment agreement with Ecuador’s government for their El Domo copper and gold project.

The partners said that the country’s investment institution approved last week a draft contract whose final version is expected to be signed in four months.

The investment agreement includes a number of incentives for the miners, which are valid for about 10 years, until March 2033.

These include a 5% reduction in the income tax rate to 20% and a full exemption on capital outflow tax (ISD) on all imports of capital goods and raw materials.

The deal also grants Adventus Mining and Salazar Resources full exemption from import duties on capital goods and raw materials, including on all equipment related to mines and mills.

It incorporates as well the approval of a special article on dispute resolution, including international arbitration protection.

The Ecuadorian government has committed to guarantee fiscal and legal stability to the companies. This means that all applicable laws related to the mining industry will be frozen during the term of the contract, unless there are new regulations that benefit the miners.

“We are thrilled to have completed this significant approval milestone (…) to further advance El Domo towards the start of construction in 2023,” Christian Kargl-Simard, President and CEO of Adventus Mining said in the statement.

Among top three mines

The Toronto-based miners’ Curipamba project consists of seven concessions, including the El Domo deposit.

Once built, El Domo will be Ecuador’s third major mining operation. The only large-scale mines in the country to date are the Mirador copper mine, run by China-backed Ecuacorriente and Lundin Gold’s (TSX: LUG) Fruta del Norte gold mine.

The operation is also expected to bring $376 million in taxes and royalties into the state’s coffers over the 10-year mine life outlined by El Domo feasibility study, which does not include the additional development of underground resources identified, the companies have said.

Adventus Mining and Salazar committed in June to investing $270 million over the next 12 years at the project. The figure doesn’t include the $50 million both miners invested up to the end of 2021.

from MINING.COM https://ift.tt/HSIan4G